-

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

In this review, I’ll share my analysis and evaluation from my hands-on experience with FreshBooks. If you’re just starting your search for the best payroll software, check out my top picks.

You probably already know FreshBooks is among the most popular payroll software, but you need to understand its strengths and weaknesses. This in-depth FreshBooks review will walk you through the pros and cons, features, and functionality to help you understand its capabilities and suitability for your business needs.

Summary: FreshBooks

FreshBooks is an online accounting and invoicing platform for small businesses and self-employed professionals. It’s popular among freelancers, contractors, and small business owners for managing finances and billing clients.

FreshBooks addresses common issues like tracking expenses, creating professional invoices, and managing client information in one place. The software’s best features include time tracking, expense management, online payments, bank transfers and reconciliation, and financial reporting.

FreshBooks Pros

- Ease of use: FreshBooks has an intuitive interface that is easy to learn and navigate, even for those new to accounting software.

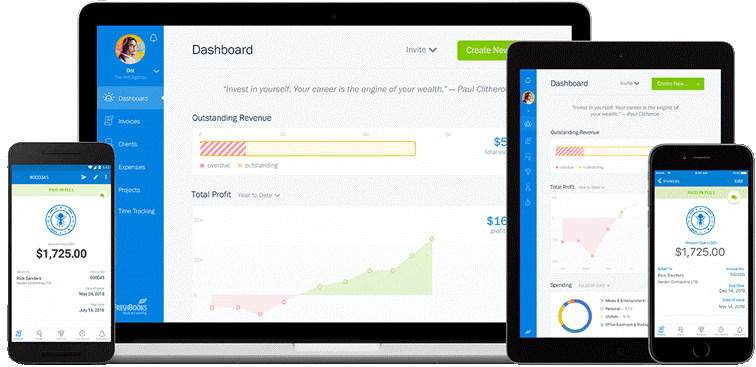

- Mobile access: FreshBooks offers full-featured iOS and Android apps that enable you to manage your accounting on the go.

- Customer support: The software provides helpful and responsive customer support, which is available by phone and email.

FreshBooks Cons

- Limited HR functionality: FreshBooks lacks some HR features offered by competitors, such as built-in time tracking and employee portals.

- Basic reporting: While adequate for many small businesses, FreshBooks' reporting options are not as advanced or customizable as some alternatives.

- No benefits administration: FreshBooks does not include tools to manage employee benefits like health insurance and retirement plans.

FreshBooks Expert Opinion

In my opinion, FreshBooks is an excellent payroll solution for small businesses looking for simplicity and affordability. Its user-friendly interface makes it easy to manage payroll, even without extensive HR knowledge. Additionally, the software offers several essential features like unlimited pay runs, direct deposit, automated taxes, and employee self-service, helping smaller teams manage payroll with ease at a lower cost.

However, while FreshBooks’ pricing is competitive, it lacks advanced payroll features that are vital for larger businesses, such as automated tax filing and complex benefits administration. Similarly, organizations with a dedicated HR department or who are heavily reliant on intricate compliance management might also find better alternatives.

As a result, FreshBooks is best suited for startups and growing businesses that require a reliable and easy-to-use payroll system without the need for extensive customization. It provides a straightforward onboarding process, which is a plus for businesses without dedicated HR personnel. With a responsive customer service team and easy-to-use services, FreshBooks can help smaller teams succeed in their individual realms while pushing towards business growth.

Why Trust Our Software Reviews

We've been testing and reviewing payroll software since 2017. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

-

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

RUN Powered by ADP

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.1 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Are You a Good Fit for FreshBooks?

Who Would Be a Good Fit for FreshBooks?

FreshBooks payroll software is ideal for small service businesses and self-employed professionals, such as marketing agencies, IT consultants, lawyers, architects, and creatives. Its intuitive interface and core features make it perfect for those with simple accounting needs who want to manage invoices, track time and expenses, and collaborate with their accountant or team easily. FreshBooks is also a good option for businesses seeking an affordable cloud solution accessible from anywhere.

Who Would Be a Bad Fit for FreshBooks?

FreshBooks payroll software is not suitable for larger businesses or those with complex accounting needs. Companies that carry inventory, need features like purchase orders, or have specific industry requirements may find the software’s lack of advanced features challenging. Additionally, businesses requiring high customization or niche integrations may need an alternative solution, as FreshBooks focuses on core functionality for broad appeal.

Best Use Cases for FreshBooks

- Small businesses: FreshBooks' affordable pricing and simple interface make it a good fit for small businesses with straightforward payroll needs.

- Solopreneurs: Self-employed professionals like freelancers and consultants may appreciate how FreshBooks combines invoicing, accounting, and payroll in one tool.

- Service industries: Marketing agencies, law firms, IT consultants, and similar client-focused businesses may find FreshBooks meets their needs well.

- Existing users: Companies already using FreshBooks for accounting will benefit from the seamless integration of its payroll features.

