20 Best Cheap Payroll Services Shortlist

Here's my pick of the 20 best services providers from the 24 we reviewed.

With so many different payroll services available, figuring out which ones offer the best services for a low cost can be tricky. You know you want someone to handle the accurate and timely processing of employee wages, taxes, and other withholdings on behalf of businesses but need to figure out which tool best fits your budget. I've got you! In this post I'll help make your choice easy, sharing the results of my extensive research of dozens of providers with my picks of the best cheap payroll services.

Why Trust Our Software Reviews

Best Cheap Payroll Services Summary

This comparison chart summarizes pricing details for my top cheap payroll services selections to help you find the best one for your budget and business needs.

| Service | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll compliance | Free trial + demo available | From $29/month | Website | |

| 2 | Best for international compliance focus | Free demo available | Pricing upon request | Website | |

| 3 | Best for paying global contractors | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best for mobile access | 30-day free trial | From $40/month + $6/user/month | Website | |

| 5 | Best for US-based businesses | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 6 | Best for automatic tax filing | Free demo available | Pricing upon request | Website | |

| 7 | Best for freelancers | Free plan available | From $14/user/month | Website | |

| 8 | Best for retail and restaurants | Not available | From $6/user/month + $35/month base fee | Website | |

| 9 | Best for automated payroll processing | 30-day free trial + free plan available | From $19/month plus $3/employee/month | Website | |

| 10 | Best for detailed reporting | 14-day free trial | From $10/user/month | Website | |

| 11 | Best for shift scheduling | Free trial available | From $20/month | Website | |

| 12 | Best for remote teams | Free demo available | From $25/month | Website | |

| 13 | Best for employee self-service | Free demo available | From $39/month | Website | |

| 14 | Best for easy setup | 6-month free trial + free demo available | From $20/month + $4/user/month | Website | |

| 15 | Best for international payments | A free plan and demo are also available | From $49/month | Website | |

| 16 | Best free payroll service for small companies | Free plan available | From $30/month | Website | |

| 17 | Best for integrations | Free demo available | From $40/month + $6/user/month | Website | |

| 18 | Best for compliance support | Not available | From $8/employee/month + $50/month base fee | Website | |

| 19 | Best for hiring across 150+ countries | Not available | From $199/employee/month | Website | |

| 20 | Best for accounting integration | 30-day free trial | From $30/user/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5 -

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3

Best Cheap Payroll Services Reviews

Below are my evaluations of the best cheap payroll services available on the market. Each features a summary of its key features, an overview of why I selected it, a screenshot of the solution, and details about trials and pricing.

Deel offers a comprehensive global workforce management solution, including a payroll platform and services. The tool and services are available in 150 countries, helping businesses of all sizes and industries scale their workforce globally while staying compliant.

Why I picked Deel: You can hire and pay both employees and contract workers using Deel, and manage your payroll through the software. If you want to hire international workers without the challenges of local employment laws and complex tax systems, this is a good solution to outsource and ensure compliance.

Deel Standout Features and Integrations:

Standout features are primarily in the fact that local experts work in-house for Deel and run payroll for their clients in the areas where their staff operates. This provides peace of mind, knowing that someone familiar with taxes and laws of the county in which your employees work is handling their payroll.

Integrations include QuickBooks, Xero, Netsuite, Workday, Workable, Expensify, Greenhouse, Hibob, BambooHR, Ashby, OneLogin, and Okta.

Pros and cons

Pros:

- 10+ payment options for clients

- 24/7 online support

- Off-cycle payroll available

Cons:

- Some add-ons have confusing additional fees

- Limited customization options

New Product Updates from Deel

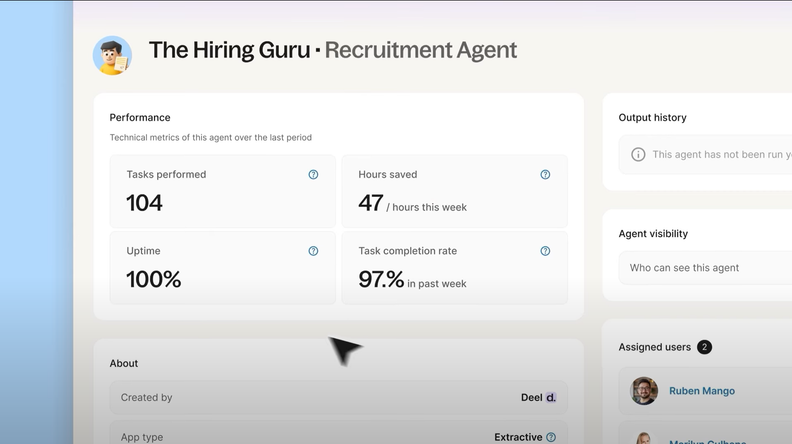

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

For global teams that need payroll handled across borders, TopSource Worldwide is my top choice. Their platform covers payroll and compliance in over 130 countries, while also offering extras like salary benchmarking and contractor misclassification audits to keep businesses aligned with local regulations.

Why I picked TopSource Worldwide: I chose TopSource because its primary strength is compliance across multiple regions. Managing payroll internationally comes with risks, and TopSource helps reduce them by focusing on correct employee classification and local law alignment. I also like that they offer advisory services—such as salary benchmarking and market selection—which make it easier to expand into new regions without guesswork.

TopSource Worldwide Standout Features and Integrations:

Features include salary benchmarking for market alignment, contractor misclassification audits to reduce legal risk, and market selection advisory to guide global expansion.

Integrations may include Oracle NetSuite, SAP B1, Microsoft Dynamics, e-commerce platforms, logistics carriers, and customer relationship management (CRM) systems.

