-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

In this review, I'm going to share my analysis and evaluation from hands-on experience with Patriot. But first, if you're just beginning your search for the best payroll software, check out my picks of the best payroll software.

You probably already know Patriot is among the most popular payroll software out there, but you need to better understand what's good and not so good about it. This in-depth Patriot review will walk you through the pros and cons, features, and functionality, to help guide you to better understand its capabilities and suitability for your scenario.

Summary: Patriot

Patriot is an online payroll and accounting software for small businesses and accounting firms. It’s commonly used by business owners, bookkeepers, and accountants to manage payroll processing, tax filings, HR, time tracking, and bookkeeping.

Patriot addresses common pain points such as navigating complex payroll and tax laws, avoiding penalties and audits, and eliminating time-consuming, error-prone manual calculations. Its best features are full-service payroll completed in three steps, automatic federal and state tax filings, employee self-service, and integrations with popular accounting software like QuickBooks.

Patriot Pros

- Unlimited payroll: Patriot allows teams to run payroll as many times as needed each month at no extra cost.

- Employee self-service: The online portal allows employees to view pay stubs, update information, and access tax documents.

- Tax filing services: Patriot helps companies handle federal, state, and local payroll tax calculations and complete filings automatically.

Patriot Cons

- Limited HR functionality: The software lacks advanced HR features like performance management, employee directories, and org charts.

- No mobile app: Users can't access the software or run payroll on the go from a smartphone app.

- Basic reporting: Patriot’s reporting options cover essentials but have limited customization compared to some alternatives.

Patriot Expert Opinion

In my opinion, Patriot is an excellent payroll solution for small businesses operating on a budget. Its user-friendly interface and full-service payroll features make it easy to implement and manage payroll efficiently. Patriot offers essential payroll capabilities like unlimited payroll runs and seamless integration with its accounting software. Additionally, the affordable pricing and smooth integration with third-party tools ensure an in-depth and cost-effective solution for businesses with straightforward payroll needs.

However, for businesses needing more advanced payroll capabilities, Patriot may fall short. While Patriot's payroll features are sufficient for straightforward needs, it lacks a mobile app and extensive third-party integrations. Similarly, Patriot doesn't handle benefits administration, and its support hours are not as extensive as some competitors. As a result, companies with more complex payroll requirements might find more value in pricier platforms that offer a broader range of features.

But for small businesses looking for a straightforward, affordable payroll solution, Patriot is worth the cost. Its transparent pricing and seamless integration with Patriot's accounting tools are particularly appealing to budget-conscious startups. In my opinion, Patriot offers a compelling blend of functionality, ease of use, and value, making it a top choice for small businesses with simple payroll needs.

Why Trust Our Software Reviews

We've been testing and reviewing payroll software since 2018. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

UKG

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2

Are You a Good Fit for Patriot?

Who Would Be a Good Fit for Patriot?

Patriot is ideal for small businesses with under 100 employees seeking to streamline basic payroll and HR tasks. Its core features, including payroll processing, tax filing, and employee onboarding, are perfect for companies without dedicated HR departments needing an affordable, all-in-one solution. Patriot's user-friendly interface and self-service portal, where employees can access their pay stubs and W-2s, require minimal technical knowledge and training.

Who Would Be a Bad Fit for Patriot?

Mid-sized and large companies with over 100 employees would not find Patriot sufficient for their needs. It lacks advanced HR features such as integrated talent management, learning management systems, and advanced reporting common in larger HR solutions. As such, companies requiring extensive customization or industry-specific functionality may also find Patriot's options lacking. Additionally, Patriot only supports payroll for the United States, making it unsuitable for global companies.

Best Use Cases for Patriot

- Small businesses: Patriot offers an affordable and user-friendly payroll solution that aligns well with the straightforward needs and limited budgets of small businesses.

- Restaurants: Features like integrated tip tracking and reporting simplify payroll processing for restaurant owners and managers using Patriot.

- Nonprofits: Patriot effectively manages the payroll needs of nonprofit organizations by supporting key tax filings and forms specific to this sector.

- Household employers: The software provides the necessary payroll and tax functionality for individuals employing nannies, caregivers, or other household staff.

- Startups: The core feature set and low price point of Patriot payroll match the needs and financial constraints of many early-stage startups.

- Accounting firms: Patriot's dedicated accountant features and wholesale pricing facilitate efficient client payroll management for accounting practices.

Worst Use Cases for Patriot

- Large enterprises: Patriot lacks the advanced HR capabilities, business software integrations, and configurability that bigger corporations typically require.

- Global workforces: Companies with international employees may find Patriot unsuitable, as the platform only handles payroll for the United States.

- Intricate payroll: Organizations dealing with highly complex pay structures, union contracts, certified payroll, or other complicated scenarios may need a more powerful solution than Patriot offers.

- Rapid growth: Fast-growing businesses can quickly strain the limits of Patriot's basic toolset, necessitating a disruptive switch to a new payroll provider.

- Dispersed teams: With very limited mobile functionality, companies with large numbers of remote or field-based workers may find using Patriot frustrating.

- Niche industries: Patriot does not handle the unique payroll requirements in sectors like agriculture and construction, making it a poor fit. (Review our list of the best construction payroll software if these are features you need.)

Need expert help selecting the right Payroll Management Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Deel

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

UKG

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.2

Patriot Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐⭐

- Integrations: ⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐

Review Methodology

We're a team of software experts who obsess about the features and functionality of different platforms. We know how critical—yet difficult and confusing—software selection can be. We test and score software to find the best solutions, whatever the use case may be.

Using our objective, data-driven testing methodology, we've tested 300+ software. We dedicate ourselves to being objective in fully and fairly testing software, to get beyond the marketing fluff and truly understand the platform.

We've developed robust testing scenarios to use the software in the same way you will. We leverage our own first-hand, practical experience with the tools, complemented by interviews with users, experts, and software vendors.

How We Test & Score Payroll Software

We've spent years building, refining, and improving our software testing and scoring system for payroll software. The rubric is designed to capture the nuances of software selection, and what makes payroll software effective, focusing on important aspects of the decision-making process.

Below, you can see exactly how our testing and scoring work across eight criteria. It allows us to provide an unbiased evaluation of the software based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (25% of final scoring)

For payroll software, the core functionality we test and evaluate are:

- Payroll processing: Accurately calculates and processes employee paychecks.

- Tax compliance: Automatically calculates and withholds federal, state, and local taxes.

- Direct deposit: Sends employee paychecks directly to their bank accounts.

