-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

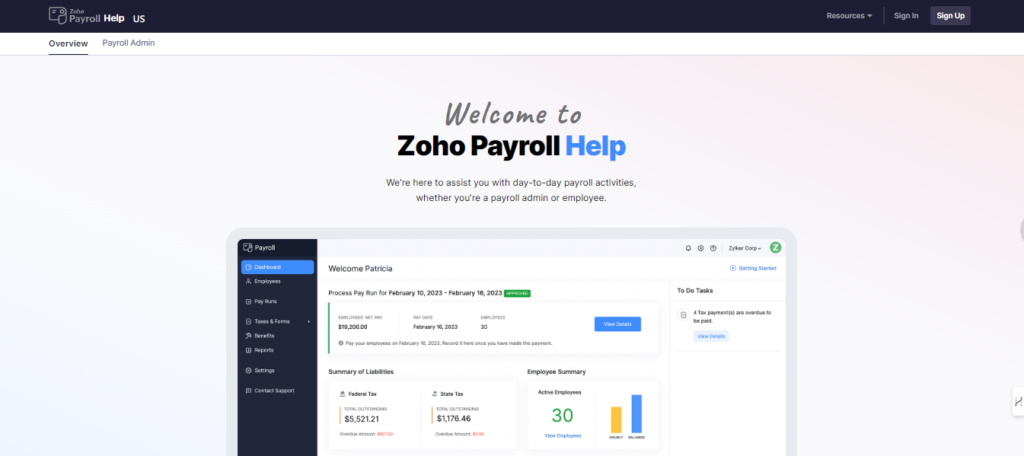

In this review, I will share my analysis and evaluation of Zoho Payroll based on my hands-on experience. If you are beginning your search for the best payroll software, check out my top picks first. Although Zoho Payroll is popular, it's essential to understand its strengths and weaknesses. This in-depth review will cover the pros and cons, key features, and functionality, helping you determine its capabilities and suitability for your needs.

Summary: Zoho Payroll

Zoho Payroll is an efficient payroll management software designed for businesses of all sizes. HR professionals and accountants commonly use it to handle payroll calculations, tax deductions, and employee benefits. It helps businesses by ensuring accurate and timely payroll processing, compliance with tax regulations, and easy integration with other Zoho applications.

Zoho Payroll addresses common pain points like manual payroll processing, tax compliance, and employee benefits management. Its best features are automated payroll calculations, tax filing, and direct deposit payments.

Zoho Payroll Pros

- Tax calculations: Zoho Payroll automates federal, state, and local tax calculations and filings to help ensure compliance and avoid penalties.

- Employee portal: Employees can access their pay stubs, tax forms, and PTO balances through a self-service portal, saving HR time.

- Reporting: Zoho Payroll provides customizable reports and dashboards for insights into labor costs, tax liabilities, salary payments, and other key payroll metrics.

Zoho Payroll Cons

- Limited HR: Zoho Payroll focuses mainly on core payroll functions, so its HR features for onboarding, benefits, and performance management are more basic than some competitors.

- Limited customization: Offers fewer customization options for payroll reports compared to some competitors.

- Steeper learning curve: Some users find Zoho Payroll less intuitive and user-friendly than top competitors, so it can take more time to learn the interface and set up the system.

Zoho Payroll Expert Opinion

In my view, Zoho Payroll is an excellent choice for small to mid-sized businesses seeking an affordable and user-friendly payroll solution. It offers essential tools like direct deposit, automated tax calculations and filings, PTO tracking, and an employee self-service portal to effectively manage payroll needs.

The interface is intuitive, even for those new to payroll software, and the mobile app is a bonus for managers needing on-the-go access. Zoho's pricing is competitive, starting lower than many rivals like Gusto or Paychex. For users of Zoho's other business apps, Payroll integrates well, unifying data and simplifying workflows.

While it may not have as many features as some enterprise-tier platforms, Zoho Payroll meets the needs of most smaller organizations. Overall, it is a top contender in its class, offering functionality, value, and ease of use.

Why Trust Our Software Reviews

We've been testing and reviewing Payroll Software since 2016. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

-

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

RUN Powered by ADP

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.1

Are You A Good Fit For Zoho Payroll?

Who Would Be a Good Fit for Zoho Payroll?

Small and medium-sized businesses needing an affordable, easy-to-use payroll solution would benefit most from Zoho Payroll. It offers features like direct deposit, tax calculations, and compliance management, making it ideal for companies without a dedicated payroll department. Zoho Payroll integrates with other Zoho apps, making it a good fit for those already using Zoho's ecosystem.

Who Would Be a Bad Fit for Zoho Payroll?

Zoho Payroll may not be the best fit for larger enterprises or companies with complex payroll needs. It is primarily designed for small to mid-sized businesses and may fall short of meeting the more sophisticated requirements of larger organizations. Zoho Payroll does not specifically mention support for garnishment payments, which can be crucial for some businesses. Additionally, while Zoho Payroll supports compliance with federal and state tax regulations in the US, companies operating in multiple states with complex compliance requirements might need a more advanced solution to handle the intricacies of multi-state operations.

Best Use Cases for Zoho Payroll

Based on the limited information available, here are some potential best use cases for Zoho Payroll software:

- Small businesses: Zoho Payroll may work well for small companies with straightforward payroll needs

- Startups: Growing startups may find Zoho Payroll an affordable option as they scale their teams

- Existing Zoho users: Organizations already using other Zoho software may benefit from the integrated Zoho Payroll tool

- Companies in India: As an India-based company, Zoho Payroll seems to cater well to the needs of Indian businesses

- Seasonal employers: Smaller businesses with fluctuating seasonal staff such as retail could find Zoho Payroll helpful in managing those employee changes

- Freelancer-heavy workforces: Companies relying heavily on contract and freelance workers may appreciate Zoho Payroll's ability to handle those payment schedules

Worst Use Cases for Zoho Payroll

With the scarcity of authoritative information, here are some speculative worst use cases for Zoho Payroll software:

- Large enterprises: Bigger companies with complex payroll and HR needs may find Zoho Payroll lacks advanced features

- Highly regulated industries: Businesses in strictly regulated fields like finance or healthcare could determine Zoho Payroll doesn't meet all their compliance requirements

- Global workforces: Multinational organizations may discover Zoho Payroll doesn't sufficiently support international employee payroll

- Companies requiring deep integrations: Zoho Payroll might not integrate seamlessly enough with other key business software and systems some companies use

- High-growth startups: Rapidly scaling startups could outgrow Zoho Payroll's capabilities quicker than expected

- Businesses needing extensive support: Companies wanting hands-on, readily available customer support may find Zoho Payroll's service options lacking

Need expert help selecting the right Payroll Management Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

-

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

RUN Powered by ADP

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.1

Zoho Payroll Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐

- Integrations: ⭐⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐

Review Methodology

We are a team of software experts focused on the features and functionality of various platforms. We understand how crucial and confusing software selection can be, so we test and score software to find the best solutions for any use case.

