10 Best Expense Management Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Get free help from our HR software advisors to find your match.

Selecting the right expense management software can be challenging, but I’m here to simplify this process for you. The software streamlines expense tracking and reporting, ensures compliance and financial transparency, and primarily addresses the pain points of manual data entry, policy enforcement, and reconciling expenses. Lean on my experience and find the right expense management system for your business needs.

Why Trust Our HR Software Reviews

We’ve been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and challenging it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions. We’ve tested over 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Expense Management Software: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top expense management software selections to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for SMS receipt and card sync | Free demo available | From $11.99/user/month | Website | |

| 2 | Best for setting budget limits | Free trial available | From $499/month | Website | |

| 3 | Best for automated approval workflows | Free demo available | From $8/user/month (billed annually) | Website | |

| 4 | Best for automated expense reporting | Free demo available | From $15/user/month | Website | |

| 5 | Best for managing multi-currency accounts | Free trial available | Pricing upon request | Website | |

| 6 | Best for small businesses | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 7 | Best for automated expense data extraction | Free demo available | From $5.20/user/month | Website | |

| 8 | Best for accounts payable automation | Free demo available | Pricing upon request | Website | |

| 9 | Best for user experience | Free plan available | Pricing upon request | Website | |

| 10 | Best for auto-scanning receipts | Free demo available | From $4/user/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3

Best Expense Management Software Reviews

Dive into my comprehensive reviews to explore the strengths and weaknesses of leading expense management software. I’ll detail their features, benefits, and ideal scenarios to help you find the perfect fit for your business needs.

Fyle is an expense management software that helps you track receipts and reconcile card transactions as soon as they happen. You can text receipts directly to Fyle and the system automatically matches them to the correct credit card spend, no new card required. This can help you reduce the time spent on manual entry and track company expenses without relying on employees to log into a separate platform.

Why I picked Fyle: I picked Fyle because it simplifies receipt tracking at the moment of purchase. You can text a photo of your receipt to Fyle, and the system automatically pulls out the key expense details. This makes it easier to capture receipts in real-time instead of waiting for employees to upload them later. Fyle also sends real-time alerts for credit card transactions, so you can see spending as it happens and start reconciling right away.

Standout features & integrations:

Features include AI-powered expense coding, automated policy violation alerts, and budget tracking by department or project. You can also configure approval workflows to match your internal processes, reducing back-and-forth during reviews. Fyle supports real-time reconciliation on your existing business credit cards, so you can match transactions without issuing new ones. It also offers a mobile app and centralized storage to help your team stay audit-ready.

Integrations include NetSuite, Sage Intacct, Xero, QuickBooks Online, QuickBooks Desktop, Sage 300 CRE, TravelPerk, Bamboo HR, Gmail, Outlook, and Slack.

Pros and cons

Pros:

- Real-time credit card reconciliation

- AI-powered expense categorization

- Text-based receipt capture

Cons:

- Limited customization for complex cases

- Auto-filing speed may vary

Precoro is a cloud-based platform designed to help businesses manage their procurement and spending processes.

Why I picked Precoro: One of the reasons I chose Precoro is its comprehensive expense module. Its features allow you to monitor corporate expenditures, speed up billing cycles, and reimburse employee expenses within a single system. You can also set budget limits for projects, departments, and locations, and monitor spending against these budgets. The system provides immediate notifications when purchases surpass allocated budgets, helping to prevent overspending.

Standout features & integrations:

Standout features include a customizable approval workflow that allows businesses to set up multi-level approvals based on their organizational structure. This ensures that all expenses are reviewed and approved by the appropriate personnel. Precoro also offers advanced reporting capabilities, enabling users to generate interactive reports using various filters and custom fields.

Integrations include QuickBooks Online, NetSuite, Xero, Google, Power BI, Slack, and HiBob.

Pros and cons

Pros:

- Subscription management tools

- Customizable approval workflows adapt to various business needs

- Real-time budget monitoring

Cons:

- Occasional challenges with data configuration

- Could offer more native integrations

Rippling is a workforce management platform that integrates HR, IT, and finance into a unified system. It enables companies to manage payroll, employee benefits, expenses, device management, and app provisioning all in one place.

