10 Best HR Software for Payroll Shortlist

Here's my pick of the 10 best software from the 24 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Payroll is one of those business critical tasks that no-one will thank you for getting right but will certainly come after you if you get it wrong (this is potentially employees and governments).

Since you're here, you're probably aware of the difficulties and are on the hunt for the best HR software for payroll solution to make this processes easier for everyone involved.

It's an important decision, so I'll make it easier for you by reviewing some of the best payroll and HR software solutions on the market today including pricing, key features, and UPSs.

Why Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

The 10 Best HR Software for Payroll Comparison Chart

This comparison chart summarizes basic details about each of my top HR software for payroll selections. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best payroll software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for globally distributed teams | Free trial + demo available | From $29/month | Website | |

| 2 | Best for US-based enterprises | 7-day free trial | From $6.19/user/month (billed annually) | Website | |

| 3 | Best for automating payroll tasks | 30-day free trial | Pricing upon request | Website | |

| 4 | Best for integrations and employee experience | Free demo available | Pricing upon request | Website | |

| 5 | Best for international payroll in 170+ countries | Free demo available | From $25 - $199/user/month | Website | |

| 6 | Best for small businesses in the US | 30-day free trial | From $40/month + $6/user/month | Website | |

| 7 | Best for midsize to enterprise companies | Free demo available | Pricing upon request | Website | |

| 8 | Best for compensation benchmarking capabilities | Free demo available | Pricing upon request | Website | |

| 9 | Best for easy onboarding | Free demo available | From $99/month | Website | |

| 10 | Best for automated tax compliance and filings | Free demo available | Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

Best HR Software for Payroll Reviews

Below, you’ll find my detailed summaries of the 10 best HR software for payroll on the market today, with a summary of each solution’s key features, an explanation of why I included them in this list, screenshots, and information about trials and pricing summarized in a comparison chart. Plus, there are 14 extra bonus options below if you’d like even more possibilities to consider.

Here’s my take on each of the best HR software with payroll:

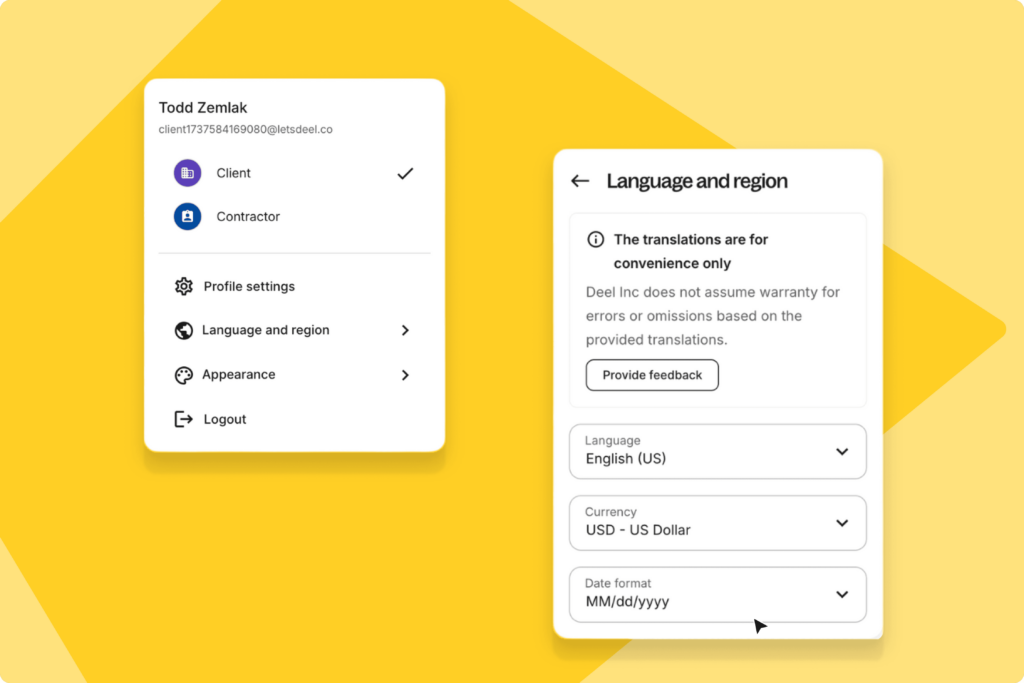

Deel is an HR and global payroll platform that enables hiring in over 150 countries. It allows you to hire anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll, which is why I think it's one of the best tools for global HR teams.

Why I picked Deel: Deel offers features for expense reimbursements, managing contractor and employee contract and pay data, doing payroll, and handling off-cycle adjustments. Local country experts provide consultation for each location you hire from, ensuring your contracts are properly worded, while helping you avoid contractor misclassification. Employees and contractors can also self-manage their pay and personal data, which reduces admin load.

An advantage of going with Deel is that it's one of the largest international payroll solutions—it's a reputable company with 24/7 online customer support and dedicated account managers. It also complies with SOC2 and ISO 27001 security standards.

Deel Standout Features & Integrations:

Features that make Deel especially great for global payroll include international payroll, local compliance monitoring, global mobility support, and dedicated account managers to help you navigate any complexities in managing a global workforce. You can also compare different country costs and see what benefits and withholdings are required.

Integrations are available with popular accounting platforms, including NetSuite, Quickbooks, and Xero. Deel also uses major payment providers like Wise, PayPal, Payoneer, and Revolut to offer flexible withdrawal options and reduce unnecessary international transfer fees.

