10 Best Invoicing and Payroll Software Shortlist

Here's my pick of the 10 best software from the 14 tools reviewed.

Selecting the right invoicing and payroll software can be a daunting task. You're looking for a way to handle financial data and invoicing tasks efficiently, but the choice of tools is overwhelming. I understand your challenges, and I'm here to make your decision-making process easier. Drawing on my extensive experience using different HR management tools, I've evaluated numerous software options to save you time and effort. The software I recommend automates invoicing and payroll processes, simplifying financial management for your business.

Why Trust Our HR Software Reviews

We’ve been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Invoicing and Payroll Software: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top invoicing and payroll software selections to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for payroll-connected reimbursements | Free demo available | From $8/user/month (billed annually) | Website | |

| 2 | Best for invoicing and time tracking | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 3 | Best for global invoicing and payroll | Free trial + demo available | From $29/month | Website | |

| 4 | Best for online accounting | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 5 | Best for managing international payroll compliance | Free demo available | From $25 - $199/user/month | Website | |

| 6 | Best for affordability | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 7 | Best for diverse business tools | 30-day free trial | From $15/user/month | Website | |

| 8 | Best for automation features | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 9 | Best for free financial software | 30-day free trial + free plan available | From $14/user/month | Website | |

| 10 | Best for comprehensive accounting solutions | Free demo available | From $61.92/month (one user only) | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Best Invoicing and Payroll Software Reviews

Here are my detailed summaries of top invoicing and payroll software that made it into my top 10 shortlist, including notes on why I picked them. Each review also includes the pros and cons of each system, their key features, and ideal scenarios for use.

Rippling Spend is a spend management software designed to help businesses manage their expenses, control corporate card spending, and handle bill payments. It consolidates these functions into a single, cloud-based platform, providing a comprehensive solution for businesses of all sizes.

Why I picked Rippling Spend: I picked Rippling Spend because of how tightly it connects invoicing and payroll functions in one place. It lets you reimburse employees and contractors globally through integrated payroll, paying them in their local currency while reporting in yours. This removes the need to jump between different systems just to answer questions about expenses. Rippling also catches duplicate expenses, flags mismatched invoices and receipts, and helps you close the books faster by syncing and categorizing expenses automatically in your general ledger.

Standout features & integrations:

Features include the ability to automatically enforce spending policies and route approvals based on real-time transaction and employee data. The software also offers real-time analytics, providing insights into spending patterns and helping you make informed financial decisions.

Integrations include Slack, Checkr, Google, Zoom, Asana, Salesforce, Microsoft 365, Guideline, GitHub, Carta, Jira, and Datadog.

Pros and cons

Pros:

- Automates expense categorization to expedite month-end close

- Enforces spending policies and routes approvals automatically

- Unified system for expense management, bill payments, and payroll

Cons:

- Setting up complex policies may require additional effort

- Mobile app is limited compared to desktop version

New Product Updates from Rippling Spend

Rippling Spend adds Rippling Travel tool & mobile enhancements

This week, Rippling Spend launched Rippling Travel and major mobile app upgrades to simplify travel booking, expense submissions, and approvals on the go. These updates save you time, enforce policies in real time, and let you manage expenses anywhere.

