Best Payroll Software for Manufacturing Shortlist

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

With so many payroll software options for manufacturing, choosing the right one is tough. Drawing from my years of experience using various HR and payroll tools, I've put together a list of the best payroll software for manufacturing settings.

Let me help you find the tool you need to streamline payroll, handle complex labor regulations, manage overtime and shift differentials, and integrate seamlessly with your existing systems.

Why Trust Our Software Reviews

We’ve been testing and reviewing recruiting software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Payroll Software For Manufacturing Summary

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll and compliance for international teams | Free trial + demo available | From $29/month | Website | |

| 2 | Best for recruiting, managing shifts, and training | Free demo available | Pricing upon request | Website | |

| 3 | Best for payroll without manual intervention | 30-day free trial | Pricing upon request | Website | |

| 4 | Best for small manufacturing businesses | 90-day free trial | Pricing upon request | Website | |

| 5 | Best for flexible scheduling and labor management in manufacturing | Not available | Pricing upon request | Website | |

| 6 | Best for workforce management and compliance in manufacturing | Free demo available | From $6/user/month (billed annually) | Website | |

| 7 | Best for comprehensive payroll and HR solutions tailored to manufacturing | Free demo available | Pricing upon request | Website | |

| 8 | Best for managing global payroll and local compliance | Not available | From $25/user/month (billed annually) | Website | |

| 9 | Best for unified payroll and IT management with global capabilities | Free demo available | From $8/user/month (billed annually) | Website | |

| 10 | Best for automated payroll and tax compliance with HR support | 30-day free trial | From $30/user/month | Website |

-

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

ClearCompany

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Payroll Software for Manufacturing Reviews

This in-depth analysis provides overviews of each payroll software tailored for the manufacturing industry. I will walk through the pros and cons of each tool, their features, and their best use cases.

Deel is a global people platform that simplifies the onboarding, offboarding, and HR processes for global teams. It stands out because it allows companies to hire worldwide without opening legal entities, streamlines HR for global teams, and offers consolidated payroll with full compliance.

Why I picked Deel:

I chose Deel for its comprehensive global payroll and compliance capabilities, which stand out in the market. Deel's ability to handle payroll and compliance in over 150 countries makes it an ideal choice for manufacturing companies with international teams. Its all-in-one platform simplifies complex processes, ensuring compliance with local laws and regulations.

Standout features & integrations:

Standout features include real-time reporting on payroll activities, a centralized dashboard for both payroll and compliance monitoring, and automated tax and deduction calculations for each country. These features significantly reduce the manual workload and help ensure accuracy and compliance with local regulations. Deel’s platform also supports multi-currency payouts, which is essential for global operations.

Integrations include QuickBooks, Xero, NetSuite, BambooHR, Greenhouse, Workday, Slack, Gusto, Rippling, and ADP.

Pros and cons

Pros:

- Scalable for all business sizes

- Compliance management

- Comprehensive global payroll

Cons:

- Setup may require a slight learning curve for new users

- No mobile app available

Paylocity offers a comprehensive HR and payroll solution tailored for the manufacturing industry, integrating advanced analytics and a range of other features to optimize workforce management.

Why I picked Paylocity:

I picked Paylocity because it covers core workforce needs like recruiting, shift management, and training. The platform’s scheduling tool helps you build and adjust shifts by role, location, or skill, while employees can swap shifts or set availability on mobile. Its recruiting module supports hiring with features like automated job postings, resume tracking, and candidate communication. On the training side, Paylocity’s learning management system gives you access to safety and compliance courses, and you can assign and track completion directly in the system.

Standout features & integrations:

Paylocity's features include automated payroll processing, real-time labor cost tracking, and customizable on-demand learning modules. The software also supports mobile punch and geofencing for time tracking, ensuring accurate payroll calculations.

Integrations include QuickBooks, ADP, Gusto, APS, Deel, Rippling, Remofirst, FreshBooks, Dayforce, and QuickBooks Payroll.

