10 Best Online Payroll Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Managing payroll is a critical yet complex task for any business. Errors can lead to compliance issues, employee dissatisfaction, and financial penalties.

The right online payroll software automates calculations, ensures accurate tax deductions, and adapts to evolving regulations, freeing your team to focus on strategic initiatives.

With years of hands-on experience implementing various payroll systems, I've identified top solutions that enhance efficiency and accuracy.

This guide presents a curated list of the best online payroll software to streamline your payroll processes and maintain compliance with confidence.

You Can Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Online Payroll Software: Price Comparison Chart

This comparison chart summarizes pricing details for my best online payroll software selections to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for managed global payroll | Free trial + demo available | From $29/month | Website | |

| 2 | Best for automated payroll processing | 90-day free trial | Pricing upon request | Website | |

| 3 | Best with expense tracking | Free demo available | Pricing upon request | Website | |

| 4 | Best for staying compliant | Free trial available | From $29/user/month | Website | |

| 5 | Best for small businesses | 30-day free trial | From $40/month + $6/user/month | Website | |

| 6 | Best for multi-currency global payments | Free demo available | From $25 - $199/user/month | Website | |

| 7 | Best for startups | Free demo available | Pricing upon request | Website | |

| 8 | Best for paying independent contractors | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 9 | Best for compensation tracking | Free demo available | From $9/user/month | Website | |

| 10 | Best for handling payroll taxes | Free demo available | From $8/user/month (billed annually) | Website |

-

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

ClearCompany

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Online Payroll Software Reviews

Here you’ll find brief descriptions of my top 10 picks for the best online payroll software. I’ve explained each system’s best use case, noteworthy features, and pros & cons, and included a screenshot to demonstrate their user interface too.

Plus, there are 10 additional bonus options below, if you’d like even more payroll systems to consider.

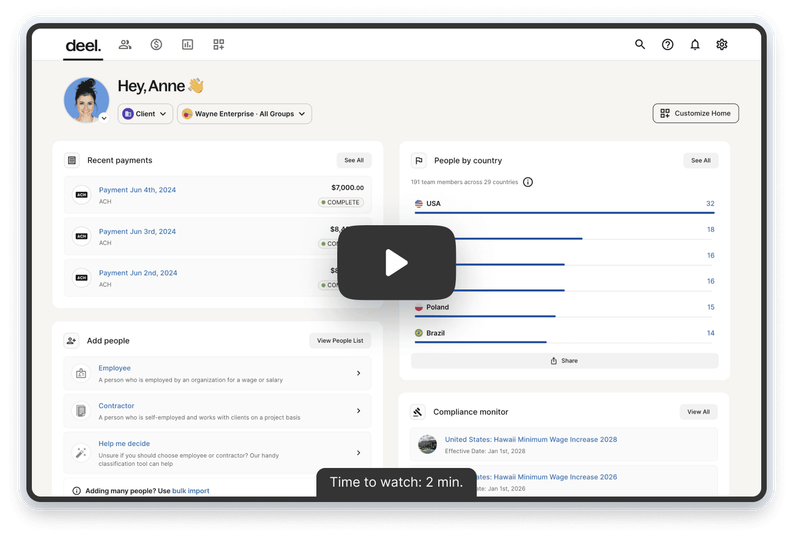

Deel is a payroll software that enables companies to hire international specialists without having to outsource their work to local payroll providers.

Why I picked Deel: Deel handles your government declarations, tax calculations, tax filings, and compliance in over 90 countries so you don’t have to. As a fully managed payroll solution, Deel gets your team up and running in a month and offers support 24/7 to you and your international staff.

Deel’s payroll reporting feature breaks down your expenses by country and allows you to adjust your team’s pay with ease. Deel also helps you find and onboard international specialists from over 150 countries, allowing you to expand your recruitment pool. The company also gives you salary benchmarks for different markets, so you can pay your global employees fairly.

Deel Standout Features and Integrations

Features include fixed payments, milestone payments, pay-as-you-go, automation, tax calculations, contractor payments, and two-factor authentification.

Integrations include Ashby, BambooHR, Greenhouse, HiBob, Lever, NetSuite, QuickBooks, Slack, Workday, Xero, and others.

Pros and cons

Pros:

- Automates your payroll and taxes

- Detailed dashboards

- Knowledgeable support staff

Cons:

- The contract templates could be simplified

- Limited invoice customization

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

RUN by ADP is a comprehensive payroll and HR software solution designed to cater to small businesses. It offers a range of services including payroll processing, time and attendance management, and compliance.

