Global payroll is the process of managing employee compensation across multiple countries through a unified, compliant system.

It covers salary calculations, multi-currency payments, tax withholdings, benefits administration, and statutory reporting—tailored to the laws of each location.

For businesses expanding internationally, global payroll isn’t just a back-office task—it’s a strategic function that ensures legal compliance, improves operational efficiency, and supports a consistent employee experience worldwide.

In this guide, we’ll break down what global payroll is, the challenges it solves, the main management models, and best practices to help you choose the right solution for your organization.

What Is Global Payroll?

Global payroll is the infrastructure behind compensating employees across borders while staying compliant with local tax, labor, and reporting regulations. It covers everything from multi-currency salary calculations and statutory deductions to filings and benefits—tailored to each country where you employ staff.

The tools and providers that support this work vary widely, especially when it comes to features like in-country compliance, EOR support, and automation.

I’ve outlined a few strong options in this roundup of global payroll platforms if you’re exploring what might work best for your team.

Key Challenges of Managing Global Payroll

The process of global payroll is complex due to the differing legal, tax, and regulatory requirements across various jurisdictions.

Compliance with local payroll laws

As mentioned above, each country and jurisdiction has its own tax and labor laws to keep track of.

For example, the UK mandates electronic or printed payslips showing gross pay, deductions, and net pay, while China requires payroll records to be retained for at least two years.

In Saudi Arabia, employers must process wages through the government’s Wages Protection System to verify timely payment.

Remaining compliant with the myriad of ever-changing payroll laws is perhaps the greatest challenge of managing global payroll.

Tax and social security nuances

Payroll tax laws differ globally in what taxes employers must withhold and contribute, and how they report them.

For example, in the United States, employers deduct federal income tax plus Social Security and Medicare, while in France, employer social contributions can exceed 30% of gross salary.

Singapore requires both employer and employee contributions to the Central Provident Fund, with rates varying by age.

These variations make local compliance expertise essential for accurate global payroll processing.

International payments and fees

Handling payroll in multiple currencies can be challenging due to exchange rate fluctuations and banking requirements and fees.

Further, as Wendy Makinson, HR Manager at Joloda Hydroroll, highlights “Some employees around the world still prefer or have to receive their payments in cash and, although this is usually possible when using a global payroll provider, it can incur additional costs.

Time zone differences

Coordinating payroll operations across multiple time zones can complicate communication and workflow, leading to delays and inefficiencies.

Data integration and accuracy

Integrating data from disparate systems and ensuring its accuracy is crucial as errors can lead to incorrect payments and compliance issues.

Data security and privacy concerns

Safeguarding employee data across different regions, each with specific privacy laws (like the Privacy Act of 1974 in the USA and GDPR in Europe), requires robust security and compliance protocols.

Transparency and visibility in payroll data

Transparency and visibility in global payroll is a challenge because payroll data often becomes siloed across different systems and regions, making it difficult to access and consolidate.

This complexity increases as varying local regulations and compensation reporting standards further complicate the retrieval of unified payroll information.

2025 Compliance Watch

Global payroll regulations continue to evolve, and staying compliant requires constant monitoring of new requirements in each jurisdiction. Here are some of the most notable changes impacting multinational employers this year:

- EU GDPR Updates – New guidance clarifies how payroll data must be stored and transferred across borders.

- United States Overtime Threshold Changes – Federal updates to the salary threshold for exempt employees may affect classification and pay calculations.

- India E-Invoicing Expansion – Mandated e-invoicing rules now extend to certain payroll-related transactions, impacting reporting formats.

- Australia STP Phase 3 Enhancements – Employers must provide more detailed payroll and superannuation reporting through Single Touch Payroll.

- Middle East Remote Work Rules – Several GCC countries have introduced new employer obligations for cross-border remote staff, including registration and local tax withholding.

Global Payroll Management Models Compared

Organizations can choose from several methods to manage their global payroll needs, each with its own set of advantages and challenges:

In-house global payroll

Some organizations choose to control global payroll processes internally with in-house teams in each country.

