10 Best Payroll Services for Small Businesses Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

With so many different payroll services for small businesses available, figuring out which is right for you is tough. You know you want to outsource paying employees accurately and on time, but need to figure out which solution is best. In this post, I'll help make your choice easy, sharing my personal experience using dozens of different payroll services with small teams and projects, and provide my picks of the best payroll services for small businesses overall.

Why Trust Our Reviews

We've been testing and reviewing HR software + services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Payroll Service Providers for Small Businesses: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top selections for small business payroll services to help you find the best payroll service for your budget.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best global payroll with free HR tools | Free trial + demo available | From $29/month | Website | |

| 2 | Best for payroll and benefits administration | 30-day free trial | Pricing upon request | Website | |

| 3 | Best for automating payroll processing | 90-day free trial | Pricing upon request | Website | |

| 4 | Best for real-time payroll insights | Free demo available | Pricing upon request | Website | |

| 5 | Best for global payroll and EOR services | Free demo available | From $25 - $199/user/month | Website | |

| 6 | Best for automated tax filings | 30-day free trial | From $40/month + $6/user/month | Website | |

| 7 | Best for businesses looking for simple features | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 8 | Best for mobile accessibility | Free demo available | Pricing upon request | Website | |

| 9 | Best with a dedicated HR manager | Free demo available | From $99/month | Website | |

| 10 | Best for US-based businesses | 30-day free trial | From $4/employee/month + $17/month base fee | Website |

-

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

Reviews of the 10 Best Payroll Service Providers for Small Businesses

Here’s a brief description of each payroll service provider for small businesses to showcase each system’s best use case, some noteworthy features, and screenshots to give a snapshot of the user interface.

Deel is a cloud-based payroll platform designed for businesses of all sizes. For small businesses looking for additional help, Deel lets you hire and pay freelancers and employees from anywhere in the world without having to figure out local laws, tax systems, or international payroll. You also get access to Deel’s HR suite for free, allowing you to manage your entire team with professional and automated tools.

Deel’s platform includes various elements that make it simple to pay employees and contractors without having to juggle several tools. Their user-friendly interface incorporates advanced payroll capabilities such as contract and stock option management, expense reimbursements, and compliance tracking for every client.

Deel is capable of flexible payment terms, allowing businesses to pay contractors on a fixed plan, per-project basis, or pay-as-you-go model. One of its key features is the ability to support multiple payroll cycles, which means businesses can run their payrolls weekly, biweekly, or monthly. Deel’s in-house experts handle all international employee deductions, withholdings, and benefits, including taxes, insurance, and retirement contributions.

Employees and contractors can self-manage their pay and personal data, which reduces admin load. Deel supports major payment channels like Wise, PayPal, Payoneer, and Revolut to offer flexible withdrawal options and reduce unnecessary international transfer fees.

Deel has positive online reviews from clients and their workers, and offers 24/7 online chat support. Employees can securely access their payroll information and perform various tasks, such as updating their personal information, requesting time off, and viewing their pay stubs.

Deel integrates with popular accounting and HR software systems such as Ashby, BambooHR, Expensify, Greenhouse, Hibob, Netsuite, Okta, OneLogin, Quickbooks, SCIM, Xero, Workday, and Workable, and has an Open API to support additional custom integrations too.

Deel’s payroll services use flat rate pricing, so you can scale up or down depending on your situation. Deel’s HR tools are completely free for businesses with fewer than 200 workers. You can also request a free demo through their website to discuss your hiring needs.

