10 Best Business Tax Software Shortlist

Here's my pick of the 10 best software from the 19 tools reviewed.

There are seemingly countless business tax software solutions available, so figuring out which is best for you is tough. You want to automate the calculation of various taxes, ensure compliance with tax laws and regulations, and identify potential deductions and credits—but now need to figure out which tool is the best fit. In this post, I make things simple, leveraging my experience as an HR expert using dozens of different business tax tools to bring you this shortlist of the best business tax software overall.

What Is Business Tax Software?

Business tax software is a digital solution designed to assist companies in managing and filing their taxes. It automates tax calculations, ensures compliance with tax laws, and helps identify deductions and credits.

The purpose is to simplify the complex process of tax preparation, reduce the risk of errors, and save time. It provides updated information on tax regulations, making it easier for businesses to stay compliant. By using business tax software, companies can efficiently handle their tax obligations, leading to more accurate financial reporting and better financial management.

Overviews Of The 10 Best Business Tax Software

Here’s a short description of each business tax software that made it into my top 10 list, including a screenshot, noteworthy features, pros and cons, and pricing details. Keep reading to find additional bonus picks at the bottom of the list.

Deel is a comprehensive HR and payroll management tool that assists businesses in hiring globally, automating payroll, ensuring compliance, and managing their entire global team in one platform.

Why I picked Deel: Deel's platform is designed to manage both employees and contractors, offering a unified solution for international hiring, global payroll administration, and compliance tasks. It offers several features that assist with business tax software needs, such as handling taxes, generating payslips, and ensuring compliance with local tax laws around the world. The platform also integrates with various financial and accounting systems, which can help businesses maintain accurate tax records and streamline their tax reporting processes.

Deel Standout Features and Integrations

Standout features include providing payroll and local benefits, a comprehensive HR information system, access to co-working spaces through WeWork, in-house visa support, easy contract creation, and worldwide equipment shipping.

Integrations include Slack, Google Workspace, Brex, HubStaff, Officely, Jira, QuickBooks, BambooHR, Xero, and Expensify.

Pros and cons

Pros:

- Fast money withdrawal

- Eliminates administrative tasks and streamlines operations

- User-friendly platform

- Fast money withdrawal

- Eliminates administrative tasks and streamlines operations

- User-friendly platform

Cons:

- Limited customization options

- System errors can cause payroll delays

- Limited customization options

- System errors can cause payroll delays

TaxCloud is a sales tax management service tailored for ecommerce businesses, providing real-time calculation of sales tax rates across over 13,000 jurisdictions in the United States. It automates the process of tax collection at the point of transaction, filing, and remittance with a promise of 100% accuracy, positioning itself as a leading solution for ecommerce sales tax compliance.

Why I Picked TaxCloud: I chose TaxCloud as the business tax software after evaluating its comprehensive compliance capabilities. What makes TaxCloud distinct is its combination of a self-serve platform backed by a team of experienced TaxGeeks, which provides both autonomy and expert support for businesses. I believe TaxCloud is best for ecommerce sales tax compliance due to its proven track record of accuracy and exceptional customer service.

TaxCloud Standout Features & Integrations

Standout features include sales tax filing and remittance services for businesses. This unique feature further reduces the compliance burden on businesses by automating the often complex and time-consuming process of filing sales tax returns and remitting tax payments to state authorities. TaxCloud takes care of the entire filing process, from preparing the returns to submitting them to the appropriate tax jurisdictions, which can save businesses significant time and resources.

Integrations include Ability Commerce, BigCommerce, QuickBooks, Square, Stripe, Shopify, WooCommerce, Odoo, Volusion, Cart.com, Oracle NetSuite, Acumatica, Sage, and Magento.

Pros and cons

Pros:

- Collect sales tax automatically

- Integrations with a variety of ecommerce tools

- Database of up-to-date sales tax rates and rules

Cons:

- Transaction volume limitations on lower plans

- May be too basic for larger enterprises

InsightSoftware is a business tax management solution that enables mid-sized businesses to navigate complex tax regulations and simplify their filing process with automation.

Why I picked InsightSoftware: I selected InsightSoftware because it helps mid-sized businesses who have complex tax needs automate their tax processes while reducing the risk of an audit. The platform collects data from third-party apps and aggregates it to help you uncover insights and make strategic decisions regarding your financial situation.

