Board governance is of vital importance for every organization.

In 2018, a Boeing 737 Max crashed in Indonesia. A month later, Boeing released a statement, describing the 737 Max as “as safe as any airplane that has ever flown the skies.” In March 2019, a second 737 Max crashed in Ethiopia, killing 157 passengers.

To quote the Los Angeles Times, “The crashes have been attributed to slipshod engineering, irresponsible cost-cutting and sweetheart arrangements with government regulators—all aspects of management that fall within the board’s jurisdiction.”

Luckily, most board decisions aren’t life or death, but the above tragic example demonstrates how incredibly important good board governance is.

In this article, we’ll look at how to define board governance, what makes it so challenging, and the best practices that today’s business leaders should be following to build ethical, compliant, and successful organizations.

Jump to:

- What Is Board Governance?

- Types Of Board Structure

- Why Board Governance Is Important

- Board Governance Challenges

- Board Governance Best Practices

What Is Board Governance?

Board governance is a term that comprises the systems and processes governing the behavior of a board of directors and the organization they represent, the scope of responsibilities of the board themselves, and a framework for board decision-making. In other words, board governance describes both what boards do, and how they do it.

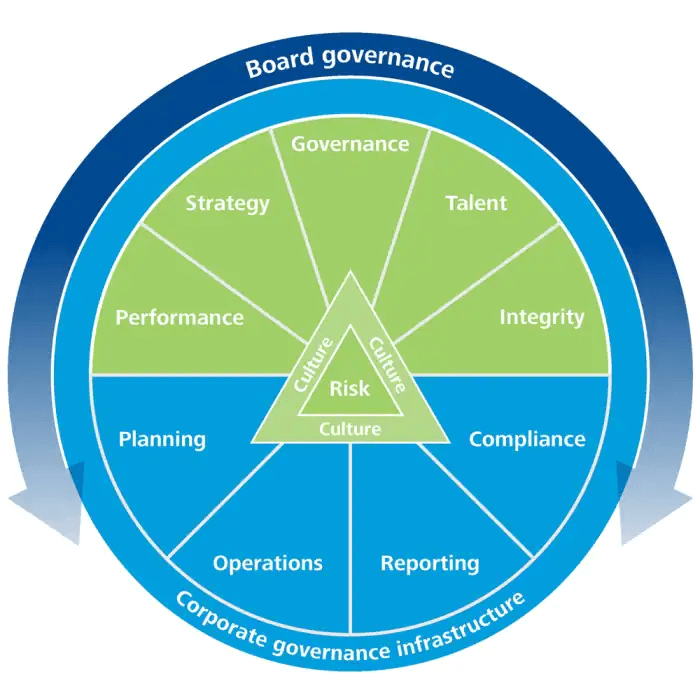

Deloitte developed a Governance Framework to illustrate the relationship between board governance and corporate governance. The responsibilities of the board will depend on both the type of organization and the structure of the board but, broadly speaking, the board will be expected to oversee the segments in green, while playing more of a monitoring role over the segments in blue.

Board Governance: Types Of Board Structure

There are wide variations in board governance between organizations, and especially between for-profits and nonprofits, but five of the most common types of boards are:

- Governing board: follows shareholder’s best interests and provides direction to organizational management

- Managing or executive board: manages the day-to-day operations of the organization and makes company decisions

- Working board: members are both part of the board of directors and the workforce of the organization–common in small or new companies

- Advisory board: provides advice and expertise to the organization’s leadership and main board

- Cortex board: focuses on the organization’s value to its community and wider community of stakeholders

- Policy board (also known as a Carver board): creates organizational policies and practices to be followed by staff members and delegates responsibility for implementation to the Chief Executive Officer and executive management.

Board Governance: What Is The Role Of The Board?

The board’s role will vary, depending on the type of board structure, the location of the organization, whether it is for-profit or not, public or private, and so on.

