10 Best Canadian Payroll Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Managing payroll in Canada can quickly become a stressful juggling act, especially when you're stuck using software that wasn’t designed for CRA compliance or the complexity of Canadian tax laws. From calculating EI and CPP contributions to navigating provincial regulations, one misstep can lead to costly errors or fines.

And let’s face it—there’s no shortage of payroll tools out there. But many aren’t built with Canadian businesses in mind, and sorting through generic options can be overwhelming when you just need something that works for your local team.

That’s where this guide comes in. I’ve evaluated dozens of payroll platforms through the lens of a Canadian HR professional with firsthand experience using and reviewing HR software.

In this article, I’ll walk you through the best Canadian payroll software available today, so you can streamline your payroll process, stay compliant, and focus on growing your team instead of battling tax tables.

Why Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Canadian Payroll Software: Pricing Comparison Chart

This comparison chart summarizes key pricing details for my top Canadian payroll software selections, or you can scroll down to compare more detailed specs side-by-side.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best payroll solution for Canadian organizations hiring foreign talent | Free trial + demo available | From $29/month | Website | |

| 2 | Best software for reliable regulatory compliance and Canadian tax knowledge | 90-day free trial + free demo | From $8/user/month (billed annually) | Website | |

| 3 | Best for teams seeking a Canadian based, user-friendly option | Free demo available | From $8/user/month | Website | |

| 4 | Best for straight-forward payroll needs for small teams | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 5 | Best for Canadian businesses interested in growing global teams | Free demo available | From $25 - $199/user/month | Website | |

| 6 | Best for managing contractors and freelancers around the globe | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 7 | Best full-service payroll software for Canadian food services teams | Free demo available | From $11/employee/month | Website | |

| 8 | Best for Canadian small businesses and their bookkeepers and accountants | Free trial available | From $4/employee/month + $20/month | Website | |

| 9 | Best for time-strapped small businesses with immediate payroll needs | 30-day free trial | From $43/month | Website | |

| 10 | Best for fast-growing companies with plans to scale up | Free demo available | From $44/employee/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

Best Canadian Payroll Software Reviews

Explore the top 10 Canadian payroll tools, each with a quick rundown of what it’s best for, key features, and a peek at the interface. Plus, bonus picks are waiting for you at the end!

Deel

Best payroll solution for Canadian organizations hiring foreign talent

Deel is a global HR solution with global payroll features that companies can run even without supervision. This software can run payroll in over 90 different countries worldwide, including Canada, while also streamlining operations, and eliminating problems with handling taxes, local compliance, and benefits.

Why I picked Deel: Deel's payroll software helps Canadian businesses stay compliant with relevant Canadian regulations. Canadian businesses won’t have to worry about taxes, compliance, government declarations, and calculations as Deel handles all of this on your behalf.

You can get your entire team operational with Deel in just a month, which is impressive since other payroll providers often take many months to finish the payroll setup process.

In addition, Deel clients can also lean on the company for help with expanding their business operations into other countries, with Deel managing all relevant regulations regarding taxes, benefits, and compliance.

Standout Features and Integrations:

Features include an easy-to-use platform that unifies EOR (employer of record) services, contractor payments, and payroll management. Deel’s in-house payroll team processes payroll directly and supports clients to resolve any issues within your payroll process. In addition, Deel can help you offer localized benefits for staff based within Canada or any other location they support.

Deel customers can also use their new global HR and payroll mobile app to review and approve payments, withdraw funds from a linked account, view and download payslips, and submit time-off requests.

Integrations include Ashby, BambooHR, Expensify, Greenhouse, Hibob, Netsuite, Okta, OneLogin, Quickbooks, SCIM, Xero, Workday, and Workable. They also have an API that supports additional custom integrations as well.

Pricing for Deel is a flat rate and varies depending on the country you're based in and the type of plan you select. They offer three plans: Direct Employees, Contractors, or EOR Employees. Payroll handling features are only available in the Direct Employees and EOR Employees packages.

Pros and cons

Pros:

- Manages Canadian compliance obligations on your behalf

- Flat rate pricing with no hidden fees

- Add-ons available to localized benefits and global payroll

Cons:

- No free trial available

- Could be too pricey for small businesses

Rise

Best software for reliable regulatory compliance and Canadian tax knowledge

Headquartered in Burnaby, BC, Rise is a Canadian payroll software that places compliance first. Their solution has been designed to make sure that small business owners and large enterprises alike are paying and remitting taxes on time and with accuracy in accordance with both provincial and federal regulations.

Why I picked Rise: Flexibility is huge for Rise, and they make sure to offer customization as a standard feature. For example, you can run payroll as many times as you need, cancel a pay run, make payments off-cycle, or even pay out a bonus without having to calculate tax. Automatic tax remittance is built in via a Canadian tax engine that’s compliant with all regulations.

Also, if you’re thinking about switching from an existing payroll provider, Rise will even talk to the CRA and government agencies on your behalf, to ensure that the transition runs smoothly and without errors or oversights.

Standout Features and Integrations:

Features within Rise's payroll software include unlimited payroll runs, ad-hoc payroll tools, daily pay tools, compliance features, direct deposit, year-end payroll forms (T4s, T4As) and other tax filings (RL1, ROEs, etc.).

Other features in Rise's platform include recruiting, onboarding, employee benefits, time tracking, time off requests, employee scheduling, and performance reviews.

Integrations include Freshbooks, Intuit Quickbooks, WealthSimple, and Xero.

Pricing for Rise begins at $8 per employee per month. A $30 minimum monthly base fee applies for small businesses with less than 20 employees. A 90-day free trial is available for their Optimize module.

