Best Direct Deposit Payroll Software Shortlist

Here's my pick of the 10 best software from the 22 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Payroll isn’t just about paying people—it’s about accuracy, compliance, and trust. But if you’ve ever dealt with late deposits, tax miscalculations, or clunky systems that create more problems than they solve, you know how frustrating it can be.

That’s why the right direct deposit payroll software matters. It automates payments, calculates taxes, and keeps you compliant—but with so many options out there, finding the best fit isn’t easy.

I’ve spent years testing HR and payroll systems, working with finance and HR leaders to see what actually delivers. In this guide, I break down the top payroll tools based on real-world use, so you can find the right solution and keep payroll running smoothly—without the stress.

Why Trust Our Software Reviews

We’ve been testing and reviewing direct deposit payroll software since 2019. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Direct Deposit Payroll Software: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top direct deposit software selections to help you find the best option for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll | Free trial + demo available | From $29/month | Website | |

| 2 | Best for automated payroll processing | 90-day free trial | Pricing upon request | Website | |

| 3 | Best for payroll error detection | Free demo available | Pricing upon request | Website | |

| 4 | Best for free 2-day direct deposit | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 5 | Best for employee time tracking | 14-day free trial | From $3.99/user/month + $19/month base fee | Website | |

| 6 | Best for integrated payroll and POS | Not available | From $6/user/month + $35/month base fee | Website | |

| 7 | Best for integrated payroll and benefits | Free demo available | From $44/employee/month | Website | |

| 8 | Best for personalized payroll support | Not available | From $40/month | Website | |

| 9 | Best for all-in-one HR solutions | Free demo available | From $8/user/month (billed annually) | Website | |

| 10 | Best for small business financial tools | Free plan available | From $14/month | Website |

-

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

ClearCompany

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Direct Deposit Payroll Software Reviews

This section provides an in-depth analysis and overview of each direct deposit payroll software. Below, we will walk through each tool’s pros and cons, features, and best use cases.

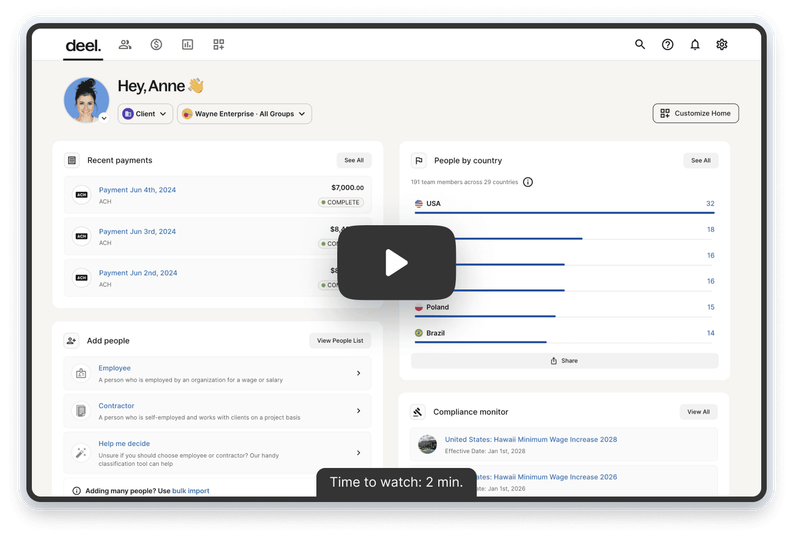

Deel is a global HR platform that simplifies managing a global team for businesses, offering tools and guidance for hiring, payroll, and compliance.

Why I picked Deel: Deel simplifies the complexities of international payroll, making it easy for companies to pay their employees via direct deposit, no matter where they are located. With Deel, businesses can manage payroll in multiple currencies. Additionally, the platform’s ability to handle compliance with local tax laws and labor regulations further enhances its appeal, making it an essential tool for companies with a diverse, global team.

Standout features & integrations:

Features include automated payroll processing, expense management, contract generation, benefits administration, time-off tracking, tax form generation, employee self-service portal, multi-language support, customizable payroll reports, compliance management, onboarding tools, currency conversion, and localized payslips.

Integrations include QuickBooks, Xero, Gusto, Rippling, BambooHR, Workday, ADP, SAP SuccessFactors, NetSuite, Slack, Trello, Asana, Google Workspace, Microsoft Office 365, HubSpot, and Greenhouse.