Using our objective, data-driven testing methodology, we have tested over 300 software tools. We strive to be objective and fair in our assessments, cutting through marketing fluff to truly understand each platform.

We create testing scenarios that mimic real-world use, combining our hands-on experience with insights from users, experts, and vendors. This approach ensures that our evaluations are thorough and practical.

How We Test & Score Payroll Software

We've spent years developing and refining our system for testing and scoring payroll software. Our rubric captures the nuances of software selection and what makes payroll software effective, focusing on critical aspects of the decision-making process.

Here, you can see how our testing and scoring work across eight criteria. We provide an unbiased evaluation based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (25% of final scoring)

For payroll software, the core functionality we test and evaluate are:

- Payroll processing: Accurately calculate and process employee paychecks and payslips on a specified schedule.

- Tax compliance: Automatically calculate and withhold required taxes and generate tax forms.

- Direct deposit: Set up automatic notifications for pay schedules and securely transfer employee paychecks directly to their bank accounts.

- Time tracking: Track employee hours worked, overtime, and paid time off.

- Benefit management: Manage employee benefits such as health insurance and retirement plans.

- Reporting: Generate detailed payroll reports for accounting and compliance purposes.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in payroll software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (15% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the payroll software. High-scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the payroll software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High-scoring software indicates little or no support is required for employee onboarding.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Payroll software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Payroll software offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the payroll software again for the core functionality. A high-scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, we review the average price of entry-level plans against core features and the value of other evaluation criteria. Software that offers more for less will score higher.

By focusing on core functionality, standout features, usability, onboarding, customer support, value, and customer reviews, I aim to identify payroll software that meets and exceeds expectations, ensuring teams have the tools they need to succeed.

