10 Best Expense Reporting Software List

Here's my pick of the 10 best software from the 20 tools reviewed.

Get free help from our HR software advisors to find your match.

There are seemingly countless expense reporting software solutions available, so figuring out which is best for you is tough. You want to enable employees to easily submit expense claims, capture receipts and expense details digitally, and automate approval workflows—but now need to figure out which tool is the best fit. In this post, I make things simple, leveraging my experience as an HR specialist and using dozens of different expense reporting tools to bring you this shortlist of the best expense reporting software overall.

What is Expense Reporting Software?

Expense reporting software is a digital tool designed to streamline the process of recording, tracking, and managing business expenses. It allows employees to input their expenses, attach receipts, and submit reimbursement requests efficiently. Expense reporting tools automate approval workflows, enforce company expense policies, and generate detailed expense reports, making it easier for organizations to monitor spending, ensure compliance, and simplify the reimbursement process.

The 10 Best Expense Reporting Software: Pricing Comparison Chart

This comparison chart summarizes basic details about each of my top expense reporting software selections. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for text-based receipt capture | Free demo available | From $11.99/user/month | Website | |

| 2 | Best for global teams | Free trial + demo available | From $29/month | Website | |

| 3 | Best for automated expense submission and approval workflows | Free demo available | From $8/user/month (billed annually) | Website | |

| 4 | Best expense reporting software for global companies | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 5 | Best accounting software for small business owners or self-employed professionals | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 6 | Best for mobile receipt scanning | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 7 | Best for customizable reporting dashboards | Free demo available | From $5.20/user/month | Website | |

| 8 | Best for streamlining expense management | Not available | From $12/user/month | Website | |

| 9 | Best expense management software for end-to-end travel management | Free demo available | From $4/user/month | Website | |

| 10 | Best expense management software for automatically generating expense receipts using smart matching technology | Free demo available | From $1,000/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3

Overviews of the 10 Best Expense Reporting Software

Here are brief descriptions of the top best expense reporting software that made it into my shortlist, showing what they do best, plus screenshots to showcase some of the features. I’ve also included an additional 10 options below if you’d like a few more choices to consider.

Fyle is an expense reporting software designed to reduce the friction of capturing and managing business spend. While it offers a full suite of features for tracking expenses, coding transactions, and automating approvals, its standout function is the ability to collect receipts via text message—no app login or new card required. This tool is built for businesses that need to collect, categorize, and review expenses without relying on employees to remember receipts at the end of the month.

I picked Fyle because it addresses a common gap in the reporting workflow: late or missing receipts. When employees text a photo of their receipt to Fyle, its optical character recognition (OCR) pulls out the details and codes the expense using your general ledger. It also supports expense approval directly from Gmail and Slack, which can be helpful if you want to review reports without logging into another system. Fyle supports real-time transaction data from existing business credit cards, so you can match receipts right away without needing to issue new cards.

Fyle offers a browser extension and mobile app to help employees submit expenses from the tools they already use. It also includes a budgeting dashboard where you can set spending limits by department or project and receive alerts when you go over. There's a centralized receipt archive, so you're not digging through inboxes come audit time. And for teams with client accounting services, Fyle’s partner portal lets you manage multiple clients from one view.

Integrations include QuickBooks Online, NetSuite, Sage Intacct, Xero, QuickBooks Desktop, Bamboo HR, TravelPerk, Dynamics 365 Business Central, and Sage 300 CRE.

Deel is a comprehensive HR platform that helps businesses hire, manage, and pay employees and contractors across the globe. It provides tools for global payroll, compliance, and HR administration, simplifying international workforce management.

Deel's expense management system lets you create custom expense categories, giving you greater control over different types of expenses. This ensures that your team's spending stays in line with company policies and reporting standards. The platform also includes a mileage expense calculator, which estimates travel costs based on trip distance and preset reimbursement rates. For companies with a global presence, Deel allows the creation of country-specific expense policies to ensure compliance with local regulations.

Other features include expense approval workflows that streamline reimbursement requests and per diem calculations, making it easier for employees to claim daily allowances for business travel. Additionally, Deel offers analytics dashboards that provide insights into expense trends, helping businesses make informed financial decisions.

Integrations include Expensify, QuickBooks, Google Workspace, Slack, JIRA, HubSpot, BambooHR, Workday, Xero, Salesforce, Microsoft Teams, Zendesk, and Jira Software Cloud.

Best for automated expense submission and approval workflows

Rippling is a comprehensive workforce management platform that integrates HR, IT, and finance functions into a single system. The platform's unified approach and integration of multiple business processes make it ideal for organizations looking to reduce department silos and automate routine tasks across various functions.

Its expense management module allows businesses to automate the process of expense submission, approval, and reimbursement. This feature supports detailed expense reporting, enabling companies to gain real-time visibility into spending patterns and trends. With automated workflows, employees can submit expenses quickly, and managers can approve them with just a few clicks.

In addition to its powerful expense management capabilities, Rippling offers comprehensive reporting tools that provide valuable insights into company finances. The platform enables users to generate detailed reports on expenses, track spending across different departments, and analyze data to identify cost-saving opportunities. Integrations include PayPal, 1Password, YubiKey, Carta, Zendesk, and various HR, finance, and IT applications.

Xero is a cloud-based online accounting software that offers a wide range of accounting features to help businesses manage their finances effectively. These include bank reconciliation, invoicing, accounts payable and receivable, expense tracking, financial reporting, and budgeting. Xero also serves businesses in over 180 countries, making it a globally-accessible accounting solution.

As a global accounting solution, Xero's expense reporting system provides support for multiple currencies. Expenses incurred in different currencies can be easily recorded and converted to the user's base currency, ensuring accurate financial reporting and eliminating the need for manual currency conversions.

Xero's expense reporting can be also accessed through its mobile app, making it convenient for users to manage their expenses on the go. Users can capture receipts using their mobile devices, attach them to expense claims, and submit them for approval from anywhere at any time. This mobility enhances productivity and efficiency for users who frequently travel or work remotely.

Xero's integrations include PayPal, Wagepoint, HubSpot CRM, ServiceM8, Make, Bluesheets, Stripe, Lightyear, XPNA, and Shopify.

Xero costs from $17 per month. There is a free trial available.

Best accounting software for small business owners or self-employed professionals

QuickBooks is a proven accounting solution that does a lot of the hard work of tracking expenses. The software helps you enter bills and purchases, then match them to transactions. You can then view how much you're spending in each expense category from your dashboard.

For small businesses, QuickBooks offers a simple, low-cost expense reporting solution. Receipts are sorted automatically and you can reclassify transactions in bulk. You can keep tabs on your cash flow easily through their dashboard.

QuickBooks online costs from $11/user/month and offers a free 30-day trial. Solo entrepreneurs can also take advantage of a special self-employed plan which costs $7.50/user/month.

FreshBooks is a cloud-based accounting platform designed for small businesses, freelancers, and self-employed professionals. It offers tools for invoicing, time tracking, expense management, and financial reporting.

FreshBooks stands out with its automated expense tracking capabilities. By connecting your bank account or credit card, FreshBooks automatically imports and categorizes your expenses daily, eliminating the need for manual data entry. This feature ensures that your financial records are always up-to-date, providing a clear picture of your spending and profitability. Additionally, you can quickly mark expenses as billable, add a markup, and pull them onto client invoices, streamlining the billing process.

Another notable feature is the mobile receipt scanning function. With the FreshBooks mobile app, you can snap a picture of a receipt, and the app will automatically capture the merchant, totals, and taxes. This not only saves time but also ensures that all expenses are accurately recorded and categorized. The scanned receipts are stored in the cloud, making them easily accessible for future reference or during tax time.

Integrations include Gusto, HubSpot, Square, FundBox, Google Sheets, PayPal, Mailchimp, WooCommerce, Airtable, Stripe, and Expensify.

Klippa SpendControl is a cloud-based solution designed to simplify how you handle business expenses. It allows you to submit, approve, and process expenses quickly through both web and mobile applications.

Klippa's expense dashboard offers real-time financial insights crucial for decision-making and strategic planning. The dashboard lets you visualize expenses, statuses, and trends, providing a comprehensive overview of your financial data. You can customize it to show the data that matters most to your team, ensuring access to tailored analytics. This helps in identifying cost-saving opportunities and improving financial operations.

Another key feature of Klippa is its optical character recognition (OCR) technology, which automatically extracts data from receipts and invoices. This means you don't have to enter information manually. Additionally, Klippa offers customizable approval workflows, so you can set up multi-level approvals that fit your company's structure. Integrations include AFAS Software, SAP, Exact Online, Odoo, Twinfield, Oracle Netsuite, Xero, Okta, QuickBooks, and Microsoft Entra ID.

I chose Emburse because it offers a seamless and efficient way to manage expenses. With Emburse, users can easily create, submit, and approve expenses anytime, anywhere, on any device. What makes Emburse stand out is its ability to streamline expense management processes, making them more manageable for everyone. The tool is best for streamlining expense management because it simplifies complex processes, increases policy compliance, and expedites reimbursements.

Key features include virtual and physical cards with spending rules, mobile receipt capture and reminders, role-based permissions and approval flows, automatic expense categorizations, world-class fraud protection, and Apple Wallet and Android Pay integration. These features work together to improve accuracy, enforce spending policies, and provide businesses with better control and visibility over their expenses.

