20 Best Payroll Services Providers Shortlist

Here’s my top picks for the best payroll services providers:

The best payroll services take the stress out of paying your team by automating calculations, ensuring compliance, and minimizing costly errors.

Handling payroll manually can eat up valuable time and increase the risk of mistakes that lead to penalties or unhappy employees. The right payroll service streamlines the process from start to finish, managing taxes, filings, and direct deposits with precision and reliability.

After testing and comparing the leading providers firsthand, I’ve curated a list of the most dependable, easy-to-use payroll services available today. In this guide, you’ll find trusted solutions that save time, improve accuracy, and help you stay compliant—no matter the size of your team.

Why Trust Our Software Reviews

Best Payroll Services Providers Summary

I’ve put together this handy comparison chart with pricing info for my favorite payroll service providers—so you can easily find the one that fits your budget and suits your business best.

| Service | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global teams | Free trial + demo available | From $29/month | Website | |

| 2 | Best for on-demand wage access | Free demo available | Pricing upon request | Website | |

| 3 | Best for access to HR advisors | Free demo available | Pricing upon request | Website | |

| 4 | Best for managing international payments | Free demo available | From $25 - $199/user/month | Website | |

| 5 | Best for global contractors and freelancers | Free demo available | Pricing upon request | Website | |

| 6 | Best for industry-specific payroll | 30-day free trial | From $40/month + $6/user/month | Website | |

| 7 | Best for US-based businesses | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 8 | Best for real-time pay previews | Free demo available | Pricing upon request | Website | |

| 9 | Best for remote global onboarding | Trial options may be available | Pricing upon request | Website | |

| 10 | Best for personalized support | Trial or quote available upon request | Pricing upon request | Website | |

| 11 | Best for union payroll and garnishments | Free demo available | Pricing upon request | Website | |

| 12 | Best for scaling internationally | Free demo available | Pricing upon request | Website | |

| 13 | Best for payroll and benefits renewals | Not available | From $8/employee/month + $50/month base fee | Website | |

| 14 | Best for automations | Free demo available | From $40/month + $6/user/month | Website | |

| 15 | Best free payroll service | Free plan available | From $30/month | Website | |

| 16 | Best for treasury and payroll in one | Not available | Pricing upon request | Website | |

| 17 | Best for payroll during mergers | Free demo available | From $39/month + $5/employee/month | Website | |

| 18 | Best for global payroll compliance | Not available | From $199/employee/month | Website | |

| 19 | Best for employee time-tracking | 14-day free trial | From $3.99/user/month + $19/month base fee | Website | |

| 20 | Best for cross-border cost previews | Free demo available | From $20/user/month (billed annually) | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5 -

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3

Best Payroll Service Providers Reviews

Below is a detailed breakdown of the top payroll service providers that stood out to me. In each review, you’ll find the key features, pros and cons, integration options, and who each tool is best suited for to help you find your next solution.

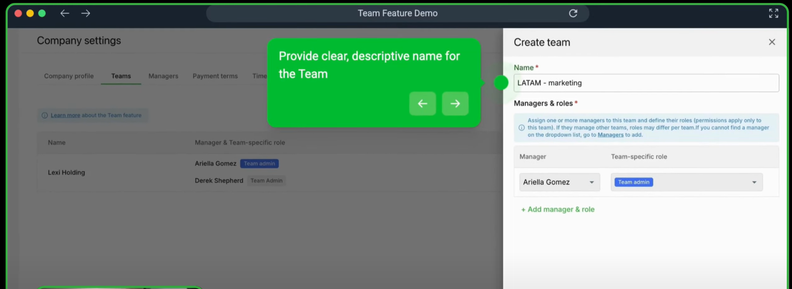

Deel is a global payroll platform available in over 150 countries. The payroll service enables you to hire anyone from anywhere, whether they’re an independent contractor or a traditional employee.

Why I picked Deel: Deel’s platform makes it easy for remote and global teams to manage their payroll. The software enables users to hire and pay contractors without having to worry about complicated tax systems, local laws, or confusing international payroll.

Deel Standout Features and Integrations:

Standout features include Deel’s local country experts who work in-house to run clients’ global payroll. I think this is incredibly valuable for business owners who are weary of local taxes and laws for international hires.

The local experts streamline payroll processes for team members in their country and ensure regional taxes are accurately accounted for.

Integrations include QuickBooks, Xero, Netsuite, Workday, Workable, Expensify, Greenhouse, Hibob, BambooHR, Ashby, OneLogin, and Okta.