- Salaried employees: FreshBooks handles paying salaried workers well but lacks some features for hourly staff.

- Mac-based businesses: FreshBooks started as a Mac-only tool and its design tends to appeal to the creative professionals who favor Macs.

Worst Use Cases for FreshBooks

- Large companies: Once a business reaches 100+ employees, it will likely outgrow FreshBooks payroll and need more sophisticated HR and payroll tools.

- Complex payrolls: Companies with many hourly workers, multiple pay rates, garnishments, or job costing needs may find FreshBooks too basic for their specific need requirements.

- Certain states: FreshBooks payroll software lacks tax filing services in some US states, so companies in those states need to handle tax filings themselves.

- Analytics-focused firms: FreshBooks offers limited customization options for payroll reporting and analytics, which may not be ideal for data-oriented teams.

- Mobile-centric companies: While FreshBooks has mobile apps, their payroll functionality is limited compared to the desktop version.

- Highly regulated industries: Businesses subject to strict labor regulations and reporting requirements, like healthcare and finance, may require a stronger and more in-depth payroll service.

-

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

FreshBooks Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐⭐

- Integrations: ⭐⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐

Review Methodology

We are a team of software experts who focus on the features and functionality of various platforms. We understand that choosing the right software can be difficult and confusing. That's why we test and score software to find the best solutions for any use case.

Using our objective, data-driven testing methodology, we've evaluated over 300 software products. We are committed to fully and fairly testing software to cut through the marketing hype and truly understand each platform.

Our robust testing scenarios mimic real-world use, and we draw on our practical experience with the tools. We also complement our findings with interviews with users, experts, and software vendors.

How We Test & Score Payroll Software

We have spent years developing and refining our system for testing and scoring payroll software. Our rubric captures the nuances of software selection and what makes payroll software effective, focusing on key aspects of the decision-making process.

Here’s how our testing and scoring work across eight criteria: core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money. This approach allows us to provide an unbiased evaluation based on these essential factors.

Core Functionality (25% of final scoring)

For payroll software, the core functionality we test and evaluate are:

- Payroll processing: Automates payroll calculations, deductions, and payments to accounts payable.

- Tax compliance: Ensures payroll taxes are withheld and filed correctly during tax time.

- Direct deposit: Enables electronic payment of wages to employee bank accounts and PayPal.

- Reporting: Provides detailed payroll data, tax reports, and expense reports.

- Employee self-service: Allows employees to view pay stubs and update personal info.

- Integrations: Connects with time tracking, accounting, and HR software.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in payroll software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (15% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the payroll software. High scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the payroll software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High scoring software indicates little or no support is required.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Payroll software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Payroll software offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the payroll software again for the core functionality. A high scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, in consideration of all the other criteria, we review the average price of entry level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

Through this comprehensive approach, focusing on core functionalities, standout features, usability, onboarding, customer support, value, and customer reviews, I aim to identify payroll software that not only meets but exceeds expectations, ensuring teams have the tools they need to succeed.

FreshBooks Review

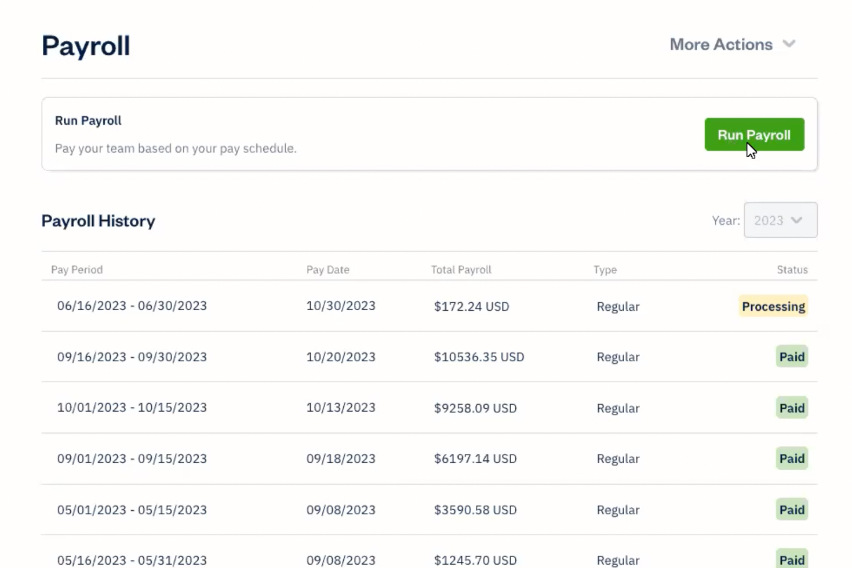

Core Payroll Software Functionality

Automatic tax calculations and filings: FreshBooks automatically calculates federal, state, and local payroll taxes for each pay run. It also prepares and files the necessary tax forms with the appropriate agencies based on your business location.