Why I picked RUN by ADP: The platform automatically calculates and files payroll taxes, reducing the administrative burden on business owners and minimizing the risk of errors. This feature is particularly beneficial for small businesses that may not have dedicated payroll staff.

Another notable feature of RUN by ADP is its robust HR support and compliance tools. The platform offers access to HR tools and expert support for hiring, onboarding, and managing employees, which enhances the overall employee experience. Additionally, RUN by ADP provides built-in compliance assistance, including automatic updates on tax laws and AI-powered error detection.

RUN by ADP Standout Features and Integrations

Features include direct deposit, an employee self-service portal, time and attendance tracking, garnishment payment services, new hire reporting, retirement plan services, workers' compensation management, payroll and tax reports, and mobile app access.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Good payroll and tax automation

- Robust mobile app

- Customizable, in-depth reporting options

Cons:

- Most HR functions are only available on higher-tier plans

- Setup can be complex

Paylocity is an online payroll software that enables businesses to keep track of employee expenses and reimbursements without difficulty.

Why I picked Paylocity: Paylocity’s expense tracking tool helps you identify all expenses with accuracy and automate your reimbursement process so your employees can get their money back faster. The software enables you to customize your payroll reports and accruals so you can run payroll exactly how you want to.

Paylocity offers a tax preparation service so that the company will handle all local, state, and federal taxes on your behalf. The platform also supports on-demand payment, allowing employees to get cash advances or pick their payday without interrupting your payroll.

Paylocity Standout Features and Integrations

Features include global payroll, expense management, a garnishment-managed service, time tracking, payroll automation, tax calculation, tax compliance, and on-demand payments.

Integrations include 7Shifts, Clover, Expensify, Microsoft Dynamics 365, Oracle Netsuite, QuickBooks Online, Sage, Square, Xero, and others.

Pros and cons

Pros:

- Helpful reports

- Makes running payroll easy

- Modular build, so you can customize the solution to your needs

Cons:

- UX can feel clunky at times

- There are multiple modules, so configuring your solution can feel overwhelming

Remote offers online payroll software as part of its global HR solutions, allowing businesses to manage payroll, team management, recruitment, and HR data consolidation all in one place.

Why I picked Remote: I like that Remote's payroll features are designed to ensure accurate and timely payments in local currencies, eliminating the complexity of manual conversions and reducing errors. The platform also offers comprehensive compliance support, which adapts to the evolving tax laws and regulations worldwide.

Furthermore, Remote offers in-house local payroll support, which helps businesses navigate international payroll. Their team of experts provides guidance tailored to the specific regulatory environments of different countries, helping businesses avoid compliance issues and penalties. This support includes managing tax withholdings, benefits, and other payroll-related requirements.

Remote Standout Features and Integrations

Features include watchtower HR compliance, contractor invoicing and management, payroll and expense management, Employer of Record (EOR), global benefits, time and attendance tracker, employee self-service, global hiring planner, remote job boards, and employee immigration and relocation support.

Integrations include Gusto Global, HiBob, Personio, BambooHR, Greenhouse, Sequoia, Easop, Zelt, Xero, Vanta, Gifted, and Workday.

Pros and cons

Pros:

- Support for immigration and relocation

- Global employer of record services

- Maintains regulatory compliance for global payroll

Cons:

- Initial learning curve when getting started

- Limited availability in certain countries

OnPay is a cloud-based payroll software that helps small business owners onboard and pay employees without difficulty.

Why I picked OnPay: OnPay has a straightforward interface that’s friendly toward novice users. The tool’s starting tutorial is comprehensive and explains how to use the payroll features in great detail, making the onboarding process smooth and short.

OnPay makes it easy for you to change pay rates and hours, adjust tax rates, and approve payroll. The software notifies you if holidays could influence the payroll processing time and prevent your workers from getting their paychecks on time, so you can adapt your timing. OnPay also alerts you when it’s time to approve your automated payrolls, sign HR paperwork, and so on.

OnPay Standout Features and Integrations

Features include unlimited pay runs, tax filings and payments, employee self-service, automated onboarding, direct messaging, PTO management, and benefits management.

Integrations include Deputy, Guideline, Mineral, PosterElite, QuickBooks Online, QuickBooks Time, Vestwell, When I Work, Xero, and others.