Pros and cons

Pros:

- Market expansion advisory services

- Contractor misclassification audits

- Global payroll compliance expertise

Cons:

- Limited published integration details

- No transparent public pricing

New Product Updates from TopSource

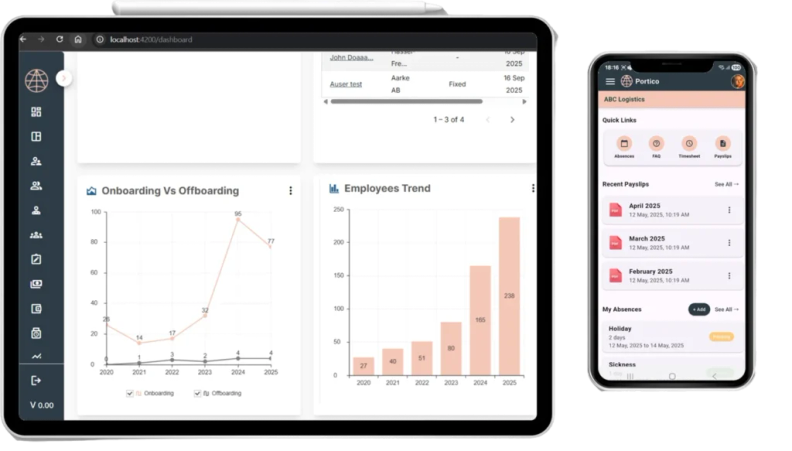

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

RemoFirst provides advanced payroll services, including payments for global employer of record (EOR) hires, international payroll, and compliance support. Their most affordable payment service is available for paying international contractors at $25/contractor/month. Their main payroll pricing starts at $199/month.

Why I picked RemoFirst: I included RemoFirst in this list because it addresses the intricacies of managing global payments, including employment through EOR agreements. Their EOR service, though more expensive, includes compliance monitoring for local labor laws within 180 countries. They also offer tools to ensure your contractors are not misclassified, so you can avoid costly fines or penalties in different jurisdictions.

RemoFirst Standout Features and Integrations:

Features include tools to pay global contractors, manage contracts, process contractor expenses, and track contractor availability through an integrated time-off tracking and calendar function. They also offer payroll services for full-time employees, as well as background checks, and services to help international employees obtain work permits or visas.

Integrations include ADP.

Pros and cons

Pros:

- Employee vs contractor misclassification tools are helpful

- Suitable for small to medium-sized businesses

- Customizable to different organizational needs

Cons:

- No mobile app

- Lacks extensive integration options

New Product Updates from RemoFirst

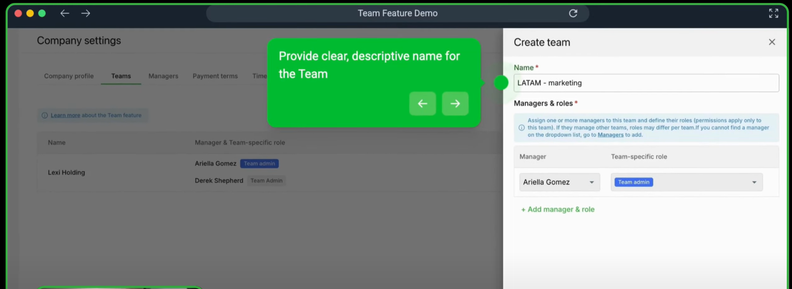

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

For payroll on the go, OnPay is my top choice. The mobile app is highly reliable and efficient, providing complete functionality and full access to the platform. Plus, it streamlines payroll and benefits administration, all with a lower learning curve and exceptional customer service.

Why I picked OnPay: I chose OnPay due to its highly capable mobile app, which exceeds what you’d typically find among cheap payroll services.

Plus, I like how OnPay offers specialized payroll services for specific industries and gives you access to an in-house insurance broker to make medical, dental, and vision plans accessible to small businesses.

OnPay Standout Features and Integrations:

Features include comprehensive but user-friendly payroll services and compliance management for all 50 states. There are also foundational HR tools available, including personnel file management, onboarding workflows, document storage, e-signature tools, and PTO tracking.

Integrations include Deputy, Guideline, Magnify, Mineral, PosterElite, QuickBooks, When I Work, Vestwell, and Xero.

Pros and cons

Pros:

- Highly capable mobile app for payroll management while on the go

- Access to in-house insurance brokers, simplifying benefits selection for small businesses

- Reputation for excellent customer service

Cons:

- Limited automation capabilities

- Not designed for companies with multinational payroll needs

Patriot Payroll is an online payroll service tailored for small to medium-sized businesses in the United States. It provides a straightforward platform that simplifies payroll management, making it accessible for business owners who need to handle payroll efficiently and accurately without breaking the bank.

Why I picked Patriot Payroll: I like that it offers essential features such as automatic tax calculations, direct deposit, and an employee portal at an affordable price. Its full-service option, which includes federal, state, and local tax filings, ensures compliance without adding significant costs, making it an economical choice for small to medium-sized businesses.

Patriot Payroll Standout Features and Integrations:

Standout features include customizable pay rates, which allow businesses to tailor pay structures to individual employees, and time-off accruals, which help manage employee leave effectively. Furthermore, its payroll reports provide comprehensive insights into payroll data, helping businesses make informed financial decisions.

Integrations include QuickBooks, TSheets, Gusto, Square, FreshBooks, Xero, accounting software, time and attendance systems, and human resources management systems.