Pros and cons

Pros:

- Cost effective

- Very easy to pull documents like ROEs

- Responsive support staff

Cons:

- Some manual data entry is necessary when vacation requests are canceled

- Reports could use greater customization options

- Few integrations available

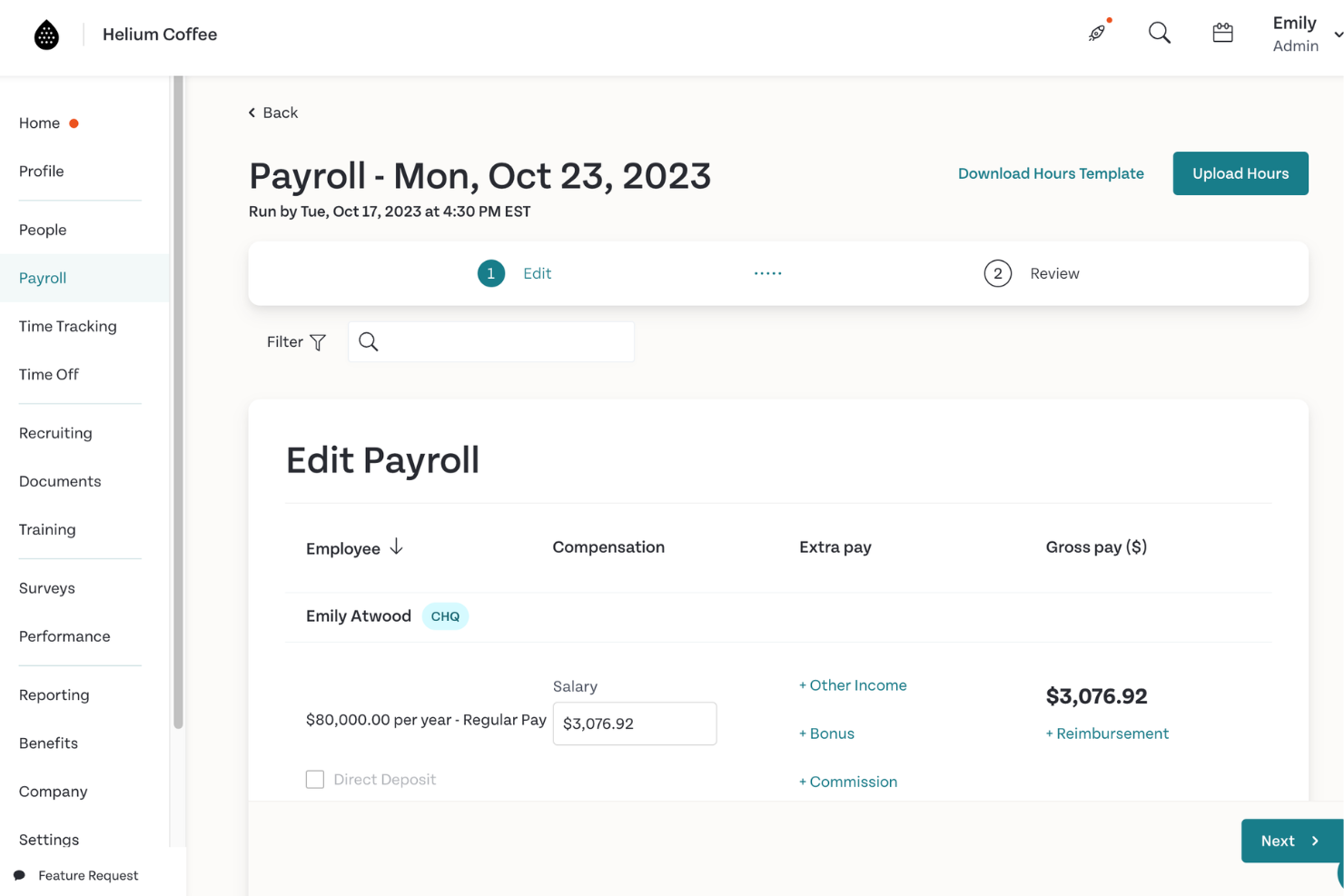

Humi is a Canadian payroll and HR software developer that's headquartered in Toronto, ON. Their software is available in English and French to serve the entire Canadian market.

Why I picked Humi: Payroll is, by nature, complicated. Humi takes the guesswork out of payroll and HR software by making their interface as intuitive and easy-to-use as possible. HR info such as hires, terminations, vacation usage, and benefits enrollment are integrated with payroll processing, reducing dual entry work. Employees can also access self-service pay stubs that detail vacation accruals and deduction breakdowns, and easily receive direct deposits.

Their platform can automatically generate T4s, Records of Employment (ROE), Canada Revenue Agency (CRA) remittances, and Employer Health Tax (EHT) calculations, simplifying multi-province payroll significantly. Plus, Humi’s tax engine is specifically designed for Canadian regulations, making any audit and compliance efforts that much easier.

Standout Features and Integrations:

Features include unlimited pay runs, automatic T4s and ROEs, records and reporting, EHT and WCB calculations, direct deposit, self-serve pay stubs, multi-province payroll, benefits, and automatic CRA remittance.

Using Humi's employee-facing mobile app, employees can also check their pay statements and time off balances, submit time-off requests, and edit their work profile while on the go.

Integrations include Xero, Indeed, Greenhouse, Voila!, Workable, and Zapier.

Pricing for Humi is based on your number of employees and how many modules you’d like to integrate into your program. A free demo is available prior to signing up.

Pros and cons

Pros:

- Covers all Canada-specific payroll needs

- Clean and intuitive design makes it easy for employees to self-serve

- Easy tracking of all employees

Cons:

- Growing list of integrations means some of your existing providers may not yet be on the list

- Documents require some elbow grease to customize

- Free trial does not include exact customization, so some guesswork must be done

Xero is a well-known accounting platform that's popular with many small businesses across Canada. While Xero is quick to mention that larger teams with more complex payrolls may need to integrate a third-party app, small teams in Canada with only a few employees will find their payroll add-on offers everything they need.

Why I picked Xero: If you’re a current Xero user with simple payroll needs, their payroll add-on is an excellent option. With the payroll option, Xero users can manually input vacation leave, hourly rate, hours, and taxes, and calculate deductions. To run payroll that is recurring, you can copy a previous pay run and make changes to keep it current. Pay stubs can also be emailed or printed directly from Xero.

Standout Features and Integrations:

Features include simple online pay runs, pay records, salary and wage payments, and vacation leave.

Integrations include Deputy, Expensify, Jibble, Remote, Rippling, TimeDock, Virtlx, and others.

Pricing for Xero begins at $17 per month and plans are based on the extent of your needs. Xero also offers a free trial.

Pros and cons

Pros:

- Lengthy list of integrations

- Simple, straight-forward functionality

- Existing Xero users can run payroll from within this familiar tool

Cons:

- Exclusively available within Xero

- Does not accommodate larger teams

- Most data needs to be manually inputted

Best for Canadian businesses interested in growing global teams

Remofirst is a global employment platform that enables companies to hire, manage, and pay remote employees in over 160 countries without the need to establish a local entity. They also provide an Employer of Record (EoR) service, taking on the legal and administrative responsibilities of employment.