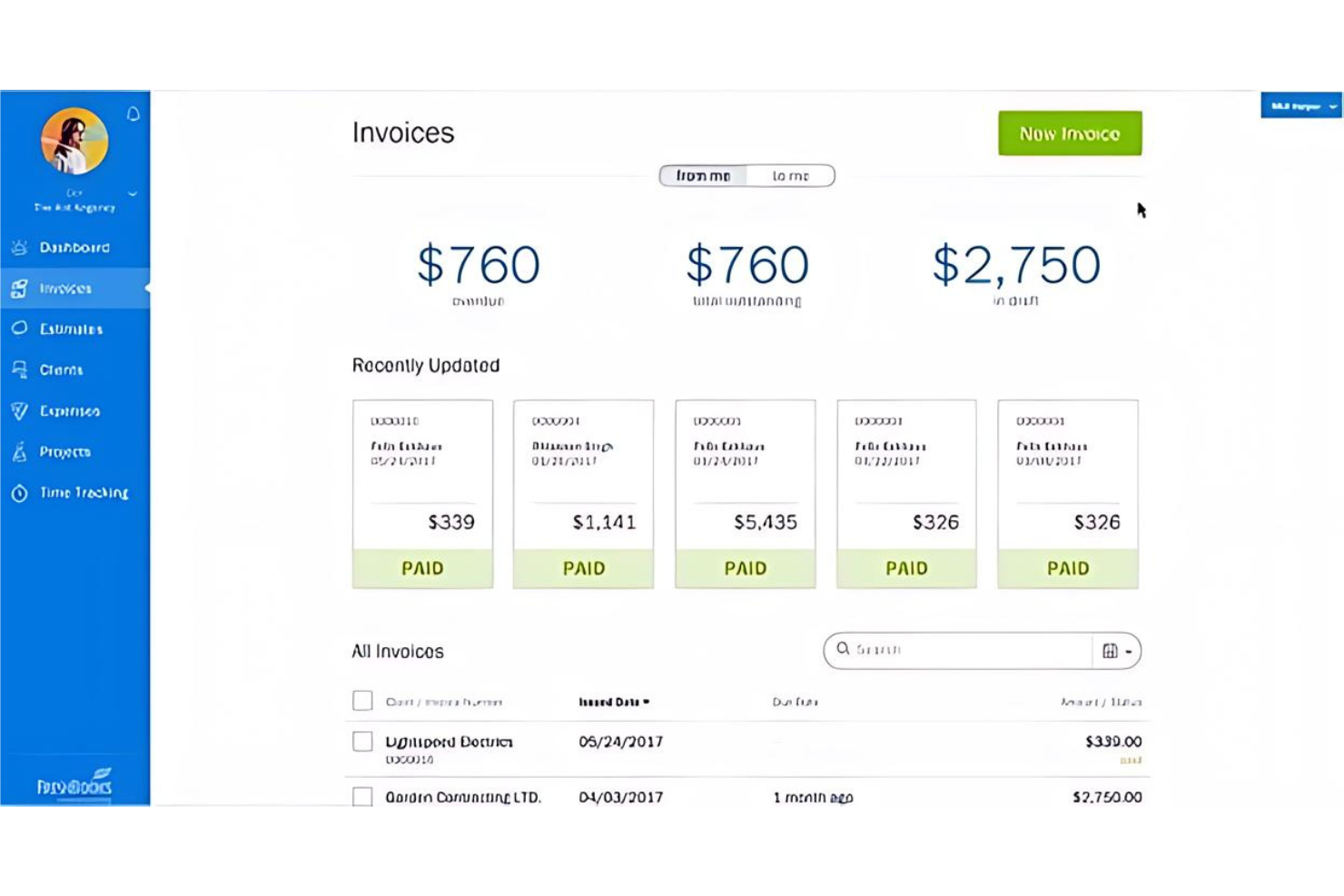

FreshBooks is a comprehensive accounting solution designed to cater to the needs of small businesses and freelancers. It streamlines invoicing and time tracking, making it easier for users to manage their finances and billing processes.

Why I picked FreshBooks: I chose FreshBooks for this list because of its user-friendly interface and robust set of features that specifically enhance invoicing and time-tracking capabilities. Its standout qualities include customizable invoices, automated payment reminders, and the ability to accept credit card payments directly on invoices. I believe FreshBooks is best for invoice and time tracking due to its automated features that save time and reduce the manual effort typically associated with these tasks.

Standout features & integrations:

Features that are particularly beneficial for small businesses and freelancers include customizable invoices that can be created quickly, automated payment reminders to nudge clients, and the ability to set automatic late fees to encourage prompt payments. Additionally, FreshBooks provides time-tracking tools that are automated and accurate, ensuring that billable hours are logged without error.