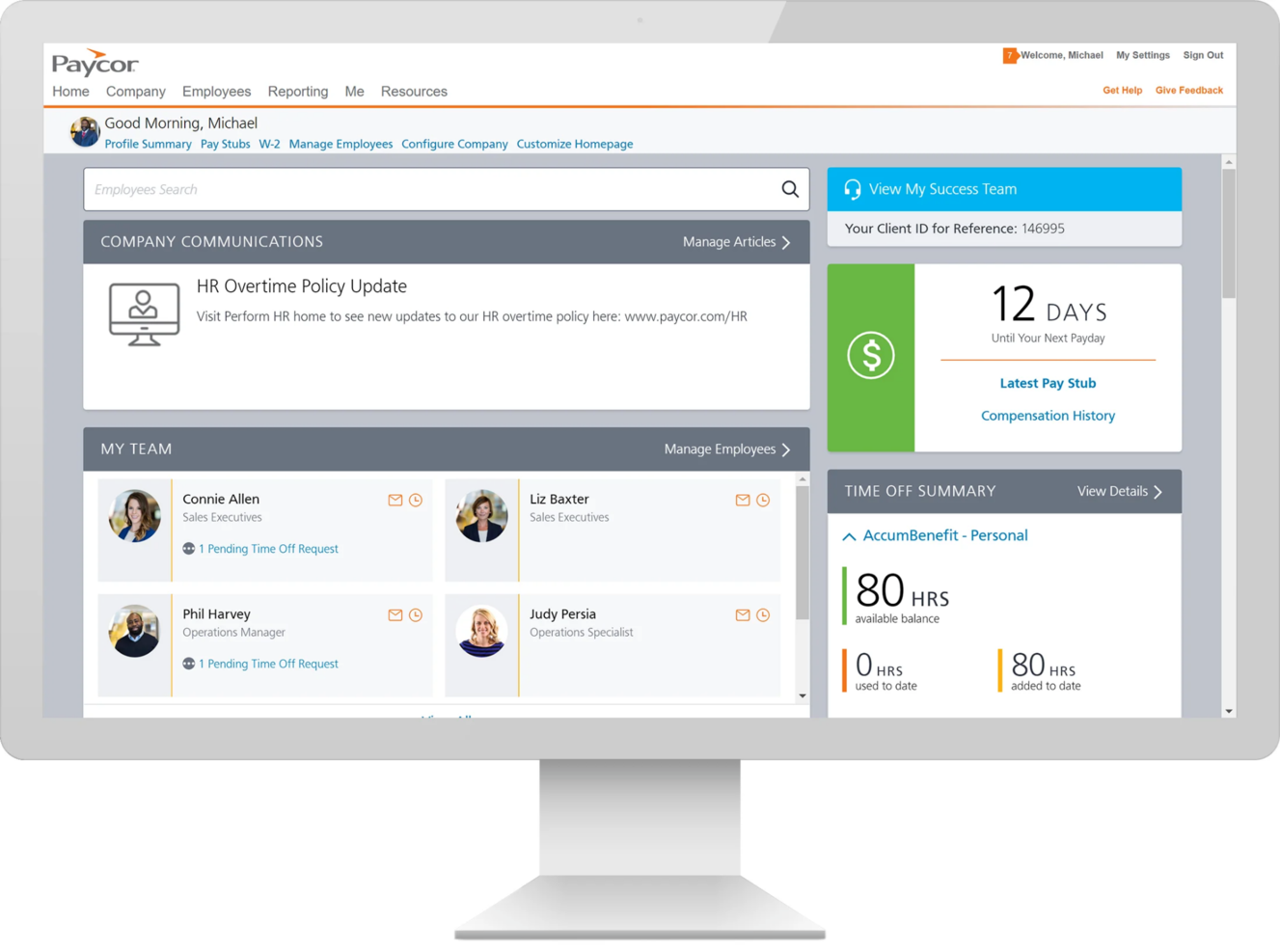

Paycor is a human resources and online payroll software that enables you to simplify your payroll process with automation. The solution integrates with 401Ks and accounting software, allowing you to set up an automated payroll and manage employee benefits without difficulty.

Paycor offers a mobile-friendly self-service portal where your team members can access all their documents and benefits information. The software automatically updates its system when tax laws and employment regulations change in every US jurisdiction, ensuring that your business is always compliant. Paycor’s reporting feature allows you to create reports based on templates. You can also schedule and share the reports directly from within the platform.

Paycor integrates with multiple apps, including CloudPay, Fidelity, HIREtech, Human Interest, Indeed, and Payfactors.

Paycor costs from $99/month plus $5/employee/month. Businesses that qualify can use the solution for free for three months.

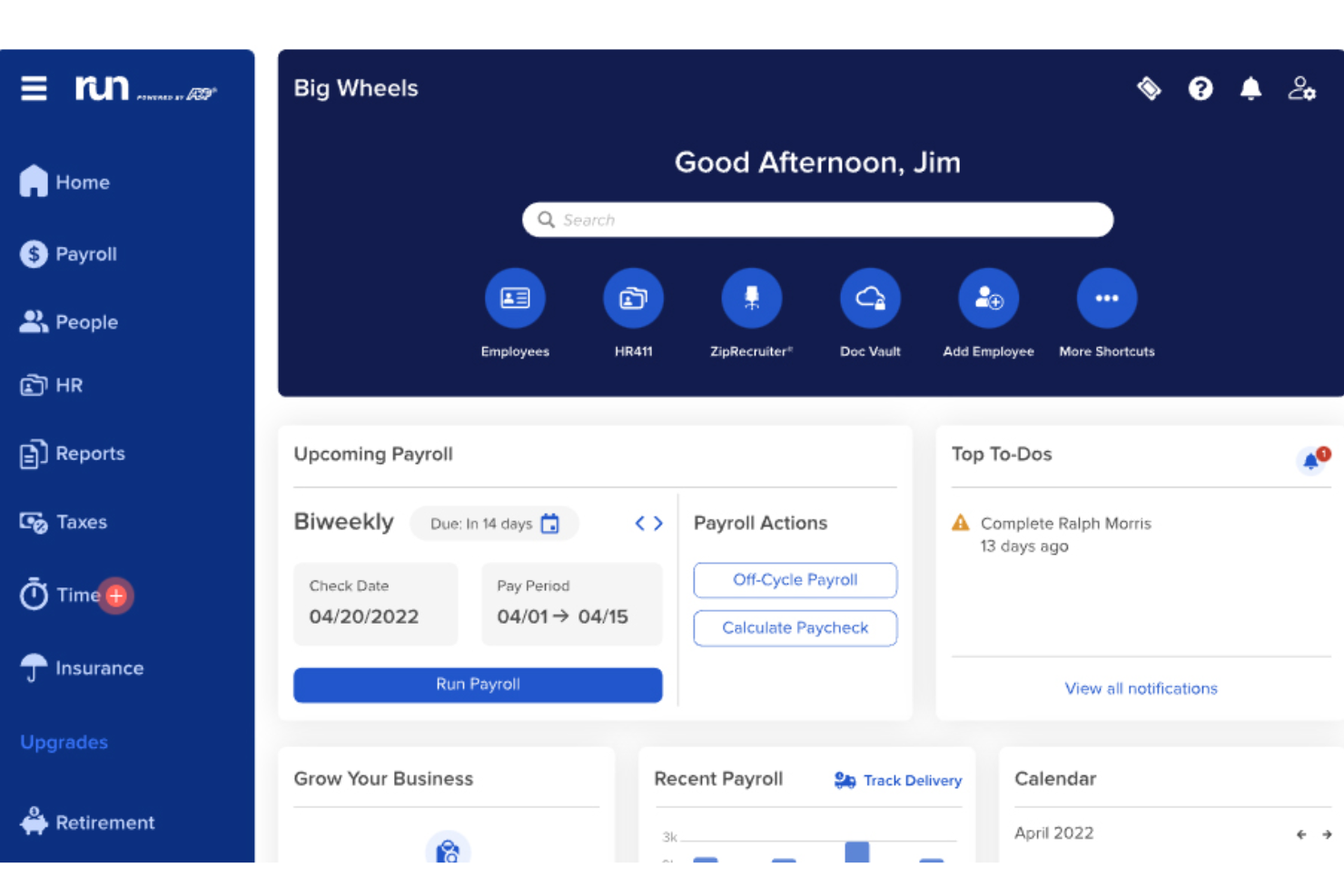

RUN by ADP is a payroll and HR platform tailored for small businesses, offering quick and accurate payroll and tax services. It includes automatic payroll tax calculations and filings, benefits, and retirement deductions, and ensures compliance with state and federal tax laws.

