Best Free Payroll Software Shortlist

Here's my pick of the 10 best software from the 24 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Managing payroll shouldn’t feel like a monthly scramble—but for many small businesses and lean teams, it often does. Between tracking hours in spreadsheets, staying on top of tax filings, and double-checking every calculation for errors, it’s easy to feel overwhelmed. And when you add in a limited budget, finding a payroll solution that’s actually free and reliable can feel next to impossible.

That’s exactly why I put this guide together. I’ve spent years reviewing HR and payroll tools for People Managing People, helping small business owners and team leads find software that actually solves their problems.

In this article, I’ll walk you through the best free payroll software available today—tools that help you save time, stay compliant, and run payroll with confidence (even if you don’t have an HR team).

Why Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Free Payroll Software Comparison Chart

This comparison chart summarizes basic details for my free payroll software selections (which also offer paid plans) to help you find the best software that works for your budget and business needs. As you’ll learn, some advanced payroll features are worth the price!

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for tracking payroll spending using custom reports | 30-day free trial | From $40/month + $6/user/month | Website | |

| 2 | Best free scheduling and time tracking software with a payroll add-on | Free plan available | From $20/location/month | Website | |

| 3 | Best online payroll service provider with multiple payroll options | 30-day free trial | Pricing upon request | Website | |

| 4 | Best for a simplified three-step payroll process | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 5 | Best for automated payroll processing | Free demo available | Pricing upon request | Website | |

| 6 | Best free payroll software for small teams with up to 10 employees | 30-day free trial + free plan available | From $19/month plus $3/employee/month | Website | |

| 7 | Best for managing unlimited databases and companies | Free trial available | From $12/month ($20 base fee + $4/user) | Website | |

| 8 | Best free spreadsheet-based payroll software for up to 50 employees | Free to use | Free to use | Website | |

| 9 | Best small business payroll software for Canadian businesses | 60-day free trial | From $6/employee/month + a $39/month base fee | Website | |

| 10 | Best online payroll solution with time-tracking and leave management tools | 30-day free trial | From $3/employee/month + $10/month base fee | Website |

-

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

ClearCompany

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Free Payroll Software Reviews

Let’s explore the top 10 free payroll software solutions, including detailed insights into their key features, pros & cons, what’s included for free, and a snapshot of the user interface, so you know what to expect. Plus, if you need more options, you’ll find additional bonus picks below to help you choose the right fit.

OnPay is a full-service payroll and HR software designed to help small business owners save time when managing their company. The solution has a clean interface and is easy to navigate, allowing users to schedule and run payroll and automate their tax and payroll calculations.

Why I picked OnPay: Their software helps you create custom payroll reports so you can easily track your spending and your team’s activity. The tool’s mobile-friendly self-service portal allows your employees to access and update their information on the go.

OnPay Features and Integrations:

Features include unlimited pay runs, tax filings and payments, employee self-service, automated onboarding, direct messaging, PTO management, and benefits management.

Integrations include Deputy, Guideline, Mineral, PosterElite, QuickBooks Online, QuickBooks Time, Vestwell, When I Work, Xero, and others.

What's Free: OnPay is free to use for 30 days. After that period, their paid plans start at $6/employee/month plus a $40/month base fee.

Pros and cons

Pros:

- Simple payroll scheduling

- Built-in notifications

- Custom reports

Cons:

- It takes about five days for employees to receive their pay

- No payroll automation

- Mobile navigation can be improved

Homebase

Best free scheduling and time tracking software with a payroll add-on

Homebase is a versatile HR platform that helps small businesses manage work schedules, time clocks, and payroll, all-in-one. It automates the payroll process and converts timesheets into hours and wages, calculates taxes, and sends correct payments to employees.

Why I picked Homebase Payroll: Their payroll system reduces data entry since the solution instantly calculates an employee’s regular hours, breaks, and overtime through their time clock and timesheet feature. This makes it easy for small businesses to run payroll without needing to double-check all the data.

Homebase Payroll Features and Integrations:

Features include automated tax payments and filings, access to W-2 and 1099 forms, employee self-onboarding, e-sign payroll forms, direct deposits, unlimited payroll runs, and free payroll transfer services.

