For as long as I can remember I have been mildly obsessed with compensation. Possibly driven by excitement, curiosity, nosiness, or all three, I found it fascinating to know what the top executives at my favorite companies were making and how they made it.

Have you heard about Starbucks’ new CEO and his lucrative compensation package? Brian Niccol could make as much as $113 million by joining the Seattle-based coffee brand. But does that mean Starbucks writes a check for $100+ million on day one? No. That number varies based on company performance and stock performance.

So how does one find out or learn about the intricacies of such a dynamic pay plan?

The Compensation Landscape

Over the past 4 years, HR has proven to be a rapidly growing and simultaneously changing field. DEI, pay equity, employee experience, and wellbeing have all played a role in the industry’s emergence.

One HR field that has been playing a big part in its emergence as a business driver is, in fact, not new at all. It’s probably one of the most fundamental of all the HR functions- compensation.

Compensation encompasses the practices in how an organization establishes the way they will incentivize employees - from entry-level talent all the way through to executives. Specifically, executive compensation has become a topic of conversation for a variety of reasons.

As pay equity and worker’s rights have become mainstream talking points, many companies are being called out for their CEO-to-employee pay ratio, starting rates, and inconsistencies in gender pay equality.

But how does one make sense of the world of compensation without working in a Total Rewards role or paying money for a payroll course?

Why You Should Master Total Compensation

The world of total compensation goes well beyond what someone brings home in their paycheck every week. Total compensation, when done well, can incentivize employees to meet specific targets, gain market share, and increase employee and customer satisfaction.

Typically, pay-for-performance programs incentivize employees to drive results in key areas that contribute to the long-term health of the company.

There are 4 major reasons why HR professionals should care about total compensation.

1. Understand how pay and incentives work

Let’s take off your HR hat for a second and talk about you as an employee. Knowledge is power and it could result in you earning more money. It could also give you more negotiating power when offered your next promotion or job offer.

As you grow your career, there will be an increasing number of pay components to your compensation package. Understanding these components is critical.

When I was first starting out my career, I was offered a role with a base salary and a Restricted Stock Unit (RSU) component to the offer. Not knowing what RSUs were, I dismissed them outright and didn’t put thought into what had the potential to be a lucrative part of the offer.

Without all of the information I should have had, I declined the job offer leaving a significant amount of money on the table. Had I had the right information, I’m confident my decision would’ve been different.

2. You can construct programs that drive company performance

If your goal is to get to the head HR spot in your company, understanding compensation is a must. It’s a space where a lot of CHROs spend their time given its importance, regulatory nature, and relevance to the employee lifecycle.

3. Spare your org a lot of regulatory headaches

Certain compensation decisions not only have legalities around them but some have to be reported to the board of directors. If you’re part of a company that has gone public, you may also have to report them to the Securities and Exchange Commission (SEC).

4. Compensation philosophy and structure can drive better company performance

When done well, a company’s compensation philosophy has the ability to drive employee engagement, performance metrics, and satisfaction, and help your organization’s strategy be more effective.

The most fundamental aspect of the relationship between company and employee is built on the premise of employees giving their time and expertise in exchange for money. To add complexity to that simple notion, companies sometimes offer incentives for better performance or for hitting key performance metrics.

An employee may get an annual raise for putting in more effort. A leader may be incentivized to drive retention on their team. A company may offer tenure milestone bonuses to drive retention and keep people at the company.

There are an infinite number of ways you can construct these programs, but you typically build compensation structures off of strategic goals and opportunities identified in reviews of your compensation processes.

If you want employees to drive customer service, develop a program where bonuses are paid out based on customer satisfaction metrics. Use these programs to ensure employees have a reason to focus on the right things.

Executives in a public company are incentivized to drive stock prices. These incentives ensure executives make the best decisions for the organization as they have a personal stake in the outcome, something a base salary may not always ensure.

How To Learn More About Compensation

If you want to learn more about pay strategies, compensation fundamentals, and how some of those executives get paid, there is a way you can grow your skills… for free.

This is also a fun, easy, and oddly satisfying (for me at least) way to learn some of the most complex compensation structures and tools.

Whether you want to learn compensation for a public company, private, not-for-profit, big company, small company, hourly population, or salaried population, this process will increase your compensation knowledge.

The Learning Process

Think about your favorite public company. Any company that has a board of directors and is publicly traded will do. Examples might include Apple, Walt Disney Company, Nike, etc. Then follow these steps.

1. Google “[Company Name] Proxy Statement [Insert current year]”

You are most likely going to be given options that take you to said company’s investor relations page where you will find the most recent proxy statement for the company.

A proxy statement is an official SEC filing that public companies produce annually (typically before major shareholder meetings) to publish important, relevant information.

Different from an annual statement, a quarterly earnings report, and other SEC filings, most of the time all of these documents are found in the same location.

Today, we will specifically be looking at the proxy statement.