Pros and cons

Pros:

- Fast direct deposits

- Good mix of HR functions designed for small businesses

- Proactive support team

Cons:

- The process of adding employees to workflows can be confusing

- Reports could be easier to customize

Remofirst is a global employment services platform that enables businesses to hire and manage remote teams internationally.

Why I picked Remofirst: Remofirst provides an employer of record (EOR) service, which allows companies to legally employ staff in over 170 countries without establishing a local entity, thus handling payroll, taxes, and benefits on their behalf. This service is particularly beneficial for online payroll software, as it simplifies the complexities associated with international payroll compliance and tax regulations.

Additionally, Remofirst manages international contractors, ensuring that contract creation, payment processing, and compliance with local laws are streamlined. Furthermore, Remofirst's workforce management capabilities integrate with online payroll systems to maintain accurate employee records and streamline administrative processes.

Remofirst Standout Features and Integrations

Features include invoice management, benefits management, onboarding and offboarding, time and attendance tracking, garnishment processing, RemoHealth health insurance, and an employee cost calculator.

Integrations include ADP.

Pros and cons

Pros:

- Includes personalized customer support

- Offers visa and immigration services

- Provides good value for money

Cons:

- Limited integrations

- May not support all international currencies

Paychex Flex is a payroll software solution that helps startups run payroll and manage their workforce with a single solution.

Why I picked Paychex Flex: Paychex Flex enables you to track your team’s daily hours, manage time sheets, approve PTO, and oversee benefits in one place. The solution offers a self-service portal where employees can access digital copies of their pay stubs, see their contributions, and manage their retirement accounts, making it easy for them to access their data.

With Paychex Flex, you can schedule your payrolls and approve them before payday with ease. You can schedule multiple runs in the same pay period, and you can oversee your work on the mobile app. The solution also gives you access to extra HR features as add-ons for additional fees.

Paychex Flex Standout Features and Integrations

Features include payroll processing, payroll tax filing, a garnishment payment service, paycheck preview and approval, new-hire reporting, and a mobile app.

Integrations include Ashby, BambooHR, Clover, Deputy, HIREtech, iCIMS, Indeed, Oracle Netsuite, QuickBooks Payroll, and others.

Pros and cons

Pros:

- Helps you save time with payroll filters and saved views

- Knowledgeable representatives

- 24/7 specialized service for US clients

Cons:

- Automatically creates multiple subfolders, making it difficult to find the right files at times

- Adding pay categories could be easier

Patriot is an online payroll service and accounting software that enables companies to include freelancers and contractors in their payroll.

Why I picked Patriot: Patriot deducts and remits all unemployment, social security, medical, and related deductions to state and federal authorities, making each deduction easy to track. The solution handles all tax calculations and tax filings, so you don’t have to worry about missing something.

With Patriot, you can include independent contractors in your payroll, making it ideal for companies outsourcing work to freelancers. Using their direct deposit feature, you can streamline your payroll operations and pay your contractors and employees simultaneously.

Patriot Standout Features and Integrations

Features include an employee portal, unlimited payroll runs, time and attendance tracking, 1099 e-filing, tax filing, PTO management, and employee information tracking.

Integrations include GoCo, Plaid, QuickBooks Online, QuickBooks Time, WorkfoceHub, and others.

Pros and cons

Pros:

- Makes payroll easy for people with no accounting experience

- Great value for a full-service payroll solution

- Enables you to send year-end electronic W2s and 1099s to your staff

Cons:

- The time management feature could be easier to use

- No mobile app, but the website is mobile-friendly

Namely is an online human resources and payroll solution that enables managers to track employee compensation and easily update it.

Why I picked Namely: Namely’s interface is easy to navigate for both administrators and employees. The solution’s benefits wizard makes it easy to set up health benefits for your team members, regardless of their location.

Namely is great at tracking employee compensation and updating it based on the available data, so you can rest assured that the payment is handled correctly. The payroll processing feature is straightforward, allowing you to double-check and validate each report for increased accuracy.

Namely Standout Features and Integrations

Features include payroll reports, time management, benefits management, garnishment administration, state and federal tax calculations, tax filing, and automated salaried proration.

Integrations include Breezy, Greenhouse, Google Suite, JazzHR, Jobvite, Lever, Onelogin, Oracle Netsuite, Workable, and others.

Pros and cons

Pros:

- Good at tracking historical data

- Multiple customization options are available

- Namely’s team does a great job at providing payroll and HR support

Cons:

- Time management feature could offer more reporting options

- Search feature could be more specific

Rippling is an online payroll platform that helps global organizations pay their remote workers in local currencies.