RUN by ADP stands out as an excellent payroll service for small businesses due to its comprehensive and user-friendly features tailored specifically for companies with 1-49 employees. One of the most significant advantages of the service is its ability to automate payroll processing, which includes calculating wages, tax deductions, and benefits.

Additionally, the platform's intelligent technology flags potential errors, ensuring compliance with federal, state, and local regulations, which is crucial for avoiding costly penalties. It also has a mobile app that simplifies payroll tasks, such as adding new employees and checking tax payments. 24/7 support is available from certified payroll experts, providing peace of mind and ensuring that help is always available when needed.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Paylocity is a cloud-based payroll and human resources platform designed to meet the needs of a wide range of business sizes, including small businesses. It offers tools to automate payroll processing, manage employee data, and ensure compliance with tax regulations.

One reason I like Paylocity is its automated tax filing feature. The system prepares, reviews, and files taxes on your behalf, helping you stay compliant with current tax laws. This reduces the risk of errors and potential penalties, giving you peace of mind during tax season.

Another benefit is Paylocity's customizable payroll reports. These reports provide real-time insights into critical metrics, allowing you to make informed decisions about your business operations.

Some of Paylocity's integrations include ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Remofirst is a software that facilitates payroll and benefits management for global and remote teams. It also offers a complete human resources information system (HRIS) and serves as an employer of record (EOR), helping to centralize your HR operations in one platform. Both large and small companies can use the software to manage their payroll, provide employee benefits, and keep track of their international employees and contractors.

The payroll management system allows you to pay employees and contractors in multiple currencies and administer employee benefits like health insurance and financial benefits. The software can help you maintain compliance with international regulatory standards, tax, and labor laws, and the company's team of support staff can help you uphold employment regulations in over 170 countries. You can create locally compliant contracts to onboard your contractors through the same system as your full-time employees.

Managers can get an overview of personnel's details like titles or roles, location, and salary through the software's talent management module. All this information is gated according to access permissions set by admins. In addition to the employee database, the software provides performance-tracking features, regulatory compliance, and candidate hiring and onboarding tools.

Pricing starts at $199/person/month for EOR and $25/person/month for contractors, and the service is available in 170+ countries. A free demo is available.

OnPay is a payroll software that helps businesses avoid mistakes and save time by handling their federal, state, and local taxes. The solution helps business owners and managers set up and save custom payroll reports so they can track their spending and oversee their team’s activity.

This service provider allows you to schedule unlimited monthly pay runs and automatically handles all your payments and tax filings. The employee self-service portal lets your team members update their information for W-2 and 1099 forms and is available across the United States.

OnPay integrates with multiple tools, including Deputy, QuickBooks Online, TSheets, When I Work, and Xero.

OnPay costs from $6/employee/month plus a $40/month base fee. They also offer a 30-day free trial and free setup.