Pros and cons

Pros:

- Automated payroll processing

- In-house visa support

- Fast setup process

Cons:

- Could have more customization options

- No mobile app

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

RUN by ADP is a payroll and HR software solution tailored for small businesses with fewer than 50 employees. It offers services such as payroll processing, tax compliance, time and attendance management, and compliance services.

Why I picked RUN by ADP: One of the key features of RUN by ADP is its automated payroll processing, which ensures that payroll is calculated accurately and on time. This automation extends to tax calculations and filings, reducing the risk of errors and ensuring compliance with federal, state, and local tax regulations. The software also supports direct deposit, allowing employees to receive their wages quickly and securely, which enhances employee satisfaction and reduces the administrative burden on HR departments.

Standout features & integrations:

Features include an employee self-service portal, HR compliance support, time and attendance tracking, garnishment payment services, new hire reporting, retirement plan services, workers' compensation management, payroll and tax reports, and mobile app access.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Good mobile app

- Employee self-service portal

- Customizable, in-depth reporting options

Cons:

- Most HR functions are only available on higher-tier plans

- Initial setup can be complex

Paylocity is a cloud-based payroll and human capital management (HCM) software solution designed to simplify and automate payroll processes for businesses of all sizes.

Why I picked Paylocity: Paylocity's direct deposit feature enables your employees to receive their paychecks directly into their bank accounts, eliminating the need for paper checks and reducing administrative tasks. By automating the payment process, you can ensure timely and accurate compensation for your team, enhancing overall satisfaction. Additionally, Paylocity's payroll system is designed to minimize errors through configurable pre-submit audits. These audits flag any irregularities, such as an employee receiving double their typical pay, allowing you to address issues before finalizing payroll.

Standout features & integrations:

Features include general ledger mapping, automatic data transfer from time and labor systems, on-demand payment options, expense management, compensation management, employee self-service portal, payroll reports, tax filing services, wage garnishment management, global payroll capabilities, and customizable reporting.

Integrations include ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Pros and cons

Pros:

- Tailored workflows and reports

- Comprehensive suite of HR and payroll features

- Includes tax compliance services

Cons:

- Setup can be time consuming

- Mobile app functionality is more limited compared to the desktop version

Patriot Payroll is an online payroll software that offers affordable payroll services with free direct deposit, making it a popular choice for small businesses.

Why I picked Patriot Payroll: I chose Patriot Payroll for its direct deposit payroll software because it offers affordable payroll solutions with free direct deposit, unlimited payrolls, and a user-friendly interface. It offers free 2-day direct deposit for qualified customers, or free 4-day direct deposit at a minimum, making it an affordable direct deposit option for businesses of all sizes.

Standout features & integrations:

Features include a simple three-step process for running payroll, free payroll setup, US-based support, customizable time-off accrual rules, free direct deposit with 2-day processing, tracking reported tips, multiple pay rates for hourly employees, and free 401(k) integration with exclusive discount pricing, making it easy for businesses to automate payroll processes, track employee benefits, and integrate with other financial services.

Integrations include Patriot Accounting, QuickBooks Online, QuickBooks Time, Plaid, and Workforce Time & Attendance.

Pros and cons

Pros:

- Combined payroll for employees and contractors

- Budget-friendly plans

- Free direct deposit

Cons:

- Some manual data entry required

- Only available for US-based businesses

Buddy Punch is an advanced payroll tool that simplifies employee scheduling and time tracking with features like GPS tracking and customizable reports.

Why I picked Buddy Punch: Buddy Punch provides simple time-tracking and payroll processing features, ensuring accurate and timely payments. The software includes GPS tracking, webcam verification, and customizable reporting, enhancing accuracy and accountability. For convenience, it also offers automated overtime calculations, PTO tracking, and mobile access, making it a standout choice for businesses looking for efficient and reliable payroll software.

Standout features & integrations:

Features include direct deposit, GPS tracking, geofencing, customizable reports, and real-time monitoring of employee hours. It also provides tools for managing paid and unpaid time off.

Integrations include QuickBooks, Paychex, Workday, ADP, Gusto, Paylocity, SurePayroll, Xero, BambooHR, and Zapier.

