Managing payroll is one of the most challenging and time-consuming responsibilities for organizations.

In fact, nearly 40% of business owners say payroll and taxes are their biggest administrative burden.

Accuracy and timeliness are critical—everyone expects to be paid correctly and on schedule, and even small mistakes can create compliance risks or hurt trust.

Payroll software helps solve these challenges by automating calculations, tax filings, and recordkeeping, making the process faster, more reliable, and far less stressful.

In this guide, I’ll explain what payroll software is, why it’s important, and the key features to look for when choosing a solution.

What Is Payroll Software?

Payroll software is a digital tool—commonly cloud-based—that automates key payroll tasks such as wage calculation, tax withholding, direct deposit, and compliance. It improves accuracy, saves time, and keeps businesses up to date with changing tax laws and employee management needs.

What Does Payroll Software Do?

Payroll software automates and streamlines the process of paying employees. It handles calculations, deductions, compliance, and record keeping to ensure accurate, timely payroll processing.

The key functions of payroll software include:

- Calculates employee wages and salaries

- Automates tax withholdings (federal, state, local)

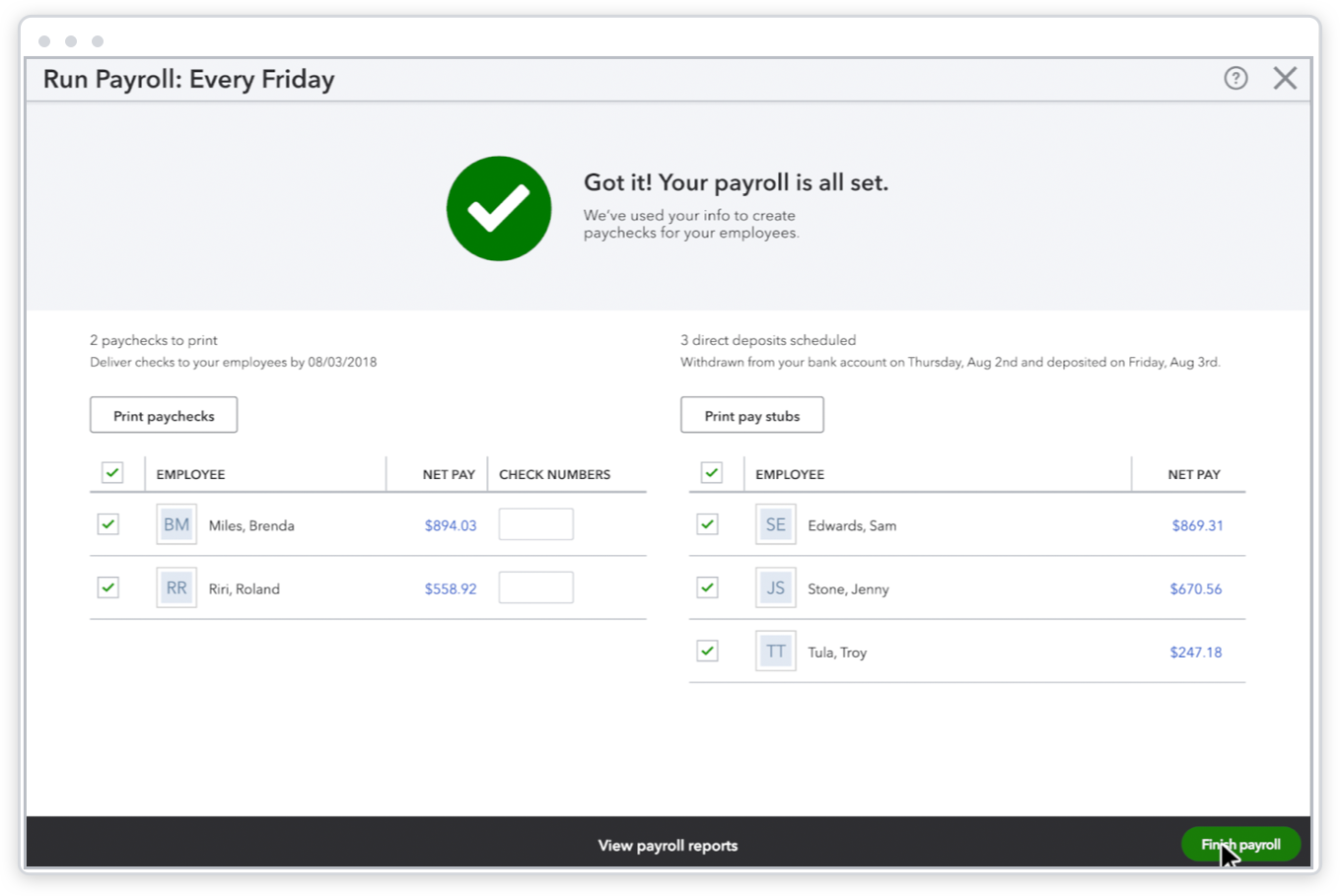

- Processes direct deposits or prints checks

- Tracks time, attendance, and paid leave

- Generates pay stubs and tax forms (e.g., W-2, 1099)

- Ensures payroll compliance with labor laws

- Manages employee benefits and deductions

- Provides payroll reports and audit trails

- Supports multi-location or multi-currency payroll (for global teams)

- Integrates with accounting and HR systems.

Benefits Of Payroll Software

The best payroll software can potentially save payroll teams lots of time and reduce paycheck errors. This leads to more satisfied employees and fewer issues for management to deal with.

Implementing the right payroll solution can have the following benefits:

1. Time savings

The automation of payroll software helps organizations reduce the time it takes to manage payroll.

For example, one org transitioned from a cumbersome 4–6 day payroll process (for four entities) to completing everything in just six hours using Paylocity.