Pros and cons

Pros:

- You can access Deal-owned EOR entities to hire internationally

- Handles contractor and employee payments

- Great for international payroll

Cons:

- More expensive than most basic payroll software

- Not much selection in available employee healthcare plans

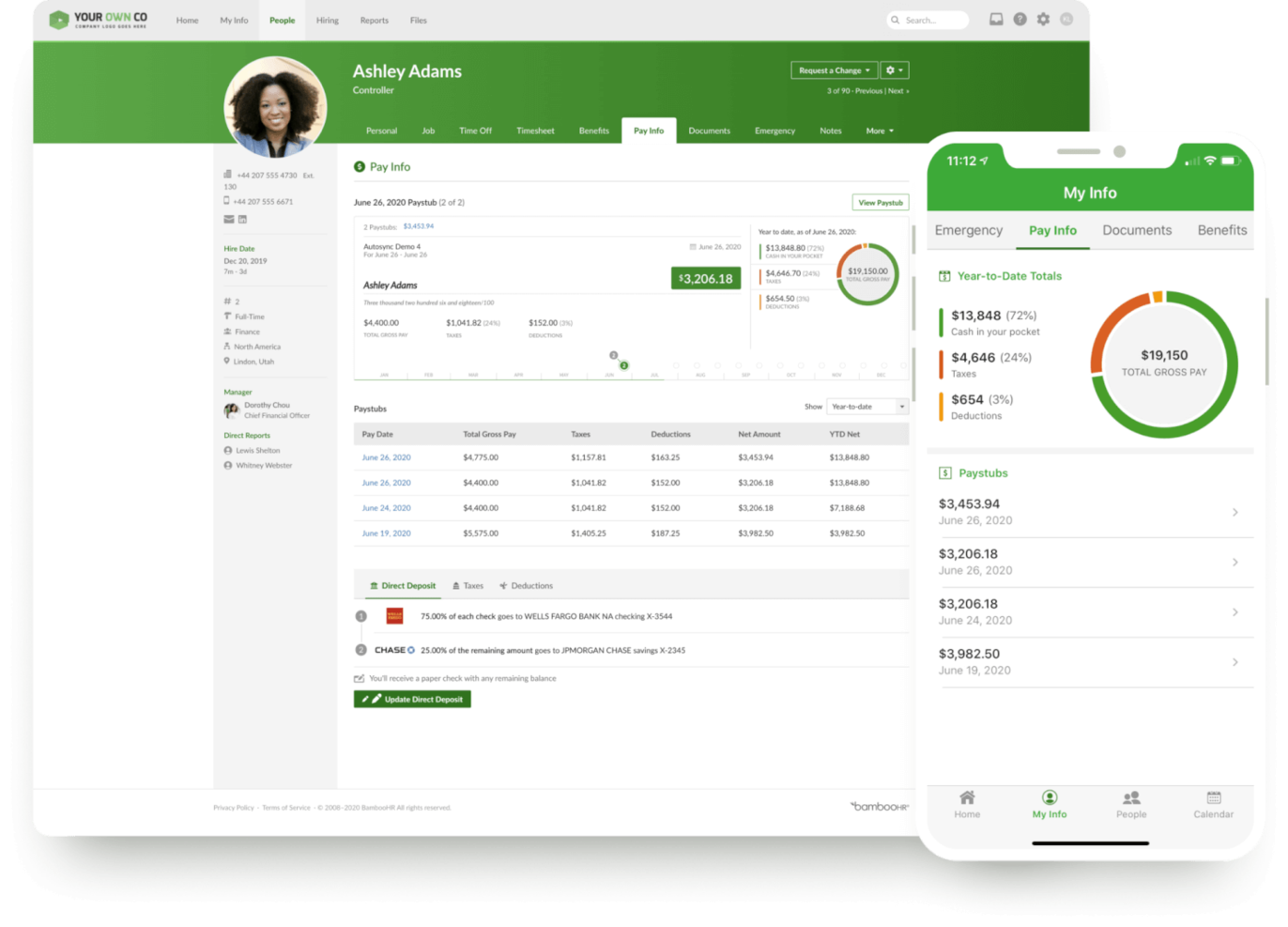

Bamboo HR is one of the most popular payroll solutions. This software acts as a central point for HR specialists, enabling them to track every aspect of employee management, from onboarding to training assignment, contract renewals, and leave notifications.

This tool comes with a good mobile app that enables your team to view organization charts, schedule PTO, track payments, and review their peers.

One of the things that I like the most about this software is that it creates an in-depth view for all your employees, enabling you to keep track of their performance, achievements, and associated compensation bonuses. This can help you reward your team and keep your employees motivated. Thanks to this functionality, I chose Bamboo HR as the best HR payroll tool for compensation tracking.

Bamboo HR costs from $4.95/employee/month. They have a 7-day free trial available.

New Product Updates from BambooHR

BambooHR Payroll Automates Mid-Period Salary Adjustments

BambooHR Payroll now automates wage calculations for salaried employees with mid-pay period salary changes, simplifying a previously manual process. For more details, visit BambooHR Product Updates.