Why I picked Rippling: Rippling allows you to deposit wages directly into local bank accounts around the world without having to rely on third-party service providers or suffer expensive conversion fees. The software also calculates and files payroll taxes for your remote workers, and allows you to automate many of your administrative tasks.

Rippling’s Time & Attendance feature helps your team members keep track of their billable hours with ease. The software allows employees to clock in and out of work and automatically syncs their approved hours with your payroll, accounting, and HR software. The platform is also highly configurable, allowing you to tailor your payroll processes to your business' needs.

Rippling Standout Features and Integrations

Features include domestic and international payrolls, an organization chart, expense management, talent management, local tax filing, country-specific compliance, and international benefits programs.

Integrations include 1Password, 15Five, Asana, Brex, Checkr, GitHub, Google Workspace, Human Interest, Slack, Zoom, and others.

Pros and cons

Pros:

- Automatically highlights possible data errors

- Stores all your company data in one place

- Simple onboarding and offboarding process for international employees

Cons:

- App can take a while to load in areas with slow internet

- Mobile app lacks some features that are available on the desktop and browser versions

Other Online Payroll Software

Here are a few more worthwhile options that didn’t make the best online payroll software list:

- Papaya Global

For AI-augmented payroll

- QuickBooks Payroll

Time tracking for payroll

- Paycor

For small HR teams

- ADP Workforce Now

For real-time reporting

- TimeTrex

For handling complex pay structures

- Agile Hero

For alignment with tax laws

- Gusto

Online payroll software for tax management

- Zenefits

Online payroll software for advanced payroll features

- PrimePay

Online payroll software for employee self-service

- Square Payroll

Online payroll software for field teams

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Online Payroll Software

Perhaps you're wondering how I selected the best online payroll software for this list? To build this top 10 list, I started by reviewing recent payroll market data to build a long list of vendors to research.

After determining my long list of top choices, I further honed my list by using the selection criteria below to see how each platform stacked up against the next one. I also drew on my years of HR experience updating payroll data myself to pinpoint the features that add a lot of value.

Here’s a short summary of the main selection and evaluation criteria I used to develop my list of the best online payroll software for this article:

Key Features

First and foremost, I made sure each of my top picks covered the following key features, which I consider to be essential for effective online payroll software:

- Core payroll features: All the payroll software in this list cover the basics:

- Payroll processing for hourly or salaried employees

We’re seeing more small businesses leveraging payroll and HR systems to simplify admin work. Most business owners just want to focus on their core tasks, not HR admin.

- Direct deposits into bank accounts

- Digital pay statements (pay stubs) and annual earning statements

- Payroll reports for each individual payroll run, plus year-end reports

- Automatic payroll withholding for taxes owed to government bodies, such as the IRS, CRA, or others

- Advanced payroll features: These are features that help differentiate the so-so payroll systems from the great ones. They include:

- Same-day or next-day payroll deposits (sometimes described as pay-on-demand or earned wage access)

- The option to make contractor-only payments

- Global payroll processing capabilities in multiple currencies

The complexity isn’t in the payroll calculations themselves, but in staying compliant with each country’s regulations. You have to be sure your system separates the data from the rules, especially when tax and social security rates change across borders.

- Time-tracking tools: It's always better to have time-tracking features within your payroll software so you don't have to transfer data between systems. Doing so opens the door for human or technical errors, which can create a negative employee experience if your staff are not paid correctly.

- Compensation management capabilities: This includes the ability to track different pay rates (e.g., salaries, hourly rates, overtime rates, vacation pay, paid leave, etc.) and changes to salaries over time.

For further details, take a look at our comprehensive list of payroll features you should know about to inform your own assessments.

How to Choose Online Payroll Software

Online payroll software can help you manage your payroll processes efficiently from any computer or device. To help you figure out which online payroll software best fits your needs, you need to pinpoint your key users and document their specific challenges first.

As you work through your own unique software selection process, keep the following points in mind:

- What problem are you trying to solve - Start by identifying the challenges you're trying to overcome. This will help you clarify the key features and functionalities the payroll software needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who will use the software and how many licenses you'll need. You'll need to evaluate if it'll just be your HR professionals, select accounting staff, or entire departments that will require access. Once that's clear, it's also useful to rank the needs of your different users to identify your key priorities for your payroll power users to ensure they're met.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, time-tracking, or HR software. You'll need to decide if the tools should integrate together, or alternatively, if you can replace multiple tools with one consolidated payroll software.