Integrations are available natively with over 100 business apps, enhancing its functionality and allowing users to streamline their workflows. Key integrations include Google Drive, PayPal, Slack, Trello, Mailchimp, Gusto, Salesforce Sales Cloud, Dropbox, Hubspot, Squarespace, and GSuite.

Pros and cons

Pros:

- Integration with over 100 business apps

- Automated time tracking for accurate billing

- Customizable invoices that can be created in seconds

Cons:

- No native payroll processing; requires third-party integration

- Limited to 5 billable clients on the Lite plan

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

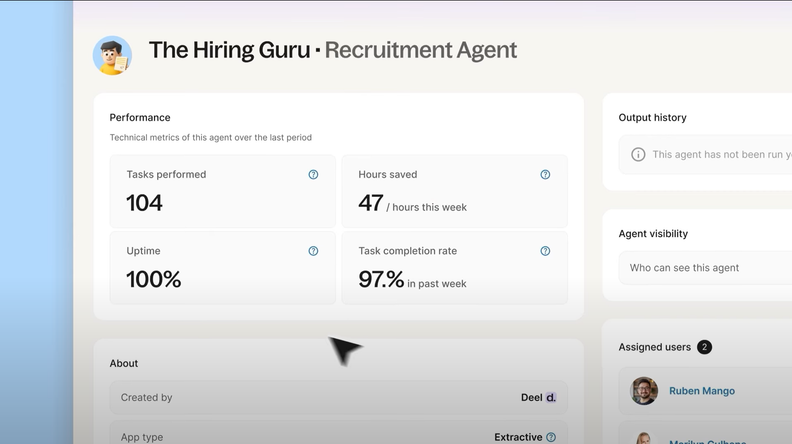

Deel is a comprehensive HR platform that provides payroll and compliance services for global teams. It allows users to hire globally, and automate payroll, compliance, HR, and more in over 150 countries for employees and contractors.

Why I picked Deel: I selected this platform for its comprehensive global workforce management capabilities, which include features like expense reimbursements, contract modifications, advanced payment scheduling, and off-cycle payroll adjustments. The platform also offers global invoicing features, simplifying the process of managing international payments and billing, which is especially beneficial when hiring contractors. Additionally, Deel has local experts in various countries to manage global payroll and ensure compliance with regional requirements.

Standout features & integrations:

Features include compliance documentation to ensure that all necessary documentation is in place, local benefits tailored to the specific needs of employees in different countries, and in-house visa support for hiring or relocating team members.

Integrations include NetSuite, Okta, OneLogin, QuickBooks, Ashby, BambooHR, Expensify, Greenhouse, Hibob, Xero, Workday, and Workable. It also offers an API for custom integrations.

Pros and cons

Pros:

- Localized benefits and compliance

- Supports various payment options, including cryptocurrency

- Offers employer of record (EOR) services

Cons:

- Limited invoice customization

- No mobile app available

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Xero is a comprehensive cloud-based accounting platform designed for small businesses and accountants. It is best for online accounting because it offers real-time financial data access from anywhere, streamlining financial processes and decision-making.

Why I picked Xero: I chose Xero for this list because of its ability to integrate with a vast number of financial institutions globally, which make it a standout choice. I believe Xero is best for cloud-based accounting due to its accessibility, real-time data updates, and comprehensive financial management tools that cater to the needs of modern small business owners.

Standout features & integrations:

Features include online invoicing, bank connections, multi-currency accounting, and detailed financial reporting. Users can track and pay bills on time, manage expenses, reconcile bank transactions, and get a clear overview of their cash flow and accounts payable and receivable.

Integrations are available natively with a wide range of tools, including Gusto, Avalara, Wagepoint, Payevo, Jibble, Humi, Timedock,Oyster, Payworks, Knit, Rise, Rippling, Remote, Deel, Hubdoc, Stripe, PayPal, WorkflowMax, Square, Expensify, Vendy, Deputy, and Shopify. It also connects with over 21,000 financial institutions globally, allowing for automated bank feeds and reconciliation.