Pros and cons

Pros:

- 24/7 online support

- 10+ payment options for clients

- Off-cycle payroll available

Cons:

- Confusing fees for some add-ons

- Occasional bugs

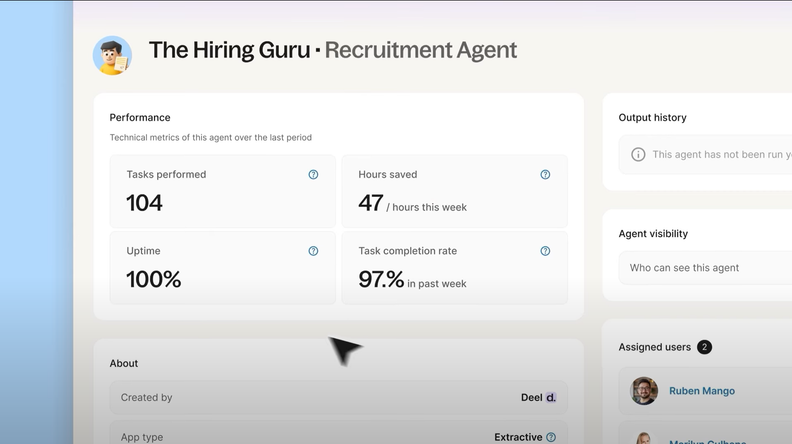

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Paylocity is a cloud-based platform that offers payroll and human capital management solutions. Designed to simplify payroll processing and enhance HR functions, it provides tools to manage employee data, benefits, and compliance.d efficient. With both basic and full-service payroll options, Patriot aims to meet the diverse needs of small business owners.

Why I picked Paylocity: Its payroll processing ensures accurate and timely compensation for your employees, handling complex calculations and tax withholdings. The platform also offers on-demand payment options, allowing employees to access earned wages before payday, which can boost satisfaction and financial well-being.

Paylocity Standout Features and Integrations:

Standout features include global payroll that ensures compliance with local regulations. It also offers federal, state, and local tax filings, garnishment services to manage wage deductions efficiently, and expense management tools that streamline the reimbursement process.

Integrations include Microsoft Teams, Azure Active Directory, Slack, BambooHR, Greenhouse, and NetSuite.

Pros and cons

Pros:

- Comprehensive tax filing

- Automated expense reimbursement

- On-demand payment options

Cons:

- No free trial option available

- Tax services limited to US jurisdictions

New Product Updates from Paylocity

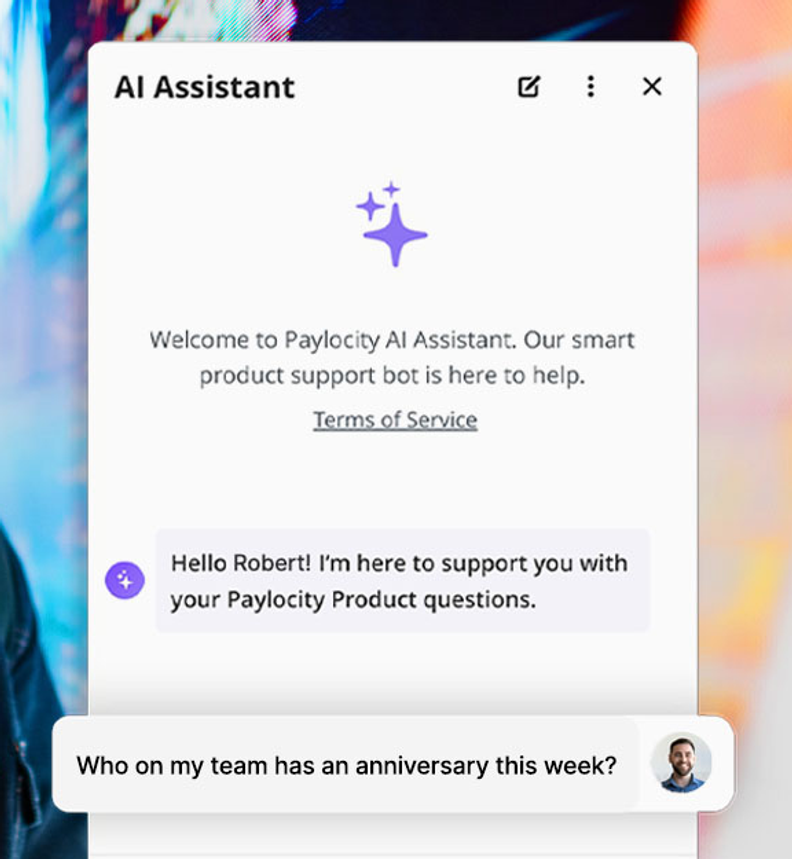

Paylocity AI Assistant Update

Paylocity introduces an AI Assistant that transitions from questions to actions swiftly, enhancing user efficiency. For more information, visit Paylocity's official site.

TopSource Worldwide is a global payroll and Employer of Record (EOR) service that helps companies hire internationally without setting up local entities. Their services cover payroll processing, HR support, and employment compliance across more than 100 countries.

Why I picked TopSource Worldwide: I picked TopSource Worldwide because of their focus on compliant employment contracts and local payroll management, which can help you navigate the complexities of hiring internationally. They also bring experience supporting businesses expanding into new markets, and provide access to HR advisors who can assist with onboarding and benefits, adding value beyond payroll processing alone.

TopSource Worldwide Standout Features and Integrations:

Standout features include global payroll management designed to align with local tax and labor laws, as well as support with statutory benefits and contributions. Their HR services cover employment contracts, onboarding, and advisory support, while their EOR offering allows you to hire without establishing a local entity. The platform also provides in-country expertise to help employers stay compliant with regional requirements.