However, there are certain core responsibilities that most boards share:

Ensuring the success of the organization

To quote the Institute of Directors, a membership-based organization of directors based in the UK and founded in 1903, the key purpose of a board is “to ensure the company's prosperity by collectively directing the company’s affairs, while meeting the appropriate interests of its shareholders and relevant stakeholders.”

Establishing a long-term strategic vision, mission and purpose

Most boards play a key role in defining the overall purpose of the organization, and then helping to steer the organization in directions that support that purpose. This will usually tend towards developing long-term strategies, structures, and policies, rather than handling the day-to-day implementation of those strategies.

Hiring and firing organizational leadership

Boards are usually responsible for selecting and recruiting the CEO and other members of the C-suite, and for dismissing any of the leadership team if their actions go against the interests of the shareholders or the long-term survival of the organization.

However, once selected, the board is usually expected to delegate the responsibilities of running the organization to the leadership team. The expression often used is “Noses in, fingers out” - boards should be fully aware of what is happening in the company, but not tempted to meddle in the day-to-day.

Helping with decision-making and risk management

A well-run board should help to keep the company strategically agile, and able to resolve conflicts and reach decisions on major questions quickly. Michael Rosendahl, the leading investment banker at PCE Investment Bankers, believes that an effective board should act as a bastion against organizational stagnation:

“Without a properly functioning decision-making apparatus at the top, the company is destined to wallow in indecision, diminishing its value to the shareholders. As investment bankers working with businesses every day, we've seen this happen to numerous companies where the owners have different objectives. For instance, one may want to grow the company, and the other wants to exit the business and benefit from the cash flow. If there isn't a way to quickly resolve these types of impasses, the company may stagnate, and animosity may develop between the shareholders.”

Providing a broader perspective to management

This is less tangible than their other roles, but often the board helps to improve the running of the organization by providing new insights or outside perspectives to the executive leadership. To quote Nabila Salem, Group President of the global cloud talent creation firm Revolent:

“Back in the day, boards were primarily filled with people with regulatory expertise and experience with cross-industry pattern recognition— especially with regards to compliance. But in the past ten years or so, this has changed. Today, board governance steers towards valuing deep industry expertise and technical knowledge. Beyond this, modern boards are also highly interested in understanding how strategic, operational, and technological knowledge from other industries can be imported into their business, with the aim of improving it.”

Board Governance: Why Is It So Important?

Good governance is essential for the long-term survival of organizations. Poorly governed companies are vulnerable to financial disaster, incompetence, corruption, and gross misconduct, as the Boeing tragedy so powerfully illustrates.

Quinton Newcomb, Head of Commercial Crime at international law firm Fieldfisher, agrees:

“Bad governance can be toxic for companies. Poor performance of a business is often traced back to poor or ineffective management or governance, or in the most extreme cases, to criminal wrongdoing. Typically, if senior executives are implicated in market abuse or fraud, that means the organization itself is implicated. For all companies, listed and private, the impact on customer trust and employee morale can be profound. Customer and investor distrust can have severe financial consequences for a business, while the internal impacts can lead to the loss of talented employees.”

In other words, the failure of a board to perform their duties well can drag down the entire organization. By contrast, a great board can lead the organization to triumph, whether by providing unique strategic direction, identifying the right executive leaders, or fostering positive cultural change.

Board Governance: The Challenges

There are few organizations who are unaware of the importance of board governance, yet board incompetence and even corruption remain rampant. This may be because board governance presents a unique set of challenges:

Company culture

For Newcomb, the main challenge is cultural. In organizations where senior leaders are not subject to challenges and scrutiny, board oversight can present a significant challenge:

“To the extent that those at the top of an organization tend to operate with more autonomy and independence, it will also generally be harder to monitor these individuals. This tends to affect the potency of those who have responsibility for compliance, who may find themselves undermined and marginalized by management.

Even in organizations with a positive corporate culture, the reality is most executives are not routinely questioned or challenged. This can all lead to a sense of invincibility among senior management, and a temptation to ignore their organization's policies and procedures.”

