Compensation is more than a paycheck—it’s one of the clearest signals of how a company values its people. When it’s misaligned with effort or expectations, it can lead to mistrust, disengagement, and burnout.

Our research found that 1 in 5 professionals would give up consciousness at work just to separate their job from their personal life—a striking data point that underscores how deeply compensation and wellbeing are connected.

A clear compensation philosophy helps close that gap, aligning pay with your values and giving employees confidence in how decisions are made.

What Is A Compensation Philosophy?

A compensation philosophy, sometimes called a compensation or pay philosophy, is a shared document that outlines an organization's approach and standing on how they reward their employees for work and how work should be done.

It acts as a framework for making compensation decisions around salaries, bonuses/commissions, equity, and benefits.

The aim is to help align compensation with the organization’s strategic goals, considering factors such as most valuable roles, financial position, size, market standing, industry, and values.

While in this article I focus on different compensation approaches and salary bands, it’s important to note that salaries are just one aspect of the overall compensation package.

A well-rounded compensation philosophy includes total compensation, salary structure, and raise/promotion models.

Why Is A Compensation Philosophy Important?

Compensation is a key driver of employee retention, engagement, and recruitment. Having a codified compensation philosophy is important because it leads to better decision-making around employee compensation and will ultimately help you attract and retain top talent.

It also helps in providing transparency to employees around pay, which helps build trust and promotes pay equity.

The benefits of a compensation philosophy include:

Alignment with business strategy

A compensation philosophy helps ensure that your pay structure aligns with the company's overall business strategy. This alignment helps attract and retain the right talent that can drive the company toward its strategic goals.

Market competitiveness

A company’s compensation philosophy helps it position itself competitively in the job market. By understanding and defining how you want to compare with similar organizations in terms of pay (e.g., above, at, or below market averages), you can make informed decisions about its pay scales.

Internal equity and fairness

A clear compensation philosophy promotes fairness and equity within the organization. It ensures that employees receive equitable pay for their contributions and responsibilities, and minimizes discrepancies that could lead to dissatisfaction or legal challenges.

I highly recommend you develop the practice of checking for pay equity as part of your compensation philosophy.

Employee motivation and satisfaction

Compensation is a key factor in employee motivation and job satisfaction. A compensation philosophy that is perceived as fair and competitive can enhance employee engagement and productivity.

Legal compliance

It aids in ensuring compliance with legal and regulatory requirements. A clear philosophy helps in structuring compensation programs that adhere to laws regarding minimum wages, overtime pay, and equal pay.

Budget management

Understanding compensation goals and constraints helps in allocating resources effectively and managing the company's budget. This enables better financial planning and budget management.

Transparency and trust

A well-articulated compensation philosophy enhances transparency. When employees understand how and why they are compensated in a certain way, it improves trust and communication within the organization.

Flexibility and adaptability

A robust compensation philosophy helps you to adapt to changes in the market, economy, or strategic direction by providing a framework for making adjustments to compensation structures as needed.

Types of compensation strategies

Here I’ll highlight the three most common strategies that are easiest and most accurate to us: lag, match, and lead.

You can use one for the whole organization or a mix! This will depend on the organization’s philosophy and market (in simple economic terms: demand and supply for the talent you are recruiting and retaining).

Percentile defined: Quick definition before we move on. A percentile in our context indicates the level at which a certain percentage of workers earn less than a given salary. For example, being in the 90th percentile means that 90% of workers earn less than that salary, while 10% earn more.

Lag-in-the-market strategy: Lower than the market median

Lag-the-market refers to a compensation strategy below the 50th percentile, indicating salaries lower than the market median.

Typically adopted by: Non-profits, struggling companies, organizations with little competition, a large supply of potential employees, or those offering substantial non-monetary perks.

Advantages:

- Attracts employees aligned with organizational values.

- Reduces overhead costs.

- Enables investment in comprehensive total rewards packages.

Key consideration: If you’re going for a Lag strategy, ensure that the non-monetary benefits and organizational values are compelling enough to attract and retain talent despite lower salary offerings.

Match-the-market strategy: Aligned with the market median

A match-the-market strategy means you will pay the median of what the marketplace is, which includes the lowest, highest, and everything in between salaries. This means you will be paying the market median (50th percentile).

Usually adopted by: Employers who don’t lack talent attraction and organizations in an employer-driven market.

Advantages:

- Balances competitiveness and cost: Aligns compensation costs with market standards while staying competitive in talent acquisition.

