Best Payroll Software for Small Businesses Shortlist

Here's my pick of the 10 best software from the 28 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

The best payroll software for small businesses simplifies employee pay, automates tax filings, and keeps your team compliant—without the hassle of spreadsheets or confusing workflows.

If you’re running payroll manually or using a clunky system that eats up hours each month, it might be time for a change. After testing a range of tools and working closely with small business owners and HR leads, I’ve shortlisted the top payroll platforms that are easy to set up, reliable, and built to scale with your business in 2025.

Why Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

The 10 Best Payroll Software for Small Businesses Comparison Chart

This comparison chart summarizes basic details about each of my top payroll software selections for small business owners. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best payroll software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payments and compliance | Free trial + demo available | From $29/month | Website | |

| 2 | Best for local and international payments | Free demo available | From $8/user/month (billed annually) | Website | |

| 3 | Best for multiple payment options | 30-day free trial | Pricing upon request | Website | |

| 4 | Best for automatically calculating deductions | 90-day free trial | Pricing upon request | Website | |

| 5 | Best for small businesses in 170+ countries | Free demo available | From $25 - $199/user/month | Website | |

| 6 | Best full-service payroll software | 30-day free trial | From $40/month + $6/user/month | Website | |

| 7 | Best for automated tax calculations | Free demo available | Pricing upon request | Website | |

| 8 | Best for personalized HR guidance | Free demo available | From $99/month | Website | |

| 9 | Best for a secure online portal | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 10 | Best for US companies | 30-day free trial | From $4/employee/month + $17/month base fee | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Guru

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6 -

Absorb LMS

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Reviews of the Best Payroll Software for Small Businesses

Here are detailed descriptions of each payroll software for small businesses that made it into my list of top picks. I’ve highlighted each tool’s key features and added a screenshot for each to show you their user interface. Plus, I’ve included 18 more bonus options below if you’d like even more choices to consider.

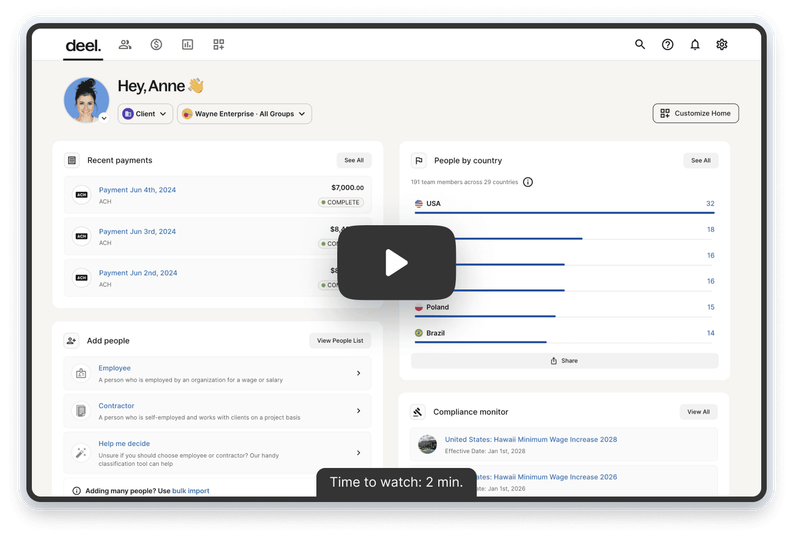

Deel is a payroll platform designed for businesses of all sizes. For small businesses looking for additional help, Deel lets you hire and pay freelancers and full-time employees from anywhere in the world without having to figure out local laws, tax systems, or international payroll. You also get access to Deel’s HR suite for free, allowing you to manage your entire team with professional and automated tools.

The Deel platform includes various elements that make it simple to pay employees and contractors without having to juggle several tools. The user-friendly interface incorporates features such as contract and stock option management, expense reimbursements, and compliance tracking for every client.

Employees and contractors can self-manage their pay and personal data, which reduces admin load. Deel uses major payment providers like Wise, PayPal, Payoneer, and Revolut to offer flexible withdrawal options and reduce unnecessary international transfer fees.