Integrations include Salesforce, NetSuite, SAP, Ebury, and various HR solutions through an API, alongside connections with eCommerce platforms, financial tools, CRM systems, ERP systems, EDI standards, online stores, and HRMS systems.

Pros and cons

Pros:

- Legal employer of record in each location

- Includes global payroll and tax management

- Salary estimator tool helps plan ahead

Cons:

- Pricing not publicly listed

- No public list of software integrations

New Product Updates from TopSource

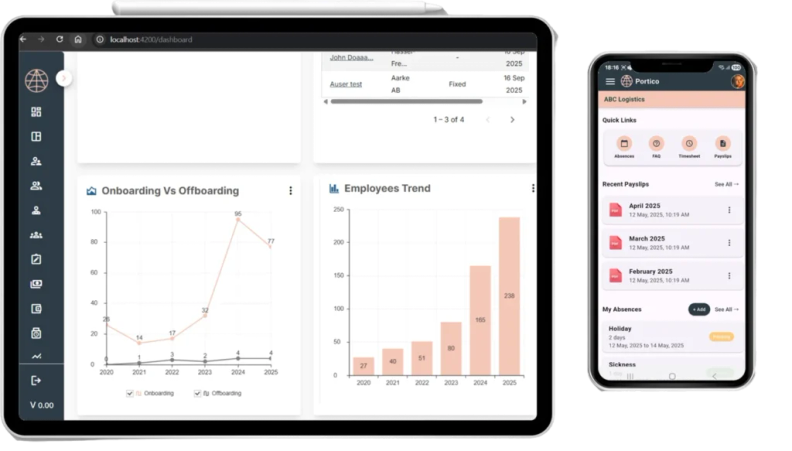

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

RemoFirst provides advanced payroll services, including payments for global employer of record (EOR) hires, international payroll, and compliance support.

Why I picked RemoFirst: I chose RemoFirst for payroll services because it addresses the intricacies of global employment, including adherence to local labor laws and managing a diverse workforce. They cater to the complexities of hiring and managing remote teams across over 180 countries, positioning themselves as a leading solution for global team management due to their same-day onboarding capability and competitive pricing.

RemoFirst Standout Features and Integrations:

Features include tools to hire internationally without establishing a local entity, and tools to manage global payroll, ensure compliance with local tax laws and regulations, and generate contracts and invoices, alongside tools for workforce management. Other services offered include support with the visa application process, obtaining work permits for employees, and background checks. RemoFirst also offers RemoHealth, which provides health insurance options for remote teams.

Integrations include ADP.

Pros and cons

Pros:

- Customizable to different organizational needs

- User-friendly interface for HR professionals

- Suitable for small to medium-sized businesses

Cons:

- Lacks extensive integration options

- No mobile app

New Product Updates from RemoFirst

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

Worksuite is a comprehensive freelancer management platform that offers employer of record (EOR) services including payroll processing. The platform allows you to hire and manage freelance and contract workers in 190 countries, and pay them in their local currency.

Why I picked Worksuite: In addition to paying your freelancers and contractors through the platform, you can manage your invoicing, maintain a talent database, onboard new recruits, and even track your projects. If your business relies heavily on contract-based employees, this can be a helpful solution for all-around management. And if you'd like to scale your freelancer workforce globally, but remain compliant, it can ensure you're meeting local labour laws.

Worksuite Standout Features and Integrations:

Standout features include the talent database, which letsy ou sort and filter contractors by various criteria such as availability and skills. The platform also facilitates customized onboarding workflows, including the collection of legal and tax documents, and automates invoice management linked to contractor profiles.

Integrations include Basecamp, Slack, Asana, Mavenlink, Pipedrive, Recurly, Zoho Subscriptions, Xero, and QuickBooks, among others. A paid Zapier account will also unlock thousands of other integrations.

Pros and cons

Pros:

- 24-hour live support available

- Risk management included to ensure compliance

- Coverage in 190 countries

Cons:

- Platform comes with a learning curve

- Pricing is not transparent

OnPay is one of the best payroll services because they offer specific versions of their software based on your industry. Whether you’re in construction, restaurants, agriculture, or a nonprofit, you’ll have a payroll provider that’s custom-tailored to your specific business.

Why I picked OnPay: Some industries have unique quirks when it comes to running payroll. For instance, restaurants typically deal with various part-time and full-time employees. Some restaurants that have delivery only pay drivers as contractors. OnPay offers different versions of their payroll service for a variety of industries to ensure even the most unique payroll needs are met which makes them stand out from the crowd.

OnPay Standout Features and Integrations:

Standout features include in-house insurance brokers to help you set up dental, vision, and health plans with partner providers. It also comes with integrated benefits administration, drastically reducing the requirement to manually enter data before running payroll. In my opinion, one of the coolest features is the 401k integrations that automatically include employer matching and even profit sharing.