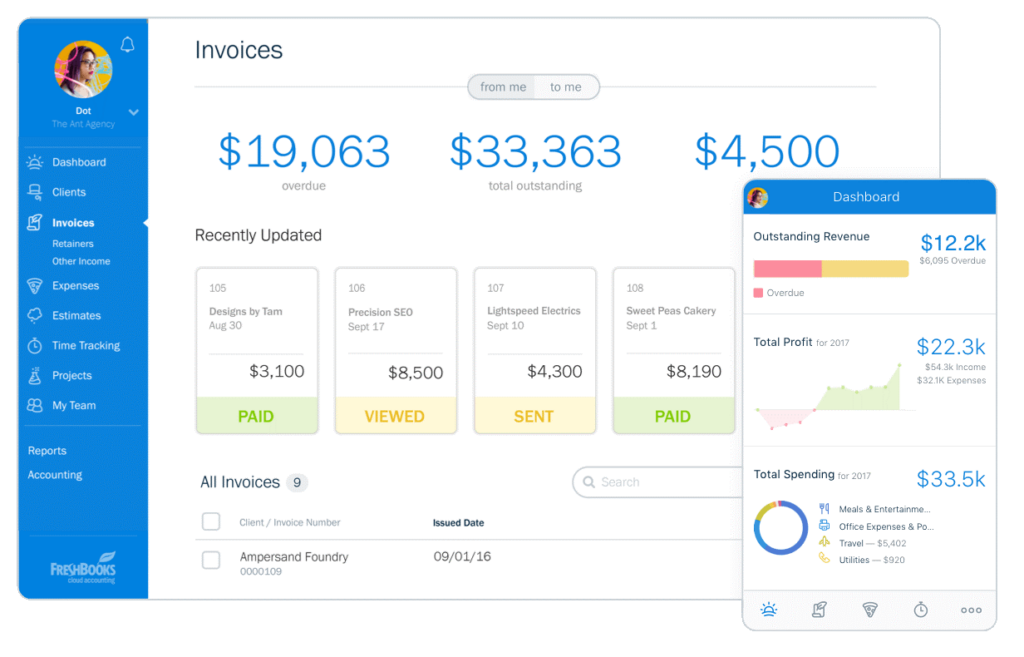

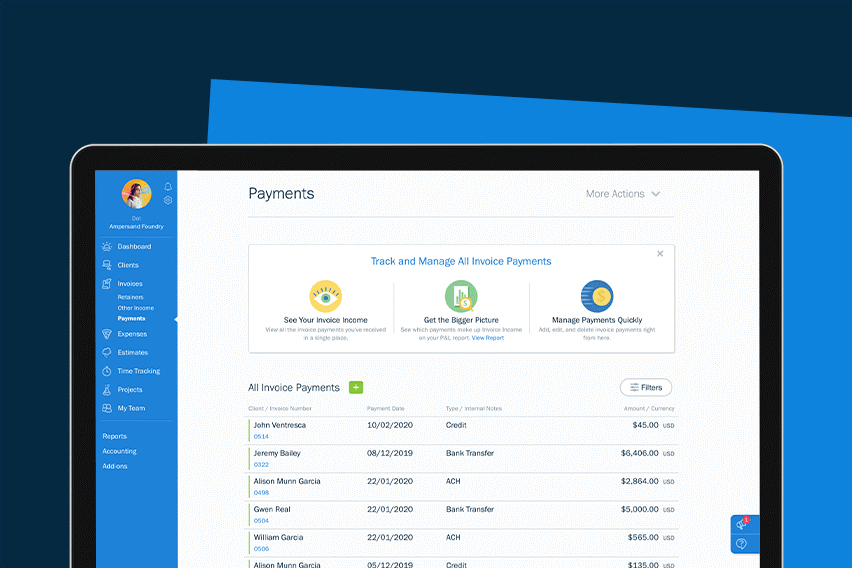

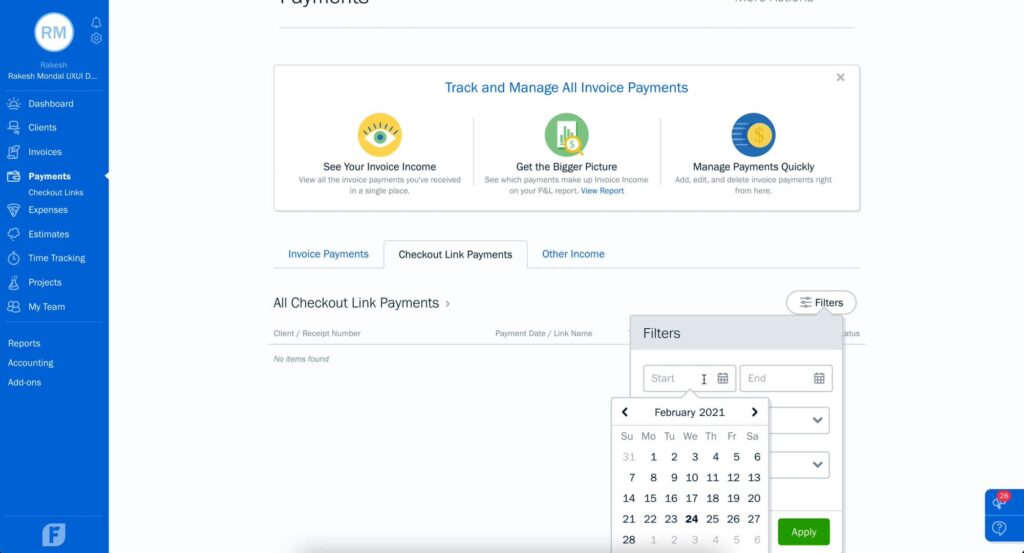

Invoicing: FreshBooks allows businesses to create and send professional invoices, track their status, and set up automated payment reminders. The invoicing feature is designed to be quick and professional, and automated reminders can nudge clients for payment, streamlining the billing process.

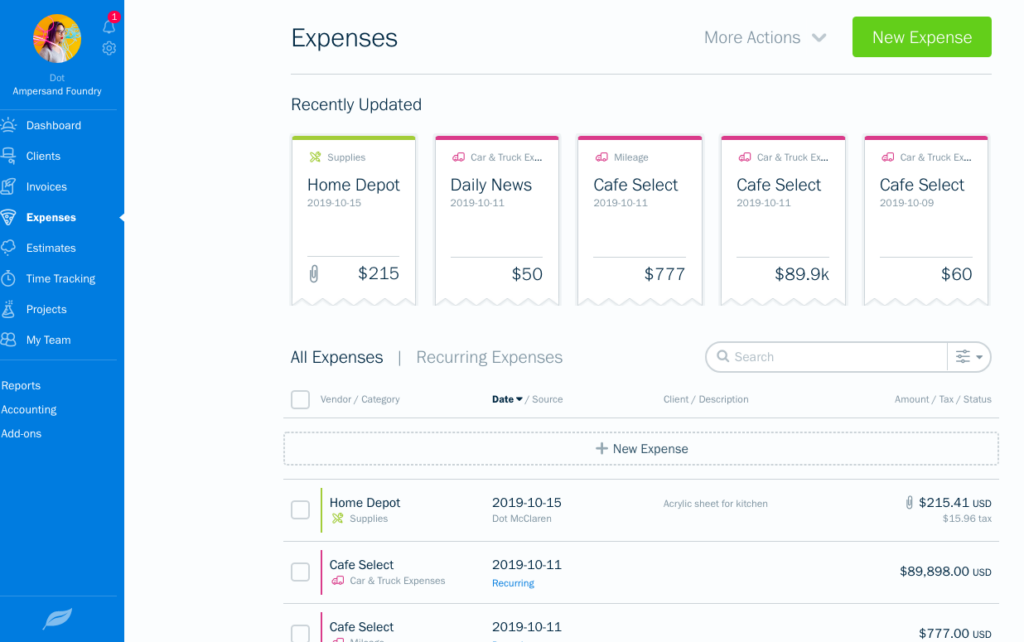

