-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

In this review, I’m going to share my analysis and evaluation from hands-on experience with OnPay. But first, if you’re just beginning your search for the best payroll software, check out my picks of the best payroll software.

You probably already know OnPay is among the most popular payroll software out there, but you need to better understand what’s good and not so good about it. This in-depth OnPay review will walk you through pros and cons, features, and functionality to help guide you to better understand its capabilities and suitability for your scenario.

Summary: OnPay

OnPay is a payroll and HR software designed to simplify payroll processing and HR tasks. It is commonly used by HR professionals, accountants, and small business owners to manage payroll, benefits, and compliance efficiently. It helps businesses with accurate payroll processing, benefits administration, and staying compliant with regulations.

OnPay addresses common pain points like payroll errors, compliance issues, and benefits management. Its best features include automated tax filings, employee self-service, and integration with accounting software. These features make OnPay a comprehensive solution for businesses looking to manage payroll and HR tasks efficiently and effectively.

OnPay Pros

- User experience: OnPay offers a clean, intuitive, and fast interface that is easy to navigate, making it accessible for both novice and experienced users. Users consistently praise its ease of use and the streamlined setup process, which helps minimize the learning curve for new users.

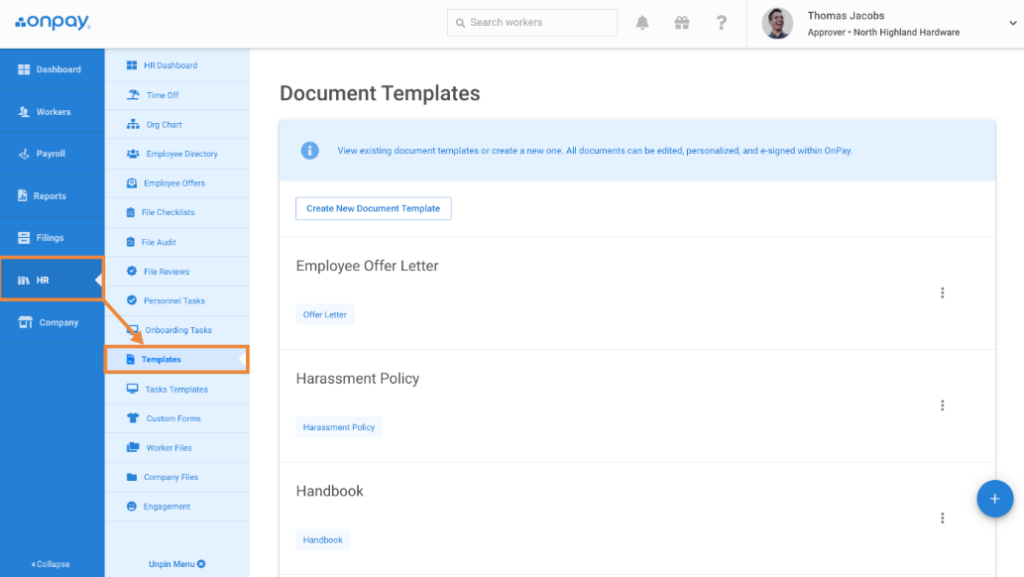

- HR tools: OnPay includes a variety of HR features such as automated onboarding flows, online I-9 and W-4 forms, in-app offer letters, and compliance audits. These tools help streamline HR processes and ensure that businesses remain compliant with regulatory requirements. The software also supports customizable document templates and electronic signing, which further enhances the efficiency of HR operations.

- Employee self-service: Employees have access to a self-service portal where they can manage their own information, view pay stubs, and access tax forms. This feature enhances transparency and reduces the administrative workload for HR departments by allowing employees to handle many of their own payroll-related tasks independently.

OnPay Cons

- Limited mobile functionality: The mobile admin version lacks some functions available on the desktop version, which can be inconvenient for users who need full access on the go.

- No automatic payroll: OnPay does not offer an automatic payroll option, requiring users to manually run payroll each period, which can be time-consuming.

- Integration limitations: While OnPay integrates with several third-party applications, it does not support as many integrations as some competitors, potentially limiting its utility for businesses with specific software needs.

OnPay Expert Opinion

In my opinion, OnPay is a solid choice for small businesses seeking an affordable and user-friendly payroll solution. Its transparent pricing model, which includes a $40 monthly base fee plus $6 per employee, makes it accessible for startups and small enterprises. OnPay excels in providing comprehensive payroll services, including unlimited payroll runs, automated tax filings, and support for both W-2 employees and 1099 contractors. The platform also offers valuable HR features such as employee self-onboarding, lifetime account access, and integration with health insurance and 401(k) plans through licensed brokers.

However, OnPay's limited scalability and fewer integration options compared to competitors like Gusto and QuickBooks Payroll may not suit larger businesses or those with complex HR needs. Additionally, while the interface is generally intuitive, some users may find the process of adding new employees and resolving payroll alerts cumbersome. Overall, OnPay is best suited for small to mid-sized companies that prioritize ease of use and cost-effectiveness over advanced HR functionalities.

Why Trust Our Software Reviews

We’ve been testing and reviewing Payroll Software since 2019. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

UKG

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2

Are You A Good Fit For OnPay?

Who Would Be a Good Fit for OnPay?