This shift freed up several days of administrative workload and enabled more strategic focus. Onboarding efficiency also improved: setting up new employees dropped from one hour per hire to under 10 minutes.

2. Reduces errors

Payroll errors can be costly financially and reputationally. By features such as automating salary calculations and tax filings, as well as employee self service, payroll software can significantly reduce payroll errors.

Another organization using Paylocity increased payroll accuracy to almost 99 percent (and payroll processing takes half the time as before).

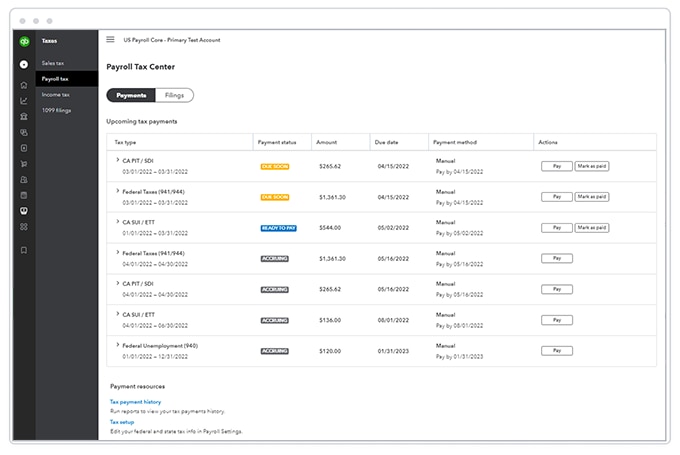

3. Easier compliance

Related to the above, payroll software simplifies compliance by automating federal, state, and local tax calculations, filings, and updates.

Features like built-in ACA reporting, wage law updates, and audit trails reduce the risk of errors and penalties.

Particularly useful for businesses with dispersed teams or rapid growth, the software ensures consistent, up-to-date compliance without manual tracking.

4. Data-driven insights and strategic decision-making

Payroll software also empowers organizations with actionable data and real-time analytics.

The tools provide visibility into key workforce trends—such as payroll costs, turnover rates, and labor allocation—through dynamic dashboards, enabling more informed executive decisions and proactive HR and payroll management.

5. Enhanced employee communication and engagement

Payroll software platforms increasingly offer internal communication tools and integrations that enable payroll teams to communicate changes quickly, promoting transparency, efficiency, and trust.

6. Available customer support

One of the often-overlooked advantages of modern payroll software is the availability of expert support, which is especially valuable for businesses without dedicated HR or compliance teams.

Providers like Gusto, ADP, and Paychex offer access to certified payroll professionals, dedicated account managers, and 24/7 customer service to help resolve issues quickly and accurately.

For example, Gusto customers frequently cite the platform’s live chat and on-call HR experts as essential when navigating complex tax filings or correcting payroll errors on tight deadlines.

Similarly, Paychex clients benefit from localized support teams familiar with state-specific laws and industry nuances.