Pros and cons

Pros:

- Unlimited payroll runs

- Includes features for managing electronic documents

- Variety of built-in reports

Cons:

- No international payroll options

- The initial setup requires a lot of manual data entry

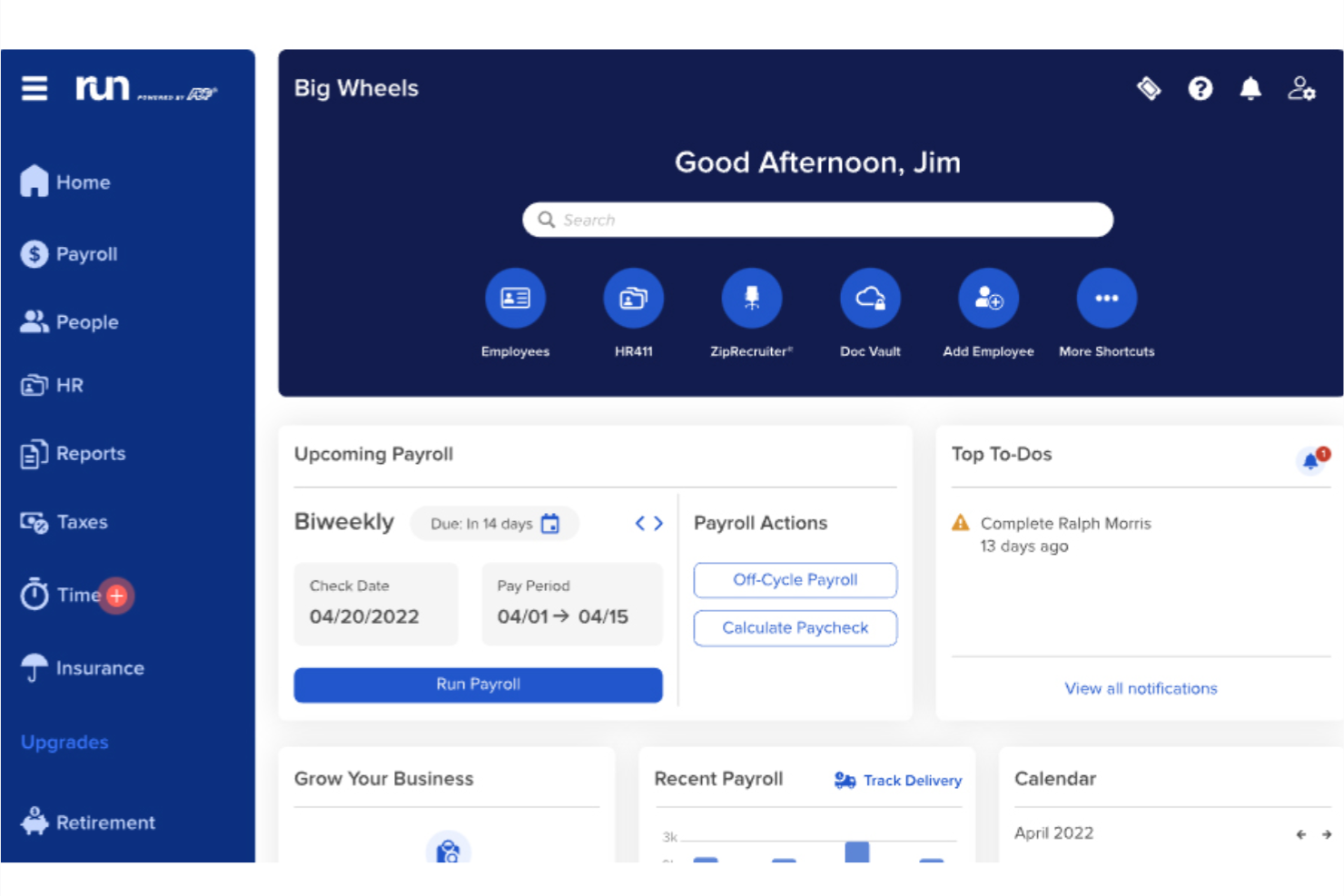

RUN by ADP is a comprehensive payroll and HR software solution designed to simplify payroll processing and human resource management for small businesses of up to 49 employees.

Why I picked RUN by ADP: I like that RUN by ADP offers automatic payroll and tax filing. This service automatically calculates, deducts, pays, and files payroll taxes, which significantly reduces the administrative burden on small business owners. Additionally, RUN by ADP offers a convenient, mobile-friendly employee self-service portal so employees can access their information anytime, anywhere.

RUN by ADP Standout Features and Integrations:

Standout features include direct deposit, HR compliance support, time and attendance tracking, garnishment payment services, retirement plan services, workers' compensation management, and payroll and tax reports. The platform also includes AI-powered error detection to help avoid costly mistakes by flagging potential errors before they happen.

Integrations include QuickBooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Customizable, in-depth reporting options

- Robust mobile app

- Employee self-service portal

Cons:

- Initial setup can be complex

- Most HR functions are only available on higher-tier plans

Wave is a payroll solution designed for freelancers and small businesses. It facilitates payroll processing, tax calculations, and employee payments, offering a simple approach to managing finances.

Why I picked Wave: It caters specifically to freelancers by providing an easy-to-use platform for managing payroll without unnecessary complexity. You can handle payroll taxes and direct deposits effortlessly, saving you time. The tool also simplifies tax calculations, ensuring you stay compliant. In my experience, Wave's intuitive interface makes it a great choice for those who need straightforward payroll management.

Standout features & integrations:

Features include automated tax calculations, direct deposit options, and a user-friendly dashboard. You can set up payroll quickly and manage employee tax forms within the platform. Additionally, the tool offers reminders for important tax deadlines.

Integrations include QuickBooks, Xero, FreshBooks, PayPal, Shopify, Etsy, Stripe, Google Workspace, HubSpot, and Square.

Pros and cons

Pros:

- Quick direct deposit options

- Automated tax reminders

- Intuitive user interface

Cons:

- Limited customer support options

- No advanced HR features

Square Payroll is a user-friendly solution that works well for retailers and restaurants that already use Square POS, offering a cloud-based, mobile-friendly option for handling basic payroll needs with a few extras.

Why I picked Square Payroll: I selected Square Payroll for the ease of integration with Square POS, making it a standout choice for retailers and restaurants that rely on Square.

Additionally, you get a lot of bang for your buck with features like automated tax filings, instant payment through Square balances or checking accounts, and tip and commission tracking.