Why I picked Rippling: The platform's expense management module allows businesses to automate and control spending with granularity. Users can set up automated approval workflows, generate detailed expense reports, and gain real-time visibility into company spending. Additionally, Rippling supports various payment methods and integrates with corporate cards and bill pay systems, ensuring all expenses are tracked and managed from a single interface.

Standout features & integrations:

Standout features include its Workflow Studio which allows businesses to create custom triggers and automate complex workflows using employee and app data. Another notable feature is the role-based policies, which enable organizations to enforce company rules automatically based on employee attributes such as level and location. It also supports global payroll capabilities.

Integrations include PayPal, 1Password, YubiKey, Carta, Zendesk, and various HR, finance, and IT applications.

Pros and cons

Pros:

- Employee self-service options

- Automated workflow features

- Comprehensive features for various operations

Cons:

- Potential learning curve when maximizing the platform's features

- Initial setup can be time-consuming

Ramp is an AI-powered spend management platform that streamlines expense reporting, travel booking, reimbursements, and policy enforcement—automatically.

Why I picked Ramp: I selected Ramp for its intelligent automation that removes the need for manual expense reports altogether. Expenses are submitted the moment a transaction occurs, with receipts matched, memos added, and policies enforced automatically. This means finance teams can focus on strategic decisions instead of chasing receipts.

Ramp also stood out for its global reimbursement support and tight ERP integrations. It processes payments in over 70 countries and supports 40+ currencies, making it a strong choice for multinational teams. With direct syncing to platforms like NetSuite and QuickBooks, it ensures accurate reporting and reduces the time to close the books each month.

Standout features & integrations:

Standout features include real-time expense tracking, AI-powered fraud detection, automated reimbursements, policy controls by merchant or category, travel booking tools, and receipt matching. Ramp also supports corporate cards with built-in spend controls and integrates expense, travel, and procurement into one cohesive platform.

Integrations include NetSuite, Sage, Xero, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Uber, Lyft, Okta, Google, Rippling, and Gmail.

Pros and cons

Pros:

- Automated expense reporting and receipt matching

- Ability to issue multiple virtual cards with customizable controls

- Comprehensive reporting features

Cons:

- Could offer more advanced accounting features

- Mostly focuses on accounts payable and spend management

New Product Updates from Ramp

Vendor Approval Workflows in Ramp

Ramp's new vendor approval workflows allow teams or managers to review new vendors, ensuring compliance with procurement policies and preventing unauthorized entries. For more details, visit Ramp Announcements.

Airwallex is a global payments and financial platform designed to help businesses manage international operations efficiently. It offers a comprehensive suite of tools including multi-currency business accounts, high-speed international transfers, and multi-currency corporate cards.

Why I picked Airwallex: I selected Airwallex for its ability to manage both virtual and physical company and employee cards, which support multiple currencies. This is particularly beneficial for businesses operating on a global scale, as it allows for tracking and managing expenses incurred in different countries. Its expense-tracking capabilities also include real-time spend visibility all integrated into one platform.

Standout features & integrations:

Standout features include local currency accounts with local bank details, international transfers, borderless cards, and automated domestic and international bill payment workflows.

Integrations include popular accounting tools like Xero, QuickBooks, NetSuite, Zoho Books, Sage, and Odoo, ecommerce marketplaces like Amazon and TikTok Shop, and platforms like Shopify, WooCommerce, Lazada, Shopee, and Magento.

Pros and cons

Pros:

- Offers robust APIs that facilitate integration with other financial tools

- Supports transactions in multiple currencies

- Provides virtual cards for supplier payments and employee expenses

Cons:

- Lacks detailed control features for user approval roles

- Not all features and services are available in every region

Xero streamlines expense management for small businesses with its comprehensive features. It is the best for small businesses due to its tailored financial tools and services.

Why I picked Xero: I selected Xero for its strong reputation among small business accounting software. Its focus on simplifying accounting for smaller operations and providing essential financial tools makes it a standout choice. Xero is best for small businesses because it delivers a suite of features that directly address the unique challenges faced by small business owners in managing their finances.

Standout features & integrations:

Standout features include easy invoice creation, expense claims, bank reconciliation, and detailed financial reporting. These tools are crucial for small businesses to maintain control over their finances.

Integrations include Hubdoc, Gusto, Stripe, PayPal, WorkflowMax, Square, Expensify, Vend, Deputy, and Shopify.

