10 Best Employer of Record in Switzerland Shortlist

Here's my pick of the 10 best services providers from the 20 we reviewed.

When hiring in Switzerland, understanding the intricacies of employment, social security, and tax laws is crucial to avoid penalties and legal issues. My best advice is to use an Employer of Record (EOR) to outsource your legal employment responsibilities and avoid having to register a new Swiss-based legal entity with the Swiss Commercial Register.

A Switzerland-based EOR will manage the complexities of Swiss employment regulations, including registration with the Swiss Federal Tax Administration and social security contributions (AHV/IV/EO), while keeping you in compliance with oversight from the State Secretariat for Economic Affairs (SECO). This way, you can focus on building your team and growing your business in Switzerland without being bogged down by local legal requirements.

Which Swiss EOR provider can truly deliver? Luckily, I've got you covered with my expert picks for the best Employer of Record services in Switzerland.

Market Details for Hiring in Switzerland

- Capital City: Bern

- Official Language: German, French, Italian, Romansh

- Payroll Frequency: Monthly (most common)

- Currency: Swiss Franc (CHF)

- Estimated Current Population: Approximately 8.96 million

- Public Holidays: 7 to 14 days (depending on canton)

Why Hire Employees in Switzerland?

Switzerland offers companies access to a highly educated, multilingual workforce known for technical precision, innovation, and strong global business skills. Professionals in Switzerland are fluent in German, French, Italian, and English, providing a major advantage for businesses operating across international markets.

The country is recognized for its deep expertise in pharmaceuticals, biotechnology, banking and finance, information technology, precision engineering, and hospitality. Companies sourcing talent in Switzerland often tap into some of the best professionals in pharmaceutical research, private banking, wealth management, luxury goods, and hotel management.

Switzerland’s strong education system, economic stability, top global innovation rankings, and high quality of life contribute to its standing as a premier market for hiring exceptional global talent. Its strategic location in the heart of Europe further strengthens its appeal for companies searching for the best international candidates.

What is an Employer of Record in Switzerland?

An Employer of Record (EOR) in Switzerland is a service that acts as the legal employer for a company’s workers in Switzerland. The parent company still controls the employees’ day-to-day work, but the EOR handles everything related to legal employment. They will handle drafting employment contracts, running payroll and withholding taxes, registering workers with social security, ensuring compliance with Swiss labor laws, and managing terminations.

Companies often use an EOR service in Switzerland to hire quickly without setting up a Swiss legal entity.

HR departments, startups, and growing international businesses seek EOR services to handle local employment rules, taxes, and employee benefits in Switzerland.

It’s a way to ensure employees are hired legally and paid properly without taking on the time and cost of opening a branch.

Why Trust Our Reviews

We’ve been testing and reviewing HR software and services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better partnership decisions. We’ve tested more than 2,000 tools and researched hundreds of service providers for different HR use cases, and written over 1,000 comprehensive reviews. Learn how we stay transparent & check out our review methodology.

Best Employer of Record in Switzerland: Comparison Chart

This comparison chart summarizes pricing details for my top Employer of Record selections for hiring staff in Switzerland to help you find the best EOR service for your budget and business needs.

| Service | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for remote teams | Free trial + demo available | From $29/month | Website | |

| 2 | Best AI-driven EOR platform | Free trial available | From $579/month | Website | |

| 3 | Best for budget-friendly options | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best for EOR support in Switzerland | Free demo available | $99/employee/month | Website | |

| 5 | Best for statutory compliance | Free demo available | Pricing upon request | Website | |

| 6 | Best for compliance focus | Free demo available | From $20/user/month (billed annually) | Website | |

| 7 | Best for ease of use | Not available | From $199/employee/month | Website | |

| 8 | Best for competitive benefits packages | Free trial available | From $29/user/month | Website | |

| 9 | Best for small businesses | Not available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 10 | Best for complex payroll needs | Free demo available | Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Reviews of the Best Employer of Record Services in Switzerland

To help you find the best EOR service provider for hiring staff in Switzerland, I’ve described my top 10 selections in detail, including their key services, unique specialties, and pros & cons. I’ve also listed 10 additional Swiss EOR services below if you’d like additional options to consider.

