Best FreshBooks Alternatives Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

FreshBooks is a well-known accounting software that helps businesses manage their invoicing, payments, expenses, projects, time-tracking, and basic payroll tasks. While it is a worthwhile solution, you may be interested in considering other FreshBooks alternatives due to specific feature needs, customization options, or pricing concerns. In this article, I’ll walk you through my recommendations for the best FreshBooks alternatives to help you manage your accounting tasks with ease.

What is FreshBooks?

FreshBooks is an accounting software designed to help small business owners and freelancers manage their finances. Users typically include entrepreneurs, freelancers, and self-employed proprietors who need to track expenses, send invoices, and manage their financial records.

Why Trust Our Software Reviews

We’ve been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best FreshBooks Alternatives: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top FreshBooks alternative selections to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global compliance management | Free trial + demo available | From $29/month | Website | |

| 2 | Best for small business accounting | 30-day free trial | From $2.50/user/month (billed monthly) | Website | |

| 3 | Best for integrated payroll and accounting tools | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 4 | Best for professional services automation | 14-day free trial | From $20/user/month (billed annually) | Website | |

| 5 | Best for project-based firms | Free demo available | Pricing upon request | Website | |

| 6 | Best for online payment processing | Free demo available | From 2.9% + 30¢ per successful transaction | Website | |

| 7 | Best for inventory management | 14-day free trial | From $20/month | Website | |

| 8 | Best for automated accounting | 14-day free trial | From $20/month | Website | |

| 9 | Best for user-friendly bookkeeping | 30-day free trial + free plan available | From $15/month (billed annually) | Website | |

| 10 | Best for advanced data management | 30-day free trial | From $20/user/month | Website |

-

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best FreshBooks Alternative Reviews

Below are in-depth summaries of my recommendations for the best FreshBooks alternatives. I’ll walk you through the pros and cons of each tool, their features, and their best use cases to help you find the best fit for your needs.

Deel is a global HR and payroll platform that helps businesses hire, manage, and pay international teams with ease. It’s an excellent FreshBooks alternative for organizations that operate across borders and need reliable invoicing and payment processing capabilities. With built-in compliance and localized payroll support, Deel can help businesses handle international payments and contracts while maintaining accurate financial records.

Why it’s a good FreshBooks alternative: I chose Deel for this list because it provides a comprehensive suite of invoicing, payroll, and compliance tools that go beyond FreshBooks’ traditional accounting features. Deel makes it easy for you to pay global teams in over 120 currencies, generate invoices automatically, and ensure each transaction meets local tax and employment laws. Its focus on compliance, automation, and global accessibility makes it a strong choice if you need to manage contractors and employees in multiple countries.

Standout features and integrations:

Features include automated invoicing with status tracking, multi-currency payment processing, and detailed financial reporting. Deel also offers immigration support, equipment leasing, and HR management services to simplify global operations.

Integrations include SAP SuccessFactors, NetSuite, Slack, Google Workspace, Hatchproof, Snowflake API, Acumatica, CrowdStrike, DefensX, Keeper, signNow, and Zoom.

Pros and cons

Pros:

- Supports 120+ currencies

- Strong compliance and security controls

- Automated global payroll management

Cons:

