Best Global Payroll Services Shortlist

The best global payroll services help you pay international employees accurately, stay compliant with local labor laws, and reduce your risk of fines, delays, and classification errors. If you’re juggling multiple payroll vendors, struggling with inconsistent reporting, or constantly worried about legal exposure in unfamiliar markets, you're not alone.

Many HR professionals managing globally distributed teams face the same challenges, and need a centralized, reliable solution that handles everything from in-country tax filings and multi-currency payments to employee self-service tools and legal compliance without needing a local entity.

I’ve spent 3+ years researching HR software and payroll solutions, and I specialize in helping companies find scalable, legally sound HR systems and services. That's why I know how hard it can be to choose the right one.

In this article, I’ll share my insights on the best global payroll services available, ranked for their global compliance capabilities, ease of use, and ability to support seamless international expansion.

You Can Trust Our Reviews

We’ve been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help you make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Global Payroll Services: Comparison Chart

This comparison chart summarizes pricing, trial, and demo details for my top global payroll service selections to help you find the best option for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best with all-in-one HR | Free trial + demo available | From $29/month | Website | |

| 2 | Best for global payroll without local entities | Free demo available | Pricing upon request | Website | |

| 3 | Best for onboarding and payment compliance | Free demo available | From $20/user/month (billed annually) | Website | |

| 4 | Best for budget-conscious remote team expansion | Free demo available | From $25 - $199/user/month | Website | |

| 5 | Best for complex enterprise payroll setups | Free demo available | From $314/month | Website | |

| 6 | Best for integrated HR and payroll | Free demo available | Pricing upon request | Website | |

| 7 | Best for scalable payroll | Free demo available | Pricing upon request | Website | |

| 8 | Best for ease of use | Free trial available | From $29/user/month | Website | |

| 9 | Best for compliant freelancer payments | Free demo available | Pricing upon request | Website | |

| 10 | Best for dedicated global payroll expertise | Free demo available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 11 | Best add-on to an HRMS solution | Free demo available | From $6.40/user | Website | |

| 12 | Best for global expansion management | Free demo available | Pricing upon request | Website | |

| 13 | Best for in-country expertise | Free demo available | From $49/contractor/month | Website | |

| 14 | Best for unified local and global payroll | Free demo available | Pricing upon request | Website | |

| 15 | Best for HR outsourcing | Free demo available | Pricing upon request | Website | |

| 16 | Best for assistance with work permits | Free demo + free trial | From $199/month | Website | |

| 17 | Best for eliminating third-party aggregators | Free demo available | Pricing upon request | Website | |

| 18 | Best for additional EOR services | Free demo available | From $29/contractor/month or $299/employee/month | Website | |

| 19 | Best for hiring without local entities | Not available | From $199/employee/month | Website | |

| 20 | Best for supporting global expansion | Free demo available | Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5 -

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Reviews of the Best Global Payroll Services

I’ve put together detailed reviews to help you quickly compare top global payroll providers. Each one explains why it made the list, highlights standout features like tax handling and local compliance support, and includes screenshots so you know what to expect before booking a demo.

Deel is a global payroll service provider that can help you hire employees in over 150 countries. It allows you to hire anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll.

Why I picked Deel: Their automated processes let you set up global payroll in less than a month. Deel has local country experts working in-house to provide consultative approaches for each location you hire from, ensuring compliance with local pay standards.

Their platform lets you handle end-to-end workforce management, including custom contract adjustments, expense reimbursements, and off-cycle payroll adjustments.

Deel offers 10+ payment options for clients, ranging from bank transfers to cryptocurrency pay-ins. You can schedule payments in advance and run off-cycle payroll runs whenever needed.

For employees and contractors on Deel, they can self-manage their pay and personal data and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals.

Deel Features and Integrations:

Key features, in addition to their global payroll service run by local experts, include several new offerings that Deel's launched over the past year, including global mobility support, integrated Slack tools, and advanced integrations. Their global mobility service helps companies with visa sponsorship, allowing them to bring in candidates from abroad.

Deel is one of the largest international payroll solutions listed here, with the company reporting over 100,000 active worker contracts. They offer 24/7 online support and dedicated account managers for specific requests.