Zoho Payroll Review

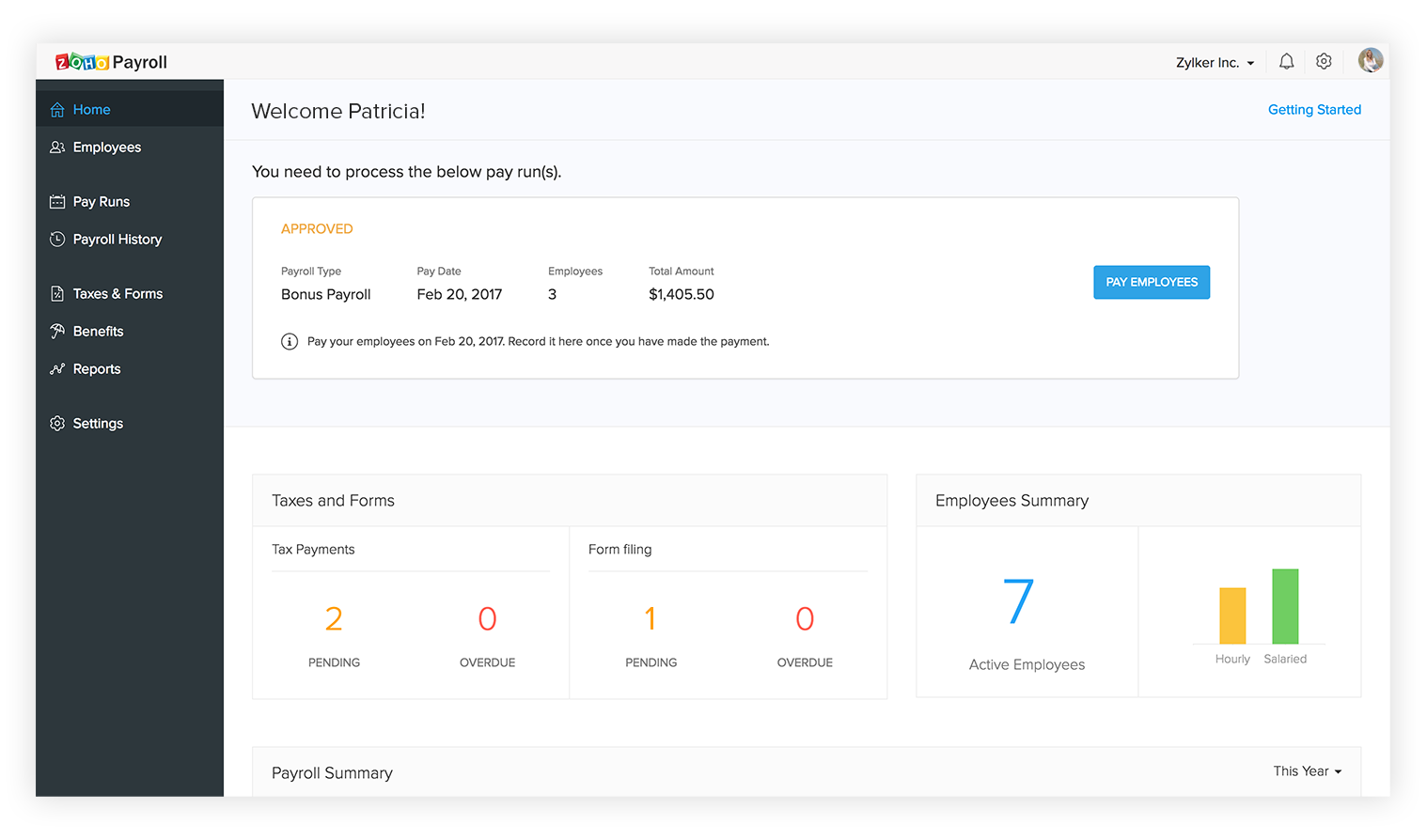

Core Payroll Software Functionality

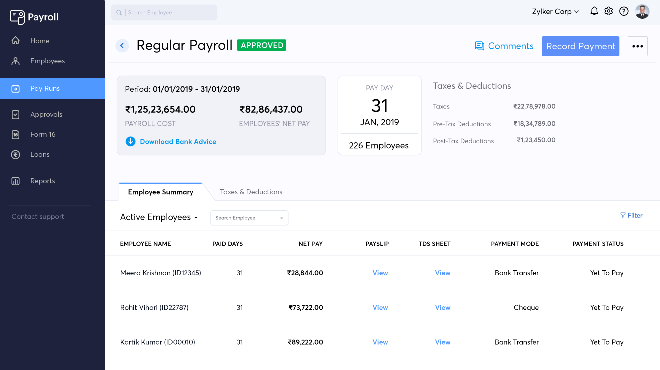

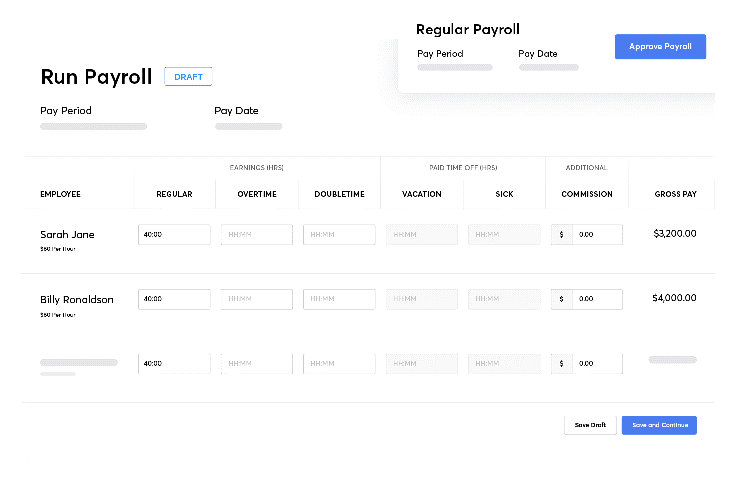

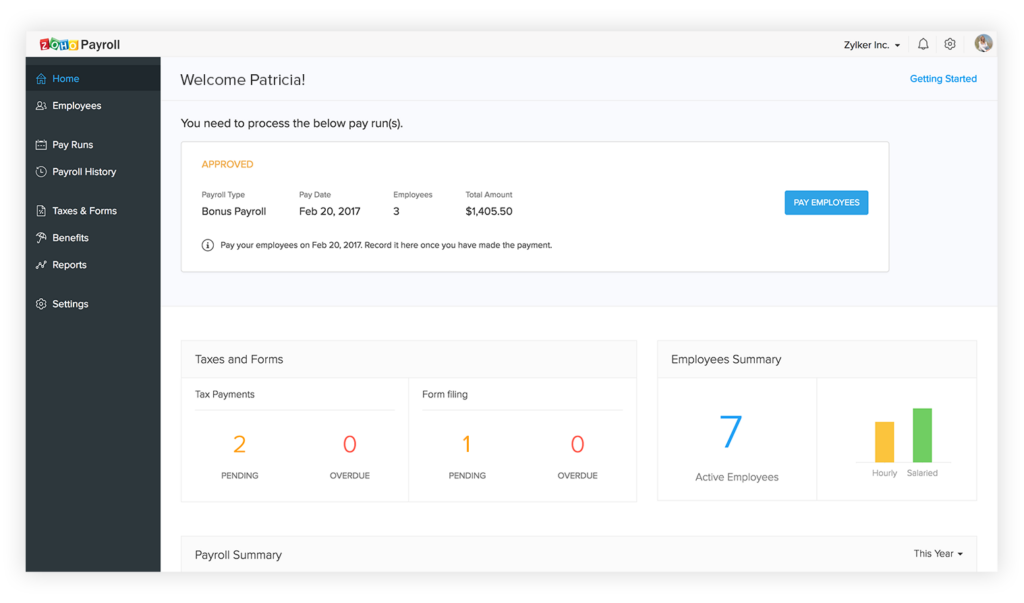

Payroll Processing: Zoho Payroll is able to process payroll efficiently, ensuring employees are paid accurately and on time. It automates calculations and deductions, reducing errors and saving time for HR departments.

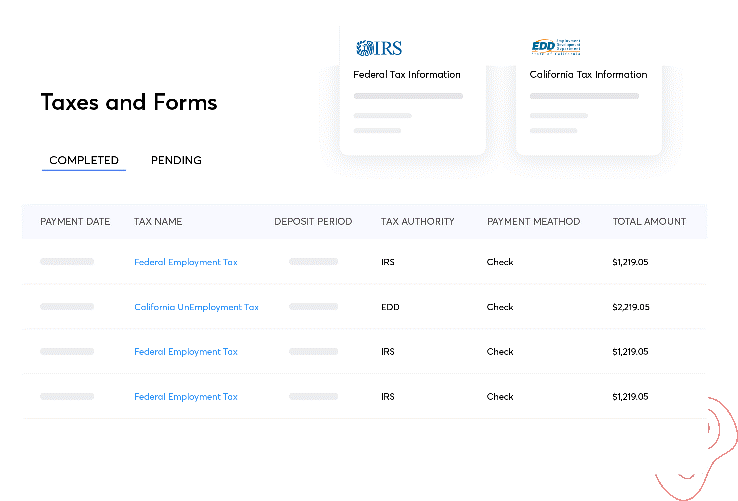

Tax Calculations and Filings: Zoho Payroll automates income tax calculations and filings, ensuring compliance with local and federal regulations. This feature minimizes the risk of penalties and simplifies tax season for businesses.

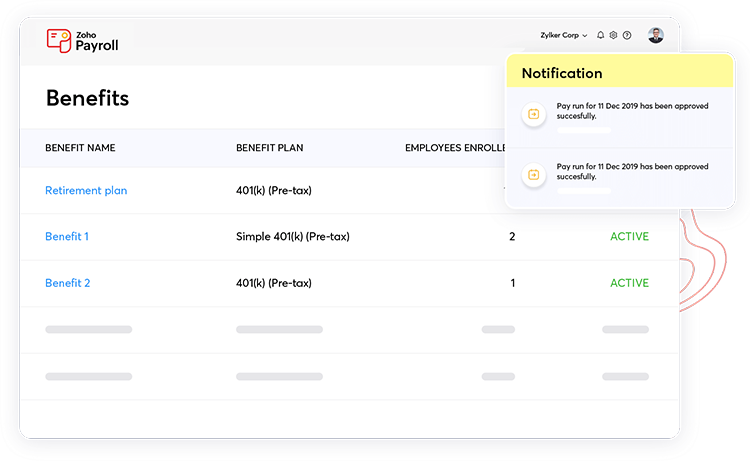

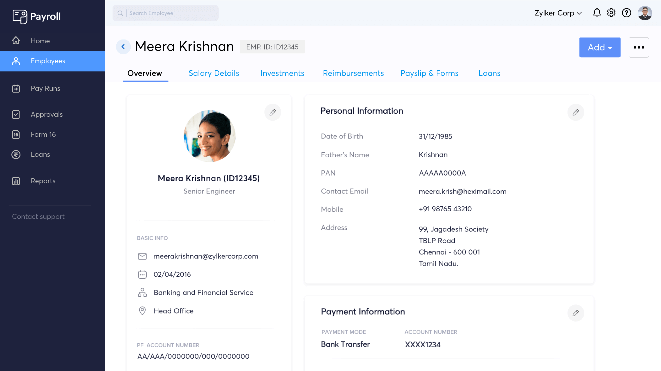

Benefits Management: Zoho Payroll provides tools for managing employee benefits, including health insurance, retirement plans, and other perks. This feature helps businesses administer benefits efficiently and ensures employees are well-informed about their benefits. Enable permissions for employees to view their employee information such as time off, contract and employment terms, benefits information, and more.