Their mobile app gives employees access to their hours, schedules, earnings, and W-2 forms, and even includes communication tools so employees can help each other trade and cover shifts.

Integrations are available with a handful of popular HR platforms, including ADP, Gusto, Paychex, Quickbooks, Rippling, Square Payroll, and SurePayroll, as well as with several point-of-sale providers.

What's Free: Homebase's Basic service plan is free forever for unlimited employees at one work location, making it an ideal solution for small businesses (paid plans begin at $20/month). Their payroll services are available as an add-on to their free package, starting at $6/employee/month plus a $39/month base fee.

New Homebase payroll customers also receive their first three months for free when they add their payroll integration to any of their plans.

Pros and cons

Pros:

- Mobile app is user-friendly for employees

- Includes early wage access for employees to help with unexpected, emergency expenses

- Free plan covers timesheets/time clocks, scheduling, messaging, and hiring tools

Cons:

- Purpose-built for USA-based organizations

- Payroll functions are only available as an add-on

Paycor

Best online payroll service provider with multiple payroll options

Paycor is an online payroll services provider that enables you to optimize your payroll process with automation. The software integrates with accounting and human resources solutions, allowing you to manage employee benefits, run payroll, and file taxes with ease.

Why I picked Paycor: Their payroll software includes a mobile-friendly employee portal your team members can use to access their pay stubs, benefits information, and other documentation. The software allows you to choose from multiple payroll options, so you can set up direct deposit, on-demand payments, or send money directly to a credit card.

Paycor Features and Integrations:

Features include a self-service portal, time & attendance tracking, recruitment and onboarding, performance management, tax filing, PTO management, automation, and analytics.

Integrations include Aetna, Beacon, iCIMS, CloudPay, Epicor, Fidelity, Human Interest, Indeed, LinkedIn, MassMutual, Payfactors, TurboTax, and others.

What's Free: Paycor is free to use for 90 days. After that, their paid plans start at $5/employee/month plus a $99/month base fee.

Pros and cons

Pros:

- Custom reporting features

- Helps you manage on-demand pay

- Unlimited payroll runs

Cons:

- Self-service portal has some bugs

- Onboarding process could be improved

- Time tracking only available as an add-on

Patriot is an online payroll and accounting solution that helps small businesses send payments, create custom reports, track time and attendance, and calculate their federal, state, and local taxes. The solution has a clean interface and is easy to use, allowing you to set up and run payroll without difficulty.

Why I picked Patriot: Patriot deducts and remits all unemployment, social security, medical, and related deductions to state and federal authorities, making each deduction easy to track. Patriot helps you calculate year-to-date totals and create tax liability reports with automation. The software helps you prepare your tax filings and its mobile-friendly design makes it easy to manage and run payroll on any device.

With Patriot, you can include independent contractors in your payroll, making it ideal for companies outsourcing work to freelancers. Using their direct deposit feature, you can streamline your payroll operations and pay your contractors and employees simlutaneously.

Patriot Standout Features and Integrations

Features include an employee portal, unlimited payroll runs, time and attendance tracking, 1099 e-filing, tax filing, PTO management, and employee information tracking.

Integrations are available with several tools, including GoCo, Plaid, QuickBooks Time, and TSheets.

What's Free: Patriot is free to use for 30 days. After that, their paid plans start at $4/employee/month plus a $17/month base fee.

Pros and cons

Pros:

- Unlimited payroll runs

- Multiple locations and pay frequencies

- Easy to use

Cons:

- Tax handling costs extra

- Automated transfers that take place on weekends or national holidays cost extra

FoxHire is an Employer of Record (EOR) platform that manages employment tasks like onboarding, payroll, insurance, and compliance on your behalf.

Why I picked FoxHire: I picked FoxHire because of how thoroughly it handles payroll for contract employees. The platform automates timesheet collection, calculates payroll taxes, processes payments, and handles direct deposits—all without requiring input from your internal team. It also manages payroll funding, invoices clients, and ensures IRS compliance, which helps reduce financial and legal risks.