Remofirst is designed to support businesses in expanding their international workforce by providing a centralized system for managing global employment tasks.

Why I picked Remofirst: With the support of Remofirst's payroll services, Canadian companies can extend their operations internationally while still using their Canadian payroll software for domestic operations.

The combination of Remofirst's global capabilities with Canadian payroll software can help Canadian businesses operate compliantly both within Canada and internationally. In addition, their software can also be used to pay Canadian or international contractors as well.

Standout Features and Integrations:

Features include contractor management, RemoHealth health insurance, visa and work permit assistance, background checks, remote access, time and attendance tracking, and workforce management.

Integrations include ADP.

Pros and cons

Pros:

- Good value for money

- Strong customer support

- Easy-to-use interface

Cons:

- No mobile app

- Limited integration with other platforms

Best for managing contractors and freelancers around the globe

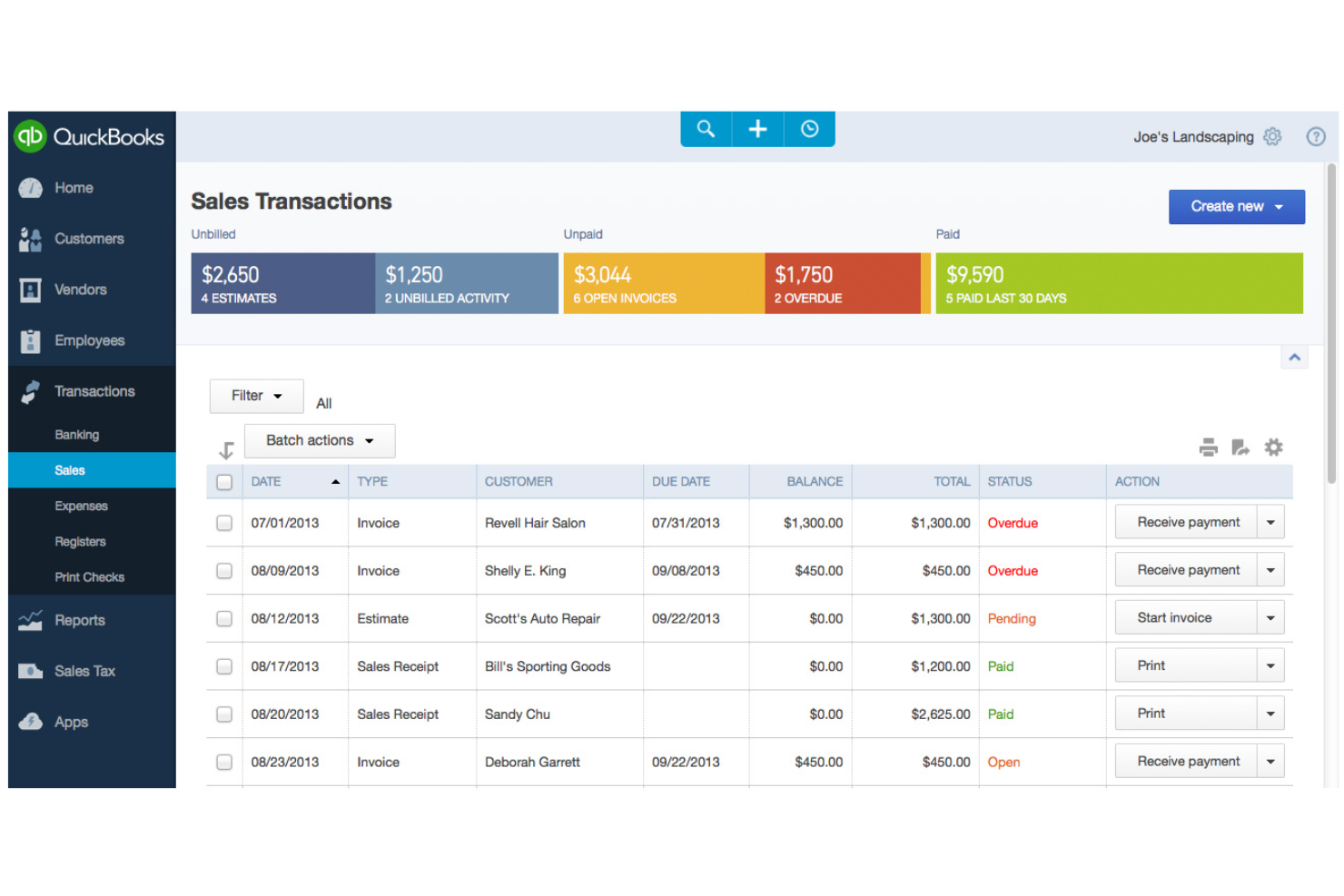

QuickBooks Online is a cloud-based accounting software designed to help small and medium-sized businesses manage their finances. It offers a range of features, including invoicing, expense tracking, and payroll management.

Why I picked QuickBooks Online: Their payroll software is suitable for managing contractors in Canada or around the globe. It offers the ability to track contractor expenses, generate and send contractor invoices, and manage contractor payments through the platform.

You can also easily categorize contractor transactions, manage your contractor database, and generate contractor-specific reports for simplified financial management. The platform's user-friendly interface and comprehensive contractor management tools make it a powerful solution for effectively organizing, tracking, and managing contractor-related activities.

Standout Features and Integrations:

Features include custom pay schedules, direct deposit, and automatic tax calculations, which means you don't have to worry about manually calculating taxes and deductions for your employees. This is a huge time-saver and helps ensure accuracy in your payroll process.

QuickBooks Online also offers robust reporting features that help you analyze your payroll data and make informed decisions about your business. You can generate reports on payroll expenses, and employee hours.

Another useful feature is the ability to generate T4 slips and other year-end tax forms for your employees. This makes tax season much less stressful, as you can easily provide your employees with the necessary documents for filing their taxes.

Integrations include over 400 business apps like Rewind Backups, Knowifiy for Customers, Plooto, Expensify, Fathom, BigCommerce, Verify, Insightly CRM, Mailchimp, and others.

Pricing starts at $24/month CAD or $30/month USD. It comes with a 30-day free trial.