Pros and cons

Pros:

- Customizable learning modules

- Mobile punch and geofencing

- Advanced analytics

Cons:

- Requires setup fee

- Limited to paid plans

- Minimum seat requirement

Paycor is a payroll and HR software platform that helps businesses simplify complex payroll processes and automate critical workforce tasks. It’s well-suited for manufacturing companies managing diverse shifts, labor costs, and strict compliance requirements.

Why I Picked Paycor: I picked Paycor for its intelligent payroll automation, which helps manufacturing businesses manage payroll with real-time calculations and automatic processing. I especially like that it can handle complex pay cycles while staying compliant with federal, state, and local regulations. Paycor also stands out for its AutoRun functionality, which allows payroll to process on a schedule without manual intervention—great for busy manufacturing teams. Additionally, Paycor’s built-in compliance support is useful for manufacturers navigating evolving labor laws.

Standout features & integrations:

Features include AutoRun for automated payroll processing, real-time payroll calculations, and flexible pay options like direct deposit, paycards, and earned wage access. Paycor also offers workforce management tools like time tracking, scheduling, and labor cost analysis.

Integrations include QuickBooks, Xero, SAP Concur, Indeed, LinkedIn, Glassdoor, Zapier, Microsoft Teams, Slack, and DocuSign.

Pros and cons

Pros:

- Wide range of integrations with popular tools

- Advanced employee performance tracking

- Industry-specific HR and payroll solutions

Cons:

- May require additional support for full customization

- UX can feel a bit clunky at times

RUN by ADP is a payroll and HR management tool tailored for small businesses with fewer than 50 employees. It simplifies payroll processing, tax management, and compliance with a wide range of features.

Why I picked RUN by ADP:

I like its robust payroll management system, which ensures fast and accurate payroll processing. This is particularly beneficial for manufacturing businesses that often deal with complex payroll structures, including varying shift patterns and overtime calculations. The software's automated tax filing and reporting capabilities further enhance payroll operations, reducing the risk of errors and ensuring compliance with ever-changing tax regulations.

Standout features & integrations:

Standout features include an employee self-service portal and mobile app, allowing employees to access information anywhere, anytime. It also offers advanced time and attendance tracking tools as an add-on to help manage labor costs effectively by providing real-time visibility into employee hours, overtime, and scheduling.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Automatically handles tax calculations and filings

- Robust mobile app

- Good compliance support

Cons:

- Many HR features are limited to higher-tier plans

- Initial setup can be complex

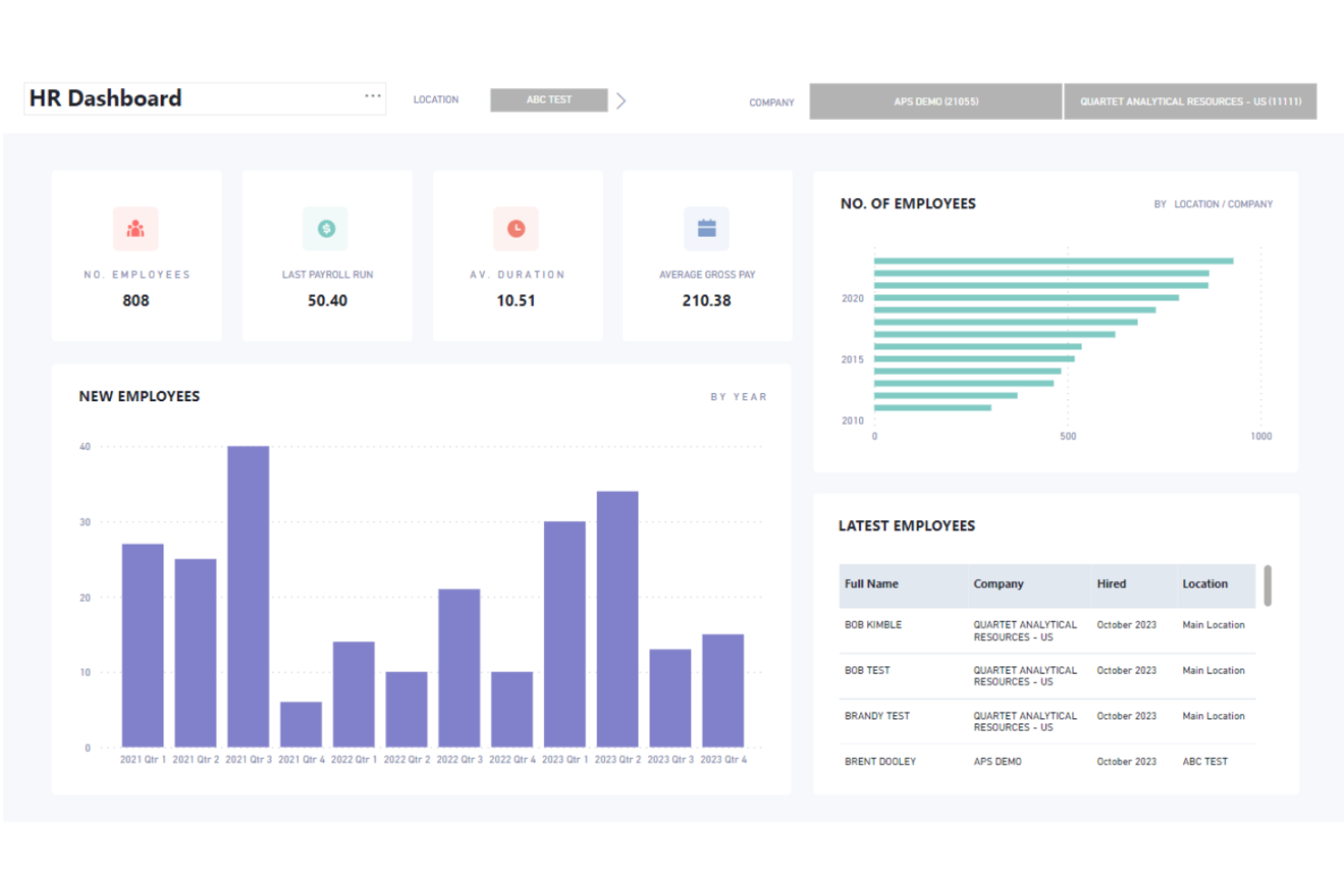

APS

Best for flexible scheduling and labor management in manufacturing

APS Payroll offers a comprehensive payroll and HR software solution for manufacturing companies, providing a range of services including paperless payroll, core HR, benefits administration, performance management, attendance, scheduling, Affordable Care Act reporting, and more. APS is designed to address the specific needs of manufacturing companies in managing employee safety and productivity, and automating core processes.

Why I picked APS:

I chose APS for its robust features tailored specifically for the manufacturing industry. APS stands out for its ability to manage complex scheduling and labor management needs, which are critical in manufacturing environments. The software's flexibility in handling various employee classifications and multiple locations makes it an ideal choice for manufacturing companies.

Standout features & integrations:

Standout features include flexible scheduling, labor management, intuitive reporting, asset tracking, and mobile management.

APS integrates natively with popular time-tracking software and shop management systems, including Sage Intacct, QuickBooks, NetSuite, ADP, Paychex, Kronos, Acumatica, AMGTime, Ascensus, Acuity Scheduling, and more.

Pros and cons

Pros:

- Intuitive reporting

- Comprehensive labor management

- Flexible scheduling

Cons:

- Slight learning curve for new users

- Limited report and interface customization

Dayforce is a comprehensive payroll and HR software solution designed for manufacturing companies. It helps optimize labor costs, boost productivity, and ensure compliance with industry regulations.

Why I picked Dayforce:

I chose Dayforce for its robust workforce management capabilities tailored specifically for the manufacturing sector. The platform stands out for its ability to streamline operations, manage compliance, and provide real-time visibility into workforce performance.

Standout features & integrations:

Dayforce offers several standout features, including advanced scheduling, real-time labor cost management, and compliance automation. The platform also provides tools for employee training and development, ensuring a skilled and compliant workforce.

Integrations include popular tools such as ADP, SAP, Oracle, Workday, Microsoft Dynamics, Salesforce, QuickBooks, NetSuite, Kronos, and BambooHR.