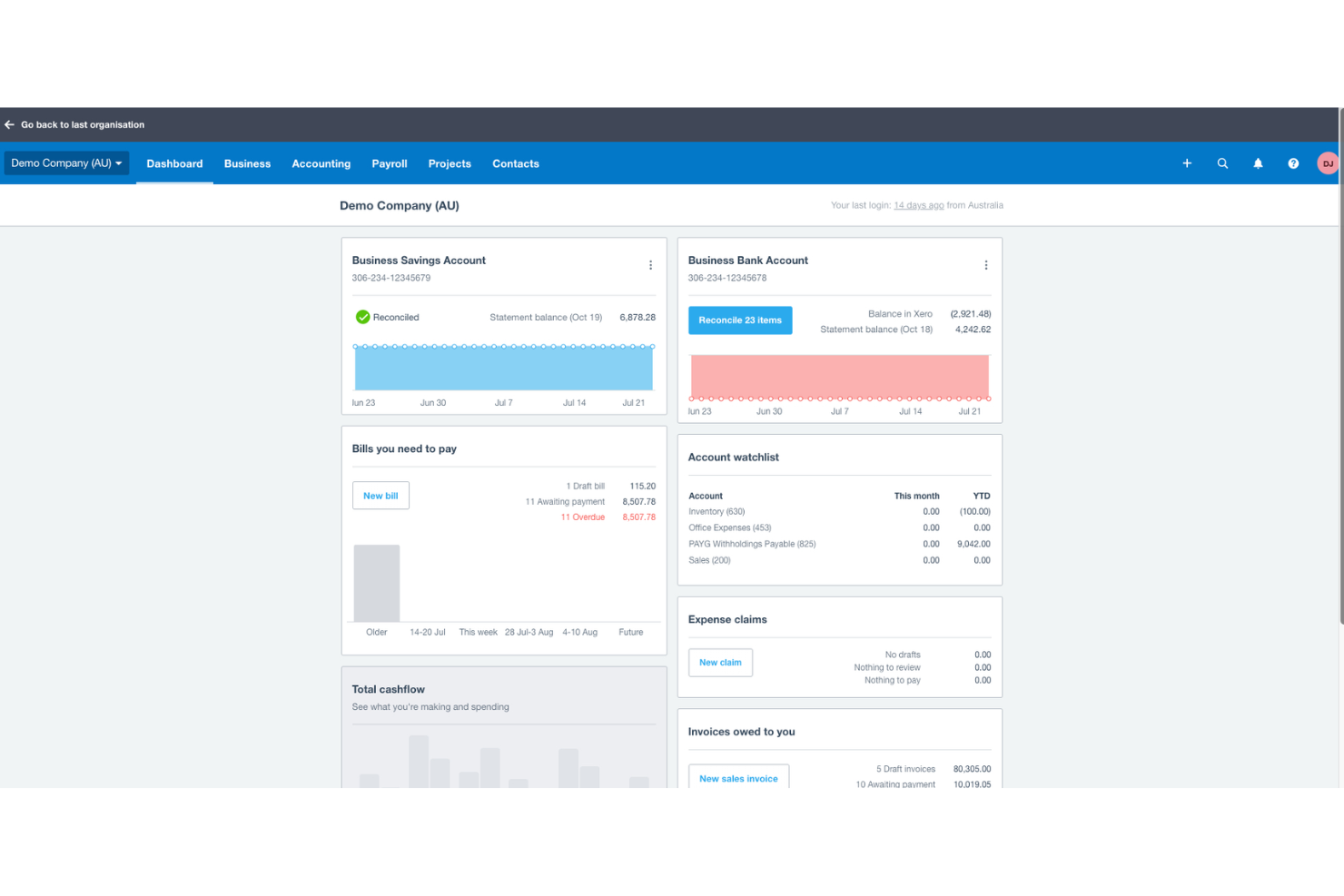

Xero is a cloud-based accounting software tailored for small and medium-sized businesses, providing a wide range of tools to handle financial tasks such as invoicing, bank reconciliation, expense tracking, and tax compliance.

Its payroll suite offers basic functions for businesses that don't require advanced features. It allows businesses to handle recurring pay runs efficiently, ensuring accurate calculations of wages, taxes, and deductions. Users can easily enter employee hours and rates, copy previous pay runs, and manage payslips digitally by email or print. This reduces administrative burden and enhances payroll accuracy.

Additionally, Xero securely stores employee data and payroll records, which facilitates quick access to important information and simplifies compliance management. It offers flexible integration with third-party payroll apps, providing more advanced payroll options while maintaining a seamless workflow.

Integrations include Hubdoc, Stripe, Xero Practice Manager, Shopify integration by Xero, HubSpot CRM integration, Xero Analytics Plus, Xero Inventory Plus, Xero Workpapers, and Spendesk.

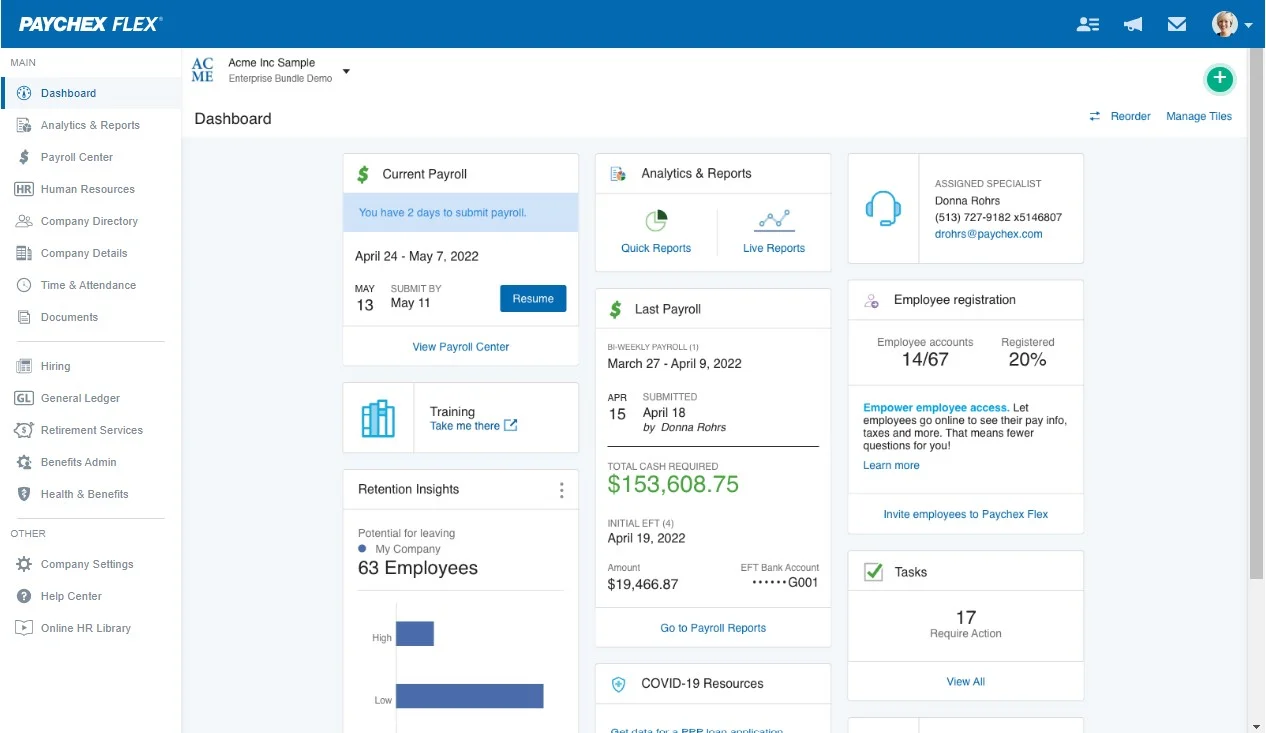

Paychex Flex is a payroll company that helps small businesses organize and run their payroll on desktop or mobile devices. The solution also gives business owners the option to submit payroll by phone to one of its specialists, and its voice assist feature enables managers to perform hands-free payroll checks, submissions, and approvals.

Paychex Flex handles your payroll taxes and reports new hires to government agencies. The software tracks your team’s payroll-related information, allowing you to create year-end reports and 1099s with ease.

