10 Best PEO Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

The best PEO software helps small and mid-sized businesses manage HR tasks like payroll, benefits, and compliance—reducing administrative burdens and legal risks.

When you’re juggling multiple roles without a full HR team, it’s easy to get bogged down in complex employment laws, expensive benefits, and manual processes that slow you down. A PEO acts as a co-employer, giving you access to better benefits, expert compliance support, and streamlined HR operations.

From automating payroll and tax filings to handling onboarding, benefits administration, and risk management, these solutions save time and provide peace of mind.

After evaluating 20 leading PEO platforms, I’ve curated a list of the best options that are intuitive, scalable, and designed to support your business as it grows.

Why Trust Our Software Reviews

We’ve been testing and reviewing HR software since 2019. During that time, we’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 complete software reviews.

As HR experts ourselves, we know how important and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions. Learn how we stay transparent & our software review methodology.

Best PEO Software Summary

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global hiring compliance | Free trial + demo available | From $29/month | Website | |

| 2 | Best for budget-friendly global hiring | Free demo available | $99/employee/month | Website | |

| 3 | Best for global payroll management | Free demo available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 4 | Best for industry-specific HR solutions | Free demo available | Pricing upon request | Website | |

| 5 | Best for advanced HR solutions | Trial options available | Pricing upon request | Website | |

| 6 | Best for small business HR solutions | Not available | From $59/user/month | Website | |

| 7 | Best for speedy hiring | Not available | Pricing upon request | Website | |

| 8 | Best for scaling small businesses | Not available | Pricing upon request | Website | |

| 9 | Best for global growth | Free demo available | Pricing upon request | Website | |

| 10 | Best for diverse employee bases | Not available | Pricing upon request | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Best PEO Software Reviews

This section provides an in-depth analysis and overview of each PEO software. I will walk through the pros and cons of each tool, its features, and best use cases.

Deel is a global people platform designed to help businesses hire, onboard, and manage employees and contractors across multiple countries. It offers solutions for payroll, compliance, and human resources.

Why I Picked Deel: Deel lets you hire full-time employees globally without the need to set up local subsidiaries. This service ensures compliance with local labor laws and regulations, reducing the administrative burden and legal risks associated with international hiring. Another notable feature is Deel's global payroll capabilities. It allows you to pay employees and contractors in their local currencies through various payment methods, including bank transfers, digital wallets, and even cryptocurrency.

Standout Features & Integrations:

Features include automated tax calculations, expense management, time-off tracking, equity management, localized benefits administration, compliance document storage, contractor misclassification protection, equipment ordering and management, HR analytics, and reporting.

Integrations include Brex, Google Workspace, Hubstaff, JIRA, Slack, QuickBooks, Xero, BambooHR, NetSuite, Workday, Greenhouse, and Okta.

Pros and cons

Pros:

- Contractor management options

- Comprehensive payment options in multiple currencies

- Strong emphasis on compliance

Cons:

- Initial setup may take some time

- Limited customization options

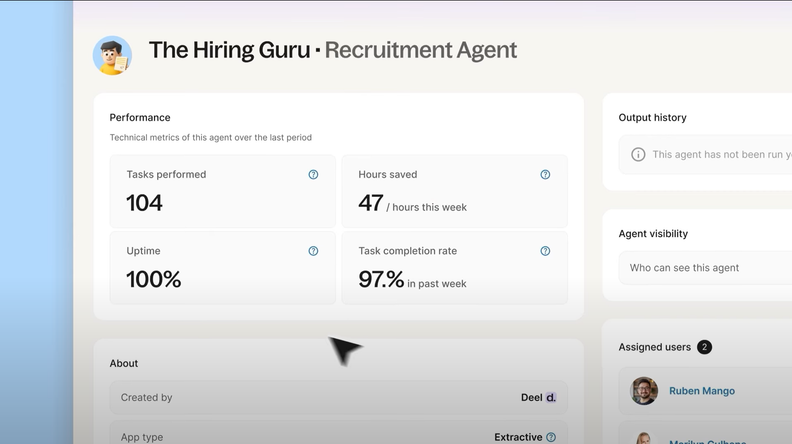

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Native Teams is a global employment platform that helps small and mid-sized businesses hire and manage international teams while remaining compliant with local labor laws. With PEO services available in 85+ countries, it takes care of payroll, benefits, contracts, and tax compliance, allowing you to focus on team growth instead of admin work.