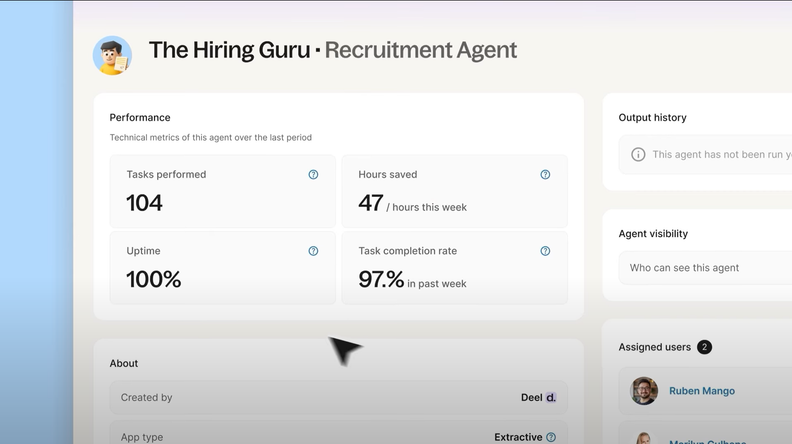

Deel offers services for hiring and managing employees in Switzerland, focusing on simplifying payroll, compliance, and benefits management for international teams. Their main client base includes companies looking to manage remote workforces across borders efficiently.

Why I picked Deel: Deel's quick onboarding process in Switzerland, with an average duration of three days, supports remote teams by reducing wait times and ensuring efficient hiring. Their automated tax document collection further aids remote teams by minimizing administrative burdens.

In addition, their comprehensive online dashboard lets you easily manage employee benefits, making it ideal for teams across various locations.

Standout Services: Deel provides automated tax document collection to help you stay compliant with local tax laws without the hassle of manual paperwork. Their comprehensive dashboard also gives you a clear view of employee benefits, making managing your team's needs easier from anywhere.

Their services are backed by a user-friendly web app and new mobile app that offers a range of features, including digital contract management and expense tracking.

Target industries: Gaming, fintech, IT services, consulting, healthcare, and manufacturing.

Specialties: Employer of Record (EOR), immigration support, global payroll, and HR solutions.

Pros and cons

Pros:

- Localized benefits options

- Automated tax document collection

- Quick onboarding process

Cons:

- Employer costs vary per country

- Limited customization options

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Borderless AI provides Employer of Record services in Switzerland, helping companies hire, pay, and manage employees without opening a local entity. Its platform uses AI to reduce the manual work of onboarding, payroll, and compliance across more than 170 countries.

Why I picked Borderless AI: As an AI-driven EOR platform, Borderless AI can help you manage Swiss employment requirements—like taxes, benefits, and contracts—without setting up a local branch. Its AI tools assist with compliance monitoring and HR tasks, which can be useful when navigating Switzerland’s evolving labor laws.

Another reason I chose it is the pay-as-you-go pricing with no upfront deposits, which helps you stay flexible while managing cash flow. You also get access to local compliance documents and 24/7 support, reducing the time spent chasing answers.

Standout Services: Borderless AI includes AI tools like HRGPT to answer employment questions and a contract generator to help you create locally compliant agreements in minutes. You can also use the compensation checker to evaluate competitive salary benchmarks by role and region. If you work with contractors, you can manage classification, documentation, and local payments through the same platform.

Target industries: SaaS, fintech, HR tech, e-commerce, and global operations

Specialties: AI-native HR, Swiss payroll, contractor management, compliance oversight, and global employment documentation

Pros and cons

Pros:

- Facilitates international expansion without the need for local entities

- Offers clear, flat-rate pricing

- Provides an AI-powered assistant

Cons:

- Reporting and analytics tools are not extensive

- Does not offer direct recruitment or applicant tracking functionalities

New Product Updates from Borderless AI

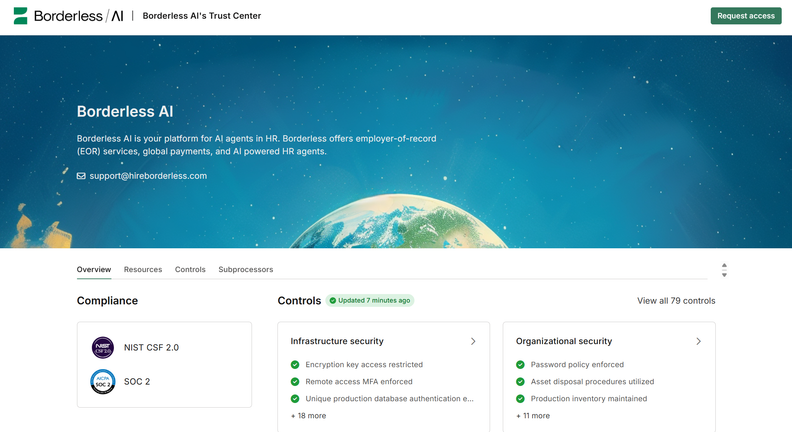

Borderless AI is Now SOC 2 Type II Certified

Borderless AI announced its SOC 2 Type II certification, emphasizing security and data protection with a new Trust Center and plans for ISO 27001 certification. More details are available at the Borderless AI Blog.