Small to mid-sized businesses that need a reliable payroll and HR solution would benefit the most from using OnPay. It offers features like automated tax filings, employee self-service, and benefits management, which are essential for companies with limited HR resources. OnPay is also ideal for businesses that need to manage compliance and want an easy-to-use interface.

Who Would Be a Bad Fit for OnPay?

Large enterprises or companies with complex HR needs might find OnPay lacking. It does not offer advanced features common in enterprise HR and Payroll systems like in-depth analytics or extensive customization options. For example, companies that require in-depth customization or industry-specific functionality may find the configuration options lacking, and those with thousands of employees may hit performance limits and may need more reporting features and integration capabilities.

Best Use Cases for OnPay

- Small businesses: OnPay is ideal for small businesses due to its affordable pricing and comprehensive payroll features, including unlimited payroll runs and automated tax filings.

- Healthcare providers: The software's ability to handle complex payroll structures and multiple pay rates makes it a good fit for healthcare providers with diverse staffing needs.

- Nonprofits: OnPay supports numerous vertical industries, including nonprofits, offering features like compliance audits and document storage that are crucial for these organizations.

- Startups: With its user-friendly interface and the ability to scale as the company grows, OnPay is perfect for startups looking for a robust payroll solution without the need for frequent upgrades.

- Remote teams: OnPay's cloud-based platform and mobile responsiveness allow remote teams to manage payroll and HR tasks from anywhere, ensuring seamless operations.

- HR departments: The software includes essential HR tools such as automated onboarding, e-signing, and an HR resource library, making it a valuable asset for HR departments.

Worst Use Cases for OnPay

- Large enterprises: OnPay may not be suitable for large enterprises that require advanced features like recruiting, compensation, and performance management, which are not fully supported.

- Manufacturing companies: Companies needing extensive time tracking and integration with complex manufacturing software might find OnPay's limited integration options insufficient.

- Global businesses: OnPay does not support global payroll, making it unsuitable for businesses with international employees.

- Retail chains: Retail chains that require advanced POS system integrations and detailed inventory management might find OnPay lacking in these areas.

- Construction firms: Firms needing detailed project tracking and integration with specialized construction management software may find OnPay's offerings limited.

- Financial services: Companies in the financial sector that require advanced compliance and regulatory features might find OnPay's capabilities insufficient for their needs.

Need expert help selecting the right Payroll Management Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

UKG

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2

OnPay Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐

- Integrations: ⭐⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐⭐

Review Methodology

We’re a team of software experts who obsess about the features and functionality of different platforms. We know how critical—yet difficult and confusing—software selection can be. We test and score software to find the best solutions, whatever the use case may be.

Using our objective, data driven testing methodology, we’ve tested 300+ software. We dedicate ourselves to being objective in fully and fairly testing software, to get beyond the marketing fluff and truly understand the platform.

We’ve developed robust testing scenarios to use the software in the same way you will. We leverage our own first-hand, practical experience of the tools, complemented by interviews with users, experts, and software vendors.

How We Test & Score Payroll Software

We’ve spent years building, refining, and improving our software testing and scoring system for payroll software. The rubric is designed to capture the nuances of software selection, and what makes payroll software effective, focusing on critical aspects of the decision-making process.

Below, you can see exactly how our testing and scoring works across eight criteria. It allows us to provide an unbiased evaluation of the software based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (25% of final scoring)

For payroll software, the core functionality we test and evaluate are:

- Payroll Processing: Automates the calculation of employee wages, taxes, and deductions.

- Tax Filing: Ensures compliance with federal, state, and local tax regulations.

- Direct Deposit: Facilitates the electronic transfer of salaries directly into employees' bank accounts.

- Employee Self-Service: Allows employees to access their payroll information, such as pay stubs and tax forms.

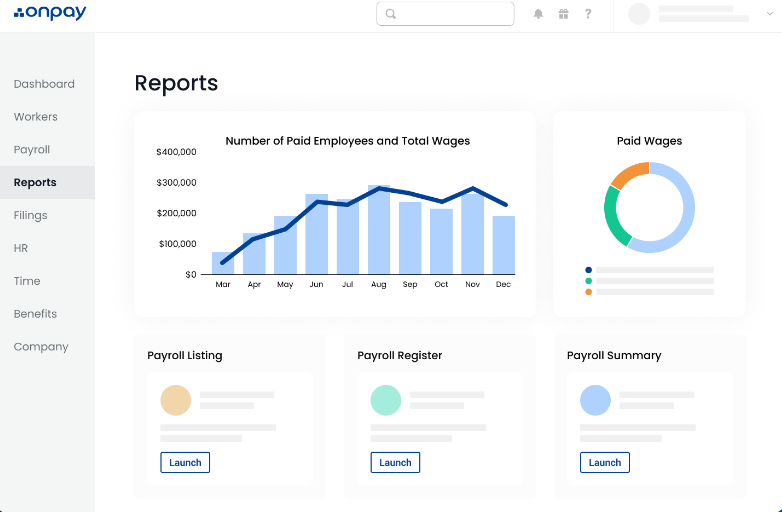

- Reporting: Generates detailed payroll reports for analysis and compliance.

