Best ACA Compliance Software Shortlist

Here's my pick of the 10 best software from the 18 tools reviewed.

The best ACA compliance software takes the stress out of tracking employee eligibility, filing required forms, and staying on top of ever-changing regulations—so you can avoid costly penalties and focus on running your business.

Without the right tools, managing ACA requirements can mean juggling spreadsheets, chasing down data, and worrying about missing key deadlines. The right platform automates reporting, centralizes employee information, and provides alerts to keep you compliant year-round.

After hands-on testing and in-depth reviews, I’ve identified the top ACA compliance solutions that are accurate, reliable, and designed to make complex reporting simple.

In this guide, you’ll find software that helps you stay compliant, protect your organization, and save hours of admin time.

Why Trust Our Software Reviews

We’ve been testing and reviewing HR management software since 2019. During that time, we’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions. Learn how we stay transparent & check out our software review methodology.

Why Trust Our Software Reviews

Best ACA Compliance Software Summary

This comparison chart summarizes pricing details for my top ACA compliance software selections to help you find the best one for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for real-time updates | Not available | Website | ||

| 2 | Best for detailed analytics | Not available | Website | ||

| 3 | Best for large enterprises | Not available | Website | ||

| 4 | Best for user-friendly interface | Not available | Website | ||

| 5 | Best for compliance accuracy | Not available | Website | ||

| 6 | Best for cost-effective plans | Not available | Website | ||

| 7 | Best for automated reporting | Not available | Website | ||

| 8 | Best for tailored solutions | Not available | Website | ||

| 9 | Best for regulatory expertise | Not available | Website | ||

| 10 | Best for small businesses | Free demo + free plan available | From $899/month | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best ACA Compliance Software Review

Below are my detailed summaries of the best ACA compliance software that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you.

