Paylocity Review: Pros, Cons, Features & Pricing

In this review, I'm going to share my analysis and evaluation from hands-on experience with Paylocity, a popular cloud-based payroll and HR software solution for small and mid-sized businesses. But first, if you're just beginning your search for the best payroll software, check out my picks of the top payroll solutions on the market.

You probably already know Paylocity is among the most widely used payroll platforms available, but you need to better understand what's good—and not so good—about it. This in-depth Paylocity review will walk you through the pros and cons, features, and functionality, to help guide you to better understand its capabilities and suitability for your specific business needs and scenario.

Paylocity Evaluation Summary

- Pricing upon request

- Free demo available

Why Trust Our Software Reviews

Paylocity Overview

pros

-

In addition to software, the company has a team of dedicated reps to support your payroll, tax, and garnishment processes.

-

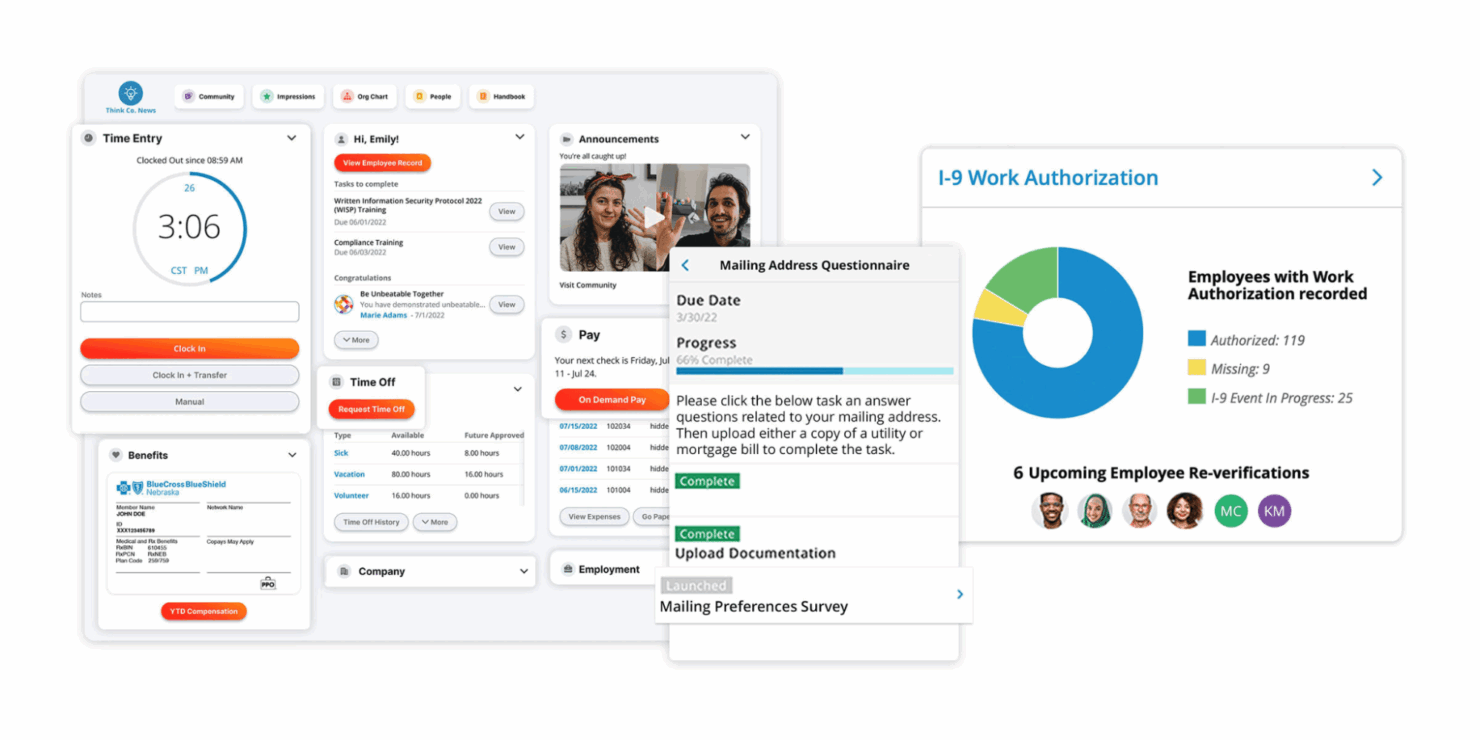

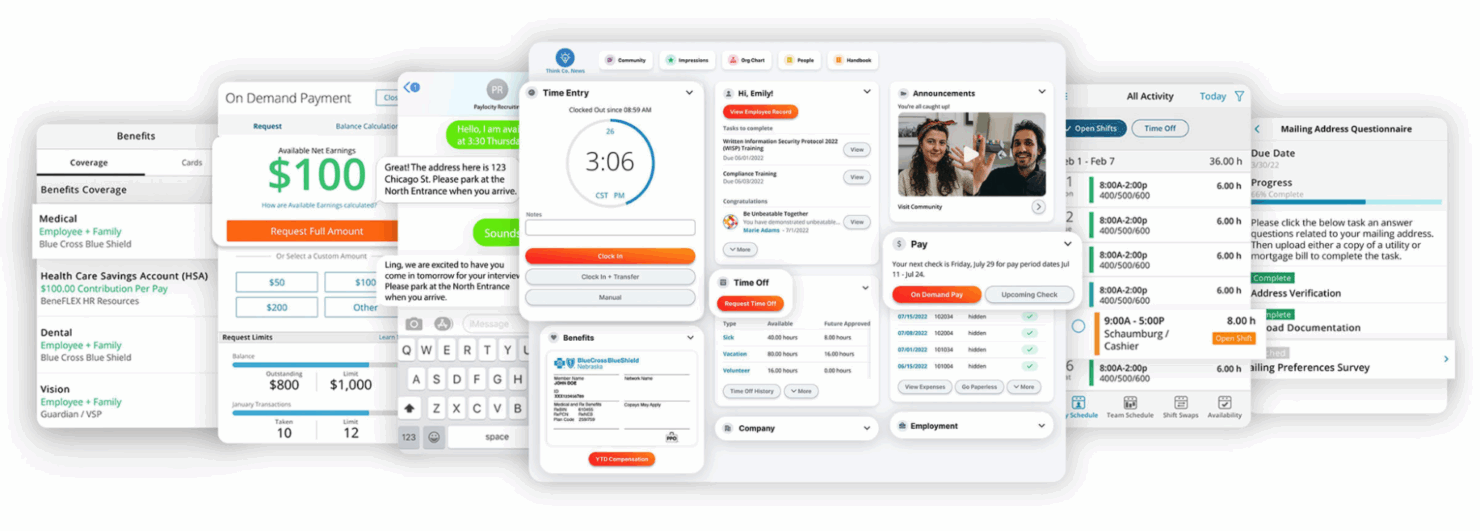

Employees can access their payroll and benefits information, update personal details, and request time off in an employee self-service portal.

-

Paylocity automates payroll processes to save time and reduce manual work for HR and payroll teams.

cons

-

The platform offers many features that can take time to learn and adopt fully.

-

A few customers have experienced slower response times or difficulty reaching support when needed.

-

Some end users report that implementation can take longer than expected and require significant time and resources.

-

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

RUN Powered by ADP

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.1

How We Test & Score Our Tools

We’ve spent years building, refining, and improving our software testing and scoring system. The rubric is designed to capture the nuances of software selection and what makes a tool effective, focusing on critical aspects of the decision-making process.

Below, you can see exactly how our testing and scoring works across seven criteria. It allows us to provide an unbiased evaluation of the software based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (25% of final score)

The starting point of our evaluation is always the core functionality of the tool. Does it have the basic features and functions that a user would expect to see? Are any of those core features locked to higher-tiered pricing plans? At its core, we expect a tool to stand up against the baseline capabilities of its competitors.

Standout Features (25% of final score)

Next, we evaluate uncommon standout features that go above and beyond the core functionality typically found in tools of its kind. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

We also evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Tools offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Ease of Use (10% of final score)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the tool. High scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final score)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use a tool with minimal training. We evaluate how quickly a team member can get set up and start using the tool with no experience. High scoring solutions indicate little or no support is required.

Customer Support (10% of final score)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base.Tools and companies that provide real-time support score best, while chatbots score worst.