Deel has positive online reviews from clients and their workers. The company offers 24/7 online chat support.

Integrations are available natively with Ashby, BambooHR, Expensify, Greenhouse, Hibob, Netsuite, Okta, OneLogin, Quickbooks, SCIM, Xero, Workday, and Workable.

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

Rippling is a complex platform that combines IT, HR, and accounting software. The solution is easy to navigate, and it doesn’t require a lot of training to get started. The menu is clear and provides quick access to the tool’s key areas, including People, Payroll, and Reporting.

Rippling automatically syncs your payroll and HR data. The automation helps you save time when running payroll. You can see important information at a glance, such as your total labor expenses, total hours worked, or deductions, and make adjustments if necessary.

One of the best things about using Rippling is its Global Payroll feature. This feature enables you to make international payments as easy as you would domestic ones. It doesn’t matter if your contractors or employees are located on the other side of the world, you’ll be able to pay them in minutes while respecting the tax-filing requirements.

Rippling offers hundreds of integrations, including with solutions like Slack, Google Workspace, Zoom, Amazon Web Services, GitHub, Asana, Zendesk, Notion, Mavenlink, and others.

Paycor is a human capital management solution with powerful analytics and payroll features. The platform helps small businesses with employee onboarding, performance reviews, time and attendance, and benefits management.

Paycor’s payroll solution provides in-depth compliance feedback to help you respect the employment laws in your state. Thanks to the software’s automation features, you can set up the payroll with ease. And once you set it up, you can schedule it to run automatically on a specific day and time.

One of the good things about using this software is that it offers multiple payment options. You can pay employees using direct deposit, paycards, or on-demand pay. You can set up different pay options for your employees and have them run in the background. Their pay-on-demand feature, in particular, is a great help for employees who need to access their earned wages before their next official payday.

This tool also has a mobile version. Your employees can use the mobile app to review their pay stubs, approve timecards, and communicate with one another.

Paycor integrates with a variety of solutions, including Certify, Payfactors, Pay Solutions, ESR, WageWorks, and others.

RUN by ADP is a small business payroll provider that helps you automate recurring payroll and file payroll taxes. The software also calculates benefits and retirement deductions, and flags potential errors to make sure you remain compliant when filing federal or local taxes.

Thanks to its automation features, RUN enables you to process invoices and run your payroll in a timely manner, so you can focus on your growing business. You can also set schedules for your team, see when they clock in and out of work, and attach notes to shifts.

One of the good things about using this solution is that the system automatically keeps track of your team’s work and calculates everything for you. The automated payroll system ensures that you pay employees and file taxes on time, so you can save time managing this aspect of the business.

RUN by ADP integrates with many popular software systems, including Absorb LMS, Avionte, ClearCompany, Clockshark, Deputy, Dolce, FinancialForce, Infor, JazzHR, Oracle, PayActiv, PlanSource, QuickBooks, Replicon, Sage Intacct, SAP SuccessFactors, Sapling, TempWorks, Wave, When I Work, Workday, Xero, ZipRecruiter, and 7Shifts.

Remofirst is a payroll software that helps employers quickly generate accurate paychecks, direct deposit payments, and tax filings. In fact, you can completely outsource your payroll processing needs to Remofirst, making them a worthy option for companies that do not have the resources or expertise to handle payroll processing internally.

Their software helps businesses manage their payroll processes remotely, including managing employee information, tracking employee hours, and processing payroll payments. Remofirst provides a convenient way for users to pay their employees through transfers directly into their employees' bank accounts, eliminating the need for paper paychecks and saving money on check-writing fees. Their self-service employee portal gives staff access to their payroll information online, including pay stubs, W-2 forms, and year-end tax information. They can also update their contact information and banking information.

Remofirst offers businesses a central platform for distributing and managing employee benefits, allowing users to easily add, remove, or update employee benefits and view and collect benefit usage statistics. Payroll reports can be customized to show specific information, such as employee compensation and taxes, and can be generated for a particular period. They can be exported to various formats, making it easy to share with accountants or other team members. Remofirst also automatically sends invoices per month with complete reports detailing payroll expenses.