Pros and cons

Pros:

- Industry leader in accounting means existing trust in accuracy and reliability

- Easy and efficient tax filing system

- Businesses with remote employees may incur additional costs for province-specific filings

Cons:

- Limited users, even then highest plan caps at 25

- Setup services and expert review are only available in higher tiers

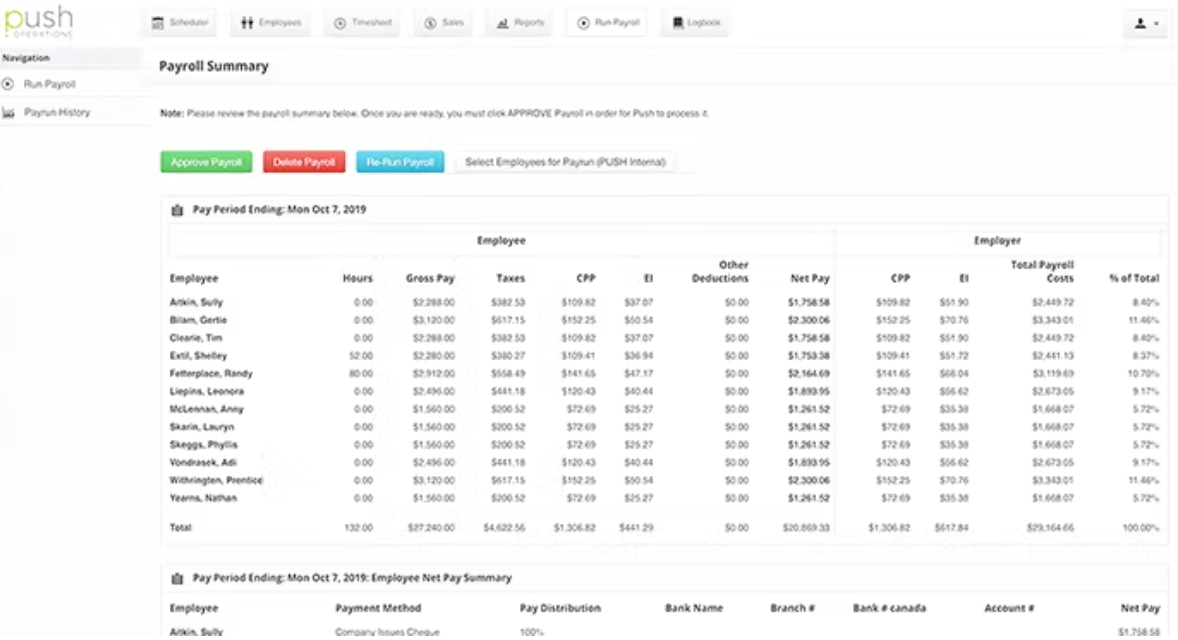

Best full-service payroll software for Canadian food services teams

Push Operations can be used as a standalone payroll software, or you can take advantage of all the features as a comprehensive employee management suite.

Push will calculate and pay taxes on your behalf, assist you in pulling T4s and ROEs, and can pay your employees by direct deposit or cheque. Push makes it easy to pay employees who have multiple rates (like overtime) and will monitor split shift premiums and minimum tip top-offs.

Why I picked Push Operations: Restaurants have very specific payroll needs, and Push Operations has developed a software to meet them. This fully integrated cloud-based payroll software boasts clients in Canada like Wendy’s, Boston Pizza, A&W, and Denny’s.

Push Operations speeds up payroll processing, saving time that would normally be spent manually inputting time calculations for employees serving a variety of shifts.

Standout Features and Integrations:

Features include regulatory compliance, onboarding, self-serve pay stubs, time tracking, real-time payroll reporting, and one-click payroll processing. Push also offers three mobile apps for Android and iOS devices, including Push Time, Push Manager, and Push Employee, which allows employees to view their digital pay statements while on the go.

Integrations include Avero, CTUIT, Focus POS systems, Greenline POS, HIK Vision, Par, Squirrel Systems, Ultipro, and Upserve.

Pricing for Push starts at $11 per employee, per month for their Starter + Payroll plan. A free demo is also available.

Pros and cons

Pros:

- Run payroll for employees with multiple pay rates

- Built to meet the specific needs of restaurants

- Helpful and courteous support

Cons:

- User permissions can be time-consuming

- Better interface on desktop than mobile

- Primarily for restaurants and food services companies

Best for Canadian small businesses and their bookkeepers and accountants

Wagepoint serves over 25,000 small businesses in Canada. Wagepoint emphasizes the human aspect of their platform and aims to provide friendly, caring support, making it an excellent choice for those who are new to payroll solutions.

Why I picked Wagepoint: This user-friendly, standalone payroll software solution was designed to be intuitive and easy to use for small businesses and those who support them, such as bookkeepers and accountants.

Wagepoint gives you the tools to pay employees via direct deposit, generate and submit ROEs, and automate your Canadian tax needs, including federal and provincial/territorial income tax, CPP/QPP, EI/QPIP, and year-end T4 and T4As. Incomes, deductions, paid time off, workers' compensation, and employer health tax/health services fund are automatically calculated for you.

Standout Features and Integrations:

Features include automated payroll calculations and taxes, direct deposit, employee self-serve access to pay stubs, responsive customer service, the ability to pay employees and independent contractors, year-end forms and reporting, and a number of reports to break down your data.

Integrations include Time by Wagepoint, QuickBooks Online, and Xero.

Pricing for Wagepoint includes two plans for small business owners. You can use the pricing calculator on the Wagepoint website to calculate subscription rates. Pricing for the solo plan begins at $20/month (CAD) plus $4/employee/month, while the unlimited plan begins at $40/month (CAD) plus $5/employee/month.

