10 Best Payroll Companies Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Get free help from our HR software advisors to find your match.

There are seemingly countless payroll companies in existence, so figuring out which is best for you is tough. You want to outsource everything about employee payments—from calculating wages, deducting taxes, and issuing direct deposits. In this post, I make things simple, leveraging my experience as an HR specialist and working with dozens of workforce management solutions to bring you this shortlist of the best payroll companies.

What is a Payroll Company?

A payroll company is an organization that manages employee payment processes for other businesses, handling wage calculations, tax deductions, and compliance with legal requirements.

A payroll company is helpful for ensuring accurate, timely employee payments, handling complex tax regulations, and freeing up business resources for other tasks.

Detailed Overviews of the 10 Best Payroll Companies

Here’s a brief description of the top 10 payroll companies that made it into my shortlist, including their main service offerings and other noteworthy features. I’ve also included screenshots to give you a snapshot of their software’s user interface.

Plus, I’ve included 10 more worthwhile companies below, if you’d like some extra options to consider.

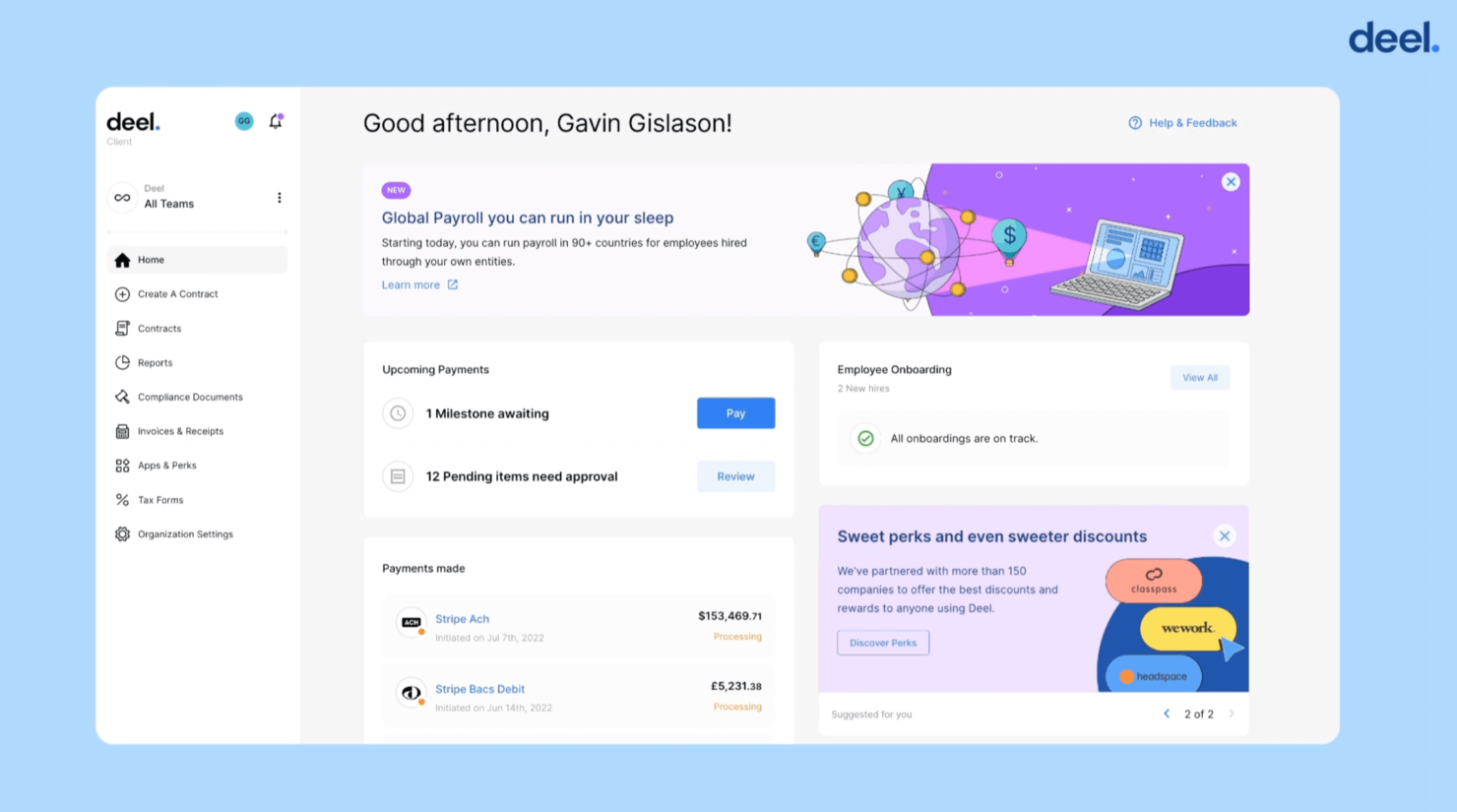

Deel

Best payroll company for paying international employees and contractors

Deel is a global payroll platform that allows you to hire anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll. Deel’s intuitive platform gives you end-to-end workforce management, including contract adjustments, expense reimbursements, and off-cycle adjustments. Local country experts provide consultative approaches for each location you hire from, ensuring compliance with local pay standards.

