10 Best Global PEO Services Shortlist

Here's my pick of the 10 best services providers from the 15 we reviewed.

Get free help from our service advisors to find your match.

Global PEO services help companies hire international employees, manage payroll, and stay compliant with local labor laws without setting up legal entities in each country. As businesses expand into new markets, these services play a vital role in simplifying HR operations and minimizing legal and administrative risks.

Choosing the right global PEO partner is essential to support your organization’s specific HR needs, regional requirements, and long-term growth strategy.

In this guide, you’ll find impartial, in-depth reviews of the best global PEO services in 2025. We highlight their core features, regional coverage, and industry expertise to help you select the provider that best fits your international expansion goals.

Why Trust Our Reviews

We’ve been testing and reviewing HR software and services since 2019. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting a provider. We invest in deep research to help our audience make better purchasing decisions.

We’ve tested more than 2,000 tools and hundreds of service providers for different HR management use cases and written over 1,000 comprehensive reviews. Learn how we stay transparent & check out our review methodology.

Best Global PEO Service Providers: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top global PEO companies to help you find the best option for your budget and business needs.

| Service | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for contractor management | Free trial + demo available | From $29/month | Website | |

| 2 | Best for small to mid-sized teams | Free demo available | From $20/user/month (billed annually) | Website | |

| 3 | Best for budget-friendly global hiring | Free demo available | $99/employee/month | Website | |

| 4 | Best for data privacy compliance | Free demo available | From $595/employee/month or $49/contractor/month | Website | |

| 5 | Best for remote team management | Not available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 6 | Best for managing staff in emerging markets | Free demo + free trial | From $199/month | Website | |

| 7 | Best India-focused PEO | Free demo available | Pricing upon request | Website | |

| 8 | Best for in-country experts | Not available | Pricing upon request | Website | |

| 9 | Best for multi-country workforce solutions | Free demo available | From $49/contractor/month | Website | |

| 10 | Best for localized payroll compliance | Free demo available | Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Guru

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6 -

Absorb LMS

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Global PEO Service Provider Reviews

Below are my detailed summaries of the best global PEO service providers in my shortlist. My reviews look at each provider’s key services, unique specialties, and pros & cons to help you find the best one for your needs.

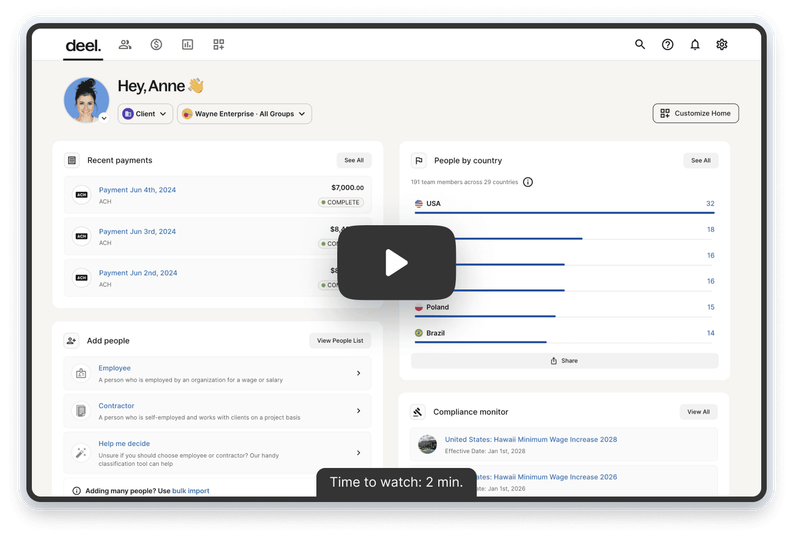

Deel simplifies international payroll, compliance, and contracts for remote teams. It focuses on hiring and managing contractors, allowing companies to expand internationally without the complexities of global employment.

Why I picked Deel: Deel helps you manage contractors with features like automated payments, localized contracts, and tax compliance tools. It simplifies managing contractor agreements and ensures compliance with local labor laws. The platform also provides localized employee contracts and automated tax compliance, helping your team avoid legal pitfalls.