Pros and cons

Pros:

- Extensive integration options with other tools

- Comprehensive financial management features

- Tailored specifically for small business needs

Cons:

- Higher-tier plans are required for additional features

- Limited invoices and bills on the Early plan

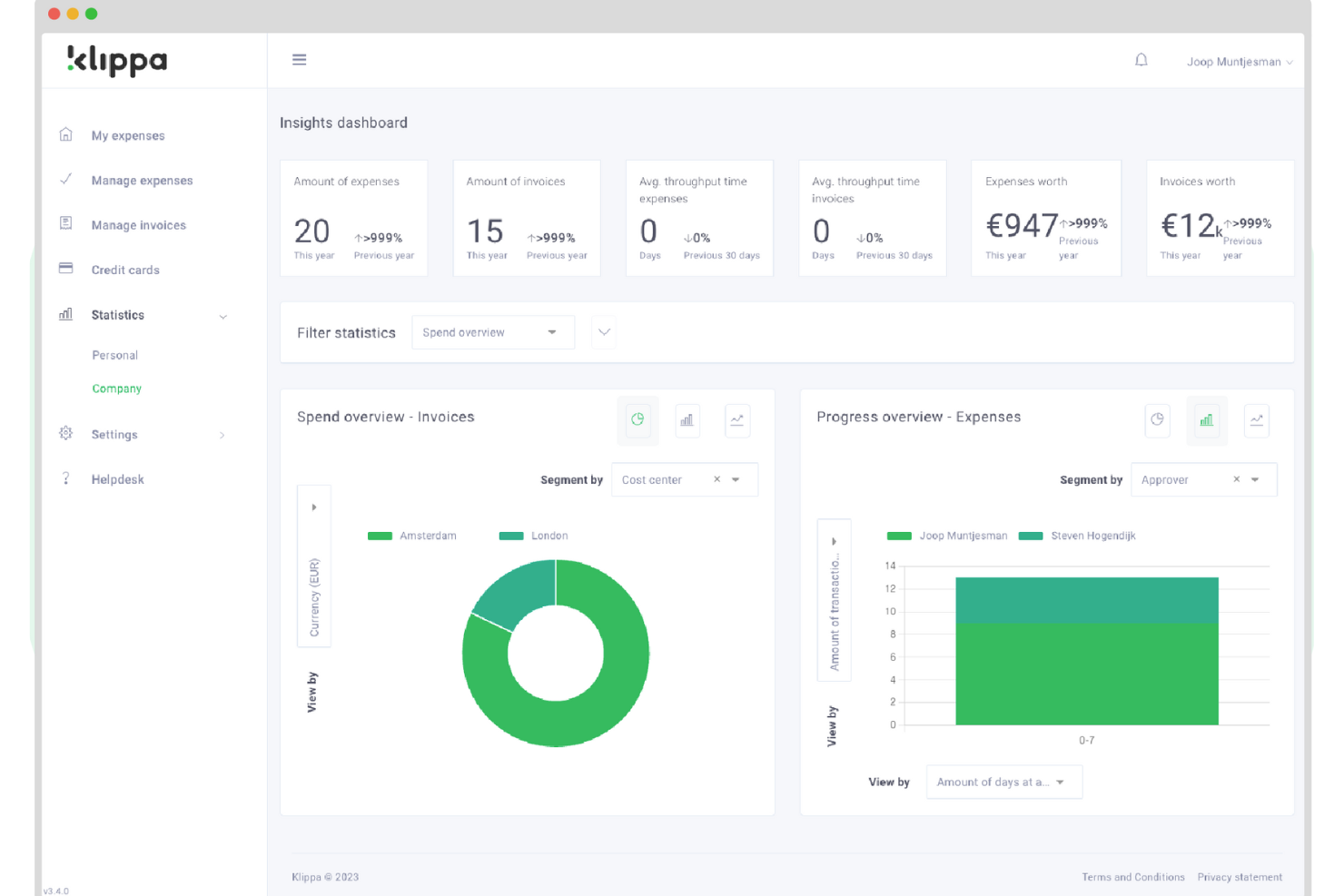

Klippa SpendControl is a cloud-based solution designed to simplify how you handle business expenses. By leveraging advanced technologies, it automates the process of submitting, approving, and processing expenses, reducing the time and effort required for these tasks.

