Managing payroll is one of the most important responsibilities for any organization, and the payroll cycle sits at the heart of that process.

A payroll cycle determines how often employees are paid, how payroll is processed, and how employers stay compliant with labor laws.

Choosing the right cycle can impact everything from employee satisfaction and cash flow to administrative costs and accuracy.

In this article, I’ll explain the main types of payroll cycles, outline the steps involved, highlight common FAQs, and share practical tips to help you decide which option works best for your business.

What Is A Payroll Cycle?

A payroll cycle is the regular schedule a company follows to calculate and distribute employee wages. It includes the pay period (the time worked), the processing period (time to calculate pay), and the payday (when employees are paid).

Common cycles are weekly, biweekly, semimonthly, or monthly. The chosen cycle affects cash flow, compliance, and employee satisfaction.

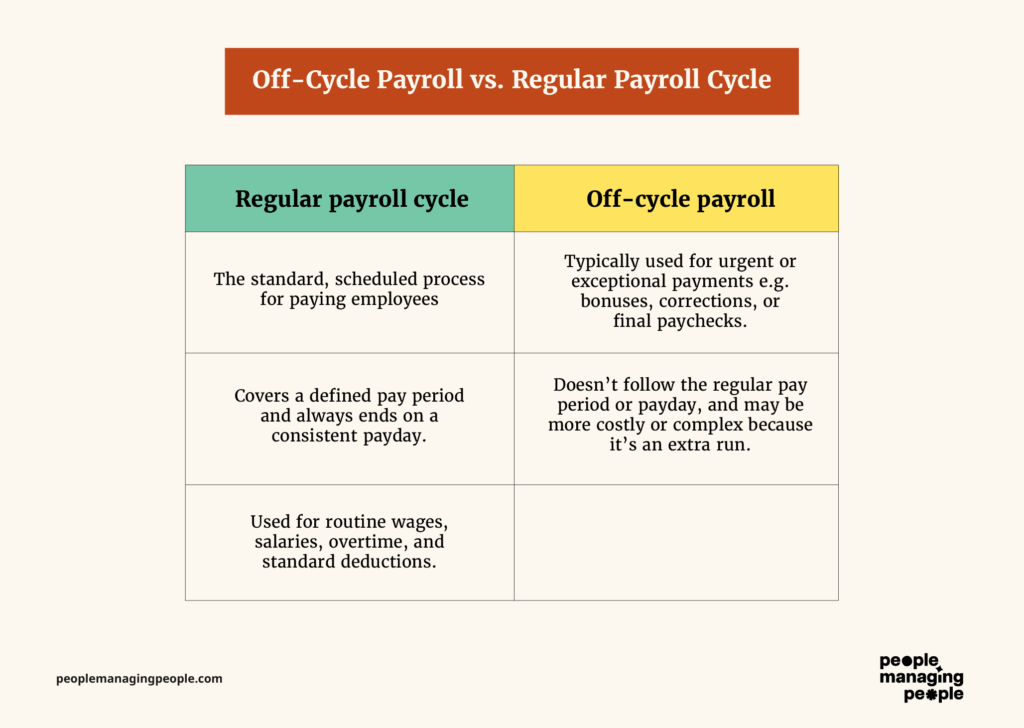

Off-cycle payroll vs. regular payroll cycle

A regular payroll cycle is the scheduled, recurring process of paying employees (weekly, biweekly, semimonthly, or monthly).

Off-cycle payroll happens outside this schedule to handle special cases like bonuses, corrections, or missed payments.