Pros and cons

Pros:

- A comprehensive set of accounting features

- Integration with over 21,000 financial institutions

- Real-time access to financial data

Cons:

- Payroll features are only suitable for a small number of employees

- Higher-tier plans can be costly for very small businesses

New Product Updates from Xero

Xero Unveils Redesigned Certification Program

Xero has revamped its certification program, offering flexible learning with digital courses, live webinars, and badges. Open to all, it's free and self-paced. For more information, visit Xero's official site.

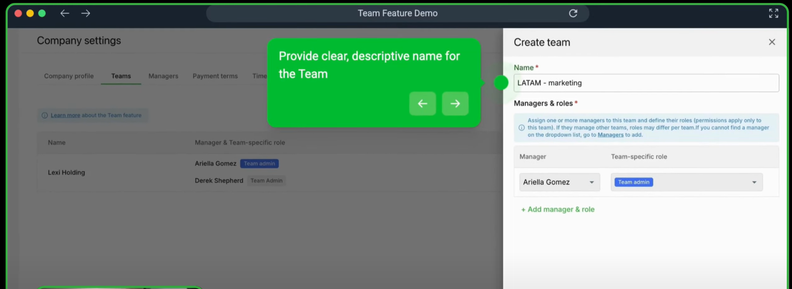

Remofirst is a global employment services platform that offers tools for hiring and managing a global team, including employer of record services, payroll management, benefits management, and compliance support.

Why I picked Remofirst: I like that Remofirst has an all-in-one HRIS platform that includes features like automatic payroll calculations, compliance audits, and dedicated account managers for support. Additionally, the platform's ability to handle local laws and regulations for employee contracts and benefits management makes it easier to hire internationally, whether it's salaried employees or contractors.

Standout features & integrations:

Features include tools for managing visas and work permits, workforce management, and equipment provisioning, ensuring businesses can efficiently handle their global workforce needs. It also includes an employee cost calculator to determine the cost of employing someone in a different country.

Integrations include ADP.

Pros and cons

Pros:

- Ensures compliance with local labor laws

- Responsive, 24/7 customer support

- Handles payroll and invoicing in multiple countries

Cons:

- Lack of extensive integrations

- No mobile app available

New Product Updates from RemoFirst

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

Patriot simplifies accounting and payroll for small businesses by offering integrated products for both Payroll and Accounting. It's recognized for its affordability, providing a comprehensive solution without a significant financial burden.

Why I picked Patriot: I selected Patriot Software for its exceptional balance of cost and functionality. It distinguishes itself from other invoicing and payroll tools through its competitive pricing, making it an ideal choice for small businesses. I regard it as best for affordability due to its ability to offer vital accounting and payroll features at a price point that is accessible for smaller operations.

Its Accounting and Payroll products are separate, though closely intertwined if you purchase both.

Standout features & integrations:

Features that make Patriot Software shine include unlimited invoicing, free setup and support, and no long-term contracts. It supports both cash-basis and accrual accounting, and users can run payroll in three easy steps. The software integrates with several essential tools, enhancing its utility for businesses.

Its Accounting product also offers account reconciliation, subaccounts, estimates, recurring invoice tools, invoice payment reminders, and receipt management tools.

Its Payroll product covers multiple pay rates, 2-day direct deposit, employee or contractor payments, electronic or printable W-2 forms, and the option to e-file 1099 forms directly with the IRS.

Integrations include QuickBooks Online, Shopify, WooCommerce, Xero, Zapier, Clover, Square, PayPal, Gusto, and ADP.

Pros and cons

Pros:

- Competitive pricing for small businesses

- Comprehensive payroll and accounting features

- Free setup and support, enhancing user experience

Cons:

- Higher-tier features require plan upgrades

- Limited third-party integrations compared to some competitors

QuickBooks is a comprehensive accounting solution that streamlines financial management for businesses. It's best for offering a suite of diverse business tools that cater to various needs, from accounting to payroll.