InsightSoftware Standout Features and Integrations:

Standout features include tax calculation, reporting, audit support, a tax repository, automated workflows, and a self-service portal. I like the platform’s tax calculation feature because it’s fast and allows you to get accurate current and deferred calculations on a state-by-state basis.

Integrations include dozens of business tools, including Oracle ERP Cloud, Oracle PeopleSoft, Microsoft 365 Business Central, SAP Business One, NetSuite, Deltek Vision Cloud, Epicor CMS, Infor CloudSuite Financials, Sage, and QuickBooks Online.

Pros and cons

Pros:

- Enables you to build custom report templates

- Flexible, customizable solution

- Consolidates all your tax information, simplifying your financial reporting

Cons:

- The platform can lag at times when importing large sets of data

- Limited automations for income tax credit and net operating loss calculations

Avalara is a business tax platform that helps North American e-commerce businesses report their inventory and file their taxes.

Why I picked Avalara: Avalara made my list thanks to its native integrations with e-commerce platforms and marketplaces. The software pulls data directly from your e-commerce tool and uses it to populate your tax forms, making it easy to calculate your tax rates according to your local jurisdiction.

Avalara Standout Features and Integrations:

Standout features include e-invoicing, business profiles, consolidated reports, document management, tax return filing, a knowledge base, and custom alerts. I like Avalara’s custom alert feature because it notifies you when you have to take action in different tax jurisdictions, making it one of the best tax software options for businesses operating in multiple states or provinces.

Integrations include 1,200+ integration partnerships with e-commerce platforms, payroll solutions, payment tools, and CRMs, such as Sage, Magento, NetSuite, Microsoft Dynamics, Shopify Plus, Stripe Invoicing, Zuora, QuickBooks, WooCommerce, Amazon Seller, and Salesforce.

Pros and cons

Pros:

- Great selection of tutorials and training materials for e-commerce businesses

- Helps you submit accurate state and federal returns

- Search feature enables you to find the right information in the platform’s FAQs

Cons:

- Can be more expensive than other tax software programs for small businesses

- Novice users can find the platform overwhelming

Vertex is a business tax solution that helps organizations who lease vehicles or equipment determine and file their taxes.

Why I picked Vertex: Lessors face complex tax management, and Vertex helps with that. The platform allows you to control and manage your lease transactions, helping you determine your taxes with 150,000+ lease-specific rules and tax calculations. The software also helps you automate taxation on lease transactions, regardless of location.

Vertex Standout Features and Integrations:

Standout features include audit trail, consumer use tax, a document import and management feature, compliance management, and exemption management. These features work in tandem to help you ensure you’re tax filings are always compliant, regardless if you’re operating a brick-and-mortar, online only, or hybrid business.

Integrations include e-commerce platforms, marketplaces, accounting, and payroll solutions, such as Adobe Commerce, BigCommerce, Aria, Infor, Microsoft Dynamics 365, NetSuite, Sage, Salesforce, and Spryker.

Pros and cons

Pros:

- Good at interpreting imported spreadsheets

- Helpful customer support

- Simple and straightforward user interface

Cons:

- Customizing your reports can be time consuming

- Reports could be more detailed

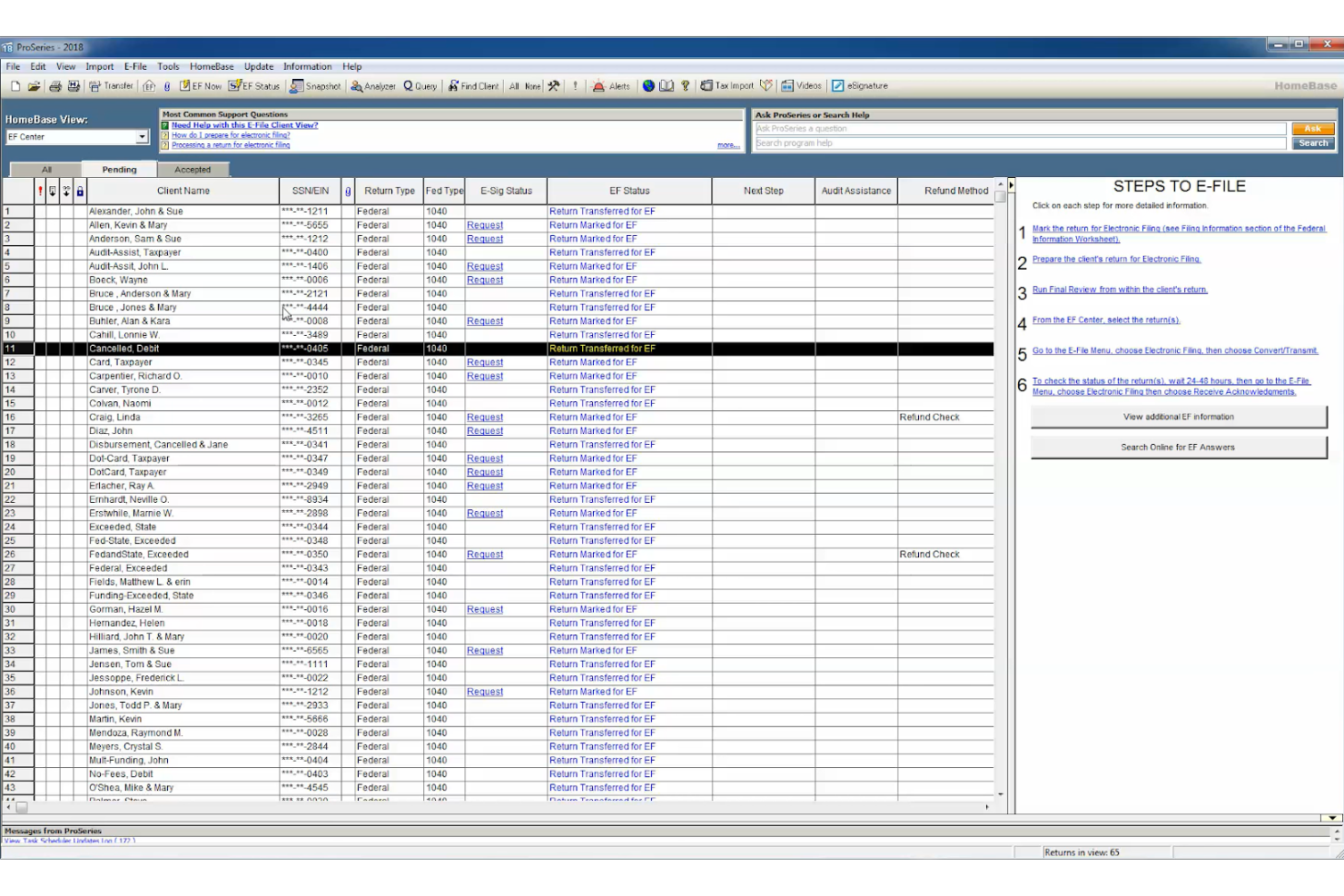

ProSeries Tax is a business tax software that helps North American business owners save time when filing their taxes with dedicated features.

Why I picked ProSeries Tax: ProSeries Tax made it into my top 10 list thanks to its time-saving features, such as quick entry sheets, a keyword-based search feature, automated data imports, and tax return input guidance. The solution is friendly toward first-time users and offers a guided workflow you can rely on to file your federal and state returns.

ProSeries Tax Standout Features and Integrations:

Standout features include a personalized training portal, e-filing, automated imports, software webinars, guided onboarding, a knowledge base, and community advice. I like the platform’s personalized training portal because it allows you to access tutorials and videos tailored to your needs and skill level.

Integrations include e-signing software and payroll solutions, such as DocuSign, QuickBooks Online Payroll, ADP Workforce Now, Gusto, SurePayroll, and Paychex Flex.

Pros and cons

Pros:

- Helpful tool for tax professionals managing multiple clients

- Interface is easy to use and navigate

- Comprehensive diagnostics and error checking tools

Cons:

- The interface may lag at times

- Limited customization options for reports

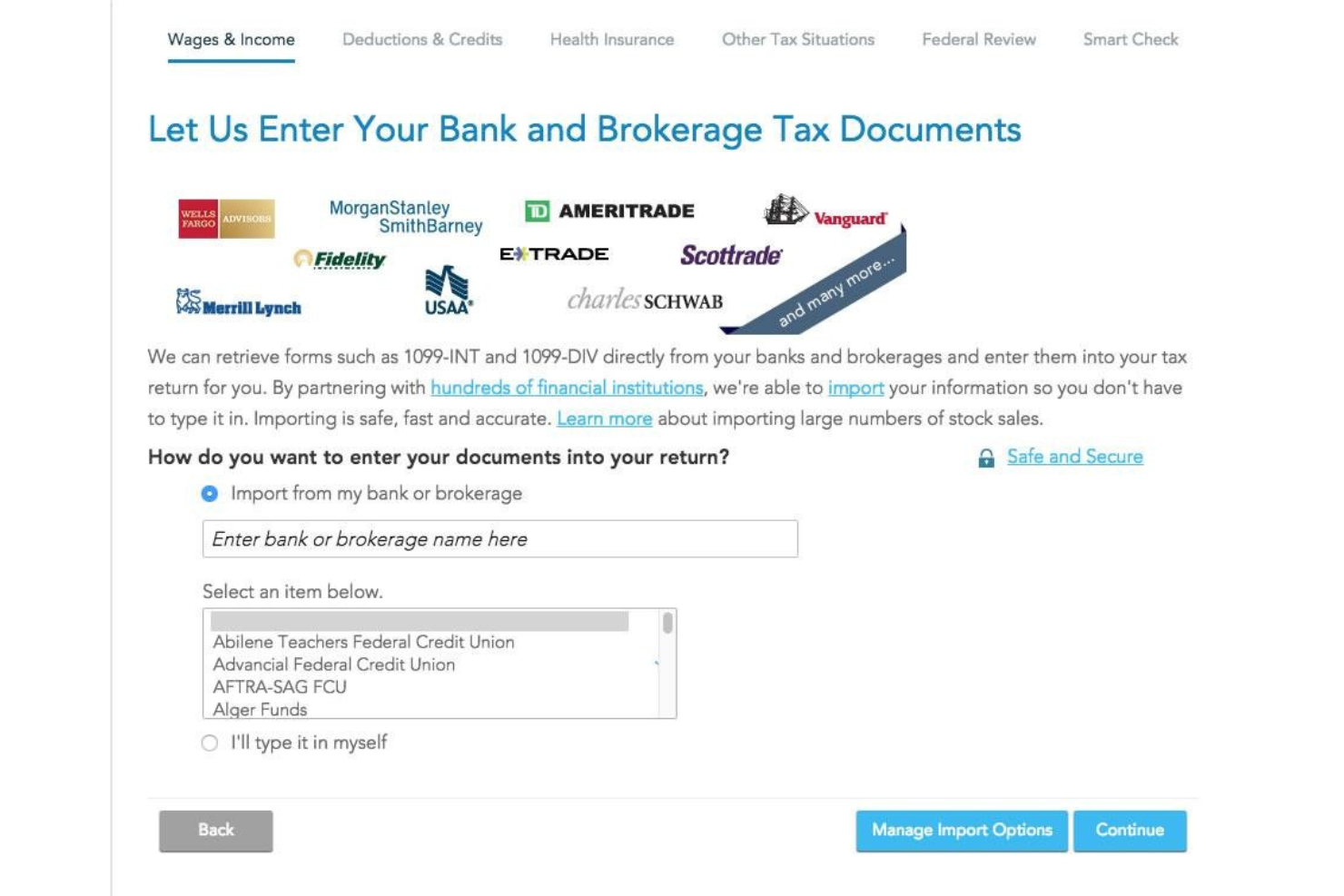

Intuit TurboTax is a popular business tax prep provider that enables you to file your taxes on your own or with the help of an expert.

Why I picked Intuit TurboTax: Intuit TurboTax made my top 10 list thanks to the user experience it offers. Filing taxes with TurboTax is like having an in-depth interview with a tax specialist. The software creates a step-by-step journey that allows you to upload documents so you can report your business income, calculate your taxes, write off business expenses, and store your federal or state tax returns.

Intuit TurboTax Standout Features and Integrations:

Standout features include document importing, crypto support, a donation calculator, rental property tax calculations, on-demand screen sharing, and chat or phone support. I like the platform’s live assistant feature because it enables you to connect with an expert and determine what deductions and credits your business is eligible for.

Intuit TurboTax integrates with dozens of payroll and HR software solutions, including ADP, Ceridian Dayforce, Paycom, Gatekeeper, PayrollMaxx, Gusto, QuickBooks, Paycor, Paylocity, and UKG Pro.

Pros and cons

Pros:

- Great customer support

- Clean and straightforward interface

- Very easy to use

Cons:

- Free version can’t handle itemized deductions

- Freemium version available only for simple tax returns

Intuit ProFile Tax is a business tax software that allows Canadian business owners to handle their federal and state filings according to current tax laws.

Why I picked Intuit ProFile Tax: I selected Intuit ProFile Tax because its vast database of tax forms makes it ideal for Canadian entrepreneurs. The software offers the right form for every tax jurisdiction in Canada, including Québec.

