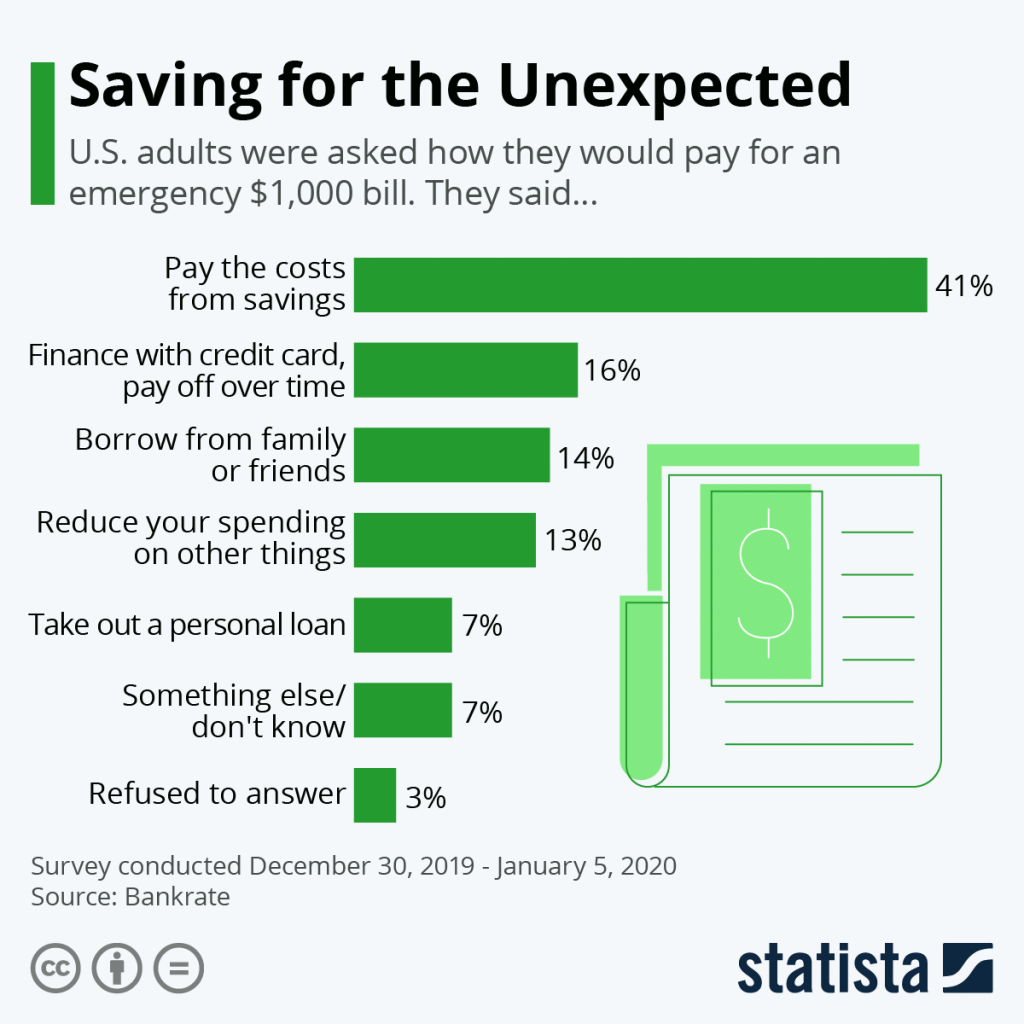

Six out of ten American employees live paycheck to paycheck, and four out of ten cannot even cover a $400 unforeseen expense.

Financial literacy is an essential skill that’s sadly lacking for many people. According to Intuit research, less than 17% of students take personal financial literacy programs in school.

The same study shows that only 55% of adults in the United States become financially literate.

Here I’ll cover why financial literacy matters and what you can do as an HR professional and employer to help educate employees.

Why Is Financial Literacy Important?

We’ve already touched on the general lack of financial literacy in the U.S. It’s an issue because of the importance of managing money in our society and its correlation to well-being and happiness.

Financial worries are a significant source of stress for many people and financial literacy is fundamental to helping people better manage their finances and reduce stress.

As employers, every year we ask employees to make decisions about benefits enrollment and we all know how difficult that can be.

Bottom line is that providing even basic financial education can lead to healthier workers that are more engaged, productive, and loyal. They’ll also make better use of their benefits which can translate into cost savings.