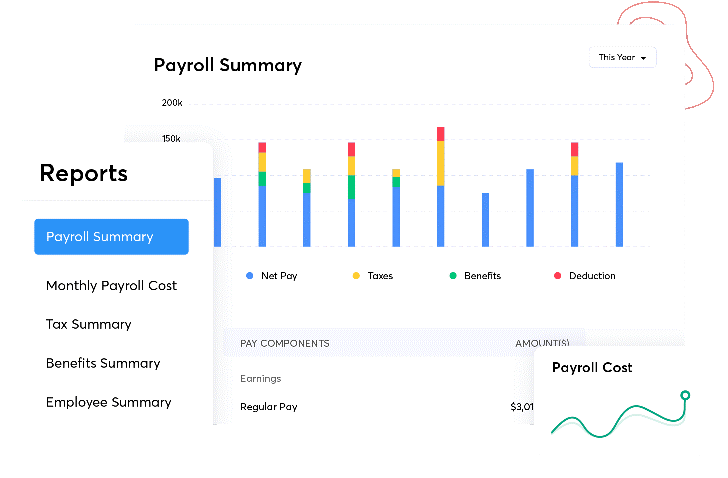

Payroll Reports and Summary: Zoho Payroll generates detailed payroll reports and summaries, providing a detailed overview of all payroll activities. This feature helps businesses maintain clear records, make informed decisions, and ensure transparency in payroll processing.

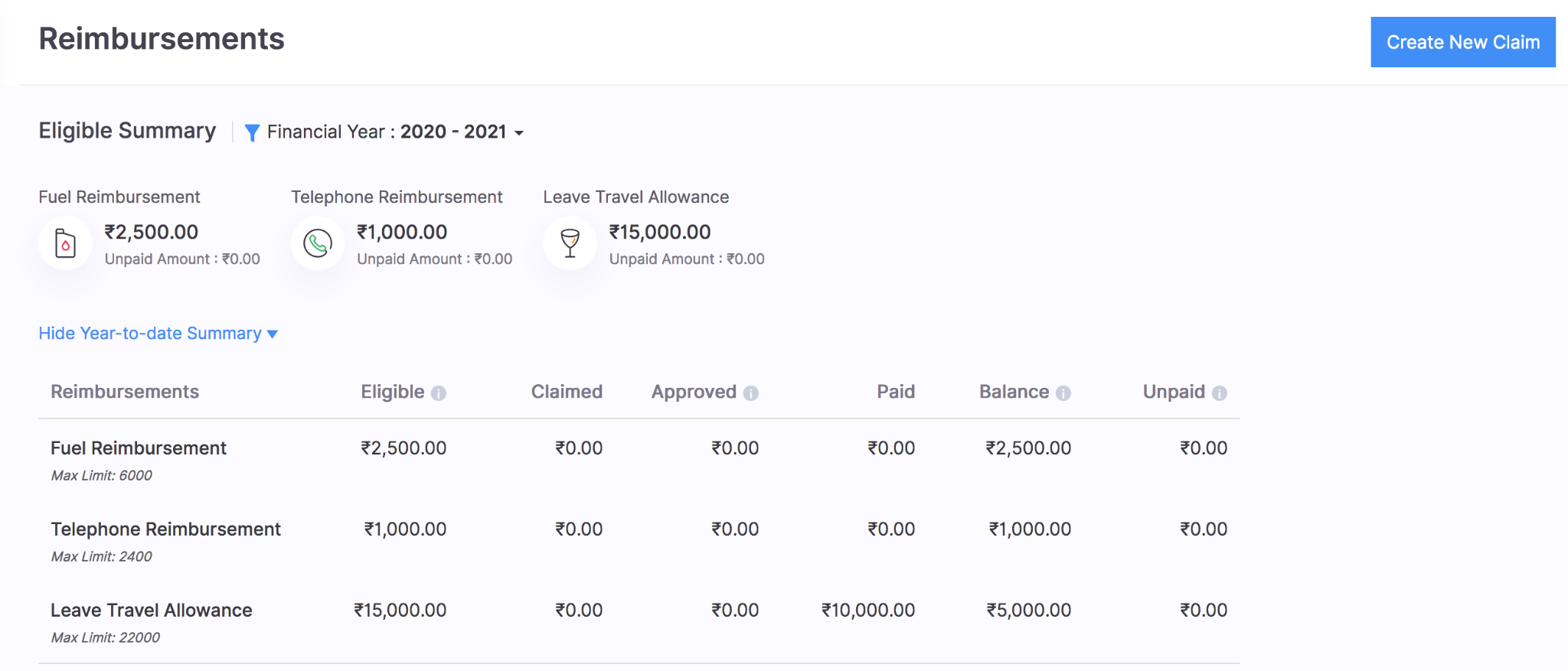

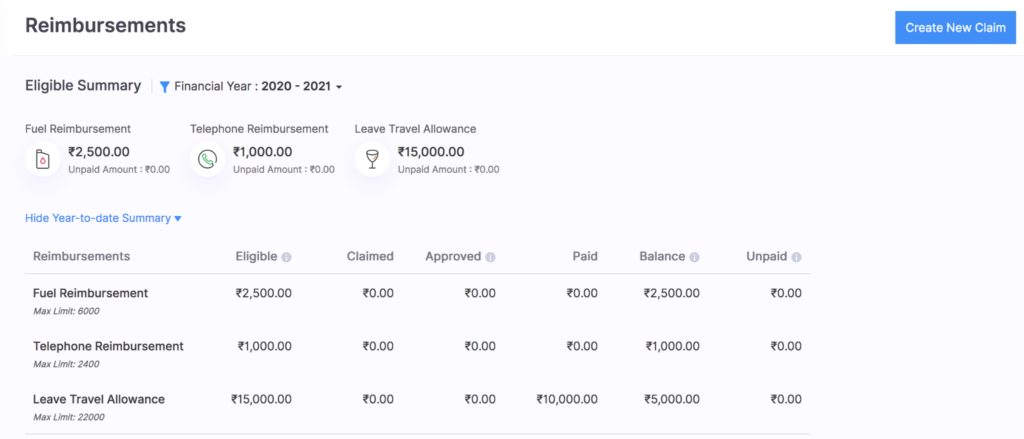

Reimbursement Claims: Zoho Payroll allows employees to submit reimbursement claims for expenses directly through the system. This feature streamlines the process for both employees and employers, ensuring timely and accurate reimbursements.