This layer of expertise reduces the risk of non-compliance, shortens onboarding time, and provides peace of mind—turning payroll software into a reliable partner, not just a processing tool.

Key Features of Payroll Software

No two solutions are the same—some cater to larger organizations or there is specialized small business payroll software.

Often, payroll is bundled in as part of a wider HR software package, but the following features are some that you’ll want to look for when choosing payroll software.

1. Automated salary and tax calculations

Payroll software automatically calculates gross pay based on salary or hourly rates, factoring in overtime, bonuses, and commissions.

It then deducts federal, state, and local taxes, as well as other withholdings like Social Security, Medicare, and benefits contributions. Many platforms also file these taxes automatically, ensuring compliance and accuracy.

2. Direct deposit and multi-pay options

Direct deposit is a core feature, allowing employees to receive paychecks electronically, often across multiple bank accounts. More advanced payroll systems offer additional options like same-day deposits, paycards, and on-demand pay.

3. Compliance alerts and legislative updates

Many platforms include built-in compliance alerts that flag tax law changes, minimum wage updates, and ACA filing deadlines. This proactive functionality helps businesses stay compliant without manually monitoring legislation.

4. Employee self-service portals

Self-service portals let employees view pay stubs, update tax withholdings (W-4), manage benefits, and download year-end forms—without needing HR assistance. This not only enhances transparency but also saves HR teams countless hours.

Some solutions offer intuitive self-service dashboards, often accessible via mobile apps. For distributed or growing teams, it’s a vital tool for improving accessibility and engagement.

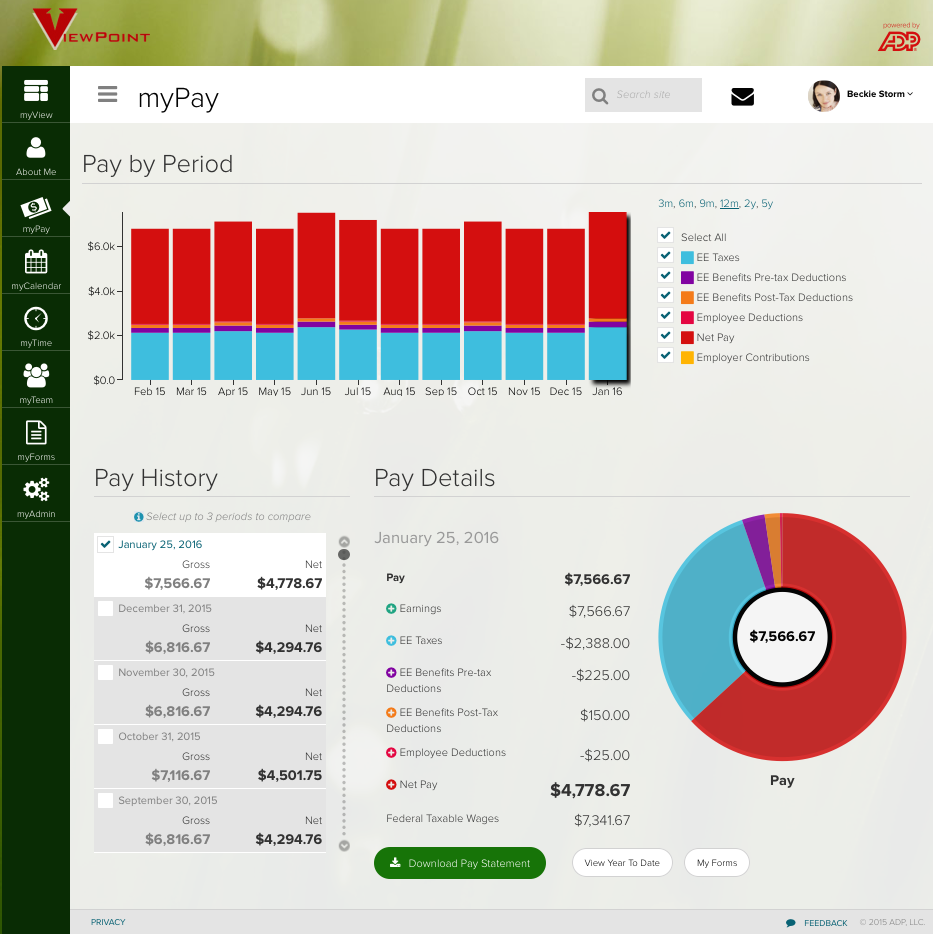

5. Custom reporting and workforce analytics

Advanced payroll tools provide customizable reports on labor costs, overtime, turnover, and more—aiding in strategic workforce planning.