Why I Picked Native Teams: I chose Native Teams because it offers a budget-friendly co-employment model that gives companies legal coverage while retaining day-to-day control over their teams. This is especially helpful for businesses operating across Europe or entering new markets without local HR teams. I also liked how the platform supports both employees and contractors, with flexible payment tools and fast onboarding timelines.

Standout Features & Integrations:

Features include global payroll, localized employee benefits, contractor and gig worker support, multi-currency payments, visa and relocation assistance, local tax handling, guided onboarding/offboarding, and risk and compliance management.

Integrations are not presently listed by Native Teams.

Pros and cons

Pros:

- Adjusts pricing with employee salaries

- Accommodates both employees and contractors

- Supports multi-currency wallets and dedicated IBAN accounts for international transactions

Cons:

- May lack advanced features needed by larger organizations

- No integrations are presently listed

New Product Updates from Native Teams

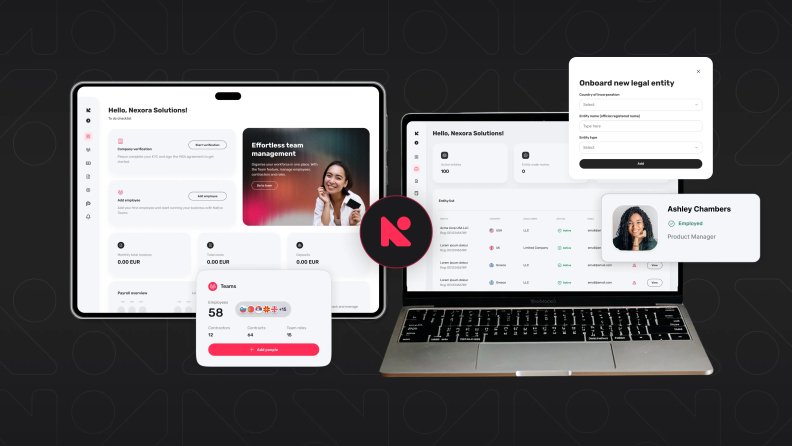

Native Teams Introduces Entity Management Solution

Native Teams unveils an all-in-one solution to streamline business entity management and reduce costs. For more information, visit Native Teams's official site.

Omnipresent is a global employment platform that helps businesses hire and manage international teams without the need to establish local entities. By handling complex administrative tasks like payroll, benefits, and compliance, Omnipresent allows you to focus on your core operations.

Why I Picked Omnipresent: They take care of employment contracts, ensuring compliance with local labor laws, so you don't have to worry about legal complexities. This means you can onboard employees in new countries quickly and confidently. Another key feature is their global payroll management. Omnipresent handles payroll processing in over 150 countries, making sure your team members are paid accurately and on time, regardless of their location.

Standout Features & Integrations:

Features include global employment compliance, international tax management, local benefits administration, employee self-service portal, HR advisory services, employment contract management, visa and immigration support, time zone coordination tools, multilingual support, data security measures, and customizable reporting.

Integrations include popular HRIS systems.

Pros and cons

Pros:

- Easy to manage payroll for global teams in one platform

- Handles tax compliance across multiple countries

- Strong local expertise in employment regulations

Cons:

- Limited flexibility in customizing certain benefits packages

- Support in certain regions can be lacking

TriNet provides complete HR solutions tailored to various industries. It customizes its services to meet the needs and challenges of different sectors.

Why I Picked TriNet: I chose TriNet for its ability to offer industry-specific HR solutions, which sets it apart from other PEO software. TriNet's combination of technology and personalized expertise addresses the specialized requirements of various industries.

Standout Features & Integrations:

Features include a simple online payroll solution, HR software for managing time and benefits, and best practices guidance on complex employment-related regulations and compliance. TriNet also offers complete benefits options and award-winning HR support.

Integrations include Assembly, Bob, ChartHop, Compt, Greenhouse, Hyperproof, Lattice, Sage Intacct, and QuickBooks

Pros and cons

Pros:

- Award-winning expertise

- Complete HR support

- Industry-specific solutions

Cons:

- May be costly for small businesses

- Limited customization options

Insperity offers complete HR solutions tailored to businesses of all sizes. It stands out due its advanced technology that supports a wide range of HR functions.