FoxHire Features and Integrations:

Features include benefits administration, background checks, worker's compensation claims management, certificate of insurance provision, employee onboarding, client contracts, employee contracts, immigration authorization, IRS compliance, and per diem regulations.

Integrations include Bullhorn ATS, SAP Fieldglass, and Loxo.

What's Free: FoxHire lets you sign up for free and get instant access to basic features, like reports and employee document management. A fee will be charged when you use its payroll services.

Pros and cons

Pros:

- Efficient employee onboarding

- Knowledgeable about US compliance

- Comprehensive payroll services

Cons:

- Relies on third-party partners for payroll outside of the US

- Limited integrations

Best free payroll software for small teams with up to 10 employees

Zoho Payroll is a payroll solution that helps small businesses with payroll processing and employee onboarding. The tool offers a self-service portal where employees can check their payslips and documents.

Why I picked Zoho Payroll: Their software automatically calculates earnings, deductions, taxes, and allowances. The software allows you to create recurring payroll routines and complete one-time payments in any pay period. The software’s termination payroll helps you manage the employee’s notice pay and other exit requirements.

Zoho Payroll Features and Integrations:

Features include automatic payroll calculations, direct deposits, income tax collection (IRS & CRA), detailed payroll reports, digital payslips, alerts, salary revision tools, predefined user roles, and employee loan management features.

Integrations are available with other Zoho tools, and with other solutions through a REST API.

What's Free: Zoho Payroll offers a free-forever version with limited functionalities for one work location with up to 10 employees. For larger teams, the software costs from $19/month plus $3/employee/month. A 30-day free trial is also available.

Pros and cons

Pros:

- Easy to make salary adjustments

- Detailed employee database

- Manages multiple payroll organizations

Cons:

- Not currently available in all US states

- Notes field is limited to 200 characters

- Difficult to edit payroll runs

Best for managing unlimited databases and companies

CheckMark Payroll is a payroll solution that allows small business owners to pay their employees via direct deposit or checks. The software’s check printing feature allows you to create branded checks for your business.

Why I picked CheckMark Payroll: Their payroll system allows you to create unlimited databases and companies, which can be helpful for small business owners managing multiple locations or accountants. The software is easy to set up and use, and offers all the instructions you need to set up your first payroll.

CheckMark Payroll Features and Integrations:

Features include unlimited employees, unlimited payroll runs, direct deposit or the ability to print checks, printed or e-filed W2s and W3s, and US-based customer support.

Integrations are available with multiple apps, including E-Syst, PROFITSystems, SilentPartner, TimeWolf, and Virtual TimeClock.

What's Free: CheckMark Payroll is free to use for 60 days. After that, the software charges a one-time fee starting from $509 making it a very affordable option for small business owners looking to avoid monthly SaaS subscription fees.

Pros and cons

Pros:

- Little to no learning curve

- Simple interface

- Supports an unlimited number of employees

Cons:

- Limited report customization options

- App can sometimes glitch on Macs

- Making changes on checks can be difficult

ExcelPayroll is a spreadsheet-based payroll solution that transforms your Microsoft Excel into a payroll service.

Why I picked ExcelPayroll: The software is free to download and use, and it’s compatible with Windows and Mac devices, making it ideal for organizations that already use MS Excel in their day-to-day work. It's a good choice for small teams with no more than 50 employees.

The most recent version available for free download is V2.37, which was released in January 2025.

ExcelPayroll Features and Integrations:

Features include the ability to prepare and print a variety of tax forms, including W3, 940, and DE9. The tool also helps you manage expense forms such as vacation accruals and deductions, keep track of employee hours, and calculate workers’ compensation.

Integrations are currently not available natively. However, the software works on Microsoft Excel, so you can import and export data with ease.

What's Free: ExcelPayroll is entirely free to use, with no strings attached.