Why I picked Deel: Deel offers 10+ payment options for clients, ranging from bank transfers to cryptocurrency pay-ins. You can schedule payments in advance and run off-cycle payroll whenever needed. Employees and contractors on Deel can self-manage their pay and personal data and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals. The company offers 24/7 online support and dedicated account managers for specific requests.

In addition to their global payroll services run by local experts, Deel has launched several new offerings over the past year, including global mobility support, integrated Slack tools, and advanced integrations. The global mobility service helps companies with visa sponsorship, allowing them to bring in candidates from abroad.

Integrations are available with NetSuite, HiBob, Xero, Ashby, and Greenhouse.

Best payroll company with AI-backed compliance verification features

Papaya Global is an online payroll software that helps companies remove barriers to global hiring. Papaya’s automated, SaaS platform provides an end-to-end global workforce management solution—everything from onboarding to cross-border payments in 160+ countries.

Why I picked Papaya Global: Their platform supports all employee options (payroll, EoR, contractors), integrates with all management tools, and uses smart technology to ensure compliance and eliminate errors. It creates a highly visible system for tracking payroll spending and real-time business intelligence (BI). Papaya Global can help any company simplify global people management. Enterprises can access Papaya’s state-of-the-art automation, security, and BI without replacing their existing payroll system.

Integrations are available with BambooHR, Expensify, Microsoft Dynamics 365, Namely, NetSuite, Priority Software, SAP Business One, SAP Concur, and SAP SuccessFactors. They can also create additional custom integrations for your existing HR software upon request.

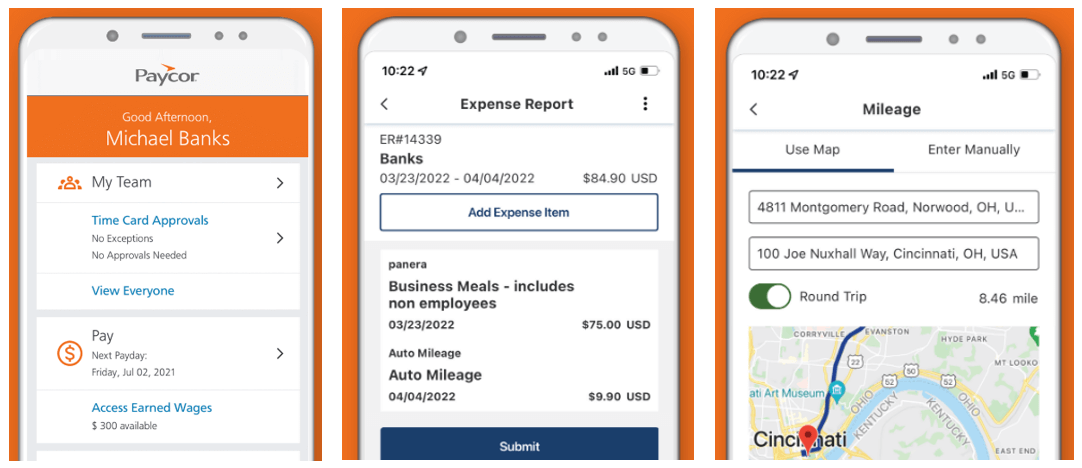

Paycor

Best company for automated payroll and mobile-friendly expense tracking tools

Paycor’s human capital management (HCM) software brings many HR functions together, including payroll processing, workforce management, talent management, employee experience features, and benefits administration.

Why I picked Paycor: Their automated payroll feature is perfect for salaried workforces since the system can run independently once you’ve onboarded your employees. Paycor also takes care of calculating employee and corporate tax filings, processing W-2 and 1099 tax forms, and submitting workers’ compensation premiums and reports on your behalf.

In terms of Paycor’s advanced features, their employee self-service capabilities are very strong. Employees can easily access their pay information via their mobile app, and even access earned wages early using their OnDemand Pay app. This feature alone eliminates the need to worry about issuing staff advances or manual payroll runs, which is often a stressful situation for both employees and payroll administrators alike.

In addition, Paycor also has several useful expense-tracking tools within their HCM software, including mobile-friendly receipt management tools and a function to track trip mileage for reimbursement.

Integrations are available with 140+ software applications through their Paycor Marketplace, including Center Expense Management, Certify by Emburse, CloudPay, HIRETech, Instant Pay, Rapid Disbursements, Payfactors, Netspend, and many others.