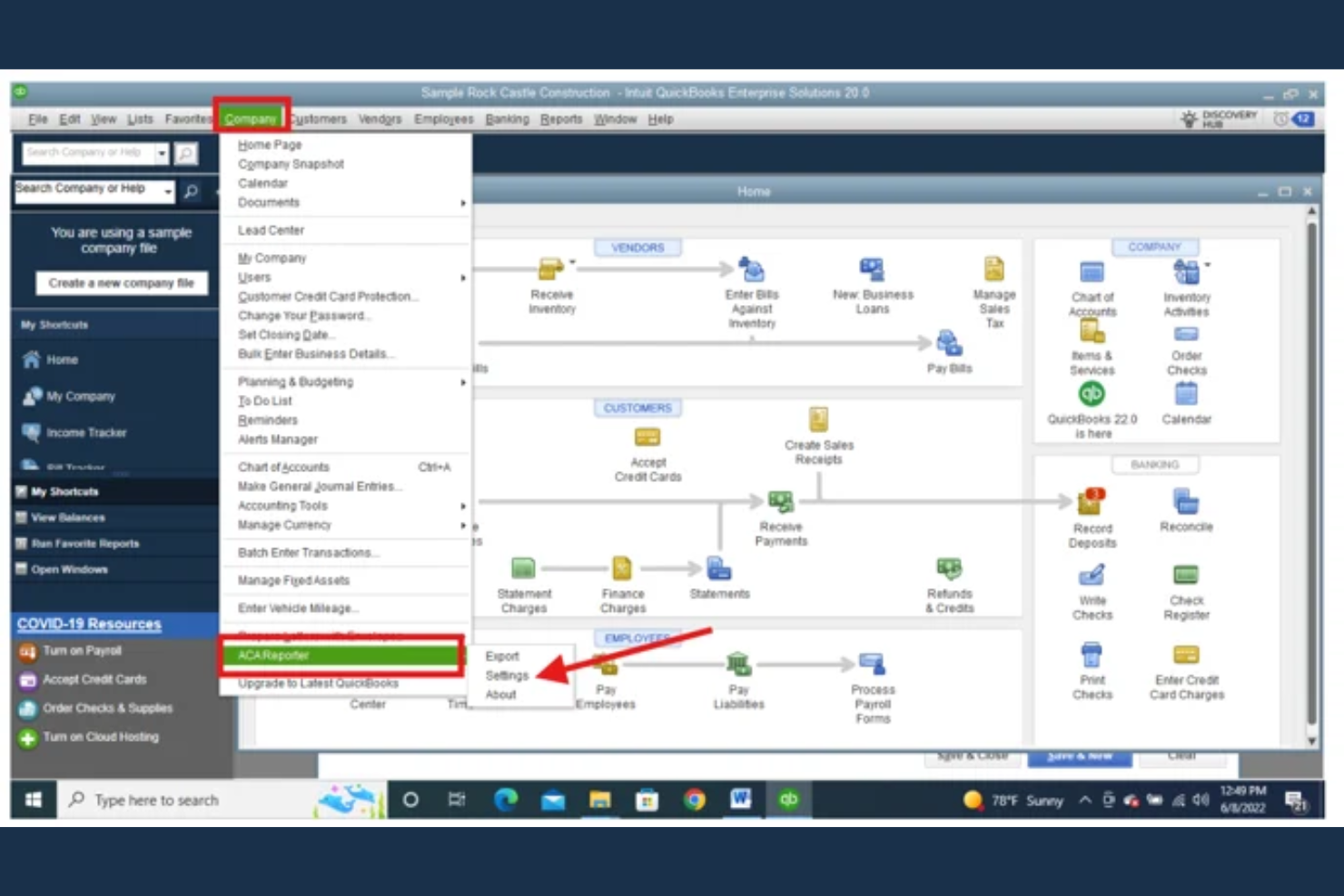

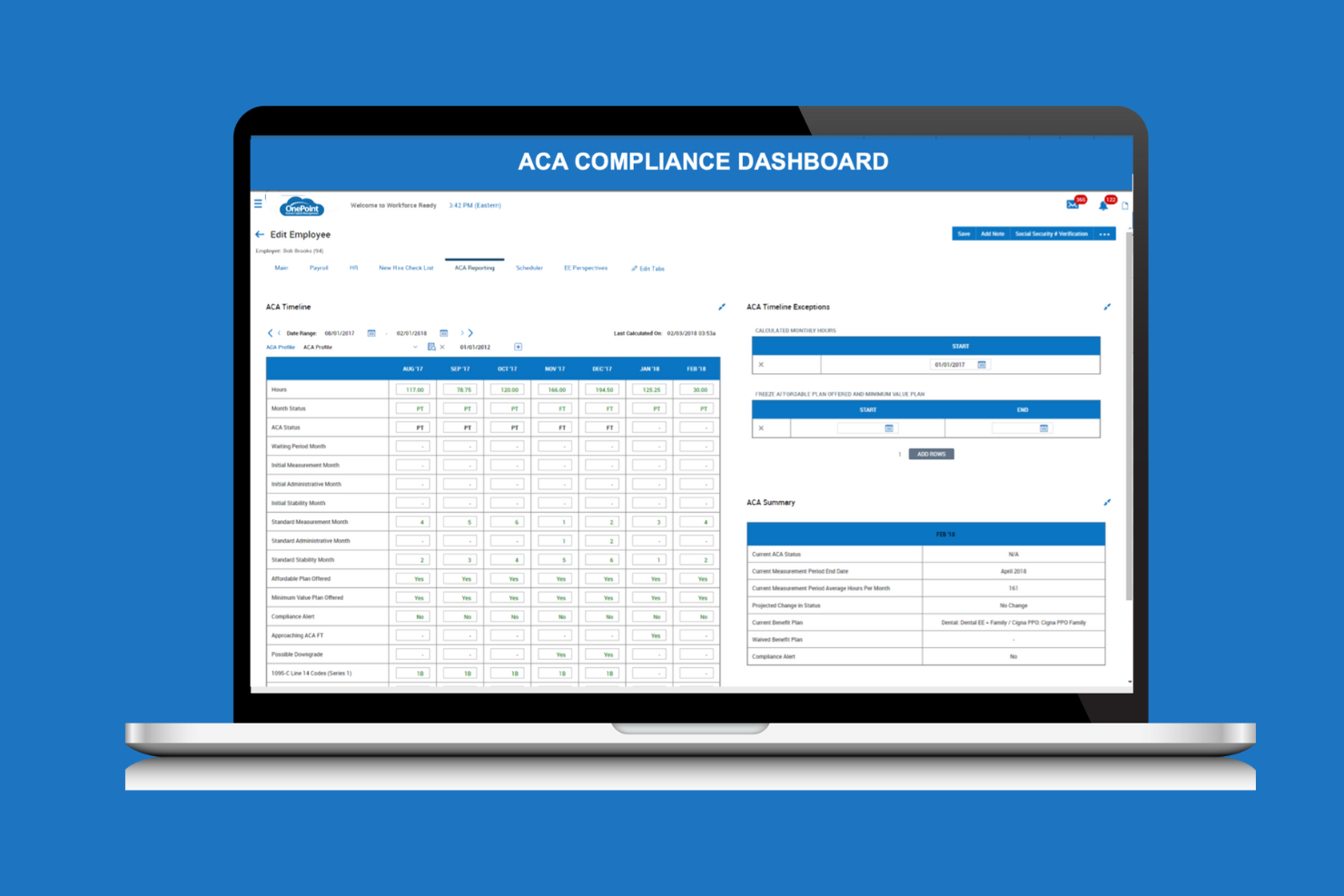

ACA Reporter is a compliance software designed for businesses that need up-to-date ACA reporting and management. It caters to HR departments looking for timely compliance insights and accurate reporting functionalities.