Remofirst’s team of experts offers 24/7 support to help users resolve any payroll issues immediately. Compliance documentation is also always accessible via your dashboard, making it easy to comply with international HR regulations at all times.

OnPay’s full-service payroll software helps entrepreneurs manage payroll, HR functions, and benefits all in one place. Their software includes a full suite of payroll services and compliance settings for all 50 states. For no additional cost, they also offer special payroll services for certain industries like restaurants, farms and agriculture, churches and clergy, and nonprofits. As well, OnPay offers great customer service, with platform specialists available to help you set up your payroll process and automate your taxes, even if you don’t have any previous experience with this kind of software.

To get your business up and running as fast as possible, new business owners will appreciate the free employee handbook and HR templates that are included in the platform. Essential HR tools such as automated onboarding flows, employee personnel files, document storage with e-sign capabilities, compliance audits, paid time-off tracking and task management features are also included.

Their team of licensed in-house insurance brokers also help small businesses set up health, dental and vision plans with top providers such as Humana, Cigna, Blue Cross / Blue Shield, Aetna and UnitedHealthcare. Once in place, benefit costs are synced with payroll, which means you won’t have to worry about capturing any cost fluctuations yourself. Another interesting feature is their 401k integration that automatically supports employer matching and profit sharing options, and can garner small businesses extra tax credits.

OnPay integrates with Deputy, Magnify, Mineral, PosterElite, QuickBooks, When I Work, Xero, and with the 401k retirement platforms America’s Best 401k, Guideline, and Vestwell.

Paychex Flex is an online platform that helps small businesses manage payroll and other HR functions. It allows employers to manage everything from calculating employee paychecks to managing employee health benefits and tracking time off requests. Users can access their accounts from anywhere, ensuring they always have access and control over their data. The platform offers features such as tax filing and compliance services, paperless onboarding tools, and employee self-service options.

Paychex Flex makes it easy for employers to track employees' hours worked and leave taken through its automated time-tracking feature. This ensures that employees are paid accurately according to the hours worked each week or day and any applicable overtime rates or vacation days taken off work. The software supports multiple payment methods for both direct deposit and paper checks. Additionally, it allows users to quickly generate reports on employee wages, salaries, overtime payouts, and deductions taken from wages, enabling businesses to stay compliant with local laws and regulations.

Paychex Flex helps simplify the filing process by automatically calculating all federal (IRS) and state tax requirements to ensure accuracy when filing returns. It also allows small businesses to make timely payments while avoiding late fees or penalties due to delayed filings or incorrect data entry.

The employee self-service portal feature allows employees to access their account information securely online without contacting HR for assistance. Employees can log into their accounts to view pay stubs, update personal information such as address changes, or view the status of benefits enrollment.

Paychex Flex integrates with popular accounting software like QuickBooks Online so employers can sync their payroll data across multiple systems for greater accuracy and convenience.

Paychex Flex protects users against online negligence resulting in a data breach, such as a hacker accessing confidential employee or customer information. Its cyber liability insurance helps small business owners protect themselves from potential public relations or litigation costs from the incident.

Bambee is a comprehensive HR and payroll platform designed specifically for small and medium-sized businesses. It offers a range of payroll features, including direct deposit, tax filings, and year-end reporting, as well as HR functions like onboarding and employee management.

Their payroll software includes a full suite of payroll functions and HR tools, which are typically found in more expensive systems. Moreover, their user interface is easy to navigate, and the software requires minimal training, making it perfect for small business owners who may not have an HR or accounting background.

One of Bambee's standout features is its HR compliance support. The platform provides personalized guidance from HR experts, helping businesses navigate complex HR regulations, including those related to payroll. It also provides businesses with access to a library of customizable HR documents, such as offer letters and employee handbooks.