Pros and cons

Pros:

- Can print tax forms and computer checks

- Great for people familiar with MS Excel

- Free for up to 50 employees

Cons:

- No phone or live chat customer support

- No employee portal

- Runs on MS Excel so you’ll need a license for that

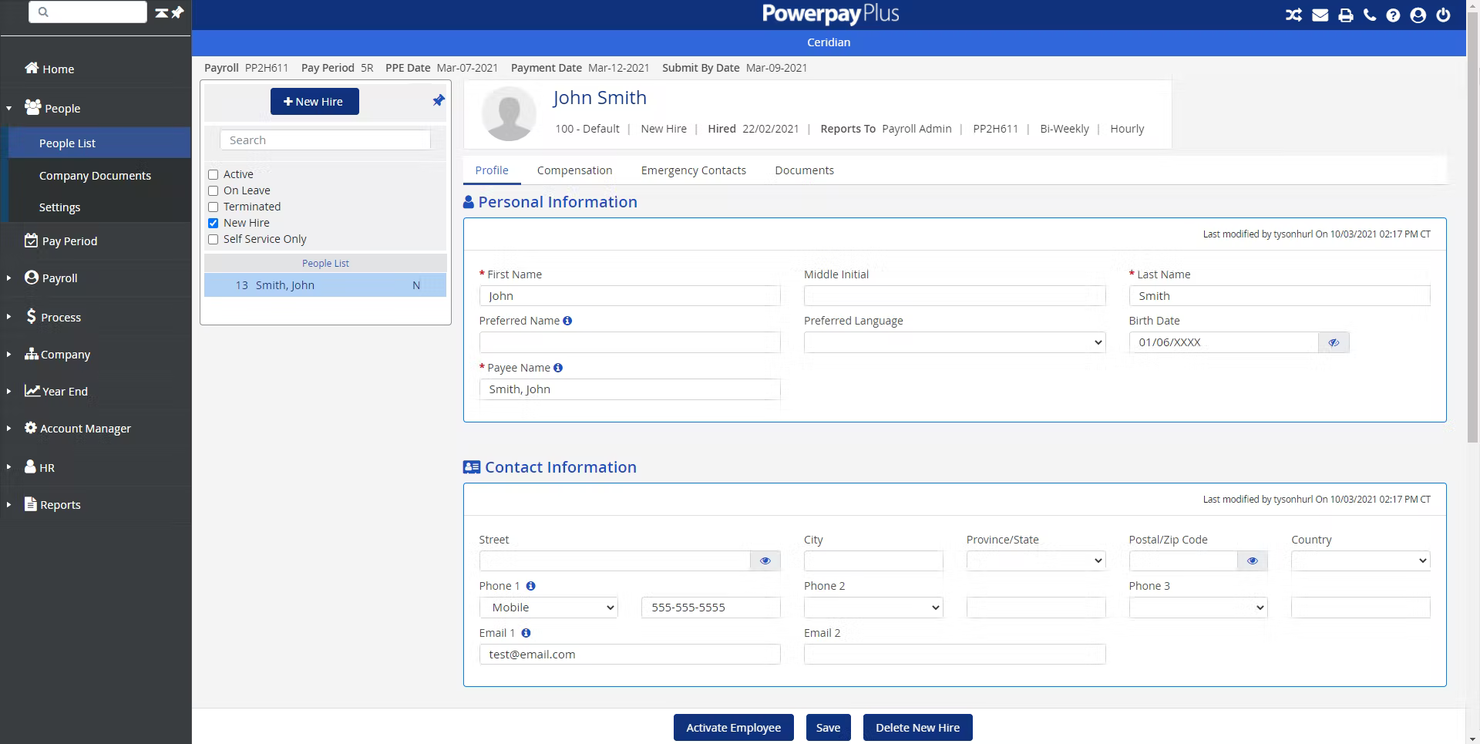

Ceridian Powerpay is a human resources and payroll solution designed to help Canadian businesses of all sizes manage and pay their employees, but they are particularly well-known as a small business payroll software. The software allows business owners to stay on top of what’s happening in their organization with automated processes and notifications.

Why I picked Ceridian Powerpay: Their HR software has a mobile-friendly design, allowing you to set up payroll and pay your team members and external collaborators on the go. The tool helps you manage all the paperwork required to stay compliant with CRA and Revenu Québec requirements.

Ceridian Powerpay Features and Integrations:

Features include employment records, payroll tax filing, advanced reporting, mobile access, employee self-service, wage garnishment, and 24/7 customer support.

Integrations are available with Ceridian Dayforce, CIBC SmartBanking, and QuickBooks Online.