Standout Services: The automated compliance feature helps your team stay aligned with local labor laws, minimizing legal risks and ensuring smooth operations. Their global payroll system integrates multiple currencies, enabling accurate and timely payments regardless of location, and simplifying financial management across borders.

Target industries: Technology, finance, marketing, consulting, and education

Specialties: Contractor management, payroll services, tax compliance, employment contracts, and international hiring

Pros and cons

Pros:

- SOC 2 Compliance

- Localized contract templates

- Diverse payment options

Cons:

- Limited customization

- Limited support in some regions

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

Multiplier helps small and mid-sized teams expand internationally by streamlining HR tasks and ensuring adherence to local labor laws and regulations. It enables businesses to build and manage pure remote teams and expand into new markets.

Why I picked Multiplier: Multiplier simplifies international hiring by automating compliance and payroll across different countries. The platform also supports localized benefits and multi-currency payments for attracting and retaining talent. Its focus on small to mid-sized teams makes it especially useful for growing businesses.

Standout Services: Multiplier offers global payroll management that helps your team process salaries in compliance with local regulations, ensuring accuracy and saving time. Its employee onboarding services make hiring international talent easy by managing legal contracts and compliance requirements.

Target industries: Technology, e-commerce, professional services, healthcare, and education

Specialties: Global payroll, compliance management, international hiring, employee benefits, and tax filing

Pros and cons

Pros:

- Multi-currency payroll support

- Visa and relocation support

- Quick contract generation

Cons:

- Inconsistent customer support

- Fixed payroll cut-off dates

Native Teams supports businesses in hiring and managing global talent by handling payroll, compliance, and employee support across 85+ countries. It enables organizations to scale internationally without setting up local entities, while offering tailored benefits and localized expertise.

Why I picked Native Teams: Native Teams is a budget-friendly fit for companies prioritizing employee care while expanding globally. I picked it for its combination of localized benefits, personalized employee support, and reliable compliance management. The platform simplifies international payroll and assists with tax and legal requirements, helping businesses stay focused on operations.

Standout services: Native Teams provides global payroll management with local currency support, contractor and gig payment tools, and tax-compliant processing. It also offers relocation services, guided onboarding, and tailored employee benefits that align with regional expectations—helping teams stay compliant and competitive.

Target industries: Technology, professional services, freelancing and gig platforms, education, and e-commerce

Specialties: Employer of Record (EOR), global payroll, compliance handling, localized benefits, employee support, contractor payments, and international hiring

Pros and cons

Pros:

- Offers localized payroll calculators for accurate salary and tax computations

- Enables hiring globally without establishing a local entity

- Provides compliant employment contracts and documentation

Cons:

- May not offer advanced HR tools beyond essential employment features

- Covers fewer countries than some competitors

New Product Updates from Native Teams

Gig Pay for Global Payments

In 2025, Native Teams rebranded and launched Gig Pay, a solution for gig platforms and workers to facilitate global payments. For more details, visit NativeTeams' website.

Atlax HXM’s direct Employer of Record model ensures compliance with local labor laws and regulations and streamlines HR processes. They have a solid privacy program, and data retention policies, and protect sensitive information throughout the employee lifecycle.

Why I picked Atlas HXM: Atlax HXM is a 100% direct PEO, ensuring compliance with local labor laws without third-party dependencies. They support secure payroll management, localized tax handling, and employment law guidance, ensuring sensitive information is managed responsibly. Their solutions are designed to help you expand globally without risking data breaches or regulatory violations.

Standout Services: Their automated payroll and benefits management system simplifies the complexities of handling compensation across borders, ensuring accuracy and compliance. The local HR expertise provided by Atlas allows your team to navigate cultural and regulatory differences effectively, enhancing your global HR strategy.