Pros and cons

Pros:

- Compliance automation

- Advanced scheduling tools

- Real-time labor cost management

Cons:

- May be cost prohibitive for small businesses

- Limited customization options

- Complex initial setup

ADP offers a full suite of payroll and HR solutions specifically designed for the manufacturing industry. It excels because it combines industry expertise with client input to create solutions that meet the unique needs of manufacturing businesses.

Why I picked ADP:

I chose ADP for its extensive range of payroll and HR services that are specifically tailored to the manufacturing sector. ADP stands out due to its ability to handle complex payroll needs, such as multiple pay rates and shift tracking, which are common in manufacturing environments. I believe ADP is best for comprehensive payroll and HR solutions because it integrates payroll, time tracking, and HR services into a single platform, making it easier for manufacturing businesses to manage their workforce efficiently.

Standout features & integrations:

ADP's standout features include fast and accurate payroll processing, time and attendance tracking, and comprehensive HR services. The platform also offers data analytics tools to help businesses make strategic decisions.

Integrations include QuickBooks, Xero, Microsoft Dynamics, Oracle, SAP, Workday, Salesforce, BambooHR, Slack, and Google Workspace.

Pros and cons

Pros:

- Data analytics tools

- Accurate payroll processing

- Able to perform complex HR tasks

Cons:

- Limited customization options

- May require support for setup

Remofirst is a global payroll service provider that offers comprehensive solutions for managing international payroll and local compliance. It simplifies the process of hiring, paying, and managing employees and contractors across 180+ countries.

Remofirst is best for managing global payroll and local compliance because it consolidates international payroll into one simple approval process, ensuring timely and accurate payments in local currencies while adhering to local laws and regulations.

Why I picked Remofirst:

I chose Remofirst for its specialized capabilities in handling global payroll and compliance, which are critical for manufacturing companies with international operations. It is best for managing global payroll and local compliance because it consolidates international payroll into one simple approval process, ensuring timely and accurate payments in local currencies while adhering to local laws and regulations.

Standout features & integrations:

Standard features include automatic calculation of hours, time off, holidays, bonuses, and commissions into payroll. It also provides local benefits management, equipment provisioning, and 24/7 customer support with a dedicated account manager.

Integrations include ADP.

Pros and cons

Pros:

- 24/7 customer support

- Local compliance expertise

- Comprehensive global payroll management

Cons:

- Limited integration options

- No mobile app

Rippling

Best for unified payroll and IT management with global capabilities

Rippling is an online payroll processing software and service that offers HR, IT, and finance cloud solutions for businesses. It provides features such as payroll processing, compliance automation, payroll analytics, role-based permissions, and global payroll capabilities.

Why I picked Rippling:

I chose Rippling for its comprehensive approach to payroll and IT management, which is particularly beneficial for manufacturing companies with global operations. Rippling stands out due to its ability to unify payroll and IT management, making it easier to handle both HR and IT tasks from a single platform. This integration is crucial for manufacturing businesses that need to manage a diverse and widespread workforce efficiently.

Standout features & integrations:

Standout features include automated payroll processing, compliance management, payroll analytics, and role-based permissions. It also supports global payroll, allowing businesses to pay employees and contractors worldwide.

Rippling integrates with over 500 tools, including Google Workspace, Checkr, Slack, Zoom, Microsoft365, Jira, AWS, Github, Brex, Carta, PayPal, and Salesforce.

Pros and cons

Pros:

- Extensive integrations

- Global payroll capabilities

- Unified payroll and IT management

Cons:

- Limited customer support options

- May require training for new users

- Pricing can be complex

Best for automated payroll and tax compliance with HR support

Quickbooks Payroll offers comprehensive payroll services tailored for manufacturing businesses, focusing on automated payroll and tax compliance with added HR support. It is designed to streamline payroll processes, ensuring accuracy and compliance with tax regulations.