Conflicts of interest

While companies may require boards to sign a conflict of interest policy at the time of joining the board, the issue is more complicated than that, observes Professor Didier Cossin of the IMD Global Board Center.

For instance, the interest of the shareholders for short-term profits may run in conflict with the interests of the company for long-term sustainability. Even independent board members may feel pressured to side with powerful or influential company directors or CEOs.

Michael Rosendahl has found that much of the challenge involved in board governance comes down to finding a consensus:

“Conflict is inevitable when you bring together multiple people with different interests and objectives. The conflict isn't necessarily destructive, but it creates challenges when trying to bring together a meeting of the minds and come to a consensus on an issue facing the company or a crucial strategic decision. Board governance challenges take on added significance in family-owned businesses where family dynamics may impact decision-making. You need a strong leader and a set of rules to ensure these factors do not negatively impact the company.”

Diverse stakeholder needs

There can be significant conflicts between the needs of diverse groups of stakeholders involved with the organization, which the board must effectively balance in order to deliver on corporate strategy.

For instance, the company’s bank, as a creditor, might prefer a conservative direction, whereas shareholders might advocate for a riskier but more potentially lucrative approach.

Increased scrutiny

Boards today are facing increased pressure to meet the demands of activist investors to address issues on everything from the composition of the board to leadership remuneration, and from transparency to corporate social responsibility initiatives.

According to research by McKinsey, governance-related demands by activist investors around the world rose from just 27 in 2009 to around 1,400 in 2019. Board members must rise to the challenge or risk significant financial and reputational damage to their organizations.

Board Governance: Best Practices For The “Next Normal”

So, how can boards today address these challenges? We’d argue that boards can play a major role in helping to steer organizations into the next normal with greater transparency, accountability, and success if they follow these three key steps:

Encourage diversity

Board composition–the profiles of the people that make up the board–has been the focus of fully 40% of all activist investor demands since 2009, data from Activist Insight shows. Today’s shareholders have come to demand boards that represent diverse backgrounds, ethnicities, genders, ages, and skill sets.

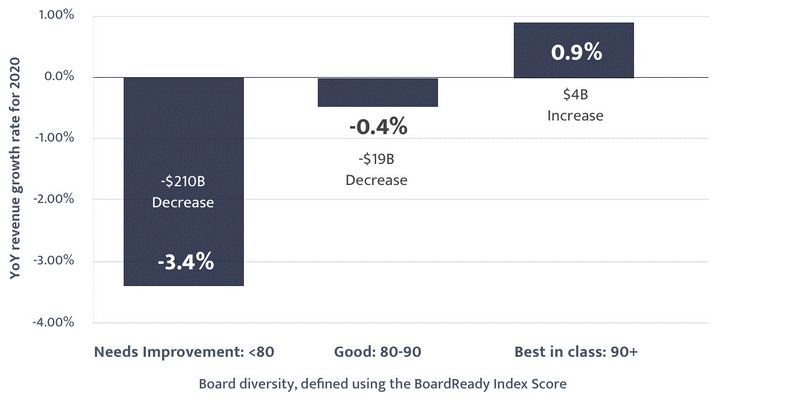

This isn’t just fairer - it’s also common sense. Research by Board Ready, a non-profit focused on helping companies with board diversity, found that organizations with diverse boards performed significantly better during the COVID-19 pandemic:

But encouraging diversity isn’t only about rethinking the composition of the board. Yes, it may well be time to bring in new profiles, adjust the size of the board to accommodate a more diverse group, or review board membership terms and renewals.

It also means that the board should play a proactive role in encouraging greater diversity within the leadership team and the workforce as a whole.

Writing in the Harvard Business Review, board consultants Reshmi Paul and Jeff McClean advocate that boards should create a “People Committee”, to monitor the organization’s commitment to its stated values, such as workforce diversity or corporate social responsibility.