Payroll Cycle Types

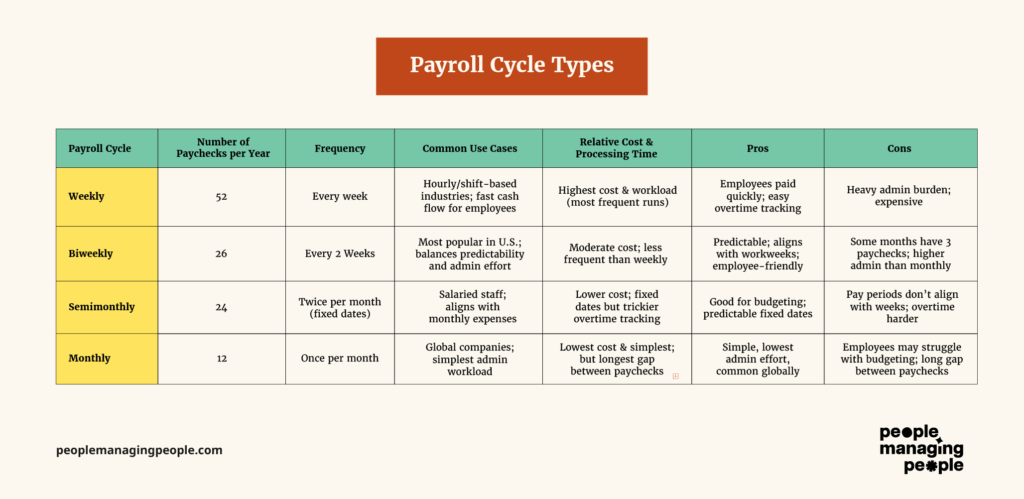

Payroll cycles come in several types, each with its own frequency, advantages, and trade-offs that affect both employers and employees.

Weekly

Employees are paid once every week, usually on the same day (e.g., every Friday). This results in 52 paychecks per year and is common in industries with hourly or shift-based work. It provides fast cash flow for employees but increases administrative workload for employers.

Biweekly

Employees are paid every two weeks, typically on the same weekday, for a total of 26 paychecks per year. It’s one of the most popular cycles in the U.S. since it balances predictability for employees with less admin work than weekly payroll. Overtime calculations are also easier because pay periods line up with workweeks.

Semimonthly

Employees are paid twice per month, often on fixed dates like the 15th and the last day of the month, resulting in 24 paychecks annually. It works well for salaried staff and aligns neatly with monthly expenses like rent or bills. However, the pay periods don’t match calendar weeks, which can make overtime tracking more complex.

Monthly

Employees receive one paycheck each month, typically on the last business day, for a total of 12 paychecks per year. This is common in many global companies and simplifies payroll administration significantly. The drawback is that employees may find budgeting more challenging with longer gaps between paychecks.

How To Choose A Payroll Cycle

Choosing the right payroll cycle requires balancing legal requirements, employee needs, cash flow, and administrative resources.

1. Check legal and compliance requirements

Payroll frequency is often dictated by labor laws, which vary by country or state. For example, some U.S. states require employees to be paid at least semi-monthly or biweekly, while others allow monthly schedules.

Understanding these rules ensures you avoid penalties, stay compliant, and build a payroll system that works across all jurisdictions where you employ staff.

2. Assess your workforce needs

The type of employees you have will heavily influence the best payroll cycle.

For example, industry standards generally dictate that hourly or contract workers typically prefer weekly or biweekly cycles because it provides quicker access to earnings.

Salaried employees, on the other hand, are generally comfortable with semimonthly or monthly pay, which also lines up better with consistent administrative processes.

3. Evaluate cash flow and budgeting

Payroll is often one of the largest recurring expenses for a business, so you need to match cycle frequency with your cash flow.

A weekly payroll requires funds to be available more often, which may strain a growing company with tight budgets. Longer cycles (semimonthly or monthly) allow more time to manage inflows and outflows of cash but might feel less employee-friendly.

Tip: If cashflow becomes a problem, payroll funding enables a company to sell its invoices to get instant cash to fulfill its payroll needs.

4. Factor in administrative resources and costs

Each payroll run requires processing wages, deductions, taxes, and benefits, so the frequency directly affects your HR or finance team’s workload.

A weekly cycle can overwhelm smaller teams or increase costs if you use payroll software or an outsourced payroll provider.

A monthly cycle reduces this burden but may create extra work when handling corrections, off-cycle payments, or overtime calculations.

Evaluating these costs against employee needs will help you determine if the added expense of weekly payroll, for example, is worth it.

5. Pilot and review

Before rolling out a payroll cycle company-wide, it’s smart to test it with a smaller team or department. This allows you to identify challenges like employee satisfaction, cash flow issues, or administrative strain without disrupting the entire workforce.