What's Free: Ceridian Powerpay is free for 60 days. After that, you can scale up to a paid plan starting at $6/employee/month plus a $39/month base fee.

Pros and cons

Pros:

- Self-service mobile app

- Good report customization options

- Intuitive, user-friendly interface

Cons:

- Onboarding could be better

- Few native integrations

- For Canadian businesses only

Sage Payroll

Best online payroll solution with time-tracking and leave management tools

Sage Payroll is a full-service online payroll solution that helps small businesses sync their accounting and payroll data into a central location.

Why I picked Sage Payroll: Their software includes some HR management functionalities, such as time tracking and leave management, allowing you to organize a small team without additional management tools.

Sage Payroll Features and Integrations:

Features include the ability to pay your employees via direct deposit, e-payment solutions, or cheques. The software’s dashboard allows you to access historical pay runs and set notifications for ongoing payroll tasks. Employees can use the self-service portal to access their payslips and documentation.

Integrations are available with all the other Sage solutions, including Sage Accounting, Sage HR, and Sage Intacct.

What's Free: Sage Payroll is free to use for 30-days. After that, their paid plans start at $3/employee/month plus a $10/month base fee.

Pros and cons

Pros:

- Multi-level access permissions

- Multiple reports to choose from

- Detailed employee records

Cons:

- Employee portal can be improved

- Some users find the UI confusing

- No mobile app

Other Free Payroll Options

Here are some other affordable payroll software options that are also worth considering:

- SurePayroll

Cloud-based payroll software with time-saving payroll automations

- Payroll4free.com

Free payroll processing service for up to 25 employees

- HR.my

Free payroll and HR solution for small teams

- Deel

Global HR platform with a free plan for up to 200 employees

- Papaya Global

Payroll and end-to-end workforce management in 160+ countries

- QuickBooks Online

For payroll and other financial management tools

- TimeTrex

For a free and open-source Community Edition of their payroll software

- Planday

Staff management solution for employee schedules, PTO, and running payroll

- GoCo

Payroll software with additional HR features

- UZIO

HRIS and payroll solution that helps with benefits administration, time tracking, and payroll processing

- Wave

Payroll software for paying employees and contractors with automatic tax calculations

- Zenefits

HR tool for managing and paying a small to medium-sized team

- Gusto

Combined payroll, HR, and benefits management tool for hybrid or remote teams.

- Keka

Small business payroll and HR solution for onboarding new employees

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other tools that are related to payroll software, that we've tested and evaluated.

- HR Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

- Learning Management Systems

Selection Criteria for Free Payroll Software

When selecting free payroll software, I base my evaluations on a combination of functionality and how well each tool meets the needs of businesses seeking free payroll support. Through my personal trials and research, I've identified an evaluation criteria designed to highlight solutions that not only fulfill basic payroll functions but deliver added value. Here is my evaluation methodology:

Core Functionalities (25% of total score): To be considered for inclusion in my list of the best free payroll software, each solution had to support the following use cases first:

- Automated tax calculation and compliance for federal, state, and local taxes.

- Direct deposit capabilities to employee bank accounts.

- Customizable deductions for various employee benefit programs.

- Pay stub generation and distribution.

- Integration with time and attendance software for accurate payroll based on actual hours worked, and integrations with business tax software to manage tax deductions and reporting.

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Advanced compliance management tools to effortlessly navigate tax law changes.

- Mobile access for managing payroll anytime, anywhere, highlighting tools that bring exceptional flexibility to payroll management.

- Reporting tools that go beyond basic payroll history to offer strategic financial insights.

- Data security measures that surpass industry standards, ensuring employee information is protected with the latest encryption technologies.

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- The balance between comprehensive functionality and simplicity, prioritizing tools that offer a streamlined experience without sacrificing power.

- Interface design that is not only visually appealing but also intuitive, such as role-based access dashboards tailored for ease of use in payroll management.

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- The availability of resources like training videos, templates, and interactive product tours that facilitate a smooth transition to the new system.

- The presence of support mechanisms such as chatbots and webinars designed to expedite the learning curve and value realization.

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Responsiveness and effectiveness of customer support channels.