- Time Tracking: Integrates with time and attendance systems to accurately track employee hours.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in payroll software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (15% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the payroll software. High scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the payroll software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High scoring software indicates little or no support is required.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Payroll software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Payroll software offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the payroll software again for the core functionality. A high scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, in consideration of all the other criteria, we review the average price of entry level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

Through this comprehensive approach, focusing on core functionalities, standout features, usability, onboarding, customer support, value, and customer reviews, I aim to identify payroll software that not only meet but exceed expectations, ensuring teams have the tools they need to succeed.

OnPay Review

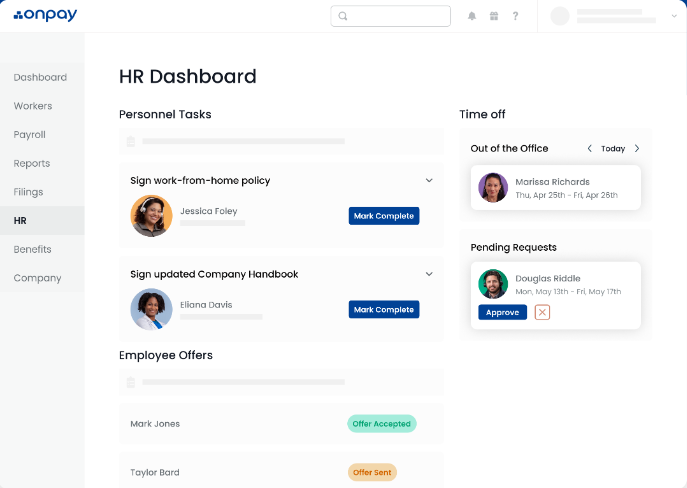

Core Payroll Software Functionality

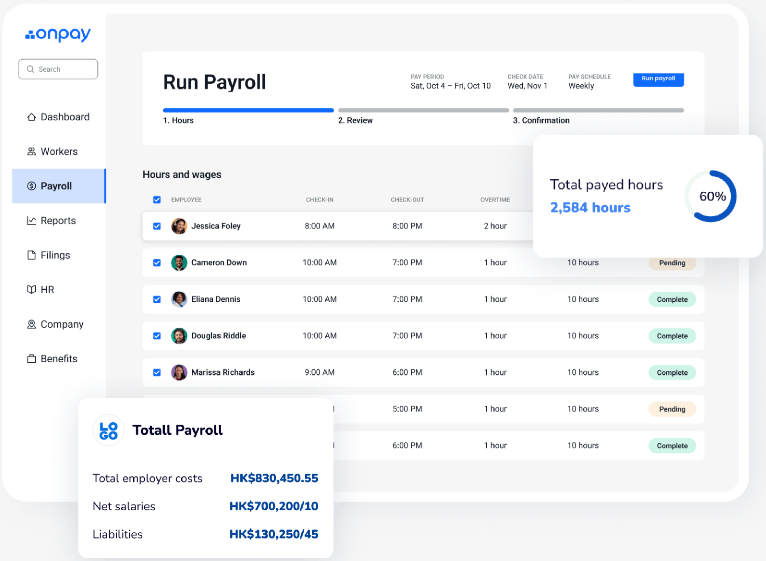

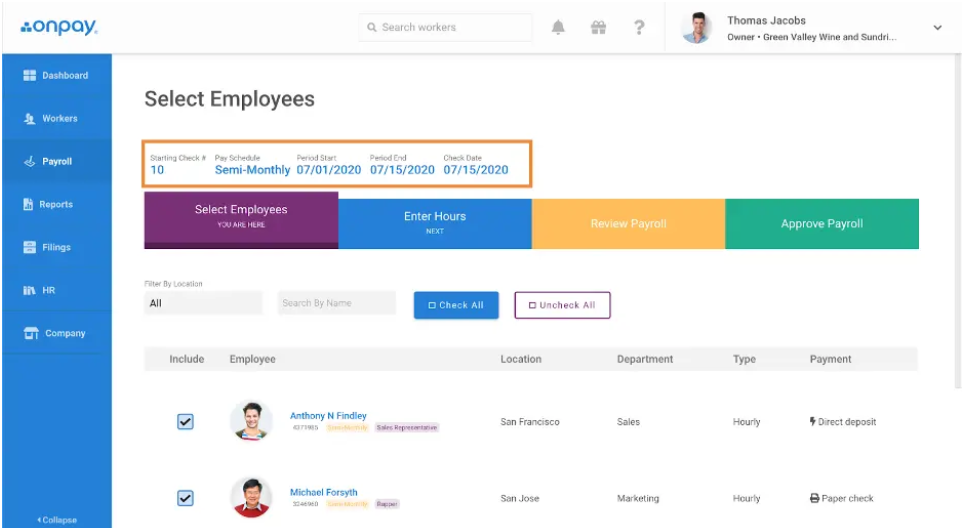

Full-Service Payroll: OnPay offers comprehensive payroll services that include unlimited monthly payroll runs, automated tax filings, and multiple pay rates and employee compensation methods. This ensures that businesses can handle payroll efficiently without worrying about compliance and accuracy.