Square Payroll Standout Features and Integrations:

Features include instant payments to employees from a Square Checking account or Square balance, and the integration with Square POS allows time-tracking information to transition to the payroll features.

Square Payroll has a companion app, plus it offers automatic tax calculation and filing and tracks tips and commissions. I really like that Square can help calculate and automate most healthcare, retirement, and workers’ compensation insurance amounts too.

Integrations include QuickBooks, Square POS, and Square Team Management.

Pros and cons

Pros:

- Integrates with Square POS

- Automated tax filing

- Works for employees and contractors

Cons:

- Limited reporting capabilities

- Benefits administration features are limited

Zoho Payroll is an end-to-end payroll solution that harnesses automation to make payroll simpler for small businesses.

Why I picked Zoho Payroll: I picked Zoho Payroll since it’s one of the lower-cost options that harnesses automation effectively to minimize the time spent managing payroll. All you have to do is enter payment information for employees, and it will use any recorded hours to handle the calculations for you.

Zoho Payroll Standout Features and Integrations:

Features include automatic payroll calculations that work for both hourly and salaried employees, as well as the ability to run separate bonus payrolls.

In my opinion, it’s well worth the $19/month base price when you consider you also get benefits administration tools, digital pay stubs with direct deposit options, comprehensive payroll reports, and an employee self-service portal accessible through the web or a companion iOS app.

Integrations include Zoho People and Zoho Books.

Pros and cons

Pros:

- Automated payroll calculations for simplicity

- Add pay runs as needed to account for bonuses or special pay

- Multiple pay schedules available to align processing with your company’s needs

Cons:

- Limited integrations

- Only available in select states

Zenefits is a comprehensive HR platform with payroll features that offers in-depth HR analytics and reporting to simplify information tracking and employee management.

Why I picked Zenefits: I chose Zenefits because it offers more customizable reporting options and analytics features than you usually get with a low-cost payroll service. Additionally, its payroll and benefits administration tools—while functioning as an add-on—are similarly top-notch and cover both in a single platform.

Zenefits Standout Features and Integrations:

Features include unlimited payrolls, direct deposit, and mobile payments, as well as the ability to set up different pay schedules for various employees.

I really like that analytics, PTO tracking, benefits administration, scheduling, and other employee management tools are also part of the base package.

Integrations include Asana, Betterment, BreezyHR, Deputy, Expensify, Greenhouse, Guideline, Lever, QuickBooks, Salesforce, and Xero.

Pros and cons

Pros:

- Detailed HR analytics

- Capable mobile app with self-service options for employees

- Automated HR and payroll tools

Cons:

- Payroll feature is an add-on, not a base feature

- Not ideal for small businesses due to registered user requirements

Homebase Payroll is a payroll and scheduling solution designed for small businesses, particularly those with hourly teams. It helps manage payroll processing, employee scheduling, and time tracking all in one place.

Why I picked Homebase Payroll: It's ideal for businesses that need to handle both scheduling and payroll efficiently. You can manage employee hours and payroll seamlessly within the same platform, reducing administrative workload. It offers time tracking and scheduling features that integrate directly with payroll, ensuring accurate payments. This makes it particularly useful for businesses with fluctuating schedules and hourly employees.

Standout features & integrations:

Features include easy shift swapping, labor cost management, and automated alerts for overtime. You can also track employee hours and export timesheets for payroll processing. The platform provides reminders and notifications to keep your team updated on schedule changes.

Integrations include QuickBooks, Square, Gusto, ADP, Clover, Shopify, Indeed, and ZipRecruiter.

Pros and cons

Pros:

- Real-time schedule updates

- Direct timesheet export

- Automated overtime alerts

Cons:

- Requires internet connection

- No international payroll support

Warp is an AI-driven payroll and HR platform tailored for startups and remote teams. It manages payroll processing, tax compliance, and employee benefits, offering support for global contractors.

Why I picked Warp: It excels in supporting remote teams by simplifying payroll management and tax compliance. The platform automates complex tasks like tax account setups and filings, saving you time and reducing the risk of penalties. You can manage benefits such as health insurance and 401(k) plans easily. With a quick onboarding process, Warp is ideal for fast-growing companies that need efficient payroll solutions.

Standout features & integrations:

Features include automated tax setups, global contractor support, and a user-friendly onboarding process. The platform provides health and retirement benefits management. It also offers a customer-first approach with no hidden fees, ensuring transparency and trust.

Integrations include QuickBooks, Xero, Gusto, Slack, Google Workspace, BambooHR, Expensify, TSheets, Lever, and FreshBooks.

Pros and cons

Pros:

- Customer-first approach

- Global contractor support

- Quick onboarding process

Cons:

- Limited customization options

- Higher cost for larger teams

Superworks is a comprehensive payroll management solution designed for businesses of all sizes. It automates payroll processes, enhances compliance, and offers employee self-service options to streamline HR operations.

Why I picked Superworks: It provides robust employee self-service features, allowing employees to access their pay slips, submit leave requests, and manage personal information. The platform automates time and attendance tracking, simplifying record-keeping and ensuring accurate payroll calculations. You can generate pay slips in batches and handle salary statements efficiently. In my experience, Superworks reduces administrative burdens and enhances employee satisfaction.

Standout features & integrations:

Features include integrated payroll systems, customizable workflows, and automated leave management. You can track employee hours and manage deductions with ease. The platform also offers tools for performance management and HR digitalization.

Integrations include QuickBooks, Xero, FreshBooks, PayPal, Shopify, Etsy, Stripe, Google Workspace, HubSpot, and Square.

Pros and cons

Pros:

- Customizable HR workflows

- Batch pay slip generation

- Automated time and attendance tracking

Cons:

- Limited customer support hours

- Initial setup can be complex

SurePayroll is an online payroll service tailored for small businesses and household employers. It simplifies payroll processing, tax calculations, and employee payments.