Integrations are available with Ashby, BambooHR, Expensify, Greenhouse, Hibon, NetSuite, Okta, OneLogin, Quickbooks, Xero, Workday, and Workable. They also have an Open API to support additional custom integrations too.

Pricing for Deel is available upon request and is a flat rate. You can also request a free demo through their website.

New Product Updates from Deel

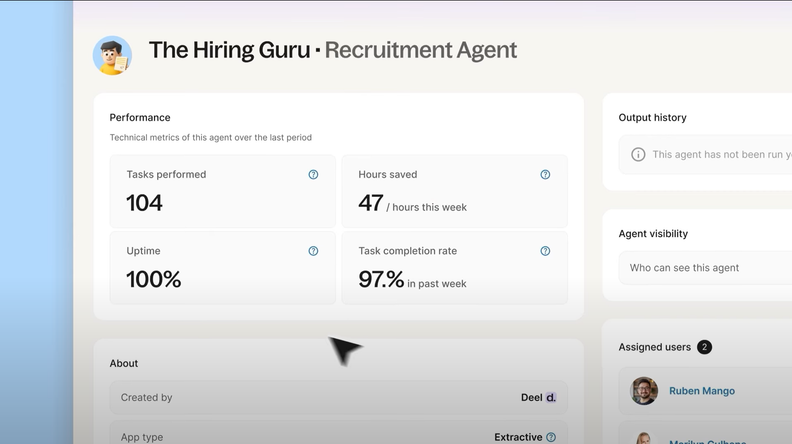

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

G-P is a global employment platform that helps businesses hire, manage, and pay international teams without setting up local entities. It offers tools to handle payroll, compliance, and HR tasks across 180+ countries. With G-P, companies can expand their workforce globally while ensuring local legal and tax compliance.

Why I picked G-P: G-P stands out for its ability to process payments to employees and contractors in over 180 countries, accommodating various currencies and preferred payment methods.

This flexibility ensures that your team members receive payments in a manner that suits them best, whether through digital wallets, ACH, bank transfers, wire transfers, or virtual cards. Plus, G-P's platform supports batch payments for multiple invoices, even in different currencies.

Another key feature is G-P's commitment to compliance. The platform offers tools to navigate complex international payroll regulations, including tax laws and worker classification rules. Their Global Payroll Compliance Checklist provides guidelines to implement a compliant global payroll system and highlights key information on global data protection regulations.

The platform even offers G-P Gia™, an AI-driven tool that provides HR compliance guidance, helping you make informed decisions and reduce operational costs.

G-P Features and Integrations:

Key features include equity payroll management, which allows you to offer equity-based compensation in supported countries while ensuring compliance with local labor laws. The platform also provides ongoing HR support, assisting with payroll, benefits, PTO, and expenses, and keeping you informed about changes in regulations.

In addition, G-P's Employment Contract Generator enables you to create compliant employment contracts quickly, reducing the time to hire and ensuring adherence to local legal requirements.

Integrations include BambooHR, Personio, TriNet, UKG Pro, UKG Ready, Workday, SAP SuccessFactors, ADP, HiBob, and Sage Intacct.

Pricing for G-P is available upon request and depends on your specific needs.

Multiplier is a global payroll solution that provides HR and online payroll services to businesses, especially those who are entering new geographic locations or employing workers in different countries. Their unified platform helps businesses to manage their global payroll and HR operations, ensuring consistency and efficiency.

Why I picked Multiplier: Multiplier handles global payroll by partnering with local payroll providers and tax experts in the countries where its clients have employees; this enables Multiplier to provide accurate and compliant payroll processing services while ensuring that all relevant local taxes and contributions are paid on behalf of the employees.

Multiplier excels in providing a comprehensive and technology-driven solution for businesses managing global payroll and HR operations. The platform offers a user-friendly interface and integrates with other HR tools, making it easy for businesses to manage their payroll, benefits, and compliance in multiple countries.

Multiplier's team of experts also provides ongoing support and guidance, ensuring that businesses are always up-to-date with the latest laws and regulations.

Multiplier Features and Integrations:

Key features and services include payroll processing, tax compliance, benefits administration, and worker's compensation. Multiplier’s global payment system supports payments in 120+ currencies.