Why I picked Quickbooks Payroll:

I chose Quickbooks Payroll for its robust automation features that simplify payroll and tax compliance, making it an ideal choice for manufacturing businesses. The tool stands out due to its comprehensive HR support, which is crucial for managing a diverse workforce in the manufacturing sector.

Standout features & integrations:

Standout features include Auto Payroll, same-day direct deposit, time tracking, and tax penalty protection. It also offers HR support, health benefits, and workers' compensation management.

Integrations include QuickBooks Online, QuickBooks Time, SimplyInsured, Mineral, Next Insurance, TSheets, Expensify, Gusto, Xero, ADP, and more.

Pros and cons

Pros:

- Comprehensive HR support

- Same-day direct deposit

- Automated tax filings

Cons:

- Additional fees for some features

- Limited to QuickBooks ecosystem

Other Payroll Software for Manufacturing To Consider

Below is a list of additional payroll software for manufacturing that we shortlisted, but did not make it to the top list. Definitely worth checking them out.

- TimeTrex

For handling complex pay structures

- Paycor

For tailored HR and payroll solutions with industry-specific features

- Gusto

For automated payroll and HR with robust compliance features

- Workday

For comprehensive enterprise planning and workforce management

- Paychex Flex

Good for scalable payroll solutions

- Papaya Global

Good for global payroll management

- Remote

Good for managing international payroll

- BambooHR

Good for HR integration with payroll

- OnPay

Good for small businesses needing comprehensive payrol

- SAP SuccessFactors

Good for comprehensive HR and payroll solutions

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Payroll Software for Manufacturing Selection Criteria

Selecting payroll software for manufacturing requires a focus on functionality and meeting specific use cases that matter most. As an expert who has personally tried and researched these tools, I can provide insights into the criteria that are essential for making an informed decision. These criteria relate directly to software buyer needs, addressing pain points, and ensuring the software is used effectively.

Core X Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Accurate payroll processing

- Compliance with labor laws and regulations

- Time and attendance tracking

- Employee self-service portals

- Integration with accounting systems

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Mobile access for on-the-go management

- Advanced reporting and analytics

- Customizable workflows

- Integration with other HR tools

- Automated tax filing

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive user interface

- Drag-and-drop scheduling

- Easy navigation

- Role-based access configuration

- Customizable dashboards

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Availability of training videos

- Interactive product tours

- Chatbots for instant support

- Webinars for in-depth training

- Pre-built templates for quick setup

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- 24/7 support availability

- Multiple support channels (phone, email, chat)

- Dedicated account managers

- Comprehensive knowledge base

- Fast response times

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models

- Flexible subscription plans

- Cost-benefit analysis

- Discounts for long-term commitments

- ROI potential

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support quality

- Reviews on feature effectiveness

- Testimonials on implementation experience

How To Choose Payroll Software for Manufacturing

As you work through your own unique software selection process, keep the following points in mind:

- Industry-Specific Features: Manufacturing companies often have unique payroll needs, such as piece rate pay, shift differentials, and complex overtime calculations. Look for payroll software that can handle these specific requirements.

- Integration Capabilities: Manufacturing businesses typically use various systems for time tracking, HR, and accounting. Ensure the payroll software can seamlessly integrate with these systems to avoid data silos and ensure consistency.

- Compliance Management: Manufacturing companies often operate across multiple jurisdictions, each with its own set of labor laws and tax regulations. Choose software that can automatically update and comply with these regulations to avoid legal issues.

- Employee Self-Service: Employee self-service portals can save time and reduce administrative workload by allowing employees to manage their own information, such as updating addresses or direct deposit details. This feature is particularly useful in manufacturing settings where employees may work different shifts and need easy access to their payroll information.

- Scalability and Flexibility: As your manufacturing business grows, your payroll needs will become more complex. Choose a payroll software that can scale with your business and adapt to changing requirements.

Trends for payroll Software for Manufacturing In 2025

Manufacturing payroll software is evolving rapidly. Here are some key trends to watch.

- AI-Powered Payroll Processing: AI is automating payroll tasks, reducing errors and saving time. This technology can handle complex calculations and compliance issues. It is crucial for improving efficiency in payroll management.