Another standout feature is the self-service portal for employees. This feature allows employees to view their pay stubs, request time off, and update their personal information, freeing up HR staff from answering routine questions and tasks.

Integration details are currently not available.

QuickBooks Online is a cloud-based accounting software designed for businesses to manage their finances, including payroll, invoicing, and expense tracking. It's a popular choice among small business owners because it's easy to use, offers a wide range of features, and can be accessed from anywhere with an internet connection.

I chose QuickBooks Online as one of the best payroll software for small businesses because it offers a comprehensive set of features that cater to the unique needs of small businesses. It's user-friendly, making it easy for business owners with little to no accounting experience to manage their finances. Plus, it's cloud-based, which means you can access your financial data from anywhere, at any time.

QuickBooks Online automatically calculates your employees' paychecks, taking into account their hours worked, deductions, and taxes. This saves you time and helps ensure accuracy. You can set up direct deposit for your employees, making payday a breeze for both you and your team. Your employees can access their pay stubs, W-2s, and other important documents through a secure online portal, reducing the amount of paperwork you need to manage. The software also helps you prepare and file your payroll tax forms, ensuring you stay compliant with federal and state regulations.

Integrations include over 400 business apps like Rewind Backups, Knowifiy for Customers, Plooto, Expensify, Fathom, BigCommerce, Verify, Insightly CRM, Mailchimp, and others.

Patriot Payroll is an online payroll service provider that helps small businesses grow on a budget. Their software includes free payroll setup, free 2-day direct deposits, and free USA-based customer support. They also offer an add-on for time & attendance tracking, which links employee work hours directly to your payroll processing module, plus an add-on for HR software if you don’t already have a digital employee database.

Patriot’s full-service payroll platform acts as a concierge for US-based businesses and takes care of their local, state and federal taxes. The company’s customer service team also reaches out if they need more information to file your taxes, so you don’t have to worry about them yourself. Their system also includes a whole host of easy-to-access payroll reports covering tax credits, tax filings and deposits, payroll registers, paycheck histories, time off reports, W-2 summaries, payroll tax liabilities, and more.

The highlight of using this payroll service provider is its effectiveness. The tool is simple to navigate and use. Their information database is comprehensive, so you can get a detailed guide on how to complete your tax files, and their customer support service is always there.

Patriot integrates with Intuit QuickBooks Online, GoCo, Plaid, Workforce.com, and WorkforceHub Time & Attendance.

Other Options

Here are a few more worthwhile options that didn’t make the best small business payroll software shortlist:

- GoCo

For flexible payroll solutions

- Buddy Punch

With time-tracking

- Zenefits

For tax filing documentation

- PrimePay

For scalable payroll

- FinancePal

For payroll management outsourcing

- Knit People

For startups

- BambooHR

For employee self-service

- Papaya Global

For expanding globally

- QuickBooks Payroll

For accounting and payroll in one

- Humi

For Canadian small businesses

- Oyster HR

Combined global payroll and benefits

- TimeTrex

For automating complex payroll processes

- Ceridian Dayforce

Payroll software for a user-friendly payroll dashboard

- Eddy

Full-service payroll software for local, US businesses

- Gusto

Payroll software for customizable reminders and notifications

- Paylocity

Payroll and workforce management solution for time tracking and tax compliance

- APS

Payroll system that uses automations to reduce payroll errors

- TriNet

Full-service HR software for tracking employee activity in real-time

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Software for Small Businesses

Selecting the best payroll software for small businesses requires an understanding of how this software can help solve common frustrations small businesses face when trying to run payroll efficiently. My approach to creating this list is grounded in thorough research into how these tools can solve the needs of business owners, payroll administrators, and employees alike. I also drew on my years of experience supporting internal payroll needs to add more expertise to my assessment.