Integration details are not currently available.

Pricing for Multiplier's global payroll service starts at $20/employee/month or $40/contractor/month. You can also request a free demo of their platform through their website.

RemoFirst is an international payroll service provider on a mission to free employers from geographical boundaries so they can access global talent with ease.

Why I picked RemoFirst: Their global payroll platform simplifies the international payroll process, paying your distributed employees in their own local currency, while giving you the option to summarize and aggregate your invoices into one payment, rather than making multiple individual payments.

RemoFirst’s software can also automatically calculate your team’s hours, time off, holidays, bonuses, and commissions so you don’t have to worry about it, especially if you are budget-conscious. Instead, you only need to review their monthly invoice and approve it for payment.

Their team of legal experts and HR professionals will also ensure your international payroll operations are always compliant with changing global regulations in all 170+ countries they operate in. To put your mind at ease, your compliance documentation is also accessible at all times through your secure dashboard.

Their customer support team is also always reachable 24/7 in case you need extra help. All clients also receive a dedicated account manager as their main point of contact too.

RemoFirst Features and Integrations:

Key features, in addition to their global payroll services, include global benefits management (including insurance and equity plans, plus time-off management), and employer of record (EOR) services, plus employee support for obtaining visas and other immigration documentation.

In addition, they can also help you with provisioning equipment to your distributed employees around the world.

Integrations include ADP.

Pricing for RemoFirst’s global payroll services cost from $199/employee/month. They also offer a $25/month plan if you only need to pay global contractors. Their services come with no hidden fees or fixed contract terms.

New Product Updates from RemoFirst

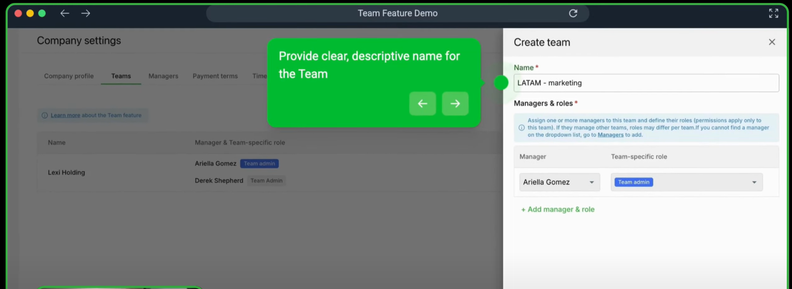

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

Lano is a global payroll and employment platform designed to help businesses manage and pay their international teams. With services spanning over 170 countries, Lano enables companies to hire, onboard, and compensate employees and contractors worldwide while ensuring compliance with local regulations.

Why I picked Lano: One reason I like Lano is its ability to centralize payroll operations across multiple countries—something especially important for complex enterprise payroll setups. Their platform lets you unify employee and salary data from various entities into a single system, giving you a clearer view of your global workforce costs.

This consolidation helps reduce administrative overhead and lowers the risk of errors that come with juggling multiple payroll systems across regions. For enterprises with layered structures and diverse teams, this level of control and consistency is key to keeping payroll accurate and manageable.

Additionally, Lano connects you to a network of vetted local payroll partners in over 170 countries. This setup helps ensure your payroll processes remain compliant with local laws, even as your operations grow and become more geographically spread out.

Lano Features and Integrations:

Features include customizable payroll reporting, allowing you to generate detailed reports tailored to your business needs, giving you insights into payroll costs and trends across your global workforce. Lano also offers automated data validation tools that reduce errors by flagging inconsistencies before payroll is processed.

In addition, Lano’s compliance management feature keeps track of changing local laws and regulations.

Integrations include HiBob, Lucca, Workday, Personio, Sage, and Zoho People.

Pricing for Lano's global payroll service starts at $22 per employee per month.

TriNet is a technology platform that provides HR services and global payroll services. It aims to help businesses manage their HR processes, employee benefits, and compliance requirements.

TriNet is best suited for businesses that operate on a global scale and need help managing their HR processes and payroll.

Why I picked TriNet: I picked TriNet as one of the best global payroll services because of its advanced features that cater to the specific needs of global businesses. Its integrated payroll system is designed to handle complex payroll regulations in various countries, making it an excellent choice for businesses that operate in multiple locations.