Why I picked Klippa SpendControl: I like its use of optical character recognition (OCR) technology. This feature automatically extracts data from receipts and invoices, eliminating the need for manual data entry and reducing errors. Additionally, Klippa offers customizable approval workflows, enabling you to set up multi-level authorization processes that align with your company's policies. Additionally, the dashboard feature provides a real-time overview of all expenses, so you're always aware of where your money's going and can make informed decisions quickly.

Standout features & integrations:

Standout features include fraud detection to maintain integrity over your expense management process, the ability to convert foreign currencies based on daily rates or set your own rate, integration with Google Maps for accurate mileage claims, and the option to export data in various formats such as XLSX, CSV, XML, UBL, and PDF.

Integrations include AFAS Software, SAP, Exact Online, Odoo, Twinfield, Oracle Netsuite, Xero, Okta, QuickBooks, and Microsoft Entra ID.

Pros and cons

Pros:

- Effective fraud detection through duplicate claim identification

- Customizable approval workflows

- Efficient OCR technology reduces manual data entry

Cons:

- Most integrations are add-ons

- Initial setup may require time

Airbase is a comprehensive spend management platform that simplifies expense management, accounts payable (AP), and corporate card spending.

Why I picked Airbase: I chose Airbase for the list because of its robust AP automation capabilities that significantly reduce manual work and improve accuracy in financial operations. Its comprehensive suite of tools and features offers unmatched consolidation and control, making it an ideal choice for businesses looking to automate their accounts payable processes. It automates the entire procure-to-pay cycle and integrates seamlessly with accounting systems, ensuring that all financial data is synchronized and up-to-date.

Standout features & integrations:

Standout features include AI-powered automation for expense management, real-time reporting, and an automatic audit trail that ensures compliance and control. Its receipt management system and mobile app enhance the user experience by allowing for easy submission and tracking of expenses.

Integrations are available natively with a variety of systems, including NetSuite, Sage Intacct, QuickBooks, Microsoft Dynamics, HRIS, Jira, Ironclad, DocuSign, Asana, Slack, TravelPerk, SSO. It supports over 70 ERP systems through its ERP Integration API. Additionally, it offers credit card integration with American Express and Silicon Valley Bank Card.

Pros and cons

Pros:

- Seamless integration with major accounting systems and other business tools

- Real-time visibility into all company spending, enhancing financial control

- Comprehensive AP automation that streamlines the entire procure-to-pay cycle

Cons:

- The platform's extensive features may present a learning curve for new users

- Pricing information is not readily available

Navan is a sophisticated expense management solution that simplifies business expense tracking, reporting, and reconciliation. It integrates travel and expense management into a unified platform, making it a versatile tool for companies that require detailed financial oversight and real-time operational control.

Why I picked Navan: I selected Navan for its user-friendly user interface and various integration capabilities, which stand out from other expense management tools. Navan is renowned for its user-centric design, which facilitates an intuitive user experience, making it the best choice for businesses prioritizing ease of use and efficient process management. This emphasis on user experience is particularly beneficial for frequent travelers and finance teams who handle extensive expense reporting.

Standout features & integrations:

Standout features include real-time expense tracking, automated policy compliance alerts, and the ability to manage expenses directly from a mobile app. These features ensure that expenses are tracked and managed efficiently, adhering to company policies without constant manual oversight. Additionally, Navan supports integration with major ERP systems like SAP and Oracle, enhancing its functionality within diverse IT ecosystems.

Integrations are available natively with significant platforms such as SAP, Oracle, Xero, Salesforce, Slack, Okta, Zoom, and Microsoft Teams.