Expenses tracking: FreshBooks enables businesses to track and categorize expenses, making it easier to manage business finances. This feature helps businesses stay organized and provides a clear picture of spending patterns, ensuring they are always tax-ready and informed about their financial health.

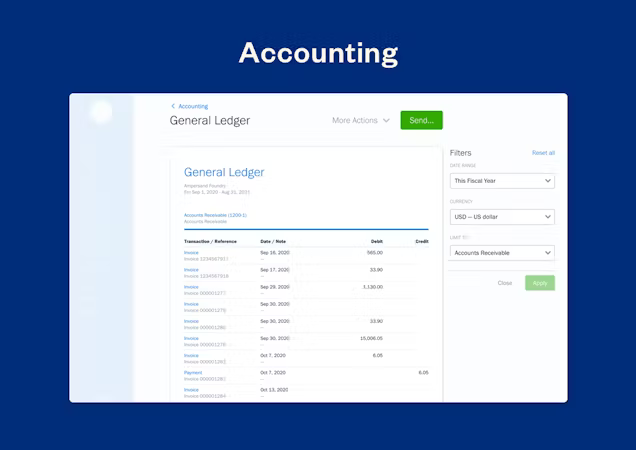

Detailed payroll reporting: FreshBooks provides various types of reports, including payroll registers, sales tax liabilities, contractor payments, and more. These reports can be exported in PDF or CSV format.