Pros and cons

Pros:

- Convenient employee self-service

- Automated calculations

- Advanced time tracking

Cons:

- Complex customization

- Limited HR features

Square Payroll is an advanced, full-service payroll software that integrates with Square's POS system, making it ideal for businesses looking to run payroll and point-of-sale operations.

Why I picked Square Payroll: Square Payroll offers a seamless integration with Square’s POS system, making the software a perfect combination for retail and service businesses. This integration streamlines payroll management by automatically syncing sales and employee hours, reducing manual entry and errors. It also offers automatic tax calculations and filings, benefits management, and flexible payment options, enhancing employee satisfaction.

Standout features & integrations:

Features include automatic tax calculations and filings, employee benefits management, direct deposit and same-day payments, timecard synchronization, new hire reporting, automated wage garnishments, flexible payment schedules, and access to 24/7 customer support.

Integrations include QuickBooks, Xero, TSheets, Homebase, Deputy, Gusto, ZipRecruiter, Google Workspace, 7shifts, and Square POS.

Pros and cons

Pros:

- Employee benefits management

- Flexible payment options

- Easy POS integration

Cons:

- Limited third-party integrations

- Requires Square POS System

Payworks is an advanced payroll solution that combines direct deposit, benefits administration, and time management for seamless and efficient HR operations. Its integrated approach ensures streamlined processes and accurate payroll management.

Why I picked Payworks: Payworks offers advanced features such as automated payroll calculations, compliance management, and real-time reporting, all integrated with employee benefits administration. It provides extensive customization options to cater to the needs of different businesses, ensuring flexibility and scalability. Additionally, the software promises data protection and accessibility, enhancing operational efficiency.

Standout features & integrations:

Features include direct deposit, an employee self-service portal, multi-jurisdiction payroll capabilities, time and attendance tracking, smooth integration with accounting systems, garnishment management, mobile accessibility, and dedicated customer support.

Integrations include QuickBooks, Sage, Xero, ADP, Ceridian, Kronos, BambooHR, Workday, SAP, and Oracle.

Pros and cons

Pros:

- Secure cloud-based platform

- Detailed audit trails

- Multi-regional payroll capabilities

Cons:

- Additional costs for customization

- Limited offline capabilities

ConnectPay provides personalized payroll solutions with direct deposit, automated tax filing, and dedicated payroll support for small businesses.

Why I picked ConnectPay: ConnectPay provides users with personalized payroll support, ensuring tailored solutions and services that many automated systems lack. This approach helps businesses navigate complex payroll processes and compliance issues with expert assistance. It also offers self-service features, allowing employees to access pay stubs and tax documents, and integrates with accounting and time-tracking tools for an efficient workflow. This service is suitable for businesses seeking a more hands-on approach to payroll management.

Standout features & integrations:

Features include direct deposit service, automated tax filing, and dedicated payroll specialists for personalized support. The platform also offers compliance management and integration with various accounting and time-tracking tools.

Integrations include QuickBooks, Xero, TSheets, Gusto, BambooHR, Deputy, Homebase, When I Work, ADP, and Paychex.

Pros and cons

Pros:

- Employee self-service

- Tailored solutions to business needs

- Dedicated payroll specialists for personalized support

Cons:

- Not suitable for international payroll

- Requires more interaction and time

Rise Payroll is an advanced HR platform that provides payroll, benefits, and workforce management solutions for businesses.

Why I picked Rise Payroll: Rise Payroll streamlines multiple HR functions into one platform, enhancing efficiency and coordination across the organization. It has reporting and employee self-service features that provide control and transparency, compliance management for relevant regulations and reduces the risk of penalties, and customizable workflows for adaptability to different needs. These HR features and integration capabilities are ideal for businesses looking to optimize their HR and payroll processes.

Standout features & integrations:

Features include direct deposit, automated payroll processing, benefits administration, and talent management tools. The platform also offers employee self-service options and strong reporting and analytics capabilities.

Integrations include Xero, QuickBooks, BambooHR, Deputy, Greenhouse, JazzHR, Slack, Google Calendar, Microsoft Outlook, and Zapier.

Pros and cons

Pros:

- Customizable and flexible workflows

- High adoption rate

- All-in-one HR solution

Cons:

- Limited mobile app functionality

- Occasional system slowness

Wave is an advanced financial tool for small businesses, providing direct deposit payroll services integrated with accounting and invoicing functionalities.