- Blockchain for Payroll Security: Blockchain technology is being used to secure payroll data. It ensures transparency and prevents tampering. This trend is important for protecting sensitive employee information.

- Mobile Payroll Solutions: Mobile apps enable payroll management on the go. Employees can access their pay information anytime, anywhere. This trend is significant for increasing accessibility and convenience.

- Cloud-Based Payroll Systems: Cloud-based systems are becoming the norm for payroll management. They offer scalability and remote access. This trend is vital for businesses looking to adapt to flexible work environments.

- Integration with HR and ERP Systems: Payroll software is increasingly integrating with HR and ERP systems. This integration streamlines data flow and improves accuracy. It is essential for creating a unified business management system.

As these trends illustrate, payroll software in the manufacturing industry is becoming more sophisticated, with a strong focus on AI, Cloud and Mobile technology, and integration with other popular business tools. Keep an eye on these trends that are shaping the future of payroll software in manufacturing in 2025.

What Is Payroll Software for Manufacturing?

Payroll software for manufacturing is a tool designed to manage and automate the payroll process for manufacturing companies. It is used by HR departments, payroll managers, and finance teams to ensure accurate and timely payment of wages to employees. This software helps users handle complex payroll calculations, tax compliance, and benefits administration specific to the manufacturing sector.

The components of payroll software for manufacturing typically include time and attendance tracking, wage calculation, tax filing, and benefits management. It also integrates with other HR systems to streamline data flow and reduce manual entry errors. This ensures that payroll processes are efficient and compliant with industry regulations.

Features of Payroll Software for Manufacturing

When selecting payroll software for a manufacturing business, it is crucial to consider features that cater specifically to the unique needs of the industry. Manufacturing companies often deal with complex pay structures, multiple shifts, and compliance with various regulations. The right payroll software can streamline these processes, ensuring accuracy and efficiency. Here are the key features to look for:

- Time Tracking Integration: This feature ensures accurate wage calculations by automatically syncing work hours to payroll. It reduces manual entry, minimizing errors and saving administrative time.

- Direct Deposit: Direct deposit provides employees with instant access to their paychecks, reducing the need for physical checks and administrative work. It enhances employee satisfaction by ensuring timely payments.

- Expense Management: Automates the expense report and payment processes, ensuring timely and accurate reimbursements. This feature is essential for managing travel and lodging expenses in the manufacturing industry.

- Compensation Management: Helps manage and allocate a compensation budget in line with organizational goals. It aids in attracting and retaining talent by ensuring competitive and fair pay.

- Employee Self-Service: Allows employees to access and update their personal information, view pay stubs, and manage their benefits. This reduces the workload on HR and payroll administrators.

- Payroll Reports: Provides customizable reports for insights into payroll data. This feature is critical for making informed business decisions and ensuring regulatory compliance.

- Payroll Auditing and Error Reporting: Proactively flags potential errors before they occur, ensuring accurate payroll processing. This feature helps in maintaining compliance and avoiding costly mistakes.

- Tax Filing: Automates the calculation, withholding, and submission of payroll taxes. This feature ensures compliance with tax regulations and reduces the risk of penalties.

- Integrated Payroll: Allows seamless integration with other HR and accounting systems, ensuring data consistency and reducing manual data entry.

- General Ledger Mapping: Automates the transfer of payroll expenses to the general ledger, ensuring accurate financial reporting. This feature saves time and reduces errors in financial reconciliation.

- Wage Garnishment: Manages garnishment orders efficiently, ensuring compliance with legal requirements. This feature automates the deduction and remittance of garnishments from employee wages.

- Global Payroll: Supports payroll processing for international employees, managing foreign currencies, time zones, and compliance requirements. This feature is essential for manufacturing companies with a global workforce.

- On-Demand Payment: Allows employees to request a portion of their paycheck ahead of payday, providing financial flexibility. This feature enhances employee satisfaction and reduces financial stress.