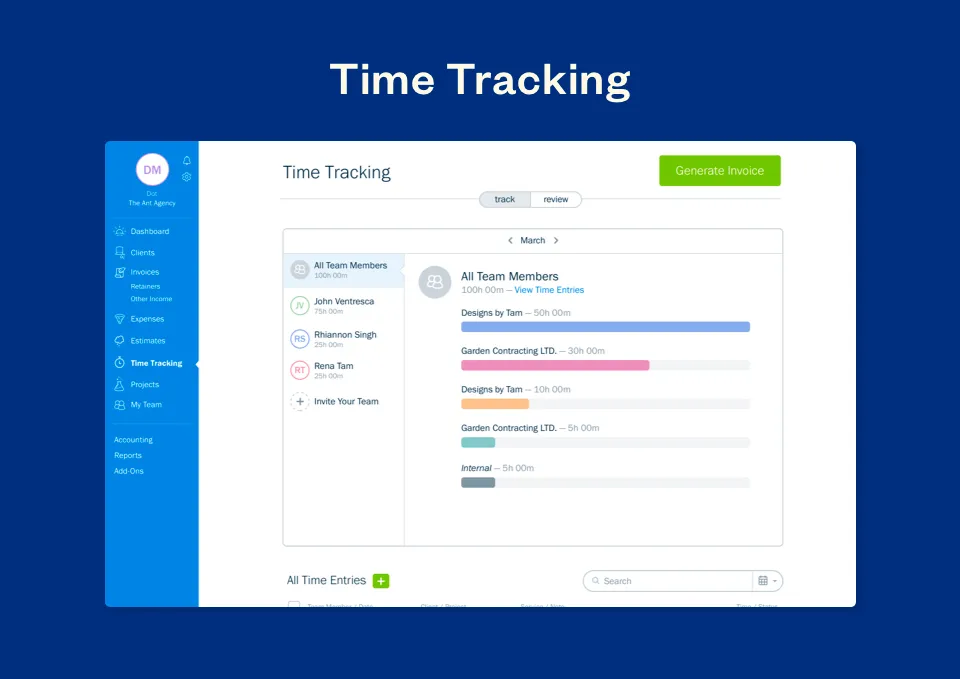

Time tracking integration: FreshBooks has a built-in time tracking tool that accurately tracks time and logs billable hours. However, it does not automatically sync with payroll to calculate wages for hourly employees.

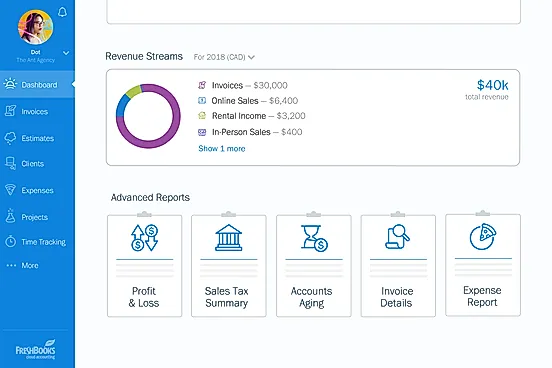

Revenue management: FreshBooks helps businesses manage revenue by tracking income and generating detailed financial reports. It offers tools to monitor financial health, ensuring businesses can make informed decisions.

FreshBooks Standout Features

Auto-pilot payroll: You can set up payroll to run automatically each period on a set schedule. FreshBooks will calculate earnings and deductions and process payments without manual intervention.

Accountant access: You can provide your accountant or bookkeeper with access to financial reports and data. They can help ensure compliance and integrate payroll with your general accounting solution.

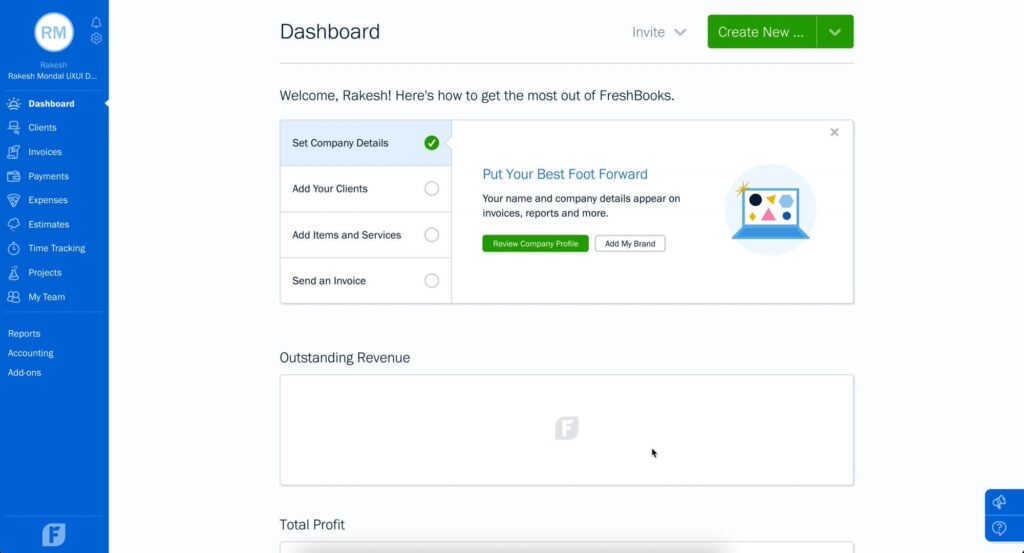

Ease of Use

I found FreshBooks very intuitive and user-friendly compared to other payroll solutions I've used. The interface is well-designed and free of clutter from rarely used FreshBooks features.