Why I picked Wave: Wave is a powerful financial tool that integrates payroll, accounting, and invoicing, allowing seamless financial management. The software automates payroll processes, manages direct deposits, and handles tax filings, making it an ideal choice for small business owners looking for an all-in-one financial management solution. Wave also offers real-time transaction syncing, detailed financial reporting, customizable invoicing, and personalized assistance and support.

Standout features & integrations:

Features include direct deposit, automated payroll processing, tax filing capabilities, and integrated accounting and invoicing tools.

Integrations include PayPal, Etsy, Shoeboxed, Google Sheets, HubSpot, Zapier, Mailchimp, Slack, QuickBooks, and Shopify.

Pros and cons

Pros:

- Real-time transaction syncing

- Customizable invoicing

- Integrated financial tools

Cons:

- No advanced HR tools

- Basic reporting features

Other Direct Deposit Payroll Software

Below is a list of additional direct deposit payroll software that I shortlisted. While they didn’t make the top 10, they’re still valuable and worth further research.

- Rippling

For unified workforce management

- BambooHR

For integrated HR and payroll

- OnPay

For comprehensive payroll management

- Paycor

For streamlined payroll and HR processing

- QuickBooks

For integrated accounting and payroll

- Gusto

For small business payroll automation

- Papaya Global

For global payroll compliance

- Humi

For Canadian businesses

- Remote

For remote team payroll

- Plooto

For automated payments

- Wagepoint

For small businesses

- ADP

For scalable payroll solutions

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Direct Deposit Payroll Software

The criteria for choosing a direct deposit payroll software should directly address buyer needs and common pain points, ensuring that the software serves its intended purpose effectively. As an expert who has personally tried and researched these tools, here are the requirements I use when evaluating software:

Core Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Ensures timely and accurate payroll calculations for employees, including full-time, part-time, and contractors

- Facilitates seamless payment to employees by directly depositing their wages into their bank accounts

- Automatically calculates, files, and pays federal, state, and local taxes to ensure compliance with all regulatory requirements

- Empowers employees to manage their payroll-related tasks through a self-service portal, allowing access to payslips and update personal information

- Provides detailed payroll reports and advanced analytics to offer insights into payroll expenses, trends, and compliance

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Smooth integration of payroll data with accounting software to ensure accurate financial records

- Convenient mobile app access for administrators and employees to handle payroll tasks from smartphones

- Customized reports on payroll data, employee hours, and compliance metrics to meet business needs

- Advanced security features to protect sensitive payroll data, including encryption, multi-factor authentication, and role-based access control

- Innovative features like automated tax filing and compliance alerts to keep businesses compliant with tax regulations

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Visually appealing and user-friendly interface that simplifies the user experience

- Well-organized menus and clearly labeled options to help users find the information and tools they need

- A clear and concise dashboard that provides an overview of essential information

- Easily understandable and usable interface design for a minimal learning curve

- Customizable reports with drag-and-drop functionality, allowing users to create the desired format easily

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Offers an advanced library of training videos to guide users through various features and functions of the software

- Provides interactive product tours that explain the software’s key features and functionalities

- Utilizes chatbots to provide instant support and answer user queries in real time

- Hosts webinars that offer in-depth training sessions on various aspects of the software

- Includes pre-built templates that allow users to quickly set up and start using the software

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Round-the-clock customer support to assist users with any issues they may encounter

- A variety of support channels, including phone, email, and chat to accommodate different user preferences and needs

- Dedicated account managers to provide personalized support and account management services

- A comprehensive help center, including resources such as FAQs, user guides, tutorials, and troubleshooting articles

- Fast response times for all support inquiries

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Competitive pricing that provides good value for the features and services include

- Clear and straightforward pricing structure that details what is included in each plan or service level

- Provides costs upfront with no hidden fees and unexpected charges

- Scalable pricing plans that can grow the business, allowing users to upgrade and adjust as their needs increase

- Offers a free trial or demo of the software, allowing potential customers to experience its features before committing

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- High overall satisfaction ratings from users

- Positive feedback related to the software’s ease of use

- Positive comments about the customer support provided

- Reviews highlighting the effectiveness of specific features within the software

- Positive user testimonials on the value for money offered by the software

Using this assessment framework helped me identify the software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

How to Choose a Direct Deposit Payroll Software

As you work through your unique software selection process, keep the following points in mind:

- Integration Capabilities: When selecting direct deposit payroll software, it's important to ensure that it integrates seamlessly with your existing systems such as HR, accounting, and time-tracking software. This helps to reduce manual data entry, minimizes errors, and streamlines operations.