2. Click on and open the proxy statement for the year

This file will most likely be 100+ pages. At first glance, it may be overwhelming but that’s okay, we are particularly interested in the section focused on “Executive Compensation.” Most proxy statements have a table of contents and the really fancy ones have hyperlinks to each section.

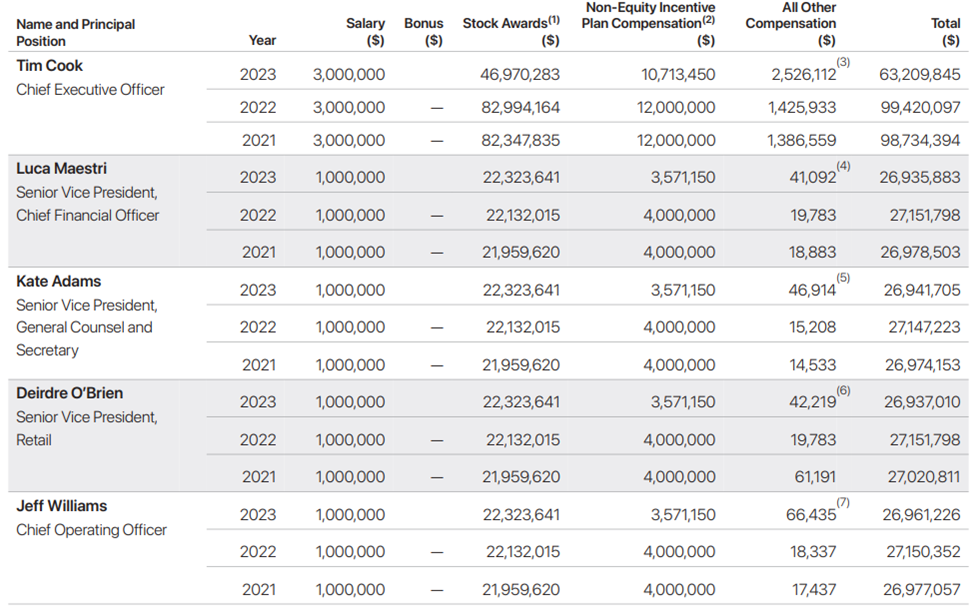

This section outlines how executives in the company are paid and what their total compensation package looks like. What we’re looking for is what the proxy statement will refer to as ‘Named Executive Officers’ (NEOs).

If you consume enough proxy statements, you will find that a lot of the concepts are similar.

I recommend printing the executive compensation section out so you have a version you can take notes on.

3. Review the “executive compensation section”

It’s long and wordy and can be a bit jargon-y. Don’t try to read it all at once. The idea in this step is that you’re going to get a lay of the land of the document.

Looking at this section can teach you a few things. First, what executives (or NEOs) take home in pay.

Second, you will find out how companies incentivize their leaders. This section can answer a few questions:

- What is the amount of “at risk” compensation in the executive’s portfolio? The term ‘at risk compensation' is used to identify parts of the compensation package that won’t be paid unless certain thresholds or metrics are met. Base pay would NOT be an example of at-risk comp, but a short-term incentive program would be.

- What does the company prioritize? This section will tell you if certain incentive programs are measured by customer satisfaction, stock performance, new business growth, diversity metrics, etc.

- What other non-cash/stock benefits do executives receive? This could include private security, gift-giving grants, car allowances, etc.

- Do they prioritize long-term cash? Stock performance?

4. Go back to the start and let the real fun begin…

You read that right. Go back and read the document again starting from the beginning.

Every time you come across a concept/word/phrase you don’t know, search on YouTube for a video (ideally under 3 minutes) to review the concept/word/phrase.

This will help you gain a better understanding of it and educate you on the concept. Continue to review materials until you feel like you have a cliff notes understanding of the concept.

You want to know enough to discuss with colleagues but don’t need to go so deep that you’re able to be a subject matter expert in a courtroom. Once you’ve got it, you can resume reviewing the proxy statement.

Below is an example of the type of information you will glean from such a report.

While this can take some time, the proxy statement is a wealth of information and a great educational tool.

Large companies tend to compensate their executives in a variety of ways. Typically there are 3-5 avenues for companies to compensate executives including base salary, short-term incentive, restricted stock units, stock options, etc.

Whether you’re looking for knowledge or ideas around base salary or the most complex of situations, it’s likely that a proxy statement will outline something that could be useful to you.

Value for Smaller Orgs

You might be looking at this and thinking why should I bother? We're a small company, I don't need to think about this right now.

The value of the exercise is in understanding the various mechanisms for compensating your executive team and how to communicate that. Not just to your exec team and regulatory bodies, but to your employees and the public as well.

If you're part of an organization with big ambitions and scaling up operations, it's a good idea to understand how you need to structure pay for executives. While you may not have all the resources to compete with a big company you're drawing inspiration from, you can gain a base understanding of what executives are looking for and what your compensation strategy can accommodate.

What's Next?

Want to keep up with all the latest in compensation and benefits? Sign up for the People Managing People newsletter and you'll get all the latest trends, expert insights and how to guides straight to your inbox.