Onboarding

FreshBooks offers a guided setup process to help new users configure payroll settings and add employee information, walking you through each step. You can also give your accountant access during onboarding and reference knowledge base articles and video tutorials for additional help.

Customer Support

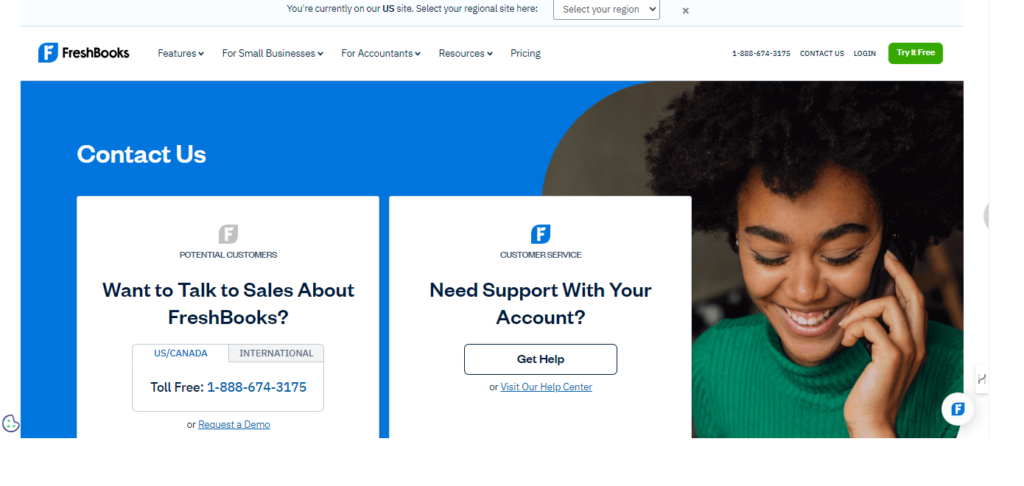

FreshBooks provides customer support through various channels. You can call for live support during extended business hours or email the support team and get a response within one business day. There is also an in-app chat to speak with a support representative in real-time.

Integrations

FreshBooks integrates directly with Stripe, G Suite, Asana, Trello, Slack, Basecamp, Zendesk, Shopify, and Fundbox. It also has an open API for building custom integrations with other business tools. For non-technical users, it supports over 3,000 apps through Zapier.