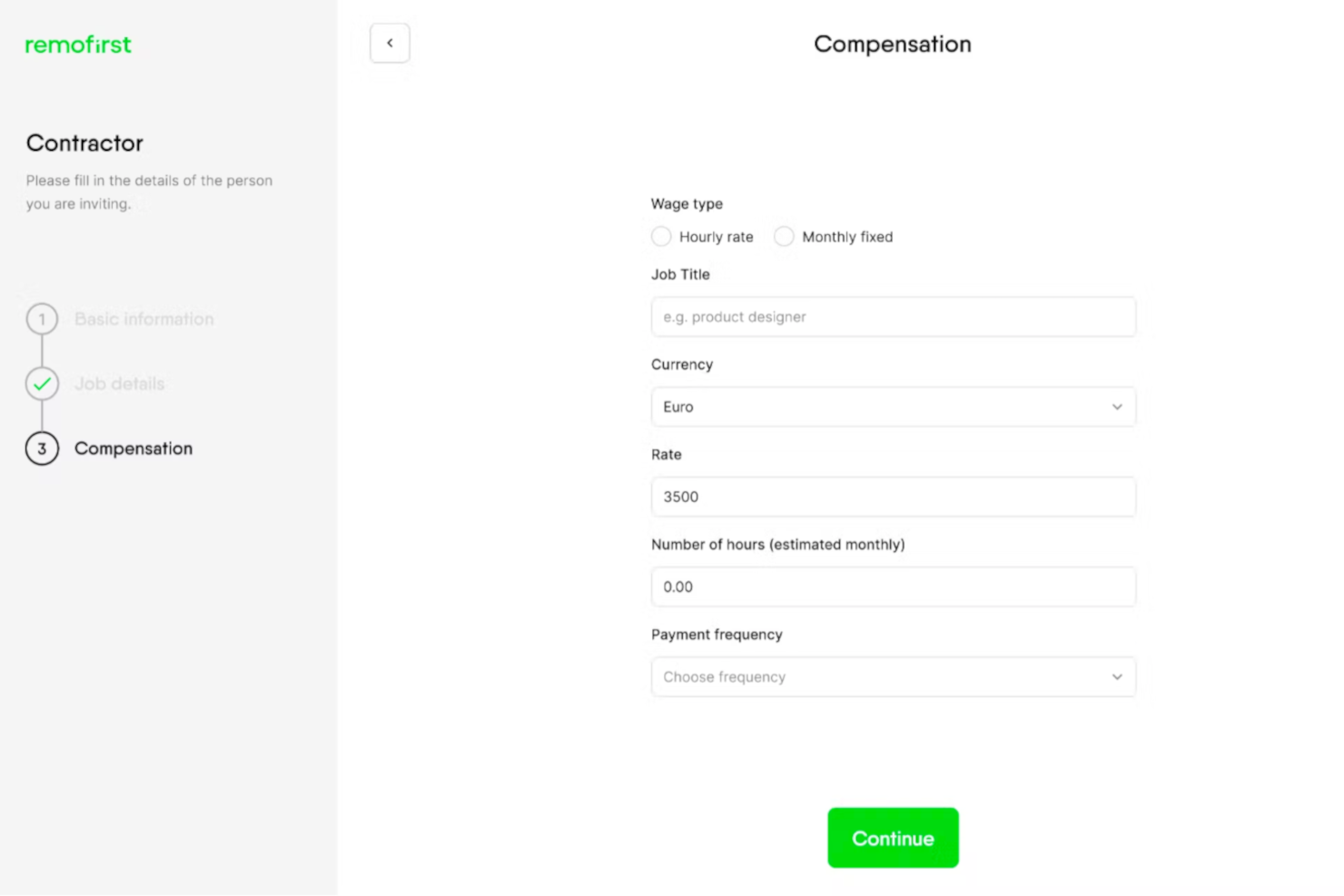

Best user-friendly payroll software for managing international teams

Remofirst is a payroll software that streamlines and automates the process of paying employees, eliminating the potential for human error while improving your payroll accuracy. It features an intelligent calculation engine that automatically calculates employee hours, overtime hours, paid time-off (PTO), and other deductions such as taxes and insurance withholdings. Employees can view and update their personal information, pay stubs, and tax information through the self-service feature, allowing them to take a proactive role in managing their payroll information to reduce errors and inaccuracies.

The software makes it easy to manage an international workforce, with features designed to help keep track of employee visas and work permits. Its dashboards and analytics make it easy to see all employee data in one place. Platform admins can see each employee's hours worked, pay rate, and taxes withheld. The interactive charts and graphs enable users to spot trends and identify potential problems with employee engagement and finances.

Remofirst offers tools to help businesses comply with local regulations, including contract templates and onboarding features. It also conducts compliance audits to help identify any risks in current practices. The software is user-friendly and intuitive, and because it's hosted in the cloud, there are no installation or maintenance fees, making it accessible anytime.