A friend of mine used to work for Delta as a flight attendant on not-much-money and one of the programs she’s most grateful for was a course in financial planning that encouraged her to start saving and taught her how to invest her money wisely. Today she’s a successful financial advisor!

So, what are the options?

How To Help Workers Improve Financial Literacy

Financial literacy programs

Employee financial wellness programs teach your staff how to make informed and effective decisions about their finances.

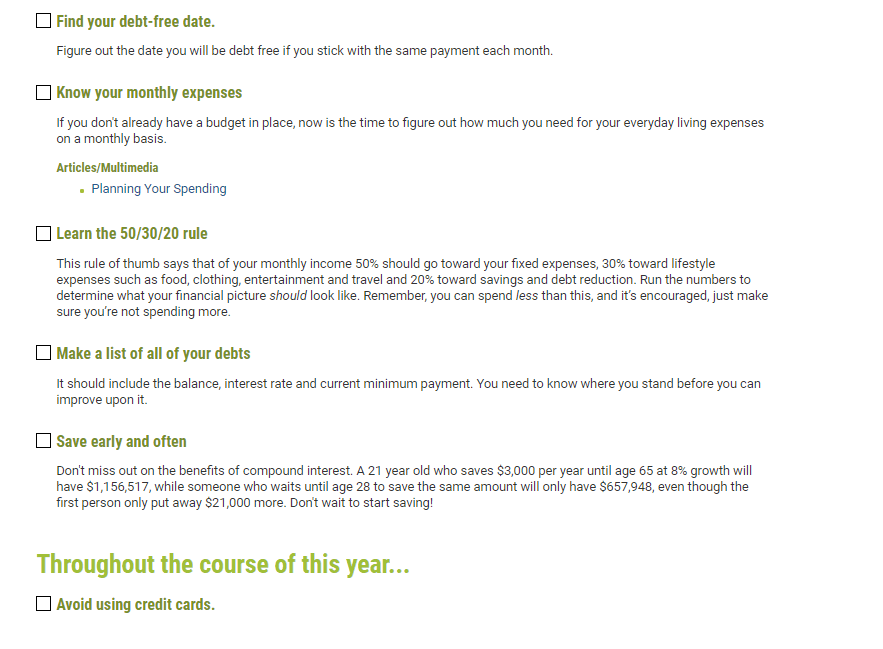

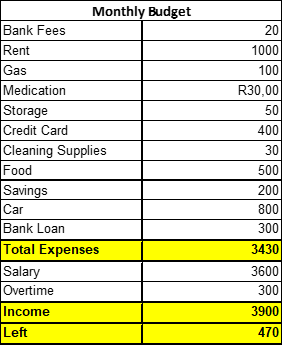

They walk away with the skills to better manage their income and expenses. They also learn more about how to build financial security and wealth.A workbook within a workplace financial literacy program might look something like this:

5 Basics Your Program Should Include

A good program will include tips on the following.

1. Identifying spending triggers

| Date | What you Bought | Amount Spent | Feelings |

|---|---|---|---|

| 2021/02/27 | Coffee | $2.50 | Tired |

| 2021/02/27 | Lunch | $10.00 | Hungry |

| 2021/02/27 | Beer | $5.00 | Stressed |

My spending triggers are boredom and shopping while hungry. Knowing this, I find better things to do than surf online or visit malls to alleviate boredom.

These triggers may be more subtle than we realize. Identifying them is an essential part of sticking to a budget. I recommend that you keep a journal for at least a month to identify those triggers.