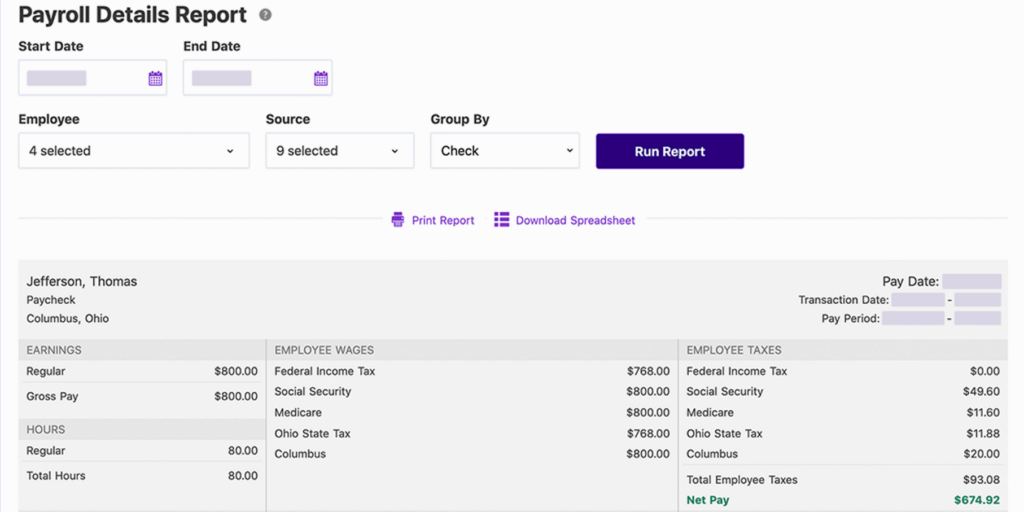

- Reporting: Generates payroll reports for internal and external use.

- Employee self-service: Allows employees to view pay stubs and update personal information.

- Benefits management: Tracks and manages employee benefits like health insurance and retirement plans.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in payroll software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (15% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the payroll software. High-scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

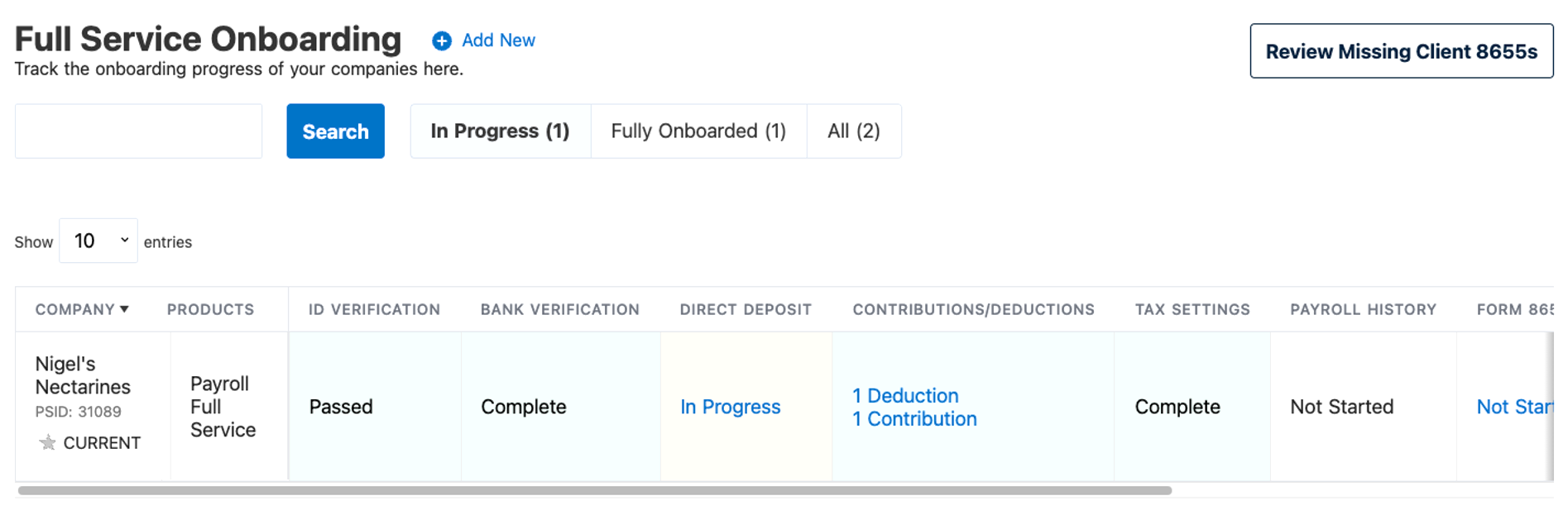

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the payroll software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High-scoring software indicates little or no support is required.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Payroll software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Payroll software offering plentiful native integrations, 3rd party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the payroll software again for the core functionality. A high-scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, in consideration of all the other criteria, we review the average price of entry-level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

Using this in-depth approach, with a strong focus on core functionalities, standout features, usability, onboarding, customer support, value, and customer reviews, I aim to identify payroll software that not only meets but exceeds expectations, ensuring teams have the tools they need to succeed.

