Seasoned HR experts know that payroll administration and taxes are among the most time-consuming aspects of the job. Yet, it's crucial to get it done accurately and on time. After all, your employees need to get paid. No pressure, right?

With the right payroll software solution, missed payments and pay mistakes will become a thing of the past.

So let's dive into what payroll software is, why you need it, and key features to look out for, so you can say goodbye to your payroll headaches for good.

What is Payroll Software?

Payroll software automates employee pay and maintains human resource records like time and attendance. It also takes the headache out of managing employee tax deductions, and it can be a life-saver for small and enterprise businesses. The best payroll software is:

- Reliable

- Intuitive and user-friendly, easy to customize to your own business needs

- Adaptable so you can manage and automate payments for all employees—including salaried, hourly, and temporary staff.

Why Do You Need Payroll Software?

When you use payroll software, you end up saving time and reducing paycheck errors. This in turn leads to more satisfied employees and fewer issues for management to deal with. Here are a few specific reasons you might opt to use a software for processing payroll:

- Ensuring federal tax compliance with the IRS (or CRA for Canadian payroll solutions), avoiding breaking tax laws by accident.

- Accounting for local tax compliance in the areas where your employees do their work.

- Getting key employee information from new hires to add them to your payroll quickly.

- Providing a self-service portal where employees can access pay stubs and tax forms, update their bank account information, use time tracking tools, and more.

12 Benefits of Payroll Software

Workforce management is complex, but a strong payroll process will take some of the burden off your HR team. Check out these 10 payroll solution benefits you’ll see when you decide to make the switch:

1. Time-Saver

According to Score.org, businesses spend over 80 hours on payroll processing every year. This can impact your bottom line since the time is not spent on other organizational needs to meet your goals.

The automation of payroll software helps you cut down on time spent in this area, allowing your HR department to focus on other areas. It can also provide you with year-end reports to help you take a big-picture look at your business.

2. Transparency

Using a payroll management system promotes transparency and builds trust among your employees. The payroll system ensures your employee feels confident their pay will be on-time and accurate.

These payroll services also allow staff limited access to their own employee benefits and time and attendance information.

3. Reduces Error

Score.org also reports payroll processing problems in the U.S. are impacting 82 million employees—and payroll problems cause morale problems.

Employees need to know their payment will be accurate—a payroll system will vastly reduce the possibility of human error, including inaccurate data input and accidental deletion of formulas.

4. Security

A manual payroll process leaves the door open to compromise your company’s security—this is true for small businesses and enterprises. Payroll software allows you to protect employee payroll data with tools like conditional system access and password protection.

5. Compliance

Payroll software gives you the confidence to know you’re on track with company rules and regulations, as well as tax filing requirements and laws. Payroll systems allow you to easily enter changes to be calculated for you—you can set it and forget it.

6. Filing Taxes Effectively

A full-service payroll software will automate your tax calculations and have tax compliance built-in. This alleviates the manual workload of tax filings and also reduces the risk of manual errors. This is especially helpful if you have a distributed workforce, because the software can help you account for both federal taxes and local taxes.

7. Manage Payroll Across Multiple Countries

In today’s world, employees can be effective working remotely from anywhere in the world – with global payroll software, you can ensure employees are paid on time, no matter where they are.

8. Easier Employee Monitoring

It can be tough to keep up with staff schedules but as a manager, it’s important for you to know where employees are and what hours they’re working. Choosing a payroll system with an employee calendar helps you easily monitor leave and overtime—at a glance, you’ll have the big picture of staff availability and hours worked.

9. Simple Expense Management

Payroll is tough enough—but you also have to think about employee benefits, bonuses, and overtime pay. Choosing a payroll system with additional financial options lets you keep track of these expenses—ensuring an accurate budget at the end of the day. For more advanced expense management, you could also consider expense management software.

10. Reliability

Since payroll software is automated, there’s no reliance on employees to get the job done every pay period. These systems are highly reliable, helping to ensure employees are paid accurately and on time.

11. Available Customer Support

If you don’t have a payroll pro in-house, having an expert available to help whenever an issue arises is crucial to your business operation. Many payroll providers provide exceptional customer support alongside their payroll system. This means you’ll have access to payroll experts who can walk your HR department through how the system works, and give you tips for a streamlined process.

12. Simplified Payroll Reporting

Many of these HR software tools have built-in reporting dashboards. You can keep an eye on your payroll processing in real-time and quickly generate payroll reports for budgeting and stakeholder management.

Now that you know the potential benefits of investing in payroll software, let’s take a look at some features you’ll likely find beneficial for your company's needs.

5 Key Features of Payroll Software

The following features are what you’ll want to look for when considering your own choice of payroll management software.

These options make payroll a breeze and ultimately lead to more satisfied employees. Here are 5 major payroll software features:

1. Payroll management

Payroll software allows you to calculate bonuses, employee expenses, garnishments, and overtime and holiday pay. You can also easily print checks for those team members who don’t enroll in direct deposits. Payroll reports are easy to run and give you a sense of overall business operations.

Key Benefits:

- Automates workflows, reducing manual work

- Reduces risk of manual errors

- Ensures employees are paid accurately and on time

2. Direct deposit

Payroll software manages your team’s direct deposits without you having to think about it. It will pay employees automatically and correctly—significantly reducing errors. Direct deposit also makes payday a lot easier for your team members.

Key Benefits:

- No need to create multiple pay checks

- Employees don’t need to manually deposit a pay check

3. Time and attendance tracking

A bonus of payroll processing software is that it also helps you maintain employee time and attendance records. This feature allows your human resource department to look at daily activity or run payroll reports to view overall employee leave information within a pay period or over time.

Key Benefits:

- Ensures pay is accurate according to hours worked

- Helps avoid unnecessary overtime, keeping things cost-effective

- Reduces the number of HR tools and apps necessary

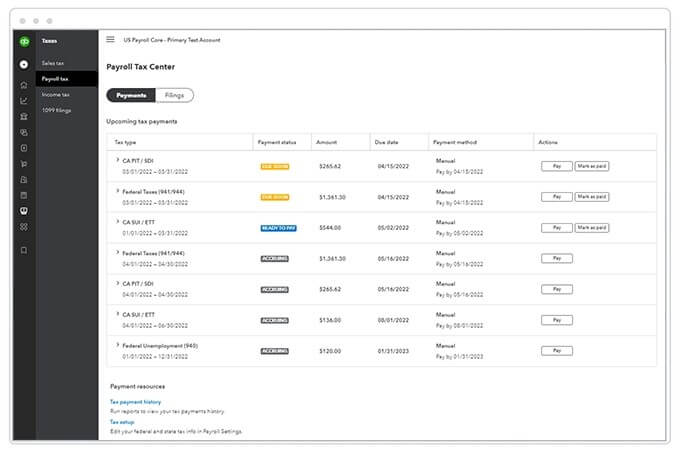

4. Income tax filing

Payroll software takes the guesswork out of calculating payroll taxes, withholdings, insurance, and retirement contributions—it can also generate tax payments and payroll forms for you. Imagine the time you’ll save when you don’t have to manage these requirements every year for every employee.

Key Benefits:

- Ensures tax laws are followed and compliance is up-to-date

- Keeps essential tax forms centralized, secure, and accessible

5. Employee Self-Service

Many payroll software options allow employees access to update their own information. Allowing access leads to transparency and will enable them to handle questions and changes independently. Staff can view their payment history, change their personal information, and change payment preferences as needed.

Key Benefits:

- Automates the employee payroll onboarding process

- Mobile apps give employees easy on-the-go access

- Employees can update their bank account and other important information

Example of Payroll Software

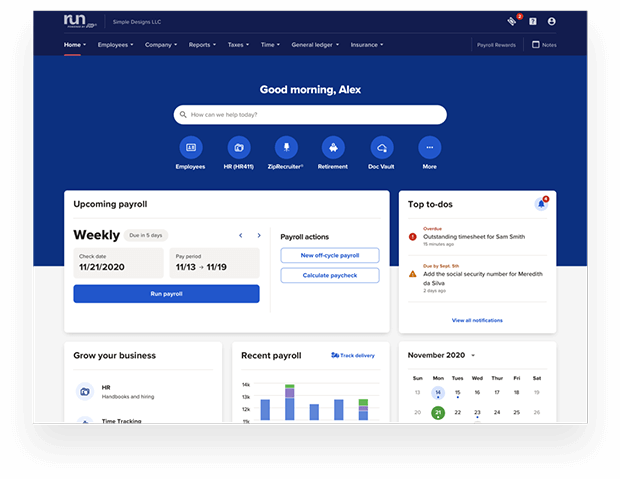

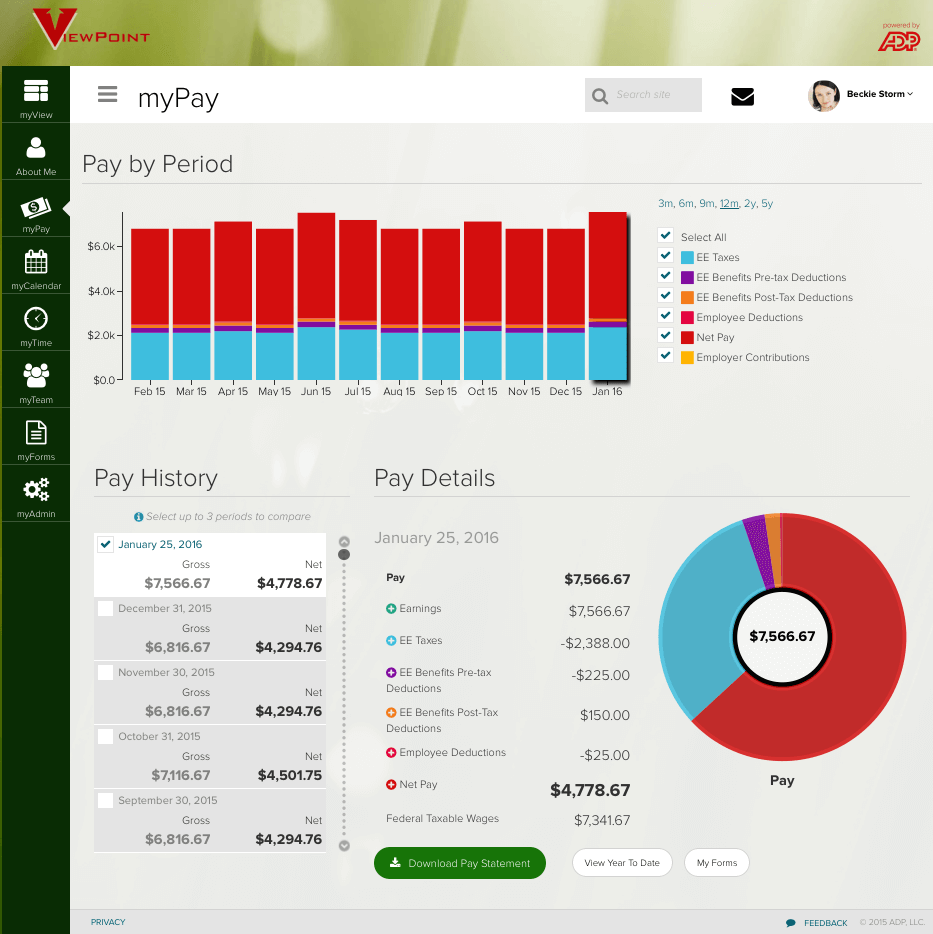

Let’s take a quick look at an example—ADP GlobalView Payroll.

ADP GlobalView Payroll combines payroll and HR into a unified system that’s easily configurable to work with your existing platforms.

It’s a great option for multinational companies because it lets you combine payroll information for all employees into one system–regardless of their location. This ability to streamline saves hours of time for HR staff and allows management to see it all in one place.

ADP GlobalView features include customizable employee dashboards and the ability to view pay periods side-by-side to compare. It also allows for employee self-service—including mobile access. This self-service option is another huge time-saver for HR staff.

ADP’s directory includes 3,000 payroll and compliance specialists - so you can rest easy knowing your company is in compliance with regulations worldwide.

How To Choose The Right Payroll Software For Your Organization

As you research and consider different payroll automation software options, it's important to factor in not just the features, but also the overall cost of the payroll software to ensure they meet your budget.

To help you along in your selection process, ask yourself these questions:

Will the software integrate with your current systems?

When you bring on payroll software, you don’t want the hassle of changing other systems, too. During the procurement stage, be sure to check if the platform will integrate with the systems and applications you already have. This might include your accounting software, human capital management (HCM) system, or other core HR software tools.

Is the software easy to use for both employees and management?

The best payroll solution is easy to navigate for all users. Make sure to look for smart, built-in processes employees find easy to access and maneuver. When employees can make changes to their personal information, it saves time for everyone. Cloud-based options are ideal, because online payroll systems are accessible from various devices in different locations.

Can the software be easily configured for your current and future needs?

When you choose a new payroll service, think about the needs of your business now and in the future. Will this software meet your company's growth in the next year? In the next five years? Think about the big-picture vision of your org and choose a payroll system that will grow with you.

Is the software compatible with businesses of your size?

While payroll software benefits companies of all sizes, some platforms may be created for businesses of a specific size and this will impact pricing. Be sure to choose a system that aligns with the needs and resources of your org. There are payroll software for small business owners available as well as enterprise-grade payroll solutions.

Does the software accommodate global payroll management?

You might not have a global workforce currently, but if it’s within your company’s plans (or even just something you’re considering), it’s worth taking into account. Having a payroll software that can handle global payroll needs will be one less barrier to growing your business internationally if and when you choose to.

Is the software compatible across different industries?

This may or may not be relevant for your business. However, specialized options are available to cater to the needs of niche industries. Consider seeking out a payroll provider that specializes in your field if needed.

Need expert help selecting the right Payroll Management Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

Streamline Your Payroll Process

Payroll software can save you time—and save you from a lot of headaches by ensuring compliance. Once you’re up and running, the payroll essentially runs itself. Use the features, benefits, and advice outlined in this article to guide your selection of the best payroll solution for your business. Keep in mind that outsourcing is also always an option, and many providers offer both software and services combined.