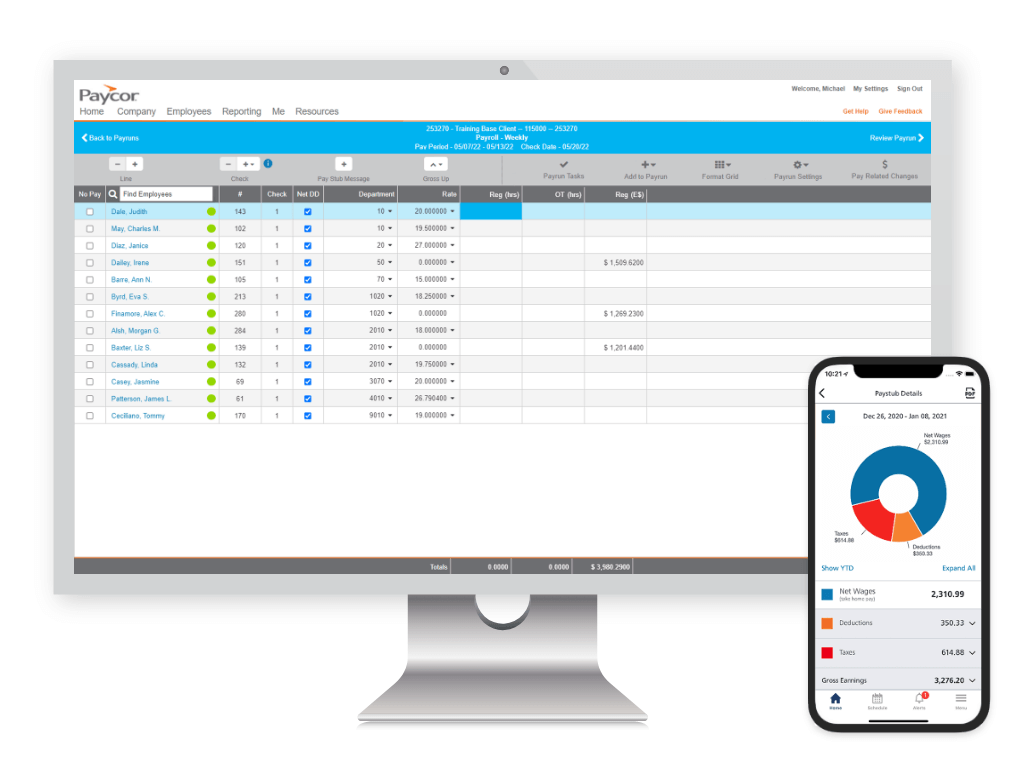

Paycor is a human capital management solution that modernizes every aspect of people management, from HR and payroll to recruiting, onboarding, talent management, career development, and employee retention. More than 40,000 business owners trust Paycor to help them solve problems and achieve their goals.

Why I picked Paycor: They are well-suited for small to medium-sized businesses with salaried employees, since you can take advantage of their ability to automatically run payroll when salaries are known. For any salary changes, Paycor includes proactive alerts to help you catch any potential errors before they become problematic. Their OnDemand Pay feature also allows employees to access their wages in advance of their next pay day, if they need it.

Paycor Standout Features & Integrations:

Features include easy-to-use yet powerful payroll tools, flexible payment options, auto-run capabilities, notifications & alerts, powerful real-time reporting, and engaging employee self-service. Paycor also integrates with tools for wage and salary verification, expense management, employee wellness, certified payroll, and FMLA to cover all your business needs.

Integrations are available with over 200 applications through Paycor's Marketplace, including Emburse Certify, Equifax, GoCo, GoodHire, HireTech, Ignite, Instant Pay, My Enroll360, Payfactors, Sterling, Tapcheck, WorkforceHub, Zillion, and other systems.

Pros and cons

Pros:

- Mobile app allows for payroll management on the go

- Offers live and on-demand product training and webinars

- All-in-one solution well suited to enterprise businesses

Cons:

- UX can be a little clunky at times

- Time cards are a bit simplistic

Paylocity is an HR and payroll software designed to help midsize and large companies scale, simplifying how they manage employee data and payments.

Why I picked Paylocity: I chose Paylocity because it not only simplifies complex payroll tasks but also enhances the overall employee experience. Its payroll tools include automated tax filing, real-time compliance checks, and multi-jurisdiction support, which makes it a strong fit for growing and distributed teams. What sets Paylocity apart, though, is how it weaves these backend efficiencies into a better front-end experience for employees. Features like on-demand pay, mobile access, and self-service portals empower employees to manage their own financial data, submit time-off requests, and view pay stubs anytime.

On top of that, Paylocity's extensive integration ecosystem makes it easy to sync with your existing tools across HR, finance, project management, and communication. Whether you're using tools like Microsoft Dynamics 365, Slack, Greenhouse, or Google Workspace, Paylocity fits right into your workflow.

Paylocity Standout Features & Integrations:

Standout features include garnishment management, ensuring that any legally required deductions are applied without manual intervention. It also provides expense management tools, allowing employees to submit expenses directly through the platform.

Integrations include ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Pros and cons

Pros:

- Benefits administration features

- Includes tax compliance services

- Global payroll services

Cons:

- Setup can be time consuming

- Lacks support for independent contractor payments

Remofirst is a payroll software that provides users with a secure, efficient, and easy-to-use platform for managing payroll processes. Users can input employee information, calculate taxes, and generate pay stubs. The software offers many features, including employee self-service, direct deposit, tax compliance, and reporting.

Why I picked Remofirst: The software provides tools for managing employee shares and dilution, as well as for issuing specialized reports on equity and bonus activity. Its reporting feature allows users to generate detailed reports on their payroll data which can be generated for a specific period. The cost calculation feature helps businesses budget costs effectively by considering various factors, including the number of employees, the type of benefits provided, and the frequency of payments. Employees can also view their equity and bonus information in real-time, and the system automatically calculates vesting schedules and payout dates.

Remofirst lets businesses manage employee benefits programs with ease. Users can track employee eligibility, enroll employees in benefits plans, and even change existing plans. It also allows businesses to generate employee enrollment and participation reports. Dashboards summarize team distribution and spending with visual graphs and charts.

Remofirst can also manage payroll and invoicing for businesses with employees abroad. The software automatically generates accurate paychecks and invoices in the local currency and tracks employee vacation days, sick leave, and expense reimbursements. Remofirst sends invoices every month, ensuring your employees are paid on time. Users can access a dedicated account manager and Remofirst's knowledge base to troubleshoot any issues.

Remofirst Standout Features & Integrations:

Features include employee self-service, time and attendance tracking, leave management, an employee cost calculator, an HR analytics dashboard, performance appraisal tools, and 24/7 customer service.