Pros and cons

Pros:

- User-friendly mobile app for on-the-go management

- Real-time visibility into expenditures

- Integrated travel and expense management features

Cons:

- Pricing is not transparent and needs to be confirmed directly for specific features or tiers

- Dependent on third-party integrations for full functionality, which might be a concern for companies with highly customized systems

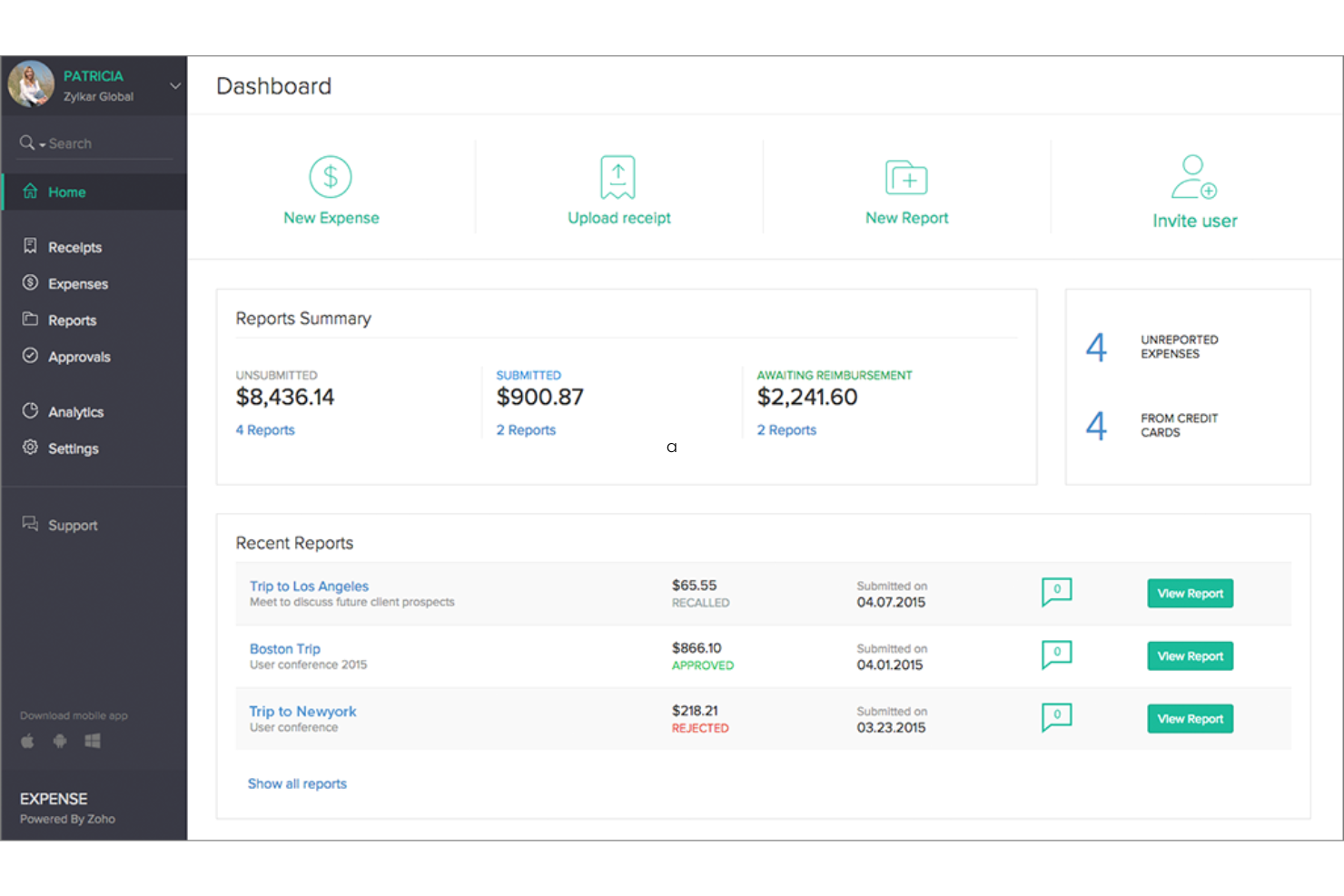

Zoho Expense is an expense management tool that automates expense recording and tracking.

Why I picked Zoho Expense: I selected Zoho Expense for this list due to its exceptional receipt scanning capability, which sets it apart from other expense management tools. I determined it to be the best for auto-scanning receipts as it offers a streamlined approach to digitizing and organizing receipts, making expense reporting more efficient.

Standout features & integrations:

Zoho Expense excels with features like automatic receipt scanning, multi-currency expenses, and integration with accounting software. It simplifies expense report creation and provides real-time expense tracking.

Integrations are available natively with Zoho Books, Zoho CRM, Zoho Invoice, Zoho People, QuickBooks Online, QuickBooks Desktop, Slack, Office 365, G Suite, and Salesforce.