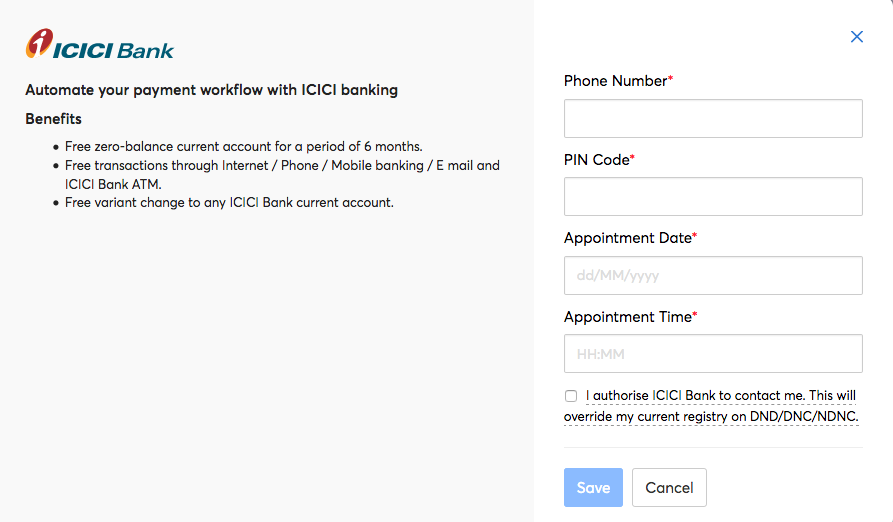

Direct Deposits: Zoho Payroll supports direct deposit, allowing employees to receive their paychecks directly into their bank accounts. This feature speeds up the payment process and eliminates the need for paper checks.

Zoho Payroll Standout Features

Automatic Payroll: Zoho Payroll simplifies payroll processes by automating calculations and payments. Enter work hours and get a clear breakdown of salary, taxes, allowances, and withholdings. Capture hours worked, including overtime, check draft payrolls to ensure accuracy, and process employee pay on time by setting paydays in advance. This reduces manual effort and ensures timely, accurate payroll management.

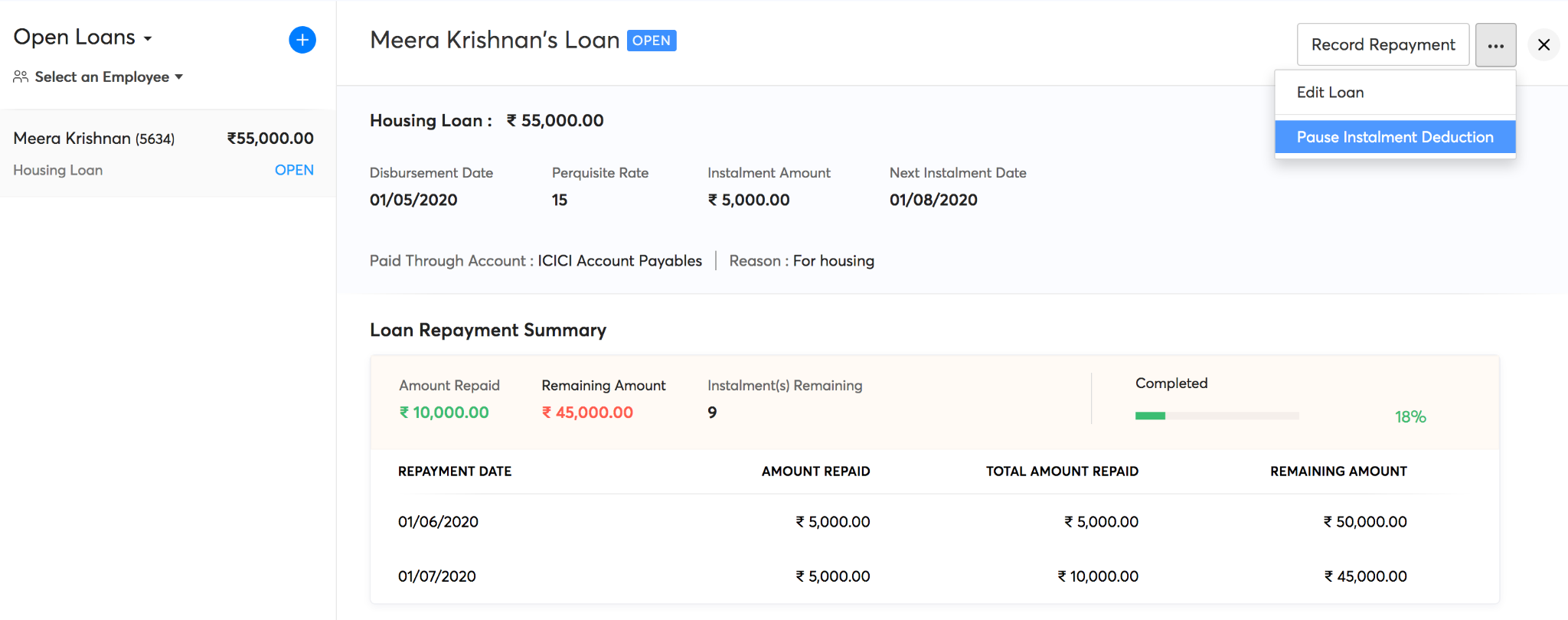

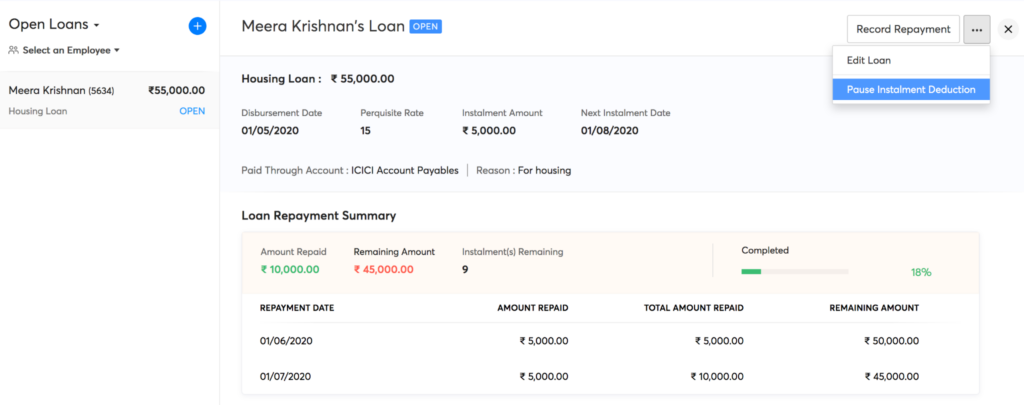

Loan Management: Zoho Payroll includes a loan management feature that allows businesses to manage employee loans directly through the payroll system. This feature automates loan deductions and repayments, simplifying the process for both employers and employees and ensuring accurate financial tracking.

