Whether you’re an entrepreneur running a small business or a W-2 employee who wants to claim a tax deduction for your side-hustle, understanding the ins and outs of business expenses like insurance, rent, and materials is important. In this article, I'll lay out what is (and is not) deductible, along with examples to guide you.

Please note this article applies to U.S.-based businesses and is intended as a guide. Consult a tax professional or use an authorized IRS e-file provider to ensure that your financial and expense reporting complies with IRS regulations.

What Are Business Expenses?

Business expenses are the costs incurred in the process of running a for-profit business. Often referred to as deductions, calculating your business expenses and subtracting them from your company’s revenue can help reduce your tax burden.

However, not all business expenses are created equal. To qualify as tax-deductible, your expenses need to be considered 'ordinary and necessary' costs associated with operating a business, as outlined in the Internal Revenue Code (IRC).

Types of Business Expenses

There are two types of business expenses I'll cover in this section: deductible and non-deductible. For each, I'll provide a definition along with some examples.

Deductible Business Expenses

Deductible business expenses are those that can be deducted from your business taxes. This includes the cost of items that your business used indirectly to provide goods or services, but remember, it must be considered 'ordinary and necessary.'

- According to the IRS, an ordinary expense is considered “common and accepted” (i.e. not unusual) in your trade or industry.

- The IRS defines a necessary expense as one that is “helpful and appropriate” in conducting business in your industry.

Examples of deductible business expenses:

Examples of deductible business expenses include but are not limited to:

- Payroll software and expenses

- Employee benefits programs

- Utilities, supplies, and materials

- Property and equipment leases

- Advertising and marketing costs

- Charitable contributions

- Commissions (supplemental wages)

- Business travel expenses

- Employee education expenses

- Employee training expenses

- Interest paid on certain business loans, business credit cards, and mortgages on properties bought by the business (or sole proprietor).

- Meals

The Internal Revenue Service (IRS) provides detailed guidelines on which expenses can be claimed to reduce your tax liability in Publication 535 (2021), Business Expenses. You can consult the full list of IRS publications for more information.

Advice for deductible business expenses:

When writing off expenses, it’s worth keeping in mind that while some expenses are fully deductible, others are only partially deductible, and others can’t be deducted in the same year as they were incurred.

Certain expenses (e.g. capitalized business assets) must be written off over several years using depreciation (or amortization for intangible assets).

It’s also important to note which expenses are deductible depends on the structure of the business. This means that the allowable deductibles and financial reporting requirements will vary between sole proprietorships, partnerships, limited liability companies (LLCs), and corporations (s-corporations, and c-corporations).

Understanding the relative tax benefits and the administrative burden—and associated costs—of each of these business structures can be instrumental to setting up your business so that it balances tax efficiency with available resources.

Non-Deductible Business Expenses

Non-deductible business expenses are those that can not be deducted from your business taxes. Anything to do with personal activities or personal spending is a non-deductible expense. I've listed examples of these expenses for you below.

Examples of non-deductible expenses

- Anticipated liabilities (or reserves for anticipated liabilities)

- Certain legal fees (e.g. those incurred in the process of acquiring an asset)

- Club dues and membership fees (with certain exceptions)

- Demolition costs or losses

- Educational costs incurred in meeting the minimum regulatory requirements to conduct business

- Government fines (e.g. late filing fees)

- Illegal activities (e.g. bribes and kickbacks)

- Lobbying expenses

- Personal expenses (unless the expense is partly for business purposes)

- Political donations

Why You Should Keep On Top Of Business Expenses

There are major perks to reviewing your business’s income and expenses on a regular basis (and not just at tax season):

- It's easier to remember the exact details and circumstances of a transaction

- You're less likely to lose important evidence like paper-based receipts

- Having accurate data allows you to plan for future expenses and stay on budget

- It's easier to project your business' profitability (or lack thereof) and adjust

In addition to reducing your administrative burden come tax season, it can also mean faster turnaround times for employee reimbursements, helping morale.

How To Report Business Expenses

Step 1: Prepare your income statement

Business expenses are reported in your business’ income statement, which should record all of your revenue and expenditure. This is a financial profit-and-loss (P&L) statement used to calculate your company's financial health. To create this, simply:

- Pick a reporting period: typically an annual, quarterly, or monthly basis.

- Generate a standard trial balance report: use your accounting software to list the end balance of each account in the general ledger for the reporting period.

- Calculate your revenue: calculate all the money earned for your services during the reporting period, even if you haven’t yet received all the payments.

Step 2: Categorize your income statement

Once you have the majority of your income statement prepared, you’ll record your business expenses by category. These categories include:

- Direct costs or cost of goods sold (COGS) such as labor costs, cost of materials, the overhead of business premises, storage, etc. These are deducted from your business’s total revenue to determine your gross income or gross profit.

- Indirect costs such as general expenses, marketing expenses, and executive compensation are deducted from gross profit to determine operating profit.