- Occasional delays in customer support

- High currency conversion fees

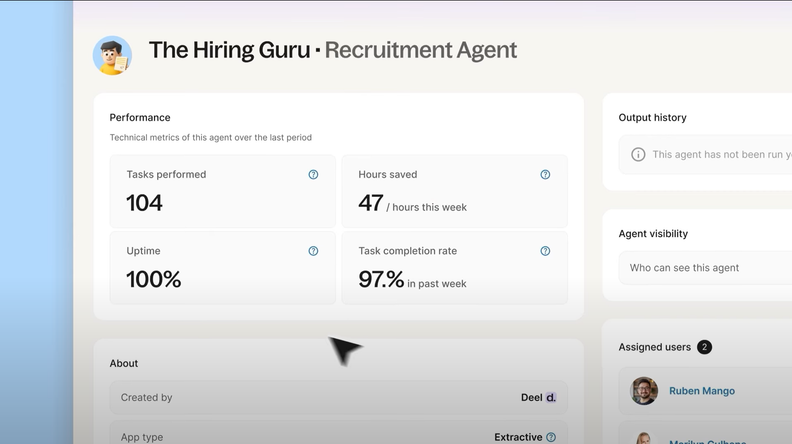

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

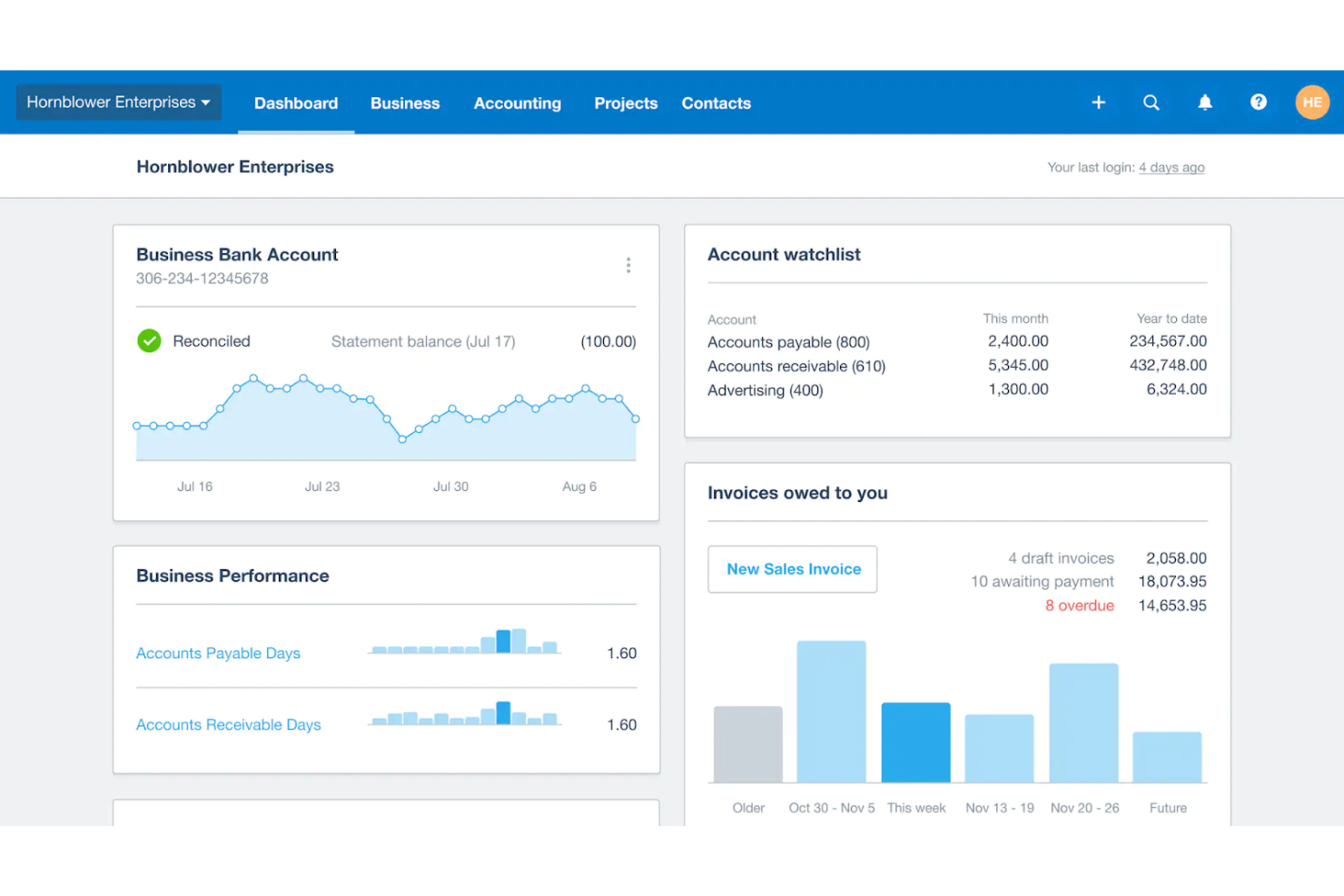

Xero is an online accounting software designed to help small businesses manage their finances efficiently. It offers comprehensive tools tailored to meet the unique needs of small businesses, ensuring easy financial management and compliance.

Why it's a good FreshBooks alternative: I chose Xero for its extensive accounting capabilities that small businesses require. Its comprehensive feature set and user-friendly interface make it a standout option for those seeking a robust FreshBooks alternative.

Standout features and integrations:

Features include invoicing, expense tracking, and bank reconciliation. It also offers payroll management and financial reporting tools that simplify complex accounting tasks for small business owners.