Why I picked SurePayroll: It's designed for easy setup, making it a great choice for small businesses that want to get started quickly. You can manage payroll online with minimal hassle, and the platform handles tax filings and direct deposits. The tool offers a user-friendly interface that guides you through the setup process. In my experience, the simplicity of SurePayroll ensures you can focus on other business tasks.

Standout features & integrations:

Features include automatic payroll tax calculations, employee self-service portals, and mobile access. You can also manage retirement plans and health benefits within the platform. The system provides alerts and reminders to help you stay compliant with tax deadlines.

Integrations include QuickBooks, Xero, FreshBooks, Intacct, Sage 50, AccountEdge, Microsoft Dynamics, NetSuite, and Peachtree.

Pros and cons

Pros:

- Alerts for compliance deadlines

- Employee self-service options

- Mobile payroll access

Cons:

- Requires internet connection

- Basic reporting tools

Trolley is a payment platform designed for businesses that need to handle international transactions. It facilitates cross-border payments and offers features to manage global payouts efficiently.

Why I picked Trolley: It specializes in international payments, making it ideal for businesses with a global workforce. You can easily send payments in multiple currencies, which simplifies handling international contractors. The platform offers tax compliance features, ensuring that your payments adhere to local regulations. In my experience, Trolley's ability to manage diverse payment methods enhances its appeal for international operations.

Standout features & integrations:

Features include customizable payment workflows, fraud detection, and automated tax compliance. You can access real-time payment tracking to monitor transaction status. Additionally, the platform offers detailed reporting tools to help you analyze payment data.

Integrations include QuickBooks, Xero, NetSuite, Stripe, PayPal, Wise, TransferWise, Dwolla, and Plaid.

Pros and cons

Pros:

- Automated tax compliance

- Real-time payment tracking

- Supports multiple currencies

Cons:

- Limited to payment processing

- Limited customer support hours

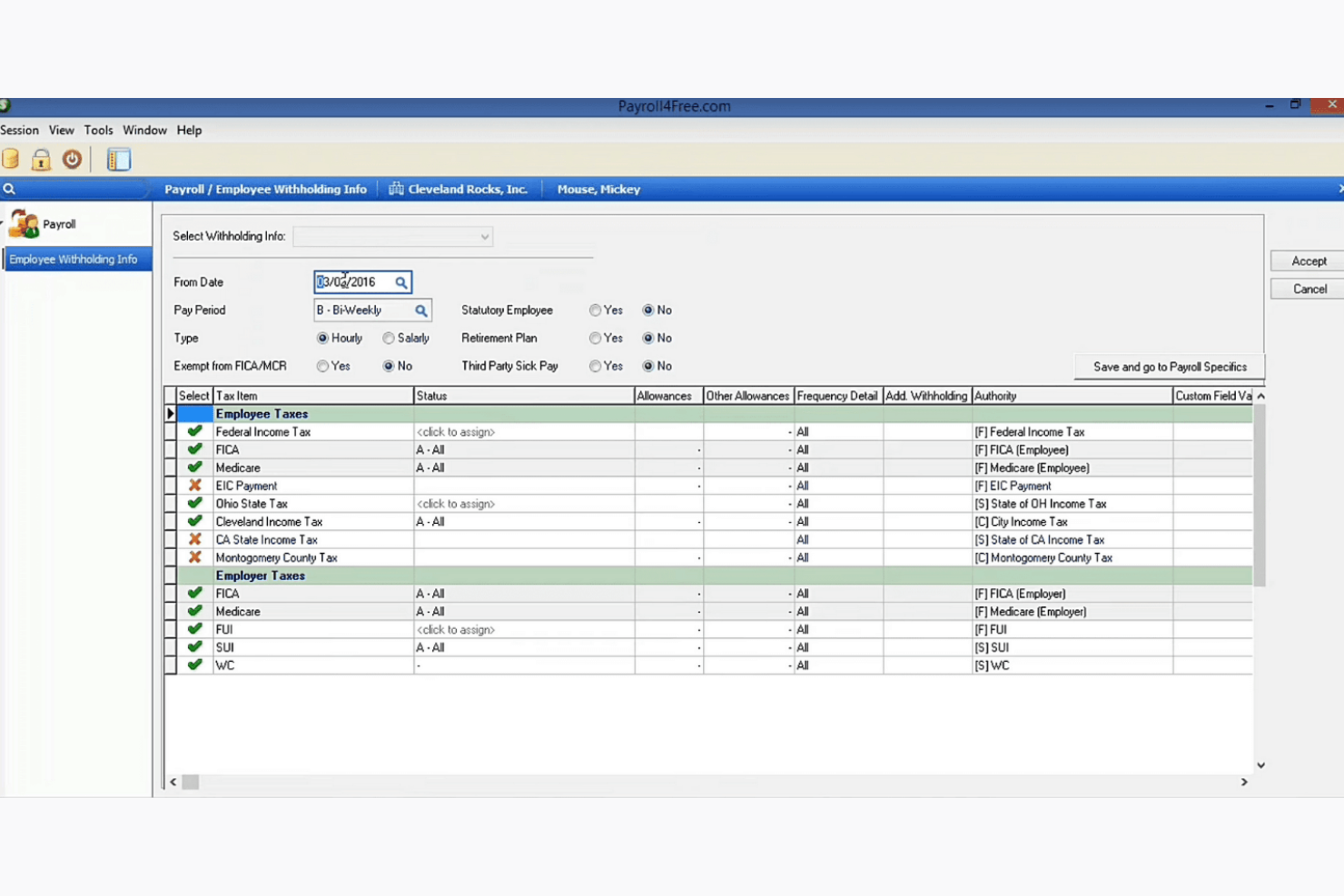

Payroll4Free is a genuinely free option that’s very user-friendly,—perfect for small businesses with 25 or fewer employees that have relatively basic payroll needs.