- The breadth of support offered, including live chat, email, and phone support, to ensure users can quickly resolve issues.

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- The existence of a free plan, or at least a free trial to test it out first!

- How the tool's paid offerings compare to its free or subscription model, ensuring users receive maximum benefits without unnecessary costs.

- The presence of scalable options that allow businesses to grow without significant jumps in price.

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Overall satisfaction rates and feedback from current and past users regarding functionality, usability, support, and value.

- Specific praise or criticism that repeatedly emerges, as this can indicate areas where the tool either excels or needs improvement.

Using this assessment framework helped me identify the free payroll software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value.

How to Choose Free Payroll Software

As you work through your own unique software selection process, keep the following points in mind:

- Business Size and Scalability: Choose payroll software that fits your current team size and grows with you. A simple free tool may work for now, but ensure it can handle more employees, advanced reporting, and compliance needs as your business expands—without steep cost jumps.

- Compliance Features: Payroll laws vary by location, so choose software that keeps up with tax rates and regulations automatically. This reduces compliance risks and avoids penalties—especially if you operate in multiple states or countries. Automated tax updates and filings are a must-have.

- Integration Capabilities: Look for payroll software that syncs with your HR, time tracking, and accounting tools to reduce manual data entry and errors. Seamless integration ensures accurate payroll by automatically importing hours worked, calculating overtime, and deducting benefits.

- Security and Data Protection: Payroll data is sensitive, so choose software with strong encryption, secure logins, and compliance with data protection laws. Look for tools that conduct regular security audits to prevent breaches and keep employee information safe.

- User Support and Resources: Reliable support is key, especially if you don’t have a payroll expert on staff. Look for software with detailed guides, FAQs, training videos, and responsive customer service via chat or email to help troubleshoot issues and stay updated on new features.

Choosing the right free payroll software means finding a solution that meets your needs today and scales with your business. Prioritizing compliance, security, integrations, and support ensures a smoother payroll process as you grow.

Trends in Free Payroll Software

Like all technology, payroll software (including free offerings) is evolving to incorporate advances in tech and satisfy changing user expectations. By analyzing product updates, press releases, and release logs, I’ve identified key trends shaping how businesses manage payroll at no cost. Here’s what’s changing:

- Increased Automation for Efficiency: Automation remains a cornerstone, with enhancements aimed at reducing manual input and errors. This includes automatic tax calculations and filings, showing a commitment to simplifying complex payroll tasks.

- Enhanced Employee Self-Service Features: Platforms are expanding their self-service capabilities, allowing employees to access payslips, manage benefits, and update personal information online. This trend reflects a move towards empowering employees and reducing administrative burdens on payroll staff.

- Advanced Security Measures: As cyber threats evolve, so do security features within payroll software. The latest updates show a heightened focus on data encryption, secure access controls, and compliance with global data protection regulations, underlining the importance of safeguarding sensitive information.

- Artificial Intelligence (AI) and Machine Learning (ML) Applications: The application of AI and ML for predictive analytics, anomaly detection, and personalized recommendations is becoming more prevalent. This novel functionality offers businesses insights into payroll trends and potential issues before they become problematic.

These trends underscore a significant shift towards making free payroll software more intuitive, automated, and secure. For HR professionals, these advancements mean access to tools that not only streamline payroll processes but also contribute to broader strategic goals like improving employee satisfaction and ensuring compliance.

What is Free Payroll Software?

Free payroll software refers to any payroll software that offers a free plan or trial. It's important to remember that freemium versions of payroll software typically have limitations in features, functionalities, or users.

Payroll software — whether free or not — automates the process of managing employee payments, deductions, and tax filings. Other important features include automated tax calculations, direct deposit setups, and customizable pay stubs, all which support the accuracy, efficiency, and transparency of payroll processes.

Free payroll software is commonly used by small to medium-sized business owners, accountants, and HR professionals seeking to streamline payroll tasks in a cost-effective manner.

Ultimately, the value of these tools lies in their ability to reduce administrative burdens, minimize errors, ensure compliance, and save money on payroll management.