Another feature that makes TriNet stand out is its HR management system. It offers a centralized platform for managing HR tasks such as employee onboarding, time tracking, and benefits administration. This feature can help businesses streamline their HR processes and improve employee engagement.

TriNet Features and Integrations:

Key features include an employee perks program, global payroll solution, compliance with local tax laws and regulations, vendor perks and deals, payroll management system, custom rewards, a variety of payment options, and recognition programs.

Integrations include QuickBooks, Oracle NetSuite, Sage Intacct, BambooHR, Lattice, Greenhouse Software, Carta, and Xero.

Pricing is available upon request and a free demo is available.

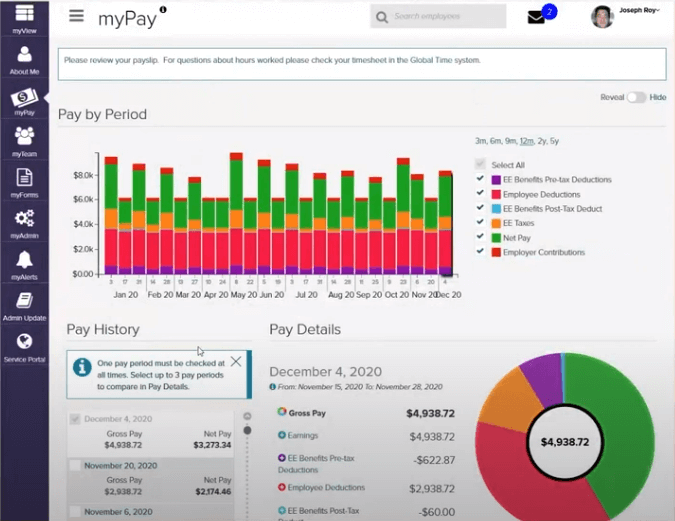

ADP’s GlobalView Payroll software is a unified global payroll and HR portal that’s flexible and scalable, making it a solid option for multinational companies of any size.

It allows you to consolidate payroll information for international employees within one centralized system, streamlining the payroll process for all employees, no matter where they’re located.

In addition, ADP’s roster of 3,000 compliance and payroll specialists provide valuable in-country expertise to ensure your payroll set up is always in compliance with international regulatory obligations.

Why I picked ADP GlobalView Payroll: Their system has several features that are helpful for distributed organizations that reduce the likelihood of staff needing to contact HR or accounting for further assistance.

For example, admin staff can proactively send communications to staff about any changes to their pay statement in advance, rather than responding to a flood of questions after the fact.

Their system also incorporates descriptive information tags that display more details when users hover over the “i” icon. These informative pop-ups also go a long way to answering common questions in advance, rather than requiring staff to reach out for further assistance.

ADP GlobalView Payroll Features and Integrations:

Features employees will appreciate include the ability to compare pay periods side-by-side and drill down into the details to understand any differences. Their system also includes a lot of employee self-service functions, and the ability to access an identical employee portal from mobile devices as well.

On the admin side, platform administrators have full control over how the employee dashboards appear, including the ability to control country-specific messaging, FAQs and display languages.

Integrations are available with 360Learning, Absorb LMS, Bob, ClearCompany, Clearlogin, Cognology, EmployeeConnect, ExpertusONE, Jostle, Limelight, Qooper, Rotageek, Sift, Spoke, Together Mentoring, uAttend, Workato, Xecex, XOR, Xoxoday, and many others.

You can also set up custom integrations with your existing HRIS system, or use ADP to moderate your HR employee data as well.

Pricing details for ADP GlobalView Payroll are available upon request. You can also request a free demo through their website.

Remote helps companies of any size hire, pay, and manage full-time, part-time, or contract workers all around the world.

Why I picked Remote: They offer global payroll services, as well as assistance with benefits administration, taxes, compliance, and employer of record (EOR) services in over 50 countries.

In addition, Remote’s equity experts can also help you develop an incentive plan and strategy to offer stock options to your international team, with them taking the lead on all the requisite tax withholding and reporting requirements.