Remofirst can help conduct international payroll in 170+ countries.

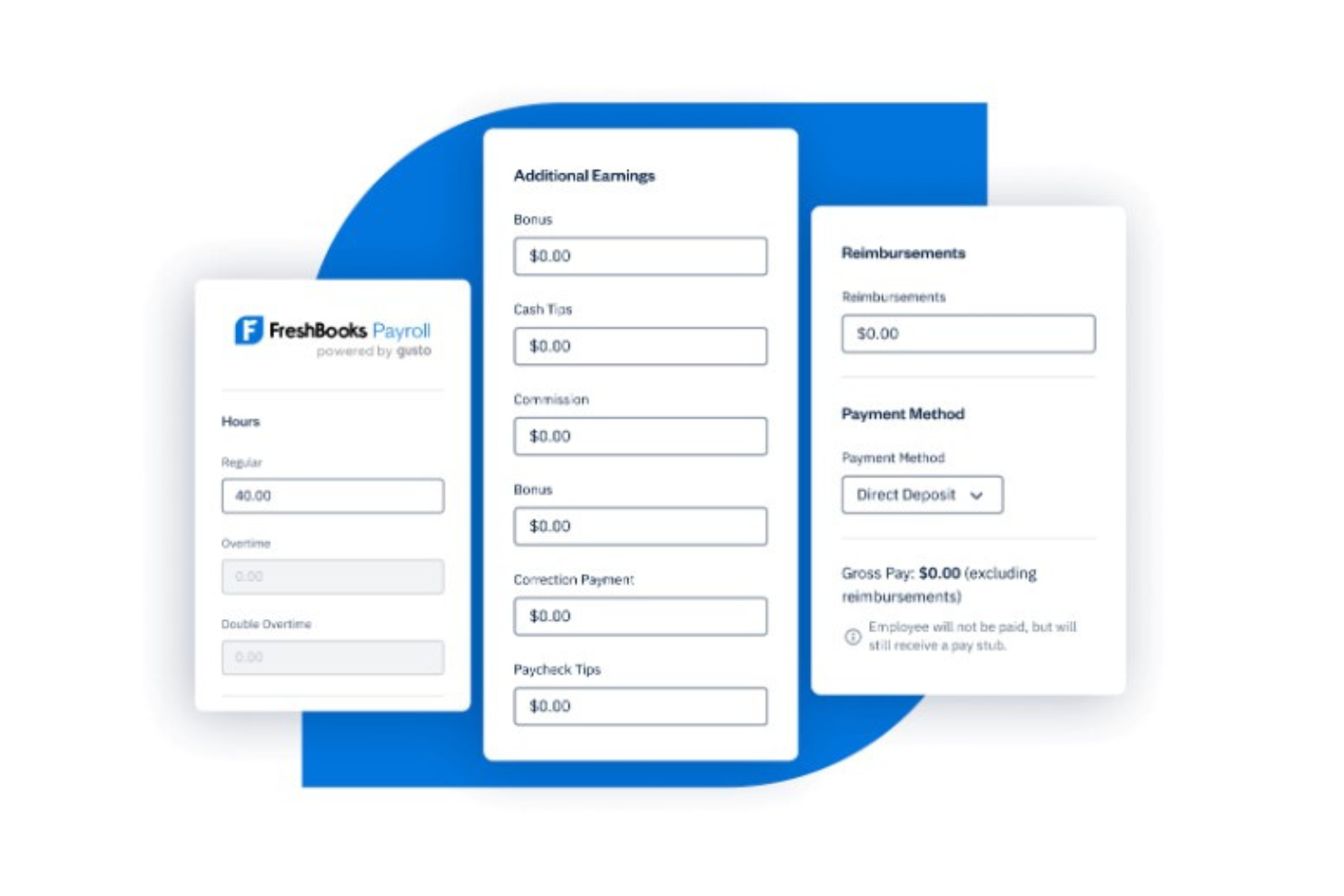

Best payroll company for a combined accounting, billing, and payroll system

FreshBooks is a digital accounting solution that provides invoicing, time tracking, and financial management features for businesses and freelancers. Their payroll service - FreshBooks Payroll - is a full-service payroll add-on that's designed to help US-based businesses automate payroll processing, including payroll tax deductions and compliance with federal and state payroll tax laws.

Why I picked FreshBooks: I included FreshBooks in this list because of the wide range of financial capabilities their software offers. In addition to their full-service payroll offering, FreshBooks can also help small businesses easily manage invoicing, employee expenses, and other common accounting tasks, all within one platform. Their payroll services include unlimited payroll runs, automatic payroll tax filings, direct deposit, and W-2 preparation.

Their online accounting solutions are tailored for small businesses, with capabilities that include creating professional invoices, tracking time automatically, and managing receipts and expenses. They also offer a range of educational resources and tools, such as a learning blog, a comprehensive glossary, and a library of reports, alongside practical tools like a free invoice generator and accounting templates.