Integrations include Stripe, PayPal, Gusto, HubSpot, Shopify, Square, GoCardless, Expensify, Bill.com, and Salesforce.

Pros and cons

Pros:

- Strong integrations with popular tools

- Supports unlimited users

- Comprehensive accounting features

Cons:

- Limited customer support options

- Can be expensive for very small businesses

New Product Updates from Xero

Xero Unveils Redesigned Certification Program

Xero has revamped its certification program, offering flexible learning with digital courses, live webinars, and badges. Open to all, it's free and self-paced. For more information, visit Xero's official site.

Patriot Software offers affordable and easy-to-use payroll and accounting software that's modular and purpose-built for small to medium-sized US-based businesses.

Why it's a good FreshBooks alternative: Patriot and FreshBooks both offer modular software for payroll and accounting purposes. However, when comparing the two, Patriot stands out due to its low pricing and USA-based customer support. It is affordable and easy to use because of its flexibility and intuitive user interface, making it ideal for small businesses without dedicated accountants.

Standout features and integrations:

Features include free payroll setup, US-based customer support, unlimited payroll runs, flexible pay rates, free 2-day direct deposit, and a simple three-step process for running payroll, free setup, and U.S.-based support.

Additionally, Patriot's Payroll software integrates with Patriot Accounting to offer a full suite of software that is easily comparable to FreshBooks.

Integrations include Patriot Accounting, QuickBooks Online, QuickBooks Time, Plaid, and Workforce Time & Attendance.

Pros and cons

Pros:

- Responsive customer support

- You can pay employees or contractors

- Integrated accounting tools

Cons:

- Patriot's Payroll and Accounting modules are sold seperately

- Only available for US-based businesses

BigTime is a software platform that automates common tasks for managing professional services, including time tracking, billing, and project management. It provides tools that streamline the management of projects, budgets, and team workflows.

Why it's a good FreshBooks alternative: I chose BigTime due to its tailored set of features for professional services firms, making it a strong alternative to FreshBooks. Its focus on project management and resource planning sets it apart, providing tools that help businesses stay on budget and improve utilization.

Standout features and integrations:

Features include time and expense tracking, resource management, project management, invoicing, and financial management. These features help businesses streamline their operations and improve profitability.

Integrations include QuickBooks, Sage Intacct, Jira, Salesforce, HubSpot, Lacerte, Slack, Google Apps, and Zapier.

Pros and cons

Pros:

- Cloud-based accessibility

- Strong integration capabilities

- Comprehensive project management tools

Cons:

- Limited customization in lower-tier plans

- Higher starting price compared to some alternatives

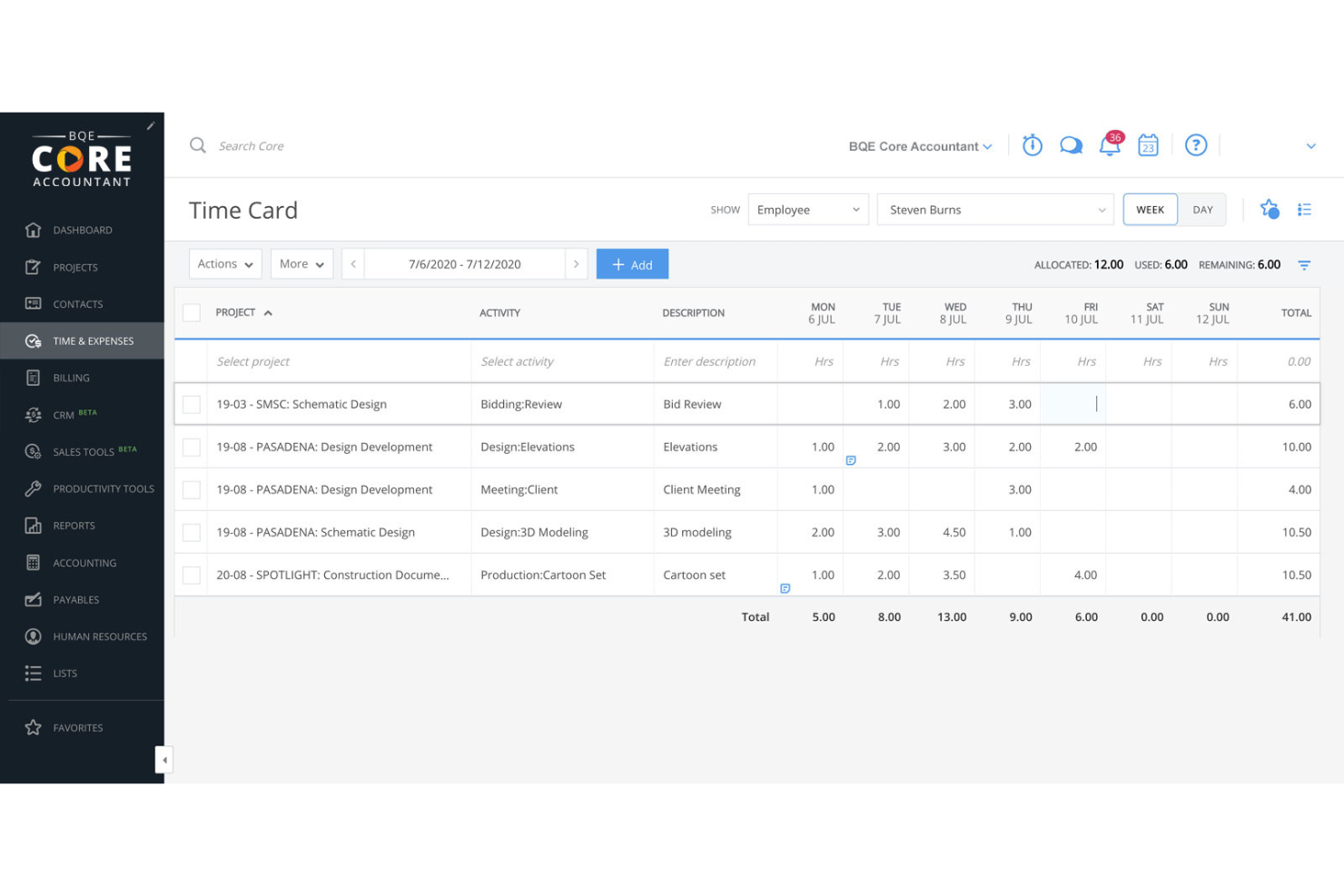

BQE Core is an all-in-one accounting and invoicing software for project-based firms such as architecture, engineering, and professional services. It stands out due to its comprehensive project management and accounting features that streamline operations and improve project outcomes.

Why it's a good FreshBooks alternative: I chose BQE Core for this list due to its suite of tools tailored for project-based firms, making it a competitor to FreshBooks. Its project management and accounting capabilities provide detailed insights and automation that can enhance efficiency and profitability.

Standout features and integrations:

Features include project management, accounting, reporting and analytics, time and expense tracking, payment processing, and professional services automation. These features provide real-time insights and streamline complex processes, making firm management more agile and data-driven.

Integrations include QuickBooks, MYOB, Dropbox, Google Drive, OneDrive, Box, Microsoft Outlook, Slack, Salesforce, and HubSpot.

Pros and cons

Pros:

- Customizable dashboards and detailed insights

- Real-time KPI visibility and automated reporting

- Comprehensive project management tools

Cons:

- Can be time-consuming to learn

- Invoice editing is not user friendly

Stripe is a comprehensive payment processing platform designed to handle online transactions. It offers robust features that support a wide range of payment methods and currencies, making it ideal for businesses operating in the global market.

Why it's a good FreshBooks alternative: I chose Stripe for this list because it offers extensive payment processing capabilities that can complement FreshBooks' invoicing and accounting features. Stripe stands out as a good FreshBooks alternative because it handles various payment methods, including credit cards, ACH transfers, and international payments, which can be integrated into a business's financial workflow.

Standout features and integrations:

Features include customizable checkout forms, fraud prevention tools, and support for processing payments in over 135 currencies. Plus, Stripe offers automated tax calculation and reporting, making it easier for businesses to manage their tax obligations.

Integrations include QuickBooks Online, NetSuite, Xero, FreshBooks, Shopify, WooCommerce, Magento, BigCommerce, Salesforce, and Zapier.

Pros and cons

Pros:

- Automated tax calculation and reporting

- Robust fraud prevention tools

- Supports a wide range of payment methods and currencies

Cons:

- Complex setup for non-technical users

- Fees can add up for high-volume transactions

ZarMoney is a comprehensive accounting, invoicing, and inventory management solution. It provides complete visibility into global inventory, making it ideal for businesses needing robust inventory management.