Paychex Flex integrates with dozens of solutions, including BambooHR, Hubworks, Indeed, JazzHR, Xero, and QuickBooks Time.

Paychex Flex offers custom pricing upon demand and a free demo.

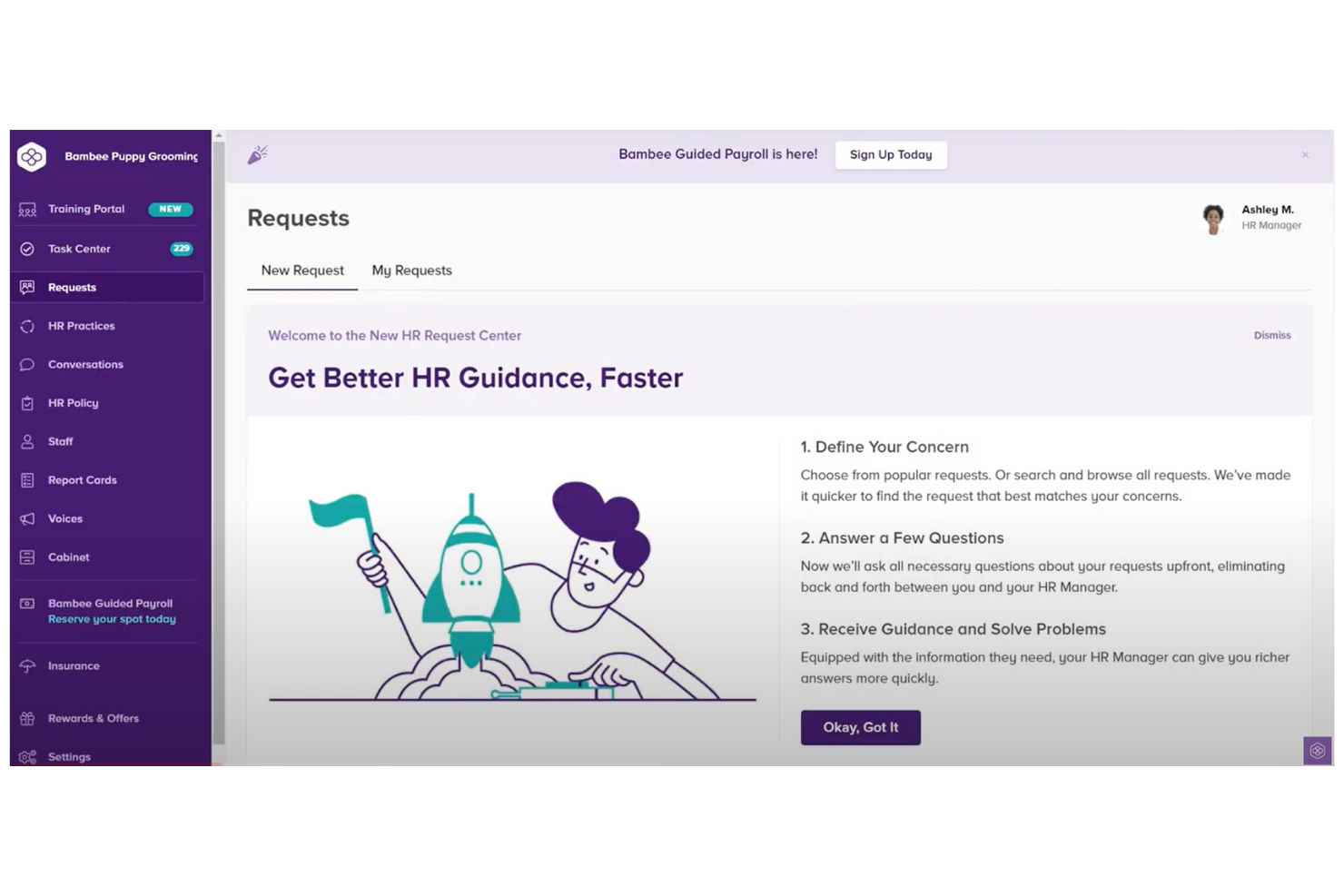

Bambee is a cloud-based HR platform designed specifically for small and medium-sized businesses. In addition to HR functions, Bambee also offers a guided payroll service to help businesses manage their payroll processes more efficiently.

I included Bambee's payroll service because of its ease of use and affordability. Their services cover a comprehensive set of payroll functions, including 2-day direct deposit, tax filings, and year-end reporting. In addition, Bambee also offers personalized support from HR experts, as well as a dedicated HR manager for every client, making it easier for businesses to navigate complex payroll regulations.

One of Bambee's standout services is their compliance assistance. They provide businesses with guidance on payroll-related compliance issues, such as minimum wage requirements and overtime rules. Bambee also ensures that businesses stay compliant with tax regulations, filing all necessary forms and making timely payments.

Another standout feature worth mentioning is their employee self-service portal. This feature allows employees to view their pay stubs, manage their personal information, and request time off, all without having to contact HR. This saves businesses time and resources and provides employees with more control over their own HR processes.

Integration details for Bambee's payroll software are currently not available.