Pros and cons

Pros:

- Long list of integrations

- User-friendly system that prioritizes the human element

- In-depth customer support

Cons:

- Seasoned payroll staff may not take full advantage of extensive support functionality

- Some reporting features may require manual customization

- Paid time off and time tracking are add-ons

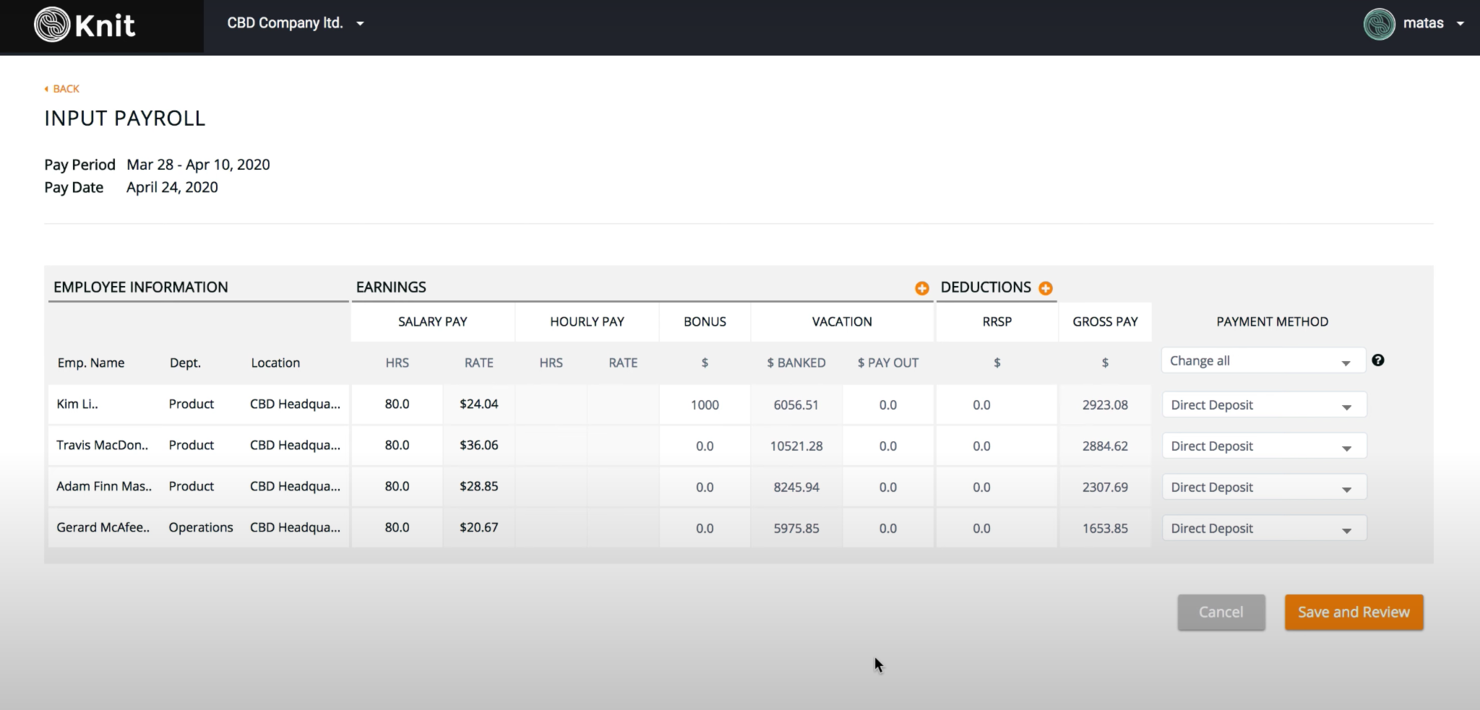

If you’re a Canadian small business owner who needs to set up payroll ASAP, Knit is the software for you. This cloud-based tool is designed to be easy to adopt, promising speedy setup with accurate payroll from day one.

Why I picked Knit: In a single click, users can calculate payroll and remit taxes to the CRA based on their specific scheduling needs. You can pull ROEs and employee reports, address EHTs and WSIB, and store T4s for employees to have self-serve access. Pay cheques can be direct deposited into employee bank accounts.

If your business needs support beyond the basics, Knit offers a support team of Canadian payroll experts. Users have the option of asking questions and managing payroll themselves, or outsourcing payroll management for Knit to conduct on your behalf.

Standout Features and Integrations:

Features include direct deposit, tax filing, automatic payroll calculations, WCB and EHT remittances, and online pay stubs.

Integrations include QuickBooks Online, TSheets, and Xero.

Pricing for Knit starts at $43 per month and the tool offers a 30-day free trial.

Pros and cons

Pros:

- Accurate and efficient compliance with Canadian regulations

- Support team can take over payroll management on your behalf

- Easy to adopt and get started fast

Cons:

- Better suited to desktop than mobile app use

- Slightly higher price point

- Primarily for Canadian small business owners

Payworks is a comprehensive payroll software that’s perfect for businesses planning to scale up. With 12 offices located across Canada from coast to coast, they provide localized support with expert knowledge regarding provincial regulations. When an organization starts working with Payworks, they are assigned a dedicated Payroll Compliance Practitioner (PCP) service representative who becomes their go-to expert, meaning that you won’t need to waste time retelling your story every time you call customer support.

Payworks offers a complete year-end package, custom reporting, and unlimited previews. In addition to the standard features like direct deposit and stat pay calculators, Payworks also supplies helpful checklists and videos on year end proceedings, and will even file on your behalf.

Standout Features and Integrations:

Features include scalability, unlimited previews, auto filing, direct deposit, and continuous enhancements.

Integrations include Microsoft Excel, Simply Accounting, and QuickBooks.

Pricing for Payworks starts at $44/employee/month and is based on the extent of the functionality your team will require. A free demo is also available.

Pros and cons

Pros:

- Easy and efficient year-end support

- Multiple locations across Canada ensures provincial expertise

- Dedicated customer service representative saves time and frustration

Cons:

- Additional cost for absence management

- Transparent pricing isn’t readily available

- Benefits integration currently doesn’t allow termination mid-month

Other Canadian Payroll Software

Here are a few more options that didn’t make the best Canadian payroll software list. I didn’t have room for a full review for each of these but they are still worthy of consideration:

- Collage

For tech-forward organizations seeking a cutting-edge software solution

- Rippling

Canadian payroll software for CAD businesses with international employees

- Papaya Global

For Canadian organizations with global expansion plans

- ADP Workforce Now

All-in-one HR solution for payroll, time tracking, benefits, and talent management

- TimeTrex

For compliant provincial and federal payroll and tax calculations

- Ceridian Dayforce

Cloud-based HCM suite with compliance-centric payroll

- Workzoom

All-in-one people management software with payroll, recruiting, time tracking, and more

- Umana

Heavily customizable payroll software catering to medium-sized businesses

- Payment Evolution

Enterprise-class cloud payroll software built for Canadian small businesses

- Wave Payroll

Accurate, automated payroll software with an emphasis on time-saving features

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Canadian Payroll Software

Selecting the best payroll software for this list required a thorough understanding of how common pain points can be alleviated by choosing the right software. My approach to selecting the best systems for this list is grounded in thorough research coupled with my personal experience maintaining payroll details within a human capital management (HCM) system for numerous years.