Features of Free Payroll Software

Choosing the right free payroll software is crucial for effectively managing your business's payroll tasks. It's essential to look for software that not only meets your basic needs but also comes with features that streamline and automate your payroll processes. Here are the most important features to look for:

- Automated Tax Calculations: Automatically calculates federal, state, and local taxes to ensure accuracy and compliance. This feature saves time and reduces the likelihood of errors in tax filings.

- Direct Deposit Functionality: Enables businesses to deposit wages directly into employees' bank accounts securely and efficiently. This convenience is now expected by most employees and saves on paper and processing times.

- Customizable Deductions: Allows for the setup of various deduction types, including retirement plans, health insurance, and garnishments, tailored to each employee. Customization ensures accurate payroll processing according to individual employee agreements.

- Pay Stub Generation: Automatically generates detailed pay stubs that can be distributed electronically to employees. This transparency helps in maintaining trust and reducing queries about wage calculations.

- Compliance Management: Keeps up with changing tax laws and regulations to help ensure your business remains compliant. This is crucial for avoiding penalties and maintaining good standing with various tax authorities.

- Time Tracking Integration: Seamlessly integrates with time tracking systems to accurately compensate employees for hours worked, including overtime. This integration ensures that payroll reflects actual hours worked, preventing disputes and ensuring fair compensation.

- Reporting Tools: Offers comprehensive reporting capabilities for payroll history, tax payments, and other relevant financial information. Good reporting tools aid in strategic planning and financial management.

- User-friendly Interface: Features an intuitive and easy-to-navigate interface to minimize the learning curve and reduce payroll processing time. A user-friendly interface can significantly enhance efficiency for those managing payroll.

- Mobile Accessibility: Provides access to payroll functions from mobile devices, allowing for payroll management on-the-go. This feature offers flexibility and ensures payroll tasks can be completed anytime, anywhere.

- Data Security: Ensures high levels of security for sensitive payroll and personal information through encryption and secure data storage. Protecting this data is paramount to maintaining employee trust and complying with privacy laws.

Selecting free payroll software that encompasses the right set of features can transform how you manage payroll, making it more efficient, compliant, and error-free. It's about finding a balance between comprehensive functionality and ease of use to best meet your business's needs.

The complexity in payroll isn’t the calculation, it’s the compliance. If your data isn’t clean, it doesn’t matter how expensive the system is.

Benefits of Free Payroll Software

Free payroll software offers several key benefits that can streamline operations, enhance accuracy, and improve employee satisfaction. Whether you're a small startup looking to manage your payroll expenses or a growing business aiming to optimize your payroll processes, understanding these benefits can guide your decision-making process:

- Cost Savings: By using free payroll software, businesses can save dramatically on the costs, allowing for better allocation of financial resources.

- Time Efficiency: Automating payroll calculations, tax withholdings, and paycheck generation means payroll can be completed more quickly and accurately, freeing up time for HR and accounting teams to focus on other tasks.

- Compliance Assurance: Free payroll software often includes features that help businesses stay compliant with local, state, and federal tax regulations, reducing the risk of costly penalties and legal issues.

- Employee Access: An employee self-service portal allows workers to view their pay stubs, tax documents, and PTO balances, enhancing transparency and reducing HR inquiries.

- Accuracy and Reliability: Automated calculations and integrations with time tracking systems help ensure that payroll is accurate and reliable, minimizing discrepancies and the need for corrections.

By selecting a solution that aligns with your organization's specific needs, you can enjoy these benefits while also providing a better experience for your employees. This strategic move not only supports your company's financial health but also contributes to a more engaged and satisfied workforce.

There’s always room for negotiation on HR software pricing. Ask for a volume discount! I always recommend trying to get a better deal based on your needs.

Costs & Pricing for Payroll Software

Payroll providers typically offer a range of plans to accommodate the diverse needs of businesses, from small startups to large enterprises. It's important to note that while free plans are available, they will come with limitations in features, the number of users, or functionality. Alternatively, some platforms offer free trials, allowing you to test the software before committing to a paid plan.

Understanding the structure of these plans and their pricing can help you make an informed decision that aligns with your business's needs and budget.