2. Drawing up a budget

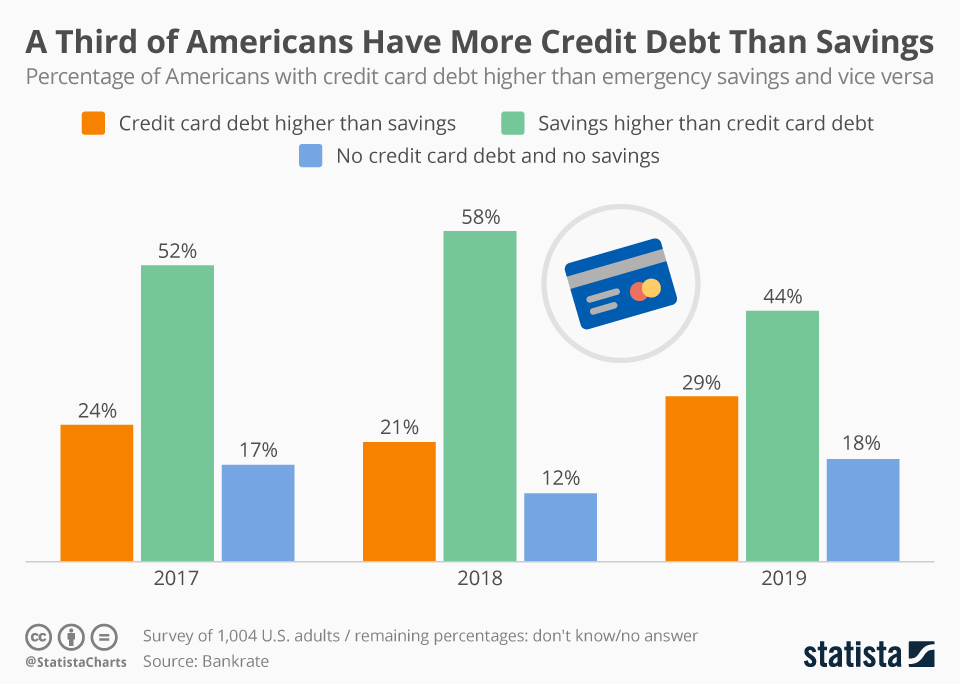

It’s a simple enough exercise to create a basic income and expense sheet. The training should also have team members identify the total amount they owe and how much interest they’re paying.

3. The difference between good and bad debt

Most people categorize a mortgage as good debt because it finances an asset. Conventional advice is that it’s better to own your home than pay someone else’s mortgage.

I’d like to have a word with the person that came up with that “gem.” It’s got more people into trouble than you realize. I’ll illustrate using an example.

Let’s assume that a house costs $300,000 and you have a $10,000 down payment. You get a reasonable rate of 4.8%. You could get a better rate if you worked on your credit rating, but you’re scared of missing out.

Besides, a 1% lower interest rate will save you less than $200 a year. It’s a no-brainer for most people.

What’s the big deal?

It can take as little as six months to improve your credit rating enough to shave off that 1% from your interest rate. By rushing, you’ll pay an extra 31% in interest over the term of the mortgage.

Which, incidentally, is usually more than the rate on those naughty credit cards everyone wants to avoid.

Speaking of those credit cards, if used responsibly they can improve your FICO score and help you get a better mortgage rate. They can also get you into trouble financially.

The point is that the concept of good and bad debt is more fluid than we realize.