RemoFirst provides Employer of Record services, focusing on global payroll management, onboarding international contractors, and legal compliance. Their main client base includes startups and companies looking to expand their talent pool internationally without setting up local entities.

Why I picked RemoFirst: RemoFirst simplifies the hiring process for budget-conscious startups by offering cost-effective global payroll management. Their visa assistance in 85 countries, including Switzerland, helps businesses pursue international expansion while managing costs.

By handling legal compliance, RemoFirst allows you to focus on your core business activities without worrying about local regulations.

Standout Services: RemoFirst's global payroll management helps your team efficiently manage salaries across multiple countries, addressing international financial challenges. Their RemoHealth insurance provides health coverage for your employees worldwide, ensuring their well-being and reducing administrative burdens.

RemoFirst also offers visa and work permit support in 85 countries, helping small HR teams navigate complex legal landscapes efficiently.

Target industries: Startups, technology, finance, healthcare, and manufacturing.

Specialties: HR management, payroll solutions, visa assistance, legal compliance, and global employment.

Pros and cons

Pros:

- Access to hiring resources

- Comprehensive health insurance

- Supports over 150 countries

Cons:

- Limited platform integrations

- Limited local offices in some regions

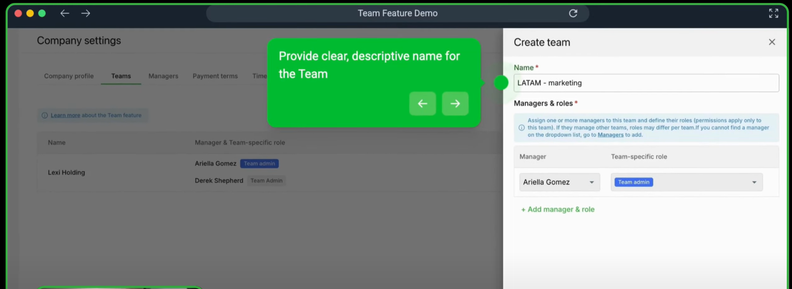

New Product Updates from RemoFirst

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

Native Teams offers services for hiring and managing employees in Switzerland, helping companies onboard talent without the need to set up a local entity. Their platform simplifies payroll, compliance, and benefits while offering hands-on support with contracts, taxes, and relocation.

Why I picked Native Teams: Native Teams stands out for its straightforward, step-by-step approach to legal employment in Switzerland. Their localized support and Swiss legal entity make it easy to onboard talent quickly—no paperwork maze or delays. The platform also helps you stay compliant with regional laws and wage requirements, which vary across cantons.

Additionally, they offer support beyond payroll, including health benefits administration, relocation help, and employee-level assistance, making them a strong fit for globally scaling teams that value employee care.

Standout Services: Native Teams provides contract generation aligned with Swiss labor laws, automated payroll in CHF, tax deductions, and guided onboarding through their Swiss entity. They also support bulk multi-currency payments, expense tracking, and provide dedicated expense cards for employees. Relocation services—including visa and permit assistance—are also available.

Target industries: Startups, fintech, consulting, healthcare, and remote-first companies.

Specialties: Employer of Record (EOR), global payroll, contractor payments, benefits administration, and relocation support.

Pros and cons

Pros:

- Covers fewer countries than some competitors

- May not offer advanced HR tools beyond essential employment features

- Offers localized payroll calculators for accurate salary and tax computations

- Provides compliant employment contracts and documentation

- Enables hiring globally without establishing a local entity

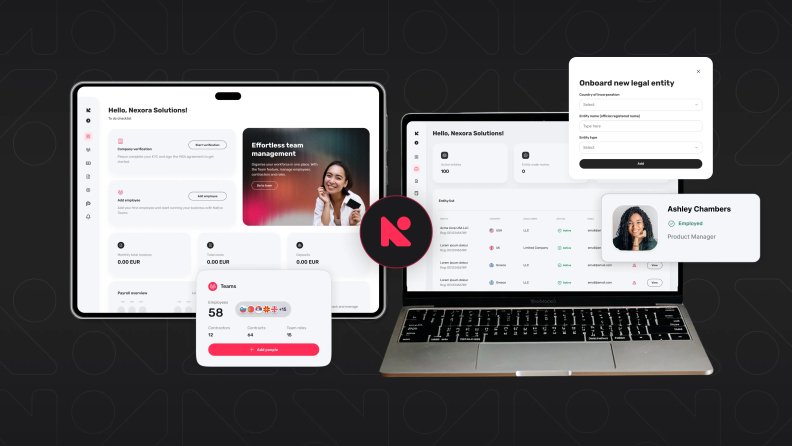

New Product Updates from Native Teams

Native Teams Introduces Entity Management Solution

Native Teams unveils an all-in-one solution to streamline business entity management and reduce costs. For more information, visit Native Teams's official site.

TopSource Worldwide provides Employer of Record (EOR) services focused on compliant hiring, global payroll management, and HR support tailored to Swiss regulations. Their services help businesses expand internationally without establishing a local entity, with particular strengths in managing payroll, accounting, and HR compliance.

Why I picked TopSource Worldwide: TopSource Worldwide simplifies hiring in Switzerland by managing employment contracts, payroll, and statutory compliance in alignment with local labor laws. Their expertise helps businesses mitigate the risks of non-compliance while streamlining HR operations.

Their additional services include onboarding support and advisory for financial compliance, allowing you to focus on growth while they handle the complexities of employment law and payroll.

Standout Services:

TopSource Worldwide offers tailored talent acquisition support to help you find qualified candidates in Switzerland. Their scalable solutions extend to local entity setup assistance, global payroll management, and HR advisory services. They also prioritize compliance and data security, helping businesses meet strict Swiss standards with confidence.

Target industries: Technology, finance, healthcare, manufacturing, and international SMBs.

Specialties: Employer of Record services, payroll management, HR support, entity setup, and compliance with Swiss labor regulations.

Pros and cons

Pros:

- Wide country coverage with 180+ supported markets

- Strategic HR guidance available for expansion planning

- Service includes direct access to local experts

Cons:

- Limited reporting or automation features compared to tech-driven platforms

- No integrations with popular HRIS platforms

New Product Updates from TopSource

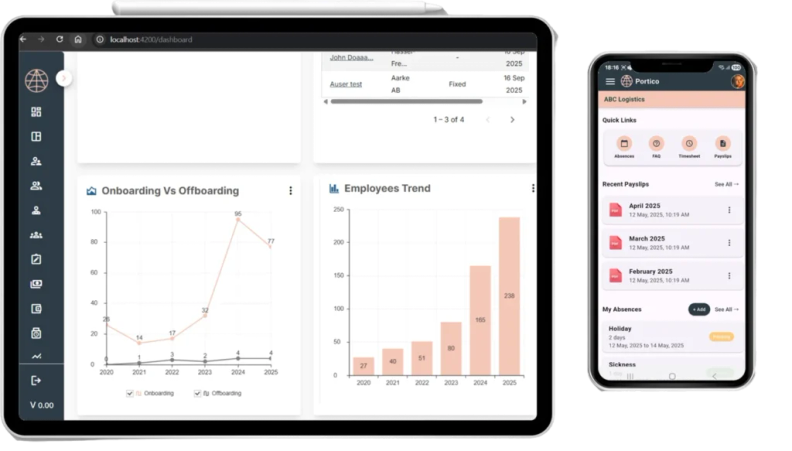

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

Multiplier offers an EOR solution that helps businesses hire and manage employees in Switzerland without setting up a local entity. They focus on employment, payroll, benefits, and compliance support for growing teams and foreign companies.

Why I picked Multiplier: Multiplier is built for companies needing a local Switzerland employer focused on compliance with local regulations. It handles income tax filings, employment contracts, and statutory benefits so your team can avoid compliance risks. The platform also streamlines onboarding and payroll tasks, making it easier to keep everything in one place.

Standout Services: Multiplier offers automated employment contract generation so you can quickly create compliant, locally accurate contracts without needing a legal team to draft them from scratch. They also provide multi-country payroll management that lets your team pay Swiss and global employees from one platform without juggling different systems.

Target industries: Technology, finance, education, healthcare, and consulting.

Specialties: Contract management, payroll processing, benefits administration, compliance tracking, and contractor onboarding.