Integrations include Google Drive, PayPal, Slack, Trello, Mailchimp, Gusto, and Salesforce Sales Cloud.

Best payroll company with enhanced customer support for US companies

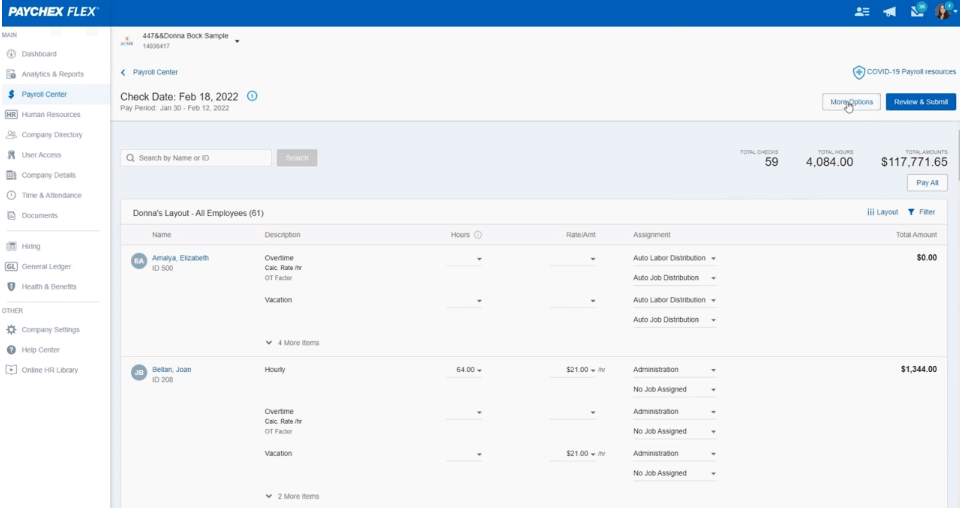

Paychex Flex is an all-in-one HR, benefits and payroll management system with configuration options for businesses of any size, from self-employed solo entrepreneurs to small businesses, all the way up to organizations with 1,000+ employees.

Why I picked Paychex Flex: Their online payroll system calculates, files, and submits payroll taxes on your behalf, and integrates HR and benefits deduction costs directly with payroll to reduce the need for manual data entry. To further improve productivity, Paychex also includes a time & attendance tracking system that automatically links tracked hours to payroll too.

To help businesses stay compliant at all times, Paychex has a roster of 200+ compliance experts who are constantly monitoring any changes to US-based tax laws and regulations. Their software also supports multiple payment options, including direct deposit, paper checks, a Pay-on-Demand feature where funds can be accessed prior to your next payroll date, or payment via pay cards that are fully compliant with US federal laws.

Their customer support services are also quite deep, and include an online chat feature, articles, how-to guides, and 24/7 live coverage for US-based customers.

Integrations are available with 300+ commonly used applications, including BambooHR, Epicor, Infor, JazzHR, Microsoft Azure, Microsoft Dynamics, Sage, SAP, and many others. Plus, Paychex Flex has an API to support any custom software integrations you may need.

Best payroll company for a streamlined payroll process

ADP Workforce Now is a comprehensive cloud-based platform that helps companies manage payroll needs in one integrated system.

Why I picked ADP Workforce Now: It lets users view information about their workforce in real time with employee self-service features that allow employees to access their personal information and make changes if needed. With its intuitive web interface, employers can easily access the data they need to accurately track employee hours, wages, benefits, taxes, and deductions. Additionally, it provides compliance support, so employers are always up-to-date on the latest laws and regulations about paying employees correctly.

ADP Workforce Now allows businesses to easily manage employee benefits such as health insurance, 401(k) plans, and vacation time tracking. Users can create custom benefit packages for different types of employees or job levels within their organization so that everyone receives the same level of care and attention when it comes to benefits administration.

It also provides an online platform for managing employee information such as contact details, job history, education, skills, and performance reviews. It enables businesses to easily track attendance data and monitor employee leave applications in real time. Additionally, this feature helps onboard new hires by providing them with the necessary paperwork quickly and efficiently so they can get up to speed faster.

Users can automate repetitive tasks like calculating paychecks and taxes, creating reports, and generating invoices. These features enable companies to streamline their payroll processes to save time and money while providing accurate information to their employees. This platform allows users to choose from various payment options such as direct deposit, cheques, or even a combination of both. This gives them the flexibility to choose the best option for their employees so that they can receive their payments quickly and securely.

Integrations include accounting solutions like Quickbooks, Wave, and Xero, ERPs like Oracle, SAP, and Workday, time and attendance solutions like Clock Shark, Deputy, and Dolce, and recruiting and onboarding solutions like GoodHire, Sapling, and Zip Recruiter.