Here's a summary of the selection criteria I used to uncover the best payroll software to cover small business needs without a hefty price tag:

Core Payroll Software Functionalities (25% of total score): To be considered for inclusion in my list of the best payroll software for small businesses, the solution had to fulfill these common use cases first:

- Direct deposit and paycheck processing

- Automatic calculation of payroll taxes

- Tools to manage employee information and records

- Comprehensive payroll reporting for financial insights

- Compliance monitoring features to track federal and state tax laws

- An employee self-service portal

Additional Standout Features (25% of total score): To help me determine the best payroll software out of the numerous options geared for small businesses, I also kept a keen eye out for any unique features, including:

- Advanced security features and data protection measures

- Mobile-friendly solutions or dedicated mobile apps for Android and iOS devices

- Usage of AI for predictive analytics in payroll processing

- Usage of blockchain technology for secure and transparent record-keeping

- Robust integration capabilities with third-party apps to maximize efficiency

- The option to request full-service payroll or HR support, if needed

Usability (10% of total score): To evaluate the usability of each payroll software, I considered the following:

- An intuitive design and user-friendly interface to speed up user adoption and minimize training time

- A balance between powerful features and ease of use

- Role-based access controls that are easy to configure for different user levels

- Mobile accessibility for payroll management on-the-go

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Quick setup processes and clear guidance for first-time users, including customizable templates

- The availability of training materials such as videos, webinars, or interactive product tours

- Training materials aimed at different user groups, including your HR professionals, accountants, bookkeepers, managers, employees

- Support for migrating data from other systems into the new platform

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- The availability of multiple support channels, including email, phone, and chat

- The existence of a self-service knowledge base, FAQ repository, or other self-help resources to speed up troubleshooting

- The overall quality, responsiveness, and helpfulness of the support team during customer onboarding and post-purchase, as inferred from customer reviews

Value for Price (10% of final score): To gauge the value of each software, I considered the following factors:

- The availability of free trials or demos to test the software before purchasing

- Transparent pricing models that clearly explain which features are included at each level

- Tiered pricing plans with an option catered specifically to small businesses' needs with the option to scale up over time

Customer Reviews (10% of final score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Whether a product has consistently high ratings across multiple review platforms, indicating a broad level of user satisfaction

- Specific praises, criticisms, or trends in customer feedback that indicate the software's strengths or areas for improvement

- Whether customer feedback specifically mentions issues with ease of use, customer support responsiveness, or lacking features

By using this assessment framework, I was able to identify the payroll software that goes beyond basic requirements to offer small businesses additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

How to Choose Payroll Software for Small Businesses

Small business payroll software can help you streamline your payroll processes without requiring a heavy financial investment. To help you figure out which payroll software best fits your small business needs, you need to pinpoint your key users and document their specific challenges first.

As you work through your own unique software selection process, keep the following points in mind:

- What problem are you trying to solve - Start by identifying the challenges you're trying to overcome. This will help you clarify the features and functionality the payroll software needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who will use the software and how many licenses you'll need. You'll need to evaluate if it'll just be your HR professionals, select accounting staff, or entire departments that will require access. Once that's clear, it's also useful to rank the needs of your different users to identify the key priorities for your power users, managers, and employees, to ensure they're all met.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as PEO software, HR software, accounting systems, or time-tracking tools. You'll need to decide if the tools will need to integrate together, or alternatively, if you can replace multiple tools with one consolidated payroll system.

- What outcomes are important - Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to improve the productivity of your team by connecting your payroll software with your time-tracking system or digitize processes that are currently completed manually. You could compare software features until you’re blue in the face but if you aren’t thinking about the outcomes you want to achieve, you could waste a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your existing workflows and systems. Evaluate what's working well, and the areas that are causing issues that need to be addressed.

Remember every business is different — don’t assume that a payroll software system will work for your small business just because it's popular.

Trends in Payroll Software for Small Businesses

As a small business, it’s easy to feel like you don’t have the time or budget to stay on top of payroll software trends. But that’s exactly why you should. Payroll isn’t just about cutting paychecks—it’s a critical function that impacts compliance, efficiency, and employee satisfaction. The right payroll software can save time, reduce costly errors, and streamline your processes, allowing you to focus on growing your business instead of getting bogged down in administrative tasks.