Why I picked QuickBooks: I chose QuickBooks for this list because it provides a robust set of features that are essential for businesses of all sizes. Its versatility and the breadth of tools available make it a standout choice for managing finances comprehensively. I believe QuickBooks is best for diverse business tools because it offers a wide array of functionalities that go beyond basic accounting, including payroll processing, time tracking, and payment solutions, all integrated into one platform.

Standout features & integrations:

Features include automated bookkeeping, invoice and payment processing, tax deductions, and comprehensive reporting. These tools are designed to automate tedious tasks, allowing business owners to focus on growth.

Integrations are available natively with numerous other tools, including TurboTax, Shopify, Square, PayPal, TSheets, Gusto, Bill.com, and many more, facilitating an efficient workflow across different business operations.

Pros and cons

Pros:

- Extensive integration options with other business applications

- Cloud-based, ensuring real-time data access from anywhere

- Connects to bank accounts and credit cards with ease

Cons:

- Limited number of users

- Occasional customer support issues

Zoho Books is an accounting software designed to cater to the needs of small to medium-sized businesses. It stands out for its automation features that help streamline accounting tasks and reduce manual work.

Why I picked Zoho Books: I selected Zoho Books for its exceptional automation capabilities that distinguish it from other accounting software. The tool's ability to automate repetitive tasks, such as invoicing and payment reminders, allows businesses to save time and focus on growth. I judge Zoho Books to be best for automation features due to its comprehensive suite of tools that facilitate automatic bank feeds, workflow rules, and much more, enhancing overall productivity.

Standout features & integrations:

Features include time-saving automations, automatic bank feeds, recurring transactions, and payment reminders. It also provides a centralized platform for managing all financial aspects of a business, from invoicing to expense tracking.

Integrations are available natively with Zoho CRM, Zoho Inventory, Zoho Expense, Zoho Subscriptions, Zoho Projects, Zoho Analytics, Zoho Checkout, Zoho Payroll, Zoho Sign, and Zoho Flow.

Pros and cons

Pros:

- Extensive support options

- Centralized financial management platform

- Automated bank feeds and payment reminders

Cons:

- Zoho Payroll is only available in India and within some US states

- Payroll features are only accessible by integrating with Zoho Payroll

Wave is a comprehensive tool for small business financial management. It is recognized as the best for free financial software, offering a set of basic financial and invoicing tools for no cost.

Why I picked Wave: I selected Wave for the list because it offers a basic financial solution for small businesses and freelancers without any fees, which is quite rare. It distinguishes itself from other invoicing and payroll software by not charging for basic features, including bookkeeping, invoicing, and the ability to accept online payments.

Standout features & integrations:

Features include invoicing, bookkeeping, and cash flow management tools, all of which are available for free. If you scale up to their paid plan, Wave also platform also offers receipt scanning and direct bank account and credit card connections for automatic transaction import, which simplifies bookkeeping.

Integrations are available natively with Google Sheets, PayPal, Stripe, Etsy, Shopify, Shoeboxed, Zapier, Mailchimp, Square, and RBC (Royal Bank of Canada).

Pros and cons

Pros:

- Customizable invoicing and expense tracking

- Direct bank account and credit card connections

- No monthly fees for basic features

Cons:

- Limited third-party app integrations

- Per-transaction fees for Wave Payments

Sage 50cloud is an accounting software designed to streamline financial processes for small and medium-sized businesses. It is best for providing a comprehensive suite of accounting solutions, including cash flow and invoice tracking, payments and account reconciliation, inventory management, and financial reporting capabilities.

Why I picked Sage 50cloud: I chose Sage 50cloud for the list because of its robust feature set that caters to a wide range of accounting needs. Its ability to manage cash flow, track inventory, and handle job costing makes it a versatile tool for businesses. I believe Sage 50cloud is best for comprehensive accounting solutions due to its integration with bank feeds, payroll subscriptions, and add-on services that enhance its functionality.

Standout features & integrations:

Features include job costing and cash flow management, which allow businesses to easily view revenue and expenses and use projections to anticipate future cash flow. The software also provides advanced inventory management, enabling businesses to track stock levels and manage purchase orders effectively.