Choosing the right payroll software for a manufacturing business involves considering features that address the industry's specific needs. From time-tracking integration to global payroll capabilities, each feature plays a crucial role in ensuring efficient and accurate payroll processing. By selecting software that offers these essential features, manufacturing companies can streamline their payroll processes, enhance compliance, and improve overall employee satisfaction.

Benefits of Payroll Software for Manufacturing

Implementing payroll software in the manufacturing sector can significantly improve efficiency, accuracy, and compliance. Here are five primary benefits that potential buyers should consider:

- Increased Accuracy: Payroll software minimizes human errors by automating calculations and data entry, ensuring employees are paid correctly and on time.

- Time Savings: Automating payroll processes reduces the time spent on manual tasks, allowing HR staff to focus on more strategic activities.

- Regulatory Compliance: The software helps ensure compliance with labor laws and tax regulations by automatically updating to reflect the latest legal requirements.

- Cost Efficiency: By reducing the need for manual labor and minimizing errors, payroll software can lower operational costs and improve the bottom line.

- Data Security: Payroll software provides robust security features to protect sensitive employee information from unauthorized access and data breaches.

Investing in payroll software can lead to significant improvements in operational efficiency and accuracy, making it a valuable tool for any manufacturing organization.

Costs and Pricing of Payroll Software for Manufacturing

When it comes to managing payroll in the manufacturing industry, selecting the right software can significantly streamline operations, ensure compliance, and save time.

Below, I have provided an overview of the common pricing options and features available in payroll software for manufacturing to help you find the right fit.

Plan Comparison Table: Payroll Software for Manufacturing

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic payroll processing, employee self-service, limited support |

| Basic Plan | $17/month + $4/employee | Payroll processing, direct deposit, printable W-2s, setup and expert support |

| Standard Plan | $40/month + $6/employee | Full-service payroll, tax filing, employee self-service, basic HR tools |

| Advanced Plan | $80/month + $12/employee | Multi-state payroll, next-day direct deposit, advanced HR tools, PTO management |

| Premium Plan | $125/month + $10/employee | Tax penalty protection, mobile time tracking, dedicated HR advisor, compliance |

Consider the size of your business, the complexity of your payroll needs, and the level of support required when choosing payroll software for manufacturing. Each plan offers different features and pricing, so you can choose which one aligns with your business goals and budget based on your needs.

Payroll Software for Manufacturing FAQs

Here are some answers to frequently asked questions you may have about payroll software tools, how it works, and how these tools can be leveraged for the manufacturing industry:

What is the best payroll software for manufacturing companies?

The best payroll software for a manufacturing company often includes features tailored to the specific needs of the industry. Look for software that supports piece rate pay, integrates with existing time and attendance systems, and offers robust reporting capabilities. Established companies with experience in the manufacturing sector, such as TruPay and VensureHR, are often good choices as they can provide tailored solutions and dedicated support teams to assist with implementation and ongoing management.

How can payroll software improve efficiency in a manufacturing company?

Payroll software can significantly improve efficiency by automating time-consuming tasks such as calculating overtime, managing piece rate pay, and ensuring compliance with tax regulations. It reduces the need for manual data entry, minimizes errors, and provides real-time access to payroll data. Additionally, features like employee self-service portals and integration with other HR systems streamline processes and free up time for HR staff to focus on strategic initiatives.

How does payroll software handle compliance with tax regulations?

Payroll software helps ensure compliance with tax regulations by automating the calculation, deduction, and reporting of payroll taxes. It keeps track of changes in tax laws and updates the system accordingly. Many payroll software solutions also offer features for filing tax forms and making tax deposits, reducing the risk of errors and penalties. Providers like TruPay and VensureHR offer comprehensive compliance support as part of their payroll services.

What kind of customer support should I expect from a payroll software provider?

When evaluating payroll software providers, look for those that offer robust customer support, including:

- 24/7 Availability: Access to support at any time, especially during critical payroll processing periods.

- Dedicated Support Teams: Personalized assistance from experts familiar with your industry and specific needs.

- Training and Resources: Comprehensive training programs and resources to help your team get the most out of the software.

- High Customer Retention Rates: Indicative of satisfied customers and reliable support services.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.