Here are four key payroll software trends shaping 2025 that can help small businesses run more smoothly:

- Integration with Other HR Systems: Payroll no longer operates in a silo. There's a clear trend towards deeper integration capabilities, particularly with accounting software, time-tracking tools, benefits administration systems, and even workforce planning tools. This reflects a growing need for seamless data flow between systems, reducing manual data entry and errors. For instance, updates in popular payroll software now often include enhanced API capabilities for smoother integration with a wider range of systems.

- Enhanced Data Security Features: As new cybersecurity threats continue to emerge, payroll systems are adapting with stricter access controls and compliance-focused security features. Payroll software providers have added enhanced data security features to help organizations protect sensitive employee data, such as two-factor authentication (2FA), end-to-end encryption or biometric identification features.

- AI and Machine Learning for Payroll Processing: Many payroll systems now use artificial intelligence (AI) and machine learning algorithms to detect payroll anomalies or predict errors before they occur. This forward-thinking approach aims to proactively address issues, such as incorrect pay or tax deductions, before they impact the payroll process.

- Employee Self-Service Portals: The functionality of employee self-service portals has become more sophisticated, indicating a shift towards empowering employees. These portals now often include access to pay stubs, tax documents, and even the ability to update personal information directly, reflecting a trend towards reducing HR administrative workload and enhancing employee engagement.

These trends underscore a broader movement towards making payroll software more integrated, automated, and user-friendly. As you continue your search for the best payroll software for your business needs, keep an eye out for software that leverages these trends to ensure your final choice offers a good balance of innovative features and functionalities.

What is Payroll Software?

Payroll software is a tool that automates employee wage calculation, tax deductions, and payroll compliance tasks. It enables small business owners and HR teams to run payroll accurately, issue direct deposits, and stay compliant with federal and state regulations.

Most platforms also include features like automated tax filing, employee self-service portals, and reporting dashboards. By streamlining complex payroll processes, payroll software reduces errors, saves time, and ensures employees are paid on time—every time.

Features of Payroll Software for Small Businesses

Choosing the right payroll software for your small business is crucial to ensure your payroll processes run smoothly. Here are the most important features to look for:

- Core Payroll Functions: Of course, every payroll software must include the basics, like direct deposit, multiple pay rates (regular, overtime, double time), wage garnishments, tax deductions, and unlimited payroll runs.

- Advanced Payroll Features: Some payroll systems are more advanced than others, and include modern options like same-day or next-day payments, pay-on-demand, or integrated expense management tools to reimburse employees through payroll.

- Employee Self-Service Portal: Offering an employee portal makes it easy for your team to access and update their information and review their pay stubs.

- Automation: The software should enable you to automate large portions of the payroll process, so you can run payroll without errors in good time and ensure your tax forms are filled in correctly.

- Multi-State Payroll Support: This feature is essential for businesses with employees in different states since it manages different state tax rates and regulations, ensuring accurate withholdings and compliance for all employees.

- Automated Tax Calculations: This feature simplifies the complex task of calculating taxes for each employee. It ensures that all payroll tax calculations are accurate and comply with current tax laws, reducing the risk of errors.

- Compliance Management: The software should automatically ensure you’re paying your employees within the confines of the labor laws and regulations in your jurisdiction, including specific overtime rules. This feature minimizes the risk of non-compliance penalties by automatically updating the software according to new tax laws.

- Customizable Payroll Reports: Customizable reports provide insights into payroll expenses, taxes, and other deductions. They are essential for financial planning and audits, offering a clear view of the company's payroll expenses.

- Time and Attendance Tracking: Integrating time tracking with payroll software automates wage calculations based on hours worked. This ensures accurate pay for hourly employees and simplifies overtime calculations.

- Data Security: Your payroll software must have robust security measures to protect sensitive employee information. Secure data storage and encrypted transactions protect against data breaches and fraud.