Patriot Review

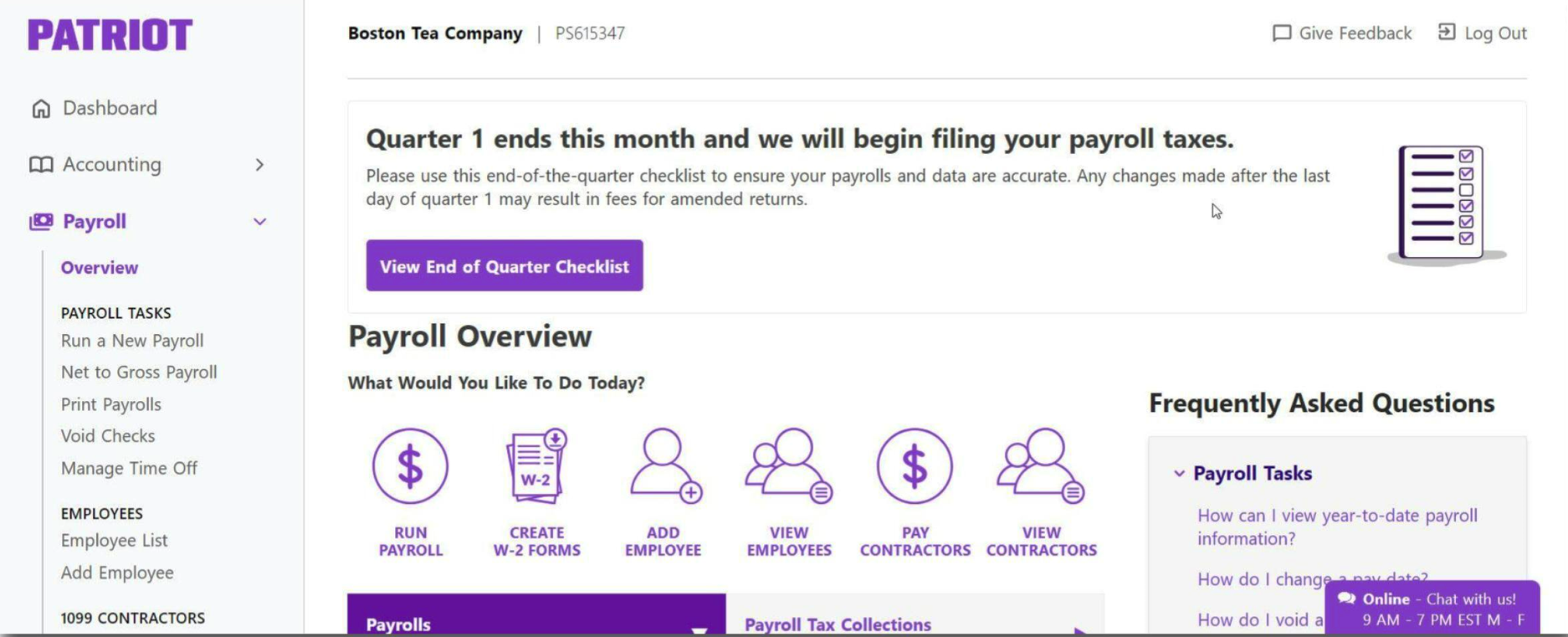

Core Payroll Software Functionality

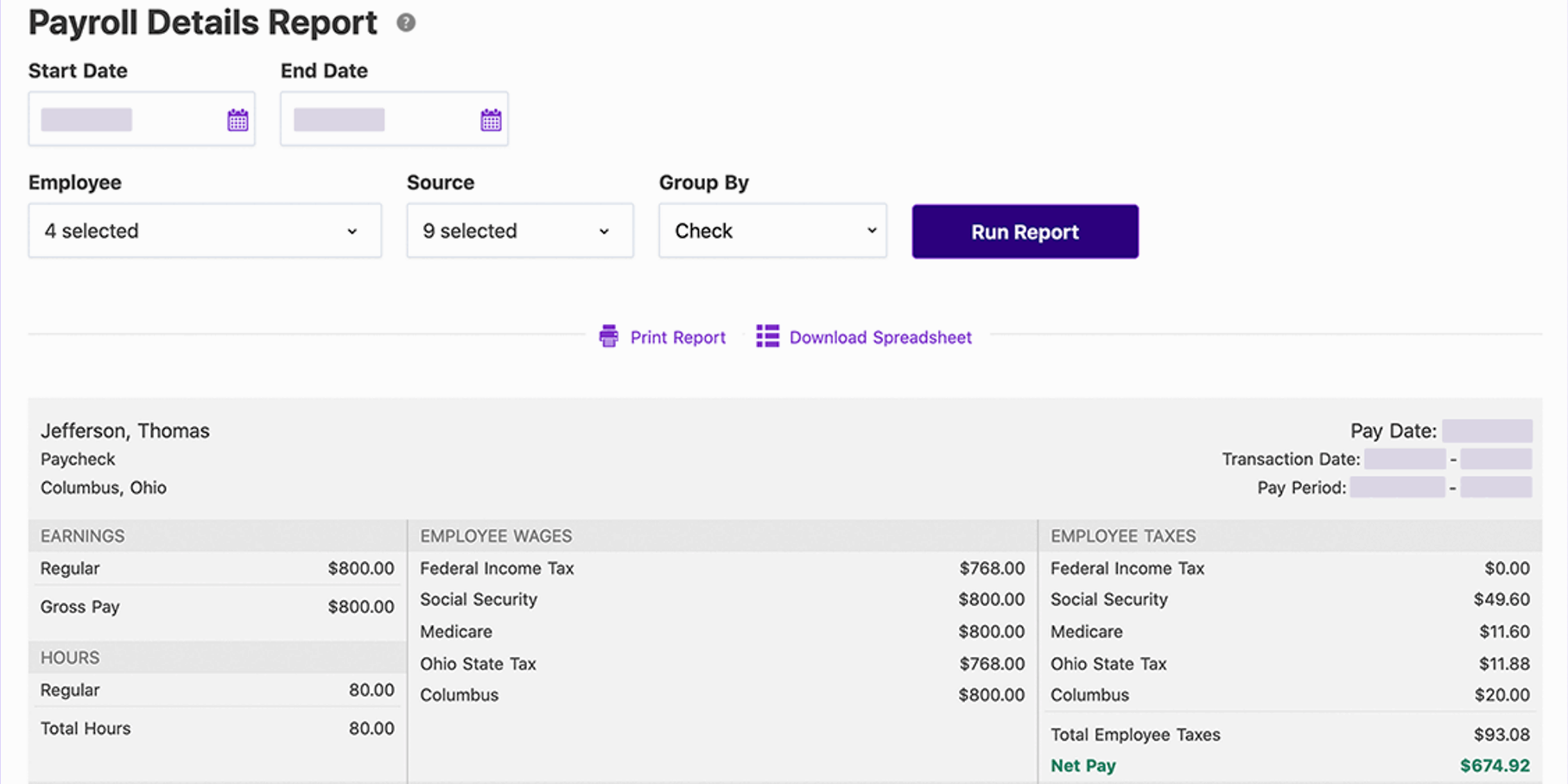

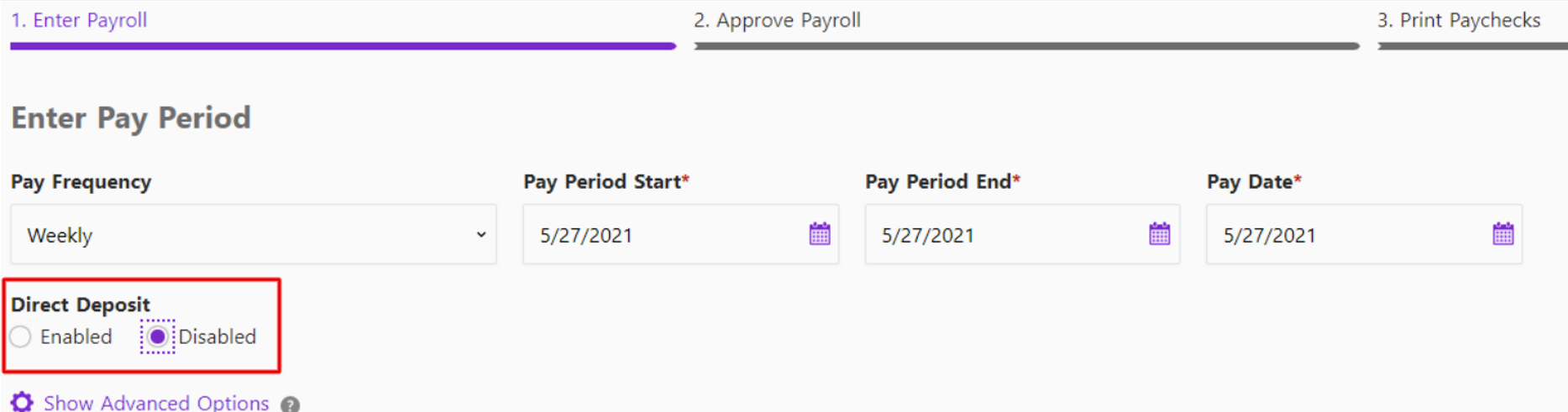

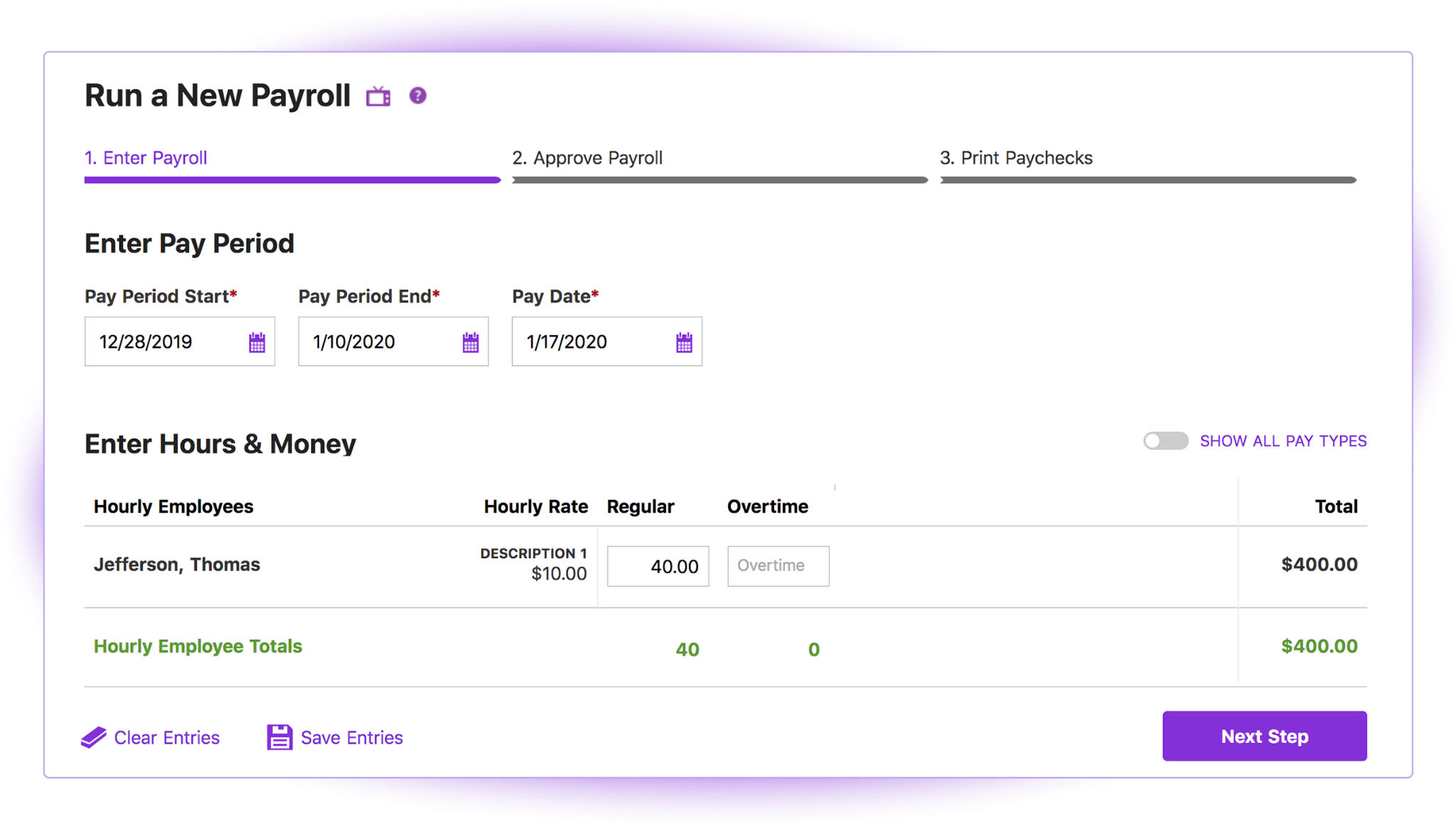

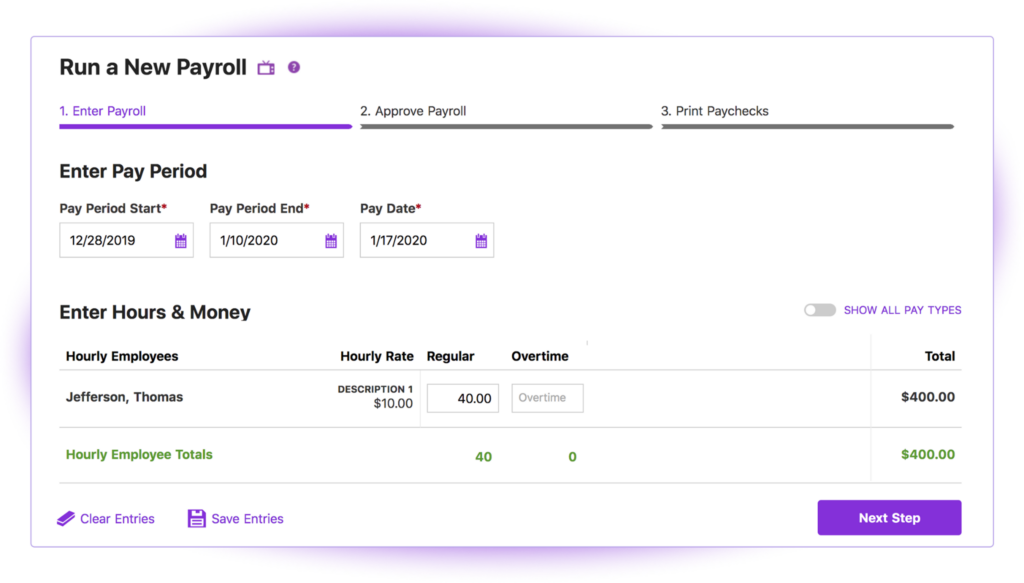

Payroll Processing: Patriot offers a straightforward payroll processing