- Tax Compliance and Automation: Payroll tax compliance is a significant pain point for many businesses. The right payroll software should automate tax calculations, withholdings, and filings to ensure compliance with federal, state, and local regulations. Additionally, the software should automatically update tax tables and file necessary documents to prevent costly penalties and save administrative time.

- Scalability: Your business needs today might not be the same tomorrow, so choose a payroll software that can scale with your business as it grows. Whether you have a small team now but plan to expand, or you operate in multiple locations, the software should accommodate increasing numbers of employees and more complex payroll requirements.

- User-Friendliness and Mobile Access: Ease of use is vital in payroll software. A user-friendly interface ensures payroll administrators can quickly learn and efficiently use the system, reducing the likelihood of errors. Additionally, mobile access allows payroll processing from anywhere, which is particularly useful for businesses with remote or on-the-go employees.

- Security Features: Handling sensitive employee data requires powerful security measures. Ensure that the payroll software offers features like data encryption, multi-factor authentication, and limited access permissions to protect against data breaches and unauthorized access.

Trends in Direct Deposit Payroll Software

Payroll software is evolving rapidly, and staying ahead of the trends can help businesses improve accuracy, compliance, and employee experience. I’ve analyzed product updates, press releases, and release logs across top payroll providers to identify the most important shifts shaping the industry.

- AI-Powered Payroll Processing: Payroll platforms are integrating AI to automate tax calculations, detect discrepancies, and flag compliance risks before they become costly mistakes. This reduces manual workload, minimizes errors, and ensures payroll runs smoothly, even as regulations change.

- Blockchain for Enhanced Security: With payroll data being a prime target for fraud, some platforms are leveraging blockchain to create transparent, tamper-proof transaction records. This helps businesses prevent payroll fraud, ensure compliance, and enhance employee trust in payment security.

- Mobile Accessibility: More payroll software providers are prioritizing mobile accessibility, giving employees instant access to pay stubs, tax documents, and direct deposit settings from their phones. HR and payroll teams can also approve payments and process payroll remotely, ensuring operations don’t stall when teams aren’t at their desks.

- Real-Time Payment Options: Traditional payroll cycles are shifting, with some platforms now offering instant or early wage access. Employees can get paid immediately after a shift or access a portion of earned wages before payday—helping with financial stability and reducing reliance on high-interest loans.

- Integration with Financial Wellness Tools: Payroll isn’t just about paying employees—it’s increasingly tied to financial well-being. Many platforms now integrate with budgeting tools, savings programs, and retirement planning resources to help employees manage their earnings effectively and reduce financial stress.

These trends indicate a shift towards more integrated systems that combine payroll with comprehensive HR functions, ensuring seamless operations and enhanced employee satisfaction. Adopting these changes can lead to improved accuracy, reduced processing time, and a more efficient payroll experience for businesses of all sizes.

What is Direct Deposit Payroll Software?

Direct deposit payroll software automates the process of transferring employees' salaries directly into their bank accounts, eliminating the need for physical checks. This ensures timely and accurate payments while streamlining payroll management for employers.

Most payroll software that offer direct deposit also provide payroll calculation, tax computation, and bank integration. Other extended features can include employee self-service portals, compliance management, and reporting tools to streamline payroll operations.

Features of Direct Deposit Payroll Software

When shopping for a direct deposit payroll software, it’s vital to choose one that connects with your current stack. Here are some important features to look for in direct deposit payroll software:

- Automatic Payment Processing: This feature ensures that payments are processed automatically on scheduled dates, eliminating the need for manual intervention and reducing the risk of errors.

- Tax Compliance and Calculation: The software should automatically calculate and withhold the correct amount of taxes, ensuring compliance with federal, state, and local tax laws.

- Time and Attendance Tracking: Integration with time-tracking systems allows the software to calculate pay based on hours worked, including overtime accurately.