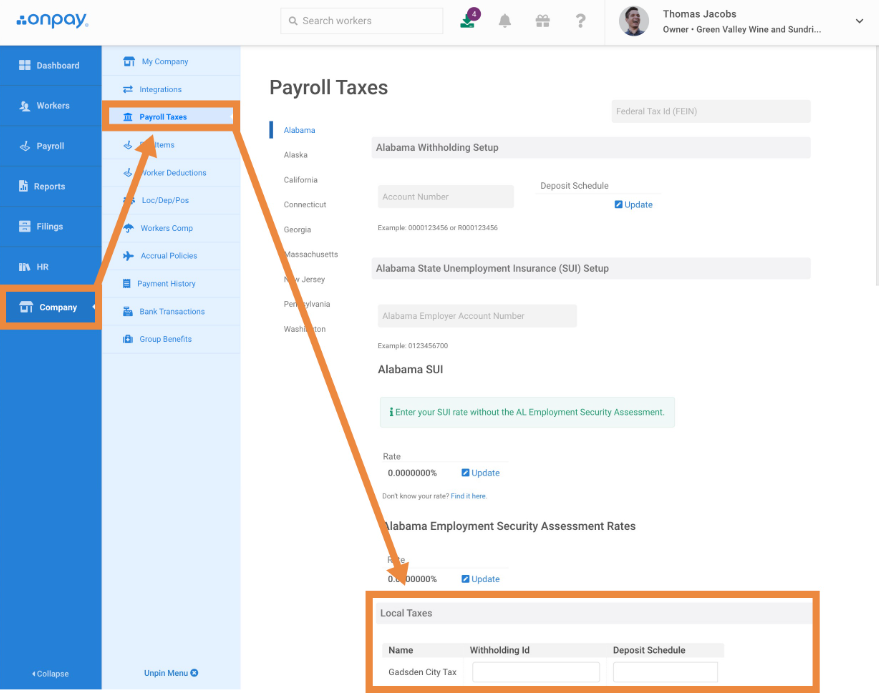

Automated Tax Filing: OnPay automatically withholds and pays federal, state, and local taxes on behalf of the employer. This feature includes generating year-end tax forms for both W-2 employees and 1099 contractors at no additional charge, simplifying the tax process for businesses.

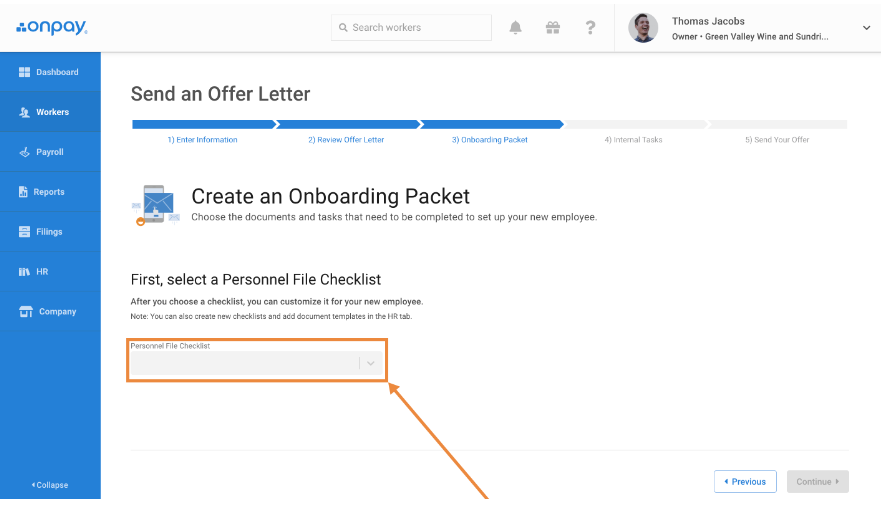

Employee Self-Onboarding: New employees can onboard themselves through OnPay’s self-service portal, entering their banking information and other necessary details. This feature saves time for HR departments and ensures that employee records are accurate and up-to-date.

Direct Deposit and Payment Options: OnPay supports various payment methods, including direct deposit, paper checks, and prepaid debit cards. Employees can enter and update their direct deposit details, and employers can manage payments seamlessly through the platform.

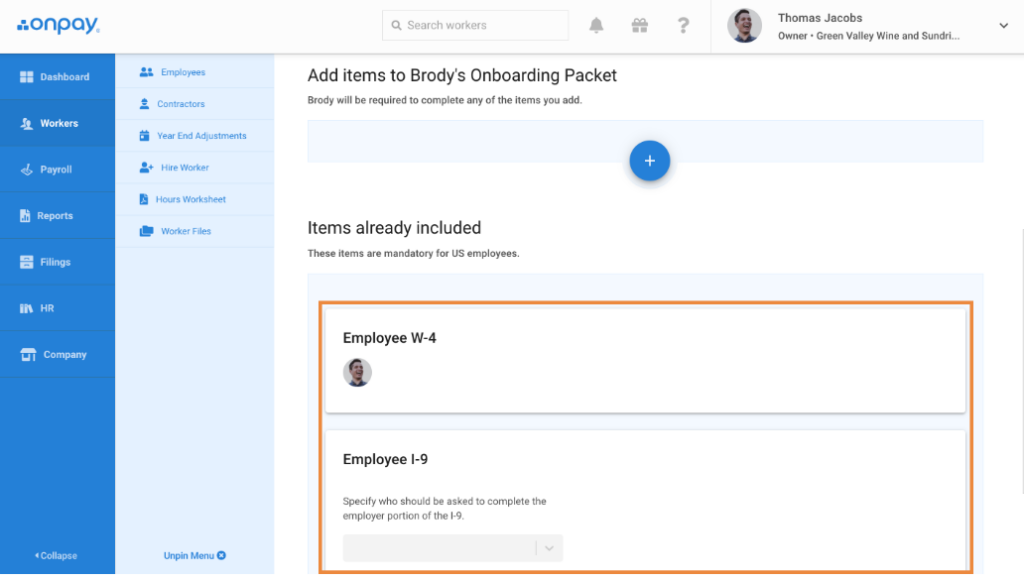

HR Tools and Compliance: OnPay includes essential HR features such as automated onboarding flows, online I-9 and W-4 forms, state new hire reporting, compliance audits, and document storage. These tools help businesses stay compliant with labor laws and streamline HR processes.