These insights help finance and HR leaders optimize budgets and forecast staffing needs with precision.

Normally more useful in larger organizations, it's still consideration when choosing payroll software for small businesses.

6. Time tracking and PTO management integration

In some instances, integrated time tracking allows employees to clock in/out, request time off, and track hours worked—directly within the payroll platform. This ensures accurate wage calculations and simplifies compliance with FLSA and state-specific overtime laws.

Example of Payroll Software

Let’s take a quick look at an example—ADP GlobalView Payroll.

ADP GlobalView Payroll combines payroll and HR into a unified system that’s easily configurable to work with your existing platforms.

It’s a great option for multinational companies because it lets you combine payroll information for all employees into one system–regardless of their location. This ability to streamline saves hours of time for HR staff and allows management to see it all in one place.

ADP GlobalView features include customizable employee dashboards and the ability to view pay periods side-by-side to compare. It also allows for employee self-service—including mobile access. This self-service option is another huge time-saver for HR staff.

ADP’s directory includes 3,000 payroll and compliance specialists - so you can rest easy knowing your company is in compliance with regulations worldwide.

How to Choose the Right Payroll Software for Your Organization

If you’re feeling payroll software could benefit your organization, follow these steps to choose the best solution for your needs:

1. Map your payroll complexity (discovery)

Inventory employee types (hourly, salaried, exempt/non-exempt, union, tipped), locations (states/localities), pay schedules, overtime rules, garnishments, PTO/leave policies, benefits, and special cases (shift differentials, prevailing wage, certified payroll, job costing).

- Deliverable: 1-page requirements brief + employee/pay rules matrix.

- Expert tip: If you pay in ≥3 states, treat “multi-state automation” as a must-have, not a nice-to-have.

2. Define compliance scope

List all obligations you must meet: FLSA, federal/state/local taxes, new-hire reporting, e-IWO garnishments, ACA (1095-C), 401(k) remittance, state leave accruals, and industry mandates (construction certified payroll, healthcare differentials).

- Deliverable: Compliance checklist with owner + system support column.

- Expert tip: Require vendors to show how they keep tax tables current and document who signs/stands behind filings.

3. Set must-have and advanced features

Core: automated salary & tax calculations, multi-state filings, direct deposit, self-service (pay stubs, W-2/1099, bank/w-4 updates), time/PTO, off-cycle runs, GL exports.

Advanced: garnishment automation, retro pay, certified payroll, job costing, analytics, custom workflows, native APIs, role-based access, audit trails.

- Deliverable: MoSCoW list (Must/Should/Could/Won’t).

- Expert tip: Don’t accept “we can do it via spreadsheet”—insist on native features for your top 5 needs.

4. Integration and data architecture plan

Map systems to connect (HRIS/ATS, time & attendance, benefits, ERP/GL, expense). Decide on method (native connector, API, SFTP flat files), field mapping, SSO/MFA, and SCIM provisioning.

- Deliverable: Integration diagram + data dictionary.

- Expert tip: Ask vendors to demo a live GL export into your chart of accounts with dimensions (location, dept, project).

5. Budget and 3-year total cost of ownership (TCO)

Capture all costs: base fee, PEPM, filings, W-2/1099 year-end, implementation, new state setups, garnishment fees, on-demand pay rails, paycards, support tiers, invoice overages. Add internal labor (implementation, monthly ops).

- Deliverable: 3-year TCO spreadsheet with best/likely/worst scenarios.

- Expert tip: Normalize proposals to the same headcount and pay-run frequency so quotes are truly comparable.

6. Shortlist 4–6 vendors that match your profile

Filter by segment (SMB vs mid-market vs enterprise), footprint (U.S. vs global), industry fit (hospitality, construction, healthcare), and complexity tolerance (unions, multiple entities).

- Deliverable: Shortlist table with “why included” notes.

- Expert tip: Disqualify early if the vendor can’t offer a sandbox or refuses a parallel run before go-live.

7. Issue a focused request for proposal (RFP) (2–3 weeks)

Ask scenario-based questions instead of yes/no: “Show a California + New York employee transfer mid-pay period,” “Process a child-support garnishment,” “Run a retro for missed differential,” “Add a new state mid-quarter.”