This means 1) taking full responsibility for employing and paying global talent, and 2) handling all compliance and administrative tasks.

The advantages are full control and customization of payroll processes tailored to company needs.

However, this method can be costly, time-consuming, and challenging to scale as it requires significant resources for compliance and local expertise in each jurisdiction.

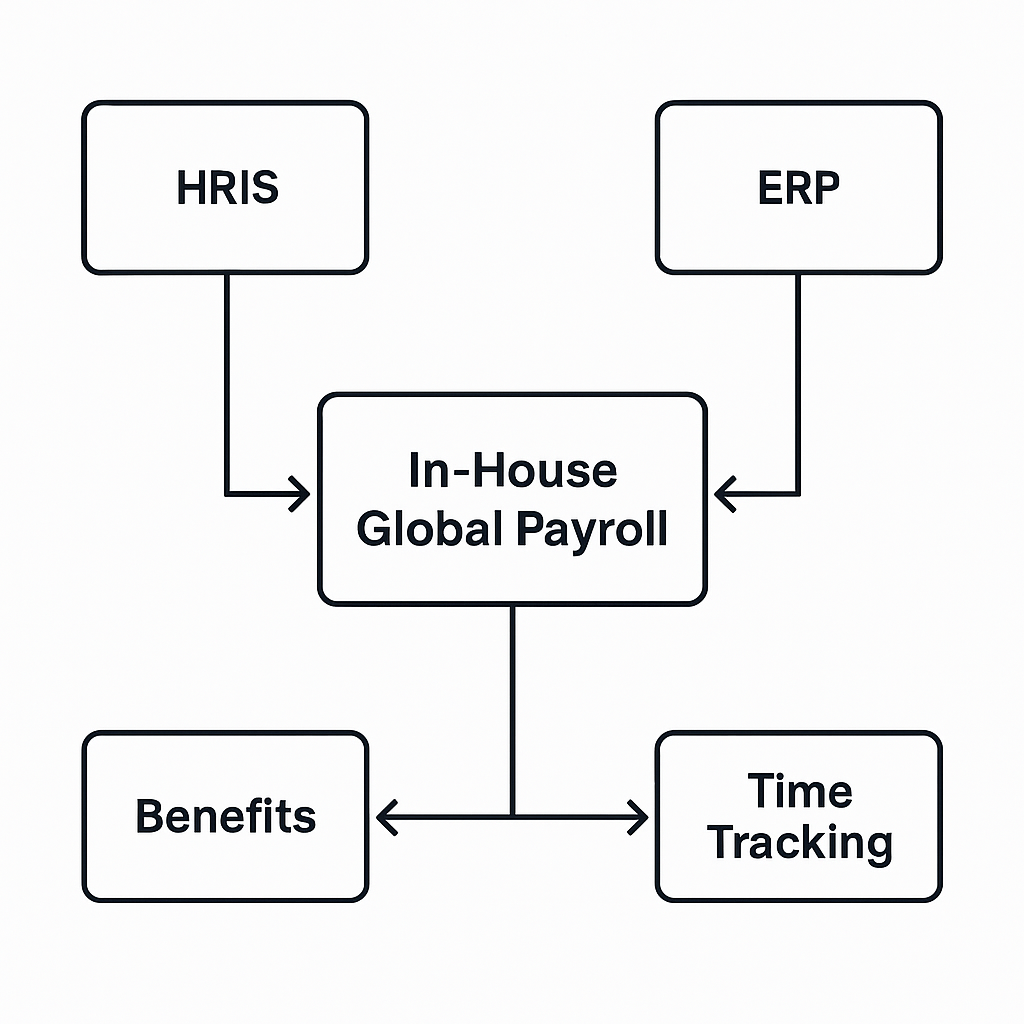

In-house global payroll management often requires close integration with other core business platforms, including human resource information systems and time tracking software.

In-house global payroll integration diagram linking HRIS, ERP, benefits, and time tracking systems.