- Employee Self-Service: This feature allows employees to access their pay stubs, tax forms, and other payroll-related information online, reducing the administrative burden on HR.

- Payroll Reporting: The ability to generate detailed payroll reports helps businesses keep track of payroll expenses and ensures transparency.

- Direct Deposit: This feature allows employees to receive their pay directly into their bank accounts, providing convenience and security.

- Expense Management: The software should be able to handle employee expense reimbursements, ensuring timely and accurate payments.

- Mobile Access: Mobile-friendly payroll software allows employees and administrators to access payroll information and perform tasks from anywhere.

- Integration with Accounting Software: Seamless integration with accounting software ensures that payroll data is accurately reflected in financial records.

- Security Features: Strong security measures, such as encryption and multi-factor authentication, protect sensitive payroll data from unauthorized access.

Choosing the right direct deposit payroll software is important for smooth business operations. By ensuring that the software includes these key features, you can streamline your payroll process, ensure compliance, and provide a better experience for your employees.

Benefits of Direct Deposit Payroll Software

Implementing direct deposit payroll software can offer numerous advantages for users and organizations. Along with simplifying the payroll processes and enhancing financial security and operational efficiency, there are other perks associated with this software type, including:

- Time-Saving: Automates the payroll process, reducing the time spent on manual calculations and check distribution, allowing HR teams to focus on more strategic tasks.

- Enhanced Security: Minimizes the risk of lost or stolen checks and reduces the potential for fraud by directly depositing funds into employees' bank accounts.

- Cost Efficiency: Lowers administrative costs by eliminating the need for paper checks, postage, and related supplies, leading to significant savings over time.

- Employee Convenience: Provides employees with quicker access to their funds and eliminates the need to visit a bank to deposit their paychecks, enhancing overall employee satisfaction.

- Improved Accuracy: Reduces the likelihood of human error in payroll calculations and processing, ensuring that employees are paid correctly and on time every pay period.

By automating and securing payroll transactions, businesses can save time and money while reducing errors and enhancing convenience for their workforce. Investing in this software can lead to a more efficient and satisfied organization.

Costs & Pricing of Direct Deposit Payroll Software

When considering direct deposit payroll software, it's essential to understand the various pricing plans and features available. Below is a table outlining the different plans, features, and costs associated with direct deposit payroll software.

Plan Comparison Table for Direct Deposit Payroll Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic payroll processing, employee self-service, and limited support |

| Basic Plan | $17/month + $4/employee | Paychecks, direct deposit, printable W-2s, setup, and expert support |

| Standard Plan | $39/month + $5/employee | Online payroll processing, mobile app, tax administration, and direct deposit |

| Plus Plan | $80/month + $12/employee | Multi-state payroll, next-day direct deposit, and advanced hiring and onboarding |

| Premium Plan | $125/month + $10/employee | Tax penalty protection, mobile time and project tracking, and personal HR advisor |

| Contractor Plan | $35/month + $6/contractor | Unlimited contractor payments, contractor self-service, and 1099 form creation |

When choosing a direct deposit payroll software, consider the size of your business, the complexity of your payroll needs, and your budget. Each plan offers different features and pricing, so select the one that best aligns with your business requirements.

Direct Deposit Payroll Software FAQs

Here are some commonly asked questions I’ve received about direct deposit payroll software.

How secure is direct deposit payroll software?

Most direct deposit payroll software uses encryption and secure protocols to protect sensitive data. Regular updates and compliance with financial regulations further enhance security.

Can direct deposit payroll software handle different pay schedules?

Yes, most direct deposit payroll software can manage various pay schedules, including weekly, bi-weekly, semi-monthly, and monthly. This flexibility helps accommodate different business needs.

How easy is it to set up direct deposit payroll software?

Setup is straightforward, with many providers offering guided setup processes and customer support. Some software solutions also provide templates and tutorials to simplify the process.

What kind of support is available for direct deposit payroll software?

Most providers offer customer support through phone, email, and chat. Some also provide extensive online resources, including FAQs, guides, and video tutorials.

What happens if there is an error in a direct deposit payment?

Errors can be quickly identified and corrected within the software. Support teams are typically available to assist in resolving any issues promptly.

Can direct deposit payroll software manage multiple bank accounts for employees?

Yes, employees can often split their direct deposits between multiple bank accounts. This feature provides flexibility for personal financial management.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.