Emburse provides important integrations with NetSuite, Sage Intacct, QuickBooks, Xero, Salesforce, Chrome River, and Certify. These integrations allow users to seamlessly connect their expense management processes with other essential business systems, enhancing efficiency and data accuracy.

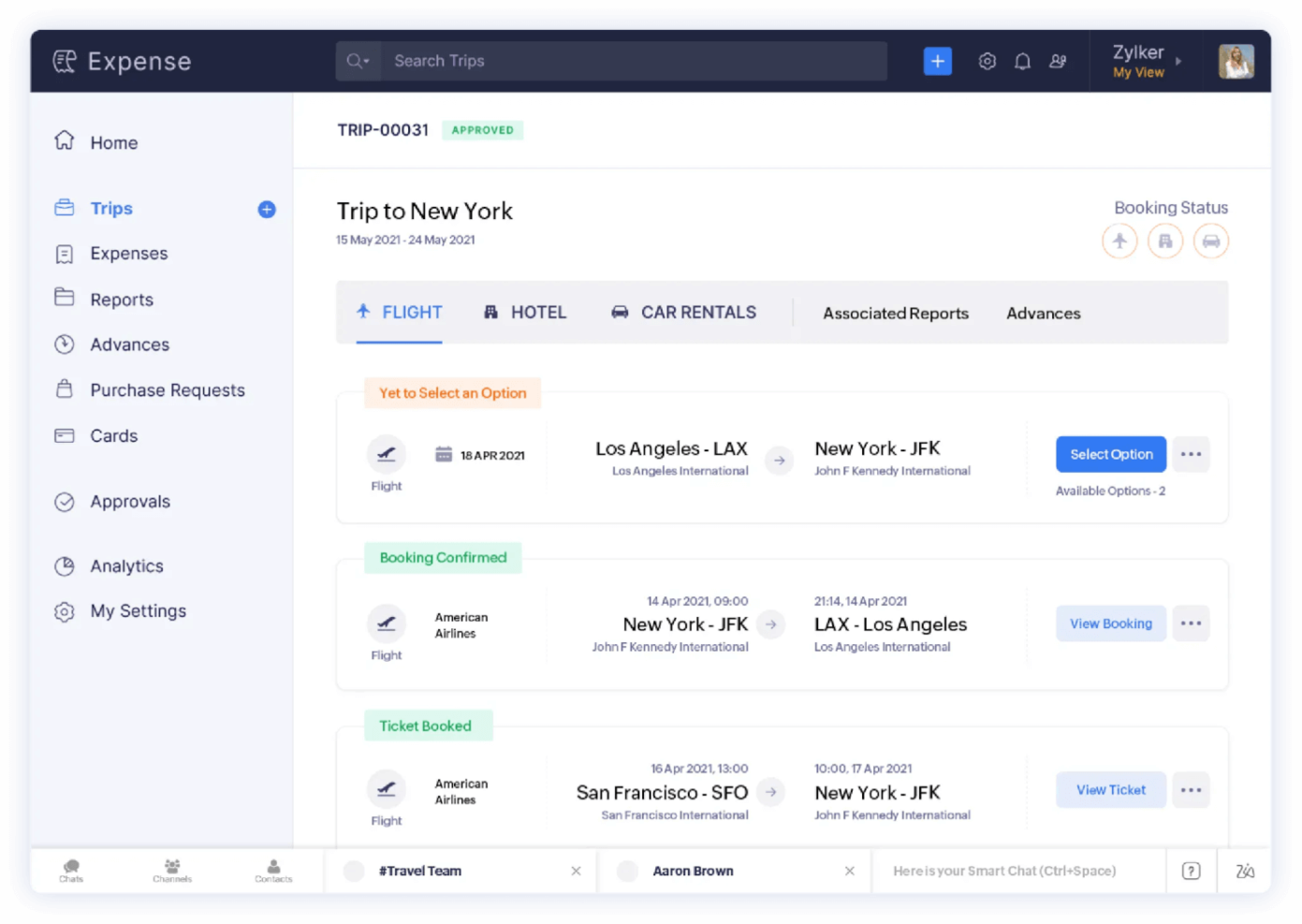

Best expense management software for end-to-end travel management

Zoho Expense offers a full range of customizable expense reporting features. These include conversion of receipts to expenses claims, report submission approval, and corporate card reconciliation. In addition, this SaaS software also supports multi-level approval, spending rules, budgeting, and analytics.

You can also manage all stages of employees’ business trips and make bookings for flights and accommodation. Other features include setting pre-travel approvals, reimbursing on time, and facilitating the reporting of expenses anywhere.