These integrations ensure that employee changes—such as new hires, promotions, or terminations—flow automatically into payroll, reducing manual data entry and the risk of costly errors.

They also connect payroll to benefits administration, time tracking, and finance modules, creating a single, synchronized source of workforce and compensation data.

Advantages: Complete control, customization to company needs.

Disadvantages: High cost, time-consuming, hard to scale.

Decentralized global payroll

In a decentralized global payroll model, organizations outsource payroll administration to individual in-country vendors e.g. an employer of record service.

This means 1) working with local third-party payroll providers in each country, and 2) managing multiple vendors across different regions.

While this approach ensures localized compliance and expertise, it also lacks standardization, reduces visibility, and can create security risks when managing multiple systems. As you can see, there are both pros and cons to outsourcing your payroll administration.

You also relinquish control of the payroll process. As Alice Ferretti, founder of HumansR, points out “A potential issue with EOR or payroll services is related to the fact that the client has very little to often no control over the individuals that are running payroll and processing payments, compared to having an in-house payroll team.

This means that while working with an EOR allows one to rely on their expertise, there could also be instances when payroll is miscalculated or have issues that impact the clients’ employees but over which the client has little to no control.

I once had a situation where payroll was not submitted on time by the EOR’s payroll specialist, and this caused the employee to miss the window to be paid till the following month.

This took a few days, many phone calls, and, eventually, the need to escalate the issue before it got resolved.

The employee ended up being paid 20 days late and, because this was their first paycheck with us, it had big implications on our ability to build a relationship with them.

It worked out in the end, but the inability we (as the client) had to troubleshoot the issue and resolve it with urgency was very stressful.”

Advantages: Local compliance expertise, easy to scale, adaptability to local needs.

Disadvantages: Managing multiple vendors, lack of standardization, security risks, loss of control.

Centralized global payroll

Some companies choose to streamline global payroll by using one global payroll provider that partners with in-country payroll vendors.

This means 1) consolidating all payroll processes into a single system, and 2) relying on one provider to coordinate with local payroll vendors on your behalf.

Potential advantages of this approach over multiple EORs include a unified platform housing all the data, standardizing payroll processes across all locations, reducing errors, and ensuring consistent application of policies.

For example, financial services company FNZ consolidated 39 payroll operations across 21 countries using CloudPay, integrated with Workday HCM.

This transformation improved control, delivered real-time analytics, and enhanced employee experience—all while ensuring strict compliance.

However, it is crucial for organizations to carefully vet potential providers to ensure reliability and trustworthiness. As with the decentralized option, you’re still relinquishing control of your payroll process.

Advantages: Streamlined processes, reduced errors, improved visibility.

Disadvantages: Dependency on a single provider, requires thorough vetting of provider reliability.

Use contractors

Of course, another option is to hire contractors who are, in theory, simpler to employ.

One thing to be mindful of here is that, if local authorities legally classify your contractor as an employee, your company is liable for unpaid taxes, back pay, and benefits, and you could also get additional fines.

Advantages: Simple and easy.

Disadvantages: Still have to factor in some local laws and regulations e.g. employee misclassification.

How to Select the Best Global Payroll Solution

Choosing between processing global payroll in-house vs outsourcing to either local vendors or a global payroll service depends on several factors related to your business needs, resources, and strategic goals.

Here’s a step-by-step process to help you make a decision:

1. Assess your business needs and goals

Geographical presence: Consider the countries where you currently have employees and where you plan to expand. The legal and administrative challenges vary by country.

Employee count: Determine how many employees you have internationally and the projected growth in these numbers.

Core business focus: Evaluate whether managing payroll internally would distract from your core business activities.

2. Evaluate your current resources

Expertise: Do you have, or can you reasonably acquire, the necessary expertise in international labor laws, tax regulations, and payroll processing?

Technology: Assess whether you have the technology to manage payroll efficiently across different countries, including compliance updates and integration with other systems.

Budget: Consider the financial implications, including the cost of setting up and maintaining an in-house process versus the fees for outsourcing.