Best basic payroll software and service for US companies

Patriot Payroll is a payroll service provider that covers payroll, setup, 2-day direct deposits, and customer support.

Why I picked Patriot Payroll: It's a full-service payroll platform that acts as a concierge for US-based businesses. The customer service team will reach out to you if they need any information, but otherwise will handle your local, state, and federal taxes with no problem.

The platform comes with a large information database that gives you tons of resources for managing your payroll and taxes. The detailed guides are super helpful for people who have limited knowledge of payroll best practices and tax filings. You can also choose from their add-ons that cover time and attendance tracking, and an employee database.

Integrations are available with other HR tools like Intuit QuickBooks Online, GoCo, Plaid, Workforce.com, and WorkforceHub Time & Attendance.

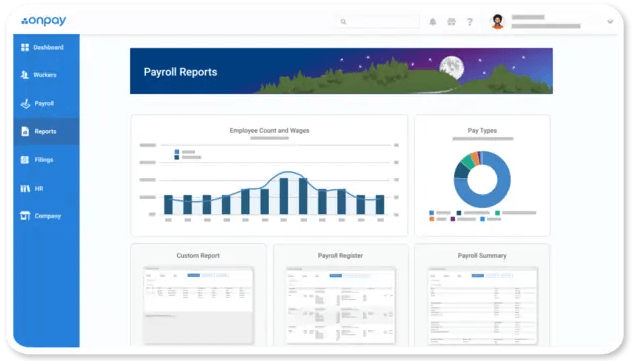

OnPay

Best payroll company for industry-specific payroll services + in-house insurance brokers

OnPay’s comprehensive HRIS platform helps entrepreneurs manage payroll, HR functions, and benefits all in one place.

Why I picked OnPay: Their software includes a full suite of payroll services and compliance settings for all 50 states. For no additional cost, they also offer special payroll services for certain industries like restaurants, farms and agriculture, churches and clergy, and nonprofits. As well, OnPay makes it easy to access pandemic-related tax credits and forgiveness applications through their COVID-19 dashboard.

Their team of licensed in-house insurance brokers can help you set up health, dental and vision plans with top providers such as Humana, Cigna, Blue Cross / Blue Shield, Aetna and UnitedHealthcare. Once in place, benefit costs are synced with payroll, which means you won’t have to worry about capturing any cost fluctuations yourself. Another interesting feature is their 401k integration which automatically supports employer matching and profit-sharing options.

Integrations are available with QuickBooks, Xero, When I Work, Deputy, Magnify, Mineral, PosterElite, and with the 401k retirement platforms Guideline, America’s Best 401k, and Vestwell.