system. It calculates wages, taxes, and deductions accurately, ensuring timely contractor payments every pay period.

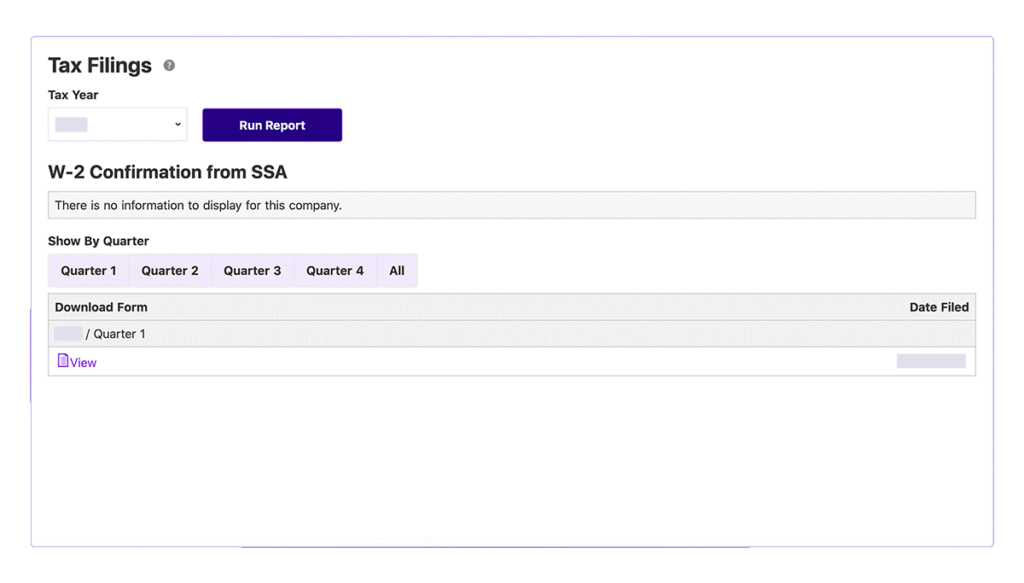

Tax Filing: Patriot handles federal, state, and local tax filings automatically, which reduces the administrative burden and minimizes the risk of errors in tax compliance.