Why I picked ACA Reporter: It excels in providing real-time updates, ensuring your team always has the latest compliance information. The platform features tools for generating accurate reports quickly. You can monitor compliance metrics as they change, helping you react promptly. Its focus on timely data makes it an essential tool for proactive compliance management.

Standout features & integrations:

Features include tools for generating accurate reports quickly, ensuring your team can stay on top of compliance. The platform offers real-time monitoring of compliance metrics, helping you react promptly to any changes. ACA Reporter also provides timely data, which is essential for proactive compliance management.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Essential for proactive management

- Offers timely data

- Monitors compliance metrics

- Generates accurate reports quickly

- Provides real-time updates

Cons:

- Can be complex to navigate

- Needs accurate data input

- Not ideal for small businesses

- May require setup time

- Limited to ACA tasks

ACAwise is an ACA reporting solution designed for e-filing Forms 1094 and 1095-B/C. Its main users are Applicable Large Employers (ALEs), Third-Party Administrators (TPAs), and Human Capital Management (HCM) providers. It focuses on preparing and e-filing ACA forms and ensuring compliance with state mandates.

Why I picked ACAwise: It offers detailed analytics to help you understand ACA reporting requirements better. This feature allows your team to calculate penalties accurately and manage compliance efficiently. ACAwise provides tools for error correction and form amendments, which are crucial for maintaining accuracy. Its postal mailing services for recipient copies further enhance its value for large organizations.

Standout features & integrations:

Features include tools for error correction and form amendments, postal mailing services for recipient copies, and compliance with state mandates. ACAwise also provides resources to help you understand ACA reporting requirements and calculate penalties.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Resources for penalty calculation

- Compliance with state mandates

- Postal mailing services

- Error correction tools

- Detailed analytics for reporting

Cons:

- Requires accurate data input

- Limited to specific industries

- Complex for small businesses

- May require training

- Limited to ACA forms

Empeon is an ACA compliance tool designed for large enterprises needing comprehensive benefits administration and ACA reporting. It serves HR departments in managing complex compliance tasks and ensuring accurate reporting.

Why I picked Empeon: It offers a scalable solution that fits the needs of large enterprises. The platform provides detailed benefits administration, helping your team manage ACA compliance efficiently. Empeon's reporting tools are designed to handle large data sets, making it ideal for big organizations. Its flexibility in adapting to various enterprise needs sets it apart.

Standout features & integrations:

Features include detailed benefits administration that helps your team manage complex compliance tasks. The platform's reporting tools are designed to handle large data sets efficiently. Empeon also offers flexibility in adapting to various enterprise needs, ensuring your compliance processes run smoothly.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Adapts to complex tasks

- Comprehensive benefits administration

- Flexible for various needs

- Handles large data sets

- Scalable for large enterprises

Cons:

- Can be resource-intensive

- Requires detailed data input

- Complex for small businesses

- Limited to large organizations

- May require extensive setup

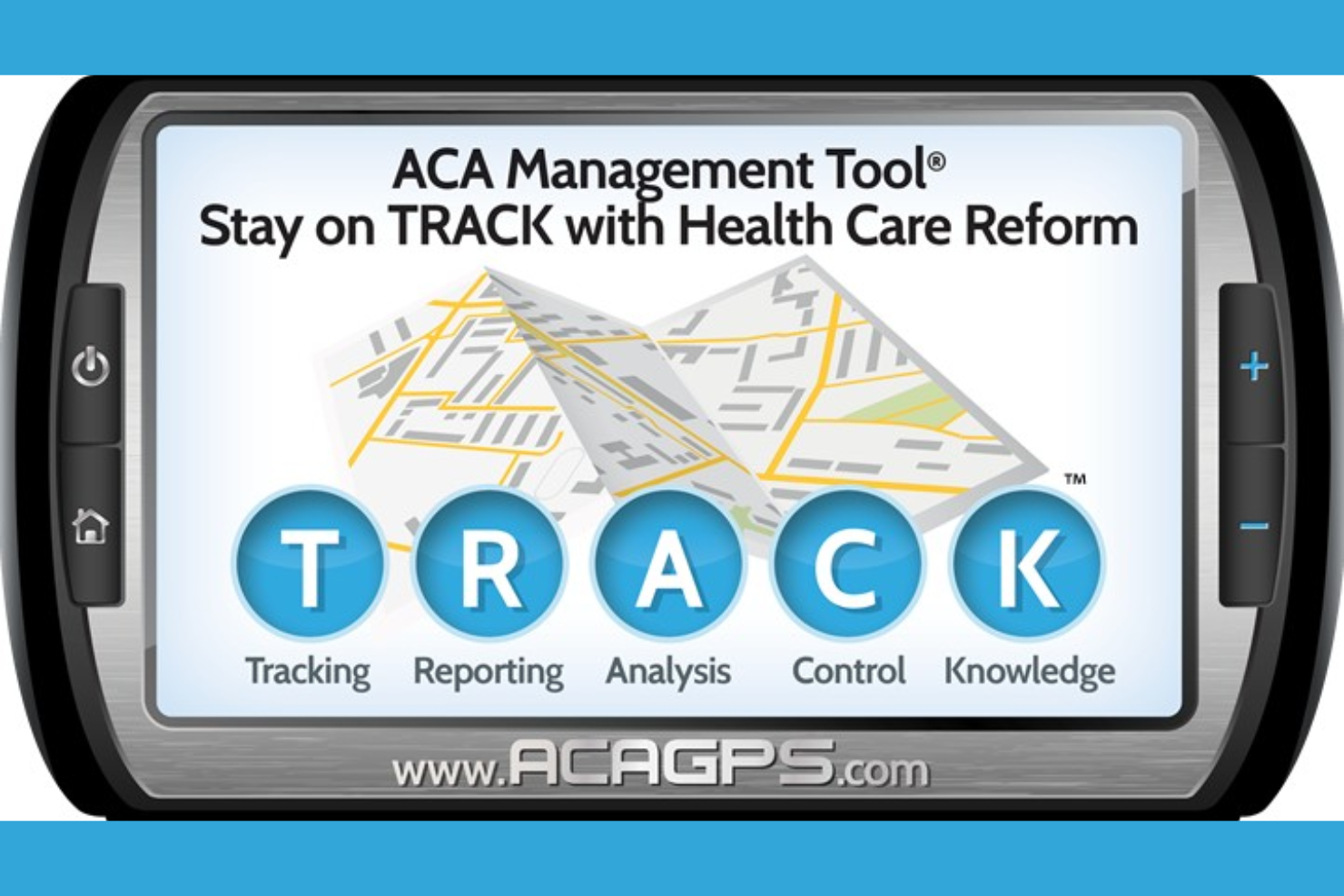

ACA GPS is a user-friendly ACA compliance software designed for organizations needing straightforward ACA reporting and tracking. It primarily serves HR departments looking for simplicity in managing ACA requirements without the hassle of complex software.

Why I picked ACA GPS: Its intuitive interface makes it easy for your team to navigate ACA compliance tasks. You can manage employee eligibility and generate necessary forms without extensive training. The dashboard provides clear insights into compliance status, helping you stay informed. ACA GPS also offers support for state filing, adding to its usability.

Standout features & integrations:

Features include an intuitive dashboard that gives clear insights into your compliance status, helping you track and manage ACA requirements efficiently. The software supports state filing, which is vital for organizations operating in multiple states. It also offers eligibility management to simplify your compliance tasks.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Clear compliance insights

- Minimal training required

- Supports state filing

- Easy eligibility management

- Intuitive user interface

Cons:

- Limited customization options

- Requires accurate data input

- Not ideal for large enterprises

- May lack advanced features

- Limited to ACA tasks

ACA Compliance and Reporting is a dedicated tool for managing ACA reporting and compliance needs efficiently. It serves HR professionals and organizations that require precise compliance management to avoid penalties.

Why I picked ACA Compliance and Reporting: It excels in ensuring compliance accuracy, which is crucial for avoiding costly penalties. The platform offers tools for detailed tracking and reporting, helping your team stay compliant with ACA regulations. Its real-time monitoring features provide insights into compliance status. The ability to generate accurate forms adds to its reliability.

Standout features & integrations:

Features include detailed tracking and reporting tools that help your team stay compliant. The platform offers real-time monitoring features, providing insights into your compliance status. It also includes form generation capabilities to ensure accuracy in reporting.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Helps avoid penalties

- Generates accurate forms

- Real-time monitoring features

- Detailed tracking tools

- Ensures compliance accuracy

Cons:

- Can be complex to manage

- Requires accurate data entry

- Not ideal for small businesses

- May require initial setup

- Limited to ACA tasks

ACA Software is a compliance solution tailored for businesses seeking affordable ACA reporting and management tools. It primarily serves small to medium-sized companies needing efficient and budget-friendly compliance solutions.

Why I picked ACA Software: It offers cost-effective plans that make ACA compliance accessible for smaller budgets. The platform simplifies form generation, ensuring your team can manage compliance tasks without overspending. Its tools for monitoring employee eligibility help you maintain compliance effortlessly. The focus on affordability doesn't compromise on essential features, making it a practical choice for many businesses.