Customer Reviews (10% of final score)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the tool again for the core functionality. A high scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final score)

Lastly, in consideration of all the other criteria, we review the average price of entry level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

Core Features

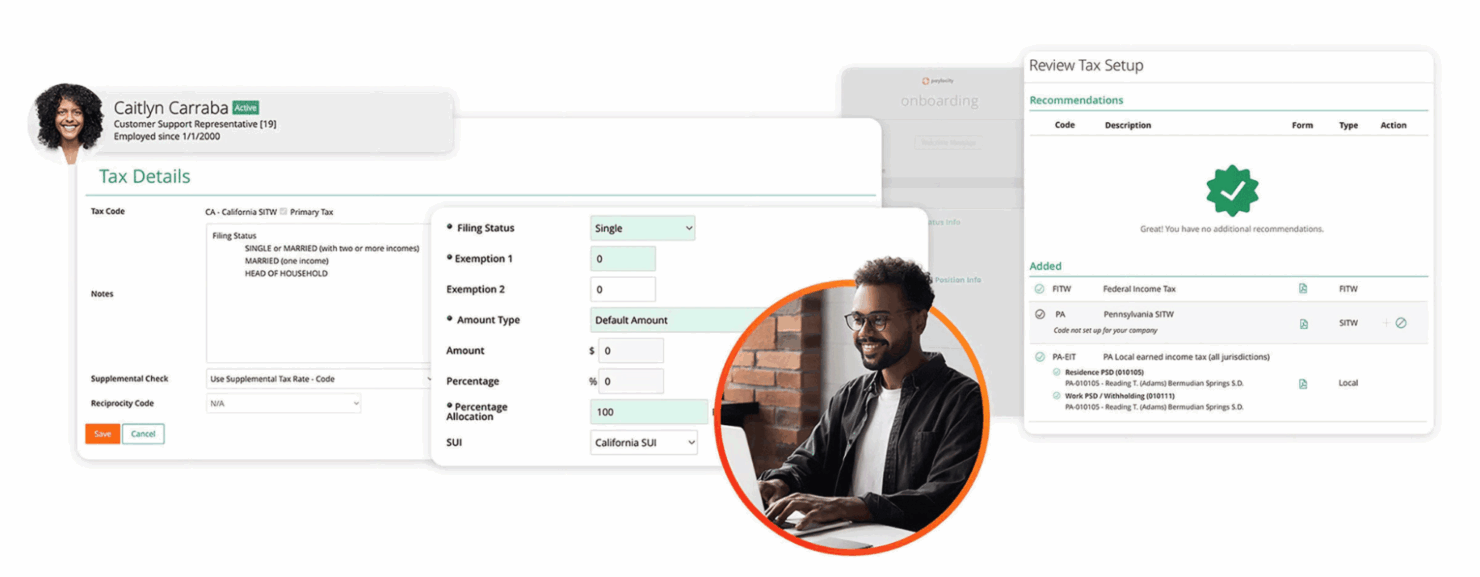

Tax filing and compliance: Paylocity automates tax calculations, withholdings, and filings at the federal, state, and local levels. It stays current with changing tax laws to ensure compliance.

Direct deposit: Paylocity allows employees’ paychecks to be deposited directly into their bank accounts. It supports multiple direct deposit accounts per employee for flexibility.

Payroll reporting: Paylocity’s standard and customizable payroll reports provide insights into labor costs and tax liabilities. Reports can be scheduled, exported, and shared with stakeholders.

Time and attendance: Paylocity's time tracking tools allow employees to clock in and out, request time off, and submit timesheets. Managers can review and approve timesheets before running payroll.

Garnishment management: Paylocity can handle wage garnishments such as child support and tax levies. It calculates applicable amounts and makes payments on the employer's behalf.

Employee self-service: Workers can view pay stubs, update direct deposit info, and access tax forms through the self-service portal. This reduces administrative tasks for HR.

Ease of Use

I find Paylocity to be intuitive and easy to navigate compared to many other payroll systems. The interface is modern and uncluttered and core functions like running payroll, adding new hires, and generating reports can be completed in just a few clicks.