Pros and cons

Pros:

- Supports visa and immigration

- Pays salaries in multiple currencies

- Manages multi-country benefits

Cons:

- Extra fees for immigration services

- Customer support speed varies

Remote People provides Employer of Record (EOR) services designed to help businesses hire and manage talent globally, including in Switzerland. Their platform supports international payroll, contractor management, employee benefits, and compliance with local labor laws, making it easier to expand into new markets without setting up a local entity.

Why I Picked Remote People: I picked Remote People because it combines global payroll, EOR services, and contractor management into a single solution. This is especially useful if you're expanding into Switzerland and need reliable compliance support while managing employees or contractors.

I also liked that their benefits administration features make it easier to offer competitive packages while staying compliant with Swiss employment regulations.

Standout Services: Remote People offers a dedicated contact point to provide personalized support when navigating Switzerland’s employment laws and onboarding requirements. Their streamlined EOR processes make it easier to manage international teams without setting up a local presence.

Target Industries: Startups, SaaS companies, tech, finance, healthcare, and multinational enterprises.

Specialties: Global payroll, EOR services, contractor management, recruitment, benefits administration, and compliance support.

Pros and cons

Pros:

- Candidate placement guarantee

- Dedicated client support contact

- Wide recruitment network

Cons:

- No publicly listed integrations

- Some services available only in certain regions

Remote offers employer of record Switzerland services to help companies hire, pay, and manage employees without needing a local entity. They support HR teams by handling onboarding, payroll, benefits, and compliance for international workers.

Why I picked Remote: Remote makes it easy to onboard employees in Switzerland within 8 working days using local contract templates and automated workflows. They handle everything from employment contracts to payroll setup so your team can immediately focus on getting new employees started. You can also access benefits management and compliance help without building local infrastructure.

Standout Services: Remote offers intellectual property protections that help you keep ownership of your company’s inventions and ideas when hiring in Switzerland.

They also provide global benefits packages, including local health insurance, pensions, and other perks with no premiums or mark-ups added, making them a cost effective choice.

Target industries: Technology, life sciences, financial services, education, and consulting.

Specialties: intellectual property protection, benefits administration, payroll setup, contractor management, and local compliance support.

Pros and cons

Pros:

- Easy benefits setup

- Strong IP protection

- Transparent management tools

Cons:

- Some features cost extra

- Limited contract flexibility

Omnipresent offers Employer of Record services in Switzerland, focusing on managing remote teams' payroll, compliance, taxes, and administrative tasks. Their primary clients are small businesses looking to expand globally without establishing local entities.

Why I picked Omnipresent: Omnipresent provides insights into local employment laws and employee costs, making it ideal for small businesses needing compliance support. Their fast setup and customized solutions help your team hire quickly, reducing time to market.

Their global hiring navigator and cost estimation tools ensure you make informed decisions while expanding internationally.

Standout Services: Omnipresent's employee costs calculator helps you estimate hiring expenses accurately, aiding in budget planning. Their global hiring navigator provides insights into local laws and practices, ensuring your team remains compliant and informed.

Omnipresent also offers global mobility support, including assistance with visas, work permits, and relocation services.

Target industries: Technology, finance, healthcare, manufacturing, and retail.

Specialties: Payroll management, compliance, PEO services, contractor management, and HR support.

Pros and cons

Pros:

- Employee cost estimation tools

- Global hiring navigator available

- Insights into local employment laws and tax regulations

Cons:

- Focused on small businesses

- Limited customization options

Mercans offers EOR services in Switzerland, focusing on payroll processing, HR management, and compliance with local labor laws. Their main clients are businesses seeking efficient payroll solutions and workforce management support without establishing a local presence.

Why I picked Mercans: Mercans provides integrated payroll solutions catering to complex payroll needs, making it ideal for businesses managing diverse workforces. Their platform supports real-time payroll processing, ensuring your team stays on top of salary disbursements.

In addition, their compliance management tools help you navigate Swiss labor laws effectively.

Standout Services: Mercans' real-time payroll processing helps your team stay on top of salary disbursements, reducing administrative delays and errors. Their compliance management tools ensure your operations adhere to Swiss labor laws, mitigating potential legal risks and supporting smooth business operations.

Target industries: Technology, finance, healthcare, manufacturing, and retail.

Specialties: Payroll processing, HR management, compliance, tax advisory, and employee benefits.