Target industries: Technology, finance, healthcare, manufacturing, and retail

Specialties: Compliance management, payroll automation, HR expertise, global hiring, and risk management

Pros and cons

Pros:

- Scalable service offerings

- In-house legal teams

- Offers a direct EOR model

Cons:

- Reported slow onboarding

- No standalone payroll services

Omnipresent helps businesses manage remote teams across the US, the UK, and over 160 other countries. It streamlines HR tasks, including onboarding, compliance management, and payroll processing, and helps businesses reduce overhead costs and avoid compliance fines.

Why I picked Omnipresent: Omnipresent also offers solutions like Employer of Record services and their Global Hiring Navigator tool helps HR teams find optimal solutions for international expansions. It simplifies payroll, benefits handling, and legal compliance across multiple countries and supports onboarding and offboarding.

Standout Services: Omnipresent's VEO (virtual employer organization) solution allows your business to recruit global talent while maintaining hiring control, simplifying the process, and ensuring compliance with local laws. Their Global Hiring Navigator tool assists in identifying the best approach to international expansion, making it easier to manage global teams.

Target industries: Technology, finance, healthcare, retail, and education

Specialties: Payroll administration, compliance management, employee benefits, Employer of Record services, and global talent recruitment

Pros and cons

Pros:

- Multi-currency payroll support

- Localized benefits packages

- In-house legal experts

Cons:

- Limited customer support in certain regions

- No standalone payroll service

Skuad's expertise in emerging markets makes it an ideal partner for companies seeking to expand their workforce, providing tailored solutions that address the unique challenges and opportunities in developing economies.

Why I picked Skuad: Skuad simplifies hiring in emerging markets by handling employment contracts, local tax compliance, and payroll processing. Their expertise helps your team navigate unique regulations and ensures employees are paid accurately and on time. Skuad’s focus on emerging markets makes it a practical choice for businesses looking to tap into growing talent pools.

Standout Services: Skuad provides localized contract management to help your HR team navigate country-specific labor laws and protect your business. Its end-to-end payroll services allow you to handle payments, taxes, and benefits without needing local expertise.

Target industries: Technology, education, healthcare, e-commerce, and retail

Specialties: Global payroll, localized compliance, contract management, benefits administration, and tax filing

Pros and cons

Pros:

- Local compliance expertise

- Quick onboarding

- Specializes in complex regions

Cons:

- Service limitations in some regions

- Some customizations lack flexibility

Remunance is an International Professional Employer Organization (PEO) that helps businesses manage their teams in India.

Why I picked Remunance: I appreciate that Remunance is built specifically for companies entering the Indian market. Managing HR, payroll, and local compliance in a new country can be overwhelming, but Remunance takes care of these complexities. Their expertise in hiring, onboarding, and ensuring regulatory compliance means you can focus on growing your business without worrying about legal hurdles or administrative burdens. Another standout aspect of Remunance is its subsidiary formation support. If you're looking to establish a legal entity in India, they guide you through the setup process, ensuring all financial and legal requirements are met.

Standout Services: Other key services include talent acquisition services tailored to the Indian market and employee onboarding and offboarding to ensure smooth transitions as teams grow and evolve. Remunance also offers relocation and permit support and localized benefits administration.

Target industries: Healthcare, IT, pharmaceutical, and banking

Specialties: Talent acquisition, payroll, compliance, benefits administration, and contractor management

Pros and cons

Pros:

- Offers relocation support

- Expertise in local compliance in India

- Efficient payroll processing ensures timely compensation

Cons:

- Dependence on Remunance for compliance may limit direct control

- Limited to India

Bradford Jacobs has extensive global infrastructure and in-depth knowledge of international regulations. It helps businesses reduce risk, save time and money, and ensure full compliance in over 180 countries.

Why I picked Bradford Jacobs: Bradford Jacobs simplifies international expansion by handling legal compliance, tax filings, and employee onboarding in multiple regions. Their in-country experts ensure your team has the support to navigate local employment regulations. With tools for payroll, benefits management, and workforce administration, they make it easier for your business to focus on growth.

Standout Services: Bradford Jacobs' EOR service manages employee payments and benefits, ensuring compliance with local regulations and freeing your team from administrative burdens. Their global payroll solutions streamline payment processes, handling taxes, social security, and pension contributions efficiently.

Target industries: Technology, finance, healthcare, manufacturing, and retail

Specialties: Compliance management, payroll administration, talent acquisition, Employer of Record services, and legal consulting

Pros and cons

Pros:

- End-to-end comprehensive HR support

- Established global network

- Supports rapid market entry

Cons:

- Integration challenges with existing systems

- Limited customization in employee benefits

Horizons streamlines recruitment, onboarding, payroll, and compliance across 180 countries. Its in-house recruitment team provides tailored talent acquisition, facilitating rapid expansions into new markets.

Why I picked Horizons: Horizons offers quick hiring and onboarding within 48 hours with solid support for payroll, compliance, and benefits tailored to local regulations. Their in-country expertise can navigate complex international labor laws and their localized recruitment teams manage compliance to avoid risks like employee misclassification. Additional services include currency conversions and tax filings.

Standout Services: Horizons' employer of record service allows your business to hire globally without establishing a local legal entity, reducing administrative burdens and costs. Their payroll management system ensures timely and accurate payroll processing, keeping your team compliant with local regulations.

Target industries: Technology, manufacturing, finance, retail, and healthcare

Specialties: Global payroll, recruitment, compliance management, employee benefits, and employment facilitation

Pros and cons

Pros:

- Integrated visa assistance

- Rapid onboarding process

- In-house recruitment team

Cons:

- Not suitable for small businesses

- No standalone payroll service

Mercans provides localized payroll compliance and manages legal declarations and third-party statements in relation to local labor laws.

Why I picked Mercans: Mercans uses its payroll platform, HR Blizz™, to ensure accuracy and compliance with local tax and labor laws. The platform also automates processes and centralizes employee data. Mercans simplifies payroll processing, manages legal declarations, and handles third-party statements, helping you comply and reduce risk tied to global payroll.

Standout Services: Their employee benefits program aids in attracting and retaining talent by offering comprehensive benefits tailored to local markets, ensuring compliance and enhancing employee satisfaction. The HR Blizz platform helps HR teams manage payroll across multiple currencies and regions, mitigating compliance risks.

Target industries: Technology, finance, manufacturing, healthcare, and energy

Specialties: Global payroll, compliance management, HR outsourcing, employee benefits, and PEO services.

Pros and cons

Pros:

- Integrated global mobility services

- Multi-currency payroll processing

- In-house payroll platform

Cons:

- Some delays in regional payroll adjustments

- Limited flexibility for offboarding

Other Global PEO Services

Here are some additional global PEO service providers that didn’t make it onto my shortlist, but are still worth checking out:

- Rippling

PEO service with integrated HR solutions

- Velocity Global

For global expansion support

- Papaya Global

For global payroll expertise

- Trinet

For industry-specific HR solutions

- Global PEO Services

For multinational payroll management

Selection Criteria for Global PEO Service Providers

When selecting the best global PEO services providers to include in this list, I considered common business needs and pain points that these providers address. This included managing compliance with local employment laws and reducing administrative burdens. I also used the following framework to keep my evaluation structured and fair:

Core Services (25% of total score): To be considered for inclusion in this list, each provider had to offer these basic HR services:

- Payroll management

- Employee benefits administration

- HR support and guidance

- Employee onboarding and offboarding

- Tax compliance

- Risk mitigation

Additional Standout Services (25% of total score): To help further narrow down the competition, I also looked for unique or especially valuable services, such as:

- Global mobility solutions

- Customized HR consulting

- Data analytics for HR insights

- Multi-currency payroll processing

- Localized employee training programs

Industry Experience (10% of total score): To get a sense of the industry experience of each provider, I considered the following:

- Years in operation

- Number of countries served

- Industry-specific expertise

- Client testimonials

- Case studies demonstrating success

Onboarding (10% of total score): To evaluate the onboarding experience for each provider, I considered the following:

- Speed of setup

- Clarity of communication

- Availability of training materials

- Support during the transition

- User-friendly technology platform

Customer Support (10% of total score): To assess the level of customer support each provider offers, I considered the following:

- Availability of live support

- Responsiveness to inquiries

- Multi-language support options

- Dedicated account managers

- Range of support channels

Value for Price (10% of total score): To evaluate the pricing and potential ROI of working with each provider, I considered the following:

- Transparency of pricing

- Comparison with industry standards

- Flexibility in pricing models

- Additional fees or hidden costs

- Customer feedback on value

Customer Reviews (10% of total score): To get a sense of the overall satisfaction of existing customers, I considered the following when reading customer reviews:

- Consistency of positive feedback

- Mention of specific pain points resolved

- Satisfaction with customer support

- Ease of use of services

- Willingness to recommend to others

Using this assessment framework helped me identify the best PEO companies that go beyond basic requirements to offer additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

How to Choose a Global PEO Services Provider

It’s easy to get bogged down in long lists of services and complex pricing structures. To help you prioritize the things that matter most for your business, keep the following factors in mind:

| Factor | What to Consider |

| Business Objectives | Ensure the provider aligns with your goals. For example, expanding into new markets or reducing admin tasks. |

| Service Scope and SLAs | Carefully confirm what's included to make sure they offer the specific services your team needs. |

| Support Availability | Look for 24/7 support if your team works across time zones. You don't want delays in urgent situations. |

| Costs and Pricing Structure | Understand the fee model. Are there hidden costs? Make sure the pricing is clear and fits your budget. |

| Communication and Reporting | Regular updates are crucial. Ensure they provide clear, timely reports on compliance and HR metrics. |

| Compliance Expertise | Confirm they have knowledge of local laws in the countries you're targeting. This reduces the risk of legal issues. |

| Technology Integration | Check if their tech integrates with your existing HR systems. This can save time and reduce errors. |

| Reputation and Reviews | Review their customer feedback and industry reputation. Prioritize providers with positive reviews and proven success. |

If you need additional help, you may want to consider partnering with a PEO broker to help you compare your options and access competitive pricing.

What are Global PEO Services?

Global PEO services handle various human resources functions for companies expanding internationally. They might offer things like:

- Managing payroll and taxes

- Ensuring compliance with local laws

- Administering employee benefits

- Handling employee onboarding and offboarding

- Providing HR support and guidance

HR professionals, small to medium-sized businesses, and companies venturing into new markets typically seek global PEO services to manage employment-related tasks and reduce legal risks. These HR services help organizations focus on growth while ensuring compliance with diverse international regulations.

Key Global PEO Services

When selecting a global PEO provider, keep an eye out for the following key services:

- Payroll management: Handles salary payments, deductions, and taxes, ensuring timely and accurate compensation.

- Tax compliance: Ensures adherence to local tax laws, reducing the risk of penalties and legal issues.

- Employee benefits administration: Manages health insurance, retirement plans, and other benefits, helping attract and retain talent.

- HR support and guidance: Provides expert advice on employment laws and HR policies, assisting in strategic decision-making.

- Employee onboarding and offboarding: Facilitates smooth transitions for new hires and departing employees, ensuring compliance and consistency.

- Global mobility solutions: Supports employees relocating internationally, managing visas and immigration processes.

- Data analytics for HR insights: Offers insights into workforce trends and performance, enabling data-driven HR strategies.

- Multi-currency payroll processing: Manages payments in various currencies, supporting businesses with international employees.

- Localized employee training programs: Develops training tailored to local cultures and regulations, enhancing workforce skills and compliance.

- Customized HR consulting: Provides tailored HR solutions to meet specific business needs and challenges.

Benefits of Global PEO Services

Partnering with a global PEO provider offers several benefits for your team and your business. Here are a few you can look forward to:

- Reduced administrative burden: International PEOs handle payroll and tax compliance, freeing your team to focus on core business activities.

- Risk management: They ensure compliance with local employment laws, minimizing legal risks and penalties.

- Access to expertise: Get guidance on HR policies and local regulations, supporting informed decision-making.

- Cost savings: Avoid the expense of setting up local entities by using cost-effective PEO services to manage international operations.

- Faster market entry: Quickly hire and onboard employees in new countries, accelerating your global expansion efforts.

- Improved employee satisfaction: Offer competitive benefits packages managed by the PEO, helping attract and retain top talent.

- Enhanced scalability: Scale your workforce up or down in response to business needs, supported by the PEO's infrastructure.

Costs & Pricing Structures of Global PEO Services

Global PEOs offer custom pricing to accommodate different business needs, sizes, and circumstances. Providers generally work within one of the following pricing structures:

- Subscription-based: Charges a recurring fee, often monthly, for continuous services.

- Per-employee pricing: Costs vary based on the number of employees managed by the PEO.

- Tiered pricing: Offers different levels of service packages at varying price points.

- Project-based: Fees are determined by specific projects or tasks undertaken by the PEO.

- Flat fee: A single, fixed price for a set range of services.

Key Factors That Influence Global PEO Services Pricing

Beyond the specific pricing model, here are some additional factors that can influence the cost of international PEO services:

- Customization needs: Tailoring services to unique business requirements can increase costs.

- Number of employees: More employees typically lead to higher fees due to increased management needs.

- Industry regulations: Complying with specific standards may require additional resources and expenses.

- Geographic scope: Managing employees across multiple countries can add complexity and cost.

- Service level: The extent and depth of services required will impact the overall pricing.

Knowing these factors before you start seeking custom quotes from providers helps you get a sense of what to expect, so you can compare and contrast quotes more effectively.

Global PEO Services: FAQs

Here are some answers to common questions about global PEO services:

How do global PEO services handle international payroll?

Global PEO services manage international payroll by ensuring compliance with local tax laws and regulations. They calculate employee salaries, withhold appropriate taxes, and handle currency conversions. This allows teams to focus on core business tasks without worrying about local payroll intricacies. They also keep up with changes in tax laws to ensure ongoing compliance.

Can a global PEO service help with employee onboarding?

Yes, global PEO services can assist with employee onboarding by managing the administrative tasks involved. They handle paperwork, ensure compliance with local employment laws, and offer support during onboarding. This helps your new hires integrate smoothly into your team, regardless of their location. The PEO can also provide cultural training to help new employees adapt.

What compliance support do global PEO services offer?

Global PEO services ensure all HR activities adhere to local laws and regulations. They keep track of changes in employment laws, helping you avoid legal pitfalls. With their expertise, your team can be confident in maintaining compliance across multiple jurisdictions. They can also provide guidance on industry-specific regulations if needed.

How flexible are global PEO services with scaling teams?

Global PEO services are typically flexible and can help you scale your team up or down as needed. They offer the infrastructure to support hiring in new locations without setting up local entities. This flexibility helps your business adapt to changing market demands and opportunities. You can adjust your workforce size quickly without long-term commitments.

Will using a global PEO service affect our company culture?

A global PEO service can support your company culture by ensuring consistent HR practices across locations. They can help you implement policies that align with your values and provide tools for effective communication. By managing administrative tasks, your team can focus on fostering a positive work environment. They also offer localized support to respect cultural differences.

Do global PEO services handle employee benefits?

Yes, global PEO services typically offer benefit management as part of their package. They work with local providers to arrange healthcare, retirement plans, and other benefits, ensuring your employees receive perks that comply with local standards.

What's the difference between a global PEO and an employer of record?

A global PEO and an Employer of Record (EOR) both help businesses manage international employment, but they differ in their roles and legal responsibilities.

A global PEO operates under a co-employment model, where the client company and the PEO share employer responsibilities, with the PEO handling HR tasks like payroll and benefits while the client remains the legal employer.

In contrast, an EOR acts as the sole legal employer of your team members in a specific country, managing compliance, taxes, and contracts, allowing your business to focus on day-to-day operations without directly employing staff in that region.

To learn more, read our analysis of the differences between a PEO and an EOR next.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.