Why I picked Payroll4Free: I chose Payroll4Free because its base plan can manage payroll for up to 25 employees, and companies that use that service can do so for free indefinitely. Plus, it supports both traditional employee pay and 1099 contractor payments, as well as having tax form creation, time-tracking, and other valuable tools.

Payroll4Free Standout Features and Integrations:

Features include payroll options for traditional employees and 1099 contractors. Additionally, it supports direct deposit, tax form creation, time-tracking, and some analytics and reporting tools, and it offers an employee portal for self-service.

Integrations include data importing and exporting only, with no direct connections available.

Pros and cons

Pros:

- Free for up to 25 employees with basic features indefinitely

- User-friendly

- Employee self-service portal

Cons:

- Ads are shown

- No companion app

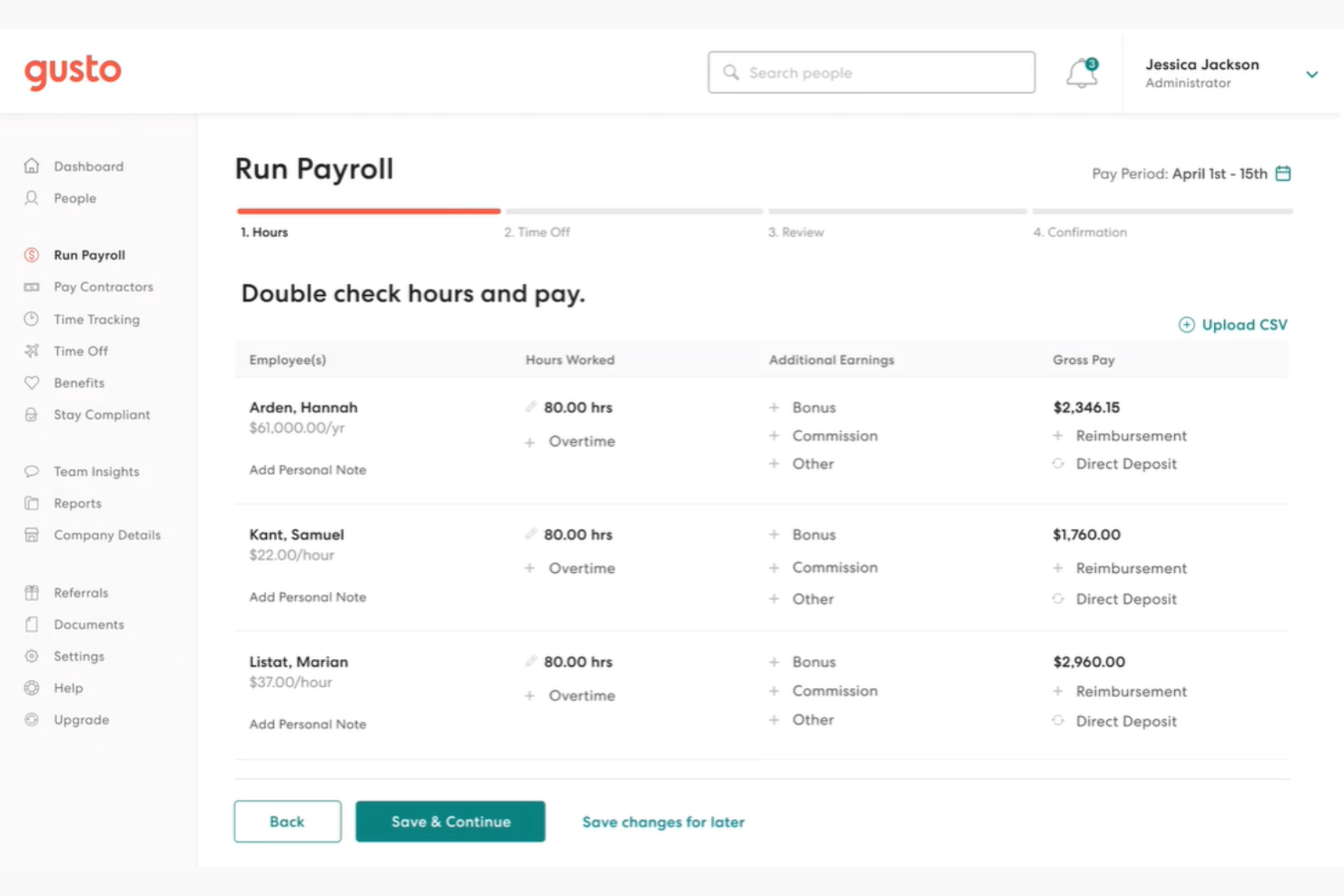

Gusto integrates with over 180 different platforms and services, and it works well for small businesses and large organizations alike. Along with comprehensive payroll features, Gusto works as an overall personnel management solution, handling taxes, time-tracking, and benefits administration.

Why I picked Gusto: I selected Gusto due to its high number of integration options, which far exceeds what you find with most cheap payroll services. Additionally, it offers automated payroll, tax document creation, and tax filings, which are advanced capabilities beyond what most would expect at this price point.

Gusto Standout Features and Integrations:

Features include automated payroll, taxes, and filings, reducing workloads significantly.

Gusto has a wide array of capabilities that go beyond things like direct deposit, debit card-based employee payments, and other things you’d normally expect from a standard payroll service.

I was especially impressed by the automatic adjustments Gusto will make to employee wages to comply with FLSA Tip Credit minimum wage requirements. Plus it can handle unlimited off-cycle payroll, flexible payment schedules, garnishment tools, and contractor payments.

Integrations include AttendanceBot, Betterment at Work, Bonusly, Bookkeeper360, Checkr, ClockShark, Connecteam, Deputy, DocuSign, eBillity, Expensify, FreshBooks, Guideline, Homebase, Hubstaff, Hyperproof, JazzHR, OnlineCheckWriter, Paperclip, QuickBooks, Relay, Sage Accounting, Salesforce, Tableau, Vestwell, VIVAHR, and Xero.