Pros and cons

Pros:

- Supports diverse workforces

- Reduces administrative delays

- Strong compliance management

Cons:

- Limited software integrations

- Pricing details are not transparent

Other Employer of Record Switzerland

Here are some additional EOR providers in Switzerland that didn’t make it onto my shortlist, but are still worth checking out:

- Horizons

For quick onboarding

- Pebl

For fast global expansion

- G-P

For enterprise clients

- Papaya Global

For data security

- Skuad

For tech startups

- Atlas HXM

For global cost calculations

- Oyster HR

For remote-first companies

- Rippling

For integrated HR and IT solutions

- NNRoad

For flexible contract options

- Bradford Jacobs

For European market exploration

Hiring in Switzerland: Important Details

- Employment laws in Switzerland are set by the Federal Labour Act and the Swiss Code of Obligations (see the Swiss State Secretariat for Economic Affairs [SECO] for more information).

- You can hire full-time employees, part-time employees, temporary workers, seasonal workers, and independent contractors in Switzerland. Contracts can be open-ended or fixed-term. Temporary and seasonal hires are often used for short-term projects, and companies must avoid misclassifying contractors under Swiss labor laws.

- Switzerland has both mandatory payroll deductions and other employment or social security contributions that must be collected, including:

- AHV (Old Age and Survivors' Insurance)

- IV (Disability Insurance)

- EO (Income Compensation Allowance)

- ALV (Unemployment Insurance)

- BVG (Occupational Pension Plan)

- Accident Insurance (UVG)

- Withholding tax (if applicable)

- Switzerland has four official languages: German, French, Italian, and Romansh.

- The standard working week in Switzerland is typically 40 to 44 working hours, with a maximum of 5 consecutive days of work.

- Overtime is allowed in Switzerland under the Federal Labour Law (LTr). It is calculated as 125% of the regular hourly wage or compensated with time off unless otherwise agreed.

- Swiss employees are paid monthly. A 13th-month salary is also common, usually paid in December or split between June and December.

- Paid vacation in Switzerland starts at a minimum of four weeks (20 working days) per year for adults and five weeks for employees under 20 years old.

- National public holidaysin Switzerland and numerous regional holidays that are celebrated in different areas (cantons). Swiss national public holidays include:

- New Year's Day – January 1

- Good Friday – Variable date (March or April)

- Easter Monday – Variable date (March or April)

- Sechseläuten – April (Zurich)

- Ascension Day – Variable date (39 days after Easter)

- Whit Monday – Variable date (50 days after Easter)

- Corpus Christi - June

- Swiss National Day – August 1

- All Saints’ Day - November

- Christmas Day – December 25

- St. Stephen's Day – December 26

- Switzerland offers both maternity and paternity leave. During these leaves, employees receive 80% of their salary, paid through Switzerland’s income compensation scheme (EO).

- Maternity leave entitlement is 14 weeks (98 days) starting immediately after childbirth.

- Paternity leave entitlement is 2 weeks, to be used within six months of the child's birth.

- Paid sick leave in Switzerland is at least three weeks during the first year of service, increasing with seniority according to cantonal laws or specific company agreements. Employers must continue salary payments during sickness, sometimes through insurance after a waiting period.

- The probationary period is typically one month, but can be extended up to three months if agreed in writing in the employment contract.

- The termination terms are mandated by the Swiss Code of Obligations (CO). The required notice period is one month during the first year of service, two months between the second and ninth year, and three months after the tenth year, unless otherwise agreed.

- Severance pay is generally not required unless agreed by contract or in cases of mass layoffs, but employees aged over 50 with more than 20 years of service may be entitled to a severance payment.

- Other relevant employment-related information for Switzerland:

- Employees are protected from dismissal during certain protected periods (such as maternity leave or illness).

- Trial periods are allowed but must be clearly stated in writing.

- Employers must respect Swiss anti-discrimination laws during hiring and employment.

Selection Criteria for Employer of Record Switzerland

Selecting the best EOR service providers for this list required a deep understanding of how they address common business needs and pain points such as ensuring compliance with Swiss labor laws, offering competitive benefits, and managing efficient global payroll processing.