Integrations include When I Work, Xero, Deputy, Mineral, PosterElite, Magnify, Quickbooks, and for 401k platforms: Guideline, Vestwell, and America’s Best 401k.

Pros and cons

Pros:

- Easily integrated benefits

- Easy to use

- In-house insurance brokers

- Great customer service during the week

Cons:

- No mobile app

- No support on weekends

Patriot Payroll is an online payroll service designed for small businesses in the United States. It offers a user-friendly platform that makes payroll management straightforward and efficient. With both basic and full-service payroll options, Patriot aims to meet the diverse needs of small business owners.

Why I picked Patriot Payroll: As a payroll service, Patriot offers comprehensive features, such as automatic tax calculations, direct deposit, and an employee portal for easy access to pay stubs and tax forms. Its full-service payroll option also includes all necessary federal, state, and local tax filings, ensuring compliance without the administrative hassle.

Patriot Payroll Standout Features and Integrations:

Standout features include customizable pay rates, allowing businesses to tailor compensation for different roles, time-off accruals, helping manage employee leave effectively, and detailed payroll reports, providing valuable insights into payroll expenses and trends to inform financial decisions.

Integrations include QuickBooks, TSheets, Gusto, Square, FreshBooks, Xero, accounting software, time and attendance systems, and human resources management systems.

Pros and cons

Pros:

- Manages electronic documents

- User-friendly interface

- Variety of built-in reports

Cons:

- No international payroll option

- The initial setup requires a lot of manual data entry

Paycom offers a comprehensive range of online payroll and HR services, including payroll management, talent acquisition, and HR management, serving businesses of all sizes. Their key business functions include employee onboarding, performance management, and compliance, with a strong focus on automation and security.

Why I picked Paycom: Paycom is known for its employee self-service capabilities, which empower your team to manage their own payroll through the Beti® system. This feature reduces administrative workload and enhances accuracy in payroll processing. The platform's AI-driven data access further supports efficient HR management, making it an ideal solution for businesses seeking to enhance employee engagement.

Standout Services: Paycom's Direct Data Exchange® feature allows you to track real-time ROI, providing valuable insights into HR operations. Their GONE® feature automates time-off decision-making, helping your team manage leave requests efficiently and without delays.

Target industries: Healthcare, retail, education, technology, and finance.

Specialties: Payroll management, talent acquisition, HR management, employee self-service, and compliance tools.

Pros and cons

Pros:

- Real-time ROI tracking

- AI-driven data access

- Strong self-service capabilities

Cons:

- Setup can be time-consuming

- Limited customization options

Neeyamo offers global payroll and Employer of Record (EOR) services, catering to businesses of various sizes and industries. They focus on providing comprehensive payroll solutions and employee management tools across over 180 countries.

Why I picked Neeyamo: Neeyamo specializes in serving niche industries with tailored payroll solutions that ensure compliance with global HR regulations. Their platforms, such as Global Payroll Core and Global Payroll Plus, are designed to efficiently handle complex payroll needs. The integration with major HCM providers, such as Workday and Oracle, enhances their capabilities, making them ideal for businesses with unique payroll requirements.

Standout Services: Neeyamo's background screening service enables you to conduct thorough checks on potential hires, ensuring compliance and minimizing hiring risks. Their onboarding tools streamline the process of integrating new employees into your team, enhancing the overall onboarding experience.

Target industries: Technology, healthcare, manufacturing, financial services, and retail.

Specialties: Global payroll, EOR services, compliance management, background screening, and onboarding tools.

Pros and cons

Pros:

- Tailored solutions for niche industries

- Strong compliance management

- Comprehensive global coverage

Cons:

- Errors in tax filings surfaced

- Occasional payment delays reported

Reliable Payroll Services offers a range of payroll and HR solutions, including payroll processing, tax management, and employee benefits, catering to businesses of all sizes. They focus on providing personalized service and compliance support, ensuring your business meets regulatory requirements effectively.

Why I picked Reliable Payroll Services: Reliable Payroll Services emphasizes personalized support, offering a 1:1 service guarantee that sets them apart. Their scalable solutions cater to businesses of varying sizes, while their commitment to compliance ensures you stay up-to-date with regulations such as ACA and workers' compensation.

This focus on personalized service makes them a great choice for businesses seeking attentive and responsive payroll solutions.

Standout Services: Reliable Payroll Services' retirement planning service helps your team prepare for the future by offering tailored retirement solutions. Their workers' compensation management ensures compliance and reduces the risk of non-compliance penalties, providing peace of mind for your business.

Target industries: Retail, healthcare, finance, technology, and manufacturing.

Specialties: Payroll processing, tax management, HR support, retirement planning, and workers' compensation management.

Pros and cons

Pros:

- Affordable compared to in-house payroll

- Focus on regulatory compliance

- Personalized customer service

Cons:

- Setup may require assistance

- Limited online resources

ADP offers payroll, HR, and compliance services for businesses ranging from small to large enterprises. They focus on key functions like payroll processing, benefits administration, and talent acquisition, serving a diverse client base across multiple industries.