- What outcomes are important - Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to provide more flexible payment options for your employees, such as on-demand pay. You could compare payroll software features until you’re blue in the face but if you aren’t thinking about the outcomes you want to achieve, you'll waste a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your existing workflows and systems. Evaluate what's working well, and any problem areas that need to be addressed.

Remember every business is different — don’t assume that a payroll system will work for your organization just because it's popular. You need a solution that ensures accuracy and fixes errors before payroll is run, so your employees can reduce time spent on payroll.

Tax Management and Compliance Monitoring

Tax management can be difficult for companies that rely on remote workers. I chose tools that are always up-to-date with the latest legislative changes and simplify tax calculation and tax filing. Other important compliance monitoring features include:

- Overtime payment calculation rules that comply with federal, state, and local laws

- Employee classification tools to avoid potential misclassification and penalties

- Leave entitlement accrual tracking that complies with the legal requirements of your jurisdiction

Ease of Use

Running payroll can be complicated. The process of checking over timesheets, calculating expense reimbursements, and updating employee pay can also take a lot of time each month. I selected payroll solutions, like Paychex and similar competitors, that are easy to use and help you save time in the process.

Customization

No two companies are the same. As a result, I picked solutions you can customize to your unique business requirements and payroll needs, such as earning types, pay schedules, expenses and deductions, and so on.

Software Integrations

It’s crucial to integrate your payroll solution with other apps you use on a daily basis, such as accounting software, human resources information systems (HRIS), HR management tools, benefits administration platforms, and so on. I selected platforms that offer a wide variety of native integrations or OPEN APIs you can connect to.

What is Online Payroll Software?

Online payroll software is a cloud-based solution that enables you to automate and simplify your organization’s payroll process. It helps business owners and HR professionals manage employee wages while keeping track of payroll tasks, deductions, benefits, PTO, and tax withholdings. Being "online" simply means that it's payroll software that offers in-browser/app access from anywhere via wifi, as well as real-time data updates for all users simultaneously.

Costs & Pricing for Online Payroll Software

When selecting payroll software, it's important to consider different pricing plans and their features to find the best fit for your organization’s needs.

In most cases, the cost of online payroll software will depend on your number of employees. Therefore, you can expect to pay a standard monthly fee plus a fee per employee. However, single-employee payroll solutions often offer more cost-effective pricing structures if you're a solo team just starting out.

To give you a general sense of what you can expect to pay for different payroll software packages, I've compiled the most common plan levels into this table:

Plan Comparison Table for Payroll Software

| Plan Type | Average Monthly Fee | Average Price per Employee | Common Features |

| Free | $0 | $0 | Basic payroll processing for a limited number of employees, basic tax calculation, and limited reports. |

| Basic | $10 - $25 per month | $2 - 4 per employee, per month | Payroll processing for a limited number of employees, basic tax filing, standard reports, employee self-service portal |

| Professional | $25 - $40 per month | $4 - $6 per employee, per month | Multi-state or province payroll, additional reports, HR features, compliance report + all the features in Basic. |

| Advanced | $40 - $60 per month | $5 - $8 per employee, per month | Customizable reports, advanced HR tools, integrations, enhanced security + all the features in Professional. |

| Enterprise | Custom pricing | Custom pricing | Scalable for a large number of employees, dedicated support, advanced analytics, custom integrations + all features in Advanced. |

| Global Payroll | Usually priced per employee | $199 - $500 per employee, per month | Ability to pay employees in multiple currencies, international direct deposit, international compliance monitoring, dedicated support + required Basic features or higher. |

Online payroll solutions are often cost-effective, but if budget is not a constraint, you might want to explore premium payroll software options for added features and customization.

Or, if you'd like to get a better understanding of the nuances behind the cost of payroll software, read my detailed breakdown of payroll software costs, including potential hidden fees.

Frequently Asked Questions about Online Payroll Software

Curious to learn more about online payroll software? Here are some answers to popular questions.

What are the main benefits of using an online payroll software?

The main benefits of using online payroll software are:

- Accessible from anywhere: Modern solutions are mobile-friendly, providing access to the platform from anywhere in the world as long as there’s an internet connection. This helps hybrid or remote organizations manage their team’s payroll and benefits.

- Payroll regulation compliance: Payroll regulations have a tendency to change often. Online payroll software providers constantly update their solutions so your company stays compliant with the latest changes to tax laws across numerous jurisdictions.