Why I Picked Insperity: I chose Insperity for its high-tech HR solutions. Insperity stands out as it provides personalized HR guidance and tools that simplify HR processes. I believe Insperity is particularly effective for businesses looking for a technology-driven approach to HR management.

Standout Features & Integrations:

Features include employee benefits administration, automated payroll and HR administration, compliance tools, and workforce management technology. Insperity also offers personalized HR guidance and support from a dedicated HR service team.

Integrations include ADP, Oracle, Sage, and QuickBooks.

Pros and cons

Pros:

- Scalable services

- Advanced technology

- Complete HR solutions

Cons:

- May be complex for small businesses

- Limited customization flexibility

Justworks PEO is a complete HR solution designed for small businesses. It offers a range of services including payroll, benefits, compliance, and HR management which are managed through an online platform.

Why I Picked Justworks PEO: I chose Justworks PEO for the list because it stands out for its complete suite of HR services tailored specifically for small businesses. Unlike other PEOs, Justworks offers a platform that integrates payroll, benefits, compliance, and HR management, making it a one-stop solution for small business owners. I believe Justworks PEO is good for small business HR solutions due to its user-friendly interface and the breadth of services it offers, which are usually accessible only to larger enterprises.

Standout Features & Integrations:

Features include access to a variety of health insurance plans, automated payroll services, and compliance support. Justworks PEO also offers integrated HR tools that help manage administrative tasks efficiently, and a time tracking solution that syncs with payroll.

Integrations include QuickBooks, Xero, Slack, Gusto, BambooHR, Expensify, TSheets, Deputy, Zenefits, and ADP.

Pros and cons

Pros:

- Access to large-company benefits

- User-friendly platform

- Complete HR solutions

Cons:

- Limited customization options

- Integration challenges with other tools

Global PEO Services is known for rapid international hiring without legal entities. This allows companies to hire employees quickly and compliantly in over 170 countries without the need to establish local subsidiaries.

Why I Picked Global PEO Services: I chose Global PEO Services for its ability to hire global prospects quickly. This tool stands out due to its HR, payroll, tax, and compliance management features, which are important for businesses looking to expand globally. Its technology platform, Mihi, also provides management of time, attendance, and benefits.

Standout Features & Integrations:

Features include complete HR support from hire to retirement. It also includes legally compliant employment contracts, benefits procurement, and a SaaS solution for managing time, attendance, and benefits. The platform also ensures compliance with local laws and provides global mobility and immigration support.

Integrations include BambooHR, Workable, ADP, Paychex, and QuickBooks.

Pros and cons

Pros:

- Proprietary technology platform

- Global compliance management

- Complete HR support

Cons:

- Limited customization

- Challenging onboarding process

Infiniti HR provides complete Professional Employer Organization (PEO) solutions, including HR, payroll, and benefits services. It leverages large-scale purchasing power to reduce costs and enhance service offerings.

Why I Picked Infiniti HR: I chose Infiniti HR for its ability to offer small businesses the benefits typically reserved for larger corporations. This tool stands out due to its complete suite of services, including HR, payroll, and benefits management, all designed to reduce employer liability and stabilize labor costs. I believe Infiniti HR is best for scaling small businesses because it allows them to access high-quality services and competitive benefits packages that would otherwise be unaffordable.

Standout Features & Integrations:

Features include a complete suite of HR services, payroll management, and benefits administration. Infiniti HR also offers state-specific HR management, on-demand HR support, and access to Fortune 500-level health, dental, vision, disability, life, and 401k plans.

Integrations include QuickBooks, Sage 50 Accounting, Slack, Google Drive, and Dropbox.

Pros and cons

Pros:

- Fortune 500-level benefits

- State-specific HR management

- On-demand HR support

Cons:

- Limited reporting capabilities

- Learning curve for new users

Velocity Global is a global HR platform designed to help businesses hire, pay, and manage their global workforce. It stands out due to its global reach, covering over 185 countries.

Why I Picked Velocity Global: I chose Velocity Global for its suite of services that make global expansion and contractor conversion straightforward and compliant. This platform includes legal compliance and payroll management. I believe it is best for global growth and contractor conversion, making it good for businesses looking to expand internationally without the hassle of setting up legal entities in each country.

Standout Features & Integrations:

Features include a Global Work Platform that simplifies hiring, paying, and managing a global workforce. The platform offers services such as Employer of Record, global benefits, global immigration, international pensions, and global talent sourcing. These features ensure that businesses can manage their international teams compliantly.