Integrations include ADP.

OnPay’s full-service payroll software offers transparent, affordable pricing and a great set of basic payroll management features that are easy to use. It's a simple, effective solution that's great for small businesses that want to manage their payroll, benefits, and employee data in one place.

Why I picked OnPay: Their customer service is excellent, with platform specialists available to help you set up your payroll process. They also have licensed in-house insurance brokers that help small businesses set up health, dental, and vision plans with providers like Humana, Cigna, Blue Cross/Blue Shield, Aetna, and UnitedHealthcare. Once in place, benefit costs are synced with payroll, which means you won’t have to worry about capturing any cost fluctuations yourself.

Another thing I love is that they offer special payroll services for certain industries like restaurants, farms and agriculture, churches and clergy, and nonprofits.

OnPay Standout Features & Integrations:

Standout Features: OnPay has a complete but simple set of payroll services and compliance settings for all 50 states, for a much lower price than many other tools. In addition to payroll, you can use a set of essential HR tools for no additional cost, including automated employee onboarding flows, employee personnel files, document storage with e-sign capabilities, compliance audits, paid time-off tracking.

Another great feature is their 401k integration that automatically supports employer matching and profit-sharing options, and can garner small businesses extra tax credits.

Integrations are available with Deputy, Magnify, Mineral, PosterElite, QuickBooks, When I Work, Xero, and with the 401k retirement platforms America’s Best 401k, Guideline, and Vestwell.

Pros and cons

Pros:

- Really good customer service

- Streamlined layout that's easy to learn to use

- Easy to set up

Cons:

- Has some automations but could use more

- Not set up to handle global payroll

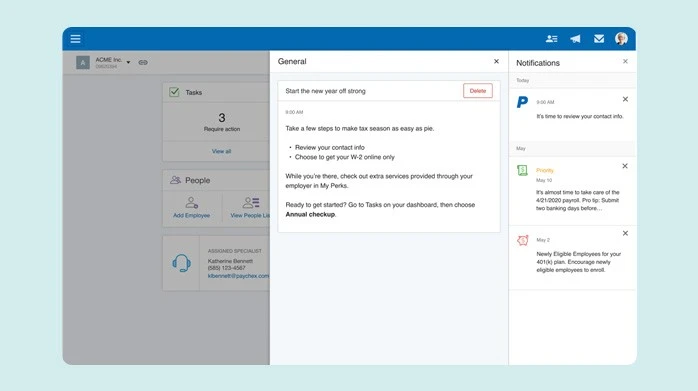

Paychex Flex is an HR software platform offering a larger set of features for time tracking, payroll processing, and benefits administration. They have many different plans, but because they offer more advanced features that go simple payroll administration, I think this is best for midsize to enterprise companies who can take advantage of those features.

Why I picked Paychex Flex: Beyond offering your standard payroll management features, Paychex Flex is great for midsize companies in that it helps you manage 401(k)s, health insurance plans, retirement savings accounts, and other benefits options in one centralized system. It tracks contributions and eligibility requirements while automating enrollment processes and simplifying benefit administration tasks such as invoicing providers or managing FSA claims.

It's also a great tool for companies doing a lot of hiring; it automates collecting required documentation from new hires and manages the process of new hire reporting to government agencies.

Paychex Flex Standout Features & Integrations:

Standout features include online payroll processing (with multiple payment options ranging from direct deposit to paycards and paper checks), as well as a very customizable employee-facing portal (you can customize employee access rights based on job roles). It also has really good tools for budgeting and forecasting and comprehensive reporting capabilities for quick analysis of financial data. It's got a great feature for businesses with hourly employees: mobile time cards, which lets employees clock in and out from their phones.

Integrations are available with major business tools such as ApplicantStack, AxisCare, BambooHR, Buddy Punch, Built for Teams, Time Tracker, Xero, and Quickbooks Online.

Pros and cons

Pros:

- Offers mobile time cards to clock in and out via mobile phone

- Detailed and customizable employee portal

- Comprehensive set of HR features (employee health, retirement, etc)

Cons:

- More complex platform and feature set; steeper learning curve

- Relatively more expensive than some payroll tools (better suited to larger businesses)

TriNet is an HR and global payroll service provider with a software platform to help businesses manage their HR processes, employee benefits, and compliance requirements. Businesses operating on a global scale can manage their payroll and other HR processes through the system.

Why I picked TriNet: The software's integrated payroll system can handle complex payroll regulations in various countries, making it a suitable choice for businesses that operate in several different locations. It can manage payroll tax withholdings and can also be used to administer employee benefits. Compensation benchmarking can be performed in the software, giving you reliable, accurate data to inform your compensation structure and pay ranges.

In addition to its payroll management capabilities, the platform can support various other HR tasks like employee onboarding, time tracking, and workforce analytics, bringing various aspects of your people operations into a single hub. It also has document management features to keep all of your HR documents organized and accounted for.

TriNet Standout Features & Integrations:

Features include an employee perks program, a global payroll solution, compliance with local tax laws and regulations, custom rewards, a variety of payment options, and employee recognition programs.

Integrations include QuickBooks, Oracle NetSuite, Sage Intacct, BambooHR, Lattice, Greenhouse Software, Carta, and Xero.