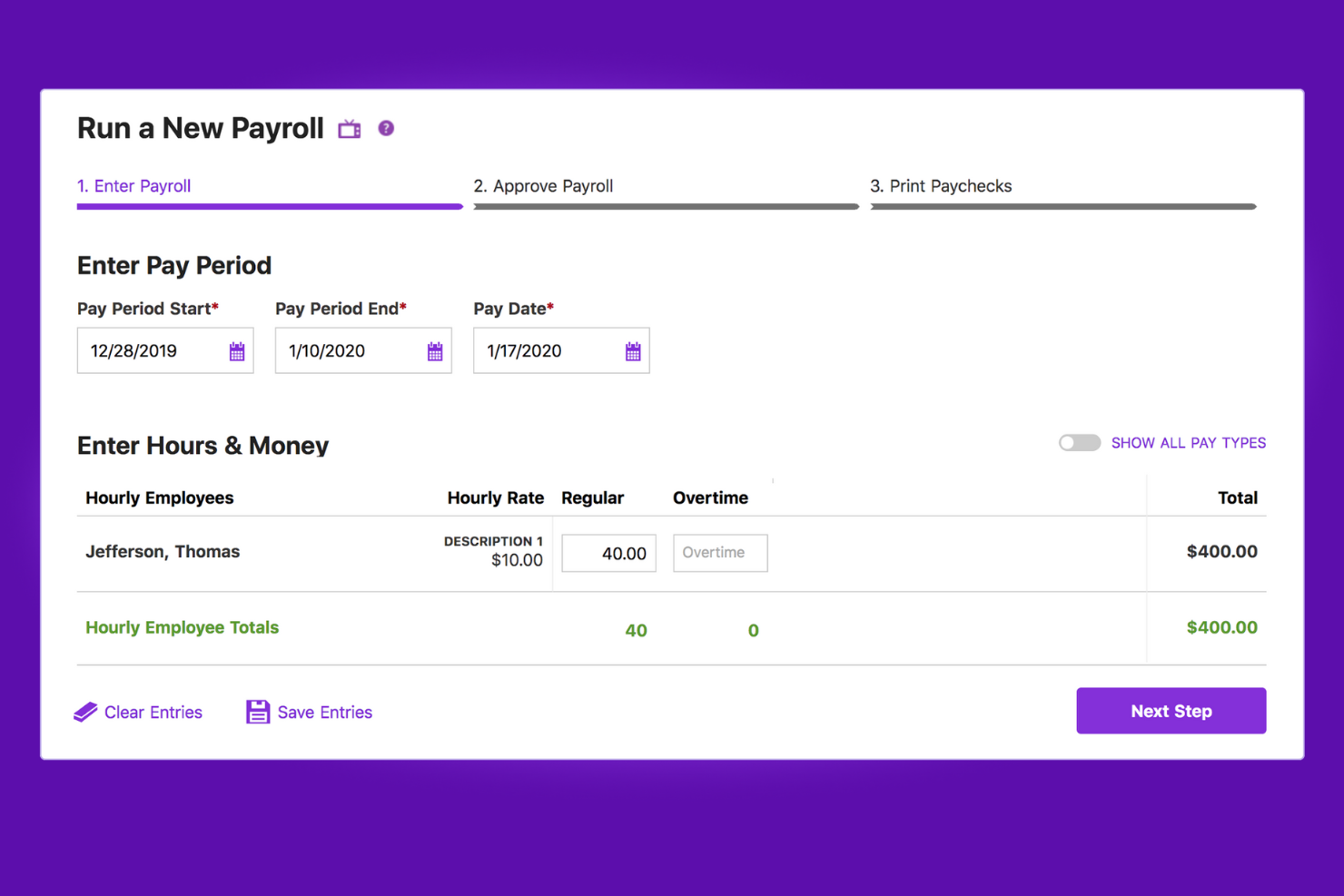

Patriot Payroll offers basic and full-service payroll options for US-based businesses. With the ability to handle payroll taxes and offer unlimited payrolls, as well as free 2-day direct deposit for qualified customers, it is best suited for small businesses needing affordable payroll solutions.

Their software and services include a wide range of features to streamline payroll processes and save time, all at an affordable cost, making it the best choice for small businesses in need of cost-effective and efficient payroll management. When comparing different payroll services, Patriot Payroll stands out due to its customizable options, free setup assistance, and robust support for tax filings and deposits.

What makes Patriot Payroll different is its inclusion of features like free 2-day direct deposit, unlimited payroll runs, and a free employee portal, all of which are designed to meet the specific needs of small businesses. Additionally, the software integrates seamlessly with accounting and HR systems, providing a holistic solution for payroll management.

Patriot Payroll offers two main payroll plans: Basic Payroll and Full Service Payroll. Both plans include a variety of features designed to assist small business owners in managing payroll efficiently. The software simplifies payroll processing into three steps: entering hours, approving payroll, and printing paychecks or using direct deposit. Users can run payroll as often as needed without incurring additional charges for extra payroll runs.

Integrations include GoCo, Plaid, QuickBooks Time, and TSheets.

Other Payroll Services for Small Businesses

Here are a few more options that didn’t make the best payroll services for small businesses list:

- Buddy Punch

For multi-state tax registration

- PrimePay

For remote access to payroll information

- TriNet

For tax filing automation

- myHR Partner

For personalized payroll administration

- WAVE

For payroll reporting

- Payworks

For Canadian small businesses

- Justworks Payroll

For managing payroll, bonuses, and commissions

- Rippling

For workflow and payment templates

- QuickBooks Payroll

For unlimited payroll runs

- Papaya Global

For expanding internationally

Related HR Software Reviews

If you're looking for better HR tools in addition to services, check out these other core HR offerings, that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Services for Small Businesses

When selecting a payroll service for your small businesses, it's important to understand which of their services will address your current challenges the most effectively. To create this list, I researched different service providers to determine which providers truly offered the services that growing businesses would want.