- Deliverable: RFP with required artifacts (SOC 2 Type II letter, sample GL file, tax filing calendar, uptime SLA).

- Expert tip: Require screen recordings answering your scenarios—saves time before live demos.

8. Script the vendor demos

Provide each vendor the same data set and demo script: add a new hire, multi-state tax setup, mid-cycle bonus, PTO accrual, garnishment, retro pay, certified payroll report, GL export, and employee self-service tasks on mobile.

- Deliverable: Demo scorecard (usability, speed, clicks, accuracy, reporting).

- Expert tip: Time each task and count clicks; usability gaps show up fast.

9. Hands-on sandbox + parallel payroll test

Run at least two full cycles in parallel with your current system; reconcile net pay, taxes, benefits, and GL by employee and by pay code.

- Deliverable: Variance log with acceptance thresholds (e.g., $0 net variance; ≤$1 rounding on taxes).

- Expert tip: Include edge cases (overtime + premium, mid-period rate change, terminations, rehires).

10. Security, privacy, and resilience due diligence

Validate SOC 2 Type II (current year), ISO 27001, encryption at rest/in transit, SSO/MFA, audit logs, role segregation, data retention/portability, incident response, RTO/RPO, and quarterly uptime.

- Deliverable: Security questionnaire + evidence pack.

- Expert tip: Clarify data ownership and export formats you can retrieve without fees at termination.

11. Evaluate support & expertise

Test support before buying: open a ticket, call the number, try chat—measure first-response and resolution time. Confirm implementation resources (project plan, dedicated CSM), payroll/tax experts on staff, and peak-period coverage (quarter/year-end).

- Deliverable: Support SLA comparison + reference call notes (same industry/size).

- Expert tip: Ask references, “What broke and how fast did they fix it?”

12. Price negotiation & terms

Negotiate caps on annual price increases, transparent add-on pricing, and credits for missed SLAs. Secure exit clauses, data export guarantees, and a named implementation team.

- Deliverable: Redlined MSA/SOW + pricing appendix.

- Expert tip: Tie a portion of fees to hitting go-live milestones (parallel run pass, quarter-end close).

13. Implementation & change management

Create a detailed project plan (data cleansing, config, integrations, training, comms, cutover). Schedule a blackout window and a mock quarter-end. Launch employee self-service with a simple “first-login” checklist.

- Deliverable: Gantt timeline + training and comms plan.

- Expert tip: Appoint a Payroll Process Owner and publish a RACI so decisions don’t stall.

14. Define success metrics and review cadence

Track cycle time (hours from close to funds release), first-pass accuracy, # off-cycles, support tickets per 100 employees, self-service adoption, and payroll cost per employee. Hold 30/60/90-day reviews to close gaps.

- Deliverable: KPI dashboard + continuous-improvement backlog.

- Expert tip: Benchmark KPIs quarterly and tie them to vendor QBRs and renewal decisions.

Bonus: Decision matrix (use these weights as a starting point)

- Compliance & accuracy – 25%

- Usability & employee self-service (web/mobile) – 20%

- Features fit (must-haves + top advanced needs) – 15%

- Integrations & reporting/GL – 15%

- Security, auditability, & resilience – 10%

- Implementation & support quality – 10%

- Total 3-year TCO – 5%

Need expert help selecting the right Payroll Management Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

Payroll Software FAQs

What are the benefits of cloud-based payroll software?

Cloud-based payroll software offers anytime, anywhere access, making it easier for HR teams and employees to manage payroll remotely. It provides automatic updates for tax laws and compliance, reducing manual oversight and risk of errors. These systems also scale easily as businesses grow and integrate with other HR and accounting tools, streamlining operations.

How does payroll software help with taxes, compliance, and regulations?

Payroll software automatically calculates and withholds the correct federal, state, and local taxes for each employee, reducing the risk of costly errors.

Many platforms also handle tax filings and generate required forms like W-2s and 1099s on schedule.

Built-in compliance alerts and updates help businesses stay aligned with labor laws, wage rules, and ACA reporting without constant manual tracking.

How does payroll software help employees?

Payroll software ensures employees are paid accurately and on time, building trust and reducing paycheck errors.

Self-service portals let staff access pay stubs, update tax withholdings, manage direct deposit details, and download forms like W-2s without relying on HR.

Many platforms also provide transparency into time-off balances, benefits, and even on-demand pay options, giving employees greater control and convenience.