- Depreciation and amortization are used to expense tangible and intangible business assets, respectively, over several years. These assets include property, furniture, equipment, vehicles, etc. (tangible) as well as patents, trademarks, intellectual property licenses, management software, etc. (intangible).

4. Interest is the final expense deducted from a company’s income.

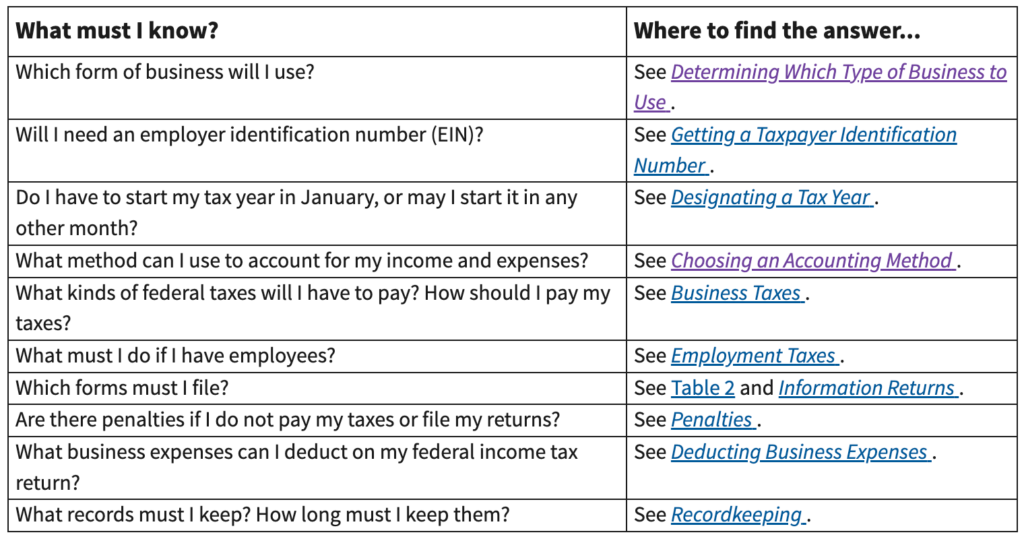

Step 3: Choose an accounting method

You'll also need to decide on an accounting method to use when reporting your income and expenses. Two basic accounting methods are cash and accrual:

- Cash accounting method: you’ll report income in the same tax year that you received it and usually deduct and/or capitalize expenses in the same tax year.

- Accrual accounting method: you’ll usually report income in the tax year you earn it, even if you only receive actual payment in a later year. Similarly, you’ll generally deduct and/or capitalize expenses in the tax year that you incurred them, regardless of whether you paid for them that year or not.

For detailed information about the different accounting methods (and periods) recognized by the IRS, consult this PDF of Publication 583 (revised January 2022). To see recent updates, bookmark About Publication 583 as an active resource.

How to Track Business Expenses

While writing off your business expenses is the best way to reduce your tax liability, it’s crucial that you keep meticulous records of all your transactions. The IRS may decide to audit you to check whether your reports match your actual expenditures.

Here are some tips and best practices for properly tracking business expenses:

- Keep your business finances separate from your personal expenses. Having a separate business bank account makes tracking your business expenses easier.

- Calculate the usage split and claim the business-use portion if an expense is partially for business purposes and partially for personal use (e.g. your home office or the bill from your cellphone service provider).

- Keep all your receipts and digitize them. To make it easier to not lose them, take photos and store them online. Most modern accounting software lets you snap a photograph and upload it directly.

- Keep your invoices and receipts organized. Ideally, sort them into folders first by month and then by expense category. This makes it easy to find the details and evidence of each transaction later.

- Keep detailed notes. Even if you think you’ll remember all the details of each transaction, make notes that include the date, expense category, and what the expense was for, e.g. entertaining a client, gas for the company car, etc.

- Review your records as frequently as possible. Even if you’re using software that automates much of the process, it’s a good idea to check in on your records frequently, verify that they’re accurate, and re-categorize anything mislabelled.

- Create a formal workflow for tracking expenses and reconciling your records. Map out which tasks need to occur daily/immediately (e.g. uploading receipts), weekly, monthly, quarterly, bi-annually, and annually.

- Consider investing in expense reporting software. It records expenditures, stores receipts, automatically categorizes transactions, and lets you view your finances in dashboards and charts. It also makes it easier to generate reports.

For more information about tracking business expenses, check out IRS Publication 583 (01/2021), Starting a Business, and Keeping Records.

Go Forth and Deduct (or not)

All this to say, calculating your business expenses and subtracting them from your company’s revenue can help to give you a bit of a tax break—that's money that can be invested back into your business. Remember these takeaways:

- There are two types of business expenses: deductible and non-deductible

- Your business expenses are reported through your income statement

- Review your expenses regularly and keep everything extremely organized

If you found this article helpful, be sure to subscribe to the People Managing People newsletter for more in-depth content on organizational development.