Value for Money

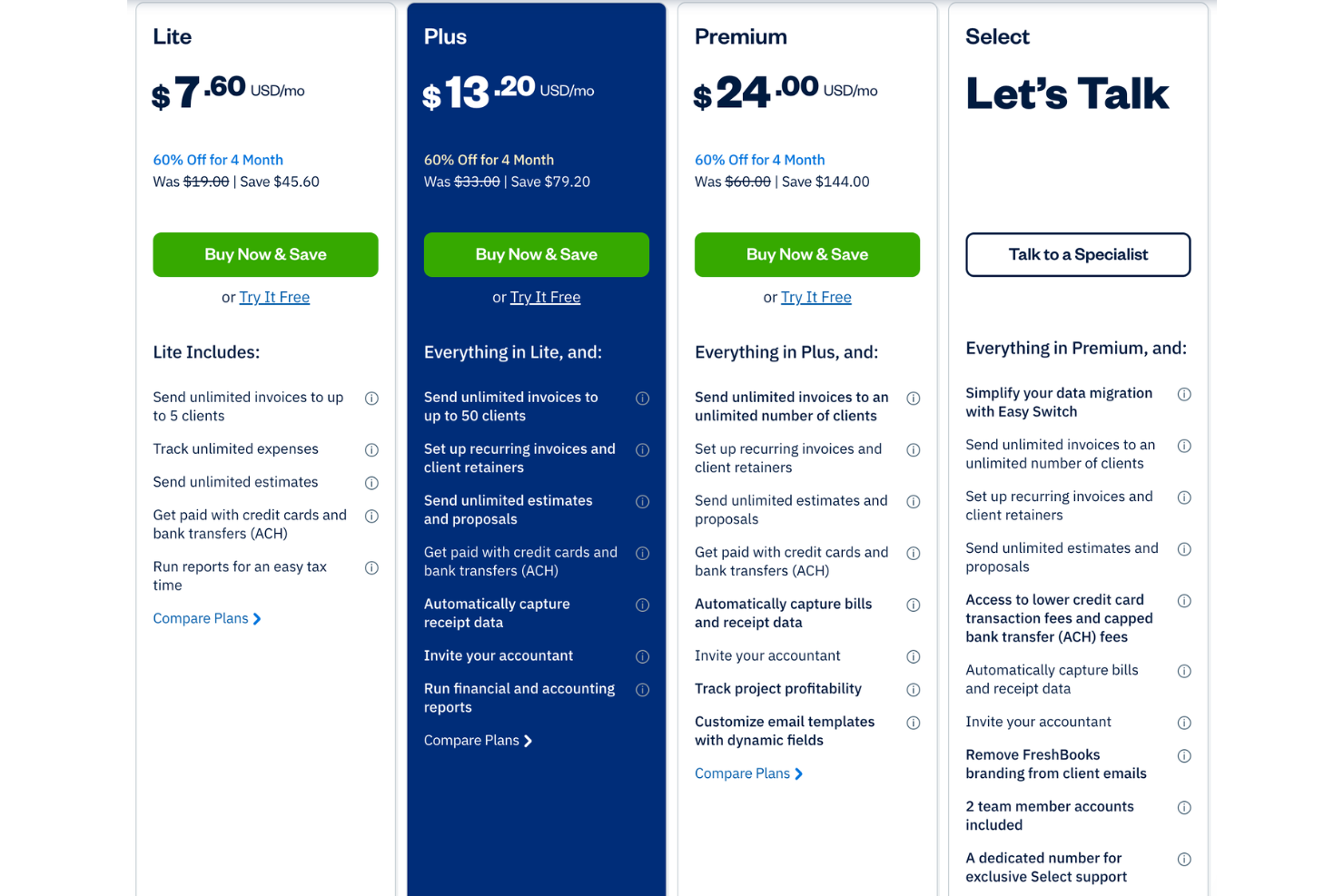

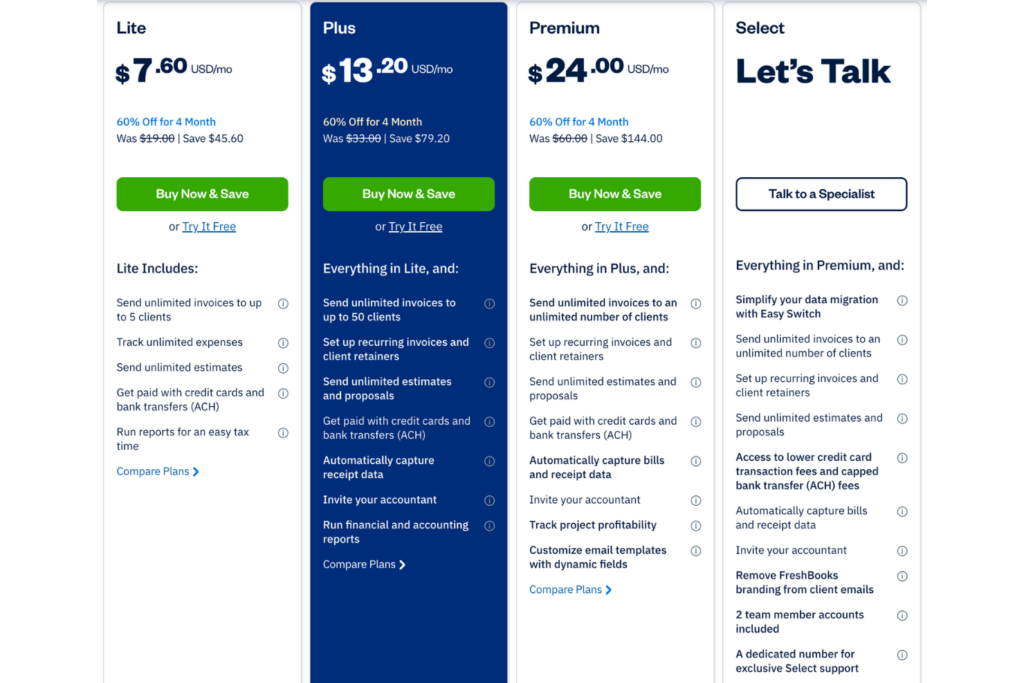

Based on my experience testing payroll software, I find FreshBooks to be average to slightly expensive compared to other options. Here are the pricing plans:

- Lite Plan: $7.60/month for up to 5 billable clients

- Plus Plan: $13.20/month for up to 50 billable clients

- Premium Plan: $24/month for an unlimited number of billable clients

- Select Plan: Custom pricing for advanced features and support

FreshBooks does not charge per employee like some competitors, which can be more affordable for businesses with many employees. However, the base pricing is higher than budget options like Wave ($20/month for payroll) or Xero ($11/month starter plan).

If budget constraints are an issue, you may want to review our list of the best free payroll tools for possible alternatives, just to see what's out there.