4. Investment categories

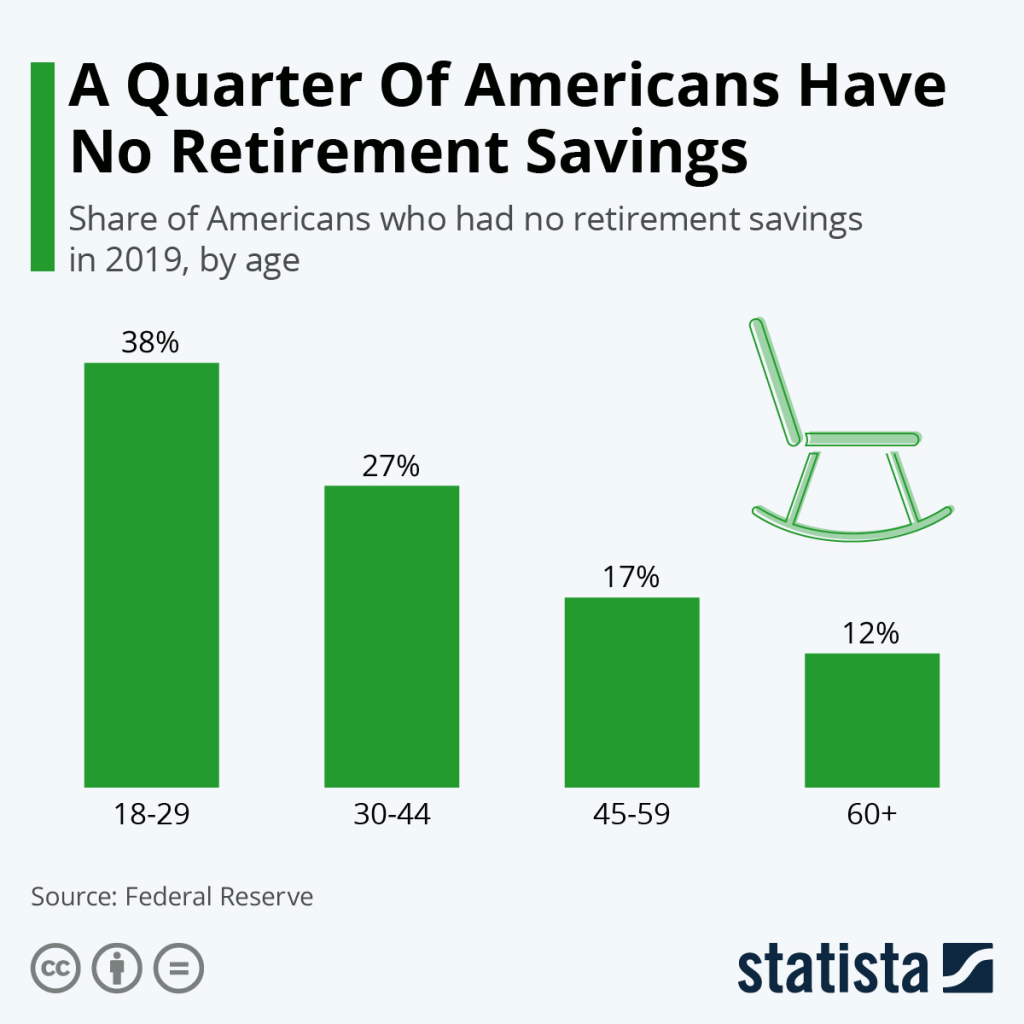

There are several investment categories out there. A balanced portfolio starts with an emergency fund and is bolstered by a range of short and long-term investments. Many people think that they must choose between a savings account with a bank and risky shares.

In reality, there are many more asset classes to consider. The choice will depend on the individual’s appetite for risk and ability to make up for potential losses.

Understanding the different asset classes is the first step toward building wealth. A good grounding allows team members to recognize good investment opportunities and risky ones.

5. Methods to pay down debt

A simple explanation of the different methods to pay down debt is always useful. These include the:

- Snowball method: Paying off the smallest debt first shows employees that it’s possible to make headway.

- The avalanche method: Paying off the debt bearing the highest interest rate saves more money in the long term.

Clear benefits communication

Any HR pro involved with the enrollment process can relate to how difficult it can be to engage colleagues so they 1) complete the process in time and 2) choose the best options for them.

Some best practices for effectively communicating employee benefits:

- Send out a benefits survey to collect feedback from employees about their understanding of your company's benefits package.

- Ensure open enrollment information and resources are easily accessible using tools like your intranet or virtual messaging board.

- Leverage multiple modes of communication to help ensure your communications reach all employees it’s imperative to utilize multiple channels of communication.

- Intranet

- Messaging communication channels (such as Slack)

- Internal Social Media Sites

- Webinars

- Lunch and learns

- Employee handbook.

- Build strong relationships with your benefits providers and leverage them to help communicate their offerings to workers.

Create a culture of financial wellness

Encourage open discussions about financial wellness within the company. This can be facilitated through lunch and learns, financial wellness challenges, or creating a financial wellness committee.

It greatly helps if leadership openly prioritizes financial literacy and shares their own experiences or lessons learned (as appropriate).

Seeing company leaders value financial education can inspire employees to take their financial well-being seriously.

10 Benefits of Improving Employee Financial Literacy

While I touched on this at the beginning, I thought I’d go a bit deeper and outline the positive impacts employee financial literacy can have on your business

While I touched on this at the beginning, I thought I’d go a bit deeper and outline the positive impacts employee financial literacy can have on your business

1. Greater focus and productivity

Financial literacy helps employees improve their personal situation. As a result, they’re better able to focus on their work and are more likely to be in a good frame of mind, which boosts productivity.

2. Reduced stress

Being in debt is stressful. Getting calls from creditors is stressful. I know—I used to have to make some of those calls, and people put in a lot of effort into dodging them.

Even when employees can cover their current commitments, they may have financial stress over price increases. A workplace financial literacy program can ease that anxiety. It will likely reduce stress in the workplace in general and Human Resources in particular by:

- Employees will not approach their colleagues for loans

- Staff members won’t continually discuss their situation with their colleagues

- HR won’t have to turn down the frequent loan or cash advance requests

Workplace financial literacy training helps reduce stress for employees in several ways:

- It gives them the skills to take control of their personal finances

- They understand the difference between useful and dangerous solutions

- It shows them what steps to take to improve their financial health

3. Lower healthcare costs

Ongoing stress about personal finances has a negative effect on the employee’s mental and physical state. They may battle with aches and pains caused by tense muscles.