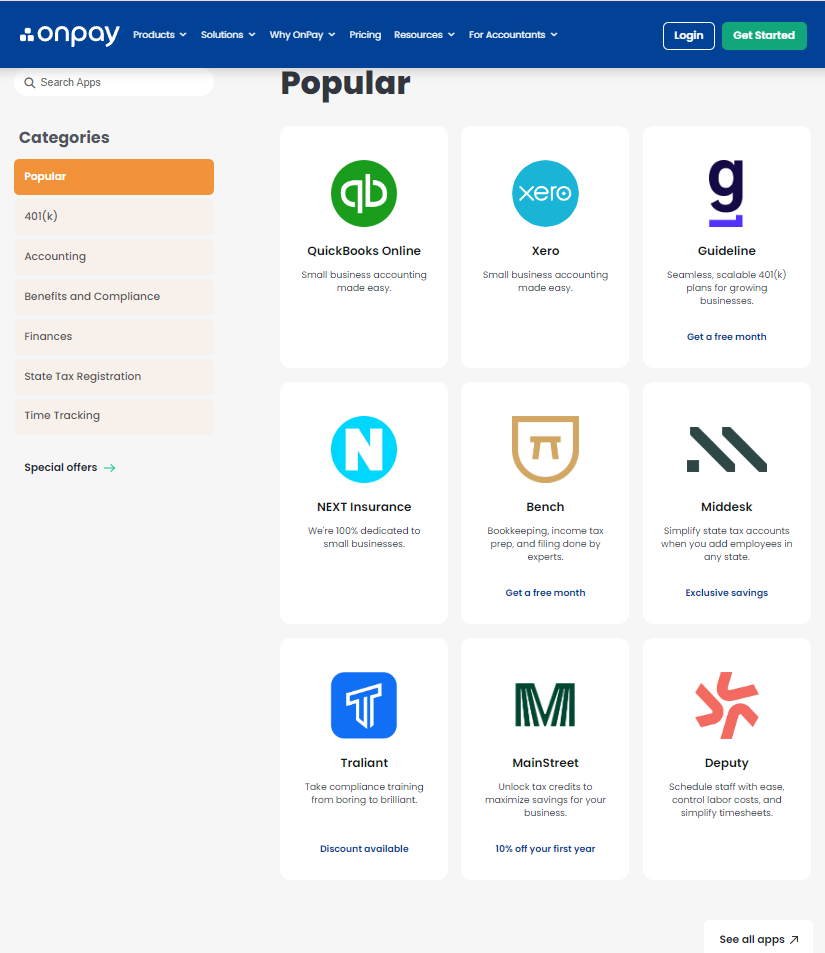

Custom Reporting and Integrations: OnPay offers a report designer with custom reporting capabilities and integrates with popular accounting and time-tracking software like QuickBooks, Xero, and Deputy. This allows businesses to generate detailed reports and maintain accurate records across different platforms without old-school spreadsheets.

OnPay Standout Features

HR Resource Library and Document Templates: OnPay provides an extensive HR resource library and built-in document templates, which are particularly useful for small businesses that may not have a dedicated HR department. These resources help businesses manage HR tasks more effectively and ensure compliance with legal requirements.