Why it's a good FreshBooks alternative: I chose ZarMoney for its strong inventory management capabilities, which stand out compared to FreshBooks. Its advanced inventory features, including support for multiple locations and predictive analysis, make it a compelling choice for businesses with complex inventory needs.

Standout features and integrations:

Features include advanced inventory management, online payments, bank connections, quotes and estimates, purchase orders, sales tax automation, and detailed reporting. These features help streamline financial processes and improve cash flow.

Integrations include Stripe, PayPal, QuickBooks Online, Xero, Shopify, WooCommerce, Amazon, eBay, Square, and Google Drive.

Pros and cons

Pros:

- Advanced reporting capabilities

- Supports multiple locations and warehouses

- Comprehensive inventory management

Cons:

- Limited customization options for some features

- May be too complex for very small businesses

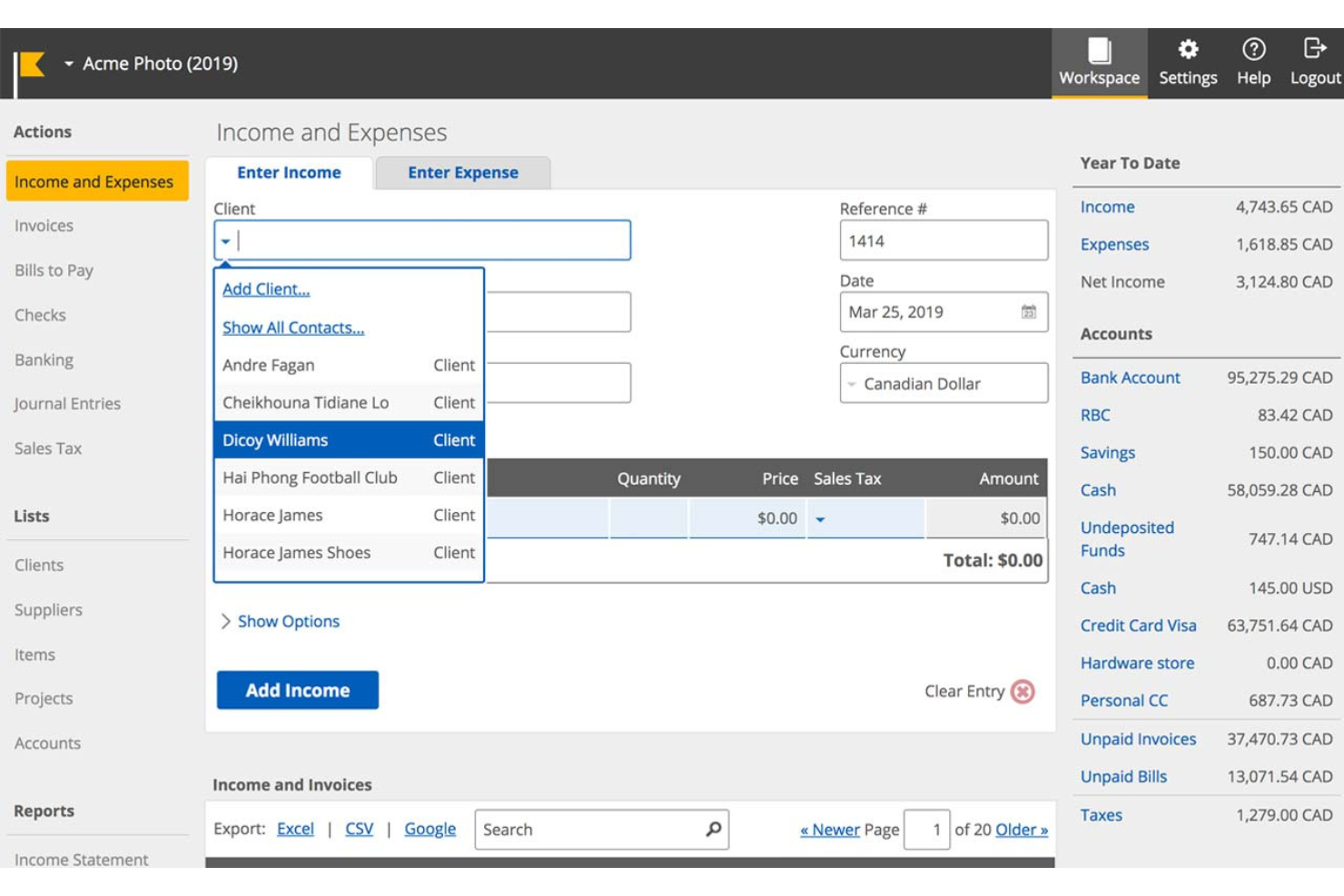

Kashoo is an accounting software designed to automate income and expense tracking for small businesses. It is best for automated accounting because it eliminates redundant tasks and manual entries, allowing users to connect their bank accounts and let the software handle the rest.