Pros and cons

Pros:

- Direct integration with multiple Zoho products

- Multi-currency and multi-organization support

- Efficient receipt scanning and data extraction

Cons:

- Additional charges for extra users beyond the plan limit

- Requires a minimum of 3 users for the starting plan

Other Expense Management Software To Consider

Below is a list of additional expense management software that I shortlisted. Even though they didn’t make it into my top 10 list, they’re still worth checking out:

- Webexpenses

For mileage tracking

- Rydoo

For managing travel expenses

- ExpenseOnDemand

For global scalability

- Expensify

For real-time data syncing

- SAP Concur Expense

For integrated travel

- NetSuite

For project tracking

- Emburse

For policy compliance

- Float

For real-time budget tracking

- Happay

For integrated corporate cards

- Paylocity

For payroll integration

Selection Criteria for Expense Management Software

Selecting expense management software requires a thorough understanding of the functionality and specific use cases most critical for businesses. The criteria for choosing this software should align with buyer needs, addressing common pain points such as tracking expenses efficiently, ensuring compliance with company policies, and integrating with existing financial systems. As an HR expert with extensive experience using and researching these tools, I’ve developed a set of essential criteria when evaluating expense management solutions.

Core Expense Management Software Functionalities (25% of total score): To be considered for inclusion in my list of the best expense management software, each solution had to fulfill these common use cases first:

- Real-time expense tracking

- Receipt capture and storage

- Expense report submission and approval workflow

- Policy compliance management

- Integration with accounting and payroll systems

Additional Standout Features (25% of total score): To help me find the best expense management software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Innovative dashboard and analytics tools for better expense visibility

- Mobile app capabilities (for Android and iOS devices) that enhance on-the-go expense reporting

- AI-powered features for automatic categorization and fraud detection

- Multi-currency and multi-language support for global businesses

- Integration with travel booking systems for streamlined travel expense management

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive navigation and user interface that minimizes the learning curve

- A clear and concise layout that facilitates quick data entry and retrieval

- Responsive design that ensures functionality across various devices and platforms

- Visual cues and guidance that help users perform tasks more efficiently

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Comprehensive training materials such as videos and user guides

- Interactive product tours that demonstrate key features and workflows

- Template libraries that help new users get started quickly

- Support channels like chatbots and webinars that provide real-time assistance

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Availability of 24/7 support through multiple channels (phone, email, chat)

- A knowledgeable and responsive support team that resolves issues promptly

- Community forums where users can share solutions and best practices

- Regular updates and clear communication about new features and fixes

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models that align with the features offered

- Flexible plans that cater to businesses of different sizes and needs

- Free trials or demos that allow for hands-on evaluation before purchase

- Cost-benefit analysis comparing the software's efficiency gains against its price

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Consistent positive feedback across various user demographics

- High ratings for specific features that are critical to expense management

- Testimonials that highlight the software's impact on business processes

- Constructive criticism and how the company addresses user concerns

How To Choose Expense Management Software

Expense management software can help you speed up your expense reimbursement process and get you out of your Excel spreadsheets. To help you figure out the best expense management software for your needs, you need to pinpoint your key users and document their specific challenges first.

As you work through your unique software selection process, keep the following points in mind:

- Integration Capabilities: Ensure that the expense management software seamlessly integrates with your existing systems, such as accounting software, enterprise resource planning (ERP), payroll, and other HR systems. This integration is crucial for automating data transfer and reducing manual entry errors. For instance, if your company uses QuickBooks for accounting, the expense software should be able to sync with it to streamline financial reporting.

- User-Friendly Interface: The software should have an intuitive and easy-to-navigate user interface. This is important because it reduces the learning curve for employees and encourages compliance with expense reporting procedures. A user-friendly mobile app, for example, allows employees to submit expenses on the go, which is particularly useful for sales teams or consultants who travel frequently.

- Customization and Scalability: The software should be customizable to fit your company's specific policies and scalable to grow with your business. This means it should allow for custom approval workflows, spending limits, and expense categories. A small startup might need basic features at first but should be able to add more complex controls as it expands.