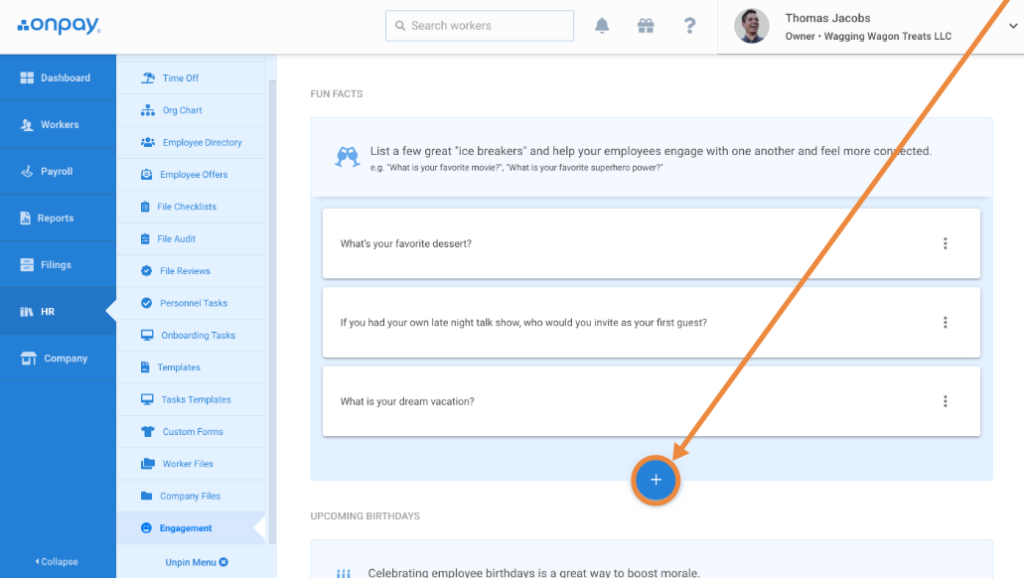

Employee Engagement Tools: OnPay includes features to enhance employee engagement, such as tracking employee information like birthdays and work anniversaries, and sending cards. Additionally, it allows employees to access their employee portal and even to share fun facts about themselves, promoting a positive workplace culture and better team bonding.

Ease of Use

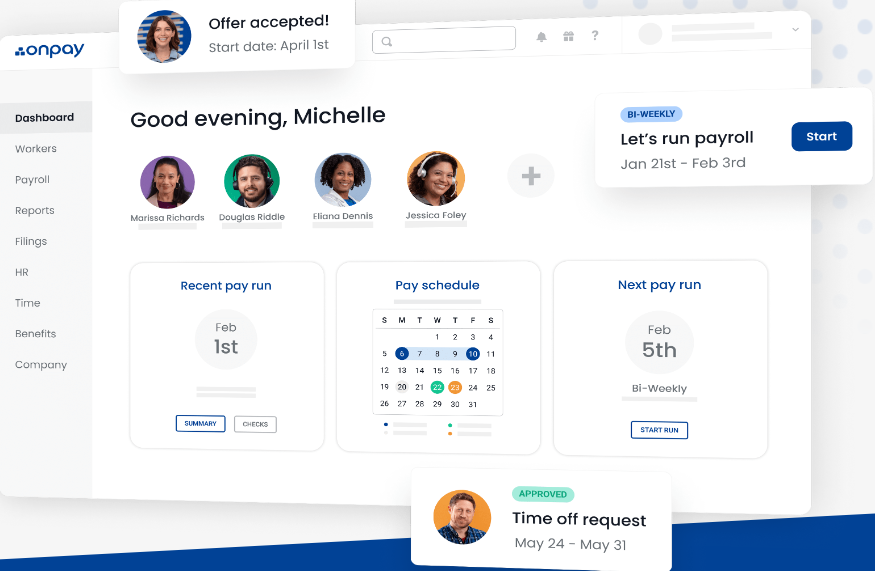

OnPay is designed to be user-friendly, making it accessible for both novice and experienced payroll managers. The platform’s clean and intuitive interface, combined with effective use of color, fonts, and navigation prompts, provides a pleasant user experience. OnPay’s setup process is straightforward, and the software offers significant built-in guidance, including step-by-step how-to guides with screenshots. Compared to other payroll software, OnPay stands out for its simplicity and ease of use, making it a preferred choice for small to medium-sized businesses looking for a software tool to process payroll and manage administrative tasks for human resources.

Onboarding

New users can expect a smooth onboarding process with OnPay. The platform offers self-onboarding for employees, allowing them to enter their information directly into the system. OnPay’s specialists assist with complex tasks such as setting up tax withholdings and benefits contributions. The software also provides a comprehensive setup guide and customer support to help businesses get started. Compared to other payroll software, OnPay’s onboarding process is efficient and user-friendly, ensuring that businesses can quickly transition to using the platform.