Why it's a good FreshBooks alternative: I chose Kashoo for this list because it offers a high level of automation that can save small business owners significant time. Its ability to automatically categorize expenses and reconcile accounts makes it a strong competitor for those looking to streamline their accounting processes.

Standout features and integrations:

Features include automated bookkeeping, income and expense tracking, and customizable reporting for income statements, balance sheets, accounts receivable and payables, and more. The software also supports multi-currency transactions and offers a visual dashboard for easy financial oversight.

Integrations include Stripe, PayPal, Square, FreshBooks, QuickBooks, Xero, Gusto, Hubdoc, Expensify, and Zapier.

Pros and cons

Pros:

- Customizable reporting

- Multi-currency support

- Automated expense

Cons:

- Limited third-party integrations compared to larger platforms

- Limited advanced features compared to some competitors

ZipBooks is a user-friendly accounting and bookkeeping tool designed to simplify financial management for small businesses. It is best for user-friendly bookkeeping due to its intuitive interface and automated features that reduce the time spent on day-to-day tasks.

Why it's a good FreshBooks alternative: I chose ZipBooks for this list because it offers a straightforward and intuitive user experience, making it easy for users to manage their bookkeeping without extensive accounting knowledge. Its automated features and intelligent insights make it a strong contender against FreshBooks.

Standout features and integrations:

Features include invoicing, payment tracking, automated billing, intelligent insights, time tracking, team management, and mobile accounting capabilities. Users can also connect their bank accounts and credit cards for smarter transaction management.

Integrations include PayPal, Stripe, Square, Gusto, Slack, Google Drive, Google Sheets, Trello, Asana, and QuickBooks.

Pros and cons

Pros:

- Intelligent insights and reporting

- Automated billing and payment tracking

- Intuitive and user-friendly interface

Cons:

- Customer support response times can vary

- Limited advanced features for larger businesses

AccountEdge is a desktop accounting software for small businesses that works on Mac or Windows operating systems. It excels in advanced data management and reporting, making it ideal for businesses needing detailed data analysis.

Why it's a good FreshBooks alternative: I chose AccountEdge for its robust data management capabilities, which stand out when compared to FreshBooks. Its ability to handle complex data imports and exports and provide extensive reporting options makes it a strong contender.

Standout features and integrations:

Features include invoicing, expense tracking, banking, payroll, inventory management, and time billing. Its data management tools allow for detailed analysis and reporting, with the option to export data to PowerBI for advanced analytics.

Integrations include PowerBI, Dropbox, Shopify, PayPal, Stripe, Square, BigCommerce, WooCommerce, Mailchimp, Gusto, Zapier, Google Drive, and Microsoft Excel.

Pros and cons

Pros:

- Available on desktop for both Mac and Windows systems

- Advanced data management and reporting

- Comprehensive feature set

Cons:

- Limited mobile app functionality

- Desktop-based, which may not suit all users

Other FreshBooks Alternatives

If you’d like a few more options to consider, here are several other worthwhile FreshBooks alternatives that are also worth checking out:

- Patriot

For affordable payroll and accounting software

- WAVE

For free invoicing and accounting tools

- Hiveage

For online invoicing

- ABBYY

For intelligent document processing

- Remote People

For global payroll solutions

- QuickBooks

For small to medium-sized businesses

- Zoho Books

For automation and workflow management

- HoneyBook

For creative professionals and freelancers

- Clio

For legal practice management

- Odoo

For integrated business applications

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for FreshBooks Alternatives

Selecting alternatives to FreshBooks requires a detailed understanding of the features and functionalities that serve common use cases, buyer needs, and pain points. As a software-testing expert, I’ve personally tried and researched many different finance and accounting systems to make sure my recommendations are accurate.