I also used the following framework to keep my evaluations structured and fair:

Core EOR Services (25% of total score): To be considered for inclusion in this list, each provider had to offer these basic services:

- Managing payroll and Swiss tax regulations

- Handling employee benefits and insurance

- Ensuring compliance with local labor laws

- Facilitating work visas and permits

- Providing HR support and guidance

Additional Standout Services (25% of total score): To help further narrow down the competition, I also looked for unique or especially valuable services, such as:

- Offering flexible relocation support

- Providing contractor-to-employee conversions

- Ensuring data security with advanced encryption

- Customizing solutions for specific industries

- Providing real-time payroll processing

Industry Experience (10% of total score): To get a sense of the industry experience of each provider, I considered the following:

- Years of operation in the industry

- Number of countries served

- Range of industries covered

- Expertise in Swiss labor laws

- Client testimonials and case studies

Customer Onboarding (10% of total score): To evaluate the customer onboarding experience for each provider, I considered the following:

- Speed of onboarding process

- Clarity of onboarding instructions

- Availability of onboarding support

- Flexibility to adapt to unique needs

- Feedback from clients on onboarding

Customer Support (10% of total score): To assess the level of customer support each provider offers, I considered the following:

- Availability of support channels

- Response time to inquiries

- Quality of support provided

- Language options for support

- Client feedback on support experience

Value for Price (10% of total score): To evaluate the pricing and potential ROI of working with each provider, I considered the following:

- Transparency of pricing structure

- Comparison with industry standards

- Flexibility in pricing plans

- Inclusions in pricing packages

- Client feedback on value for money

Customer Reviews (10% of total score): To get a sense of the overall satisfaction of existing customers, I considered the following when reading customer reviews:

- Overall satisfaction ratings

- Commonly praised features

- Reported challenges or issues

- Frequency of positive feedback

- Consistency in service delivery feedback

How to Choose an Employer of Record in Switzerland

It’s easy to get bogged down in long lists of services and complex pricing structures. To help you prioritize the things that matter most for your business, keep the following factors in mind:

| Factor | What to Consider |

| Business Objectives | Align the provider's services with your strategic goals. If you're expanding rapidly, ensure they can support quick scaling in multiple locations. |

| Service Scope and SLAs | Look for clear definitions of services and service level agreements (SLAs). Ensure they cover all your needs, from payroll to compliance and employee management. |

| Support Availability | Check if the provider offers 24/7 support and multiple contact methods. Quick response times can be crucial for resolving urgent issues effectively. |

| Costs and Pricing Structure | Understand the full pricing details, including any hidden fees. Compare with other providers to ensure you're getting good value for your investment. |

| Communication and Reporting | Ensure they offer regular updates and transparent reporting. This helps you stay informed about employee management and compliance requirements. |

| Geographic Reach | Verify their ability to operate in all regions where you plan to hire. This is vital for global expansion. |

| Compliance Expertise | Confirm their knowledge of Swiss labor laws and regulations. Expertise in compliance helps avoid legal pitfalls and penalties. |

| Customization Options | Check if they offer tailored solutions for your industry. Customization can address specific challenges unique to your business sector. |

Key Employer of Record Services

When selecting an EOR provider in Switzerland, keep an eye out for the following key services:

- Payroll management: Efficiently handles salary disbursements and tax withholdings, ensuring compliance with Swiss financial regulations.

- Compliance expertise: Provides guidance on local labor laws to help you avoid legal issues and penalties.

- Employee benefits administration: Manages health insurance and retirement plans, ensuring your team receives competitive benefits.

- Work visa facilitation: Assists in obtaining necessary visas and permits for international employees, simplifying the relocation process.

- HR support and guidance: Offers expert advice and support for employee relations and performance management.

- Real-time payroll processing: Ensures timely and accurate salary payments, reducing administrative errors.

- Contractor conversions: Transitions contractors to full-time employees smoothly, adapting to changing business needs.

- Data security measures: Protects sensitive employee information with advanced encryption and privacy standards.

- Global hiring navigator: Provides insights into hiring practices and costs in different regions, supporting strategic expansion.

- Customizable reporting: Offers detailed and tailored reports to keep you informed about workforce management and compliance status.

Benefits of a Swiss Employer of Record

Partnering with an EOR provider in Switzerland offers several benefits for your team and your business. Here are a few benefits you can look forward to:

- Simplified compliance: Ensures adherence to Swiss labor laws, reducing the risk of legal issues through expert guidance.

- Efficient payroll management: Handles salary disbursements accurately and on time, freeing your team from administrative burdens.

- Access to global talent: Facilitates hiring and managing employees across borders, expanding your talent pool without establishing local entities.

- Cost-effective operations: Manages HR tasks and benefits, allowing you to focus resources on core business activities.

- Quick market entry: Speeds up the process of entering new markets by handling local employment logistics and compliance needs.

- Enhanced data security: Protects sensitive employee information with advanced security measures, ensuring privacy compliance.