Benefits of Payroll Software

Payroll solutions can help small business owners save time when running payroll and remove the need to hire a specialist such as a bookkeeper, accountant, or a full-payroll service. depending on your location and tax legislation. Here are several benefits you can expect to gain by investing in payroll software:

- Time Savings: By automating many aspects of running payroll, payroll software reduces the hours spent on payroll processing, allowing HR staff and business owners to focus on more strategic tasks.

- Enhanced Accuracy: Again, thanks to automation tools, payroll software minimizes human error. For example, most systems streamline the process of tracking employee work hours, and link that data directly to payroll to simplify the process (rather than having to manually export data from one time-tracking system into your payroll software).

- Compliance Assurance: Since payroll software is updated regularly to comply with the latest tax laws and regulations, this helps businesses avoid costly penalties associated with non-compliance and ensures that payroll practices are always up to date.

- Improved Record Keeping: The software provides a centralized database for all payroll-related information. Efficient record-keeping is essential for audits, financial planning, and compliance with labor laws, making it easier for businesses to manage and retrieve payroll data when needed.

- Employee Self-Service: By empowering employees to access their pay stubs, tax documents, and personal information, you'll reduce administrative burdens on HR staff and encourage your employees to self-manage their own data.

Many payroll service providers in this list also have useful HR features incorporated into their software too.

Costs & Pricing for Small Business Payroll Software

Often, the decision to invest in new software (or not) comes down to the monthly price. This is even more true for small businesses that need to accomplish all the standard aspects of payroll while working within a limited budget. That's why I selected the systems for this list with transparent pricing at the top of my mind. I also included several global payroll options in case you're ready to grow your business internationally.

In the table below, I've broken down the typical price ranges for each plan type to give you a rough estimate of what to expect. In general, you can expect to pay a monthly fee per employee, plus an additional base fee per month.

Plan Comparison Table for Payroll Software

| Plan Type | Average Monthly Fee | Average Price per Employee | Common Features |

| Free | $0 | $0 | Basic payroll processing for a limited number of employees, basic tax calculation, and limited reports. |

| Basic | $10 - $25 per month | $2 - 4 per employee, per month | Payroll processing for a limited number of employees, basic tax filing, standard reports, employee self-service portal |

| Professional | $25 - $40 per month | $4 - $6 per employee, per month | Multi-state or province payroll, additional reports, HR features, compliance report + all the features in Basic. |

| Advanced | $40 - $60 per month | $5 - $8 per employee, per month | Customizable reports, advanced HR tools, integrations, enhanced security + all the features in Professional. |

| Enterprise | Custom pricing | Custom pricing | Scalable for a large number of employees, dedicated support, advanced analytics, custom integrations + all features in Advanced. |

| Global Payroll | Usually priced per employee | $199 - $500 per employee, per month | Ability to pay employees in multiple currencies, international direct deposit, international compliance monitoring, dedicated support + required Basic features or higher. |

When considering which plan to choose, you should weigh your specific needs against the features and limitations of each plan. Price sensitivity, the number of employees you have, and how much HR support you require are the key factors to consider. Remember, the right software can significantly impact your organization's productivity and operational efficiency, so choose a plan that best fits your current needs while also allowing for future growth.

Payroll Software: FAQs

Here are some answers to popular questions we often receive about payroll software for small businesses:

What payroll system is best if I don't have dedicated payroll staff?

There’s no shame in asking for help with your payroll operations if you’re already stretched too thin. Thankfully, there are numerous payroll options out there that are helpful for small businesses with limited resources.

Automated payroll software is designed to remove a lot of the tedious elements of paying employees by using customizable automations. Typical automations you can expect are integrated time tracking that calculates employee wages based on timesheet data, automatic calculations for taxes and other withholdings, calculations for stat holiday pay and other payroll taxes, the creation of pay statements (pay stubs), and automatic direct deposits.

If you want to be completely hands-off from your payroll process, you may also want to consider partnering with a payroll service provider. They can alleviate the the pressure of running payroll, allowing you to focus on business-critical items. For a monthly fee, payroll services will pay your employees, keep track of their wages and benefits, and file your tax forms in a timely manner.