Here’s a summary of the selection criteria I used to create this list:

Core Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Invoicing tools to create, send, and track invoices

- Expense tracking tools to monitor and categorize business expenses

- Time-tracking features to log billable hours and integrate them into invoices

- Financial reports such as profit and loss statements

- Payment processing abilities, including the ability to accept online payments directly through the platform

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Integration with e-commerce platforms like Shopify or WooCommerce

- Advanced reporting tools that are customizable and go beyond standard financial statements

- Fully functional mobile apps for managing finances on the go

- Multi-currency support for transactions, including automatic currency conversions

- Predictive analytics and or AI-driven insights to aid in financial planning

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- A clean and intuitive user interface design that reduces the learning curve

- Easy-to-navigate menus and dashboards

- The ability to tailor the user interface for specific business needs

- Drag-and-drop features for tasks like scheduling and organizing

- A mobile-friendly design ensuring accessibility from any device

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Availability of comprehensive video tutorials

- Pre-built templates to speed up the initial setup

- Interactive product tours to familiarize users with key features

- AI-driven chatbots for instant support during onboarding

- Regular webinars to help users get the most out of the tool

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- 24/7 customer support options

- Multiple support channels including phone, email, and live chat

- Quick response times to resolve issues promptly

- Extensive online resources or a knowledge base with answers to popular FAQs

- Active user communities or forms for peer support

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Competitive pricing with various tiers to suit different business sizes

- Availability of free trials to test the software before committing

- A balance between the number of features offered and the cost

- Availability of discounts for annual subscriptions or multiple users

- Pricing that scales with business growth

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- High overall user satisfaction ratings

- Positive feedback on key features like invoicing and expense tracking

- Reviews highlighting ease of use and intuitive design

- Positive experiences with customer support

- Users feel they receive good value for the price paid

Using this assessment framework helped me identify the software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

Why Look for a FreshBooks Alternative?

While FreshBooks is certainly a popular and well-known accounting system, there are several reasons why you might want to look for an alternative option, including:

- Cost: FreshBooks can be expensive for small businesses.

- Features: You need more advanced features that FreshBooks lacks.

- Customization: FreshBooks does not offer enough customization options.

- User Interface: You find FreshBooks' interface difficult to navigate.

- Integration: FreshBooks does not integrate well with other tools you use.

Alternatives to FreshBooks can provide more affordable pricing, advanced features, better customization, a more user-friendly interface, and improved integration with other tools. These options can better meet the specific needs of your business.

Key Features to Look for in FreshBooks Alternatives

Here are some key features of FreshBooks that your alternative software should be able to replicate or improve upon to be a good fit:

- Invoicing: Create professional invoices quickly and easily.

- Payments: Accept online, recurring, and invoice-free payments.

- Time Tracking: Automatically track time and log billable hours.

- Accounting: Use reports and tools to track money in and out.

- Expenses & Receipts: Log expenses and receipts to keep your books tax-ready.

- Reports: Generate tax time and business health reports.

- Projects: Track project status and collaborate with clients and team members.

- Proposals: Create organized and professional proposals to win new clients.

- Estimates: Set clear expectations with clients and organize project plans.

- Client Management: Manage client information all in one place.

Are There Any Free FreshBooks Alternatives?

If you're looking for free alternatives to FreshBooks, there are several options that may work if you have limited accounting needs. These tools offer a range of features from invoicing to expense tracking, and some even provide advanced functionalities like inventory management and integrations with other business applications. Here are the best free alternatives to FreshBooks worth considering:

- Zoho Books: Zoho Books provides a free plan for businesses with less than $50,000 in annual revenue. It includes features like invoicing, expense tracking, and bank reconciliation.

- GnuCash: GnuCash is an open-source accounting software that supports double-entry accounting, expense tracking, and financial reporting. It's compatible with multiple operating systems, including Linux.

- Brightbook: Brightbook is designed for freelancers and small businesses. It offers features like invoicing, expense tracking, and basic financial reporting.

- ProfitBooks: ProfitBooks provides free accounting software with inventory management capabilities, making it ideal for retail businesses. It also includes invoicing and expense tracking.

- Manager: Manager is a free desktop-based accounting software that supports multiple operating systems. It offers features like invoicing, expense tracking, and financial reporting.

- Odoo: Odoo offers a free plan for its accounting app, which can be integrated with other Odoo business applications. It's suitable for businesses looking for a customizable and scalable solution.

These payroll and invoicing tools provide a variety of features that can help you manage your business finances effectively without the need for a paid subscription.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.