Integrations include Workday, SAP, Bob, BambooHR, ADP, QuickBooks, Greenhouse, Lever, Oracle, Namely, Kronos, and Paychex.

Pros and cons

Pros:

- Legal compliance in 185+ countries

- Comprehensive HR services

- Extensive global reach

Cons:

- Potentially complex setup

- Limited customization for SMEs

Zempleo is a certified minority-owned business that specializes in providing payroll, IC compliance, and managed services.

Why I Picked Zempleo: I chose Zempleo for this list as it is a minority-owned business with experience in managing large-scale payroll and staffing projects. Their commitment to diversity and inclusion sets them apart from other PEO software. I believe Zempleo is best for diverse, compliant payroll due to their specialized services and federal compliance capabilities.

Standout Features & Integrations:

Features include a high-touch, personal service for payroll solutions. The company also provides a good user experience for managing projects of any size and includes a strong focus on diversity and inclusion.

Integrations include ADP, QuickBooks, Gusto, Xero, BambooHR, SAP SuccessFactors, Workday, Paychex, Namely, and Kronos.

Pros and cons

Pros:

- Strong focus on diversity

- Extensive project management experience

- High-touch personal service

Cons:

- Limited integration information

- Limited customization options

Other PEO Software

Below is a list of additional PEO software that I shortlisted, but did not make it to the top list. Definitely still worth checking them out!

- CoAdvantage

For affordable Fortune-500 benefits

- XcelHR

For complex regulatory environments

- Vensure

For attracting talent

- Atlas HXM

Direct PEO

- Worksuite

For large freelance teams

- Multiplier

For international onboarding

- ADP TotalSource

For businesses of all sizes

- Amplify

For employee benefits packages

- Paychex PEO

For tax administration

- Nextep

For technology integration

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated.

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

- Learning Management Systems

Selection Criteria for PEO Software

My criteria for choosing PEO software should centers around common buyer needs and pain points.

As an expert who has personally tried and researched this software type, here are the requirements I use when evaluating these tools.

Core PEO Software Functionality: 25% of total weighting score

- Payroll processing

- Benefits administration

- Compliance and risk management

- Employee self-service portals

- Time and attendance tracking

Additional Standout Features: 25% of total weighting score

- Integration with third-party applications

- Advanced analytics and reporting

- Mobile app accessibility

- Customizable workflows

- AI-driven insights

Usability: 10% of total weighting score

- Intuitive user interface

- Drag-and-drop functionality

- Role-based access control

- Customizable dashboards

- Easy navigation

Onboarding: 10% of total weighting score

- Availability of training videos

- Interactive product tours

- Chatbots for instant support

- Webinars for in-depth training

- Pre-built templates for quick setup

Customer Support: 10% of total weighting score

- 24/7 support availability

- Multi-channel support (phone, email, chat)

- Dedicated account managers

- complete knowledge base

- Fast response times

Value For Money: 10% of total weighting score

- Transparent pricing models

- Flexible subscription plans

- Cost-benefit analysis

- Discounts for long-term commitments

- ROI potential

Customer Reviews: 10% of total weighting score

- Overall satisfaction ratings

- Specific feedback on features

- User testimonials

- Frequency of updates and improvements

- Comparison with competitors

How To Choose PEO Software

As you work through your unique software selection process, keep the following points in mind.

| Factor | What to Consider |

|---|---|

| Services Offered | Check whether the PEO provides payroll, benefits administration, compliance support, risk management, and HR consulting—all in one solution. |

| Compliance Expertise | Look for expertise in federal, state, and local employment laws, especially if you operate in multiple states or highly regulated industries. |

| Benefits Options | Evaluate the quality, variety, and cost-effectiveness of benefits the PEO can access, including health insurance, retirement plans, and perks. |

| Technology Platform | Ensure the software is intuitive, mobile-friendly, and integrates with your existing tools (e.g., accounting, ATS, or time-tracking systems). |

| Pricing Model | Understand how fees are structured—per employee, flat rate, or as a percentage of payroll—and ensure it aligns with your budget. |

| Scalability | Consider whether the PEO can grow with your business, support remote teams, and adapt as you expand into new states or countries. |

| Level of Support | Look for access to dedicated HR specialists or account managers, along with responsive customer support and onboarding assistance. |

| Reputation & Certifications | Verify that the PEO is accredited (e.g., ESAC or IRS-certified) and has a strong track record with companies similar to yours. |

| Employee Experience | Choose a solution that offers easy employee self-service for onboarding, benefits enrollment, and accessing pay stubs or tax forms. |

| Data Security & Compliance | Ensure the platform uses encryption, secure data storage, and follows data privacy regulations to protect sensitive employee information. |

Trends in PEO Software

PEO software is changing remarkably, transforming how businesses manage their human resources and payroll.