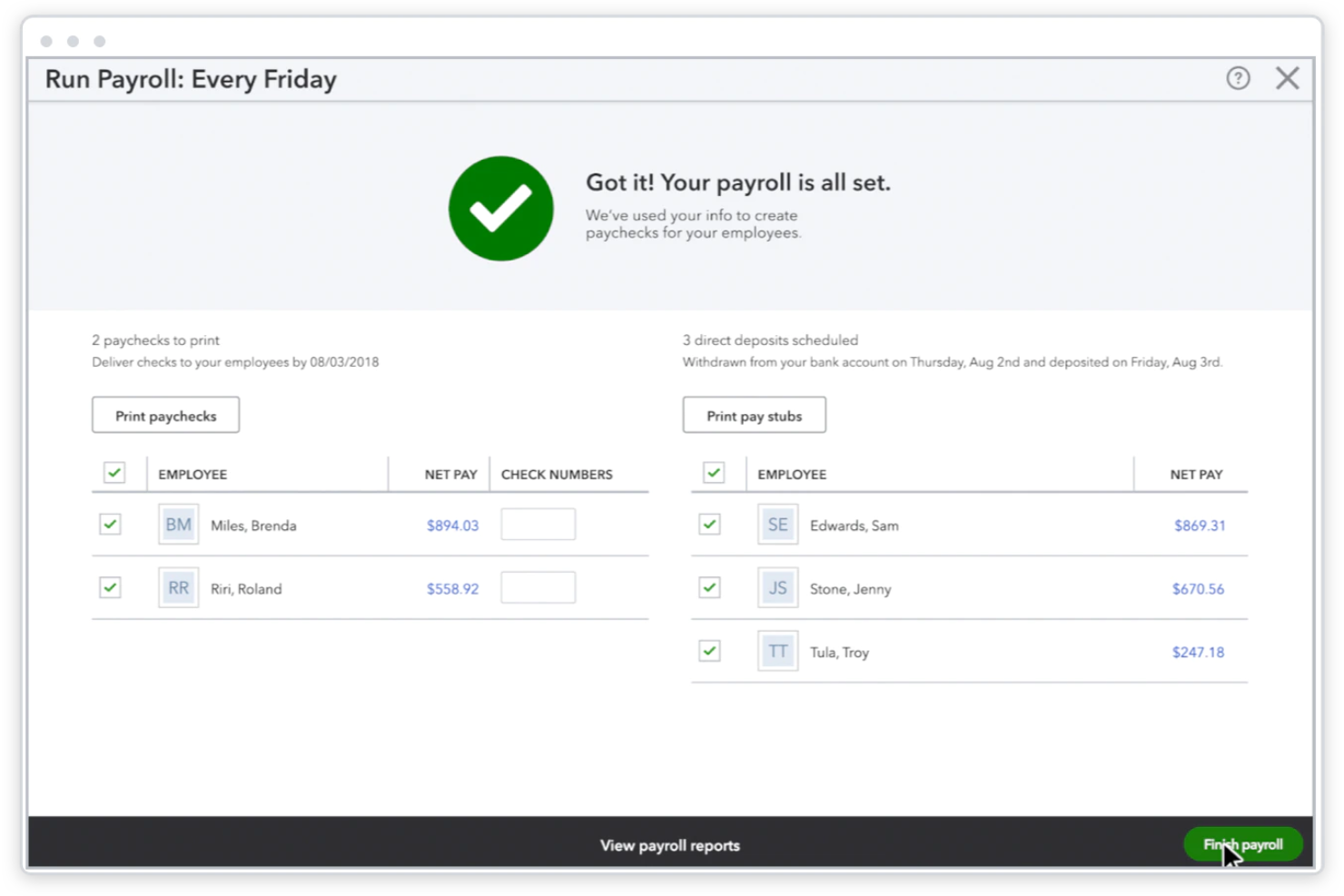

Best payroll management and accounting platform for small businesses

QuickBooks Online is a payroll management and accounting software designed to cater to the needs of small businesses. You can use it to manage your company's invoicing, expense tracking, payroll, and taxes. It's available in the US, Canada, Australia, and the United Kingdom.

Why I picked QuickBooks Online: The software can modernize your payroll processes by automating how pay is calculated and sent out to employees. It can also automatically calculate and deduct income taxes, and run your tax filings in all 50 US states. You can essentially set it and forget it when it comes to paying your staff. Of course, you can still review and approve payments before they're sent out.

Beyond its basic payroll features, it also facilitates garnishments, deductions, health benefits, and workers comp management. And, you can manage your expenses and receipts as well as invoices and payments through the same platform.

Integrations are available with over 450 business apps like Square, Stripe, Paychex, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, Etsy, Katana, and ProjectWorks.

Best Payroll Companies: Pricing Comparison Chart

This comparison chart summarizes basic details for the best payroll companies that made my shortlist. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best payroll company for you.

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing, with free HR tool for businesses | Website |

| Papaya Global | EOR from $650/employee/month or $2/contractor/month; Global payroll from $3 to $12/employee/month | Website |

| Paycor | From $5/employee/month + $99/month base fee | Website |

| Remofirst | From $199/employee/month for EOR and $25/mo for contractors | Website |

| Freshbooks | $4.50/month | Website |

| Paychex Flex | From $39/month + $5/employee/month | Website |

| ADP Workforce Now | From $160/month for up to 49 employees | Website |

| Patriot Software | From $4/employee/month + $17/month base fee | Website |

| OnPay | From $6/employee/month + $40/month base fee | Website |

| QuickBooks Online | from $22.50/month | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Payroll Companies

Here are a few more worthwhile options that didn’t make the best payroll companies list:

- Gusto

Best HR software for full-service payroll outsourcing

- Zenefits

Best for sophisticated, time-saving payroll features and automations

- PayUSA

Best payroll system for integrated time & attendance tracking to reduce manual data entry

- Buddy Punch

Best combined payroll and time-tracking solution with an affordable pricing model

- Remote

Best payroll company for offering employees international stock options

- Multiplier

Best for global payroll outsourcing and additional HR support via PEO and EOR services

- Oyster HR

Best hiring and payroll management platform for coverage across 180+ countries

- ADP GlobalView Payroll

Best payroll company for multinational organizations of any size

- QuickBooks Payroll

Best user-friendly payroll service provider with automatic tax calculations and tax penalty protection

- Namely

Best online payroll service with a useful payroll wizard to streamline the payroll process

Selection Criteria for Payroll Companies

I'm happy to explain how I developed this list of the best payroll companies if you're curious about my methodology.

I started by reviewing recent payroll market data to compile a long list of payroll companies that are well-known in the payroll space. I then drilled into the finer details of each company's payroll offerings, to see how they compared to each other and what made each one standout.