- Error reduction: Manually keeping track of timesheets and payroll expenses can lead to errors. The best payroll software reduces this risk by storing all your payroll data in one place.

- Tax management: Payroll software automatically calculates, withholds, and remits payroll taxes at a local, state, or federal level, making it easier to manage your taxes.

- Benefits administration: Most online payroll tools enable you to manage employee benefits, such as PTO, health insurance, and retirement plans.

What’s the difference between online payroll software and full-service payroll?

The main difference between online payroll software and full-service payroll solutions is the level of service and support provided.

With online payroll software, you get a hands-on solution that enables you to manage your payroll in-house with the help of automated tools.

On the other hand, full-service payroll is typically a hands-off approach where you outsource your payroll management tasks to a third-party company. There are pros and cons of payroll outsourcing, though. This approach involves a higher level of customer support that often includes dedicated account managers or payroll specialists.

What's the difference between online payroll software and on-premise payroll software?

The term “online payroll software” refers to payroll software that is hosted on the internet via a software cloud. Another name for it is “cloud-based payroll software.” In contrast, on-premise payroll software is installed and run from a server within an organization’s physical office and is, therefore, not accessible from outside the organization’s IT infrastructure.

Online, or cloud-based, payroll software is generally considered easier to use and is the preferred configuration for most organizations. Software updates and data backups are handled by the payroll host company. They also offer customer support for advanced troubleshooting, as needed. It’s suitable for businesses looking for flexibility, accessibility, limited maintenance, and lower initial costs.

On-premise payroll software requires more internal resources from your organization, including dedicated IT staff who are responsible for troubleshooting any issues, updating the software as needed, and ensuring your payroll data is sufficiently backed up. It is more appropriate for organizations that prefer having direct control over their data systems and have the necessary IT infrastructure to maintain them internally.

Are there industry-specific payroll options out there?

Payroll software isn’t one-size-fits-all—many industries have specialized tools built to meet their unique needs. Whether you’re in construction, hospitality, manufacturing, or staffing, industry-specific systems go beyond basic payroll with features tailored to your day-to-day operations.

For example, construction payroll software supports union dues, certified payroll reporting, job costing, and multi-site management. Restaurant payroll tools handle tip distribution, shift scheduling, and integrate with POS systems for accurate, sales-based pay runs. Manufacturing payroll software tackles shift differentials, piece-rate pay, and syncs with production data for precise labor costing.

There are plenty of niche options out there, so take time to explore vendors—or use our search bar to see if we’ve already reviewed the right fit for your industry.

Other Payroll Software Reviews

If this list didn't have exactly what you were hoping for, worry not. There are other types of payroll software out there that may be a better fit for your needs:

- Payroll Software for Small Businesses

- Payroll Software for CAD Businesses

- Automated Payroll Software

- Free Payroll Software

- Payroll Software for Contractors

- Payroll software for Mac

More Resources for Payroll Pros

Trying to brush up on your payroll best practices? These detailed guides and how-to articles will point you in the right direction:

- How To Manage Payroll For Small Business (for SMBs and startups)

- Simple checklist for running a successful payroll (for first-time payroll warriors)

- Payroll Costs: A Comprehensive Breakdown and Tips to Reduce (to save $$)

- Or our detailed guides on Wage Administration and Understanding Payroll Taxes (to ensure you're up-to-date on everything payroll-related)

Manage Your Workforce Expenses Better with Online Payroll Software

Online payroll software helps you minimize human errors and makes it easier to stay compliant with the latest tax regulations. At the same time, this type of solution allows you to offer benefits to your remote or hybrid workers, reducing churn and increasing employee satisfaction.

As Lisa Shuster, the Chief People Officer for iHire, said: “[...] employers need to be creative and comprehensive with their total rewards strategy, which comprises compensation, benefits, developmental opportunities, recognition and other perks that motivate staff and enable a top-notch employee experience.

Consider offering mental health benefits, well-being and family caregiving support and financial planning services in your total rewards strategy. Invest in workers’ professional development with the idea that you can enable brighter futures through upskilling, internal career paths or debt-free college education. Though, flexibility is perhaps the most sought-after benefit of all.”

Join Our Mailing List

If you found this article helpful, consider subscribing to our People Managing People newsletter. Our industry experts cover everything from how to master your payroll challenges, to how to capitalize on the latest compensation trends to keep your top talent in place. Plus, you'll get it delivered straight into your inbox for free.