Ease of Use

Zoho Payroll is easy to use compared to other payroll software options out there. The interface is intuitive and well-organized, making it accessible even for those new to payroll systems. Guided setup processes and clear navigation also contribute to a great overall user experience. In my experience and research, Zoho Payroll is consistently found to be straightforward and efficient, with many praising its user-friendly design.

Onboarding

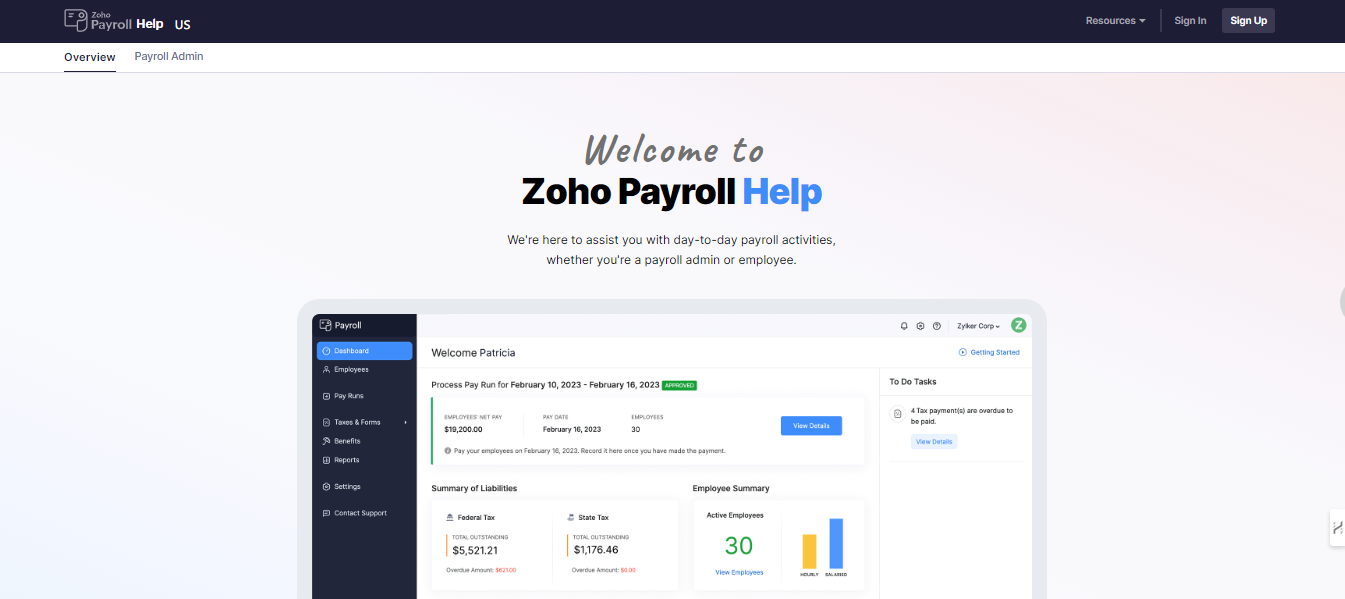

New users can expect a smooth onboarding process with Zoho Payroll. The software offers a guided setup with clear instructions, helping users configure payroll settings and add employee information easily. Zoho provides extensive training resources, including tutorials and documentation, to upskill new users. Additionally, live support is available to address any questions during onboarding. Compared to other payroll software, Zoho Payroll stands out for its detailed and supportive onboarding process, ensuring users can quickly get started and feel confident using the platform.

Customer Support

Zoho Payroll offers several support options. Users can get detailed help via email or immediate assistance through phone support. The online help center includes guides and FAQs for self-service. Real-time support is available through live chat, and community forums allow users to share advice and experiences. Regular product updates ensure continuous improvement and a status page lets users monitor system performance and downtime. Users can also provide feedback and suggestions for improvements.