Integrations are available with several tools to enhance its accounting capabilities, including Sage Payroll, Sage CRM, Sage Banking Cloud, Microsoft Office 365, AutoEntry, Stripe, PayPal, Salesforce, Microsoft Outlook, and Shopify.

Pros and cons

Pros:

- Integrated payment processing solutions

- Advanced inventory management capabilities

- Comprehensive accounting features

Cons:

- Payroll capabilities are only accessible by integrating with Sage Payroll

- Additional costs for add-ons and more advanced features

Other Invoicing and Payroll Software to Consider

Below is a list of additional invoicing and payroll software that didn’t make it into my top 10 list, but are still worth checking out:

- KashFlow

For UK-based payroll and compliance

- Paychex

For integrated HR solutions

- Native Teams

For budget-friendly contractor payments

- Papaya Global

For multi-currency payment support

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Invoicing and Payroll Software

Selecting invoicing and payroll software requires a thorough understanding of the functionality and specific use cases that are critical for businesses. As an HR expert with extensive experience using and researching these tools, I’ve developed a set of criteria that are vital when evaluating invoicing and payroll solutions.

Core Invoicing and Payroll Software Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Generating and sending invoices

- Tracking billable hours and expenses

- Managing payroll processing

- Tax calculation and compliance reporting

- Employee self-service for pay stubs and tax documents

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Innovative automation capabilities that reduce manual data entry

- Integration with other financial systems including timesheet software

- Real-time financial reporting and analytics to monitor profitability

- Customizable invoice and payroll templates

- Mobile access and functionality for on-the-go management

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive navigation and clear, logical menu structures

- Aesthetic design that contributes to a positive user experience

- A balance between comprehensive features and simplicity

- Responsive design for use across various screen sizes and devices (both Android and iOS)

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Availability of step-by-step guides and tutorials

- Interactive product tours that familiarize users with key features

- Access to customer service chatbots for immediate assistance

- Webinars and training sessions to educate new users

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Responsiveness and availability of multiple customer support channels including email, phone, and live chat

- Access to knowledgeable support staff who understand the intricacies of invoicing and payroll

- Access to a comprehensive knowledge base or FAQ section

- Proactive support that anticipates and addresses common issues

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models without hidden fees

- Tiered pricing that aligns with different business sizes and needs

- Free trials or demos to evaluate the software before purchase

- Comparison of feature sets relative to the cost

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Consistency in positive feedback across various user demographics

- Specific mentions of reliability and uptime

- User testimonials that highlight ease of use and efficiency gains

- Reports of positive outcomes, such as time savings or improved accuracy in financial management

Using this assessment framework helped me identify the software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

How to Choose Invoicing and Payroll Software

As you work through your own unique software selection process, keep the following points in mind:

- Integration Capabilities: Ensure the software can integrate with your existing systems. This is crucial for maintaining data consistency and reducing manual data entry. For instance, if your business uses a specific accounting system, the invoicing and payroll software should be able to integrate with it to streamline financial management.

- Compliance Features: Look for software that helps you comply with tax laws and regulations. Non-compliance can lead to penalties and legal issues. Software that automatically updates tax rates and generates necessary reports can be invaluable, especially for businesses operating in multiple jurisdictions.

- Scalability: Choose software that can grow with your business. If you anticipate hiring more employees or expanding operations, the software should be able to handle increased workload and additional users without performance issues. This is particularly important for startups and growing businesses that expect to scale rapidly.

- User-Friendly Interface: Select software with an intuitive interface to reduce training time and increase adoption rates. A user-friendly system ensures that employees can manage invoicing and payroll tasks efficiently without a steep learning curve, which is essential in fast-paced work environments.

- Customer Support: Prioritize software providers that offer reliable customer support. When payroll or invoicing issues arise, having access to prompt and knowledgeable support can prevent delays and frustration. This is especially relevant for small businesses that may not have dedicated IT support staff.