Pros and cons

Pros:

- Global payroll management for multi-national businesses

- Company provides HR services as well as software

- Centralizes all of your HR processes in one platform

Cons:

- Full functionality may not be needed

- Robust system, comes with a learning curve

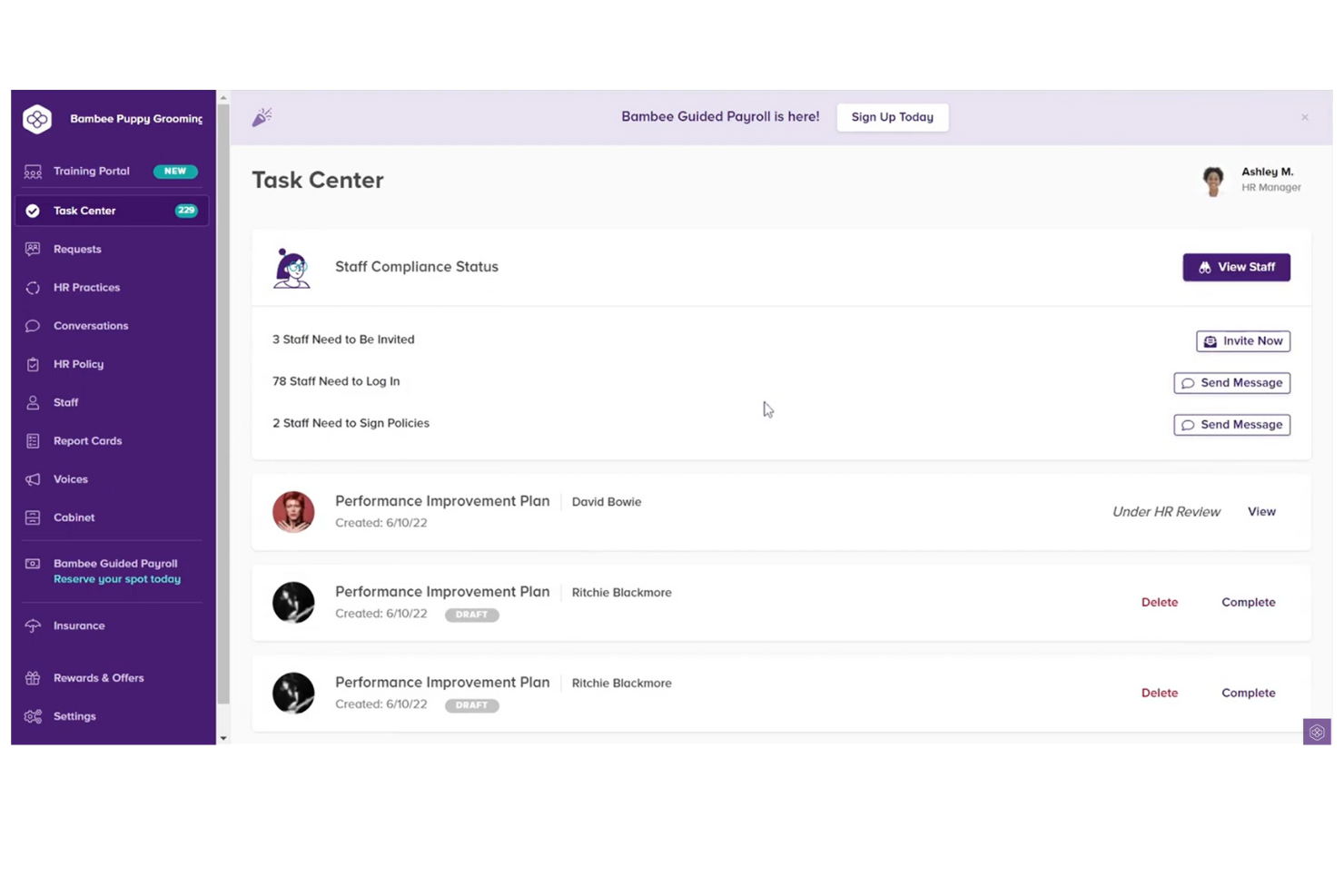

Bambee's cloud-based HR software is specifically tailored for small and medium-sized businesses. Their software covers a wide range of functions, including employee onboarding, compliance, and employee termination. They also offer a guided payroll service, which is available as an add-on.

Why I picked Bambee: I included Bambee in this list because their combined HR and payroll service covers everything needed to manage HR tasks efficiently. I also appreciate the fact that each client receives a dedicated account manager for an affordable monthly price, a great service for any small business owner who doesn't have the budget or resources to hire an in-house HR or payroll specialist.

Bambee Standout Features & Integrations:

Features include 2-day direct deposit, integrated compliance monitoring, and automatic federal, state, and local taxes. It also includes task management tools to ensure no key tasks fall through the cracks.

Integration details are currently not available.

GoCo is a comprehensive, cloud-based HR software platform designed to alleviate the administrative burden on small and mid-sized businesses handling various human resources processes. The platform offers a solution that consolidates essential HR functions such as onboarding, benefits administration, payroll management, and compliance tracking.

Why I picked GoCo: GoCo's embedded payroll feature allows for automatic syncing of employee information such as hours worked, new hires, and changes in employee status, therefore reducing the need for manual data entry and minimizing the risk of errors. I especially like that GoCo automates payroll tax filings and ensures compliance with various regulations.

GoCo Standout Features & Integrations:

Features include employee onboarding with customizable workflows and document management, ensuring a smooth transition for new hires. The employee self-service tool is another crucial aspect, allowing employees to manage their personal information and benefits independently. Additionally, the compliance management feature is essential for helping organizations stay up-to-date with labor laws and regulations

Integrations include Slack, Microsoft Teams, Zapier, QuickBooks Online, Greenhouse, and Gusto.