3. Analyze the pros and cons

Control and customization: In-house processing gives you more control (mistakes are on you and can be rectified by you) and potentially more customization options, which is valuable if you have complex payroll needs.

Scalability: Outsourcing to an EOR or payroll service will help you scale more easily because you don’t have to set up a legal entity in a new market.

Risk management: Outsourcing can reduce the risk of non-compliance and the burden of legal penalties.

5. Long-term strategic fit

Long-term cost: While outsourcing might seem cheaper upfront, it may end up being more expensive in the long run.

As Ferretti highlights “Global providers and EORs can become more expensive if the international team expands, especially if the team expands within the same location.

For example, a team of 100 people across 30 different countries, with an average of 3 to 4 employees in each country, will greatly benefit from an EOR because it would be too expensive and time-consuming to set up the internal capacity to hire and run payroll in-house.

On the other hand, if a company has 100 people across 5 countries with an average of 10-20 people per country, then it could be more cost-effective to build an international HR team in-house.

This varies from company to company and from country to country, but in general, the more employees you have in the same location, the less cost-effective an EOR becomes.”

Business strategy: Align your choice with your overall business strategy. For example, if rapid international expansion is a goal, outsourcing might provide the agility you need.

6. Request proposals and conduct due diligence

Gather proposals: Request detailed proposals from several EOR and global payroll service providers. Some things to look out for besides cost, reputation, and partner-dependent vs owned-entity.

- Local expertise

- Transparent pricing

- Accurate employer burden calculations

- Customer support levels

- Long-term scalability

- Partner-dependent vs owned entity providers (latter is recommended).

- Partner-dependent services rely on local partners in each country to handle employment and payroll, acting as intermediaries.

- Owned-entity EORs have established a legal entity in the countries they operate to directly manage employees and payroll processes.

Check references and reviews: Speak with current and former clients to understand their experiences. Online reviews and testimonials can also provide insights.

7. Make a decision

Make a decision based on your business’s capacity to manage payroll internally without compromising compliance and operational efficiency, and how well each option supports your long-term business objectives.

Best Practices for Building a Robust Global Payroll System

If you decide to go it alone and handle global payroll in-house, here are some best practices to help guide you:

1. Standardize where possible

Aim to standardize processes across different countries to reduce complexity and increase efficiency. However, also allow for local customization where necessary to meet specific legal and cultural requirements.

2. Stay updated on local laws

Continuously check your knowledge of local employment laws, tax regulations, and reporting requirements in each country. This may involve regular training for your payroll team or consultations with local experts.

3. Leverage technology

"You’re getting data from all over the place for 15 clients or employees in 10 countries. There’s no way your brain can process all of that without technology, and the systems aren’t keeping up." — Norma Delgado, Founder of Global Payroll Geeks

Use specialized payroll software that can handle multiple currencies, languages, and regulatory environments. As always, ensure your provider is scalable and can integrate with other HR software and accounting systems.

4. Ensure data security and privacy

Implement robust data protection measures to secure sensitive employee information. This includes following international data protection laws such as GDPR in Europe and similar regulations in other regions.

5. Regular audits and reconciliations

Regardless of whether payroll is international or not, it’s good practice to conduct regular audits of your payroll processes to ensure accuracy and compliance. This helps identify and rectify discrepancies early and maintains the integrity of your payroll system.

6. Effective communication

Maintain clear and open communication channels with your employees regarding payroll matters. This includes providing detailed payslips, explaining any deductions clearly, and being responsive to payroll queries.

7. Centralized reporting

Develop a centralized reporting system that provides visibility into payroll operations across all countries. This aids in strategic decision-making and ensures consistency in reporting standards.

8. Train your team

Invest in continuous training for your payroll team to keep them updated on the latest payroll technologies, regulatory changes, and best practices. Consider payroll certifications that cover global payroll management.

9. Plan for contingencies

Establish contingency plans for payroll processing to handle unexpected situations such as technological failures, data breaches, or sudden changes in legislation.