- Flexible workforce solutions: Offers services like contractor conversions and visa facilitation, adapting to your changing business needs.

Costs & Pricing Structures for EOR Services in Switzerland

Typically, the cost of an EOR service follows a fee per-employee, per-month pricing model, offering predictability and flexibility for companies expanding into new markets.

In general, EOR services in Switzerland cost between $199 to $599 per employee, per month.

Alternatively, some EOR services in Switzerland charge a percentage of the employee’s salary, ranging between 10% to 15%.

Key factors that can influence the pricing of an employer of record service include:

- Customization needs: Tailoring services to specific business requirements can increase costs due to additional resources.

- Industry regulations: Complying with specific industry standards may require specialized expertise, impacting pricing.

- Number of employees: Managing a larger workforce typically results in higher costs due to increased administrative work.

- Geographic reach: Expanding services to multiple regions can affect pricing due to varying compliance needs.

- Service complexity: More complex service offerings can lead to higher costs due to the depth of support required.

Some EORs in Switzerland operate under different pricing structures, including fixed monthly rates, percentage-based models tied to salary, or custom pricing based on specific business needs. Understanding how each factor impacts the final cost can help ensure the service fits both your hiring goals and your budget.

FAQs About EOR Services in Switzerland

Here are some answers to common questions about employer of record providers in Switzerland:

What is the minimum wage in Switzerland?

Switzerland does not have a national minimum wage; instead, individual cantons set their own rates.

As of January 1, 2025, the following cantons have established minimum wages:

- Geneva at CHF 24.48 per hour

- Basel-City at CHF 22.00

- Neuchâtel at CHF 21.31

- Jura at CHF 21.40, and

- Ticino ranges between CHF 19.00 and CHF 20.50, depending on the sector.

The minimum wages across Swiss cantons are typically adjusted annually to reflect changes in the cost of living.

In regions without statutory minimum wages, compensation is often determined through collective labor agreements (CLAs) between employers and trade unions. These agreements set industry-specific wage standards, ensuring fair compensation across various sectors.

For the most current information on minimum wage regulations in Switzerland, consult the State Secretariat for Economic Affairs (SECO) or the relevant cantonal labor offices.

Are collective bargaining agreements common in Switzerland?

Yes, collective bargaining agreements (CBAs) are relatively common in Switzerland and play a key role in regulating employment conditions across many sectors. While not all workers are covered by a CBA, approximately half of all Swiss employees benefit from one.

These agreements are typically negotiated between trade unions and employer associations and can set binding rules on wages, working hours, holidays, and other employment terms within specific industries or companies.

Switzerland’s decentralized labor market relies heavily on social partnership and consensus. Some CBAs are declared generally binding by the federal or cantonal authorities, meaning they apply to all employers and employees in that sector—even if they are not union members. This helps promote fair labor standards and minimize labor disputes.

How does an employer of record help with compliance?

An employer of record ensures your business complies with Swiss labor laws by managing all employment-related legalities. They handle contracts, payroll, and benefits according to local regulations. This reduces the risk of legal issues and penalties, allowing you to focus on your core business operations.

Can an employer of record manage international hires?

Yes, an employer of record can facilitate hiring across borders, making it easier to expand your team internationally. They manage employment logistics, including work permits and local compliance, so you don’t need to establish a local entity. This is particularly beneficial for companies looking to quickly enter new markets or access talent abroad.

What’s the difference between an employer of record and a staffing agency?

An employer of record becomes the legal employer of your team, handling compliance and payroll, while you manage day-to-day tasks.

A staffing agency, on the other hand, recruits and provides temporary staff, often handling both employment and management.

Choose based on whether you need ongoing employment support or temporary staffing solutions.

How are costs typically structured with an employer of record?

Costs can vary based on pricing models like subscription-based or per employee. Factors such as the number of employees, geographic reach, and service complexity also influence pricing. Understanding these elements helps you prepare for costs and compare providers effectively.

Is it possible to transition employees from a contractor status?

Yes, many EOR providers offer contractor-to-employee conversion services. This helps you transition contractors to full-time employees smoothly, adapting to changing business needs. This service helps maintain compliance and manage benefits as your workforce grows.

What kind of businesses benefit most from using an employer of record?

Businesses looking to expand internationally without setting up local entities benefit most from using an employer of record. Startups, small to medium-sized enterprises, and companies in industries with complex compliance needs often find these services particularly useful. They help simplify hiring and manage regulatory requirements efficiently.

What's Next?

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.