Pros and cons

Pros:

- Emphasis on compliance

- Self-service benefits administration

- Good onboarding for new employees

Cons:

- Lacks a good range of customization options

- Mobile app could be more robust

Other HR Software for Running Payroll

I shortlisted a few more tools during my research—they're not in my top 10 for HR software for doing payroll, but still worth checking out:

- Factorial

For automating bonuses

- Omnipresent

For global payroll compliance

- PrimePay

For small to medium businesses

- Insperity

For additional expert services

- Patriot Software

For small-to-midsize US companies

- Push

For restaurants and hospitality businesses

- NetSuite SuitePeople

For tracking employee goals

- NaturalHR

For advanced analytics and reporting

- Rippling

For mid-market businesses

- Remote

For companies with international contractors

- Justworks

For managing hourly & salaried timesheets

- Papaya Global

For built-in payment tech

- ADP Workforce Now

For startups and scaling businesses

- Humi

For Canadian companies

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for HR Software with Payroll

My approach to choosing the best HR and payroll software for this list is grounded in my years of HR management experience and thorough research to ensure my recommendations are based on actual utility and performance.

To give you added confidence in my list, here’s a summary of the evaluation criteria I used to make my final selections for the best HR software for payroll:

Core HR Software for Payroll Functionalities (25% of score): To be considered for inclusion in this list, here are the core HR functionalities each system had to offer:

- Tools to automate payroll calculations and pay employees via direct deposit

- Tools to manage pay-related details, including salaries, bonuses, incentives, pay stubs, and expense reimbursements

- The ability to manage and track employee data such as time off and overtime and calculate accurate wage payments

- Automatic tax deduction calculations, and tax filing features

- Basic compliance monitoring capabilities

- Integrated modules for easy digital data management

- Some form of employee self-service module to reduce administrative requests

- Software integrations with other key systems including compensation management systems, time and attendance tracking tools, benefits administration systems, and other HR management solutions

- Customizable user roles and permissions to curate who can access your employee data

Additional Standout Features (25% of final score): To help differentiate one payroll system from another, I also took note of any unique features, including:

- Solutions that offer global payroll abilities, such as aggregated payroll runs spanning multiple currencies, to support international organizations or workforces

- AI-driven payroll automations, such as tax code updates or predictive analytics for labor costs

- Customizable reporting and analytics tools that offer deeper workforce insights

- Mobile accessibility by way of dedicated apps for Android and iOS mobile devices, or mobile-friendly user interfaces for both employee and admin users

Usability (10% of final score): To assess each software system's usability, I considered the following:

- The design of their user interface, with a preference for simple navigation and menu designs that make information easily accessible

- Role-based access control features that are easy to set up, ensuring users only see the information they need

- Responsive designs that work across different operating systems, including mobile devices

- Self-service features for different types of users (employees, managers, administrators, power users, etc.) to ensure a positive user experience

Onboarding (10% of final score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- The availability of best practice guides to streamline the setup process

- Whether comprehensive training materials are available, including videos and interactive tutorials, to speed up internal training for new users

- The availability of dedicated customer success managers or on-call customer support teams, including 24/7 help via chatbots

- Any templates that you can customize to your specific needs, including adding your company branding, to speed up onboarding

Customer Support (10% of final score): To evaluate the level of customer support each vendor offered, I considered the following:

- Whether multiple support channels are available for assistance, including email, phone, and live chat

- Whether customer support is only available within specific time frames or zones, or 24/7 via chatbots

- The existence of any proactive support options, such as a dedicated account manager or regular check-ins

- Whether they offer a customer-facing knowledge base, FAQs, or other self-service tools to aid problem-solving

- The overall quality, responsiveness, and helpfulness of the support team during customer onboarding and post-purchase, as inferred from customer reviews

Value for Price (10% of final score): To gauge the value of each software, I considered the following factors:

- The availability of free trials or demos to test the software before purchasing

- Competitive and transparent pricing models that reflect the software's feature depth and explain which features are included at each level

- Tiered pricing plans that cater to different business sizes, from small to medium-sized businesses (SMBs) up to enterprise-level organizations

Customer Reviews (10% of final score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Whether a product has consistently high ratings across multiple review platforms, indicating a broad level of user satisfaction

- Specific praises, criticisms, or trends in customer feedback that indicate the software's strengths or areas for improvement

- Whether customer feedback specifically mentions issues with ease of use, customer support responsiveness, or lacking features

- Any testimonials or real-world examples of how the software has improved payroll processes

By using this assessment framework, I was able to identify the HR software for payroll that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

How to Choose HR Software for Payroll

Follow this process to help you find the best solution for your specific needs:

Step 1: Define Your Needs

The first step is always getting clear on your specific needs e.g. workforce composition (number, type, location) and growth plans.

Some key questions to ask at this stage:

- How many employees do we have, and how fast do we expect to grow?

- Do we have a mix of full-time, part-time, and contract workers?

- Are we hiring internationally, and do we need multi-country payroll support?

- Do we need a system that handles different pay schedules (e.g., biweekly, monthly)?

- Do we need automated payroll runs, or will we manually approve payroll before processing?

- What payroll calculations do we need (e.g., taxes, deductions, bonuses, reimbursements)?

- How do we currently handle overtime, commissions, and employee benefits?

- Does our payroll need to manage tax filings, withholdings, and statutory deductions automatically?

- Are we operating in multiple states or countries with different tax laws?

- Do we require built-in compliance updates for tax law changes?

- What other tools will it need to integrate with?

- What existing tools could combined HR and payroll software replace?

Best Practices:

- Involve multiple stakeholders: Gather input from HR, finance, compliance, and IT to ensure the system meets all business needs.

- Audit your current payroll process: Identify inefficiencies, compliance risks, and manual tasks that need automation.

Step 2: Research and Compare Vendors

Once needs are defined, research payroll software vendors that align with your requirements.

You can use guides like this one as well as your network and HR communities.

Best Practice: Shortlist 3–5 vendors and create a vendor comparison matrix to objectively assess features, pricing, and support options.

Once you've made your shortlist, reach out and book in some live demo calls to help you assess the tool.