Payroll software for one employee also exists if you’re looking for something super basic just to get the job done.

What are payroll taxes?

Payroll taxes are tax payments employers are legally required to withhold from their employees’ compensation, including their wages, bonuses, or commissions. The reserved funds are then paid to either state, provincial, or federal government bodies, depending on the specific tax regulations of your country or jurisdiction.

Key elements of payroll taxes for US-based organizations include:

- Federal income taxes based on the amount an employee earns

- Social Security and Medicare taxes

- State and local taxes

What software integrations are important for payroll software?

Software integrations are key to helping you get the most out of whichever payroll option you choose. For payroll software in particular, it’s crucial that your system integrates with your HR management tool to capture any changes to your employee information. Integrations with time-tracking software are also a plus since your timesheet data won’t need to be reconciled manually before you run payroll.

How user-friendly are these software solutions for non-HR professionals?

Most modern payroll software is designed with non-HR professionals in mind, focusing on simplicity and ease of use. These platforms often have intuitive interfaces, step-by-step guides, and automated processes to minimize manual input and reduce errors. They usually also provide tutorials, help centers, and customer support to assist users with little to no HR background. The goal is to make payroll management as straightforward as possible, allowing small business owners or managers without specialized HR knowledge to handle payroll efficiently and with confidence.

Are there payroll solutions tailored for specific industries?

Absolutely, some payroll solutions are indeed tailored for specific industries, offering features and functionalities that address the unique challenges and requirements of those sectors. For example, construction, hospitality, and healthcare industries often have unique payroll needs related to things like:

- Shift differentials

- Union rules

- Overtime regulations

- And other industry-specific factors

These specialized solutions provide tools for managing such complexities, ensuring compliance, and streamlining payroll processes specific to the industry’s demands. It’s super helpful for businesses looking for software that “gets” the intricacies of their operations.

If you’re managing a construction company, take a look at these construction-focused payroll systems next. Some solutions are even device optimized, such as payroll software for Mac.

What kind of customer support is available with these software?

The customer support available with payroll software typically ranges from online resources like FAQs and tutorials to direct support through email, chat, or phone. Many solutions aimed at small businesses understand the importance of accessible, responsive support, given that users may not have in-depth payroll or HR expertise. Some software providers go above and beyond by offering dedicated account managers or 24/7 support lines to ensure users can get help whenever they need it, crucial for navigating urgent payroll issues or compliance questions.

Other Resources for Small Business Owners

To help you in your journey to run a successful and profitable small business, here's a collection of our other top resources you should also check out:

- Applicant Tracking Systems for Small Businesses to Recruit Better

- Employee Scheduling Software for Small Business

- ERP Systems for Small Businesses on a Budget

- Free Payroll Software for Tight Budgets

- HRIS for Small Businesses to Manage HR Data

- HRMS for Small Business

- HR Software for Small Business

- Learning Management Systems (LMS) for Small Businesses

- Payroll Services for Small Businesses

- Recruitment Software for Small Businesses

Simplify Your Payroll Process With Software Solutions

Running a small business is complex. There are a lot of things an owner should look out for. But one of the most complicated aspects of being a small business owner is running the numbers and filing your taxes.

Payroll software solutions can help you simplify this aspect of your business. Thanks to modern automation, you can set up the payroll and run it in the background, so you can focus on growing your business.

Delegation is important for business managers. Beth Schneider, president of Process Prodigy, said “Delegation is about handing over authority, and for many small-business owners, that's a scary concept because you don't know what will happen when you give up control. But the good news is, delegating doesn't have to be scary-you have more control than you think”.

And when you delegate your payroll process to a software solution that helps you avoid costly mistakes, you increase the effectiveness of your business.

For new businesses looking to establish efficient payroll systems from the start, startup payroll software options can provide the foundation needed for growth.

Lastly, for hands-on tips to help you improve your business processes, subscribe to our People Managing People newsletter too. We cover everything from payroll to improving employee engagement, and how to motivate your employees to reach their full potential. Plus, it's delivered to your inbox for free each week.