Intuit ProFile Tax offers a lot of training materials, so business owners should be able to prepare for tax season on their own. However, if taxpayers encounter any problems, they can quickly find solutions by reaching out to the support department or searching for the topic on the platform’s forum.

Intuit ProFile Tax Standout Features and Integrations:

Standout features include a knowledge base, form auto-filling, e-filing, email templates, document import, cloud backups, and an automated real-time auditor. I’m a fan of the platform’s email templates because they help you save time when preparing common communications, such as engagement letters, payment emails, or client invoices.

Integrations include QuickBooks, Caseware, and QBOA.

Pros and cons

Pros:

- Auto-populating form lines from the CRA’s site can help you save time

- Proactive support

- Rich tutorial database

Cons:

- No option to pay for just one filing

- Interface looks a bit dated

UltraTax CS is a professional tax software that helps you handle complex tax scenarios with accuracy and efficiency.

Why I picked UltraTax CS: I selected UltraTax CS because of its powerful automation features. The solution takes care of your data entry and tax calculations with minimal supervision, saving you time and reducing the probability of calculation errors for complex tax scenarios. The platform also allows you to link personal tax returns and business entities and pulls from previous returns to complete your tax forms.

UltraTax CS Standout Features and Integrations:

Standout features include document management, data sharing, e-signatures, a client organizer, a web organizer, a fixed asset manager, planner CS, and state apportionment. I like the platform’s document management feature because it allows you to store your documents in customizable folders for easy access. You can also scan paper documents and import them into UltraTax CS.

Integrations include payroll and accounting solutions, such as SmartVault, TaxDome, SafeSend, Sagenext, Workpapers CS, Verito Technologies, CS Professional Suite, and Onvio.

Pros and cons

Pros:

- Powerful diagnostic feature

- Helps you organize your documents and files

- Accurate search feature

Cons:

- New users may find the interface confusing

- Large state returns may slow down the app

TaxAct is a business tax software that enables you to file your taxes on your own while providing contextual help for each step of the filing process.

Why I picked TaxAct: I selected TaxAct for my top 10 list because it gives you helpful tips on how to calculate and file your taxes correctly with the IRS. The software offers a great user experience and even comes with a mobile app, allowing you to file your taxes using only your mobile device.

TaxAct Standout Features and Integrations:

Standout features include e-filing, tax deductions and credits calculations, unlimited free tax expert support, document import, and a mobile app. I like TaxAct’s mobile app because it allows you to upload documents by taking pictures with your phone’s camera.

Integrations include several payroll solutions, such as QuickBooks, Sage Online, Xero, TaxDome, and Wave.

Pros and cons

Pros:

- Unlimited support

- Easy document uploading process

- Allows you to import your tax documents from other providers to minimize filing errors

Cons:

- The knowledge base’s search function could be more accurate

- Filers can’t downgrade to a cheaper plan once they start filing their tax returns

The 10 Best Business Tax Software Summary

This comparison chart summarizes basic details about each of my top business tax software selections. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best software for your budget and business needs.

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing, with free HR tool for businesses | Website |

| TaxCloud | From $9/month | Website |

| Insightsoftware | Pricing upon request | Website |

| Avalara | From $19/month | Website |

| Vertex | Pricing upon request | Website |

| ProSeries Tax | From $389/year | Website |

| Intuit TurboTax | From $99/filing | Website |

| Intuit ProFile Tax | From $445/unlimited filings | Website |

| UltraTax CS | Pricing upon request | Website |

| TaxAct | From $99.95/filing | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

Here are some other great business tax solutions I came across during my research. I didn’t have room for a full review for each of these but they are still worthy of consideration:

- QuickBooks Self-Employed

Best for built-in reports

- Oracle Cloud EPM Tax Reporting

Best for automation

- TaxSlayer

Best for independent contractors

- H&R Block

Best for Canadian small business owners

- Drake Software

Best for ease of use

- TurboTax Business

Best for partnerships, multi-member LLC’s, trusts and estates

- FreeTaxUSA

Best free tax software

- ProTax by QuickBooks Online Accountant

Best for year-end tax prep for Canadian businesses

- TaxCycle

Best for personalized support

Selection Criteria for Business Tax Software

Here’s a short summary of the main selection and evaluation criteria I used to develop my list of the best business tax software for this article:

Core Functionalities

All the solutions I included on my list will help you calculate and file your business taxes. To achieve that, here are the core functionalities I initially checked for:

- Tax calculations: The software should help you calculate your income and expenses

- Tax filing: The platform should enable you to file your tax forms with the state or federal authorities

If you're looking for software that can handle both taxes and payroll, you might be interested in our roundup of all-in-one payroll software platforms that offer robust tax features

Key Features

Business tax software offers a lot of different features, but the following ones are crucial:

- Accuracy guarantee: Top-rated solutions guarantee the accuracy of their filings, so they develop step-by-step guides so you can file your returns without errors

- Cloud-based access: Being able to access the tax software from anywhere, using any device, can make it easier to keep track of your business expenses

- Data imports: Filling up tax reports can be time-consuming, so solutions that automatically import and fill the tax information in for you can be huge time savers

Usability

While usability is important for every software, it’s especially important for tax prep software because the tax preparation process is complicated enough without adding a layer of technical difficulty. I only included tools that offered easy to use DIY (do-it-yourself) solutions on my list.

Expert Support

Even small tax errors can lead to severe penalties, so you should be able to receive expert help when needed. The tools I picked offer proper customer support.

Software Integrations

It’s essential to use a tool that communicates with other solutions in your app ecosystem, such as your payroll or invoicing tools so you won’t have to waste time entering that data manually. Integrations with expense reporting tools are also a welcome addition too.

Pricing

The pricing of business tax software varies wildly, but I picked solutions that charge you fairly based on what they offer.

People Also Ask

Want to find out more about business tax software? Here are some answers to common questions readers have on this topic.

What are the benefits of using business tax software?

Business tax software gives you peace of mind when filing your taxes by minimizing filing errors. These solutions also save you time when calculating your business expenses and can help you track your payroll costs and reduce your taxes.

What is the best tax software for a small business?

Finding the best small business tax software for you depends on your specific needs and preferences. Here are some factors you should take into consideration:

- Yearly cost: Make sure that the software’s cost fits your budget. Keep in mind to add the state filing fees to the overall cost as well.

- Features and functionality: Not all business software is created equal. Look for solutions that match your preferences, such as those offering support for different business structures, forms, schedules, small business payroll, and tax scenarios.

- Ease of use: The software’s user interface, such as navigation, design, and help options can have a significant impact on how easy it will be to use it.

- Customer support: Make sure that the provider offers good customer service and technical support, such as phone, chat, email, or in-person assistance.

- Software integrations: Tools that offer native integrations with other solutions you use frequently, such as your payroll management tool, your enterprise resource planning (ERP) software, and so on, can help you save time when calculating your taxes.

What type of business expenses should I be tracking as a sole proprietor?

As a sole proprietor, you can deduct many ordinary and necessary expenses that you incur in running your business. Here are some common types of business expenses you should be tracking:

- Office expenses: Such as rent, utilities, supplies, postage, furniture, equipment, and maintenance

- Travel expenses: May include airfare, lodging, meals, car rental, mileage, tolls, and parking

- Entertainment expenses: May include meals and event tickets for clients

- Advertising and marketing expenses: Such as websites, social media and online advertising, or offline advertising

- Professional fees and services expenses: Whenever you pay for accounting, legal, consulting, and outsourcing fees

- Insurance expenses: Typical insurance costs include liability, property, health, and disability insurance premiums

- Taxes and license expenses: May include your income tax, self-employment tax, sales tax, property tax, and business licenses

- Education expenses: Such as tuition, books, fees, supplies, and courses or seminars that improve your skills or knowledge in your field

Other Finance Software Reviews

Interested in managing your organization’s finances? Here are some other valuable resources from People Managing People you may be interested in:

- Expense Reporting Software for Business

- Payroll Software

- Payroll Companies to Run Your Payroll Process

- Payroll Software for Small Businesses

- Payroll Services for Small Businesses

- Free Payroll Software for Tight Budgets

Final Thoughts

Filing your taxes accurately and on time can mean the difference between a good business year and a lousy one. As Nellie Akalp, CEO and founder of CorpNet, said:

”Filing your business taxes on time is not only a legal obligation, but also a smart financial move. It can help you avoid penalties, interest, and audits, as well as take advantage of deductions, credits, and refunds that can lower your tax bill and boost your cash flow.”

Subscribe to the People Managing People newsletter to receive tips on how to manage your company’s finances from top industry experts directly in your inbox.