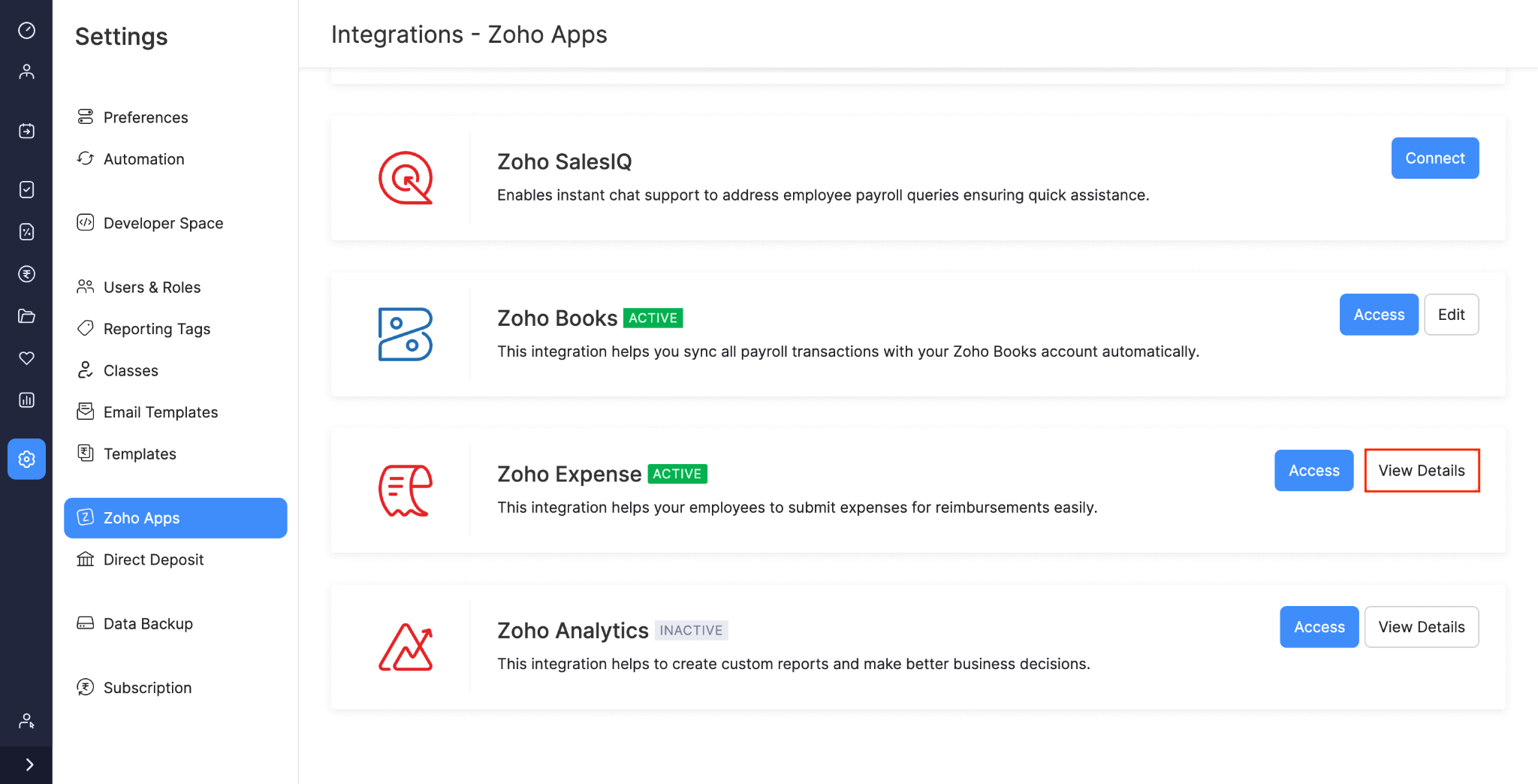

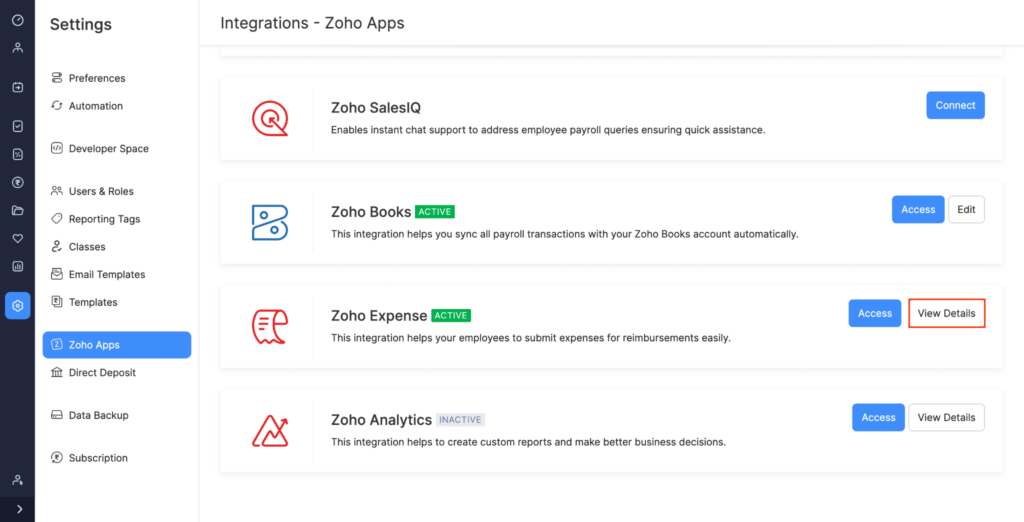

Integrations

Zoho Payroll integrates natively with QuickBooks, Xero, Stripe, and other Zoho applications. In addition to native integrations, Zoho Payroll offers options through an API, Zapier, and an app marketplace. These options allow users to connect Zoho Payroll with a wide range of third-party tools and services, further enhancing its functionality and flexibility.

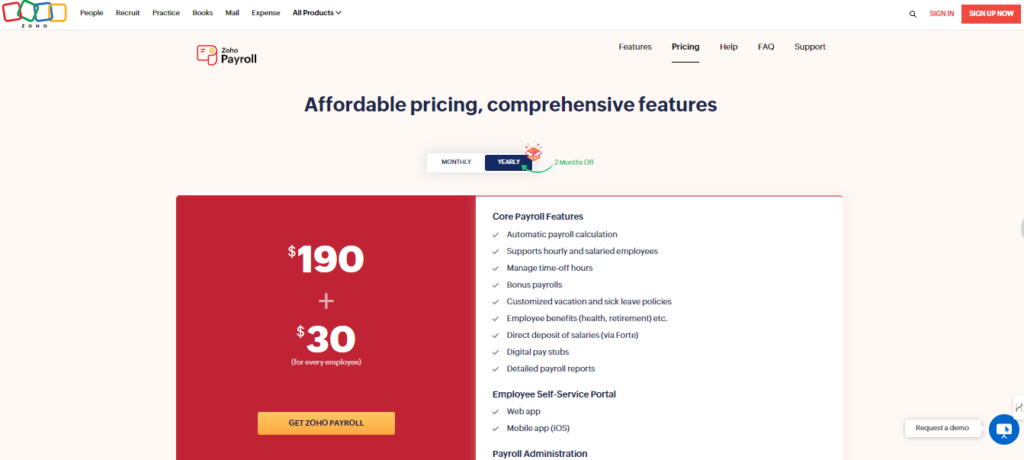

Value for Money

Zoho Payroll provides a cost-effective and straightforward solution for businesses to manage their payroll processes. The service includes a 14-day free trial, allowing potential customers to explore its capabilities without any financial commitment. This trial period is particularly useful for businesses to assess whether the software meets their specific needs.

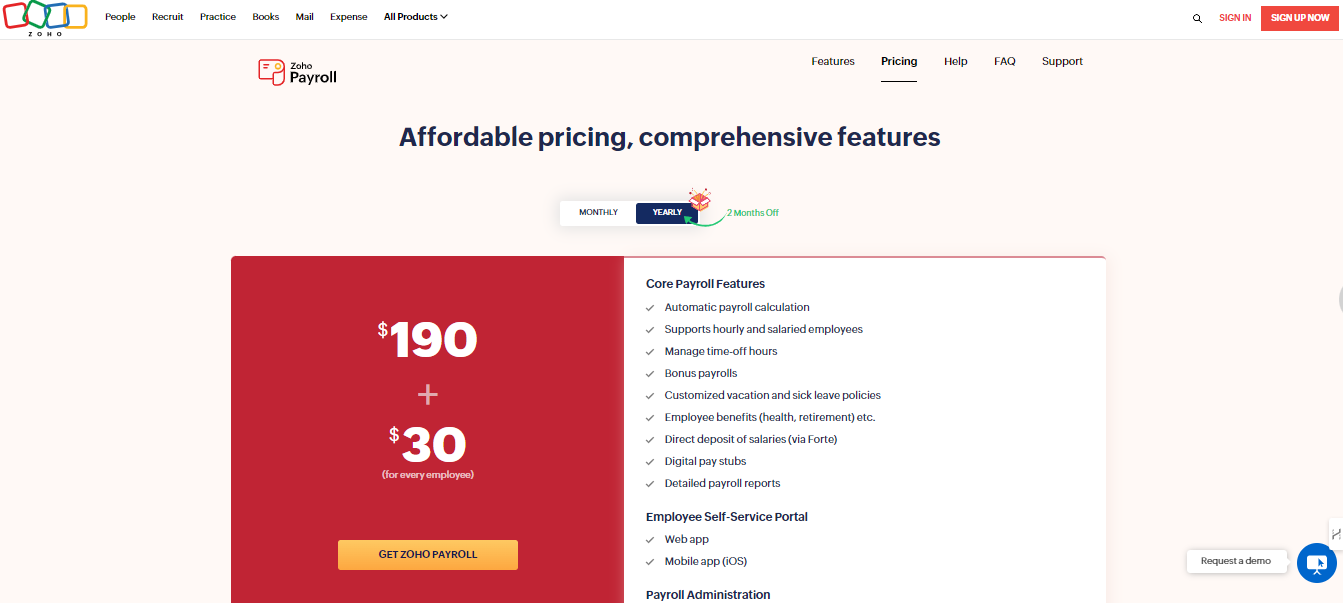

Overall, Zoho Payroll pricing is refreshingly transparent and easy to understand. It includes an annual plan with the following costs:

- $190 base fee

- $30 per employee

This pricing structure ensures that businesses can efficiently manage their payroll without hidden costs or complexities. The base fee covers essential payroll functionalities, while the per-employee fee allows the service to scale with business growth.

