10 Best AI Risk Management Tools Shortlist

Here's my pick of the 10 best software from the 14 tools reviewed.

Risk management in HR isn’t just about avoiding mistakes; it’s about protecting people, data, and trust. From compliance slip-ups to data breaches and workplace misconduct, the stakes are high, and the landscape is constantly shifting. It’s no wonder managing it all can feel overwhelming.

That’s where AI-powered risk management tools can make a real difference. These platforms help you detect potential issues before they escalate by analyzing vast amounts of data, flagging anomalies, and surfacing insights that keep your organization compliant and secure. Instead of reacting to crises, you’re equipped to prevent them.

I’ve personally tested and reviewed today’s leading AI risk management tools to help you find the right fit for your team. Whether your focus is on data privacy, regulatory compliance, or fraud prevention, you’ll find options here that align with your priorities and scale with your needs. Let’s explore the tools that can help you manage risk with more confidence and clarity.

Why Trust Our Software Reviews

Best AI Risk Management Tools Summary

This comparison chart summarizes pricing details for my top AI risk management tool selections to help you find the best one for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for privacy compliance | Free demo available | Pricing upon request | Website | |

| 2 | Best for data scientists | Free plan available | From $9/month | Website | |

| 3 | Best for incident management | Free demo available. | Pricing upon request | Website | |

| 4 | Best for enterprise risk | Free demo available | From $25/user/month (billed annually, min 5 seats). | Website | |

| 5 | Best for startups | Not available | Pricing upon request | Website | |

| 6 | Best for construction risk management | Free demo available | Pricing upon request | Website | |

| 7 | Best for AI risk diagnostics | Free demo available | Pricing upon request | Website | |

| 8 | Best for fraud prevention | Free demo available | Pricing upon request | Website | |

| 9 | Best for ethical AI | Free demo available | Pricing upon request | Website | |

| 10 | Best for AI governance | Free trial available | Pricing upon request | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best AI Risk Management Tool Reviews

Below are my detailed summaries of the best AI risk management tools that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you and your team.

OneTrust helps organizations automate data privacy and compliance processes. It’s built for privacy, risk, and compliance teams that need to manage global data protection requirements efficiently.

Why I picked OneTrust: I chose OneTrust for its use of AI to scale privacy management and risk governance. Its automation features support privacy impact assessments (PIAs), vendor risk reviews, and consent management. The platform’s intelligence engine helps teams stay aligned with more than 50 global regulations, while Gen AI tools such as OneTrust Copilot provide real-time guidance on regulatory updates and data usage risks. This makes it especially useful for enterprises managing complex, multi-region compliance.

Standout features & integrations:

Features include automated data mapping that simplifies tracking data flows. You can use privacy impact assessments to evaluate risks and ensure compliance. The platform also offers consent management to handle user data preferences.

Integrations include Microsoft, Salesforce, Adobe, AWS, Google Cloud, ServiceNow, Okta, SAP, Oracle, and Slack.

Pros and cons

Pros:

- Includes consent and preference management

- 50+ global regulations and frameworks covered

- Automated vendor risk assessments, DSRs, and audits

Cons:

- Slow sync times for configuration updates

- Manual processes within automated tools

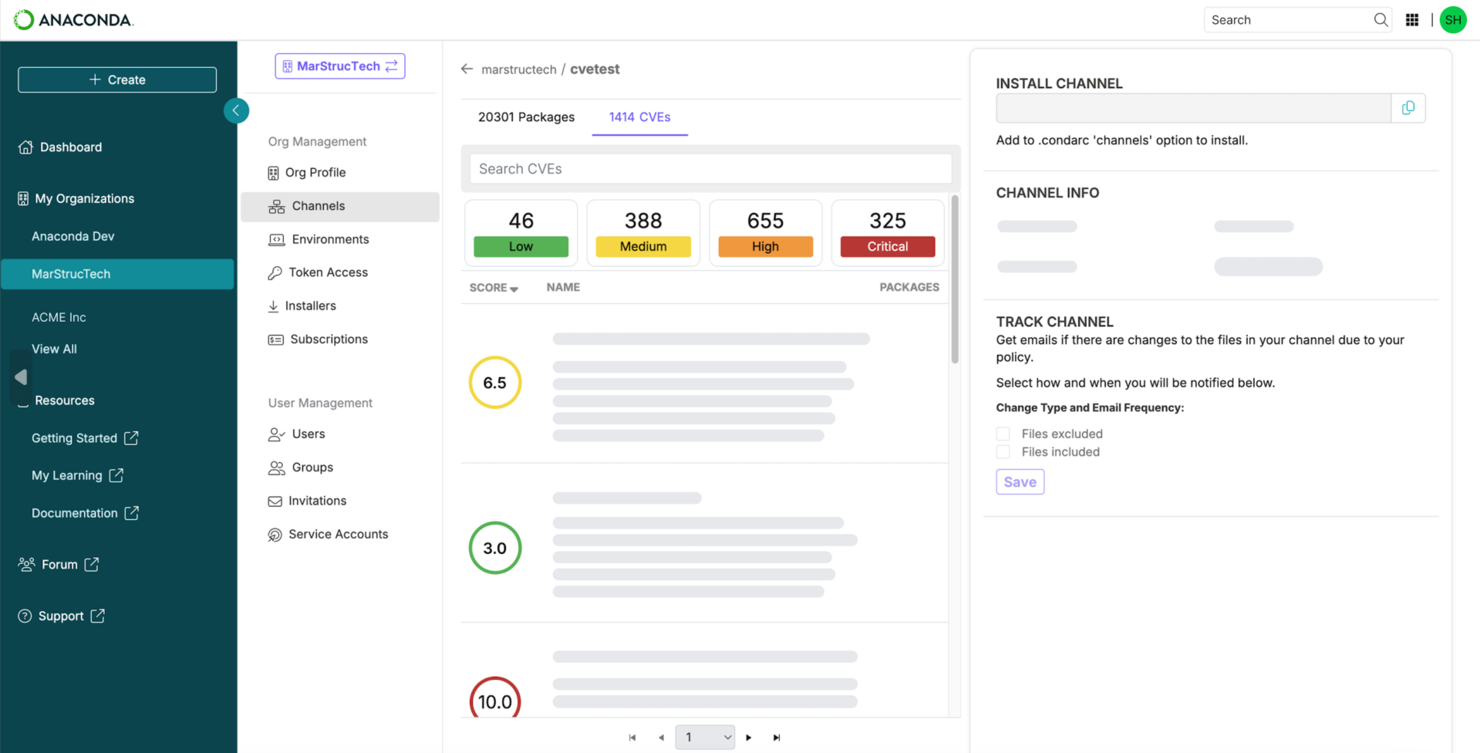

Anaconda is a data science platform built to help data scientists and analysts develop, deploy, and manage AI models using open-source tools. It simplifies AI workflows through its trusted Python distribution and extensive package management capabilities.

Why I picked Anaconda: Anaconda caters to data scientists with its extensive library of open-source packages. It offers a user-friendly interface that simplifies the deployment of AI models.

The platform’s Jupyter Notebooks integration makes it easy to document and share insights. Its package manager facilitates the installation of AI tools, making it a fit for data-driven projects.

Standout features & integrations:

Features include a package manager for easy installation, Jupyter Notebooks for documenting and sharing insights, and a library of 8,000 open-source data science and machine learning packages. You can leverage these features to refine your data science workflows. The platform's environment management ensures compatibility across projects.

Integrations include Oracle, AWS, Lenovo, IBM, Microsoft, OpenEye, Azure, Snowflake, and Esri.

Pros and cons

Pros:

- Professional support for large-scale AI projects

- All-in-one distribution for ease of setup

- 8,000+ open-source AI and ML packages

Cons:

- Business license required for large companies

- System resource consumption

Resolver is an AI-powered risk and incident management platform that helps organizations identify, investigate, and respond to security and compliance events. It centralizes incident reporting and automates triage, routing, and resolution processes, enabling teams to act quickly and maintain accountability.

Why I picked Resolver: its strength in AI-driven incident management and response automation. Its guided intake and intelligent tagging features improve data accuracy at the reporting stage, while automated workflows streamline triage and resolution. These tools make it ideal for teams that handle complex risk or security incidents and want to reduce manual workload.

Standout features & integrations:

Features guided incident intake powered by LLMs, automatic triage and tagging, role-based playbooks, and customizable dashboards. Users can track incidents end-to-end with clear audit trails and analytics that reveal patterns and root causes.

Integrations include Salesforce, ServiceNow, Everbridge, Slack, and Samdesk.

Pros and cons

Pros:

- Centralized data for cross-team visibility and reporting

- Automated triage and dynamic response playbooks

- AI-guided incident intake and classification

Cons:

- May require customization for complex workflows

- Limited offline capabilities due to browser-based setup

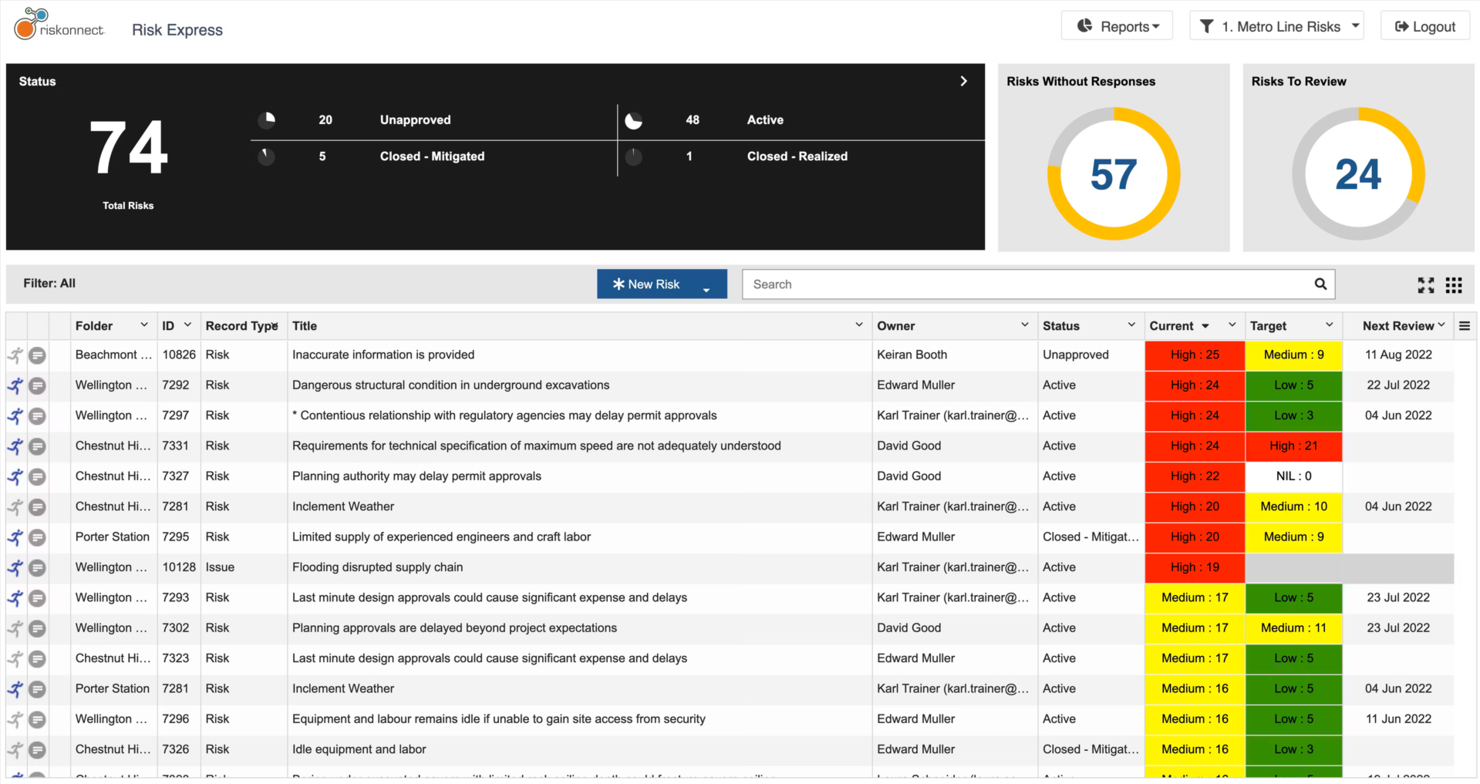

Riskonnect uses AI to help enterprises identify, assess, and mitigate risk across all business units. It unifies risk data, analytics, and workflows into a single platform, enabling real-time insight and collaboration from operational teams to executives.

Why I picked Riskonnect: Riskonnect excels in managing enterprise risk with its AI-powered analytics that offer real-time insights. These capabilities help your team make informed decisions about risk mitigation.

The software's incident management and reporting tools ensure timely responses to potential high-risk threats. Its focus on risk visibility makes it a valuable asset for large organizations.

Standout features & integrations:

Features include incident management to address and resolve risks. The software offers risk assessment tools that provide detailed analytics. You can also benefit from customizable dashboards that allow you to visualize risk data.

Integrations include Oracle, Slack, Everbridge, Microsoft Excel, WTW, Twilio, ServiceNow, UCF, SAP, Workday, AWS 33, FilNet, IBM Doors, and Lineslip.

Pros and cons

Pros:

- Centralized visibility across enterprise risk domains

- Highly configurable dashboards and workflow automation

- Predictive AI models generate real-time risk insights

Cons:

- Requires training for full feature adoption

- Accuracy depends on input data quality

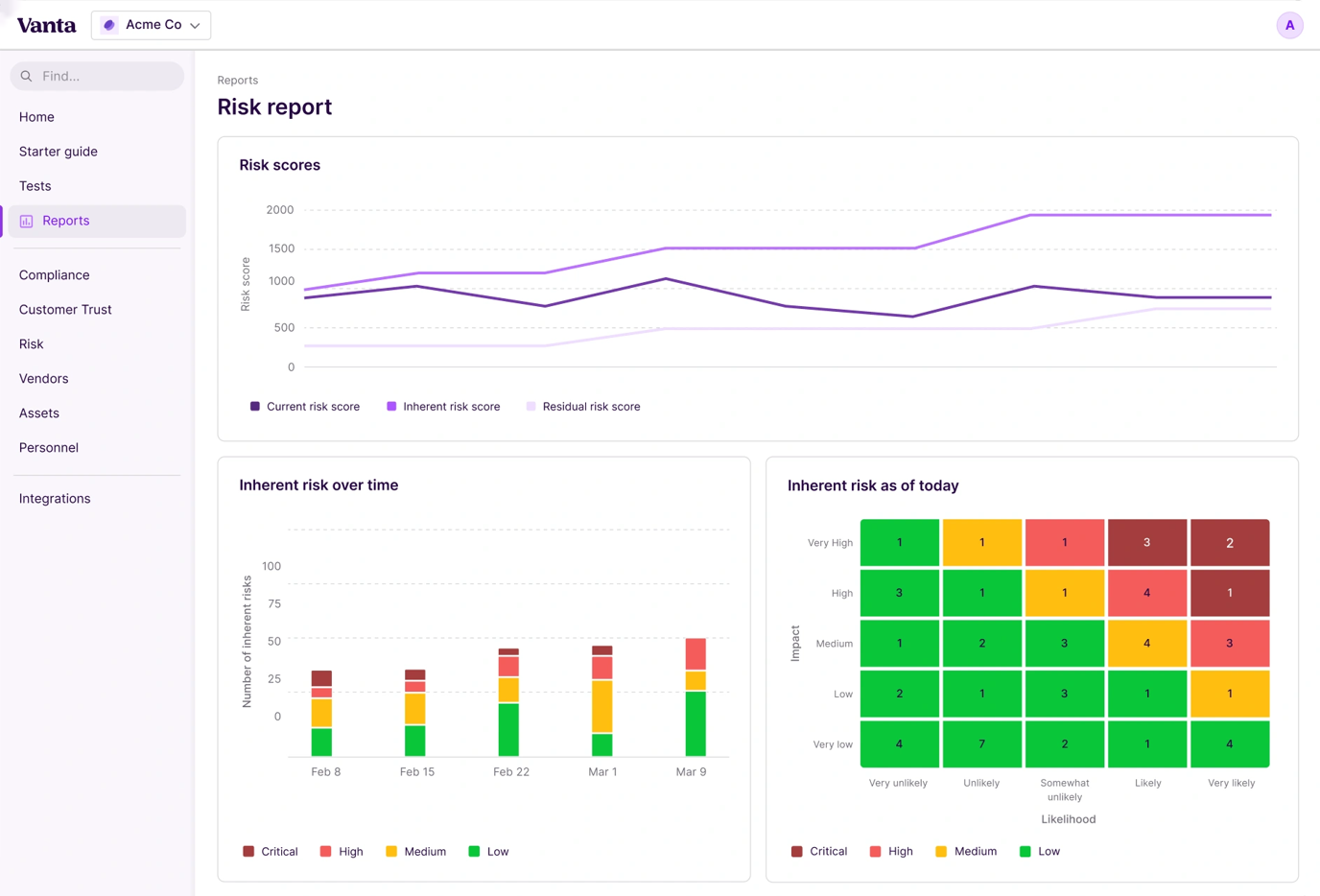

Vanta is a security and compliance automation platform designed for startups and growing businesses. It helps teams achieve and maintain compliance standards like SOC 2, ISO 27001, and GDPR by leveraging Generative AI to automate the monitoring of security practices.

Why I picked Vanta: Vanta acts like a startup’s first security hire, using Generative AI to create policies, validate evidence, and remediate test failures automatically. The Vanta AI Agent handles much of the heavy lifting, enabling teams to become audit-ready in days instead of months. For early-stage companies, it provides a clear security roadmap, continuous monitoring, and built-in scalability as compliance needs grow.

Standout features & integrations:

Features include real-time cybersecurity monitoring to keep your data safe. Automated evidence collection simplifies the audit process for compliance. You can also benefit from customizable security policies that align with your organization's needs.

Integrations include AWS, Google Cloud, Azure, Slack, GitHub, Jira, Okta, Datadog, PagerDuty, and Duo.

Pros and cons

Pros:

- Auto-generation of key documents

- 400+ pre-built system integrations

- Automates up to 90% of compliance workflows

Cons:

- Agent installation required

- Frequent alerts can become cumbersome

Document Crunch is an AI-powered platform that helps construction teams identify and mitigate risk-management processes throughout the project lifecycle. Designed specifically for the construction industry, it supports risk management from bid pursuit to project execution.

Why I picked Document Crunch: Document Crunch combines contract analysis and construction risk intelligence in one platform. Its AI engine, CrunchAI, helps users quickly spot red flags, standardize reviews, and apply best practices at every phase of a project. This makes it valuable for contractors and legal teams that need faster, more consistent decisions to reduce project risk.