- Compliance and Security: The software must adhere to tax laws and regulations for expense reporting in your region. It should also provide robust security measures to protect sensitive financial data. For a multinational corporation, this means the software should be capable of handling multiple currencies and tax regulations while keeping data secure across borders.

- Analytical and Reporting Tools: Look for software that offers comprehensive analytics and reporting features. These tools can help you gain insights into spending patterns and help with budgeting and forecasting. For example, a non-profit organization could configure these features to ensure that spending aligns with grant restrictions or donor stipulations.

Trends for Expense Management Software in 2025

Expense management software is evolving rapidly. Here are the key trends shaping its future:

- Integration with AI for Predictive Analytics: Artificial intelligence is integrated into expense management software to provide predictive analytics. This trend allows for better budget forecasting and fraud detection. It's important because it helps businesses proactively manage their spending.

- Real-Time Expense Tracking: Real-time expense tracking is becoming a standard feature. This allows for immediate visibility and control over expenditures. It's interesting as it enables quicker decision-making and policy enforcement.

- Enhanced Mobile Experience: The mobile experience for expense management is significantly enhanced. Users can now manage expenses anytime, anywhere, with greater ease. This is important for the growing mobile workforce that relies on convenience and accessibility.

- Automated Compliance Checks: Expense management software is increasingly incorporating automated compliance checks. This ensures that expense claims adhere to company policies and external regulations. It's progressive because it reduces the risk of non-compliance and associated penalties.

- Personalized User Dashboards: Personalized dashboards are being offered by expense management tools. These dashboards provide tailored insights and a user-friendly interface. This unique trend improves user engagement and the overall expense management process.

In conclusion, these trends are setting the stage for a more efficient and user-centric approach to expense management in 2025.

What is Expense Management Software?

Expense management software is a digital tool designed to streamline the tracking, approving, and reimbursing of employee-incurred expenses. Businesses of all sizes use it to manage and control their spending, ensuring that expenses are legitimate, necessary, and within company policy.

The software typically includes expense reporting, policy enforcement, receipt tracking, and reimbursement processing features. It simplifies financial record-keeping and provides insights into spending patterns, helping companies to make informed budgeting decisions.

Features of Expense Management Software

When selecting expense management software, it's essential to consider the features that will streamline and enhance the financial operations of your business. The right features can simplify the expense reporting process, ensure compliance with company policies, and provide valuable insights into spending patterns. Here are the most important features to look for:

- Receipt Capture: This feature allows users to capture receipts using their mobile devices digitally. It's crucial for reducing paperwork and making the expense reporting process more efficient.

- Multi-Currency Support: With this, the software can handle transactions in different currencies. It is important for businesses with global operations to accurately track and reimburse expenses in the local currency of their employees.

- Mileage Tracking: This feature automates the calculation of mileage reimbursement. It is essential for companies with employees who travel frequently to ensure accurate expense reporting for travel.

- Policy Compliance: This feature is important to prevent fraudulent claims and ensure all expenses are legitimate and within company guidelines.

- Approval Workflow: This establishes a clear expense report submissions and approvals process. It is important for maintaining control over expenses and ensuring timely reimbursements.

- Integration Capabilities: The ability to integrate with other financial systems and software is important for a seamless data flow across different business platforms, reducing manual data entry and errors.

- Real-Time Analytics: This feature provides insights into spending patterns and trends, which is important for making informed decisions about company finances and budgeting.

- Mobile Accessibility: Allows users to submit and manage expenses on the go. This is important for convenience and ensuring that expense reporting can happen anytime, anywhere.

- Customizable Reports: The software can generate tailored reports for different needs. This is important for providing stakeholders with relevant financial data and strategic planning.

- Data Security: Ensures that all financial data is securely stored and managed. This is crucial for protecting sensitive information and maintaining trust in the expense management process.

These features collectively create a robust expense management system that simplifies the expense reporting process and provides strategic value to the organization. They ensure the business can manage its expenses effectively while maintaining transparency and control over its financial operations.

Benefits of Expense Management Software

Expense management software is a powerful tool that can transform how organizations handle their financial processes. By automating and streamlining expense reporting, tracking, and reimbursement, these systems offer a range of benefits that can lead to cost savings, compliance, and improved operational efficiency. Here are several benefits that users and organizations can expect from implementing expense management software:

- Streamlined Expense Reporting: Simplifies the submission process. Expense management software allows employees to easily submit expenses, often through mobile apps, which can significantly reduce the time and effort required compared to manual methods.