Integrations

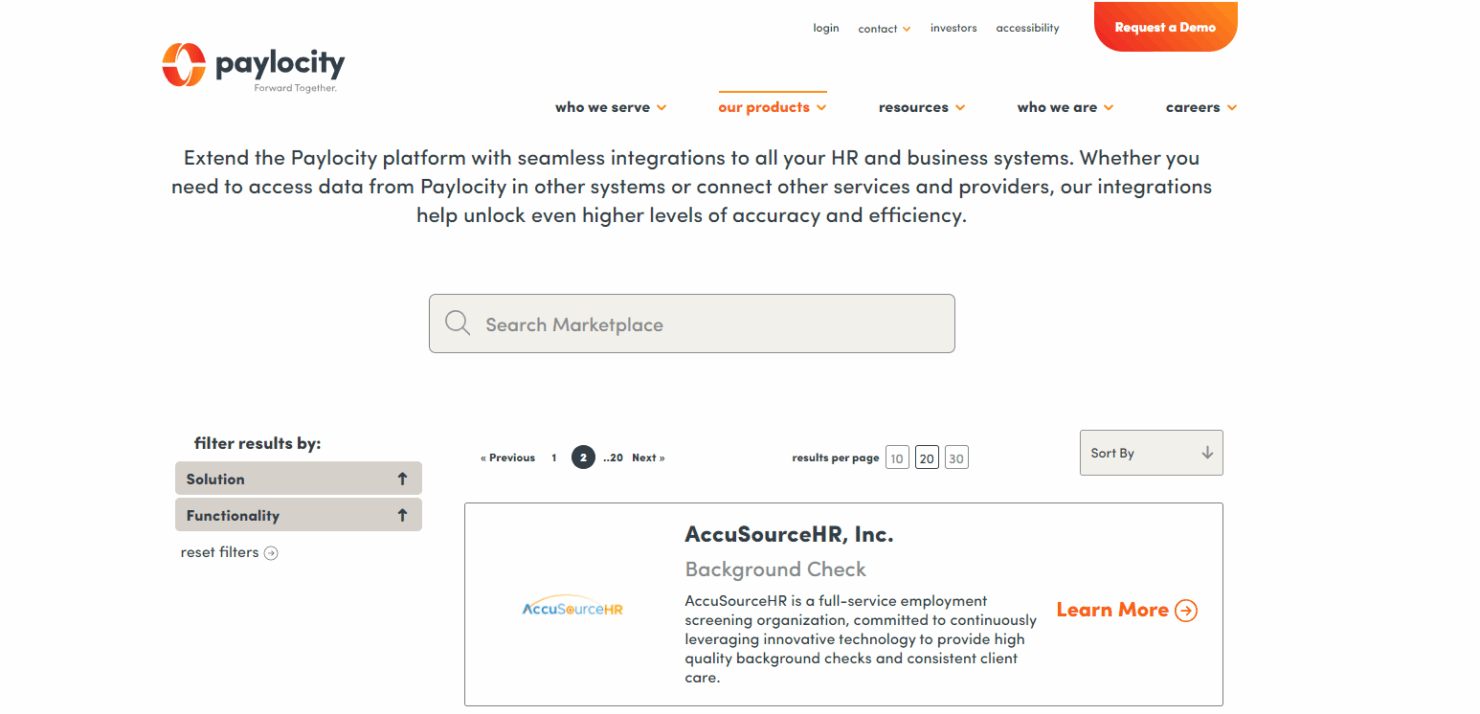

Paylocity integrates with: QuickBooks, Xero, Sage Intacct, Oracle NetSuite, SAP Concur, Salesforce, BambooHR, UltiPro, iCIMS, and Jobvite.

Paylocity also offers an API for custom integrations and data sharing. The Paylocity Marketplace has pre-built connectors to hundreds of third-party apps for HR, finance, and benefits.

Paylocity Specs

- API

- Application Tracking

- Approval Workflows

- Attendance Tracking

- Budgeting

- Calendar Management

- Compliance Tracking

- Employee Database

- Employee Incentive Management

- Employee Onboarding

- Expense Tracking

- External Integrations

- Feedback Management

- Forecasting

- Payroll

- Time Management

- Timesheets

- Vacation & Absence Calendar

Alternatives to Paylocity

Paylocity FAQs

Is Paylocity FedRAMP certified?

Is Paylocity GDPR compliant?

How does Paylocity handle data backups?

Is there a mobile app for Paylocity?

Is Paylocity secure?

Is Paylocity HIPAA compliant?

Is Paylocity SOC 2 compliant?

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.