Standout features & integrations:

Features include simplified form generation, allowing your team to handle compliance tasks efficiently. The platform offers tools for monitoring employee eligibility, helping you stay compliant with ACA regulations. Additionally, ACA Software provides user-friendly interfaces to ensure your team can navigate the system with ease.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Practical for budget-conscious companies

- User-friendly interfaces

- Monitors employee eligibility

- Simplifies form generation

- Affordable for small businesses

Cons:

- Limited customization options

- Requires accurate data input

- Not ideal for large enterprises

- May lack advanced features

- Limited to ACA tasks

Paycom (Enhanced ACA) is a compliance tool designed to automate ACA reporting and streamline HR tasks for businesses of all sizes. It primarily serves HR departments looking to reduce manual work and improve accuracy in ACA compliance.

Why I picked Paycom (Enhanced ACA): Its automated reporting feature minimizes manual entry, saving your team time and effort. The platform generates necessary forms and tracks compliance metrics automatically. It provides a centralized dashboard for managing ACA tasks efficiently. Real-time updates keep you informed about compliance changes.

Standout features & integrations:

Features include a centralized dashboard that allows your team to manage ACA tasks efficiently. The platform provides real-time updates, keeping you informed about compliance changes as they happen. It also generates necessary forms and tracks compliance metrics automatically.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Generates necessary forms

- Real-time compliance updates

- Centralized management dashboard

- Reduces manual entry

- Automates reporting tasks

Cons:

- Can be resource-intensive

- Requires accurate data entry

- Complex for small businesses

- Limited to ACA tasks

- May need initial setup time

SyncStream Solutions is a compliance software designed to help businesses manage ACA reporting and compliance needs. It primarily serves HR departments and organizations requiring customized solutions for their specific ACA challenges.

Why I picked SyncStream Solutions: It offers tailored solutions that adapt to your unique ACA compliance needs. You can customize ACA reporting, making it easier to address your specific situations. The platform provides tools for managing complex compliance requirements. Its ability to handle diverse client needs sets it apart.

Standout features & integrations:

Features include customizable reporting options that let you address unique compliance scenarios. The platform offers tools for handling complex ACA requirements, ensuring your team stays compliant. It also provides support for managing diverse client needs effectively.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Offers tailored solutions

- Adapts to unique compliance scenarios

- Supports diverse client needs

- Handles complex requirements

- Customizable reporting options

Cons:

- Can be complex to implement

- Requires detailed data input

- Not ideal for small businesses

- Limited to ACA tasks

- May require initial customization

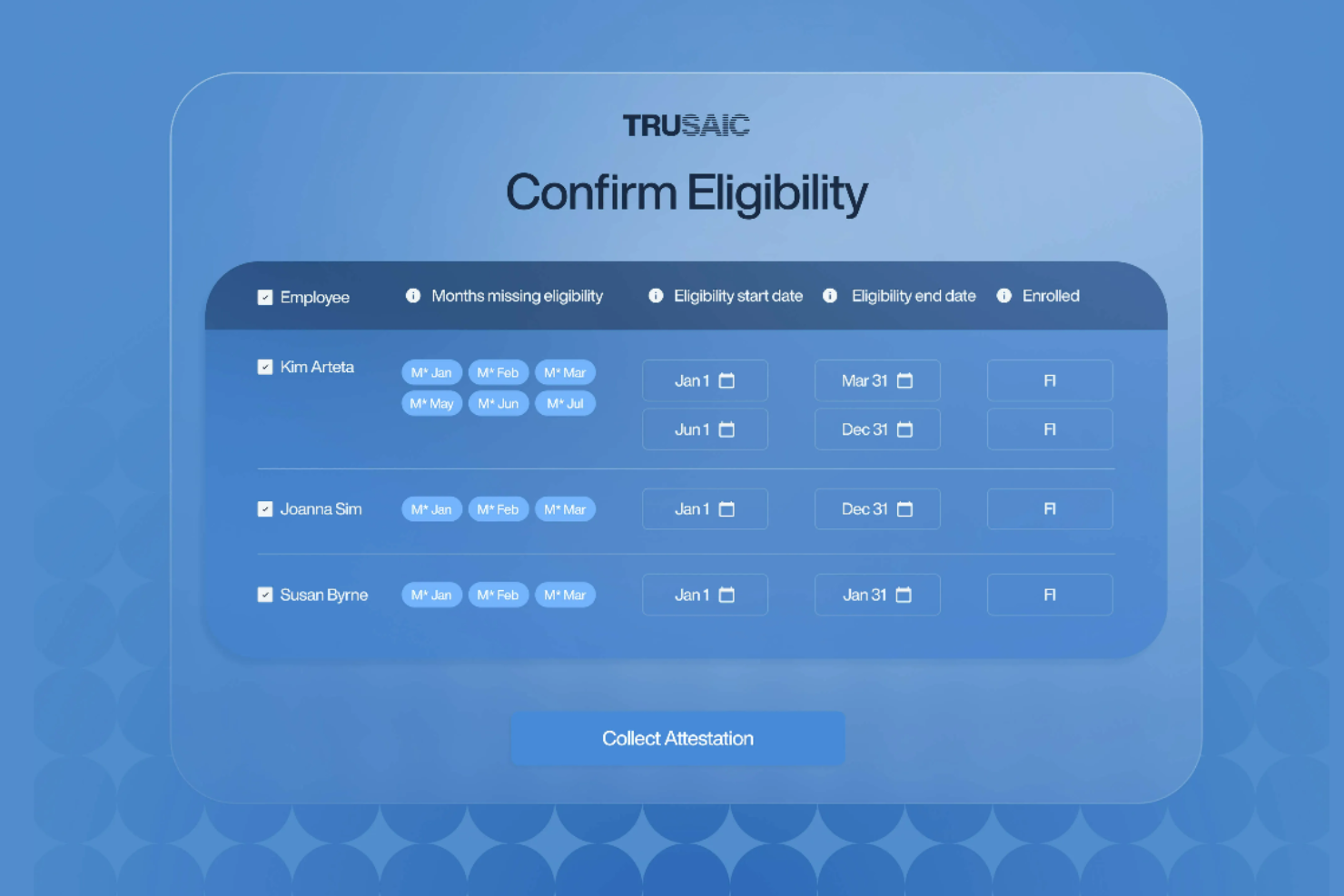

Trusaic is an ACA compliance solution focused on providing regulatory expertise and tailored compliance management. It serves businesses that require in-depth understanding and handling of ACA regulations to ensure compliance and avoid penalties.

Why I picked Trusaic: Its strong regulatory expertise offers your team guidance in navigating complex ACA requirements. The platform provides tailored compliance management to fit your specific needs. You can benefit from its detailed audit support, ensuring your compliance processes are thorough. Trusaic's focus on understanding and managing regulations sets it apart.

Standout features & integrations:

Features include detailed audit support, which ensures your compliance processes are thorough. The platform provides tailored compliance management to fit your specific needs. It also offers guidance in navigating complex ACA requirements, helping your team stay compliant.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Focuses on regulation understanding

- Helps navigate complex requirements

- Offers detailed audit support

- Provides tailored management

- Strong regulatory expertise

Cons:

- Can be resource-intensive

- Needs accurate data entry

- Not ideal for small businesses

- May require initial setup time

- Limited to ACA compliance

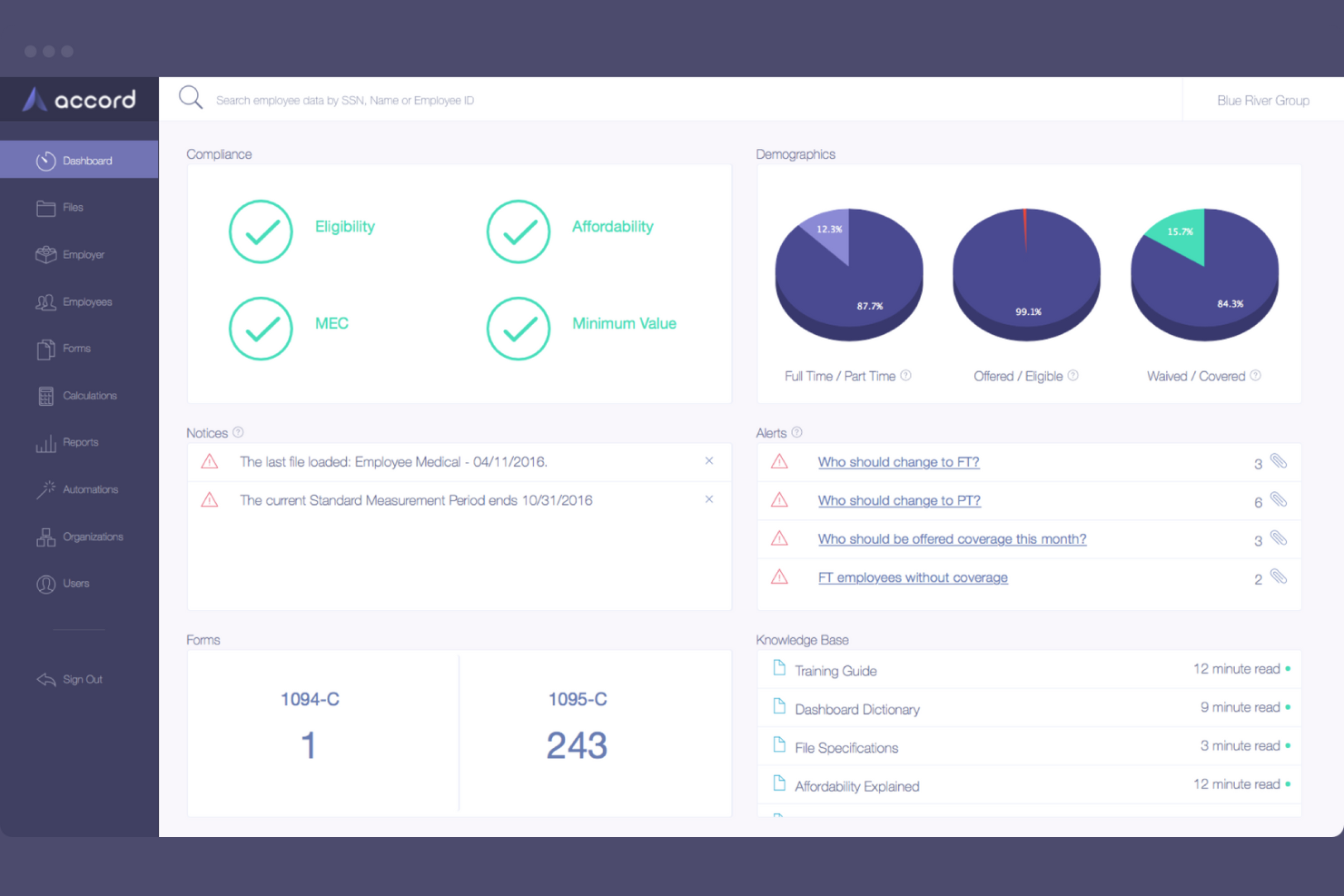

Accord is an ACA compliance software designed to assist small businesses with eligibility tracking, form generation, and accurate reporting. It caters to companies needing streamlined ACA processes without the complexity of larger systems.

Why I picked Accord: Its focus on small businesses means you get a tailored experience that fits your needs. The eligibility tracking feature helps you manage ACA fundamentals effectively. Accord's form generation ensures your 1094-C and 1095-C forms are accurate by assembling multi-source data efficiently. The Form Patrol feature prevents incorrect forms from being issued, saving your team time and stress.

Standout features & integrations:

Features include eligibility tracking, which helps you focus on ACA fundamentals and manage compliance. Form generation ensures your forms are accurate by assembling data from multiple sources. The Form Patrol feature examines code combinations to prevent incorrect forms from being issued.

Integrations include ADP, BambooHR, Gusto, QuickBooks, Sage, Workday, Zenefits, and Xero.

Pros and cons

Pros:

- Simple for non-experts

- Prevents incorrect forms

- Accurate form generation

- Easy eligibility tracking

- Tailored for small businesses

Cons:

- Focused on specific industries

- Requires accurate data input

- Not ideal for large enterprises

- May need initial setup help

- Limited to ACA compliance

Other ACA Compliance Software

Here are some additional ACA compliance software options that didn’t make it onto my shortlist, but are still worth checking out:

- Passport Software

For multi-state employers

- Paycor

For payroll integration

- WEX

For integrated services

- Heartland

For payroll solutions

- ONESOURCE

For tax compliance

- EmployeeTech

For user support

- Selerix

For benefits enrollment

- Medcom Benefits

For employer reporting

ACA Compliance Software Selection Criteria

When selecting the best ACA compliance software to include in this list, I considered common buyer needs and pain points like managing complex reporting requirements and ensuring timely filing. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Generate ACA forms

- Track employee eligibility

- Provide compliance reports

- Manage filing deadlines

- Offer error correction tools

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- State-specific compliance

- Real-time updates

- Advanced analytics

- Customizable dashboards

- Integration with payroll systems

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive interface

- Minimal learning curve

- Clear navigation

- Responsive design

- Ease of access to features

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Access to templates

- Interactive product tours

- Supportive chatbots

- Regular webinars

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 support availability

- Multiple contact options

- Knowledgeable staff

- Response time

- Comprehensive help resources

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Features included in base price

- Transparent pricing structure

- Discounts for annual billing

- Free trial availability

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction rating

- Commonly praised features

- Frequent complaints

- User recommendations

- Trends in feedback over time

How to Choose ACA Compliance Software

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

| Scalability | Will the software grow with your business? Consider if it can handle more employees or additional locations without a hitch. Look for solutions that adapt to your growth. |

| Integrations | Does it work with your existing systems? Check if it integrates with your payroll, HR, and accounting software to avoid manual data entry and ensure seamless operations. |

| Customizability | Can you tailor it to your needs? Evaluate if the software allows you to customize reports and dashboards to match your business processes and compliance requirements. |

| Ease of use | Is it user-friendly? Ensure your team can navigate it without extensive training. Look for intuitive interfaces and clear instructions to minimize the learning curve. |

| Implementation and onboarding | How smooth is the setup? Assess the time and resources needed to get started. Check if the vendor offers support, training materials, or onboarding assistance to help you. |

| Cost | Does it fit your budget? Compare the total cost, including setup fees and ongoing expenses. Look for transparent pricing and consider if it offers value for money. |

| Security safeguards | Is your data protected? Verify the software's security measures, such as encryption and access controls, to ensure compliance with data protection standards. |

What Is ACA Compliance Software?