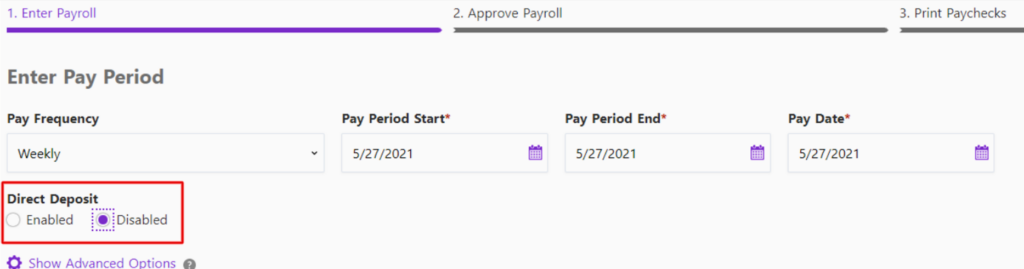

Direct Deposit: Patriot supports direct deposit, allowing employees to receive their paychecks directly into their bank accounts. This function is reliable and convenient for both employers and employees.

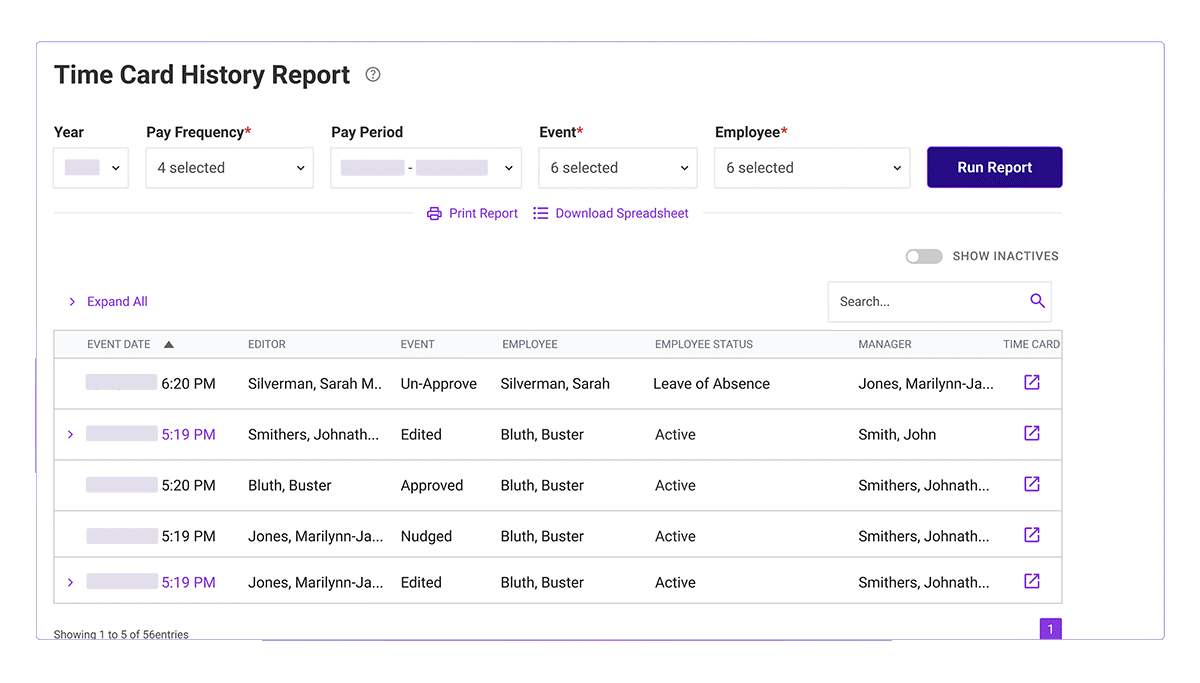

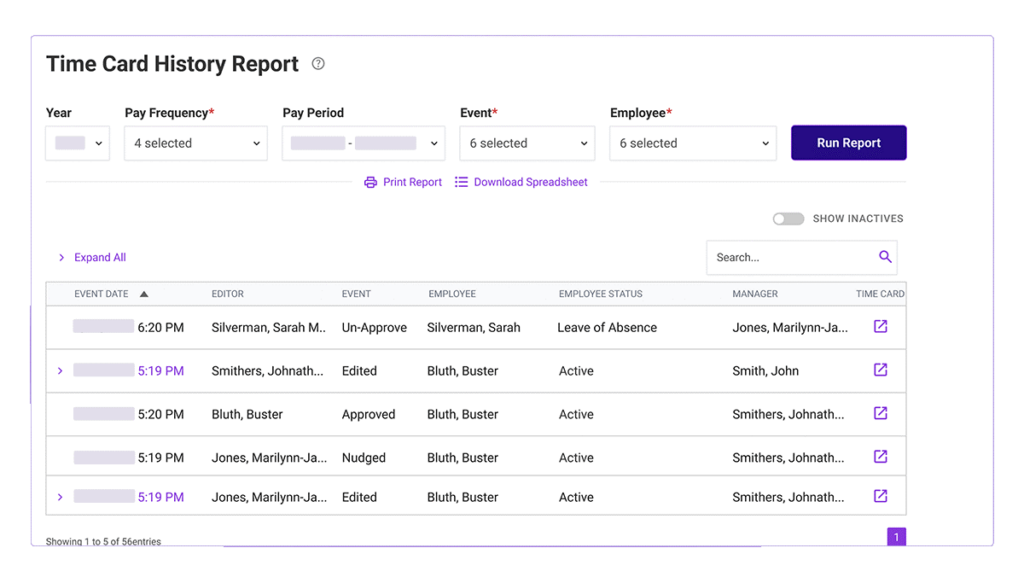

Time and Attendance Tracking: The integrated time and attendance tracking tool helps human resource professionals monitor employee hours. It syncs with payroll, reducing manual entry and errors.

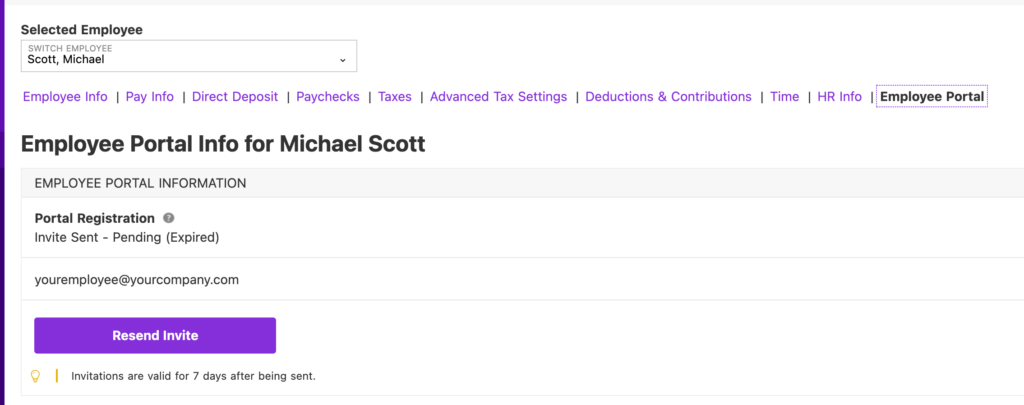

Employee Self-Service: The platform includes a self-service portal where employees can view pay stubs, update personal information, and access tax documents. This feature empowers employees and reduces the HR workload.