To compile my final top 10 choices, I compared each payroll company even more stringently using the following selection criteria:

- Core payroll features: All the payroll companies in this list cover the basics:

- Payroll processing for hourly or salaried workers

- Direct deposit into employee bank accounts

- Digital pay statements (pay stubs) and annual earning statements

- Automatic withholding and filing of payroll taxes for government bodies (e.g., the IRS or CRA)

- Payroll reports for each individual payroll run plus year-end reports.

- Advanced payroll features: These are the payroll features I consider as "bells and whistles" that are not always available with all payroll providers:

- Global payroll processing in multiple currencies

- Same-day pay access for employees (also known as pay-on-demand or earned wage access)

- The ability to include contractor payments in your standard payroll run

- Additional HR features or services: These functionalities go beyond the realms of payroll, but they're definitely a bonus if you can access them too:

- Assistance with benefits management

- Assistance with corporate bookkeeping

- Additional global HR or EOR services.

- Level of customer support: You will be trusting your most important business function — paying your employees — to an outside organization, so you want to ensure they'll be there to support you when needed. This includes support via:

- Phone

- Online chat

- A dedicated Account Manager

- Or an online knowledge base (for self-service solutions).

- Software integrations: To improve productivity and reduce manual data entry, you want to make sure the payroll company you choose offers software that will work with your existing tools. Key integrations to look for include:

- HR data management systems (HRIS, HRMS, HCM systems)

- Time and attendance tracking software (a.k.a., timesheets)

- Benefits administration software

- Compensation management software.

Frequently Asked Questions about Payroll Companies

Still curious about payroll companies and what they have to offer? Take a look through these answers to popular FAQs to get you grounded.

How do payroll companies work?

Payroll companies offer both payroll software and payroll services that assist organizations in managing their payroll process.

If you’re self-sufficient enough to run your own basic payroll yourself, you can likely get away with managing your business needs through a SaaS (software-as-a-service) pricing plan where you pay a monthly fee for using your payroll software of choice, and that’s it.

However, if your resources are limited and you need extra support, payroll companies can help you with extra services for an additional fee.

For more details on this topic, pop over to our article explaining what payroll service is and the reasons you might need it.

What key features do payroll companies offer?

Here’s a summary of the core features you can expect to receive when working with the best payroll service providers in this list:

- Automations: These are the tools that allow payroll functions to run on their own without time-consuming human oversight—the bread and butter of payroll systems.

- Compliance tools: Built-in features that ensure your payroll configuration is set up to calculate, collect, report, and file all your tax payments as required. Many systems also include oversight by teams of compliance and payroll specialists too.

- Advanced payment features: Many modern payroll systems now include pay-on-demand features where employees can access earned wages in advance of their next payday, or receive payment in their own local currency if they’re based internationally.

- Employee self-service & mobile access: All the payroll providers in this list offer employee portals where staff can access their pay stubs digitally, plus additional functions like time-off requests, time-tracking features, and more.

Interested in more nitty-gritty payroll details? Take a look at our comprehensive list of payroll features as well.

How much do payroll companies charge?

The cost of working with a payroll company will depend on the type of features you need their support with. While most of the payroll companies in this list do offer pricing details for their basic payroll software, you’ll need to contact each provider directly to receive a personalized service offer for any add-ons.

In general, payroll companies charge a basic monthly fee plus an additional charge based on the number of employees you have listed as active on your payroll register.

What are the best payroll options for small business owners?

There are many solid options for small business payroll providers out there. And luckily for you, I’ve already done all the leg work for you. To save you time, take a look at my list of the best payroll software for small businesses instead.

If you’re running a startup or operating on a very tight budget, you’ll also want to browse my list of the best free payroll software too.

Other Payroll Resources

With so many different payroll providers out there (including 440 HR & payroll software companies in the US alone as of 2022), we couldn’t possibly fit them all into one article! If you’re still interested in considering other options, I recommend reviewing these other payroll solutions too:

- Best Payroll Software: Reviewed and Compared

- Best Automated Payroll to Save Teams Time

- Best Online Payroll Software for Paying Staff

- Best HR Software for Payroll

If you’re looking for payroll software specifically for internationally-based staff, you’ll want to check out these other types of payroll and HR services as well:

- Best Global Payroll Service Providers

- Best PEO Companies (Professional Employer Organizations)

Not sure which one is the right fit? This explanation of PEO vs EOR services will explain how each HR service works.

You should also take a peek at our how-to articles, Keep Your Payroll on Time, All the Time and How to Manage Payroll for Small Business for some expert tips too.

Stay Connected & Join Our Community

If you found this article useful, I recommend subscribing to our People Managing People newsletter as well. You'll learn about the latest trends in HR leadership, tricks and tips to help you process payroll more efficiently, and how-to guides for any HR topic you can think of. Plus, it's delivered to your inbox for free each week.

You're also welcome to join our People Managing People community if you'd like to take things one step further. By signing up, you'll gain access to a community of like-minded people leaders that you can crowdsource information from whenever you need additional guidance.