Here's a summary of the selection criteria I used to determine the best payroll services for small businesses in this article:

Core Payroll Services & Functionalities (25% of total score): To be considered for inclusion in this list, each service provider had to fulfill these common use cases first:

- Ensure accurate wage calculations

- Manage tax deductions and filings

- Maintain compliance with labor laws

- Provide employee access to payroll information

- Offer support for benefits and garnishments

Additional Standout Services (25% of total score): To help me find the best service out of numerous available options, I also kept a keen eye out for unique offerings, including the following:

- Integration with accounting software for seamless financial management

- Mobile app access for payroll processing on the go

- Customizable payroll reports for in-depth financial analysis

- Enhanced security features to protect sensitive payroll data

- Specialized support for industries with unique payroll needs

Industry Experience (10% of total score): To evaluate the industry experience of each payroll service provider, I considered the following:

- Established track record in the payroll industry

- Staff credentials and certifications in payroll management

- Experience with businesses similar in size and industry

Customer Onboarding (10% of total score): To get a sense of each provider's customer onboarding process, I considered the following factors:

- Availability of training videos and resources for new users

- Step-by-step guides and templates for quick setup

- Hands-on service tours and demos

- Chatbots and live support for immediate assistance

- Webinars and ongoing training sessions

Customer Support (10% of total score): To evaluate the level of customer support each company offered, I considered the following:

- 24/7 customer support availability

- Multiple support channels (phone, email, chat)

- Knowledgeable support staff with payroll expertise

- Prompt response times for support inquiries

- Availability of a dedicated account manager

Value for Price (10% of total score): To gauge the overall value of each service, I considered the following factors:

- Transparent pricing with no hidden fees

- Flexible pricing plans to suit different business sizes

- Cost savings through efficient payroll processing

- Discounts for long-term contracts or bundled services

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how happy real users are with a service. Here are the factors I considered:

- Positive feedback on service reliability and accuracy

- High ratings for customer satisfaction and support

- Testimonials highlighting the ease of use and efficiency

- Reviews noting effective handling of compliance and tax issues

- Consistent praise for overall value and service quality

Using this assessment framework helped me identify the payroll services that go beyond basic requirements to offer small businesses additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

How to Choose a Payroll Service

Payroll services are a great way to get the responsibilities of payroll processing off your desk completely. To help you figure out which payroll service best fits your small business needs, you need to pinpoint your key users and document their specific challenges first.

As you work through your own unique selection process, keep the following points in mind:

- What problem are you trying to solve - Start by identifying the challenges you're trying to overcome, such as managing compliance regulations and tax requirements for employees in different jurisdictions. This will help you clarify the key services your payroll partner needs to provide.

- Who will benefit from the service - Consider who will manage the payroll service relationship (i.e., who will your main contact people be in-house?) and how having a payroll provider will improve their day-to-day work tasks.

- What is your budget - To evaluate cost, combine your current employee headcount with your expected growth for the near future. Since payroll providers typically charge a monthly fee based on the number of employees you have, this will allow you to estimate your monthly costs.

- What outcomes are important - Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to improve your team's productivity by offloading time-consuming payroll processing tasks onto a third party, giving them more time for other tasks. You could compare service providers until you’re blue in the face, but you could waste a lot of valuable time if you aren’t thinking about the outcomes you want to achieve.

- How it would work within your organization - Consider how the service provider's software ecosystem would work alongside your existing workflows and systems. Would their software framework integrate with your existing HR software, or would you face data management roadblocks?

Remember every business is different — don’t assume that a payroll service will work for your small business just because it's popular.

What are Payroll Services?

Payroll services are third-party providers that can process payroll on your behalf. They can help you with a range of payroll-related tasks, like basic payroll processing and bookkeeping, and submitting direct deposits into employee bank accounts.

The primary purpose of payroll services is to free you from time-consuming tasks around navigating compensation management, deductions, and location-specific tax compliances.

Key Payroll Services & Features

The depth of services provided varies from one payroll company to the next. And the features included in different payroll software can vary, too. Here are some common payroll features and services offered:

- Automated Payroll Processing: Automates the calculation of wages, ensuring employees are paid accurately and on time, reducing manual errors. The service should also offer multiple payment options, including direct deposit, physical paychecks, or even on-demand pay.

- Tax Filing Services: Helping you file taxes locally and federally with the IRS, CRA, or any other relevant governing body, ensuring compliance with tax regulations and avoiding penalties. This may also include making year-end tax payments on your behalf.

- Tax Compliance: Your payroll service provider will ensure you’re up-to-date on all applicable federal and state tax laws.

- Garnishment Services: Manages court-ordered wage garnishments, ensuring accurate deductions and compliance with legal requirements.

- Employee Self-Service Portal: Allows employees to access their payroll information, pay stubs, and tax documents, reducing administrative workload and improving transparency.

- Time and Attendance Tracking: Clocking employee hours and syncing them automatically with your online payroll services. This could also include managing PTO and time off requests.

- Benefits Administration: Manages employee benefits such as employee health benefits, disability and life insurance, retirement plans, RRSP contributions, health budgets, and other perks, ensuring accurate deductions and contributions.

- Payroll Reporting: Generates detailed payroll reports covering expenses, taxes, and deductions, helping businesses maintain clear financial records and make informed decisions.

- Bookkeeping: Maintaining the paperwork and records-keeping involved with running payroll for auditing and compliance purposes.

- Customer Support: Offers expert assistance and troubleshooting for payroll-related issues, ensuring smooth and efficient payroll operations.

- Software Integrations: You'll want your payroll service provider's software to integrate with your other small business human resource software, such as a cloud-based human resources information system (HRIS), allowing you to sync your employee data from other sources easily, preventing the possibility of errors.

Finding a payroll provider that offers these services can make a significant impact on your HR operations. By investing in a comprehensive payroll service that manages these details for you, you'll be able to focus on growth and productivity, knowing that your payroll needs are being managed accurately and effectively.

Trends in Payroll Services for Small Businesses

Being aware of trends in payroll services for small businesses is crucial for HR professionals and payroll specialists to ensure effective payroll management and compliance with evolving regulations. By staying informed about the latest trends, professionals can adopt modern tools and technologies that streamline payroll processes, enhance accuracy, and boost operational efficiency. This awareness enables small businesses to stay competitive in attracting and retaining top talent by offering efficient and accurate payroll services, contributing to employee satisfaction and overall business success. Here are four key trends for 2025:

Automation and AI-Driven Payroll Processing

Automation in payroll processing, utilizing Artificial Intelligence (AI) not only minimizes time-consuming tasks, such as manual data entry, but also enhances accuracy in payroll management. Other benefits include:

- Compliance: AI algorithms can handle complex calculations and tax withholdings, ensuring accuracy and compliance.