Garnishment Management: Patriot efficiently manages wage garnishments by calculating and processing them according to legal requirements, ensuring compliance and accuracy. The system supports automatic tax rate updates and customizable payroll options, which helps maintain accurate payroll processing for both employees and contractors.

Patriot Standout Features

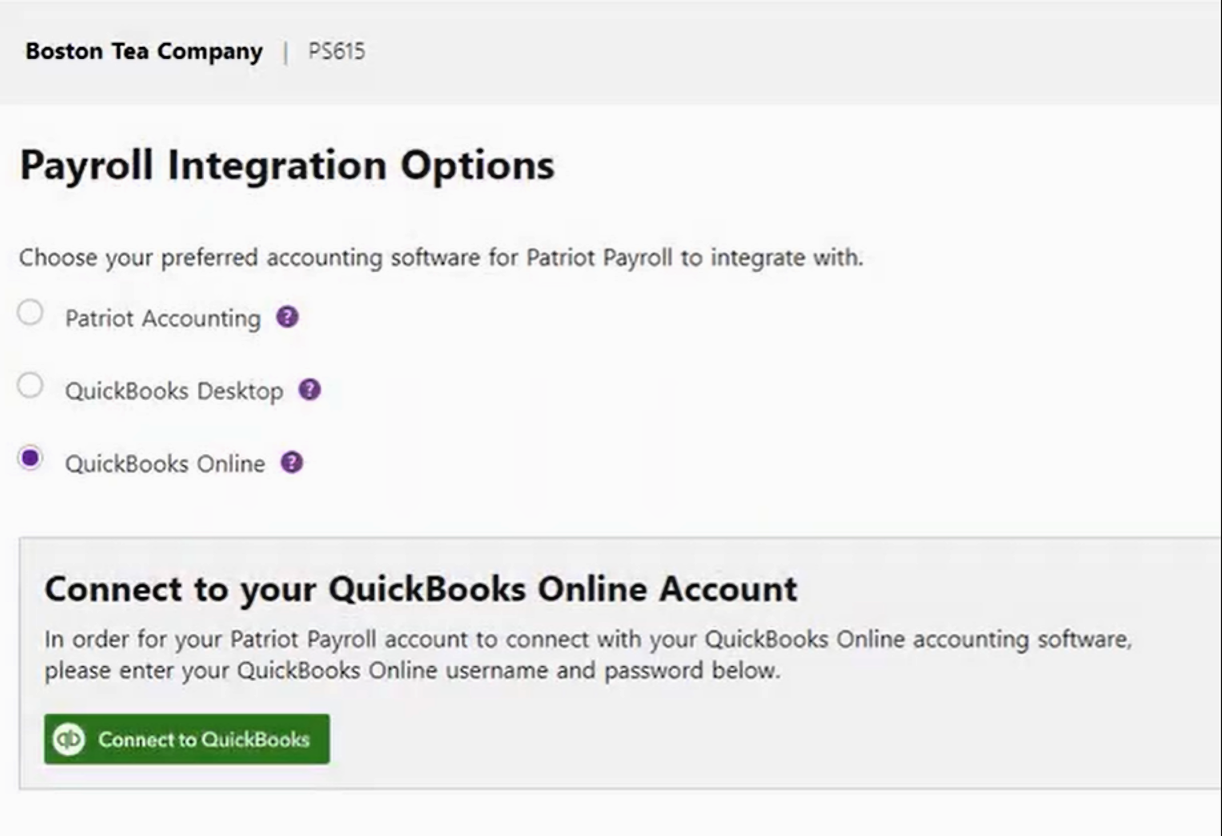

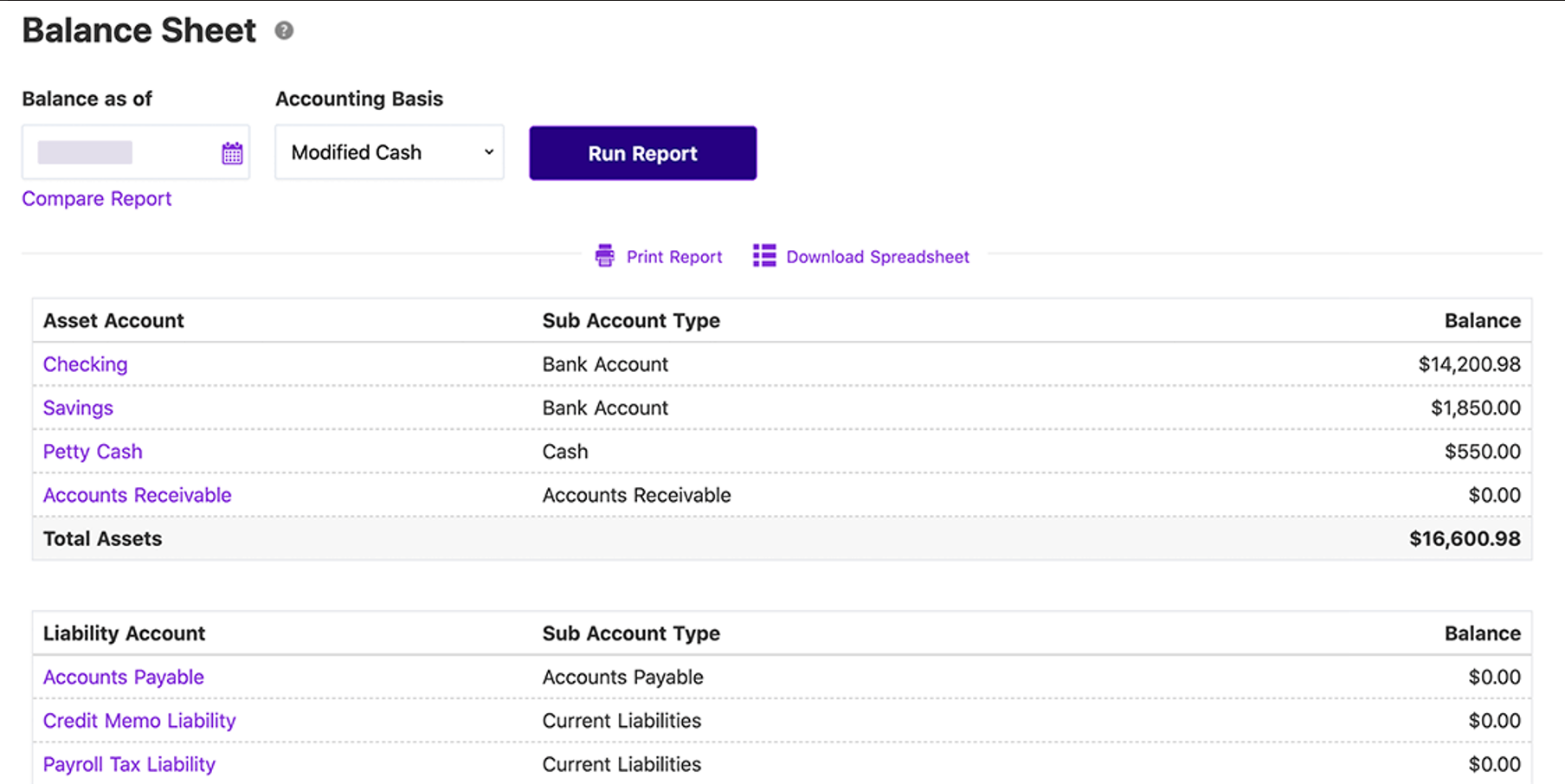

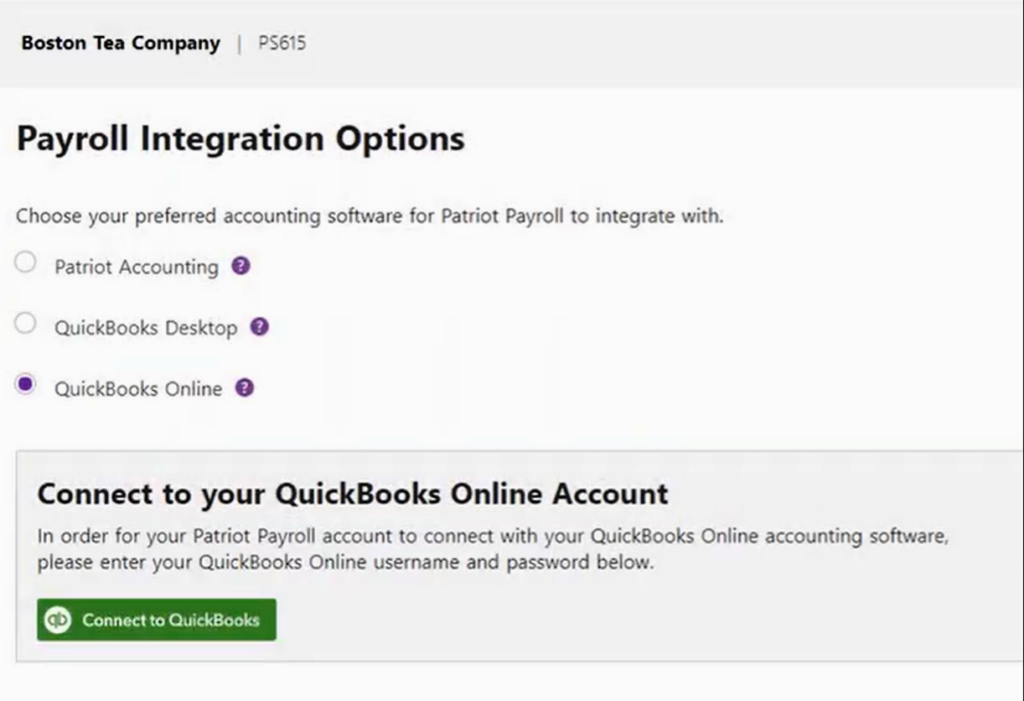

Patriot Accounting Integration: Patriot offers integration with its accounting software, ensuring that payroll data flows directly into accounting records. This feature automates the transfer of payroll information, including gross pay, net pay, employee and employer taxes, and deductions, directly into the accounting system.

Free Expert Support: Patriot provides free expert support for routine inquiries, which is a standout feature in the payroll software market where many providers charge extra for premium support services.