Step 3: Finalize Selection and Negotiate Terms

Once a vendor is chosen, review pricing plans, service-level agreements (SLAs), and contract terms.

Clarify any additional costs, such as implementation fees, tax filing charges, or user licenses, before signing.

If the software includes customer support tiers, ensure your company gets the appropriate level of assistance and be super clear about any additional support costs.

Trends in HR Software for Payroll in 2025

The HR payroll software landscape continues to evolve to satisfy changing organizational needs and incorporate technological advancements, such as artificial intelligence (AI).

Here are several emerging trends that are currently impacting HR and payroll software development:

- AI-Driven Payroll Processes: Payroll systems have begun using artificial intelligence (AI) to automate routine tasks, detect anomalies, monitor compliance, reduce errors, and save time. This advancement in payroll technology is a response to the increasing complexity of payroll regulations, helping to make payroll processes more efficient.

- Global Payroll Capabilities: As businesses become more global, the need for payroll software that can manage multi-country payroll across different currencies has become crucial. Tools like Papaya Global and Deel have emerged as leaders in this space, offering solutions that simplify the complexity of global payroll, tax, and compliance issues.

- Enhanced Data Security Features: As new cybersecurity threats continue to emerge, HR and payroll software providers have added enhanced data security features such as two-factor authentication, or biometric identification features, to help organizations protect sensitive employee data.

- Flexible Payment Options: Modern payroll software has started to incorporate more flexible payment options including bank transfers, payments to digital wallets, and payments made in cryptocurrency. Early-wage access or earned-wage access is also rising in popularity, allowing your employees to withdraw their pay in between pay periods, improving their cash flow and increasing their employee satisfaction.

As technology continues to advance, HR professionals can expect payroll software to become even more intuitive and employee-centric, further simplifying the complexities of payroll management.

What is HR Software for Payroll?

HR software for payroll is a digital tool designed to automate much of the process of paying employee wages.

Key features include automated wage calculations, tax compliance tools, direct deposit, time and attendance integration, benefits management, payroll reporting, and self-service portals where employees can update and access their pay information.

Payroll processing features normally come as part of a wider talent management system with tools for other HR responsibilities such as performance management and employee wellbeing.

Features of HR Software for Payroll

To deliver the core functionality I outlined above, here are some features I think are key in an enterprise HR system for managing payroll:

- Payroll Processing and Management Automation: These combined features allow your HR department to automate many aspects of running payroll, including calculating wages, taxes, and deductions. It also includes tools to manage salaries, bonuses, incentives, pay stubs, expense reimbursements, and more.

- Compliance Management: HR and payroll software is consistently updated to reference the latest tax rates and regulations. This is vital for maintaining compliance with government laws and avoiding penalties.

- Tax Filing: To help you with your corporate tax obligations, HR and payroll software also includes tools to prepare annual tax documents such as T4's, W-2's, and 1099 forms.

- Direct Deposit: It almost goes without saying, but every payroll system in this list allows you to deposit pay directly into your employees' bank accounts. Some offer additional payment options, such as pay cards or early earned wage access as well.

- Time and Attendance Tracking: It's difficult to ensure wage payments are correct without verifying your employees' work hours. The best HR software for payroll keeps track of your team's hours worked, overtime, paid time-off (PTO), and unpaid time off to ensure payroll calculations are accurate.

- Customizable Payroll Reports: There's no use in collecting data if you can't interpret it. The HR solution should help your HR department create customizable payroll reports so you can present them to your management team for financial planning, compliance reporting, and auditing purposes.

- Talent Management: The software should collect and interpret employee data, such as employee lifecycle states, employee benefits enrolment, employee engagement, and churn rates, so your talent management team can plan for the future.

- Self-Service Employee Portal: This feature gives employees access to their payroll information, pay stubs, and tax documents. This empowers employees and reduces the workload of the HR department by minimizing inquiries.

- Data Security and Privacy: This feature ensures that all payroll data is securely stored and managed, protecting sensitive employee information. This is critical for complying with data protection laws and for maintaining employee trust.

- Scalability: Scalability is important for businesses planning to expand, as it ensures the payroll system can handle an increasing number of employees without compromising performance.

You can find more detail in this article that goes into more depth about payroll system features.

Benefits of HR Software for Payroll

HR software for payroll is designed to make all aspects of your payroll process more efficient.

By investing in modern HR and payroll software, you can reduce administrative burdens, make better data-driven decisions, and uncover actionable insights to help you strategically manage your workforce more effectively.

By selecting the best HR and payroll software for your specific business needs, you can expect to gain the following benefits:

- Increased Efficiency: By automating routine payroll tasks, HR software with payroll significantly reduces the time and effort required to process payroll. This allows your HR staff to focus on more strategic tasks, improving productivity.

- Enhanced Accuracy: By minimizing human errors due to data entry and manual payroll calculations, HR and payroll software ensures accurate payroll processing with no need for retroactive corrections.

- Improved Compliance: These software systems automatically update tax rates and compliance requirements on your behalf, reducing the risk of penalties for non-compliance.

- Improved Information Transparency for Employees: By empowering employees to access their pay stubs, tax documents, and benefits information through self-service portals, this improves information transparency, reduces HR inquiries, and creates a better employee experience.

- Better Reporting and Analytics: These software systems include comprehensive reporting and analytics tools that offer insights into payroll expenses, employee compensation, and tax obligations. These insights can inform better strategic business decisions and more robust financial planning.

Costs & Pricing for HR Software for Payroll

The price range for HR and payroll software varies depending on the type of payroll features and services offered.

To give you a wide range to choose from, this list includes everything from basic payroll and HR systems to more complex global payroll platforms. All of them operate on a SaaS (software-as-a-service) model, meaning they offer their payroll services through a monthly subscription model.