- Time Efficiency: AI automates routine tasks like payroll scheduling, freeing up HR professionals to focus on strategic initiatives.

- Error Reduction: AI can help reduces human errors in data entry, enhancing overall payroll accuracy.

By implementing AI-driven payroll systems, you can significantly reduce your manual workload and repetitive tasks, allowing you the time and resources to concentrate on more value-added activities. This can be especially beneficial if you work in small business, as your time and resources are particularly limited and valuable.

Cloud-Based Payroll Solutions

The shift towards cloud-based payroll solutions is a response to the need for data security and confidentiality. These systems offer enhanced security features, regular backups, and the ability to access payroll data securely from anywhere. This trend is particularly crucial for businesses with remote or hybrid work models, providing HR teams the flexibility to manage payroll remotely while ensuring data security. This trends can also be extremely beneficial to small businesses, which likely do not have the resources necessary to deal with a data leak.

On-Demand Pay and Flexible Payment Options

On-demand pay and flexible payment options have emerged as a response to the growing demand for employee-centric benefits. While it is certainly non-traditional, this trend offers a variety of benefits, including:

- Immediate Access to Wages: Allows employees to access a portion of their earned wages before the scheduled payday.

- Employee Satisfaction: Increases morale and loyalty by providing financial flexibility and autonomy.

- Retention Tool: Acts as a competitive advantage in attracting and retaining talent, especially in a dynamic workforce.

Implementing on-demand pay systems can be a strategic move for HR Managers to boost employee engagement and loyalty, making it a valuable addition to employee benefits packages. Moreover, while it may seem like a risk for small businesses, its impact on employee satisfaction and retention still make it a worthwhile strategy to consider.

Enhanced Compliance Features

With constantly changing payroll and labor laws, enhanced compliance features in payroll services are a must. Modern payroll systems are equipped to stay updated with the latest tax laws and regulations, ensuring businesses remain compliant. This is particularly crucial for small businesses, who cannot necessarily afford the legal fees associated with making tax mistakes.

For People Ops professionals, HR managers, and business leaders in small businesses, these emerging trends in payroll services offer strategic solutions to their most pressing challenges. Adopting these trends can not only make your job easier, but can also help position your small business for success in a competitive landscape.

Costs & Pricing of Payroll Services

The cost associated with any new service or software is always something to consider, especially for a small business or startup. Typically, payroll service providers charge based on a combination of base fees and additional costs per employee or transaction. These costs can vary significantly depending on the features and level of service required.

Key factors that can influence the pricing of payroll services for small businesses include:

- Number of Employees: The more employees you have, the higher the cost, as most providers charge per employee.

- Frequency of Payroll: More frequent payroll runs, such as weekly instead of bi-weekly or monthly, can increase costs.

- Features and Services Included: Advanced features like tax filing, direct deposit, and benefits administration can add to the base price. Does it cater to your specific industry, like restaurant payroll software?

- Customization Needs: Custom reporting, integrations with other systems, and tailored services can lead to higher fees.

- Customer Support Level: Access to dedicated support or 24/7 customer service often comes with a premium.

- Compliance Services: Services that include comprehensive compliance management and updates to stay current with regulations can be more expensive.

- Contract Length: Long-term contracts may offer discounts, while month-to-month services might cost more.

- Setup and Onboarding Fees: Initial setup and onboarding can incur additional one-time charges.

- Additional Services: Extra services like time and attendance tracking or garnishment processing can affect the overall cost.

- Free Options: Free consultations or limited trials are often available but usually come with restrictions on features or duration, and may not provide full access to the service’s capabilities.

Understanding these key points will help you make an informed decision when selecting the best payroll service for your specific needs and budget.

Payroll Services: Frequently Asked Questions

Here are some answers to FAQs I hear often when discussing payroll services for small businesses:

What are the benefits of payroll services?

There are plenty of reasons why payroll services are beneficial for small businesses. Payroll services take some of the pressure of running a company off your shoulders, allowing you to focus on growing your business. They help you avoid legal difficulties by filing your taxes on your behalf. Simply put, they ensure you’re managing payroll properly at your small business.

And perhaps most importantly, payroll services enable you to pay your employees on time. And this is crucial to forming an effective team. By helping you create and respect a payment schedule, payroll services make it easier for you to build an effective team that propels your business to the next level.

How much do payroll services cost?

Naturally, the cost of payroll services will vary by provider and the depth of the services they offer. In general, for basic payroll services, you can expect to pay a flat monthly fee ranging between $19 to $99/month plus an additional fee ranging between $4 to $25/employee/month.

Some payroll service providers offer more advanced HR support services such as international or global payroll. For that type of advanced or complete payroll service, you can expect to pay a bit more. The cost is typically between $199 to $499/employee/month with no additional fees.

These are some rough numbers to give you a ballpark. But some services and software have paid add-ons and other additional costs. So make sure you really research the price point before signing up.

While there are no free payroll services, there are some free payroll software options. Keep in mind, you’ll still need to run a software solution. On the other hand, a service provider handles everything for you. You can automate your payroll process with one of these software tools, but it still won’t completely run itself.

A Payroll Service Helps You Focus On Growing Your Business

By investing in a payroll service for your small business, you’re investing in your people. It shows your staff that getting them paid on time and accurately is important to you. And not only that, it frees up your time for important tasks like strategic planning, product development, and meeting with your team members. For those operating in industries with complex compliance requirements, specialized payroll software can offer more targeted solutions.

If you want to receive advice on how to run a small business directly in your inbox, subscribe to the People Managing People newsletter.