Standout features & integrations:

Features include AI-based contract and specification review, automated risk flagging, and built-in guidance for preconstruction and field teams. The platform also supports workflow standardization and real-time insights during project execution.

Integrations include Microsoft Word and Procore.

Pros and cons

Pros:

- Real-time insights across project phases

- Standardized review process for teams

- AI-driven document and risk analysis

Cons:

- Functionality is limited to contracts

- Limited to the construction industry

Lumenova AI is an AI diagnostics platform designed for IT teams and data scientists. It provides tools to analyze and optimize AI models, ensuring they perform efficiently and effectively.

Why I picked Lumenova AI: It combines model diagnostics with end-to-end AI risk governance. The platform continuously monitors AI models for drift, performance, fairness, and compliance, giving organizations the data needed to maintain trust and performance. Its diagnostic tools identify inefficiencies early, while policy enforcement and automated documentation simplify responsible AI adoption.

Standout features & integrations:

Features include automated model evaluations, AI inventory tracking, and real-time performance checks. It also provides compliance guardrails, model explainability tools, and risk scoring across AI assets. Lumenova AI integrates with enterprise cloud and data platforms to support large-scale AI deployment across a range of industry standards from healthcare to finance.

Integrations are not publicly listed on their website; however, Lumenova AI is designed to integrate with most existing systems via API/webhooks, including MLOps/model registries, data warehouses/lakes, identity providers (SSO/IAM), SIEM/SOC solutions, BI/analytics dashboards, ITSM/ticketing platforms, HRIS/ATS, and GRC systems.

Pros and cons

Pros:

- Supports scalable AI governance across teams

- Built-in diagnostics for model drift and bias

- Continuous monitoring for risk and compliance

Cons:

- Requires integration with existing data systems

- Enterprise-focused setup may be complex

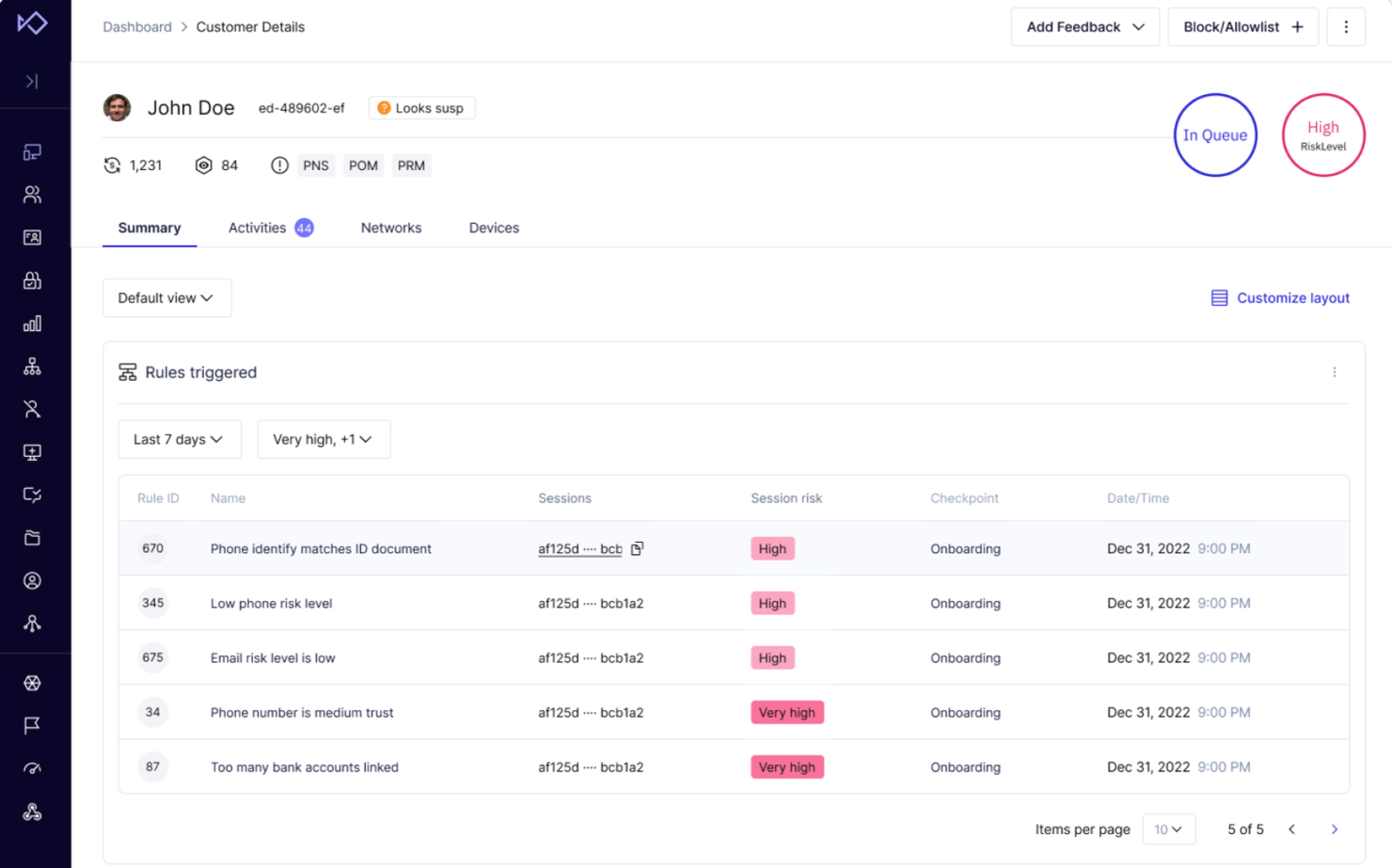

Sardine is an AI-risk management platform that helps financial institutions and fintechs detect, prevent, and respond to fraud in real time. It combines behavioral metrics, device intelligence, and machine learning to identify high-risk activity before it impacts transactions.

Why I picked Sardine: Sardine specializes in fraud prevention with AI-driven detection capabilities that identify suspicious patterns. These features allow your team to act quickly against potential fraud.

The tool offers real-time monitoring to keep your transactions secure. Its focus on preventing fraud makes it an essential tool for businesses concerned about transaction safety.

Standout features & integrations:

Features include real-time monitoring to ensure transaction security. You can use its pattern recognition to identify suspicious activities. The platform also provides customizable alerts to keep your team informed of potential threats.

Integrations include Zoom, Google Meet, Ashby ATS, Airbase, and DataGrail.

Pros and cons

Pros:

- Device and behavior analytics improve accuracy

- AI agents automate KYC and compliance tasks

- Real-time fraud detection across transactions

Cons:

- Enterprise setup may increase onboarding time

- Requires ongoing model tuning for best performance

Credo AI enables organizations to manage ethical and regulatory oversight across the AI lifecycle. It helps compliance officers and data teams ensure that AI systems meet internal policies and global standards such as the EU AI Act, NIST AI RMF, and ISO 42001.

Why I picked Credo AI: Credo AI emphasizes ethical AI practices, offering features such as bias detection and fairness assessments. These AI capabilities can help you identify and mitigate potential ethical risks in your AI systems.

The platform also provides transparency reports to ensure your AI models meet ethical guidelines. Its focus on ethical governance makes it a solid option for organizations prioritizing responsible AI use.

Standout features & integrations:

Features include bias and fairness analysis, policy automation, and governance artifact generation for internal and external audits. The platform also includes Generative AI Guardrails to govern responsible use of AI models and continuously audit generative systems.

Integrations include Jira, AWS, ServiceNow (coming soon), Asana, Databricks, Microsoft Dynamics 365, Azure, Salesforce, and Collibra.

Pros and cons

Pros:

- Transparent ecosystems that mitigate risk

- Bias detection and fairness tools

- AI governance advisory services

Cons:

- Possible integration challenges

- Higher cost than some competitors

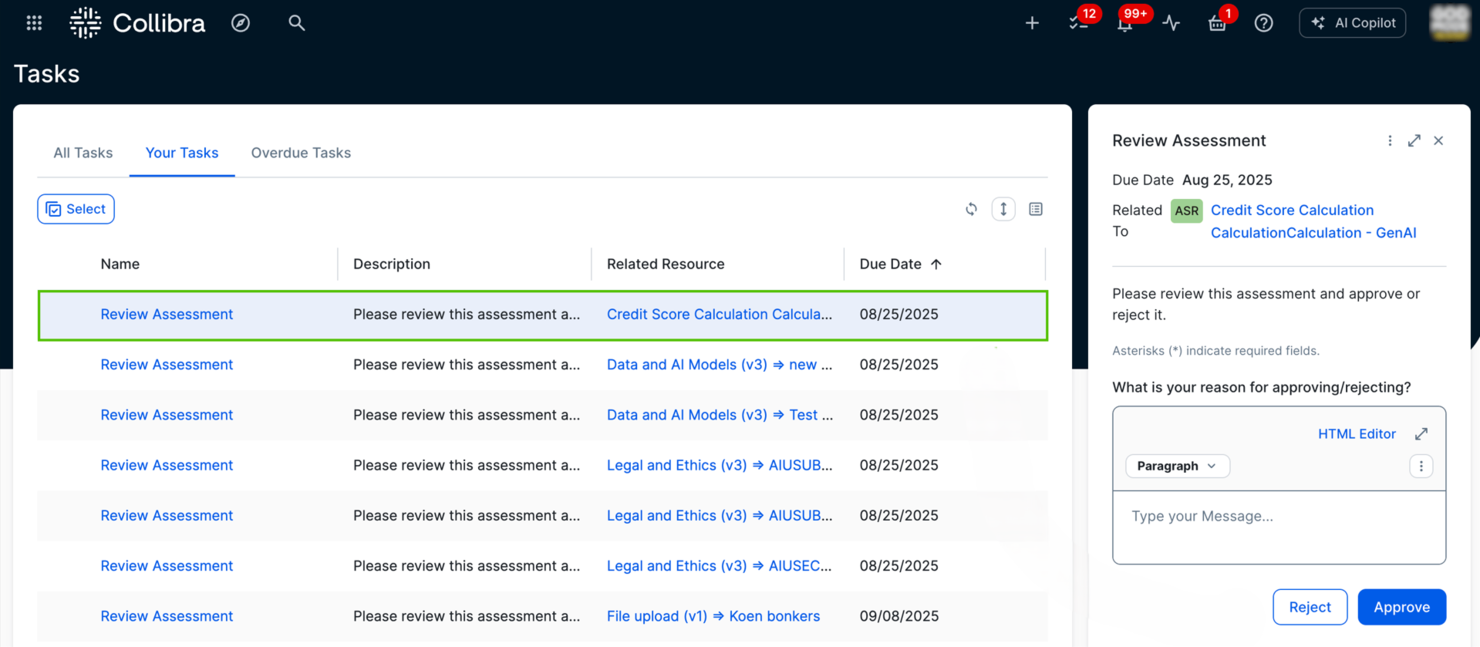

Collibra's AI governance software is designed for organizations aiming to manage their AI lifecycle. The platform unifies governance across cloud and on-prem environments, giving teams full visibility and control over AI inputs, processes, and outputs.

Why I picked Collibra: Collibra stands out for its focus on AI governance, ensuring AI models are transparent and compliant with regulatory requirements like the EU AI Act. It provides lifecycle management to unify teams and traceability features for transparency.

The tool’s compliance automation aligns with global standards, making it suitable for organizations that prioritize data governance. Its integration capabilities with platforms like Databricks and AWS further enhance its appeal. The platform’s recent updates, such as AI Model and AI Agent asset categorization improvements, strengthen model management and accountability.

Standout features & integrations:

Features include end-to-end data and AI governance, automated compliance validation, and lifecycle management that links AI use cases to datasets for traceability. Its model governance ensures transparency and policy alignment. The software's integration capabilities make it versatile for various AI/ML platforms.

Integrations include Databricks, AWS, Google Cloud Storage, Azure, Excel, Snowflake, Power BI, Tableau, IBM, SAP, Salesforce, and Oracle.

Pros and cons

Pros:

- Integrates with major AI/ML platforms

- Automates compliance with global regulations

- Built-in AI model traceability across initiatives

Cons:

- Requires active multi-departmental data governance participation

- Less intuitive user navigation

Other AI Risk Management Tools

Here are some additional AI risk management tools options that didn’t make it onto my shortlist, but are still worth checking out:

- RiskPal

For travel risk assessments

- Risk Generator

For small business compliance

- Robust Intelligence

For data integrity checks

- Prompt Security

For AI threat detection

AI Risk Management Tool Selection Criteria

When selecting the best AI risk management tools to include in this list, I considered common buyer needs and pain points like data privacy concerns and compliance with regulations. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Risk identification

- Compliance monitoring

- Data protection

- Threat detection

- Incident response

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- AI-driven analytics

- Real-time monitoring

- Customizable dashboards

- Automated reporting

- Predictive risk categories

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive interface

- Easy navigation

- Minimal learning curve

- Customizable settings

- Mobile accessibility

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Availability of templates

- Access to webinars

- Supportive chatbots

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 availability

- Live chat support

- Help center resources

- Responsive email support

- Dedicated account managers

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Flexible subscription plans

- Transparent pricing structure

- Discounts for annual billing

- Cost-benefit ratio

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction ratings

- Feedback on functionality

- Ease of use comments

- Support service reviews

- Comparative pricing feedback

How to Choose AI Risk Management Tools

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

|---|---|

| Scalability | Can the tool grow with your business? Consider if it supports increasing data volumes and user numbers without compromising performance. |

| Integrations | Does it connect with your current systems? Look for native integrations with your existing software to avoid manual data entry and ensure a smooth workflow. |

| Customizability | Can you tailor the tool to fit your processes? Assess if it allows modifications in workflows and reports to align with your specific needs. |

| Ease of use | Is the interface intuitive? Ensure your team can navigate without constant training. A steep learning curve can delay adoption and reduce productivity. |

| Implementation and onboarding | How long does it take to get started? Evaluate the time and resources needed for setup and training. Look for tools offering onboarding support. |

| Cost | Does it fit your budget? Compare pricing plans and watch for hidden fees. Check if the cost aligns with the value and features you’re getting. |

| Security safeguards | Are there strong security measures? Verify if the tool complies with industry standards for data protection, such as encryption and regular security audits. |

| Compliance requirements | Does it support the necessary regulations? Confirm if the tool meets industry-specific compliance standards like GDPR or HIPAA, ensuring your operations remain lawful. |

What Are AI Risk Management Tools?