ACA compliance software is designed to help businesses meet the requirements of the Affordable Care Act by managing reporting and tracking employee eligibility.

HR professionals, payroll managers, and compliance officers typically use these tools to ensure accurate reporting and avoid penalties.

Features like form generation, eligibility tracking, and compliance reporting help with managing complex requirements and maintaining accurate records. Overall, these tools simplify the compliance process, saving time and reducing the risk of errors.

Features of ACA Compliance Software

When selecting ACA compliance software, keep an eye out for the following key features:

- Form generation: Automates the creation of necessary ACA forms, ensuring accuracy and saving your team time.

- Eligibility tracking: Monitors employee status to help you stay compliant with ACA regulations.

- Compliance reporting: Provides detailed reports to track your compliance status and identify any areas that need attention.

- Real-time updates: Keeps you informed of any changes in compliance requirements, so you can react promptly.

- Customizable dashboards: Allows you to tailor the interface to fit your business needs and streamline your workflow.

- Integration capabilities: Ensures seamless data flow between your existing systems like payroll and HR software.

- Security safeguards: Protects sensitive employee data with encryption and access controls, ensuring compliance with data protection standards.

- Audit support: Offers tools and resources to help you prepare for and manage audits effectively.

- State-specific compliance: Manages varying regulations across different states, essential for businesses with multi-state operations.

- Training resources: Provides videos, webinars, and other materials to help onboard your team and ensure they use the software effectively.

Benefits of ACA Compliance Software

Implementing ACA compliance software provides several benefits for your team and your business. Here are a few you can look forward to:

- Time savings: Automates form generation and reporting tasks, freeing up your team to focus on other priorities.

- Error reduction: Ensures accuracy in data entry and compliance reporting, minimizing the risk of costly mistakes.

- Regulatory compliance: Keeps you up-to-date with real-time updates on ACA requirements, helping you maintain compliance effortlessly.

- Data security: Protects sensitive information with strong security safeguards, ensuring your data stays confidential.

- Improved decision-making: Provides detailed compliance reports and insights, helping you make informed decisions about your workforce.

- Scalability: Adapts to your business growth, allowing you to manage compliance as your employee count increases.

- Multi-state management: Handles varying state regulations, making it easier for businesses operating in multiple locations to stay compliant.

Costs and Pricing of ACA Compliance Software

Selecting ACA compliance software requires an understanding of the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes common plans, their average prices, and typical features included in ACA compliance software solutions:

Plan Comparison Table for ACA Compliance Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic reporting, limited data storage, and basic support. |

| Personal Plan | $10-$30/user/month | Form generation, eligibility tracking, compliance alerts, and email support. |

| Business Plan | $40-$70/user/month | Advanced reporting, integration capabilities, audit support, and phone support. |

| Enterprise Plan | $80-$150/user/month | Customizable dashboards, multi-state compliance, dedicated account manager, and 24/7 support. |

ACA Compliance Software FAQs

Here are some answers to common questions about ACA compliance software:

How does ACA compliance software help with tracking employee hours?

ACA compliance software automates the tracking of employee hours, especially for part-time and variable-hour employees. This ensures you determine eligibility accurately and avoid penalties. The software consolidates data from payroll and HR systems, offering a seamless tracking process.

What should employers consider when choosing a third-party provider for ACA compliance?

Consider the provider’s upfront costs, data format compatibility, and support level. ACA compliance software should offer robust data security to protect employee information. Evaluate if the provider can integrate with your payroll and HR systems for seamless data management.

How does ACA compliance software handle data security?

ACA compliance software adopts best practices to protect employee data, ensuring compliance with data privacy laws. It encrypts sensitive information and controls access, safeguarding against unauthorized breaches. This is crucial for maintaining employee trust and avoiding legal issues.

Can ACA compliance software help with IRS form submissions?

Yes, most ACA compliance platforms generate and electronically file IRS forms 1094-C and 1095-C directly from the system. They often provide templates and pre-filled forms to simplify the process. Some include built-in error checking to ensure the information meets IRS standards before submission. This not only speeds up the process but also minimizes the risk of costly filing errors.

What’s Next:

If you're in the process of researching ACA compliance software, connect with a Software Select advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.