Pros and cons

Pros:

- 180+ integrations available

- User-friendly, intuitive design with a reduced learning curve

- Accommodates contractor payroll

Cons:

- Benefits options only available at higher price tiers

- Only supports US payments

Justworks Payroll is a platform designed for small to medium-sized businesses needing comprehensive payroll and HR support. It manages payroll processing, benefits administration, and compliance with labor laws.

Why I picked Justworks Payroll: It excels in providing compliance support, which is crucial for businesses navigating complex labor regulations. Justworks offers automated compliance alerts and handles tax filings, helping you stay on top of legal requirements. You can manage employee benefits like health insurance and retirement plans through the platform. This makes it an attractive option for businesses that prioritize compliance and benefits management.

Standout features & integrations:

Features include automated payroll processing, benefits administration, and compliance alerts. You can track employee hours and manage PTO within the platform. The tool also provides access to HR consulting services to assist with legal and compliance questions.

Integrations include QuickBooks, Xero, Gusto, Slack, Google Workspace, BambooHR, Expensify, TSheets, and Lever.

Pros and cons

Pros:

- PTO tracking capabilities

- Comprehensive benefits management

- Strong compliance support

Cons:

- Limited customization options

- Not ideal for very small businesses

Remote People offers payroll solutions for managing employees and contractors in over 150 countries. It supports employer of record (EOR) hiring, international recruitment, and global payroll processing, making it a suitable option for businesses expanding their international workforce.

Why I Picked Remote People: I included Remote People because it simplifies global payroll and compliance across 150+ countries, helping businesses manage international employees and contractors without needing local entities. Its EOR service handles onboarding, tax compliance, and benefits administration while reducing HR and payroll costs by up to 18% on average for small and medium-sized businesses. Additionally, its recruitment tools make it easier to source local and expatriate talent worldwide, which is especially useful for companies growing internationally.

Remote People Standout Features and Integrations

Features include international recruitment tools, global payroll processing, contractor management services with liability coverage, and employer of record support for compliant hiring. The platform also provides employee background checks, relocation assistance, and global employee benefits to help businesses manage international teams more effectively.

Integrations are not presently listed by Remote People.

Pros and cons

Pros:

- Wide recruitment network

- Dedicated client support contact

- Candidate placement guarantee

Cons:

- Some services available only in certain regions

- No publicly listed integrations

QuickBooks Payroll is a payroll processing solution designed for small to medium-sized businesses. It offers payroll management, tax calculations, and direct deposit services.

Why I picked QuickBooks Payroll: It integrates effortlessly with QuickBooks accounting software, making it ideal if you're already using QuickBooks for your financials. You can sync payroll data directly with your accounting records, eliminating the need for manual entries. The tool handles tax filings and provides automatic updates to ensure compliance. In my experience, the integration with QuickBooks accounting simplifies financial management for your business.

Standout features & integrations:

Features include automated payroll processing, tax penalty protection, and same-day direct deposit. You can access 24/7 support to address any payroll-related queries. The platform also offers a mobile app to manage payroll on the go.

Integrations include QuickBooks Online, TSheets, Expensify, Xero, Gusto, Square, Shopify, Clover, PayPal, and Bill.com.

Pros and cons

Pros:

- Comprehensive mobile app

- Same-day direct deposit

- Tax penalty protection

Cons:

- Requires QuickBooks for full functionality

- Limited to US-based businesses

Other Cheap Payroll Service Options

I’ve included a few more options that didn’t make my top for cheap payroll services but are still worth exploring:

- Paycor

For workforce analytics

- Oyster HR

For local labor law compliance

- Employment Hero

For Canadian companies

- Remote

For global teams

What Are Cheap Payroll Services?

Cheap payroll services are tools that manage payroll processing, tax calculations, and employee payments at an affordable price. Small business owners, freelancers, and HR professionals commonly use these tools to reduce manual workload and ensure compliance. Automated tax filing, direct deposit, and employee self-service features help with accuracy, efficiency, and employee satisfaction. Overall, these tools provide a cost-effective way to manage payroll and related tasks.

Selection Criteria for Cheap Payroll Services

When selecting the best cheap payroll service providers to include in this list, I considered common business needs and pain points that these providers address. This included things like minimizing administrative overhead for payroll processing and ensuring timely, compliant employee payments. I also used the following framework to keep my evaluation structured and fair:

Core Services (25% of total score)

To be considered for inclusion in this list, each provider had to offer these basic services:

- Employee wage calculation

- Direct deposit and check issuance

- Tax filing and reporting

- Pay stub generation

- Year-end W-2 and 1099 preparation

Additional Standout Services (25% of total score)

To help further narrow down the competition, I also looked for unique or especially valuable services, such as:

- Automated compliance updates

- Employee self-service portals

- Mobile payroll apps

- Integration with accounting software

- Contractor payment support

Industry Experience (10% of total score)

To get a sense of the industry experience of each provider, I considered the following:

- Years of operation in payroll services

- Number of clients served across industries

- Specialization in small business payroll

- Presence of certified payroll professionals

- Proven track record with compliance and audits

Onboarding (10% of total score)

To evaluate the onboarding experience for each provider, I considered the following:

- Availability of setup assistance

- Step-by-step onboarding tutorials

- Time required to process first payroll

- Ease of migrating data from previous provider

- Access to dedicated onboarding specialists

Customer Support (10% of total score)

To assess the level of customer support each provider offers, I considered the following:

- Availability of live chat or phone support

- Speed of response to support tickets

- Availability of support outside business hours

- Knowledge and helpfulness of support staff

- Quality of self-service help resources

Value For Price (10% of total score)

To evaluate the pricing and potential ROI of working with each provider, I considered the following:

- Monthly base pricing and per-employee fees

- Included services at each pricing tier

- Transparency of pricing structure

- Cost savings compared to manual payroll

- ROI relative to service breadth

Customer Reviews (10% of total score)