Zoho Payroll offers excellent value for money by combining a thorough feature set with affordable pricing, making it an attractive choice for human resources looking to optimize their payroll operations while keeping costs manageable. Additionally, integration with other Zoho products enhances its value, providing a smooth and cohesive financial management solution.

Product Specifications

| Feature | Zoho Payroll |

| Bonus pay runs | ✅ |

| Auto tax calculations | ✅ |

| Direct deposit | ✅ |

| Print paychecks | ✅ |

| Employee self-service portal | ✅ |

| Leave and PTO tracking | ✅ |

| Attendance management | ✅ |

| Reporting and analytics | ✅ |

| Customizable pay components | ✅ |

| Zoho integrations | ✅ |

| New hire reporting | ✅ |

| Document management | ✅ |

| Multi-state payroll | ❌ |

| Multi-country payroll | ❌ |

| Expense reimbursements | ✅ |

| Mobile app | ✅ |

| Payroll reminders | ✅ |

| Secure online access | ✅ |

| 24/7 chat support | ✅ |

| Phone support | ✅ |

| Tax penalty protection | ❌ |

| Accounting software integrations | ✅ |

| Automated prorated payments | ✅ |

Zoho Payroll Alternatives

If you're looking for alternative payroll software options to Zoho Payroll, here are a few worth checking out:

- Gusto: Offers more robust HR features beyond just payroll processing, including benefits administration, onboarding, and PTO tracking.

- QuickBooks Payroll: Integrates well with QuickBooks accounting software for small businesses already using Intuit products.

- ADP Run: Provides a wider range of customization options and support for larger businesses compared to Zoho Payroll.

- Paychex: Includes a mobile app for employers and employees, as well as 24/7 phone support which Zoho lacks.

Zoho Payroll Frequently Asked Questions

What is Zoho Payroll?

Zoho Payroll is a cloud-based payroll processing and management software. It automates common payroll tasks like calculating wages and taxes, generating pay stubs, and filing tax forms. The software can handle payroll for both full-time employees and contractors. Zoho Payroll also includes an employee self-service portal where workers can view pay stubs, tax forms, PTO balances, and more.

Is there a mobile app for Zoho Payroll?

Yes, Zoho Payroll offers mobile apps for iOS and Android devices. In the mobile app, employees can:

- View current and historical pay stubs.

- Submit timesheets and time off requests.

- Access tax forms and other documents. Managers and admins can also review and approve timesheets and time off requests right from the mobile app.

Is Zoho Payroll HIPAA compliant?

Yes, Zoho Payroll is HIPAA compliant. The software adheres to HIPAA regulations and Zoho will sign a business associate agreement (BAA) with covered entities who use Zoho Payroll.

Is Zoho Payroll SOC 2 compliant?

Yes, Zoho Payroll is SOC 2 Type 2 certified. This means an independent auditor has validated that Zoho Payroll’s systems and processes meet the SOC 2 trust principles of security, availability, processing integrity, confidentiality, and privacy

Is Zoho Payroll secure?

Yes, Zoho Payroll employs industry-standard security measures to protect customer data. This includes:

- Encrypting data in transit using secure TLS protocol.

- Encrypting data at rest using AES-256 encryption.

- Hosting data in highly secure, access-controlled data centers.

- Providing role-based access controls and audit trails.

- Automatically backing up data daily to geographically separate servers.

Is Zoho Payroll FedRAMP certified?

No, at this time Zoho Payroll is not FedRAMP certified. However, Zoho is actively working towards achieving FedRAMP certification for its products.

Is Zoho Payroll GDPR compliant?

Yes, Zoho Payroll is GDPR compliant. Zoho provides a Data Processing Agreement (DPA) to customers to cover the handling and protection of personal data in accordance with GDPR rules. Customers also have the ability to delete personal data from Zoho Payroll to comply with data deletion requests.

Does Zoho Payroll handle tax compliance?

Yes, Zoho Payroll helps automate tax compliance for businesses. The software:

- Calculates federal, state, and local payroll taxes.

- Withholds appropriate tax amounts from employee paychecks.

- Allows e-filing of quarterly and annual payroll tax forms.

- Generates W-2 and 1099 forms. However, businesses are still ultimately responsible for ensuring payroll tax amounts are accurate and remitted to tax agencies on time.

Zoho Payroll Company Overview & History

Zoho Payroll is a cloud-based payroll software solution from Zoho Corporation, a multinational technology company specializing in web-based business tools. Zoho Corporation is headquartered in Chennai, India, with offices in the United States, China, Japan, and other countries, and employs over 9,000 people worldwide.

Besides Zoho Payroll, Zoho Corporation offers a suite of over 55 business software applications, including customer relationship management (CRM), project management, email, and IT management. Zoho is known for its affordable, easy-to-use, cloud-based tools for businesses of all sizes, serving millions of users globally.

Zoho Corporation remains privately held and has over 15,000 employees and 100 million users around the world.

Zoho Payroll Major Milestones

- 1996: Zoho Corporation was founded in New Jersey, USA (originally called AdventNet Inc)

- 1998: The company moved to California

- 2001: Opens new international offices in Japan

- 2004: Zoho Virtual Office is launched followed by a string of products such as Zoho Writer, Zoho Sheets, Zoho Docs, Zoho Books, and Zoho People in 2005 through to 2008

- 2008: Zoho hits their million user milestone

- 2009: The company was renamed to Zoho Corporation Pvt Ltd and continues launching products such as Zoho Recruit

- 2015: Zoho reaches over 15 million users and will see another 5 million by 2016

- 2019: Zoho Payroll is launched

- 2021: Zoho celebrates its 25th anniversary and Zoho CEO receives the prestigious Padma Shri award

- 2021: Zoho Payroll was named "top payroll software" by multiple industry publications

- 2023: Zoho Corporation surpasses 100 million users

Want to learn more about Zoho Payroll? Check out their site for additional information.

From $19/month plus $3/employee/month

30-day free trial + free plan available

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.