Remote Features and Integrations:

Key features include multi-country payroll processing that simplifies the payroll process and ensures compliance and accuracy in payroll management.

Remote also supports hiring in 85+ countries with their EOR product, and contractor management across 180+ countries, with new regions added constantly. Because of Remote’s 100% owned-entity model, you have access to local legal and HR experts for additional hiring and compliance guidance.

Integrations are available with 25+ software applications including Workday, BambooHR, Easop, Greenhouse, Gusto, Hibob, Personio, Sequoia, Slack, Xero, Zelt, and other systems.

They also have an Open API to support additional custom integrations, and companies can seamlessly connect Remote with over 5,000 external apps via the Zapier integration.

Pricing starts at EOR from $599/employee/month or $29/contractor/month, and they offer a 30-day free trial + a free plan is available.

Worksome is a platform designed to help businesses manage their external workforce, including freelancers and contractors. It offers tools to find, hire, and pay external talent efficiently. By centralizing these processes, Worksome aims to reduce administrative tasks and ensure compliance with global regulations.

Why I picked Worksome: I like that Worksome has a built-in worker classification feature. This tool helps you classify workers in various regions, ensuring compliance with local labor laws and reducing the risk of misclassification. By handling this process within the platform, you can pay workers properly and avoid potential legal issues.

Worksome also offers Employer of Record (EOR) and Agent of Record (AOR) services, which enable businesses to compliantly engage talent in over 150 countries.

These services allow companies to hire and pay workers without setting up a local entity, handling payroll, taxes, and compliance on their behalf. This is particularly useful for companies scaling internationally or working with a remote workforce.

Worksome Features and Integrations:

Features include invoice and billing management, which centralizes all invoices and payments in one location, making it easy to track expenses and allocate correct purchase orders.

The platform also provides worker payment and tax verification, which helps streamline contractor payments and reduce compliance-related overcharges.

In addition, Worksome offers real-time cost visibility, giving you a clear overview of freelancer and staffing agency costs.

Integrations include SAP SuccessFactors, Workday, Xero, Netsuite, Intuit Quickbooks, Asana, Monday.com, Trello, Google Docs, and Google Sheets.

Omnipresent is a global employment services provider that helps businesses hire and manage international talent across over 165 countries. They handle complex tasks like payroll, compliance, taxes, and administrative work, ensuring your team gets paid accurately and on time.

Why I picked Omnipresent: Omnipresent stands out for its comprehensive international payroll expertise. Their dedicated international payroll team brings decades of experience in operational payroll, regulatory compliance, and payroll implementation across industries. They handle everything from calculating employment taxes and social contributions to managing variable components like bonuses and commissions.

Another key feature is their support for multi-pay cycle management. Omnipresent accommodates jurisdiction-specific payroll cycles, including 13th and 14th-month salaries where required. They also facilitate local currency payments and manage foreign exchanges, ensuring employees are compensated according to local customs while simplifying invoicing processes for businesses.

Omnipresent Features and Integrations:

Features include compliance with local labor laws for payslips, accurate calculation of employment taxes and social costs, support for local currencies and foreign exchange management, multi-pay cycle handling, and tailored invoicing options. Omnipresent also manages variable compensation components and offers support throughout the employee lifecycle, from onboarding to offboarding.

Integrations include BambooHR, Bob, HR Partner, Gusto, Personio, Dayforce, Justworks, and UKG Ready.

Transformify's core product is an HRMS, and the Employer of Record (EOR) add-on is capable of supporting your global payroll needs.

Why I picked Transformify: The company's EOR service allows you to hire globally in over 184 countries. They handle your payroll, taxes, and compliance to ensure everything is up to code for you as a global employer. They're also capable of managing your benefits administration and supporting employee onboarding and offboarding.

This is a great option if you'd like to hire employees from abroad without taking on the hefty workload that often comes with it. Meanwhile, you maintain control over your intellectual property and data. And if you're looking to hire global talent on a freelance basis, the Freelancer Management System (FMS) add-on might be a good option, too.

Transformify Standout Features & Integrations:

Features include employee onboarding and offboarding, document management, localized document templates, e-signature, tax filings and reports, pay slips, benefits and deductions, time off and attendance, NDAs and IP protection, compliance documents collection, and reporting tools.