Here’s a summary of the selection criteria I used to develop this list of the best Canadian payroll software:

Core Payroll Software Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to offer the following basic payroll software functionalities first:

- Automated and accurate calculation of wages and taxes and timely employee payment processing

- Compliance with CRA reporting and remittance requirements

- Management of employee benefits and deductions

- Generation and submission of year-end tax forms

- Digital pay stubs that are accessible to employees through a self-service portal

- Integration capabilities to sync data with time tracking and other Canadian HR software to reduce manual data entry

In addition to these basic requirements, each software system in this list needed to either 1) show clear evidence of being developed within Canada by Canadian payroll specialists, or 2) demonstrate their experience in serving the Canadian labor market specifically.

Additional Standout Features (25% of total score): To help me pinpoint the best Canadian payroll software, I also took note of any unique features, including:

- Sophisticated features, such as pay-on-demand or earned-wage-access

- Advanced analytics and reporting capabilities for deeper financial insights

- Advanced integrations with bookkeeping and accounting software to streamline operations

- Enhanced security features, such as multi-factor authentication, to protect sensitive employee data

- Environmental sustainability through paperless payroll processes

Usability (10% of total score): To evaluate the usability of each payroll system, I considered the following:

- An intuitive design and user-friendly interface that simplifies complex processes and requires minimal training to master

- Quick access to essential features without overwhelming users

- A user-friendly mobile experience or dedicated mobile apps for Android and iOS mobile devices

- Role-based access control that's straightforward to configure

Customer Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Quick setup processes and clear guidance for first-time users

- The availability of training materials such as videos or interactive tutorials

- Support systems like chatbots and webinars to guide new users through the initial learning curve

- Support for migrating historical employee data into the new platform

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- The availability of multiple support channels, including email, phone, and chat

- The existence of a self-service knowledge base, FAQ repository, or other self-help resources to speed up troubleshooting

- The overall quality, responsiveness, and helpfulness of the support team during customer onboarding and post-purchase, as inferred from customer reviews

- Whether the company offers a dedicated account manager, full-service payroll services, or any additional human resources support services

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- The availability of free trials or demos to test the software before purchasing

- Transparent pricing models that clearly explain which payroll features are included at each level, with no additional hidden costs for training or set-up

- Tiered pricing plans that cater to different business sizes, from small to medium-sized businesses (SMBs) up to enterprise-level organizations

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Whether a product has consistently high ratings across multiple review platforms, indicating a broad level of user satisfaction

- Specific praises, criticisms, or trends in customer feedback that indicate the software's strengths or areas for improvement

- Whether customer feedback specifically mentions issues with ease of use, customer support responsiveness, or lacking features

- Any testimonials that highlight how a platform solved a particular challenge or adapted to changing payroll needs

By using this assessment framework, I was able to identify the Canadian payroll software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

How to Choose Canadian Payroll Software

Canadian payroll software offers numerous benefits for Canadian organizations, including straightforward compliance monitoring against Canadian laws and regulations, to start.

To help you figure out which Canadian payroll software best fits your needs, you need to pinpoint your key users and document their specific challenges first.

As you work through your own unique software selection process, keep the following points in mind:

- What problem are you trying to solve? Start by identifying the challenges you're trying to overcome. This will help you clarify the features and functionalities the payroll software needs to provide. These challenges may include:

- Trouble managing tax regulations across different provinces and employee types,

- Trouble ensuring proper compliance with Canadian tax regulations (especially if you've been fined by the CRA for doing something incorrectly),

- A lack of bilingual content to serve your French-speaking employees, or

- More advanced integrations with other systems you're already using.

- Who are your main users? Consider who will use the software and how many licenses you'll need. Once that's clear, it's also useful to rank the needs of your different users to identify the key priorities for your power users, managers, and employees, to ensure they're all met.

- You'll need to evaluate if it'll just be your HR professionals, select accounting staff, or both entire departments that will require admin-level access.

- What is your budget? To evaluate cost, do a headcount of your existing workforce, plus your projections for the next 5 to 10 years. Since most payroll software charges a monthly fee per employee, this will help you proactively estimate your monthly costs.

- It's crucial to determine a realistic budget for your new payroll system up-front, so you don't waste time considering software that's out of your price range.

- What outcomes are important? Review the capabilities you want to gain or improve, and how you will measure success. Being clear on your desired outcomes upfront is crucial to avoid wasting valuable time. Key outcomes you may want to measure include:

- Enhanced compliance monitoring features to avoid CRA penalties,

- Gaining new features to improve your employee experience, such as on-demand pay, or

- Improved access to support resources, such as those written in French.

- Do you require specific software integrations? Clarify whether your new payroll software will replace existing tools, or need to integrate with them. Key systems to integrate with include accounting, time-tracking, or other human resources software.

- Are all the integrations you need available, or can they be custom-configured using an API?

- Can you reduce your monthly SaaS costs by replacing multiple tools with an all-in-one Canadian HR management system?

- Does the payroll software satisfy your technical requirements? Consider the software selection alongside your existing workflows and systems. Evaluate what's working well, and any problem areas that need to be addressed.

- Does the new system integrate with your corporate workspace (Microsoft SharePoint, Google Workspace, etc.)?

- Does the new system offer security features that meet your needs (e.g., two-factor authentication (2FA), etc.)?

Remember, every business is different — don’t assume that a payroll system will work for your organization just because it's popular or made in Canada.

Trends in Canadian Payroll Software

The landscape of Canadian payroll software has continued to evolve, driven by regulatory changes, technological advancements in artificial intelligence (AI) and machine learning (ML), and shifting business needs. Here are several trends that are impacting payroll software development in Canada currently:

- Integration of AI and Machine Learning: Some payroll systems have started to use AI and machine learning algorithms to predict payroll outcomes, identify discrepancies, and suggest optimizations. This cutting-edge feature represents a significant leap towards proactive payroll management, offering insights that can lead to cost savings and more strategic financial planning.

- AI-Powered Payroll Queries: An unusual yet increasingly popular feature is the use of AI to handle employee payroll queries. This AI-driven approach not only improves efficiency but also enhances the employee experience by providing instant responses to common questions.