As technology advances, staying informed about the latest developments is essential. Here are some key trends to watch closely that could impact your organization:

- All-in-one HR platforms: Modern PEOs are offering unified platforms that combine payroll, benefits, onboarding, time tracking, and performance management—minimizing the need for extra tools.

- AI-driven insights and automation: AI is helping automate compliance alerts, payroll error checks, and employee analytics—saving time and reducing risk.

- Employee self-service portals: User-friendly dashboards let employees access pay stubs, request time off, enroll in benefits, and update info without HR support.

- Mobile-first design: PEO platforms are becoming more mobile-friendly to support remote and hybrid teams who manage HR tasks on the go.

- Customizable dashboards and reporting: Employers now get more tailored analytics—like turnover rates, headcount trends, and cost-per-hire—right from the platform.

- Built-in compliance monitoring: PEO software increasingly includes real-time compliance tracking for things like labor laws, wage requirements, and employee classifications.

- Global Workforce Capabilities: Some PEOs are expanding into EOR-style services, supporting international hiring and compliance through the same tech stack.

- Integration with Other Tools: Seamless plug-ins with accounting software (like QuickBooks), Slack, ATSs, and performance tools are becoming standard.

- Employee Experience Focus: UX is getting a glow-up—expect slicker onboarding, personalized benefit dashboards, and pulse surveys to keep teams engaged.

What is PEO Software?

PEO software is a platform used by Professional Employer Organizations (PEOs) to power the outsourced HR services for small and mid-sized businesses. It combines technology with co-employment support, handling tasks like payroll, tax filings, benefits administration, compliance, and risk management.

By partnering with a PEO, companies gain access to better benefits and expert HR guidance without building a full in-house HR team. The software streamlines these processes, giving both employers and employees an easy way to manage HR tasks in one centralized system.

Features of PEO Software

When choosing PEO software, it's essential to recognize the key features that will let you manage your HR tasks more efficiently. Here are the most essential features to look for.

- Payroll and tax management: Automates payroll processing, direct deposits, and tax filings at all levels. Helps avoid errors and stay compliant with IRS and state requirements.

- Benefits administration: Manages employee enrollment in health, dental, vision, and retirement plans. Employees can self-select benefits and handle changes directly in the system.

- Employee self-service portal: Allows employees to view pay stubs, update personal info, request PTO, and access company policies. Cuts down on HR admin time and boosts transparency.

- HR compliance tools: Sends alerts about labor law changes, helps manage policies, and stores key documents like handbooks and signed agreements. Reduces legal risk for your business.

- Time and attendance tracking: Employees can clock in/out, log hours, and submit time-off requests. Data syncs with payroll for accurate wage calculations.

- Onboarding and offboarding: Streamlines hiring with digital offer letters, task checklists, and document signing and collection. Also supports smooth offboarding with exit checklists and compliance tools.

- Reporting and dashboards: Offers real-time data on payroll, turnover, headcount, and benefits usage. Helps leaders make more informed HR and financial decisions.

- Mobile access: Employees and admins can access tools on the go via mobile apps or mobile-optimized portals. Useful for remote teams or field workers.

- Integrations: Connects with third-party tools like accounting software, ATS platforms, or Slack. Many offer open APIs for custom workflows and automation.

Benefits of PEO Software

By leveraging PEO software, companies can outsource complex HR tasks, allowing them to focus on their core business activities. Below are five benefits of PEO software for both users and organizations.

- Simplified HR processes: PEO software automates and simplifies HR tasks such as payroll processing, benefits administration, and compliance management, reducing administrative burden.

- Access to competitive benefits: By pooling employees from multiple companies, PEOs can offer high-quality benefits packages at competitive rates similar to those available to large corporations.

- Compliance and risk management: PEO software helps businesses comply with ever-changing federal and state employment laws, reducing the risk of costly fines and legal issues.