Ease of Use

Overall, Patriot is one of the easiest payroll systems I've used. Its intuitive interface and step-by-step guidance during payroll setup and processing makes it accessible for users with different levels of technical expertise.

Onboarding

New users can expect a smooth onboarding process with Patriot. The platform offers helpful guides, video tutorials, and live support to get users started. Compared to other small business accounting and payroll software, Patriot’s onboarding is thorough and user-friendly, ensuring users can quickly become proficient.

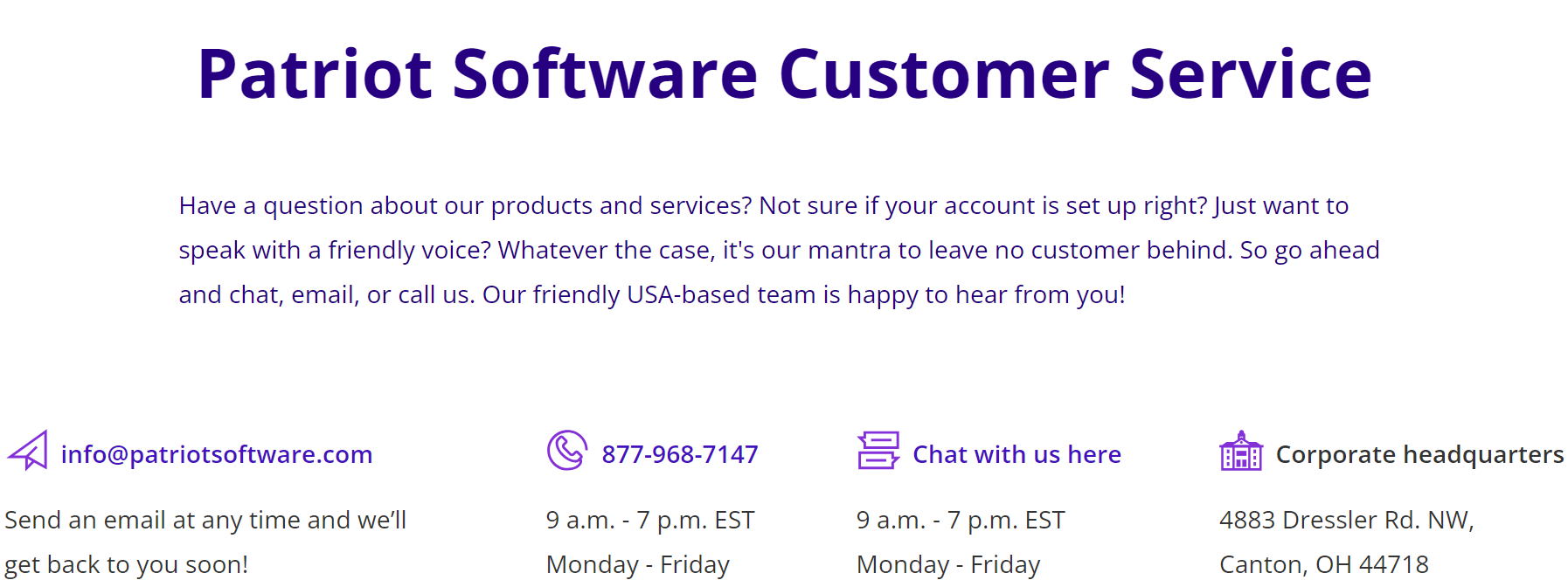

Customer Support

Patriot's customer service and support are available through email, phone, and live chat. They also offer an advanced knowledge base and video tutorials for additional information. Users can access a status page to monitor downtime, and the platform is regularly updated with new features based on customer feedback.