- Predictive Analytics for Payroll Management: Another developing trend is the use of predictive analytics that forecast future payroll costs and trends based on historical data. This advanced feature helps businesses plan more effectively and manage their finances more efficiently.

- Global Payroll Management Abilities: As businesses become more global, the need for payroll software that can manage multi-country payroll across different currencies has become crucial. Tools like Papaya Global and Deel have emerged as leaders in this space, offering solutions that simplify the complexity of global payroll, tax, and compliance issues. Some can even help you stickhandle Canadian work permit and immigration issues too!

These trends indicate a shift towards more intelligent payroll solutions that exceed basic payroll processing needs to offer strategic value to businesses. More businesses are exploring employer of record relationships that can handle payroll, so solutions will have to keep pace with what those services offer.

As Canadian payroll software continues to evolve, you can expect to see more sophisticated features designed to streamline payroll management, ensure compliance, and enhance decision-making capabilities.

What is Canadian Payroll Software?

Canadian payroll software is a digital solution that automates and facilitates the intricate task of managing employee compensation and payroll-related tasks for businesses in Canada.

It calculates salaries, deductions, and taxes, and generates pay stubs and reports, ensuring accurate payments and full compliance with Canadian payroll laws, while reducing the time and hassle of manual payroll work.

Features of Canadian Payroll Software

Aside from being able to manage your basic payroll needs in compliance with Canadian regulations, here are some of the other key payroll features to look for:

- Canadian Payroll Tax Filing: Most of the payroll software on this list have tools to help you file your federal payroll taxes with the CRA, including Employment Insurance (EI) and Canada Pension Plan (CPP) contributions.

- Provincial Tax Filing: There may also be tools to help you with filing specialized provincial payroll taxes, including the Employer Health Tax in Ontario or British Columbia, Quebec Pension Plan (QPP) contributions, and workers' compensation premiums for each province or territory.

- CRA Compliance: This feature is vital because it guarantees that the software is updated with the latest tax rates and Canada Revenue Agency rules and regulations, preventing legal issues and ensuring accurate payroll tax calculations.

- Year-End Tax Form Preparation: Automating the preparation and distribution of required tax forms — including T4, T4A, and RL-1 slips — is crucial for meeting CRA deadlines and requirements, reducing workloads during the busy year-end period.

- Multiple Payment Options: Many tools will allow you to pay employees by direct deposit or cheque, and may also have invoicing options for contractors and freelancers.

- Electronic Records of Employment (ROE): This feature is important because it automates the creation and submission of ROEs to Service Canada, a mandatory step when an employee leaves a company, ensuring compliance and efficiency.

- Employee Self-Service: Usually employee portals are available where staff can access their pay stubs and tax forms, update their bank account information, and more.

- Workforce Management & Time-Tracking: Some systems provide tools for employee time tracking, managing time off requests, scheduling shifts, and more. Integrated time tracking, in particular, is helpful since it ensures accurate pay based on the exact hours worked.

- Payroll Services: In addition to software, some providers also offer payroll management solutions (also called full-service payroll or PEO payroll services), meaning they can handle pay runs on your behalf.

- Customizable Reporting & Analytics: Most payroll software will generate payroll reports and may offer real-time dashboards to help you track your payroll process. Customizable reports help businesses make informed financial decisions and ensure transparency.

Choosing a Canadian payroll software that offers these features will help you automate tedious portions of your payroll process and ensure compliance with Canadian tax laws and labor regulations. By prioritizing these features, you'll reduce the risk of errors, and maintain good standing with regulatory bodies, all while saving time and resources.

Benefits of Canadian Payroll Software

Choosing the right Canadian payroll software goes beyond automating pay. It’s about staying compliant, managing a diverse workforce, and meeting the unique demands of doing business in Canada.

Here are the top benefits you can expect when investing in the right solution:

- Compliance with Canadian Regulations: Using software that automatically updates to reflect changes in CRA guidelines and national and provincial tax laws and regulations helps businesses avoid penalties and ensures compliance.

- Robust Reporting for Canadian Requirements: This feature aids in strategic decision-making and ensures that businesses have the necessary documentation to meet CRA audits and inquiries, providing peace of mind and operational transparency.

- French and English Language Support: Given Canada's bilingual nature, having software that supports both English and French is essential for clear communication and to accommodate all employees comfortably.

- Localized Data Security: Canadian payroll software is designed to comply with Canadian data privacy laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA) and other provincial data protection laws, ensuring sensitive employee information is securely managed.

- Customizable for Canadian Union Rules: For organizations with unionized workers, Canadian payroll software can be customized to adhere to union-specific rules and collective bargaining agreements, ensuring that payroll reflects negotiated terms accurately.

These benefits highlight the importance of selecting a solution that's designed with the Canadian market in mind, ensuring that HR professionals can manage payroll efficiently, accurately, and in compliance with all relevant laws and regulations.

Costs & Pricing for Canadian Payroll Software

Whenever you’re investing in a new HR solution, it’s important to consider how cost-effective it will be. Payroll software providers offer a range of pricing options to suit different business sizes and needs. Understanding these options will help you make an informed decision that aligns with your business requirements and budget constraints.

The payroll systems in this list generally offer a subscription-based payment model based on the number of employees you have. However, some payroll providers offer custom pricing based on your business needs (see our breakdown of payroll software costs for more details).

Plan Comparison Table for Canadian Payroll Software

| Plan Type | Average Monthly Price | Price Per Employee, Per Month | Common Features |

|---|---|---|---|

| Free | $0 | $0 | Basic payroll processing, CRA remittance, T4 slips, ROE, direct deposit, up to a certain number of employees |

| Basic | $20-$30 per month | $2-$4 | All Free features plus additional employees, enhanced reporting, and customer support |

| Standard | $30-$50 per month | $3-$5 | All Basic features plus multi-province support, advanced reporting, and integration with other software |

| Premium | $50-$70 per month | $4-$6 | All Standard features plus priority customer support, custom features, and advanced analytics |

| Enterprise | Custom Pricing | Custom | All Premium features plus unlimited employees, dedicated account manager, and bespoke integrations |

As you're trying to determine the best plan for you, it's essential to weigh the cost against the features and support provided. Consider both your current needs and future growth to select a plan that offers the best value and flexibility for your business. The price per employee metric is particularly useful to help you forecast incremental costs if your business scales.

If you’re starting out with just a few employees, a free or basic plan might be enough initially. However, there are several compelling reasons to consider upgrading to a more advanced plan as you grow:

- Growing Workforce Needs: As your team expands, your payroll needs will naturally grow more complex. Advanced plans are built to handle higher transaction volumes and come with enhanced tools for managing a larger staff.

- Access to Advanced Features: You may find that additional payroll features become essential, such as automated tax filings, direct deposit, benefits administration, compliance tracking, and in-depth financial reporting—features that may be absent from basic plans.

- Handling Complex Payroll Situations: If your business has complex payroll requirements (e.g., onboarding employees across different provinces or countries), a more robust plan can better manage diverse tax laws, regulations, and even multi-currency transactions.

- Improved Customer Support: Higher-tier plans often provide enhanced customer support, including dedicated support teams, quicker response times, and personalized assistance, ensuring you get help when you need it most.

- Integration with Other Systems: If your current payroll solution doesn’t integrate well with other key systems like HR management software, accounting platforms, or time-tracking tools, an upgrade might provide the compatibility you need.

Ultimately, it's important to secure a plan that offers the features you need to serve your current needs and solve your challenges without exceeding your budget.

FAQs: Common Questions About Canadian Payroll Processing

Still have questions about how to process payroll in Canada, and what software you can use to help you out? Here are some answers to FAQs on this topic:

What makes Canadian payroll software unique?

Not all payroll software is built for the complexities of Canadian payroll. Here’s what sets Canadian payroll software apart:

-

Built-in compliance: It handles Canada’s multi-layered payroll system, including both federal and provincial tax rules.

-

CPP and EI contributions: It automatically calculates and applies contributions from both employers and employees.

-

Regional accuracy: It supports businesses with staff across different provinces, managing varied deductions with ease.

-

Error reduction: It removes the guesswork from tax and deduction calculations, helping you stay compliant and pay employees accurately.

For Canadian employers, it’s a must-have to ensure payroll runs smoothly and legally.

What is an Employer of Record for Canada?

A Canadian Employer of Record (EOR) is a third-party service that legally employs workers in Canada on your company’s behalf.

Here’s what that means:

-

Legal employer: The EOR handles payroll, tax deductions, benefits, and compliance with Canadian labor laws.

-

Operational control stays with you: You manage your employee’s day-to-day work—while the EOR takes care of the legal and administrative side.

-

Simplified expansion: It’s an easy way to hire in Canada without setting up a local entity or mastering complex regulations.

-

Compliance peace of mind: Your HR team can focus on people—not paperwork—knowing all local legal obligations are covered.

It’s a smart solution for companies looking to hire Canadian talent or expand into the Canadian market efficiently. To find out more about Canadian EOR services, check out my list of the best employer of record services in Canada.

How do Canadian payroll software handle provincial tax differences?

Most Canadian payroll software is equipped for handling provincial tax differences. These systems are built to automatically adjust calculations based on the employee’s location, whether someone’s in Ontario with its health premiums or Québec with its unique tax requirements. Generally, the software updates payroll calculations to comply with provincial and federal tax laws.

This built-in assurance means fewer headaches for HR and payroll teams because the software stays on top of legislative changes, ensuring accuracy and compliance without manual intervention. However, you’ll want to be sure to double check with the provider how they handle provincial taxes before you buy, to be sure it will cover your needs.

What are the data security measures in Canadian payroll software?

Canadian payroll software providers generally take data security seriously by employing a mix of the following safeguards:

- Encryption to ensure data in transit and at rest is unreadable to unauthorized users.

- Secure data centers with robust physical and cyber security measures protect against breaches.

- Role-based access controls to ensure only authorized personnel can view or modify sensitive information.

Regular security audits and compliance with Canadian privacy laws further bolster trust. It’s like having a digital fortress safeguarding employee data—pretty solid! Check with a provider what security systems they have in place so you’re well-informed ahead of purchasing.

What are the most important employee self-service features in payroll platforms?

The most important employee self-service features in payroll platforms are tools that give employees direct access to their payroll and benefits information, reducing the need for HR support. This includes:

- access to view and download pay stubs,

- the ability to retrieve Canadian tax forms like T4s,

- tools to update personal information such as banking details and contact information,

- the ability to request leave, track vacation or sick time, and view attendance records,

- tools to view benefits coverage and make adjustments, and

- tools to track retirement or RRSP contributions.

Together, these features empower employees to handle their payroll and benefits needs independently, allowing HR teams to focus on more complex inquiries.

How do these platforms manage employee benefits and deductions?

These platforms typically have automation capabilities to handle various deductions like taxes, retirement contributions, and health insurance premiums, adjusting them according to employee selections and legislative requirements.

For benefits, they track eligibility, enrollments, and changes, ensuring accurate benefit deductions from paychecks.

It simplifies what could be a complex process, making sure everything from health benefits to pension contributions is accurately recorded and applied.

What's the difference between cloud-based payroll software and desktop payroll software?

The primary difference between cloud-based and desktop payroll software is access and storage.

- Cloud-based software is online, so you can reach payroll data from any device with internet access—ideal for remote or multi-location work.

- Desktop payroll software, however, is installed on one computer, limiting access to that device only. Desktop software may offer tighter data control, but it lacks the convenience of cloud accessibility.

Another difference is in updates and maintenance.

- Cloud-based software updates automatically, keeping the system current without user input, which can help ensure compliance.

- Desktop software, on the other hand, requires manual updates, which can be time-consuming and lead to inconsistent versions if not done regularly.

Compared to all the different types of payroll software available, cloud-based options work the best for businesses needing easy access and scalability, while desktop software suits those who prefer local data management.

Final Thoughts

One of the biggest benefits of cloud-based payroll software is that it’s constantly being updated. As new functionality becomes available and each solution adopts it in their own time, the list of the best Canadian payroll software will inevitably evolve over time.

If you're based in the Greater Toronto Area and looking for more than just Canadian payroll support, you may want to consider engaging a Toronto-based consulting firm for additional assistance and strategic advice.

To remain up to date on all the latest insights from top thinkers in Canadian HR and payroll, don’t forget to subscribe to our newsletter. From there, you’ll have access to articles and podcasts interviews from passionate industry experts, right from the comfort of your own inbox.