- Cost savings: Outsourcing HR functions to a PEO can lead to significant cost savings by reducing the need for in-house HR staff and minimizing payroll and benefits administration errors.

- Enhanced employee experience: PEO software provides employees access to better benefits and simplified HR services, improving overall job satisfaction and retention rates.

PEO software is a valuable tool for businesses of all sizes, offering a range of benefits that can help simplify operations, reduce costs, and improve employee satisfaction.

Costs & Pricing of PEO Software

This section provides an estimate of average PEO software plans and costs. The data is based on industry standards and common pricing models.

Plan Comparison Table for PEO Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic HR tools, limited employee management, and basic reporting |

| Personal Plan | $40 - $80 per month | Payroll processing, basic benefits administration, and compliance support |

| Business Plan | $80 - $160 per month | Advanced payroll, complete benefits, employee self-service, and compliance tools |

| Enterprise Plan | $160 - $250 per month | Full HR suite, advanced analytics, dedicated support, and custom integrations |

PEO Software FAQs

Here are some answers to frequently asked questions you may have about PEO software and how it works.

How is PEO software different from regular HR software?

PEO software is offered as part of a co-employment relationship, where the PEO becomes the employer of record for tax and benefits purposes. Unlike standalone HR software, it includes access to benefits plans, compliance support, and HR expertise in addition to payroll and admin tools. Regular HR software is just a tool, while a PEO combines both software and professional services.

How does PEO software help with compliance management?

PEO software helps with compliance management by providing tools and resources to ensure your business adheres to labor laws and regulations. This includes automated tax filing, generation of compliance reports, and tracking of regulatory changes. The software can also offer guidance on best practices for HR policies and procedures, helping you avoid legal pitfalls. Additionally, some PEO software includes access to legal experts who can provide advice and support on complex compliance issues.

Can PEO software handle international payroll and compliance?

Yes, some PEO software solutions are designed to handle international payroll and compliance. These solutions offer features such as multi-currency payroll processing, compliance with local labor laws, and management of international employee benefits. They also provide tools for managing global workforce data and ensuring compliance with international regulations, such as GDPR. When choosing a PEO software for international operations, look for providers with a strong track record in global payroll and compliance management.

How does PEO software integrate with other business tools?

PEO software typically offers integration capabilities with various business tools, such as accounting software, CRM systems, and project management tools. These integrations allow for seamless data transfer and synchronization between systems, reducing the need for manual data entry and minimizing errors. For example, integrating PEO software with accounting software can simplify payroll processing and financial reporting. When evaluating PEO software, check for available integrations and ensure they align with the tools you currently use.

What are the potential drawbacks of using PEO software?

While PEO software offers many benefits, there are potential drawbacks to consider.

- Cost: PEO services can be expensive, especially for small businesses with tight budgets. It’s important to weigh the costs against the benefits and ensure the software provides value for money. (See PEO services for small businesses for some cost-effective options.)

- Loss of Control: Outsourcing HR tasks to a PEO can result in a loss of direct control over certain HR functions. Businesses need to ensure they are comfortable with this arrangement and maintain clear communication with the PEO provider.

- Complexity: The relationship between a business and a PEO can be complex, requiring time to fully understand the terms and conditions of the service agreement.

- Dependence on the Provider: Relying on a PEO provider for important HR functions means that any issues with the provider, such as service disruptions or changes in terms, can impact your business operations.

How do I evaluate the customer support offered by PEO software providers?

When evaluating software customer support, consider the following factors.

- Availability: Check if customer support is available 24/7 or during specific hours. Ensure the support hours align with your business needs.

- Support Channels: Look for multiple support channels, such as phone, email, live chat, and online resources (e.g., knowledge base, FAQs, tutorials).

- Response Time: Inquire about the average response time for support requests and whether there are any guarantees for timely assistance.

- Expertise: Ensure the support team has the necessary expertise to address complex HR and compliance issues.

- Customer Reviews: Read reviews and testimonials from other users to gauge their experiences with the provider’s customer support.

What tax management benefits does PEO software provide?

PEO software typically includes integrated tax management systems that automate federal, state, and local tax filings while reducing payroll processing time. These systems also provide audit reports and continuous compliance monitoring to minimize tax-related risks and penalties. By consolidating tax management into a single platform, PEO solutions help businesses avoid costly errors and stay current with constantly changing tax regulations across multiple jurisdictions, which is especially valuable for companies with employees in multiple states.

What’s Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.