Trends in Invoicing and Payroll Software In 2025

In 2025, invoicing and payroll software trends reflect evolving work environments and technological advancements. These trends are shaping the way businesses manage financial transactions and employee compensation:

- Remote Work and Flexible Payroll Solutions: Remote work has made flexible payroll solutions a necessity. Cloud-based systems offer accessibility from anywhere, while new software caters to diverse payment structures, benefiting remote and gig economy workers.

- AI and Automation in Payroll Processing: AI and automation are revolutionizing payroll tasks, improving precision and efficiency. These technologies automate data entry, enhance compliance, and provide sophisticated analytics, reshaping payroll management.

- Real-time Payroll Analytics and Insights: Businesses increasingly seek immediate payroll data insights. Contemporary software includes analytics for on-the-spot payroll metrics, aiding in swift decision-making and labor cost management.

- Financial Wellness Programs Integrated with Payroll: Payroll software now often includes financial wellness tools. These programs assist employees with budgeting and saving, contributing to their overall financial health and job satisfaction.

- Payroll Data and Cybersecurity: The security of payroll data is paramount. Payroll systems are focusing on advanced security features like encryption and multi-factor authentication to protect sensitive employee information.

What is Invoicing and Payroll Software?

Invoicing and payroll software is a digital solution designed to manage and automate financial transactions related to billing clients and compensating employees. Businesses of all sizes use it to streamline their payroll and invoicing processes. The software issues and tracks invoices for services rendered or products sold, while separately calculating and distributing employee wages, withholdings, and tax filings.

Typically, software companies offer the components of invoicing and payroll software as separate modules covering each core set of capabilities. The software should cover invoice creation, payment tracking, tax calculation, wage disbursement, and financial reporting. These tools are crucial for maintaining accurate financial records, ensuring compliance with tax laws, and managing cash flow effectively.

Features of Invoicing and Payroll Software

When selecting invoicing and payroll software, it's crucial to consider the features that will support your business's financial operations effectively. The right tools can simplify the process of managing employee compensation and business transactions. Here are some key features to look for:

- Automated Billing and Invoicing: This feature streamlines the creation and distribution of invoices. It saves time and reduces errors by automating repetitive tasks.

- Tax Calculation and Compliance: Accurate tax calculations are essential for compliance with local, state, and federal regulations. This feature ensures that payroll and invoicing adhere to the latest tax laws.

- Time Tracking Integration: By integrating time tracking, the software can accurately calculate pay based on hours worked. This is particularly important for businesses with hourly employees or those who bill clients by the hour.

- Expense Management: This allows for the tracking and categorization of business expenses. Effective expense management is critical for budgeting and financial planning.

- Customizable Payroll Reports: Custom reports provide insights into payroll expenses and trends. These insights are valuable for making informed business decisions.

- Direct Deposit: Offering direct deposit is convenient for employees and reduces the administrative burden of processing paper checks. While it is a very standard feature, it also improves employee satisfaction.

- Employee Self-Service Portal: An employee portal gives staff access to pay stubs, tax forms, and the ability to update personal information. This empowers employees and reduces HR workload.

- Multi-Currency and Multi-Language Support: For businesses operating internationally, this feature accommodates different currencies and languages, which is vital for global operations.

- Data Security: Protecting sensitive financial information is paramount. Strong security measures are necessary to safeguard against data breaches.

- Integration Capabilities: The ability to integrate with other systems, such as accounting or HR software, allows for a more cohesive financial management ecosystem.

Benefits of Invoicing and Payroll Software

Invoicing and payroll software can significantly improve the efficiency and accuracy of financial operations within a business. These tools offer a range of advantages that can benefit both the user and the organization as a whole. Here are several benefits you can expect to gain by using this type of software:

- Improved Financial Accuracy: Using invoicing and payroll software minimizes the risk of mistakes that can occur with manual data entry, ensuring that financial records are precise and reliable.

- Time Savings: The automation of invoicing and payroll tasks saves valuable time for employees, allowing them to focus on more strategic activities that contribute to business growth.

- Enhanced Compliance: Software solutions stay updated with the latest tax rates and regulations, helping businesses to remain compliant and avoid penalties.