After collecting feedback and making adjustments, you can confidently implement the best cycle across the organization.

Steps In The Payroll Cycle

The payroll cycle follows a series of steps that ensure employees are paid accurately, on time, and in compliance with legal requirements.

1. Collect employee data

Gather all time and attendance records, hours worked, overtime, commissions, or bonuses for the pay period. For salaried employees, confirm there are no changes like leave without pay, deductions, or allowances. This step ensures accuracy before calculations begin.

2. Verify employment and compensation details

Cross-check employee status (active, terminated, new hire) and confirm pay rates, tax details, and benefit elections. This includes checking compliance with employment contracts and local labor laws.

Doing this prevents errors that could lead to underpayment, overpayment, or compliance issues.

3. Calculate gross pay

For hourly employees, multiply hours worked by the pay rate (plus overtime if applicable). For salaried employees, divide the annual salary according to the chosen pay cycle. Gross pay is the starting point before any deductions are applied.

4. Apply deductions and withholdings

Subtract statutory deductions like income tax, social security, or pension contributions, as well as voluntary deductions such as health insurance, retirement savings, or wage garnishments.

Employers must also factor in contributions they are required to make. This step ensures legal compliance and correct benefit funding.

5. Calculate net pay

After deductions, the remaining amount is the employee’s take-home pay. This final figure is what will be deposited or issued on payday. Accuracy here is critical for employee trust and satisfaction.

6. Review and approve payroll

Payroll results should be audited for errors, such as incorrect hours, duplicate entries, or misapplied deductions. Managers or finance leaders typically approve the payroll run before payments are processed. This step adds an extra layer of accountability and quality control.

7. Distribute employee pay

Issue payments through direct deposit, checks, or payroll cards on the scheduled payday.

Employees should receive detailed pay stubs that show earnings, deductions, and net pay for transparency. Timely payment is not just best practice but also a legal requirement in many jurisdictions.

8. File taxes and submit reports

Employers must remit withheld taxes and employer contributions to government authorities. Reporting obligations may include monthly, quarterly, or annual filings, depending on the country. This step ensures compliance and avoids penalties.

9. Maintain payroll records

Store payroll data, pay stubs, and tax filings securely for the legally required retention period (often several years). Proper recordkeeping supports payroll audits, employee inquiries, and legal compliance.

Payroll Cycle FAQS

Which is the most common payroll cycle type?

In the U.S., biweekly payroll (every two weeks, 26 paychecks per year) is the most common. It balances administrative efficiency with employee satisfaction, especially since it aligns with weekly work schedules and makes overtime tracking easier. Globally, monthly payroll is often standard due to simpler administration.

What’s the difference between biweekly and semimonthly payroll?

Biweekly means employees are paid every two weeks on the same weekday, which results in 26 paychecks per year and occasionally 3 paydays in a single month. Semimonthly means employees are paid on fixed dates (e.g., the 15th and last day of the month), resulting in 24 paychecks per year. The main differences are paycheck frequency and how well each aligns with workweeks.

Can a company change its payroll cycle?

Yes, but it requires clear communication, compliance with labor laws, and proper planning. Employers typically must give notice to employees before making a switch. For example, moving from biweekly to semimonthly might require adjusting contracts and recalculating pay amounts.

Why do some companies choose weekly payroll?

Weekly payroll is common in industries with hourly or seasonal workers, like retail, hospitality, or construction. It gives employees faster access to their earnings, which can be important for financial stability. However, it creates higher administrative costs and workload for the employer.

Which payroll cycle is cheapest for employers?

Monthly payroll is usually the cheapest because it requires the fewest processing runs (12 per year). This reduces administrative effort, payroll provider fees, and opportunities for errors. The trade-off is that employees may prefer more frequent paychecks for budgeting.

What happens if payday falls on a holiday or weekend?

Employers usually pay employees on the business day before the holiday or weekend. For example, if payday falls on a Saturday, payroll would be issued on Friday. This ensures employees still get paid on time.

How do off-cycle payrolls fit in?

Off-cycle payrolls are unscheduled runs outside the normal cycle. They’re used for special payments like bonuses, final paychecks, or correcting missed/incorrect payments. While necessary at times, they add costs and administrative complexity.