Zoho Expense costs from $45/user/month. A free plan for up to three users is also available, as well as a free demo.

Acumatica

Best expense management software for automatically generating expense receipts using smart matching technology

Acumatica provides of a broad range of cloud ERP solutions that include a financial management module equipped with currency management, deferred revenue accounting, and advanced expense management, as well as reporting, dashboards, and data analysis tools.

Acumatica’s advanced expense management system works by auto-generating expense receipts based on the transactions you've made using any designated corporate credit card. The module automates expense receipt creation using smart matching, which is powered by artificial intelligence and machine learning. It enables users to configure connections to over 14,000 financial institutions to sync up all corporate credit card transactions with Acumatica. Configuring the connections only take minutes and includes multiple levels of security.

One of the main benefits of Acumatica’s advanced expense management software is the shortened expense cycles. The scheduled bank feed imports help eliminate the need for manual credit card statement imports, while automated expense receipt creation helps reduce the effort of having to chase down employee expense receipts. The reporting, dashboards, and data analysis toolkit, on the other hand, delivers detailed expense reports for accounting compliance.

Acumatica’s reporting tools are capable of delivering customized views of various aspects of the business, including expense reporting, through personalized dashboards. This provides financial and accounting teams with all the information they need to analyze trends and make better financial decisions in real time.

Acumatica charges only for the functionality your business needs, not by the number of users or seats. You can request their pricing details and a free demo through their website.

Other Expense Reporting Software Options

Here are a few more expense management software options that didn’t make the top list:

- Happay

Expense management software for spend management

- ITILITE

Expense software for encouraging cost-conscious booking decisions

- Projectworks

Expense reporting within a resource management platform

- Nexonia

Expense software for flexible approval workflows

- ABUKAI Expenses

For automatic expense categorization

- Bx

Free productivity platform for mobile expense reporting and accounting

- Gorilla Expense

Expense software for automatic expense report creation

- Expensify

For synching expense reports to accounting software

- ProjectCompanion

Windows-based expense management solution

- AutoEntry

Accounting tool for automated expense data entry

Selection Criteria for Expense Reporting Software

Wondering how I selected the best expense reporting software for this article? Here’s a summary of my evaluation criteria:

- User Interface (UI): I've chosen software with a straightforward expense reporting process built-in to save time and improve productivity for busy executives and other frequent users.

- Usability: I've selected expense reporting software that all levels of users - from employees to accounts payable staff and other finance team members - will find intuitive and easy to use.

- Software Integrations: I look for easy integration with everyday business tools such as email, accounting software, and project management tools.

- Value for Price: My priority here is finding expense reporting software that packs in a wealth of features at an affordable price.

Expense Reporting Software: Key Features

I also assessed these key features when making my final selections for this list:

- Receipt scanning or receipt capture: 48% of finance professionals note that this is one of the most compelling features for expense management software.

- Direct deposit capabilities: 36% of finance professionals note that this is one of the most compelling features for expense management software.

- Mobile expense reporting: An easy way for employees to report business expenses and upload receipts from their mobile devices while on the go.

- Compliance management: Helps companies stay compliant with the latest rules from local, state, and federal tax agencies.

- Automated tax calculation: Features for including taxes such as GST or VAT where required.

- Integrated corporate credit card management: Built-in control of credit cards issued to employees.

- Multi-currency capability: Useful for dealing with travel expenses from overseas business trips or billing from foreign suppliers.

- Categorization of expenses: The ability to allocate receipts into a designated expense category in accordance with your company's expense policy.

Frequently Asked Questions about Expense Reporting Software

Still not sure if expense reporting software is exactly what you need? Here are some answers to frequently asked questions I’ve received on this topic:

What is expense reporting software?

Expense reporting software provides an easy way for employees to submit expense receipts and certify expense claims. These tools also help finance teams administer expense reports, check for fraud, and reduce inaccuracies.

It’s becoming increasingly common for US organizations to offer additional compensation, like well-being programs and additional financial incentives to their employees. Expense reporting software helps you track, manage, and reimburse all your complex expenses.

What is the best accounting system for small business?

The best accounting and expense reporting software for a small business is one that fits the size, nature, and requirements of the company. There are many tools on the market, all with different features and capabilities. Many of these offer free plans or free trials, so you can easily experiment to find out which is the best match for your specific needs. Managing expenses is just one part of the financial equation. To fully automate your financial operations, consider coupling this with a top-tier payroll software solution.

What Do You Think About These Expense Reporting Software?

What’s hot and what’s not in the world of expense reporting software? We’d love to hear your thoughts in the comments section below. And if you’d like to hear our thoughts, be sure to sign up for our newsletter. You’ll get illuminating insights from the biggest brains in the business. Don’t miss out!