AI risk management tools are software solutions that use artificial intelligence to identify, assess, and mitigate potential risks within an organization. These tools are typically used by risk managers, compliance officers, and data analysts to enhance decision-making and protect organizational assets. Features like automated risk assessments, real-time monitoring, and predictive analytics help with identifying vulnerabilities, ensuring compliance, and optimizing risk algorithms. Overall, these tools provide users with the insights needed to manage risks and maintain operational integrity proactively.

Features

When selecting AI risk management tools, keep an eye out for the following key features:

- Automated risk assessments: Use AI to evaluate potential risks quickly, saving time and reducing human error.

- Real-time monitoring: Continuously tracks data and activities to detect and respond to threats as they occur.

- Predictive analytics: Analyze historical data to forecast future risks, allowing proactive measures to be taken.

- Compliance automation: Ensures adherence to industry regulations by automating compliance checks and reporting.

- Incident response automation: Provides tools to automatically respond to identified risks, minimizing damage and downtime.

- Customizable dashboards: Offer the ability to tailor data visualization to meet specific organizational needs, improving clarity and focus.

- Bias detection: Identifies and mitigates biases in AI models, ensuring fair and ethical decision-making.

- Performance analytics: Provide insights into the efficiency and effectiveness of risk management strategies, supporting continuous improvement.

- Data protection: Safeguards sensitive information through encryption and access controls, maintaining data integrity.

- Integration capabilities: Smoothly connect with existing systems, facilitating data flow and collaboration across platforms.

Benefits

Implementing AI risk management tools provides several benefits for your team and your business. Here are a few you can look forward to:

- Enhanced decision-making: AI-driven insights and analytics help your team make informed risk management decisions quickly.

- Increased efficiency: Automated processes reduce manual tasks, allowing your team to focus on strategic initiatives.

- Proactive risk mitigation: Predictive analytics enable you to anticipate and address risks before they become issues.

- Improved compliance: Automated compliance checks ensure your organization meets industry regulations consistently.

- Cost savings: Efficient risk management practices and reduced incidents lower operational costs and potential financial losses.

- Data security: Strong data protection features safeguard your sensitive data from breaches and unauthorized access.

- Ethical AI usage: Bias detection tools ensure your AI models operate fairly, maintaining trust and integrity in decision-making.

Costs & Pricing

Selecting AI risk management tools requires an understanding of the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes common plans, their average prices, and typical features included in AI risk management tool solutions:

Plan Comparison Table for AI Risk Management Tools

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic risk identification, limited data protection, and basic reporting. |

| Basic Plan | $15-200/user/month | Automated risk assessments, real-time monitoring, and basic compliance checks. Stipulations on the minimum or maximum number of seats. |

| Business Plan | $5,000-$20,000/year | Predictive analytics, customizable dashboards, and enhanced incident response automation. |

| Enterprise Plan | +$20,000/year | Advanced AI-driven insights, full compliance automation, and extensive integration capabilities. |

AI Risk Management Tools FAQs

Here are some answers to common questions about AI risk management tools:

How do AI risk management tools integrate with existing systems?

AI risk management tools typically offer integrations with popular platforms like Salesforce, SAP, and Microsoft Dynamics. You can connect these tools through APIs or native integrations, ensuring data flows between systems. Before purchasing, check if the tool supports the specific systems your organization uses. Some vendors also offer custom integration services if needed.

Can AI risk management tools help with regulatory compliance?

Yes, AI risk management tools can help with regulatory compliance by automating compliance checks and generating reports. These tools often include features that map to specific regulations like GDPR or HIPAA, helping your team stay compliant. Regular updates ensure the tool remains aligned with changing regulations, reducing the risk of non-compliance.

How do AI risk management tools handle data security?

AI risk management tools handle data security through encryption, access controls, validation, and regular security audits. You should ensure the tool complies with industry standards for data protection. Look for AI technologies with features like end-to-end encryption and multi-factor authentication to safeguard sensitive information. Regular updates and audits help maintain security integrity and mitigate new risks.

How can AI risk management tools enhance decision-making?

AI risk management tools enhance decision-making by providing AI-generated, data-driven insights and analytics. Through the use of AI, these tools analyze vast amounts of data to identify patterns and predict potential real-world risks. Stakeholders can use this information to make informed decisions, reducing the likelihood of errors. Look for AI tools with real-time analytics for the most timely insights.

What’s Next:

If you're in the process of researching AI risk management tools, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.