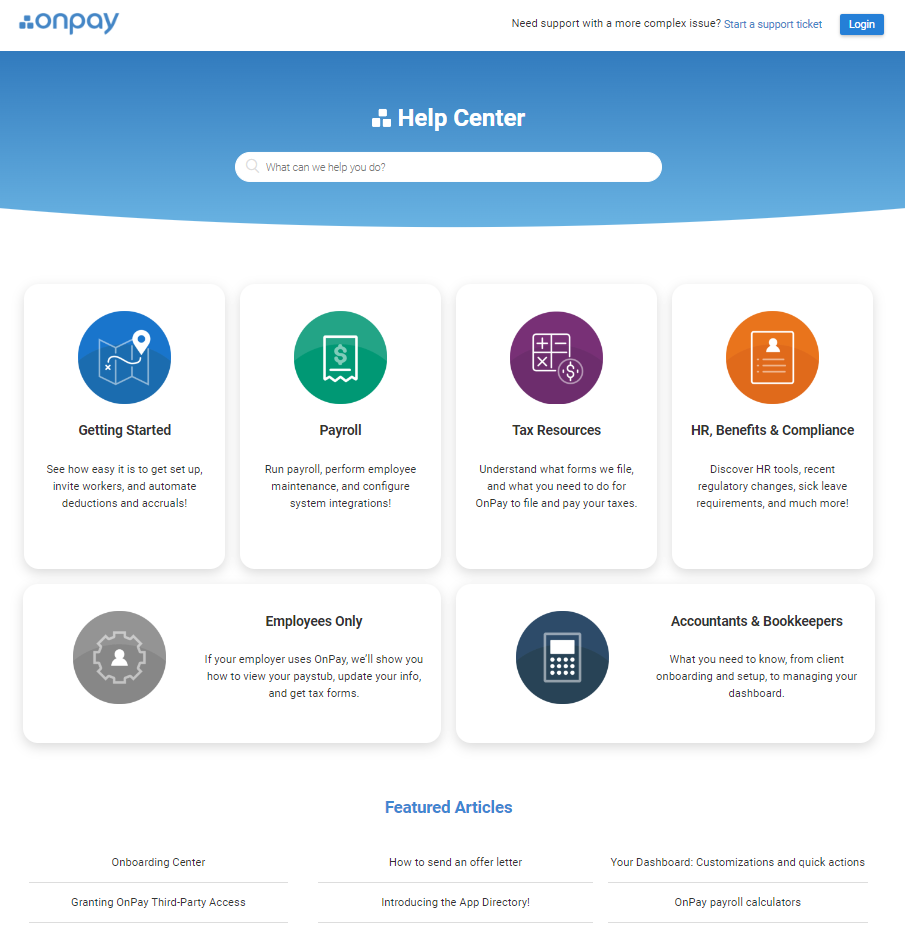

Customer Support

OnPay provides support via phone, email tickets, and live chat. They also have an online help center with detailed resources, guides, how-to GIFs, and an extensive FAQ page. Their phone support hours are available Monday through Friday from 9am to 8pm ET. OnPay also provides a status page to monitor downtime and frequent product updates, ensuring that users have access to the latest features and improvements.

Integrations

OnPay integrates natively with QuickBooks Online, QuickBooks Desktop, Xero, QuickBooks Time, When I Work, and Deputy.

In addition to native integrations, OnPay offers options through an API, allowing businesses to connect with other third-party tools and customize their payroll and HR processes further. This flexibility ensures that OnPay can meet the diverse needs of different businesses.

Value for Money

OnPay is generally considered to be on the affordable side when it comes to payroll software pricing. It offers a straightforward pricing model that is transparent and competitive, especially for small to mid-sized businesses. The cost structure is simple, with a base fee and an additional per-employee charge, making it easy for businesses to predict their monthly expenses without worrying about hidden fees or unexpected costs.

Pricing for OnPay

- Base fee: $40 per month

- Per employee fee: $6 per employee per month

This pricing includes all features, such as payroll processing, tax filing, HR tools, and employee benefits management, without any additional hidden costs

Product Specifications

| Feature | OnPay |

| Full-service payroll | ✅ |

| Unlimited monthly pay runs | ✅ |

| All tax filings and payments | ✅ |

| W-2 and 1099 workers | ✅ |

| Pay by direct deposit, debit card, or check | ✅ |

| Multiple pay rates and schedules | ✅ |

| Garnishments | ✅ |

| Unemployment insurance withholding | ✅ |

| Custom and pre-built reports | ✅ |

| Key integrations | ✅ |

| Mobile optimization | ✅ |

| Multi-state payroll | ✅ |

| Available in all 50 states | ✅ |

| Single sign-on | ✅ |

| Automated onboarding flows | ✅ |

| E-signing | ✅ |

| In-app offer letters | ✅ |

| In-app I-9 and W-4 forms | ✅ |

| State new hire reporting | ✅ |

| Custom personnel checklists | ✅ |

| Delegate and track non-HR tasks | ✅ |

| Built-in document templates | ✅ |

| Six levels of permissions | ✅ |

| Document and personnel file storage | ✅ |

| Direct messaging | ✅ |

| Compliance audits | ✅ |

| HR resource library | ✅ |

| Custom paid time-off policies | ✅ |

| Multiple accrual tiers | ✅ |

| Automatic accrual tracking | ✅ |

| Employee app requests and approvals | ✅ |

| PTO calendar and reminders | ✅ |

| Email notifications | ✅ |

| Detailed employees and contact info | ✅ |

| Searchable company directory | ✅ |

| Visual org chart | ✅ |

| Automatic org chart updates | ✅ |

| Benefits in all 50 states | ✅ |

| Medical, dental, and vision plans from major providers | ✅ |

| Integrated 401(k) retirement plans | ✅ |

| Quick employee census | ✅ |

| Add on life, vision, disability, and more | ✅ |

| Broker of record integration | ✅ |

| Integrated workers’ comp | ✅ |

| Fully integrated workers' comp administration | ✅ |

| Pay-as-you-go policies | ✅ |

| Automatic updates for team changes | ✅ |

| QuickBooks Online integration | ✅ |

| QuickBooks Desktop integration | ✅ |

| Xero integration | ✅ |

| QuickBooks Time integration | ✅ |

| Deputy integration | ✅ |

| When I Work integration | ✅ |

| Mineral integration | ✅ |

| PosterElite integration | ✅ |

| Self-onboarding | ✅ |

| Lifetime accounts | ✅ |

| Pull paystubs, employment docs, and tax forms | ✅ |

| Accountant dashboard | ✅ |

| Seamless integrations | ✅ |

| Payroll your way | ✅ |

| More ways to grow | ✅ |

| Partner perks | ✅ |

| Special payroll services by industry | ✅ |

| Free account migration | ✅ |

| Support for setting up integrations | ✅ |

| Weekday and emergency weekend support | ✅ |

| Accuracy guarantee | ✅ |

| No built-in accounting software | ❌ |

| No built-in time tracking software | ❌ |

| No volume discounts | ❌ |

| Mailing tax docs costs extra | ❌ |

OnPay Alternatives

If you’re looking for alternative payroll software options to OnPay, here are a few worth checking out:

- Rippling: Offers a comprehensive platform that integrates payroll, benefits, HR, and IT management, making it a more holistic solution compared to OnPay.