Why I picked ADP: ADP excels in global compliance, making it a strong choice for businesses operating in multiple countries. Their services include compliance management and workforce management, which help you navigate complex international regulations. ADP's advanced AI capabilities further support your team's global operations, ensuring you stay ahead of compliance requirements.

Standout Services: ADP's time and attendance management service helps you track employee hours accurately, reducing errors and saving you time. Their talent acquisition service streamlines the hiring process, allowing you to find the best candidates for your team efficiently.

Target industries: Financial services, retail, healthcare, government, and education.

Specialties: Payroll processing, HR outsourcing, compliance management, workforce management, and AI capabilities.

Pros and cons

Pros:

- Advanced AI capabilities

- Strong global presence

- Wide range of services

Cons:

- Frequent updates required

- Complex setup for small businesses

HSP Group is a global payroll provider that helps you manage cross-border payroll, legal compliance, and entity administration from one place. Their proprietary GateWay platform acts as the command center—giving you real-time visibility into payroll, HR, tax, and legal obligations in 60+ countries.

Why I picked HSP Group: I picked HSP because of how much ground they cover. Instead of stitching together different vendors for HR, tax, payroll, and entity setup, you get one partner—and one platform—for all of it. If you're expanding globally and want control without chasing ten systems or consultants, this setup makes your life easier. I also like that their payroll model scales with your business, whether you're using an EoR or setting up a permanent entity.

HSP Group Standout Features and Integrations:

Standout features include support for EoR-to-entity transitions when you’re ready to localize operations, and mobility solutions that manage global employee relocations while keeping you compliant. GateWay automates document management and deadline tracking, and gives you a single view of tax obligations, payroll tasks, and compliance gaps across jurisdictions.

Rather than integrating with third-party tools, HSP connects all of its services—global payroll, tax, HR admin, and legal setup—through its proprietary GateWay platform.

Pros and cons

Pros:

- Real-time compliance tracking system

- Smooth EoR-to-entity transition

- Unified platform for global HR

Cons:

- No pricing publicly available

- Integrations not clearly documented

Justworks Payroll offers payroll, HR, and benefits services designed to keep employee management, payments, and benefits in one connected system. They serve small to mid-sized companies that want to simplify payroll processing while coordinating benefits administration under a single platform.

Why I picked Justworks Payroll: Justworks Payroll lets you renew benefits and manage payroll in sync, so you avoid mismatches or gaps at renewal time. You can add or remove benefits during payroll cycles and see their impact on deductions. Their built‑in tax filings, benefits administration, and payroll scheduling support this renewal coordination.

Standout Services: Justworks Payroll offers automated benefits enrollment tools, allowing your team to choose or change benefits during open enrollment periods without needing to complete manual forms. Their time tracking integration also ties hours and pay changes directly to benefits deductions, so renewals or changes reflect immediately.

Target industries: Tech, professional services, startups, agencies, and nonprofits.

Specialties: Payroll, benefits administration, HR compliance, contractor payments, and multi‑state payroll.

Pros and cons

Pros:

- Payroll and benefits in one system

- Good support when onboarding new teams

- Easy user interface for non-experts

Cons:

- Limited customization in HR tools

- Mobile app lacks full admin features

Gusto’s automation features are some of the best available of any payroll software, which has made it one of the leading payroll providers since 2011 with over 60,000 customers worldwide.

Why I picked Gusto: The platform is easy to use for anyone even without previous payroll experience thanks to the fully automated payroll. I picked this one because it drastically reduces your workload when juggling the many complicated payroll tasks.

Compared to other platforms that are clunky or confusing, this tool simplifies anything and you certainly don’t need to have an accounting background to make sense of it all.

Gusto Standout Features and Integrations:

Standout features include a variety of ways to fully automate different payroll and HR tasks. I really like how you can set up your payroll to run automatically, with a simple reminder sent to you 24 hours beforehand. Gusto will also calculate local, state, and federal taxes, then, they’ll file and pay them automatically as well.

I also like Gusto’s self-service portal for your employees and contractors. It can automatically generate W-2s and 1099 forms for everyone at the end of the year. It'll even send out an email to let everyone know their tax forms are ready, and how to retrieve them.

Integrations include Carta, ClickUp, HubSpot, Cloudflare, Connecteam, Document360, Notion, BlueJeans, DocuSign, Pingboard, Zendesk, Amplitude, Checkr, Betterment at Work, Dynatrace, Fivetran, Flatly, Gorgias, and Hootsuite.

Pros and cons

Pros:

- Affordable full-service payroll service

- Unlimited payroll runs in every state

- Wide variety of integrations

- All plans include basic reports

Cons:

- Next-day direct deposit isn’t offered in Simple plan

- Limited support for Simple and Plususers

Payroll4Free is exactly what you think it is. A completely free service with basic payroll services. It’s built specifically for small businesses with under 25 employees.

Why I picked Payroll4Free: It’s completely free. For some business owners who are bootstrapping but need a minimum viable solution, Payroll4Free will get the job done.

While it doesn’t have a ton of features, there isn’t much that beats free when you have a limited budget.