10. Seek employee feedback

Regularly gather feedback from employees about the payroll process and address any issues or concerns promptly. This can help improve the system and increase employee satisfaction.

Emerging Tech Trends in Global Payroll

Technology is rapidly reshaping how organizations manage payroll across borders, making processes faster, more accurate, and more compliant.

Adopting these innovations can help businesses stay ahead of regulatory changes and streamline global operations:

- AI-driven compliance alerts – Machine learning tools can monitor legislative updates in each country and automatically flag potential compliance risks before payroll runs.

- Automation in multi-currency conversions – Advanced payroll platforms can automatically apply real-time exchange rates to salaries and benefits, minimizing manual calculations and errors.

- Integrated data analytics – Payroll systems now provide dashboards that track costs, headcount, and tax liabilities by country, giving finance teams better decision-making insights.

- Self-service payroll portals – Cloud-based portals allow employees to securely access payslips, tax documents, and benefits information from anywhere in the world.

- Blockchain for cross-border payments – Distributed ledger technology enables faster, more secure international salary transfers, reducing currency conversion delays and banking fees.

Understanding Global Payroll Costs and Budgeting

To help you consider the costs associated with a global payroll solution, we've broken them down in a table with estimates around what each one could set you back in USD.

| Category | Cost Type | Details | Estimated Cost |

| Software | Software and infrastructure | Initial costs for multi-country payroll software and necessary IT infrastructure. | $50,000 - $200,000 |

| Software | Integration costs | Costs for integrating payroll system with HR and accounting software | $10,000 - $50,000 |

| Operational | Salaries for payroll staff | Wages for payroll specialists familiar with international regulations. | $60,000 - $120,000 per year |

| Operational | Training costs | Costs for regular training to stay updated on technologies and legislative changes. | $5,000 - $20,000 per year |

| Compliance and Regulatory | Legal and Consulting fees | Fees for legal experts or consultants to ensure compliance and navigate bureaucratic processes. | $20,000 - $100,000 per year |

| Compliance and Regulatory | Audit fees | Costs for conducting regular audits for accuracy and compliance. | $10,000 - $30,000 per year |

| Outsourcing | Service provider fees | Fees for global payroll providers, varying by employee count, countries, and service complexity. | $15 - $50 per employee per month |

| Currency Exchange & Transaction | Currency conversion | Costs for converting currencies for international payroll disbursements. | 0.5% - 2% of transaction amount |

| Currency Exchange & Transaction | Bank fees | Bank transaction fees for international transfers and payments. | $10 - $50 per transaction |

| Error Rectification and Penalties | Error correction | Costs to correct payroll errors, including back payments and interest. | $5,000 - $20,000 per incident |

| Error Rectification and Penalties | Penalties for non-compliance | Fines and penalties for non-compliance with payroll-related laws. | $10,000 - $50,000 per incident |

| Miscellaneous Costs | Project management | Project management costs for implementing new systems or changing providers. | $10,000 - $40,000 per project |

For a more detailed breakdown, pop over to our pricing guide to global payroll services next.

Global Payroll FAQs

Do I need a local legal entity to run payroll in another country?

In many countries, you must establish a local legal entity or work with an Employer of Record (EOR) to legally pay employees. Requirements vary by jurisdiction, so it’s essential to check local regulations before hiring.

How long does it take to set up global payroll in a new country?

Setup timelines vary widely—from a few weeks to several months—depending on whether you already have a local entity, the complexity of compliance requirements, and the readiness of your payroll provider.

What is the difference between centralized and decentralized global payroll?

Centralized payroll uses one unified system for all countries, while decentralized payroll relies on separate processes or providers in each location. Centralization offers more consistency and control, while decentralization can provide greater local customization.

Subscribe To The People Managing People Newsletter

For more advice on managing global payroll and remote workforces, subscribe to our weekly newsletter for HR and business leaders. You’ll receive all our latest content to help you grow in your career and make greater impact in your organization.