Product Specifications

| Feature | FreshBooks Support |

| Direct deposit | ✅ |

| Employee self-service portal | ✅ |

| Tax filing and forms | ✅ |

| Payroll reporting | ✅ |

| Mobile app | ✅ |

| Unlimited payroll runs | ✅ |

| Automated payroll deductions | ✅ |

| Accounting software integration | ✅ |

| Garnishment management | ✅ |

| Time tracking | ✅ |

| Contractor payments | ✅ |

| Multiple pay rates | ✅ |

| Multi-state payroll | ❌ |

| Benefits administration | ❌ |

| PTO/vacation tracking | ❌ |

| HR functions (onboarding, etc.) | ❌ |

| Workers' compensation | ❌ |

| Certified payroll | ❌ |

FreshBooks Alternatives

If you're looking for alternative payroll software options to FreshBooks, here are a few worth checking out:

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

FreshBooks Frequently Asked Questions

What is FreshBooks?

FreshBooks is cloud-based accounting software designed for small business owners, freelancers, and their teams. It allows users to create and send invoices, track expenses, manage projects and clients, and view financial reports all in one place. FreshBooks is known for its intuitive interface, time-saving automations, and excellent customer support.

Is there a mobile app for FreshBooks?

Yes, FreshBooks offers mobile apps for iOS and Android devices. The apps allow users to:

- Create and send recurring invoices

- Snap photos of receipts to log expenses

- Track time spent on projects

- View dashboards and reports

The mobile apps sync automatically with the web version, so data is always up to date across devices.

Is FreshBooks HIPAA compliant?

No, FreshBooks does not advertise itself as HIPAA compliant. The software is designed for general business accounting and has not implemented all the safeguards required by HIPAA regulations to handle protected health information (PHI). Businesses in the healthcare sector that need to comply with HIPAA should look for accounting software specifically designed for their industry.

Is FreshBooks SOC 2 compliant?

Yes, FreshBooks has achieved SOC 2 Type II compliance. This means an independent auditor has examined FreshBooks’ systems and processes and found they meet the trust services criteria for security, availability, processing integrity, confidentiality, and privacy. The SOC 2 report assures users that FreshBooks maintains a secure environment for processing their financial data.

Is FreshBooks secure?

Yes, FreshBooks takes the security and privacy of user data seriously:

- All data is encrypted in transit using 256-bit SSL/TLS encryption

- Data is encrypted at rest using AES-256 encryption

- FreshBooks conducts regular third-party security audits and penetration tests

- Multi-factor authentication and single sign-on are supported

- Detailed access controls and audit logging are in place

Is FreshBooks FedRAMP certified?

No, FreshBooks does not currently have FedRAMP certification. FedRAMP is a government-wide program that provides a standardized approach to security assessment, authorization, and continuous monitoring for cloud products and services used by federal agencies. While FreshBooks maintains robust security practices, it is not authorized for use by U.S. federal government agencies at this time.

Is FreshBooks GDPR compliant?

Yes, FreshBooks is committed to complying with the General Data Protection Regulation (GDPR) for users in the European Union. Key steps taken include:

- Appointing a Data Protection Officer

- Updating terms of service and privacy policies

- Implementing processes for data portability, modification, and deletion requests

- Ensuring data processing agreements are in place with third-party vendors

FreshBooks also maintains a data processing addendum (DPA) that customers can sign to ensure GDPR compliance.

Does FreshBooks have an API?

Yes, FreshBooks offers a REST-based API that allows developers to integrate FreshBooks functionality into their own applications. The API provides endpoints for interacting with key FreshBooks entities such as clients, invoices, estimates, expenses, time entries, and more. API access is available on all paid plans. Developers need to register an app and obtain OAuth 2.0 client credentials before making API calls.

FreshBooks Company Overview & History

FreshBooks is an online accounting software company designed for small and medium-sized businesses, freelancers, and firms. As a cloud-based SaaS provider, FreshBooks offers bookkeeping, invoicing, time tracking, and payment processing solutions through web and mobile apps. Headquartered in Toronto, Canada, FreshBooks serves over 30 million users in more than 160 countries.

As a privately held company, FreshBooks does not disclose detailed financial information. However, it has raised significant funding over the years, totaling over $155 million. In 2021, FreshBooks secured $80.75 million in Series E funding, along with an additional $50 million in debt financing, bringing the total to $130.75 million. This round of funding was led by Accomplice, with participation from investors such as JPMorgan Chase, Gaingels, BMO, and Manulife, resulting in a valuation of over $1 billion with the company achieving "unicorn" status.

FreshBooks Major Milestones

- 2003: Founded by Mike McDerment and Joe Sawada in Toronto

- 2006: Reaches 100,000 users

- 2009: Launches first iPhone app

- 2014: Secures $30 million in Series A funding

- 2017: Releases FreshBooks mobile app for Android

- 2018: Surpasses $10 billion in client billings processed

- 2021: Raises $130 million Series E, reaches $1 billion valuation

Want to learn more about FreshBooks? Check out their site for additional information.

From $15/month

30-day free trial