The increased levels of cortisol in the body affect the body’s overall hormone balance. This affects several systems such as hunger regulation, blood sugar control, immunity, sleep, and mood regulation.

The disruption predisposes employees to conditions such as diabetes and cardiovascular disease.

The upshot is that they require more medical attention, increasing their healthcare costs. If you’re paying their medical insurance, the premiums increase.

4. Less absenteeism

When employees are better able to manage their stress, they should naturally start to feel healthier. Their moods should also become more balanced and positive. Absenteeism due to illness or depression should decrease.

5. Better retention and loyalty

30% of new hires leave within three months. Even in a tough job market, great employees are in high demand. If you wish to keep them focused on your business, you need to provide benefits that few others do.

What’s more valuable:

- Providing a 1% pay increase over the competition, or

- Teaching the person how to make the most out of their salary every month?

The workplace is changing, and so are employee goals. The days of sticking with one company for life are over. People are choosing experience over money today.

Companies with a distinctive culture are way ahead of their competitors and can attract top talent. Upskilling employees with life skills that help them outside of working hours shows that you care.

More importantly, employees will feel a better sense of loyalty to the company. You helped them improve their financial situation; they’ll want to reciprocate.

6. Reduces staff vulnerability

Desperation makes people do things they’d never normally consider. They might be tempted to “borrow” money from a client or company account or simply steal it outright.

Staff in need are also vulnerable to the less-than-savory elements of society. Syndicates might approach them about buying confidential customer information, proprietary secrets, or company operational schedules.

While most people are inherently honest, the allure of an easy solution may prove too tempting.

7. A new appreciation of non-cash remuneration

Startups, in particular, might need to think of alternative ways to attract top-level staff. Some options might include stock options, daycare facilities, or gym facilities at work.

These choices benefit the employee but usually replace some of the cash components of their salaries. The employee stands to gain more than the primary cash value but may not always understand the benefits.

By teaching them more about managing money and investments, you highlight the value of their perks. They develop a new understanding of what their actual cost to the company is.

8. Less need for employees to have a side hustle

Side hustles can become a nightmare for HR. It’s difficult for staff not to let their secondary work interfere with their full-time job, especially when it’s something they’re passionate about.

They may become distracted at work or too tired to put in a full day’s effort. People may use company resources and contacts to build their business.

While they’re unlikely to compete in the same industry as you, they could inadvertently tarnish your reputation by association. If, for example, they fail to deliver on a promise to a mutual client, it might reflect poorly on you.

9. A better potential for employees to upskill themselves

Gaining a further education is often expensive. So much so that around 60% of the workforce lack basic working skills. The staff members that are battling to cope can’t afford to upskill themselves.

Those with full-time jobs and reasonable financial security might not feel the need to continue learning.

Financial wellness programs emphasize the importance of continued education. As your staff members become financially literate, they may be motivated to upskill themselves further.

Better yet, they’ll be in a better financial position to pay for their studies and understand how to seek aid.

10. Employees will better understand the business case

Working for a business and owning one are two very different experiences. A staff member receiving their paycheck every month may not understand how vital their productivity is to the company.

They may see a soaring stock price or million-dollar turnover and think that the business is in great shape. It’s a misconception that could lead them to believe that they’re getting a bad deal and want to leave.

With a basic understanding of how finances work, they’ll better understand their role in growing the business. They’ll realize that your business doing well improves their financial future.

Financial Literacy Is A Win-Win

Actively assisting your staff in achieving their goals is the best way to engender loyalty.

By giving them the skills to manage their finances, you help them achieve one of their most important goals. Your team member benefits through better security, less stress, and a broader understanding of economics in general.

You benefit through better productivity, lower absenteeism, improved retention, and employees that are better able to upskill themselves. Financial education through employee financial wellness initiatives benefits all parties.

From a personal standpoint, there’s no better feeling than knowing you’ve made a palpable difference in someone’s life.

I used to love watching that “Aha” moment when my advice made someone realize that they could dig themselves out of debt. Even better was when I saw the improvements they made.

Creating a simple financial literacy program for your employees increases their satisfaction and aids productivity.If you want to learn more methods of improving the well-being of your employees, and other topics in people and culture, subscribe to the People Managing People newsletter.