- Real-Time Expense Tracking: Offers visibility into spending. Users can monitor expenses as they occur, providing businesses with immediate insights into their financial outgoings and helping to manage budgets more effectively.

- Enhanced Policy Compliance: Enforces company spending policies. The software can be configured to flag or reject expenses that don't comply with company policies, reducing the risk of fraudulent claims and ensuring budget adherence.

- Efficient Reimbursement Process: Accelerates employee reimbursements. By automating the approval workflow, expense management software speeds up the reimbursement process, increasing employee satisfaction and reducing administrative workload.

- Data-Driven Decision Making: Facilitates strategic planning. The analytics and reporting features of expense management software provide valuable data that can inform strategic business decisions, helping to identify cost-saving opportunities and optimize spending patterns.

Adopting expense management software can be a game-changer for businesses looking to enhance their financial operations. With these benefits, organizations can expect to save time and money and gain valuable insights that drive smarter spending decisions.

Costs & Pricing of Expense Management Software

Expense management software is critical for businesses of all sizes to track and manage their spending efficiently. These software solutions come in various plans to cater to different business needs and budgets.

Understanding the plan options and their pricing is essential for software buyers new to this type of software, as it helps them make an informed decision that aligns with their financial capabilities and business requirements.

Plan Comparison Table for Expense Management Software

| Plan Type | Average Price | Common Features |

| Free | $0 | - Basic expense tracking- Receipt scanning- Mobile app access- Limited reporting features |

| Standard | $8 - $15 per user/month | - Advanced expense tracking- Integration with accounting software- Multi-level approvals- Customizable policies and controls |

| Professional | $15 - $30 per user/month | - Everything in Standard- Corporate card reconciliation- Advanced reporting and analytics- Increased data storage and security features |

| Enterprise | Custom pricing | - Everything in Professional- VIP support- Custom integrations and workflows- Dedicated account management |

When considering which plan to choose, software buyers should evaluate the specific needs of their business and the level of support and customization they require. Scalability and integration capabilities are also important factors to consider as the business grows.

Depending on your needs, you may be able to start with an expense management tool on a small business plan, then hold off on scaling up until you actually need it.

Expense Management Software FAQs

Here are some answers to frequently asked questions you may have about expense management software and how it works:

How can expense management software improve financial processes for businesses?

Expense management software streamlines the process of tracking, submitting, and reimbursing employee expenses, reducing the need for manual data entry and minimizing errors. This can lead to faster reimbursement times and improved spending patterns visibility, helping businesses manage their budgets better.

What are the key features to look for in expense management software?

Key features include automated receipt capture, integration with accounting software, real-time expense reporting, policy compliance checks, multi-currency support, and mobile accessibility. These features help ensure the software can handle various aspects of expense management efficiently.

Can expense management software help with tax compliance?

Yes, many expense management tools include features that assist with tax compliance, such as tracking deductible expenses, managing VAT or GST, and preparing reports that can be used for tax filing purposes. This helps businesses maintain accurate records and potentially reduce their tax liabilities.

Is cloud-based expense management software secure?

Cloud-based expense management solutions typically offer strong security measures, including data encryption, secure data centers, and compliance with regulations like GDPR. However, reviewing the provider’s security policies is important to ensure they meet your company’s standards.

How does expense management software handle different currencies and international travel expenses?

Most expense management software supports multiple currencies and automatically converts transactions to a home currency. They also allow for custom rules for different countries, making it easier for businesses with international operations to manage travel expenses accurately.

What kind of support can I expect with expense management software?

Support options vary by provider but often include online help centers, live chat support, phone support, and email. Some providers also offer dedicated account managers and onboarding assistance to help companies set up and optimize their use of the software.

How does expense management software integrate with other business systems?

Expense management software typically integrates with various business systems, including ERP, HR, payroll, and accounting. These integrations allow for seamless data flow across platforms, improving efficiency and data accuracy.

What is the average cost of expense management software?

Pricing for expense management software can vary widely based on features, the number of users, and additional services offered. Some providers offer a basic service for a monthly fee per user, while others may have tiers or custom pricing based on the scale and specific needs of the business.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.