PayrollFree Standout Features and Integrations:

Standout features include a simple (while slightly dated) interface, payroll services for employees and contractors, and year-end tax forms such as 1099s and W-2s.

In my opinion, one surprising feature of the free platform is the employee portal.

If you do want a little bit more, Payroll4Free does offer more advanced features if you want to upgrade to a paid plan (up to $30/month).

Integrations include QuickBooks and most other common accounting software.

Pros and cons

Pros:

- Completely free

- Employee portal

- Vacation time tracking

Cons:

- Tax filing and remittance is a paid add-on

- Limited integrations

Cloudpay provides fully managed global payroll services, specializing in payroll processing and compliance management for businesses operating across multiple countries. Their primary client base comprises multinational companies seeking efficient and unified payroll solutions.

Why I picked Cloudpay: Cloudpay specializes in serving multinational companies with its global payroll services, ensuring compliance with international regulations. Their cloud-based platform simplifies payroll processing, reducing administrative burdens for your team. The integration with major HCM providers, such as Workday and Oracle, enhances the overall service, making it ideal for businesses with complex payroll needs.

Standout Services: Cloudpay's pay-on-demand solutions allow your team to access earned wages before payday, improving employee satisfaction and financial well-being. Their salary payments service ensures accurate and timely disbursement of employee wages across different countries, reducing the risk of errors and delays.

Target industries: Manufacturing, technology, finance, healthcare, and retail.

Specialties: Payroll processing, compliance management, global payroll services, pay-on-demand solutions, and salary payments.

Pros and cons

Pros:

- Pay-on-demand solutions

- Cloud-based platform

- Integration with HCM providers

Cons:

- Support availability varies by region

- Complex setup for new users

Paychex offers a wide range of HR and payroll services, including payroll processing, HR consulting, and benefits management, catering to businesses of all sizes. Their main client base ranges from self-employed individuals to large enterprises, with a focus on improving payroll accuracy and HR compliance.

Why I picked Paychex: Paychex specializes in payroll tax services, providing comprehensive support to ensure your business stays compliant with tax regulations. Their payroll processing system simplifies tax filing and payment, reducing the risk of errors. The integration of payroll and HR functions in their cloud-based platform enhances productivity and compliance for your team.

Standout Services: Paychex's time and attendance tracking helps you manage employee work hours efficiently, reducing payroll errors. Their retirement plan administration offers tailored solutions to help your team plan for the future, enhancing employee satisfaction and retention.

Target industries: Retail, healthcare, manufacturing, financial services, and hospitality.

Specialties: Payroll processing, HR consulting, PEO services, retirement plan administration, and business insurance.

Pros and cons

Pros:

- Cloud-based platform

- Flexible HR solutions

- Comprehensive tax services

Cons:

- Higher cost for advanced features

- Occasional technical issues

Remote People is a payroll and recruitment platform designed for businesses that hire remote talent in over 150 countries. It provides global payroll services, contractor management, and Employer of Record (EOR) solutions while ensuring compliance with local labor laws and tax regulations.

Why I Picked Remote People: I picked Remote People for its strong focus on compliance when managing payroll and employment across multiple countries. Their Employer of Record (EOR) services make it possible to hire international employees without setting up a local entity, which is a major advantage for companies expanding globally. Remote People also helps manage contractor payments and employment contracts, giving businesses flexibility when working with a mix of full-time employees and independent contractors. Additionally, with built-in tools like global salary calculators and background checks, Remote People simplifies the complexities of managing international teams.

Remote People Standout Features and Integrations:

Features include a three-step recruitment process that delivers a shortlist of vetted candidates within five days, comprehensive employee benefits tailored to local markets, and SOC 2–compliant data security to protect sensitive HR and payroll information. The platform also offers real-time insights and reporting, enabling businesses to make informed decisions on payroll and workforce planning.

Integrations are not currently listed by Remote People.

Pros and cons

Pros:

- Candidate placement guarantee

- Dedicated client support contact

- Wide recruitment network

Cons:

- No publicly listed integrations

- Some services available only in certain regions

Buddy Punch is a payroll service that helps businesses monitor, manage, and track employee time and attendance more effectively.

Why I picked Buddy Punch: Buddy Punch is an all-in-one payroll and time-tracking solution. It’s best suited for small and medium businesses that have a lot of hourly employees. Buddy Punch’s time tracking capabilities are super helpful in managing and reviewing time worked by employees.

Buddy Punch Standout Features and Integrations:

Standout features include automated payroll and time-tracking. I think this is helpful if you’re looking to save more time on HR and admin tasks. The software also includes different modules for payroll and time-tracking so you can keep an eye on payroll costs and hours worked.

Plus, Buddy Punch allows for automated payroll tax filings and an unlimited number of payroll runs.

Integrations include ADP, Paychex, Paylocity, PayPlus, QuickBooks, Gusto, SurePayroll, Workday, and Zapier.