Integrations

Patriot integrates natively with QuickBooks Online, QuickBooks Desktop, and QuickBooks Time. Additionally, Patriot offers options through an API and Zapier for further integrations, allowing users to connect with various other tools and services as needed.

Value for Money

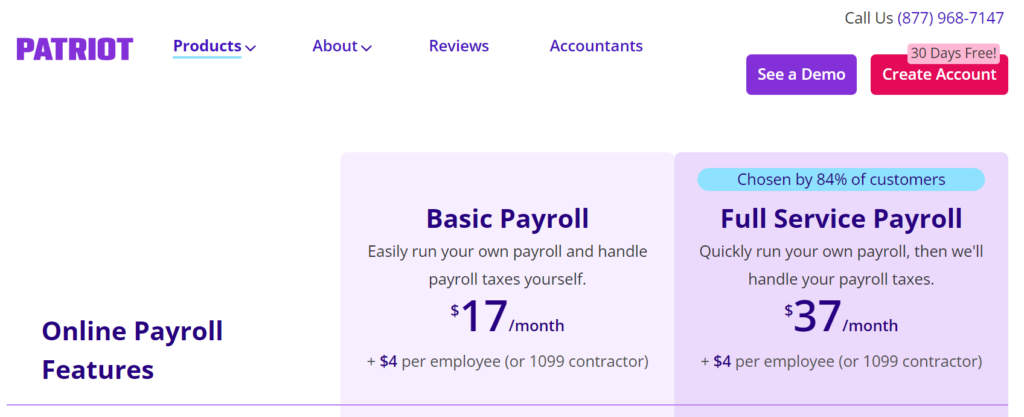

In my experience reviewing payroll software, I've found that Patriot payroll software is one of the most affordable options on the market for small businesses. Its transparent and straightforward pricing model makes it a strong value for companies with basic payroll needs.

Patriot offers two main pricing plans:

- Basic Payroll: From $17/month (base fee) + $4/employee/month. This tier includes two-day direct deposit for qualified customers, an employee portal, and unlimited payroll processing.

- Full Service Payroll: From $37/month (base fee) + $4/employee/month. This option includes all of the Basic features, plus e-filing of federal, state, and local taxes.

Additional services such as 1099 e-filing ($20 per 1099 or $2 for self-print) and e-file with Patriot support ($12 per additional state) are available for extra charges. There are no setup fees, contracts, or cancellation fees.

While higher-priced competitors may offer more advanced features and integrations, Patriot's pricing is hard to beat for small businesses that want reliable, no-frills payroll processing. The lack of hidden fees sets Patriot apart in an industry where many vendors charge add-ons for the setup process, cancellations, and every feature.

Product Specifications

| Feature | Patriot |

| Unlimited payroll runs | ✅ |

| Direct deposit | ✅ |

| Payroll tax filing | ✅ |

| W-2 and 1099 tax forms | ✅ |

| Employee self-service portal | ✅ |

| Paid time off (PTO) tracking | ✅ |

| Workers' compensation integration | ✅ |

| Accounting software integration | ✅ |

| New hire reporting | ✅ |

| Wage garnishment management | ✅ |

| Detailed payroll reporting | ✅ |

| Online paystub access | ✅ |

| Multistate payroll | ✅ |

| Labor law poster compliance | ✅ |

| Free expert support | ✅ |

| Mobile app | ❌ |

| Talent management | ❌ |

| Benefits administration | ❌ |

| Robust HR features | ❌ |

| Global payroll | ❌ |

Patriot Alternatives

If you're looking for alternative payroll software options to Patriot, here are a few worth checking out:

- Gusto: Gusto offers a more modern user interface and additional HR features like employee onboarding and benefits administration.

- QuickBooks Payroll: QuickBooks Payroll integrates with QuickBooks accounting software and offers more advanced reporting capabilities.

- Paychex: Paychex is a more advanced solution that includes HR consulting services and a dedicated support representative for each client.

- ADP Run: ADP Run provides more customization options and supports businesses with up to 49 employees, while Patriot caps at 100 employees.

If you're searching for a lower-priced option, take a look at this list of free payroll alternatives, just to see what's out there.

Patriot FAQs

What is Patriot?

Patriot is an online payroll and accounting software for small businesses and accountants in the United States. The company was founded in 2002 and offers a full-service payroll solution, including tax filings and payments, as well as DIY payroll where the business handles tax filings themselves. Patriot also provides accounting software to track income and expenses, invoice customers, and generate financial reports.

Is Patriot HIPAA compliant?

No, Patriot is not HIPAA compliant according to their website. The software is not designed to handle protected health information (PHI) covered under HIPAA regulations. Businesses in the healthcare industry that need to comply with HIPAA will need to use a different payroll and accounting service.

Is Patriot SOC 2 compliant?

Based on my research, I did not find any information stating that Patriot is SOC 2 compliant. SOC 2 is a voluntary compliance standard for service organizations, specifying how they should manage customer data. Businesses can request a SOC 2 report from their service providers to verify compliance.

Is Patriot secure?

Yes, Patriot states that they use industry-standard security measures to protect customer data. These include:

- 256-bit SSL encryption for data transmission

- Multiple firewalls

Intrusion detection systems - Physical security at their data centers

Patriot also performs regular security audits and backups data in multiple locations.

Is Patriot FedRAMP certified?

No, I did not find any evidence that Patriot is FedRAMP certified. FedRAMP is a government-wide program that provides a standardized approach to security assessment, authorization, and monitoring for cloud products and services used by federal agencies. Most of Patriot’s customers appear to be small private-sector businesses.

Is Patriot GDPR compliant?

Patriot aims to comply with GDPR around data privacy and protection. According to their privacy policy, the company only collects personal data necessary to provide their services, obtains consent where required, and deletes data upon request. However, customers are ultimately responsible for ensuring their compliance when using Patriot to process employee and contractor data.

How long has Patriot been in business?

Patriot has been providing payroll and accounting software since 2002, so the company has been in business for 20 years. Patriot was founded by a CPA who wanted to offer an affordable, full-service payroll for American small businesses and has since expanded to serve over 30,000 customers.

Patriot Company Overview & History

Patriot is a private technology company that provides online payroll and accounting software for American businesses and accountants. The company is headquartered in Canton, Ohio, USA.

Founded in 2002 by Mike Kappel, who continues to serve as its CEO, Patriot is known for its affordable, easy-to-use payroll and accounting solutions. Its main products include Patriot PAY for payroll and Patriot Accounting for bookkeeping needs.

Patriot has experienced significant growth, processing over $5 billion in payroll annually for thousands of small business customers. The company is dedicated to providing user-friendly software and prides itself on its US-based support team, offering accessible and reliable customer service tailored for small business owners.

Patriot Major Milestones

- 2002: Patriot founded by Mike Kappel in Canton, Ohio

- 2003: Launched Patriot PAY online payroll software

- 2008: Released Patriot Accounting software

- 2010: Launched Payroll Tax Filing Service

- 2016: Ranked #1843 on the Inc. 5000 list of fastest-growing private companies

- 2017: Ranked #1720 on the Inc. 5000 list

Want to learn more about Patriot Software? Check out their site for additional information.

From $17/user/month + $4/employee

30-day free trial

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter.