Best Payroll Software for Trucking Companies Shortlist

Here's my pick of the 10 best software from the 18 tools reviewed.

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Running payroll in a trucking company isn’t just about cutting checks, it’s about navigating a web of complexities unique to the transportation industry.

From managing per-mile and hourly pay to tracking driver hours across state lines and staying compliant with constantly evolving DOT and tax regulations, payroll can quickly become a time sink without the right tools in place.

That’s where specialized payroll software for trucking companies comes in. The right platform doesn’t just automate payments—it ensures accuracy for multi-pay structures, integrates seamlessly with ELDs and TMS tools, reduces administrative overhead, and keeps you audit-ready at all times.

In this guide, I draw on years of experience analyzing HR and payroll platforms for operationally intensive industries to spotlight the best payroll software options built specifically for trucking companies. Whether you’re running a small fleet or managing a growing logistics operation, you’ll find tools here that are purpose-built to streamline payroll, support compliance, and save time where it matters most—on the road.

Why Trust Our Software Reviews

We’ve been testing and reviewing payroll software since 2019. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our payroll software for trucking companies review methodology.

Best Payroll Software for Trucking Companies Summary

This comparison chart summarizes basic details about each of my top selections of payroll software solutions for trucking companies. You can view pricing details and the availability of free trials or demos side-by-side to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll and compliance | Free trial + demo available | From $29/month | Website | |

| 2 | Best for small trucking companies | 90-day free trial | Pricing upon request | Website | |

| 3 | Best for on-demand payments and self-service | Free demo available | Pricing upon request | Website | |

| 4 | Best for affordable payroll with free direct deposit | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 5 | Best for flexible attendance tracking | Not available | Pricing upon request | Website | |

| 6 | Best for automated driver payments | Not available | From $150/month, $20/Truck | Website | |

| 7 | Best for complex payroll calculations | Not available | Pricing upon request | Website | |

| 8 | Best for real-time accounting | Not available | Pricing upon request | Website | |

| 9 | Best for mobile payroll management | 3-month free trial | From $39/month + $5/month/employee | Website | |

| 10 | Best for compliance guarantee | Not available | Pricing upon request | Website |

-

edays

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7 -

ClearCompany

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Best Payroll Software for Trucking Companies Reviews

This in-depth analysis provides overviews of the best trucking payroll software tailored for companies. It covers the pros and cons of each tool, their features, and best use cases.

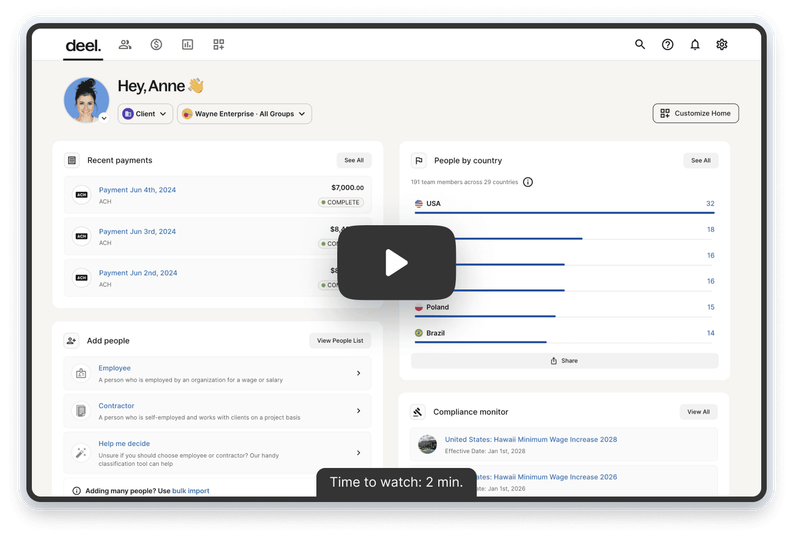

Deel is a global payroll and compliance tool that offers solutions for managing international teams, including payroll, HR, and compliance services in over 150 countries. Its unique selling proposition lies in its ability to handle both employees and contractors, ensuring timely payments, local benefits, and compliance with country-specific regulations, making it the best choice for businesses looking to expand their operations internationally.

Why I picked Deel:

Deel offers advanced global payroll and compliance solutions, which are crucial for managing a diverse and geographically dispersed workforce. It's best for global payroll and compliance because it provides extensive coverage with its 100+ entities and visa support, making it easier to hire and manage a global workforce. Additionally, Deel's integration with popular HR and accounting tools and its support for both employees and contractors further enhance its utility.

Standout features and integrations:

Features include global payroll and compliance, contractor management, employee onboarding, automated tax compliance, benefits administration, time tracking and expense management, legal document management, localized contracts, workforce analytics, and integration with existing HR and accounting systems.

Integrations include Xero, BambooHR, Slack, Google Workspace, QuickBooks, and HubStaff.

Pros and cons

Pros:

- Localized payroll solutions

- Flexible contract types

- Global compliance expertise

Cons:

- Limited customization

- Complex initial setup

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

RUN powered by ADP is a payroll and HR platform tailored for small businesses, offering services such as automatic payroll tax calculation and filing, benefits administration, time and attendance management, and compliance support.

Why I picked RUN by ADP:

Ideal for small trucking businesses, RUN provides automated payroll processing, which simplifies managing driver pay, including hourly rates, mileage-based pay, and bonuses. It also offers automated tax filing and compliance support, helping businesses navigate complex multi-state tax regulations often encountered in the trucking industry. With its mobile access, RUN allows business owners and drivers to access payroll and HR information from anywhere, a crucial feature for businesses that operate on the road.

Standout features and integrations:

Features include direct deposit, employee self-service portal, HR compliance support, time and attendance tracking, garnishment payment services, new hire reporting, retirement plan services, workers' compensation management, and payroll and tax reports.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Robust mobile app

- Employee self-service portal

- Customizable, in-depth reporting options

Cons:

- Most HR functions are only available on higher-tier plans

- Not ideal for businesses with more than 49 employees

Paylocity offers HR and payroll solutions tailored for the transportation and logistics industry. It integrates HR and payroll functions to streamline operations and ensure compliance.

Why I picked Paylocity:

I chose Paylocity for its integration of HR and payroll functions, which is crucial for trucking companies that need to manage a diverse workforce and comply with various regulations. It offers features like on-demand payment for employees to access wages when they need to and an employee self-service portal to encourage more autonomy. Paylocity also automates complex payroll workflows and provides real-time access to employee data.

Standout features and integrations:

Features include automated payroll processing, real-time financial analysis, and a comprehensive HR management system.

Integrations include QuickBooks for both accounts receivable and payable, NetSuite, Xero, ADP, SAP, Oracle, Microsoft Dynamics, Sage, Workday, and BambooHR.

Pros and cons

Pros:

- Automated payroll processing

- Real-time financial analysis

- Comprehensive HR and payroll integration

Cons:

- May require an extensive setup process

- Pricing information not readily available

Patriot Payroll is an online payroll software designed for small businesses with 1 to 500 employees, offering both basic and full-service payroll options.

Why I picked Patriot Payroll:

I chose Patriot Payroll because it offers a comprehensive and affordable payroll solution that meets the unique needs of the trucking industry. Patriot Payroll has a free direct deposit feature, which is a significant advantage as it helps businesses save on additional banking fees.

Patriot Payroll combines low-cost plans with essential payroll features, ensuring that businesses can manage their payroll without incurring high costs. The software's ability to handle payroll tax filings and provide electronic or printable W-2s adds to its appeal, making it a reliable and cost-effective solution for trucking companies.

Standout features and integrations:

Features include flexible pay rates, a simple three-step process for running payroll, free setup and free direct deposit, customizable time-off accrual rules, and U.S.-based support.

Integrations include Patriot Accounting, QuickBooks Online, QuickBooks Time, Plaid, and Workforce Time & Attendance.

Pros and cons

Pros:

- Supports contractor payments

- Compliant with tax rules in all 50 US States

- Responsive customer support

Cons:

- No employee scheduling features

- For US-based businesses only

APS Payroll delivers specialized payroll and HR solutions designed for the trucking industry. APS Payroll and HR solutions excel in providing flexible attendance tracking, making it ideal for managing varied employee types and pay frequencies across multiple locations.

Why I picked APS:

I chose APS for its attendance tracking capabilities, which are crucial for trucking companies with diverse and dispersed workforces. APS stands out by offering a centralized system that simplifies the management of multi-location attendance and automates HR workflows, ensuring operational efficiency.

Standout features and integrations:

Features include mobile management, configurable scheduling, flexible attendance, centralized real-time data access, seamless HR automation, and compliance tracking.

Integrations include QuickBooks, Sage Intacct, Xero, ADP, Paychex, BambooHR, TSheets, Kronos, and NetSuite.

Pros and cons

Pros:

- Configurable scheduling

- Mobile management

- Flexible attendance tracking

Cons:

- Slight learning curve for certain features

- Limitations with complex deductions

TruckSmartz delivers automated driver payments, streamlining payroll for trucking companies. It automates driver payments, ensuring faster and more efficient payroll management.

Why I picked TruckSmartz:

I chose TruckSmartz for this list because it stands out with its fully automated payroll processes, which are crucial for trucking companies that need to manage complex driver payments efficiently. It is best for automated driver payments because it eliminates manual payroll tasks, resulting in quicker and more accurate payments to drivers, which enhances their efficiency and satisfaction.

Standout features and integrations:

Features include resource management, trips and orders management, fuel and mileage reports, and compliance handling. It also provides vehicle inspection and maintenance services.

Integrations include QuickBooks, Xero, FreshBooks, Sage Intacct, Paylocity, APS, Gusto, Axon, Roll by ADP, and Greenshades.

Pros and cons

Pros:

- Integration capabilities

- Comprehensive management tools

- Automated payroll

Cons:

- Occasional crashes during demos

- Limited customization

Greenshades offers a comprehensive payroll and HR software solution specifically designed for the transportation and logistics industry. It excels in managing complex payroll calculations, making it ideal for trucking companies with diverse pay structures.

Why I picked Greenshades:

I chose Greenshades for its capacity to handle the intricate payroll needs of the transportation industry. Its ability to automate complex payroll calculations, such as pay per mile, pay per load, and piecework pay, sets it apart from other payroll solutions. This makes it the best choice for trucking companies that require detailed and accurate payroll management.

Standout features and integrations:

Features include simplified payroll processing for both drivers and non-drivers, automation of complex calculations and compliance with employment regulations. It also offers automated tax calculations, time and labor management, and employee self-service options.

Integrations include Microsoft Dynamics GP, Dynamics 365, Sage ERP, NetSuite, Acumatica, TMW, Bullhorn, and Avionte.

Pros and cons

Pros:

- Integrates with popular platforms

- Supports diverse pay structures

- Automates complex payroll

Cons:

- Setup may require technical expertise

- Compatibility issues with some integrations

Axon Software provides accounting and payroll software tailored for trucking companies, focusing on increasing productivity and reducing errors in driver pay. It offers real-time accounting, which helps trucking companies manage their finances more efficiently and accurately.

Why I picked Axon:

I chose Axon for its unique real-time accounting capabilities, which set it apart from other trucking accounting software and payroll solutions. This feature ensures that financial data is always up-to-date, providing trucking companies with accurate and timely insights into their financial health. Axon's ability to integrate various accounting functions in real-time makes it the best choice for trucking companies needing precise and immediate financial information.

Standout features and integrations:

Features include real-time financial analysis, integrated accounting, and custom reporting. These features help trucking companies streamline their financial operations and reduce errors in driver pay.

Integrations include PC*MILER, ELD, QuickBooks, Microsoft Excel, Microsoft Word, Adobe Acrobat, Google Maps, PayPal, Stripe, and Authorize.Net.

Pros and cons

Pros:

- Custom reporting

- Integrated accounting functions

- Real-time financial updates

Cons:

- May require significant training

- Pricing not publicly available

Roll by ADP is a payroll software designed for transportation companies, including trucking businesses. It offers mobile payroll management, allowing users to handle payroll tasks from anywhere using their mobile devices.

Why I picked Roll by ADP:

I chose Roll by ADP for its mobile-first approach, which stands out in the trucking industry where mobility is crucial. It allows trucking companies to run payroll, pay by the mile, load, or per diem rate, and manage bonuses and other payroll needs directly from a mobile app. The ability to manage payroll on the go makes it highly suitable for trucking companies. I believe Roll by ADP is best for mobile payroll management due to its comprehensive mobile features that cater to the unique needs of the transportation sector.

Standout features and integrations:

Features include payroll and tax services, employee self-service, intelligent assistance, and support for 1099 contractors. It also provides options for layover pay, stop pay, and detention pay, making it versatile for various payment structures in the trucking industry.

Integrations include QuickBooks, Xero, Sage, FreshBooks, Gusto, Paychex, Square, Wave, Zoho Books, and TSheets.

Pros and cons

Pros:

- Easy to use

- Flexible payment options

- Mobile payroll management

Cons:

- Basic reporting tools

- Requires internet access

Connect & Simplify offers comprehensive payroll and HR solutions tailored for trucking companies. It ensures compliance with state, local, and federal guidelines, making it ideal for companies needing robust compliance support.

Why I picked Connect & Simplify:

I chose Connect & Simplify for its strong emphasis on compliance, which is crucial for trucking companies dealing with complex regulations. The platform's ability to handle intricate tax and travel regulations sets it apart from other payroll solutions.

Standout features and integrations:

Features include automated payroll processing, benefits management, and custom reporting. It integrates with various tools to streamline HR and payroll tasks, ensuring accurate and timely payments.

Integrations include QuickBooks, Xero, ADP, Paychex, Gusto, Sage, BambooHR, Zenefits, TSheets, and Expensify.

Pros and cons

Pros:

- Efficient driver settlement management

- Detailed mileage tracking

- Strong compliance support

Cons:

- Complex initial setup

- Limited mobile app features

Other Payroll Software for Trucking Companies

Below is a list of additional payroll software for trucking companies that we shortlisted, but did not make it to the top list. It’s definitely worth checking them out.

- Strategy Systems

For automated mileage calculation

- Sage Intacct

For financial management integration

- QuickBooks Payroll

For tax penalty protection

- Gusto

For driver retention

- Orange Digital

For comprehensive transport industry solutions

- Aurora Software

For robust accounting and payroll integration

- Axis

For integrated driver payroll features

- PayWow

For user-friendly payroll management for trucking

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Software for Trucking Companies

Selecting payroll software for trucking companies involves evaluating functionality and how it addresses specific use cases that are essential for this industry. The criteria relate to the unique needs and pain points of trucking companies, such as managing driver payments, compliance with regulations, and handling complex payroll structures.

My approach to choosing the best software options for this list is grounded in my experience as an HR technology analyst and thorough research to ensure my recommendations are based on actual utility and performance.

Core Payroll Software for Trucking Companies Functionality (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Manage driver payments and settlements

- Handle multi-state tax compliance

- Generate detailed payroll reports

- Integrate with time-tracking systems

- Support direct deposit and other payment methods

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Customizable payroll templates for different types of drivers

- Real-time analytics and reporting dashboards

- Integration with fuel management and expense tracking systems

- Mobile app access for drivers to view pay stubs and reports

- Automated compliance updates for changing regulations

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive user interface with easy navigation

- Drag-and-drop features for scheduling and payroll adjustments

- Customizable dashboards for quick access to key metrics

- Role-based access control for different user levels

- Clear and concise error messages and prompts

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Availability of comprehensive training videos and tutorials

- Interactive product tours and walkthroughs

- Pre-built templates for quick setup

- Access to live webinars and Q&A sessions

- Chatbots and live chat support for immediate assistance

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- 24/7 customer support availability

- Dedicated account managers for personalized assistance

- Extensive knowledge base and FAQs

- Multi-channel support options (phone, email, chat)

- Fast response times and resolution rates

Value For Money (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models with no hidden fees

- Flexible subscription plans to suit different business sizes

- Cost-benefit analysis comparing features to price

- Discounts for long-term commitments or bulk purchases

- Free trial periods to test the software before committing

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- High overall satisfaction ratings from users

- Positive feedback on ease of use and functionality

- Testimonials highlighting specific benefits and improvements

- Consistent praise for customer support and onboarding experience

- Reviews indicating reliable performance and uptime

Using this assessment framework helped me identify the software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, excellent support, and overall value for price.

How to Choose Payroll Software for Trucking Companies

As you work through your own unique software selection process, keep the following points in mind:

- Trucking-Specific Features: Trucking companies have unique payroll needs, such as paying drivers by mile, load, or hour, and tracking International Fuel Tax Agreement (IFTA) data. Ensure you look for software that offers these specialized functionalities.

- Integration Capabilities: The ability to integrate with other systems, such as Transportation Management Systems (TMS), Electronic Logging Devices (ELDs), and accounting software, is essential for seamless operations.

- Ease of Use: User-friendly interfaces and straightforward workflows are essential for efficient payroll management. Look for software that simplifies payroll processing through intuitive platforms. Features such as automatic time-tracking and seamless integration with mileage-tracking tools can greatly enhance efficiency.

- Compliance and Reporting: Ensuring compliance with federal and state regulations, as well as managing labor costs, is a significant concern for trucking companies. Look for software that automates tax calculations and filings, and generates necessary forms like W-2s and 1099s. Prioritize solutions that offer robust compliance tools and comprehensive reporting capabilities.

- Cost and Scalability: Consider the cost of the software and its ability to expand to fit your business needs. Look for pricing plans that align with the size of your fleet to ensure you receive value for your investment. The software should offer essential features like mileage tracking and driver settlements. A scalable solution will accommodate your business's growth, providing flexibility and additional features as your fleet expands.

By considering these factors, you can select payroll software that not only meets your current needs but also supports your cash flow and business growth.

Trends in Payroll Software for Trucking Companies

Payroll software for trucking companies is evolving rapidly. Here are some key trends to watch this year.

- Integration with Telematics Systems: Payroll software is now integrated with telematics systems. This allows for real-time tracking of driver hours and routes. It ensures accurate payroll calculations based on actual work done.

- Blockchain for Payroll Security: Blockchain technology is being used to enhance payroll security. It provides a tamper-proof ledger for all transactions. This reduces the risk of fraud and ensures data integrity.

- Mobile Payroll Management: Mobile apps for payroll management are gaining popularity. They allow drivers to access their payroll information on the go. This increases transparency and convenience for employees.

- AI-Powered Payroll Analytics: AI is being used to analyze payroll data. It helps in identifying patterns and anomalies. This can lead to more efficient payroll processing and error reduction.

- Automated Compliance Updates: Payroll software is now offering automated compliance updates. This ensures that the software is always up-to-date with the latest regulations. It reduces the risk of non-compliance and associated penalties.

As these technologies continue to evolve, they will offer significant benefits in efficiency, accuracy, and overall payroll management for trucking companies.

What is Payroll Software for Trucking Companies?

Payroll software for trucking companies is a specialized tool designed to manage and automate the payroll processes specific to the trucking industry. It is used by payroll administrators, HR professionals, and fleet managers to handle driver payments, track hours, and ensure compliance with industry regulations. Users need it to accurately calculate wages, manage deductions, and generate payroll reports efficiently.

The components of payroll software for trucking companies include time tracking, wage calculation, tax management, and compliance features. It also integrates with other systems like GPS for tracking driver hours and accounting software for financial reporting.

Features of Payroll Software for Trucking Companies

Managing payroll can be a complex and intricate process for a trucking company, so it is essential to have payroll software that helps automate and streamline the payroll process, ensuring timely and accurate payments to drivers and other employees.

As you handle various operational aspects, from mileage calculations to driver settlements, here are the most important features to look for in payroll software for trucking companies:

- Driver Settlement Management: This feature allows for accurate calculation and distribution of driver payments, ensuring that drivers are paid correctly based on miles driven, loads delivered, and other factors.

- Compliance Tracking: Ensures that the company adheres to federal and state regulations, which is essential for avoiding fines and legal issues.

- Fuel Tax Reporting: Automates the calculation and reporting of fuel taxes, saving time and reducing errors in tax filings.

- Time and Attendance Tracking: Monitors driver hours and attendance, which is important for managing overtime and ensuring compliance with hours-of-service regulations.

- Direct Deposit: Provides the ability to pay drivers directly into their bank accounts, which is convenient and reduces the need for paper checks.

- Benefits Administration: Manages employee benefits such as health insurance and retirement plans, which is important for maintaining employee satisfaction and retention.

- Expense Tracking: Tracks and reimburses driver expenses, ensuring that all costs are accounted for and reimbursed promptly.

- Customizable Pay Rates: Allows for different pay rates based on various criteria, which is important for accurately compensating drivers with different roles and responsibilities.

- Reporting and Analytics: Provides detailed reports and analytics on payroll data, which helps in making informed business decisions.

- Integration with Accounting Software: Ensures seamless data transfer between payroll and accounting systems, which is crucial for maintaining accurate financial records.

By focusing on these features, you can acquire an efficient and effective payroll system tailored to the unique needs of your trucking company.

Benefits of Payroll Software for Trucking Companies

In the trucking industry, managing payroll can be a complex and time-consuming task. Payroll software designed specifically for trucking companies can streamline this process, offering numerous benefits that enhance efficiency, accuracy, and compliance.

Below are five primary benefits of using payroll software for your trucking company:

- Customized Pay Stubs: Specialized payroll software allows for personalized pay stubs that include essential details such as load numbers, delivery dates, starting and ending cities, miles driven, and pay per load. This transparency helps in retaining drivers by clearly showing what they are being paid for.

- Flexible Report Customization: Payroll software for trucking companies offers flexibility in report customization, allowing businesses to tailor reports to their specific needs. This includes insights into payment frequencies and detailed breakdowns of deductions and allocations, providing a comprehensive financial overview.

- Tailored Deductions and Allocations: The complexity of trucking payroll often involves various deductions and allocations. Payroll software simplifies this by clearly outlining what is deducted from each paycheck and how that money is used, ensuring drivers are well-informed about their earnings.

- Efficient Focus on Mileage or Percentage-Based Payments: Payroll software efficiently manages payments based on mileage or percentage-based pay structures, ensuring accurate and fair compensation for drivers. This is crucial in the trucking industry where pay structures can vary significantly.

- Improved Compliance and Tax Filing: Payroll software helps trucking companies stay compliant with tax regulations by automating payroll tax filing and ensuring accurate calculations. This reduces the risk of errors and penalties, providing peace of mind for business owners.

- Improved Driver Retention and Satisfaction: Timely, transparent paydelivered with detail and accuracy goes a long way in retaining quality drivers. Integrated benefits management and self-serve portals further enhance their experience.

- Seamless System Integrations: Many trucking payroll platforms sync with ELDs, dispatch tools, TMS platforms, and accounting software like QuickBooks or Xero—reducing data duplication and ensuring operational alignment.

- Time and Cost Savings for Admin Teams: By automating repetitive tasks like tax filing, settlement calculations, and report generation, your HR and accounting staff can focus on more strategic work. This can lead to measurable cost savings over time.

Using payroll software designed for the trucking industry not only improves accuracy and efficiency in payroll processing but also allows companies to focus on growing their business while professionals handle the payroll. This strategic investment can lead to better driver retention, enhanced financial transparency, and overall operational efficiency.

Costs and Pricing of Payroll Software for Trucking Companies

When considering payroll software for your trucking company, you should be aware of the various plan options and pricing structures available. The pricing and features of these plans can vary significantly, so it's important to understand what each plan offers to find the best fit for your needs.

This guide provides an overview of various payroll software options tailored for trucking companies, detailing their plans, average prices, and features to help you make an informed decision.

Payroll Software for Trucking Companies Plan Comparison Table

| Plan Type | Average Price | Common Features |

| Free | $0 | Basic payroll processing, limited customer support, and simple reporting tools |

| Basic | $50/month | Payroll processing, tax calculations, direct deposit, basic reporting, and email support |

| Standard | $150/month | All Basic features, plus time tracking, employee self-service, compliance management, and phone support |

| Premium | $300/month | All Standard features, plus advanced reporting, integration with other software, priority support, and mobile app access |

| Enterprise | Custom pricing (starting at $500/month) | All Premium features, plus a dedicated account manager, personalized setup and training, custom reporting, and enhanced security features |

More advanced payroll systems that include features like global payroll and employer of record (EOR) services, tend to be more expensive. For these platforms, you can expect to pay between $25 to $500 per employee, depending on the specific service configuration you choose.

Payroll Software for Trucking Companies FAQs

Here are some answers to frequently asked questions you may have about payroll software for trucking companies and how it works:

What features should I look for in payroll software for trucking companies?

When selecting payroll software for trucking companies, look for features such as automated payroll processing, tax compliance, direct deposit, employee self-service portals, and integration with other systems like accounting and time tracking. Additionally, consider software that can handle complex pay structures, including mileage and per diem payments.

How does payroll software handle different pay rates for drivers?

Payroll software designed for trucking companies can manage various pay rates by allowing you to set up different pay structures for each driver. This includes hourly rates, mileage rates, and per diem payments. The software can automatically calculate the correct pay based on the data entered, ensuring accurate and timely payments.

Can payroll software help with tax compliance for trucking companies?

Yes, payroll software can assist with tax compliance by automatically calculating and withholding the correct amount of federal, state, and local taxes. It can also generate necessary tax forms, such as W-2s and 1099s, and ensure that all tax filings are completed on time. This helps reduce the risk of errors and penalties.

Is it possible to integrate payroll software with other systems used by trucking companies?

Many payroll software solutions offer integration capabilities with other systems commonly used by trucking companies, such as accounting software, time-tracking systems, and fleet management tools. This integration helps streamline operations and ensures that data is consistent across all platforms.

What support options are available for payroll software users?

Support options for payroll software users typically include online resources such as FAQs, user guides, and video tutorials. Many providers also offer customer support through phone, email, or live chat. Some software solutions may provide dedicated account managers or premium support packages for additional assistance.

Can payroll software handle payroll for both company drivers and independent contractors?

Yes, payroll software can manage payroll for both company drivers and independent contractors. It can differentiate between the two types of workers and apply the appropriate tax treatments and payment methods. This ensures that both employees and contractors are paid accurately and in compliance with regulations.

What are the costs associated with payroll software for trucking companies?

The costs of payroll software for trucking companies can vary based on factors such as the number of employees, the features included, and the level of support provided. Some software solutions charge a monthly subscription fee, while others may have a per-employee pricing model. It’s important to evaluate the pricing structure and choose a solution that fits your budget and needs.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.