To get a sense of the overall satisfaction of existing customers, I considered the following when reading customer reviews:

- Satisfaction with ease of use

- Comments on customer service experiences

- Reports of technical issues or bugs

- Perceived value for the cost

- Loyalty or repeat business from users

How to Choose a Cheap Payroll Service

It’s easy to get bogged down in long lists of services and complex pricing structures. To help you prioritize the things that matter most for your business, keep the following factors in mind:

| Factor | What to Consider |

|---|---|

| Business Objectives | Make sure the provider aligns with your goals, whether it’s saving time, ensuring compliance, or scaling with your growth. If you’re a startup, your needs may differ from a growing small business. |

| Service Scope and SLAs | Look for clear commitments on turnaround times, tax filings, and error resolutions. Confirm if they handle state and federal compliance, benefits deductions, and end-of-year forms. |

| Support Availability | You’ll want responsive support when issues arise. Check if support is available via phone or chat, during extended hours, and if you’ll get a dedicated rep or team. |

| Costs and Pricing Structure | Understand base fees, per-employee charges, and hidden costs for things like year-end filings. Transparent, flat-rate pricing is ideal for predictable budgeting. |

| Communication and Reporting | Make sure your team can access clear, timely payroll reports. Dashboards and automated email updates help track payments, taxes, and compliance. |

| Ease of Use | Choose a platform that's simple to navigate and doesn’t require hours of training. A clean interface and intuitive process will save you time every pay run. |

| Integration Options | Check if the system connects with your accounting, time tracking, and HR tools. Integrations reduce manual data entry and errors. |

| Scalability | Ensure the service can grow with your business—handling more employees, locations, and compliance requirements without significant cost increases. |

Key Services

When selecting a cheap payroll service provider, keep an eye out for the following key services:

- Payroll processing: Automates the calculation and distribution of employee wages, saving time and reducing errors.

- Direct deposit: Sends employee payments directly to bank accounts, offering speed and convenience.

- Tax filing: Handles federal, state, and local payroll tax filings to ensure compliance and avoid penalties.

- W-2 and 1099 preparation: Generates year-end tax forms for employees and contractors, simplifying tax season.

- Employee self-service portal: Allows employees to view pay stubs, tax documents, and personal info without HR involvement.

- Time tracking integration: Syncs with timekeeping tools to ensure accurate hours and eliminate manual entry.

- Garnishment and deduction management: Processes court-ordered wage garnishments and other deductions correctly.

- New hire reporting: Automatically files required reports with government agencies when new employees are added.

- Mobile access: Lets employers and employees access payroll features from a smartphone or tablet.

- Custom reporting: Offers downloadable reports tailored to your business needs for audits, budgeting, or analysis.

Benefits

Implementing a payroll service provides several benefits for your team and your business. Here are a few you can look forward to:

- Scales with growth: Supports more employees and features without needing a whole new system.

- Lower operating costs: Keeps payroll expenses down by offering essential tools at an affordable price.

- Fewer manual tasks: Automates calculations, filings, and payments so your team doesn’t have to do them by hand.

- Faster pay cycles: Speeds up payday with features like direct deposit and scheduled payroll runs.

- Easier tax compliance: Helps you avoid penalties by handling filings and staying current with tax rates.

- More time for people work: Frees up HR and managers to focus on employee support and team goals.

- Better employee access: Lets employees handle their own pay stubs and tax forms through self-service tools.

Costs & Pricing

Cheap payroll service providers typically come at a custom price to accommodate various business needs, sizes, and circumstances. Providers generally work within one of the following pricing structures:

- Flat monthly fee: A set monthly rate that covers a specific number of employees and standard services.

- Per employee per month: A base monthly fee plus an added charge for each employee on payroll.

- Pay-per-run: You’re charged each time you run payroll, which works well for businesses that don’t pay on a fixed schedule.

- Tiered plans: Providers offer multiple service packages at different price points, letting you pick based on your needs.

- Custom quotes: Pricing is based entirely on the size of your business, services needed, and any add-ons requested.

Key Factors That Influence Payroll Service Provider Pricing

Beyond the specific pricing model, here are some additional factors that can influence the cost of cheap payroll service providers:

- Number of employees: More employees means more processing, forms, and payments, which usually raises the cost.

- Payroll frequency: Running payroll weekly instead of monthly can lead to higher charges due to more processing.

- Tax filing needs: If you operate in multiple states or have complex tax needs, pricing may go up to cover that work.

- Employee classification: Managing a mix of full-time employees and contractors may require extra services and cost more.

- Level of support: If you want live support or a dedicated rep, you might pay more than for basic chat or email help.

- Integration needs: Syncing with tools like accounting or time-tracking systems may add setup or monthly fees.

- Compliance complexity: Businesses in highly regulated industries may pay more for help staying on top of rules.

Being aware of these factors before you start seeking out custom quotes from providers helps you get a sense of what to expect, and compare and contrast quotes more effectively.

Cheap Payroll Services FAQs

Here are some answers to common questions about cheap payroll services:

How do I simplify my payroll process?

Generally, there are a few strategies that simplify payroll processes for businesses. First, find a payroll service that uses automation. Those allow for a set-it-and-forget-it approach, eliminating redundant tasks.

Favoring electronic tax forms and filing, along with direct deposit, also simplifies the process. Finally, integrations can eliminate redundant data entry across your various solutions, which not only saves time but can reduce error rates since the process is less manual.

Are cheap payroll services safe to use?

They can be, as long as the provider uses encryption, secure logins, and follows data protection standards. Look for services that mention SOC 2 compliance or similar safeguards. You should also check if they offer two-factor authentication.

Do cheap payroll services include tax filing?

Some do, but not all. A few only calculate taxes and leave the filing to you, while others handle both filing and payment. Always confirm what’s included in the base price, since tax filing might cost extra.

What’s Next:

If you're in the process of researching cheap payroll services, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.