Pros and cons

Pros:

- Mobile app for Android and iOS

- Automated tax filings

- Impressive online support

- User-friendly interface

Cons:

- Attendance “punching out” sometimes glitches

- Can be a bit confusing to review past pay periods

Multiplier offers payroll, global employment, and contractor management services to help you hire and pay people in multiple countries without needing local entities. Their main clients are companies expanding internationally or managing distributed teams.

Why I picked Multiplier: Multiplier forecasts the full cost of hiring in other countries before making commitments, thanks to its transparent pricing and cost‑breakdown tools. They factor in local salary, taxes, benefits, and currency so you know what you’ll pay. The platform also supports cross‑currency payments and localized compliance, directly tied to its USP.

Standout Services: Multiplier provides integration with HR and accounting systems, enabling your payroll data to flow directly into the tools you already use, eliminating the need for manual data entry. They also offer visa and immigration support helps when hiring in places where work permits or relocation are required, reducing legal friction.

Target industries: Tech startups, SaaS, e‑commerce, remote‑first companies, and consulting.

Specialties: Employer‑of‑record services, contractor payroll, multi‑currency payments, localized compliance, and benefits administration.

Pros and cons

Pros:

- Support available 24/5

- Integrated compliance for many countries

- Multi‑currency and crypto payments

Cons:

- Onboarding in complex countries can lag

- No iOS mobile app for employees

Other Payroll Service Providers

Here are a few more options that didn’t make my shortlist, but could still be worth considering:

- Oyster HR

For local hiring contracts

- Lano

For linking pay and invoices

- Paycor

For local tax setups

- Paychex Flex

Reporting features

- Square Payroll

For tips and commissions

- RUN Powered by ADP®

For payroll and HR

- PrimePay

For early paycheck access

- QuickBooks Payroll

For Quickbooks Accounting users

- Remote

For international benefits management

- Papaya Global

For multi-country payroll compliance

Related Software Reviews

If you still haven't found what you're looking for, check out these related tools we tested and evaluated:

- Accounting Software

- ERP Software

- POS Systems

- Billing Software

- Forecasting Software

- Merchant Account Services

- Expense Report Software

What is Payroll Service?

Payroll services providers are third-party providers that handle employee compensation, tax filings, and payroll compliance on your company’s behalf.

This service is typically used by HR teams, CFOs, and business owners to:

- Eliminate the burden of managing pay cycles

- Manage deductions

- Lead government reporting

They can also help ensure employees are paid accurately and on time, while reducing the risk of costly tax errors and compliance issues.

Payroll Services Selection Criteria

When creating this list of top payroll services, I focused on what matters most to buyers: staying compliant and avoiding costly mistakes. To keep the evaluation fair and structured, I used a clear framework to guide every choice.

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Process payroll for employees

- Calculate taxes and deductions

- Generate payroll reports

- Provide direct deposit options

- Offer employee self-service portals

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Integration with time and attendance systems

- Automated compliance updates

- Customizable reporting tools

- Multi-currency support

- Mobile app accessibility

- Ability to manage multi-company payroll

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive interface design

- Ease of navigation

- Availability of tutorials or guides

- Speed of performance

- Customization options

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Access to interactive product tours

- Presence of chatbots for assistance

- Inclusion of webinars for new users

- Availability of templates for setup

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 support availability

- Multi-channel support options

- Response time to queries

- Access to a dedicated account manager

- Quality of self-help resources

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing models

- Transparency in pricing

- Inclusion of essential features in base price

- Discounts for annual subscriptions

- Cost-effectiveness for small businesses

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Positive feedback on reliability

- Satisfaction with customer service

- Ease of implementation

- User-friendliness

- Overall value for money

How to Choose a Payroll Service

As you work through the payroll service selection process, keep the following points in mind:

- Business Needs: Identify the key features that match your business needs. For example, small businesses often prioritize simple, user-friendly tools with essential payroll functions, while larger companies may require more advanced features. Focus on what will streamline your payroll tasks and support your company’s growth.

- Service Integration: Choose a provider that integrates easily with your existing software, such as accounting and HR systems. This will help streamline your operations and reduce manual work.

- Pricing: Carefully evaluate the cost structure, including monthly fees or per-pay-period charges before you make a decision. Make sure to watch for extra costs tied to tax filing, direct deposit, or year-end reporting.

- Customer Support: Quick, reliable support matters, especially when payroll problems arise. When shopping for a payroll services provider, check the level of customer support each option offers, such as dedicated account managers and 24/7 availability.

- Reputation and Reliability: Check for feedback and experiences from businesses like yours to confirm the provider has a solid track record in your industry. Things like consistent results, positive client reviews, and reliable support can help you ensure the provider understands your needs and can handle common challenges in your space.

Key Services

When selecting a payroll service provider, keep an eye out for the following key services:

- Payroll Processing: Efficiently manages employee paychecks, direct deposits, and tax calculations.

- Tax Filing Services: Ensures accurate filing of payroll taxes, including state, federal, and local requirements.

- Employee Self-Service Portal: Provides employees access to pay stubs, tax forms, and personal information updates.

- Compliance Support: Navigates complex wage and hour laws, tax regulations, and payroll compliance to avoid penalties.