For basic payroll and HR systems, you can expect such payroll overhead to include a monthly base fee plus an additional charge per employee. The typical range for base fees is between $10 to $99 per month, with a per-employee charge between $2 to $10.

Below is a breakdown of typical plan options and their pricing:

Plan Comparison Table for HR Software for Payroll

| Plan Type | Average Monthly Fee | Average Price per Employee | Common Features |

| Free | $0 | $0 | Basic payroll processing for a limited number of employees, basic tax calculation, and limited reports. |

| Basic | $10 - $25 per month | $2 - 4 per employee, per month | Payroll processing for a limited number of employees, basic tax filing, standard reports, employee self-service portal |

| Professional | $25 - $40 per month | $4 - $6 per employee, per month | Multi-state or province payroll, additional reports, HR features, compliance report + all the features in Basic. |

| Advanced | $40 - $99 per month | $5 - $10 per employee, per month | Customizable reports, advanced HR tools, integrations, enhanced security + all the features in Professional. |

| Enterprise | Custom pricing | Custom pricing | Scalable for a large number of employees, dedicated support, advanced analytics, custom integrations + all features in Advanced. |

| Global Payroll | Usually priced per employee | $25 - $500 per employee, per month | Ability to pay employees in multiple currencies, international direct deposit, international compliance monitoring, dedicated support + required Basic features or higher. |

More complex systems that offer global payroll and employer of record (EOR) services will cost you a little more.

For these platforms, you can expect to pay between $25 to $500 per employee (with no additional monthly fee) depending on the service configuration you go with.

New & Noteworthy Product Updates

Below, I've summarized the most recent release notes and product updates for my top HR software for payroll recommendations.

Discover what’s now possible through new feature releases, improvements, and updates for web, desktop, and mobile apps

2025 Q1 HR Software For Payroll Updates

Deel

In January 2025, Deel announced several updates to enhance user control and transparency within its platform. These enhancements aim to streamline payroll processes, improve data accuracy, and simplify scheduling for global teams.

One significant update allows U.S. employers to generate and distribute year-end W-2 and W-3 tax forms directly from the Deel platform, ensuring compliance with IRS deadlines.

Additionally, employees can now request personal information changes through Deel, subject to administrative approval, which maintains data integrity.

The platform also introduced localized datepicker formats, automatically adjusting to users' regional preferences for date representation.

Verdict: Hot

Deel's January 2025 updates effectively address key user needs by enhancing compliance, data accuracy, and user experience, making them highly valuable for organizations managing global teams.

Paychex

In February 2025, Paychex introduced several enhancements to its Paychex Flex® platform, aiming to streamline HR processes and improve user experience.

The updates include AI-assisted recruiting through integration with Findem, allowing for efficient talent acquisition.

A new Annual Employee Checkup feature encourages employees to update their information and opt for electronic W-2s via the My Perks hub.

Additionally, the platform now supports direct import of W-2 data into tax preparation software like TurboTax® and H&R Block®, simplifying tax filing for employees.

These enhancements provide significant value by automating recruitment, ensuring accurate employee data, and facilitating seamless tax preparation, thereby reducing administrative burdens and enhancing overall efficiency.

Verdict: Warm

While not groundbreaking, Paychex's February 2025 updates offer some automation and user-friendly features that enhance operational efficiency for businesses.

BambooHR

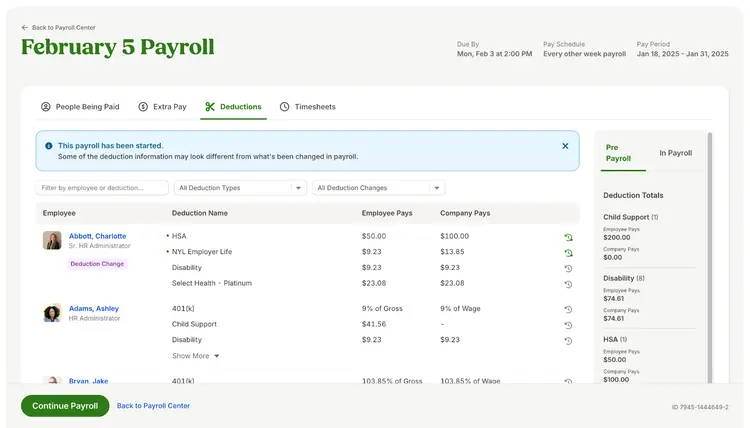

BambooHR has rolled out payroll updates to improve efficiency and accuracy. These include QuickBooks Online integration, a pre-payroll deductions page, and expanded holiday pay settings. The goal is to automate tasks, reduce errors, and give users more control.

The QuickBooks Online integration allows users to automate the transfer of payroll journal entry reports from BambooHR to QBO, reducing manual data entry and potential errors.

The pre-payroll deductions page offers a comprehensive view of all deductions before initiating payroll, complete with labels, filters, and easy access to deduction histories.

Additionally, the updated holiday pay settings enable all customers to designate holiday hours and assign flexible pay rates for different holidays, with automatic integration into payroll for both salaried and hourly employees.

Verdict: Hot

BambooHR's recent updates effectively address critical aspects of payroll management, offering automation, transparency, and flexibility that are highly beneficial to organizations seeking efficient and accurate payroll solutions.

Summary

Using a payroll processing system with incorporated HR functionalities can really make your life a lot easier.

You'll gain a central location for all your employee records and documents and be able to track your employees' work hours accurately, ensuring they're always paid correctly.

As more orgz hire remote and international workers, in 2025 there are more companies developing global payroll solutions and offering full-service EOR and payroll platforms that help you pay an international workforce that's made up of both employees and contractors.

Subscribe to our newsletter to keep updated on all the latest developments in payroll and HR technology.