This could look like “adding cultural outcomes and metrics to CEO scorecards, highlighting successes within key business units, and measuring and holding executives accountable for engagement and buy-in from employees at all levels. Adding a people committee with chartered responsibility to monitor and develop adherence to institutional culture will ensure initiatives sustain beyond the tenure of any one leader and filter throughout the entire organization.”

Finally, diverse board membership will not be enough to ensure true board diversity.

For boards to benefit from the multiple perspectives of members from different backgrounds, it will be important to “invite more varied and open discourse, meaning the board will be less likely to fall foul of herd mentality,” remarks Lily Searle, a senior corporate associate at Fieldfisher. She adds, “This is particularly important, given the diversity of the world around us, as all types of stakeholders will expect to be considered in key decisions.”

Avoid micromanaging

Boards need to take a close look at their relationship with the executive team. Driving long-term strategy is the top priority of the board, but it can be all too easy to fall into the trap of acting as a line manager for the CEO.

If today’s boards are to play a key role in steering their organizations toward a more ethical, fair, and sustainable future, they need to remember this advice from Nabila Salem:

“One of the most common mistakes I see, particularly on mission-driven boards, is micromanaging. While this is often done with the best of intentions, the most well-governed boards understand that the daily tasks of a business should absolutely not be their priority.

Your leaders exist to fill this gap and to deal with the daily operations of your business. Just as the board should not attempt to control the minutiae of staff activities, neither should staff members need assistance from the board when it comes to daily business as usual tasks.

This kind of activity takes away from what should be the true focus of any board; to direct company affairs with a view to long-term sustainability and growth, while meeting the interests and demands of its stakeholders and shareholders. The board needs to be looking at long-term goals and whether the business is equipped to achieve these.”

To do this, boards need to find a CEO and a leadership team they can trust—and then go ahead and trust them to do the jobs they were hired for.

According to Salem, “The familiar stereotype of a ‘crony’ relationship between boards and their CEO has all but vanished. It has been replaced with boards that genuinely lean on their CEO to provide oversight and industry expertise, and to help implement the long-term objectives of the board through day-to-day operations.”

Proactively review board governance

To quote McKinsey, “It is always better to be your own activist rather than have demands thrust upon you.”

For many organizations, that means taking a long hard look at their board governance and taking proactive steps to update board processes and protocols to meet rising stakeholder expectations. Failure to acknowledge these changes can lead to unexpected–and costly–consequences.

For instance, Searle provides a great example of how society’s view of the role of the board has changed:

“In March 2022, legal pressure group ClientEarth commenced legal action against Shell’s board over what it calls "mismanagement of climate risk" in a first of its kind case that seeks to hold directors personally liable for "net-zero failures".

Having purchased shares in Shell, ClientEarth alleges that Shell's board is in breach of its duties under UK company law, pursuing near-term profit at the expense of enduring company viability.”

Companies that do not take steps to establish a regular review of their board governance may find themselves similarly under fire from activist investors.

This could mean increasing transparency around leadership remuneration, reviewing the impact of business activities on global concerns such as climate change, or reviewing how shareholders participate in board decision-making processes.

Board Governance: How Technology Can Help

While much of good board governance comes down to organizational culture and policies, software can help make board governance easier.

Board membership can be demanding, especially for those members who sit on multiple boards.

Board governance software can reduce the administrative hassles involved so that every board member has more time available for their governance responsibilities.

Board governance software can be used for tasks like:

- Automating board meeting scheduling;

- Building an agenda, setting time limits, and assigning responsibility for each segment;

- Storing meeting agendas and minutes securely in a searchable digital format;

- Collaborating and commenting on documents;

- Assigning and tracking board members’ tasks;

- Voting on resolutions;

- Approving and signing documents electronically.

As a result, they can make decisions more transparent, make meetings more efficient, save time, and encourage member accountability and engagement.

Of course, every board is different, and there is no one-size-fits-all software solution that works for every board. That’s why we’ve put together a list comparing the best board governance software, so you can find the best solution for your board.