- Time and Attendance Tracking: Integrates time tracking systems to streamline payroll calculations.

- Multi-State Payroll Solutions: Handles payroll processing across multiple states with accurate compliance.

- Customizable Payroll Options: Tailors payroll processing to meet the specific needs of your business, including bonuses and commissions.

- Benefits and Deductions Management: Automates calculations for employee benefits and deductions such as healthcare, retirement, and garnishments.

- Advanced Reporting Tools: Uses data-driven insights to monitor payroll trends and ensure transparency.

- Integration With HR and Accounting Systems: Seamlessly connects payroll services with your existing HR and accounting software for efficiency.

Benefits

Partnering with a payroll services provider offers several benefits for your team and your business. Here are a few you can look forward to:

- Cost Savings: Streamlines payroll processes and reduce errors, saving time and money for your business.

- Compliance Assurance: Stays updated on payroll tax regulations and employment laws to avoid fines and legal issues.

- Enhanced Efficiency: Automates payroll processing, freeing up internal resources for other core business activities.

- Access to Expertise: Works with experienced payroll specialists who can guide you through complex payroll scenarios.

- Improved Employee Satisfaction: Ensures timely and accurate payment to employees, enhancing trust and morale.

- Risk Reduction: Minimizes the risk of payroll errors, audits, and penalties with professional management.

- Scalability: Supports your business’s growth with payroll solutions that adapt to increasing employee numbers or complexity.

Costs & Pricing

Payroll services are priced based on your business size, needs, and the scope of services required. Providers commonly use one of the following pricing structures:

- Per-Employee-Per-Month (PEPM): Charges a recurring fee based on the number of employees processed.

- Flat Fee: Offers a consistent monthly or annual charge for services, regardless of employee count.

- Pay-As-You-Go: Allows businesses to pay only for specific payroll runs or additional features, adding flexibility.

- Tiered Pricing: Provides different service levels at varying price points to cater to small, medium, and large businesses.

- Custom Pricing: Tailors the cost based on the unique requirements of your business, such as industry or special payroll needs.

Key Factors That Influence Payroll Services Pricing

Several factors affect the cost of payroll services, including:

- Number of Employees: Larger workforces typically incur higher costs due to the increased processing volume.

- Service Scope: Additional features like direct deposits, tax filing, or time-tracking integrations may increase pricing.

- Industry Requirements: Businesses in industries with complex payroll rules or compliance needs may face higher fees.

- Customization Needs: Tailored solutions for unique payroll requirements, such as multi-state or international payroll, can raise costs.

- Frequency of Payroll: More frequent payroll runs (e.g., weekly vs. bi-weekly) may result in higher charges.

- Add-Ons: Optional services like benefits administration, HR support, or accounting software integrations can impact overall pricing.

- Contract Length: Long-term agreements might include discounts, while short-term or month-to-month plans could have a premium.

Being aware of these factors helps you anticipate costs and effectively evaluate quotes from payroll service providers.

Payroll Service: FAQs

Here are the answers to a couple popular questions many people have about payroll services.

What are the compliance considerations when selecting a payroll service?

You should look for automatic tax filing, real-time updates on federal and state regulations, and built-in wage and hour law checks. Pick a payroll service that provides compliance alerts, automated records, and support for year-end reporting. Ideally, choose providers known for accuracy and who offer compliance guarantees to protect your company from costly penalties.

How do payroll services handle employee benefits and deductions?

Payroll services automate benefit deductions—like health insurance, retirement contributions, and garnishments—each pay period. Many services include benefits administration tools that sync enrollment changes and let you track eligibility or handle open enrollment. Check if the provider can manage your specific plans and generate detailed deduction reports for auditing and transparency.

How secure are payroll services in handling sensitive employee data?

Top payroll providers use encryption, secure data centers, and routine security audits to keep employee data safe. Look for multi-factor authentication, detailed access controls, and third-party certifications (like SOC 2). Ask vendors about breach response plans so you’re confident only authorized staff see payroll details.

How can payroll services integrate with existing HR or accounting software?

Most leading payroll services offer integrations or open APIs for popular HRIS and accounting systems. This lets you sync employee data, reduce double entry, and automate reporting. Before buying, check if the payroll service supports direct integrations with your core software for a smoother workflow.

What should I look for in payroll service customer support?

Prioritize 24/7 access to knowledgeable representatives and multiple support channels—phone, chat, and email. Look for dedicated account managers or help desks specializing in HR and payroll issues. Fast, reliable support helps you resolve payroll errors quickly and keeps your team paid on time.

Can payroll services handle multi-state or international employees?

Yes, many modern payroll platforms can manage workers across states and even globally. They automatically apply local tax rates, file required forms, and handle compliance for each location. If you employ people in multiple states or countries, confirm the provider understands those specific jurisdictions and offers localized support.

How often can I run payroll with these services?

Most payroll providers let you run payroll as often as needed—weekly, bi-weekly, semi-monthly, or on-demand. Some services even support unlimited runs each month for no extra fee. Ask about run limits or extra charges, especially if you have hourly workers or complex pay cycles.

What's Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.