Plan Comparison Table for Payroll Software

Below is a table outlining the pricing and plan structures commonly found in payroll software, designed to give you a clear comparison of what each plan typically offers.

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free | $0 | Basic payroll processing, limited to a certain number of employees, and basic tax filing |

| Basic | $10-30 per month | Payroll processing for a larger number of employees, tax filing, and some reporting capabilities |

| Professional | $30-60 per month | Enhanced payroll features, multi-state tax filing, advanced reporting, and integration with other software |

| Enterprise | $60+ per month | Custom payroll solutions, dedicated support, advanced security features, and unlimited employees |

Choosing the right plan requires careful consideration of your business's size, payroll complexity, and the specific features you need. Keep in mind that while higher-priced plans offer more features, the best choice for your business balances cost with the functionalities most critical to your payroll processes.

Free Payroll Software: FAQs

Here are some answers to frequently asked questions you may have about payroll software and how it works:

What is payroll software?

Payroll software is designed to streamline the time-consuming tasks associated with paying employees, including tracking employee work hours and allocating employee pay based on their hourly rates or annual salaries. Payroll software also automates payroll deductions, including federal, local and state taxes, and workers’ compensation contributions.

You can also use payroll software to automate deductions for benefits like health insurance, monthly parking space rentals, or any other additional fees you may need to deduct from your staff each time you process payroll.

Is payroll software considered HR software or financial software?

Payroll software is considered both an HR solution and a form of finance and accounting software. As such, it is often used by a combination of in-house accounting staff and HR professionals.

Why is some payroll software free?

Free payroll software is usually offered as a reduced feature plan (called a freemium plan) by many payroll software vendors as a way of drawing you in to test out their product, with the hope that you will eventually scale up to a paid plan. Some payroll providers may also offer free payroll software in the form of a lengthy free trial to help you determine if the payroll system is a good fit for your needs.

If you’re running a startup or a small business, you may be able to get away with using a free version of payroll software. You might also benefit from using it in combination with a free employee scheduling software, to line up hours worked with hours scheduled. However, paid plans will always give you more advanced features and better customer support.

If you’d like to take a look at some more advanced payroll options, take a look at my list of the best payroll software too.

Do more expensive payroll providers offer better features?

As the saying goes, you get what you pay for. If you’re using free software or a low-cost system, you can’t reasonably expect it to have comparable features to other premium payroll options. If you have more complicated needs, there are plenty of other payroll providers out there that have more sophisticated features.

Some advanced features you may want to consider include:

- Integrated time-tracking: This is a useful feature that links your employee work hours directly into your payroll modules so you don’t have to manually transfer data from a separate time-tracking system into your payroll software.

- Compensation management: More advanced payroll systems offer tools to compare staff salaries against industry benchmarks to ensure you’re paying your staff at fair market value.

- Advanced reporting & analytics: Basic payroll systems should include some form of basic payroll reports, however, when you’re paying for a system, you can expect a greater ability to customize these reports to your individual needs, rather than using built-in templates that cannot be changed.

- Earned wage access (EWA): This is an advanced payroll feature that allows companies to grant employees access to a portion of their earned wages before their next official pay day. It’s a modern offering that can help employees manage unexpected cash flow situations. It’s also been shown to increase employee retention and satisfaction, while reducing stress related to financial challenges.

As you can see in my review, not all payroll software is created equal! To find the perfect payroll tool for your company, you need to be crystal clear on your needs first.

More Advanced Payroll Options

If the free payroll providers in this list aren't quite satisfying your needs, don't fret. There are plenty of more sophisticated payroll options out there to choose from:

- Best Payroll Software

- Automated Payroll Software

- Canadian Payroll Software

- Payroll Software for Small Businesses

- Payroll Services for Small Businesses

Final Thoughts

Using a payroll solution is important because it enables you to pay your employees on time, which helps keep them motivated. As John Boitnott, Inc. journalist, said:

"Money isn't the only thing that motivates someone to perform well at their job, but it certainly factors in heavily."

Before you go, subscribe to the People Managing People newsletter to receive expert advice directly in your inbox. We'll send you plenty of free tips and tricks to help you run your business efficiently without overextending your overhead budget, helping you work better and smarter for absolutely no charge.