- Attracts and retains standard industry talent: Suitable for attracting professionals seeking fair industry-standard compensation.

Key consideration: When adopting a Match-the-Market strategy, it's crucial to regularly monitor market salary trends to stay current. Also, companies need to ensure they offer additional incentives or benefits to differentiate themselves, as compensation alone will be similar to that of other market players.

Lead-the-market strategy: Above the market median

This means you’ll pay above the market median (75th percentile). A lead-the-market strategy means you are one of the top payers for talent in your marketplace.

Usually adopted by: The strategy is usually used by organizations that are in an employee-driven market, have high competition, or are in an industry where salaries are constantly increasing.

Advantages:

- Attracts top talent: Competitive compensation is highly effective in attracting and retaining top talent including high-performers and industry leaders.

- Enhances company reputation: Positions the company as an employer of choice, enhancing its employer brand and attractiveness to potential employees.

- Promotes innovation and excellence: By attracting top talent, it fosters a culture of innovation, excellence, and industry leadership.

Key consideration: Implementing a Lead-the-Market strategy requires significant financial resources and careful budget management. It may also raise expectations for high performance and results from employees.

Compensation Philosophy Examples

Each organization’s compensation philosophy will differ depending on its industry, region, resources, and the type of talent it wants to attract, as shown by these examples:

- “Lesser base but more perks.” The government of Canada is known for paying below the market median but offering perks that are unheard of elsewhere in Canada. Some of these are double or more paid vacation time and PTO, generous pension plans, reduced work hours, average performance expectations, and unionized environments.

- “Middle of the road.” Financial institutions (with the exception of investment banking) are known for paying median salaries, having decent total rewards packages, and having regular expectations for performance.

- “High salaries and high expectations.” Tech giants are known for being one of the top payers for their HQ employees in Canada with above-median salaries, generous sign-on bonuses, and high-yielding RSUs. The downside is that they expect top performance, more than average work hours, and unpaid on-call for certain roles.

How To Create Your Compensation Philosophy

Creating a compensation philosophy involves a structured approach to defining how an organization values and compensates its employees.

1. Assess organizational goals and culture

Align the compensation philosophy with the organization's overall mission, values, and strategic objectives.

Actions:

- Form a compensation committee comprised human resources/P&C, a finance executive, and the CEO

- Put together a first draft of your compensation philosophy using input from each stakeholder.

Top tip: It should be very clear who the owners of each action are and what the expectations of the new tasks are. Some of the questions you should answer include:

- Are all my salary bands created using the same salary percentile?

- Are each of my jobs defined and tied to a data set (role matching)? Ex. For the software developers in my organization, we are using the data set ‘software engineers’. You want the role from your data set to match the role in your organization at least 60%.*

- What is our cadence for checking external salary data?

- Who will be refreshing our salary bands and when?

- Who will be responsible for keeping a pulse on pay equity?

- Have we rolled out this process transparently to employees?

- Are discussions around compensation used as a part of employee development conversations?

- How often will we reassess our core compensation philosophy?

- Do we adopt one compensation philosophy across the board, or multiple philosophies for different areas of the organization where labor competition might be tighter?

2. Analyze market and industry standards

Understand the competitive landscape to ensure your compensation is competitive and fair.

Actions:

- Research salary benchmarks in your industry and region.

- Analyze competitor compensation strategies.

Some salary benchmarking datasets you may want to utilize are Salary.com, Payscale, and SalaryExpert.

After researching the data, decide if you’ll be lagging, matching, or leading the market.

3. Create your pay bands

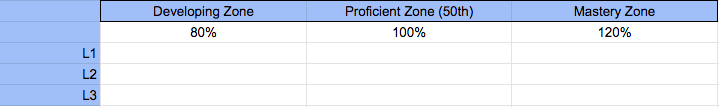

Now you’ve identified your market and model it’s time to create your pay bands for each role. One of the models I’ve used in the past is depicted below.

In the example, you will find three important items: our philosophy (three compensation zones and three different levels per role), our chosen percentile (50th), and the salary data (80-120%).

Let’s assume that you’ve agreed to use the 50th percentile for salary data and your role matching suggests that L1 is $80,000. If you fill in the blanks your pay band will look like this:

Now you can repeat this stage for all your roles and “Hooray!” your pay bands are ready.