- Gusto: Known for its user-friendly interface and scalability, Gusto provides additional features like global contractor payments and a dedicated employee app, which OnPay lacks.

- Paychex Flex: Provides extensive HR tools and a highly rated mobile app, making it a great choice for businesses that need more robust HR features than what OnPay offers.

- Patriot Payroll: Offers a more affordable solution with strong customer support and ease of administration, making it a cost-effective alternative to OnPay.

OnPay Frequently Asked Questions

What is OnPay?

OnPay is a cloud-based payroll and HR software designed to simplify payroll processing, tax filing, and benefits management for small to medium-sized businesses. It offers features such as direct deposit, automated tax filings, and employee self-service portals. For businesses looking to streamline HR tasks while ensuring compliance with regulations, OnPay provides a user-friendly platform. If you’re exploring similar HR solutions, this comprehensive guide to the best HR software for small businesses can help you compare your options and find the right fit for your business needs.

Is there a mobile app for OnPay?

Yes, OnPay offers a mobile-friendly platform that allows users to access payroll and HR features on the go. Employees can view their pay stubs, update personal information, and access tax forms through the mobile interface. The mobile access ensures that both employers and employees can manage payroll tasks conveniently from their smartphones or tablets.

Is OnPay HIPAA compliant?

Yes, OnPay is HIPAA compliant. This means that OnPay adheres to the Health Insurance Portability and Accountability Act (HIPAA) regulations, ensuring the protection of sensitive health information. This compliance is crucial for businesses in the healthcare sector that need to handle employee health data securely.

Is OnPay SOC 2 compliant?

Yes, OnPay is SOC 2 compliant. SOC 2 compliance indicates that OnPay has implemented stringent security measures to protect customer data. This certification is essential for businesses that need assurance about the security, availability, and confidentiality of their data when using OnPay’s services.

Is OnPay secure?

OnPay employs industry-standard security measures to protect user data. This includes SSL high-grade encryption (AES-256) for data transmission and secure data facilities with 24/7 security guards and surveillance systems. Additionally, OnPay uses multi-factor authentication (MFA) to enhance account security and prevent unauthorized access.

Is OnPay FedRAMP certified?

Yes, OnPay is FedRAMP certified. The Federal Risk and Authorization Management Program (FedRAMP) certification ensures that OnPay meets the rigorous security standards required for cloud services used by federal agencies. This certification provides an added layer of trust for government clients and other organizations with high-security requirements.

Is OnPay GDPR compliant?

Yes, OnPay is GDPR compliant. The General Data Protection Regulation (GDPR) compliance means that OnPay adheres to the data protection and privacy regulations set forth by the European Union. This compliance is essential for businesses that handle the personal data of EU citizens, ensuring that their data is processed and stored securely.

Is OnPay secure for handling sensitive information?

OnPay takes several measures to ensure the security of sensitive information. These measures include:

- SSL Encryption: OnPay uses AES-256 encryption to protect data during transmission.

- Secure Data Facilities: Data is stored in secure facilities with 24/7 security and surveillance.

- Multi-Factor Authentication: OnPay supports various MFA methods, including SMS, email, hardware, and software-based authentication.

- Regular Audits: OnPay undergoes regular security audits to maintain compliance with industry guidelines and standards.

OnPay Company Overview & History

OnPay is a privately held company offering payroll, HR, and benefits management software designed to streamline and automate these processes for small and medium-sized businesses. Based in Atlanta, OnPay separated from its parent company in 2015 as a payroll provider. In 2020, the company secured $6 million in Series A funding through venture capital.

The executive team is led by founder and CEO Jesse Burgess, with Mark McKee serving as President and Chief Operating Officer. In 2022, OnPay expanded its Atlanta headquarters to accommodate significant team growth, doubling its staff size year-over-year with plans to continue this growth trajectory.

OnPay’s platform offers a variety of features including direct deposit, employee self-onboarding, automated payroll taxes, unlimited pay runs, and compliance management. Additionally, OnPay provides insurance services through OnPay Insurance Agency, LLC. The company is renowned for its user-friendly platform and top-rated customer service, earning accolades such as PCMag Editors' Choice and Forbes Advisor's "Best of" awards.

OnPay Major Milestones

- 2007: Jesse Burgess joins the family payroll business and begins streamlining operations.

- 2015: OnPay is officially launched as a subsidiary of the traditional payroll company.

- 2011: OnPay begins to gain traction in the payroll and HR services market.

- 2020: OnPay raises $6 million in a Series A funding round.

- 2021: OnPay announces plans to relocate its headquarters to Atlanta's Ponce City Market.

- 2022: OnPay earns PCMag Editors' Choice and Forbes Advisor's "Best of" awards.

- 2022: OnPay more than doubles its headcount and positions for further growth.

- 2024: OnPay receives the Best Overall All-in-One Payroll and HR Solution for Small Businesses by Forbes.

Want to learn more about OnPay? Check out their site for additional information.

From $40/month + $6/user/month

30-day free trial

What Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.