- Better Cash Flow Management: With instant access to financial data, businesses can manage their cash flow more effectively, making informed decisions to maintain a healthy financial status.

- Employee Self-Service: Employees can view their pay stubs, track their time, and manage their personal information, which reduces administrative workload and improves employee satisfaction.

The adoption of invoicing and payroll software can be a game-changer for businesses looking to improve their financial operations. These tools not only simplify and automate tasks but also provide a level of accuracy and efficiency that manual processes cannot match. As organizations continue to seek ways to improve productivity and maintain compliance, the role of invoicing and payroll software becomes increasingly important.

Costs & Pricing of Invoicing and Payroll Software

Selecting the right invoicing and payroll software is crucial for businesses to manage their finances effectively. With a variety of options available, it's important to understand the different plans and pricing structures to find a solution that fits your business needs and budget. Here's a breakdown of the plan options and pricing for invoicing and payroll software.

Plan Comparison Table for Invoicing and Payroll Software

| Plan Type | Average Price | Common Features |

| Free Option | $0 | Limited features, including basic invoicing capabilities, limited transactions, and basic reporting |

| Entry-Level | $10 - $20 per month | Basic invoicing, expense tracking, simple reports, and limited users |

| Mid-Range | $20 - $40 per month | Advanced invoicing features, multi-user access, time tracking, and more integrations |

| High-End | $40+ per month | Full payroll services, advanced reporting, custom invoicing, and premium support |

When considering which plan to choose, software buyers should weigh the specific needs of their business against the features and limitations of each plan. It's also important to consider the potential for business growth and the scalability of the software.

Invoicing and Payroll Software FAQs

Here are some answers to the frequently asked questions I’ve received about invoicing and payroll software:

What features should I look for in invoicing software?

When selecting invoicing software, consider features that streamline your financial management and client interactions. Key features include a user-friendly interface, customization and branding options, integration capabilities with other business tools, automation for recurring invoices, and robust security and compliance measures. These features help in presenting your brand professionally, ensuring efficient operations, and safeguarding your business’s financial information.

How can I ensure the invoicing software fits my business size and type?

Choose invoicing software that aligns with your business’s size and nature. Software designed for large enterprises may offer different functionalities compared to those tailored for small businesses or self-employed freelancers. You should also assess the software’s scalability, as your invoicing needs might change as your business grows. This will help you ensure the software can accommodate increased transactions, clients, or features over time.

Is it important for invoicing software to offer customization options for invoices?

Yes, customization is crucial for personalizing invoices with your brand logo, colors, and specific details. This helps in leaving a professional impression on clients. Look for software that provides customization options, enabling you to create invoices that reflect your brand identity.

What integration options should invoicing software provide?

Invoicing software should integrate with your business’s other tools for efficient operations. Look for software that offers integration options with accounting software, payment gateways, or CRM systems. This ensures smooth data flow between different platforms, reducing manual entry and the chances of errors.

How does invoicing software handle automated invoicing and reminders?

Good invoicing software should simplify your workload by automating recurring invoices and reminders for due payments. This feature saves time, ensures timely invoicing, and improves cash flow. Check if the software can automate invoicing schedules and send reminders to clients for overdue payments.

What security measures should be in place to safeguard data in invoicing software?

Prioritize security when selecting invoicing software, especially when handling sensitive financial information. Look for software that employs robust security measures like data encryption, regular backups, and secure servers. Ensure the software follows industry practices to safeguard your financial data from unauthorized access.

Is compliance with relevant regulations important for invoicing software?

Yes, compliance with regulations is critical, especially in handling financial transactions. Ensure the invoicing software you choose complies with relevant industry regulations and standards, including adherence to tax regulations, invoicing standards, and data protection laws.

What should I consider regarding the pricing structure of invoicing software?

Understand the invoicing software’s pricing structure and evaluate whether it offers a plan that suits your budget and aligns with the value it provides. Consider factors like subscription plans, additional features, and scalability options. Look for flexible pricing plans tailored to different business needs.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.