Remember: You will use different philosophies for different sets of employees. For example, an easy-to-fill role should have a different philosophy, and therefore different benchmarks, to one that is highly skilled and more difficult to fill.

4. Create your total rewards package

Compensation goes beyond salary and it’s more important than ever that we understand our current and future workforce and offer the best package.

Total compensation refers to monetary and non-monetary benefits an employee receives.

- Total compensation. This is the monetary portion of the equation (‘take home $’) and is usually made of base salary, commission, bonus, awards, and equity.

- Total rewards. This is the nonmonetary (although costly to employers) portion. It can include benefits (extended healthcare, vision, dental), PTO, remote-friendly, flexible work schedules, learning stipends, wellness programs, etc.

Top tip: Before putting any programs in place I suggest you do focus groups, keep an eye on our employee surveys for comments, and understand how your workforce is transforming (e.g. is there a wave of ‘new parents’?) to put together the best package for your current and future workforce.

5. Communicate the philosophy to employees

As mentioned, transparency in compensation leads to better understanding and acceptance among employees.

Actions:

- Prepare clear communication materials

- Organize meetings to explain the philosophy.

Improve transparency: Develop an FAQ document and use multiple communication channels for broader reach.

6. Review

After all this hard work you should aim to do at least three types of reviews to keep your compensation philosophy and total rewards package accurate and relevant.

Compensation philosophy review

Revisiting your philosophy and making sure it is still aligned with your values. This exercise can be done once a year, or every time an impactful change has happened like a merger, acquisition, rapid growth, or change in values.

Salary band reviews

It’s best practice to revisit your salary data with updated information 3-4x per year.

I’m not suggesting you change your pay bands that often as peaks usually even out after the dust has settled.

However, you don’t want to be stuck on either side of the graph changing your salary bands when we are at rock bottom or when they are sky high because nobody wants to take a pay cut.

Total rewards

My advice is to review your total rewards annually. It’s normal that your organization will grow and change over time and thus people will too.

Through your eNPS, employee feedback/comments, industry trends, or even how extended benefits are being used, you can get a good idea of what’s most important for your organization now and in the future.

What Should A Compensation Philosophy Include?

To summarize, your compensation philosophy should include:

- Ownership: Who is responsible for maintaining and updating your compensation philosophy? This could be HR, leadership, or a dedicated compensation committee. Clear ownership ensures accountability and alignment across the organization.

- Cadence for updating: Markets shift, industries evolve, and employee expectations change. Your compensation philosophy should outline how often you review and adjust compensation structures—whether annually, biannually, or as needed—to stay competitive and equitable.

- Your compensation strategy: e.g. lag, match, above for certain roles

- Guidance around pay equity: Guidelines on internal equity, external market competitiveness, and compliance with pay transparency laws.

- Salary ranges: Structured salary bands for roles and levels within your company.

- Total compensation: Base salary + bonuses, stock options, commissions, and profit-sharing.

- Approach to global compensation: Local market adjustments, currency and exchange rate impact, compliance with international regulations:

- Total rewards: Non-monetary benefits that contribute to employee well-being and satisfaction

Key Takeaways

- Compensation philosophy is necessary for organizations that want to properly utilize compensation to attract and retain the right talent for them.

- Your compensation philosophy should be strongly tied to your values and strategic goals.

Your compensation philosophy should be reviewed regularly to ensure you’re properly aligned with market trends.

Compensation Philosophy FAQs

When should you write a compensation philosophy?

How often should you revisit your compensation philosophy

What are some limitations of a compensation philosophy

Join The People Managing People Community

For further support on managing compensation in your org, join the People Managing People Community, a supportive community of HR and business leaders sharing knowledge to help you progress in your career and make greater impact in your org.

You might also want to consider taking one of these compensation certifications to help you get more confident handling compensation matters.

* Usually salary data will be shown like this:

- ‘Software Developer'

- 25th $60k, 50th $90k, 75th $125k

- Qualifications:

- 2+ years in web app development

- 2+ years experience in agile development environment

- 1+ years in architecture design

Your job might look like this:

- 'Software engineer'

- Salary - TBC

- Qualifications:

- 2+ yrs experience developing using ruby on rails

- Experience in agile and/or kanban environments

- Knowledge in system design, scaling systems

- Ability to pair program and convey technical information simply

So, in this case, you can see there is a 60%+ overlap between the responsibilities of the two roles. This means you can use that 'software developer' salary data for your 'software engineer' position (job matching).