Integrations are not currently listed by the vendor.

Pricing for Transformify's HRMS starts at $6.40 per user, but the EOR add-on starts at $635.

HSP Group is a global payroll and expansion services provider that helps you run payroll in over 100 countries—without juggling multiple vendors or losing visibility into compliance.

Their proprietary GateWay platform acts as your command center, giving you one place to manage global pay runs, monitor legal obligations, and track payroll accuracy across regions.

Why I picked HSP Group: HSP stood out for how they combine global payroll delivery with in-country compliance expertise. When you're paying people across jurisdictions, the challenge isn’t just making the payment—it’s getting tax filings, deadlines, and contracts right. HSP’s model gives you a single point of contact plus on-the-ground specialists who ensure each market stays compliant and audit-ready.

I also liked that HSP goes beyond payroll. Their support spans entity setup, accounting, tax, and HR governance—so if you're scaling into new regions or shifting from an EoR to your own local entity, you don’t have to restart with new partners.

HSP Group Features and Integrations:

The GateWay platform offers built-in compliance tracking, automated document management, and centralized calendar views for key payroll events across countries. This gives you visibility into what’s due where, and when—helping you catch issues early.

You also get access to global payroll project consulting, technical tax advisory, and relocation support, all led by internal teams rather than outsourced partners. Integrations cover key operational areas, including Employer of Record (EoR), HR administration, entity management, accounting, and technical consulting.

Pricing details are not provided publicly.

Horizons offers streamlined global HR solutions including global PEO services, international payroll and recruitment, global mobility & immigration support, and transition services for foreign subsidiaries wishing to become a PEO.

Why I picked Horizons: Their global payroll service is available in 150 countries, and is fully compliant with all international and local payroll tax laws. You can use Horizons to run payroll for your global employees, as well as manage international contractor payments too.

They have in-country expertise in every country they serve, including an onsite team of HR specialists who are well-versed in local employment labor laws too. They also have more niche service offerings, including tips and guides for global expansion, strategic mergers & acquisitions, and how to access new and emerging markets.

Horizons Features and Integrations:

Features include multi-country payroll, hiring tools, fast new hire onboarding, and local compliance monitoring.

Integration details are currently not available.

Pricing details for Horizons are available upon request. You can also request a free demo through their website.

Rippling is a full-service payroll and HR solutions provider capable of addressing the different requirements of businesses at scale. Its products include a robust applicant tracking system (ATS), time and attendance tracking, learning management, as well as full payroll processing and benefits management.

Why I picked Rippling: They offer full payroll services, along with HR and IT support across different countries.

This means that if you have internationally distributed employees and teams, you can now leverage this feature-rich platform to manage global HR, IT, and payroll processes. This includes keeping track of employee time and attendance, the inventory of assigned laptops and other devices, payroll, and benefits, regardless of where they are in the world.

Rippling Features and Integrations:

Their core features are automated payroll and tax filing, including detailed HR, payroll, and tax reports. The platform automatically calculates the hours worked, paid time off (PTO), benefits deductions, taxes, and withholdings during payroll processing. Accounting and payroll departments have the option to make payroll payments via check or direct deposit.

Finally, the system will automatically calculate payroll, apply the appropriate deductions, and process employee payments in the right currency via international wire, thanks to its automated currency conversion. Rippling will also file payroll taxes for globally distributed employees and teams automatically.

Integrations are available with 1Password, Asana, DocuSign, Dropbox, GitHub, Google Workspace, LinkedIn, Microsoft 365, Netsuite, Sage Intacct, Slack, Typeform, QuickBooks, and many other popular software systems

Mercans is a global payroll outsourcing specialist with local presence in 160+ countries, with no payroll aggregators or sub-contractors, like some platforms use. Through their network of local specialists and subject matter experts, they ensure compliance with all payroll tax laws and labor laws to give human resource teams peace of mind.

Why I picked Mercans: Mercans also offers a wealth of other services to help businesses establish themselves globally. These include global PEO, EOR and GEO (global employment outsourcing) services, HR management and advisory services, global mobility and talent management, incorporation and local compliance services, and business process outsourcing.

They are currently used by some very big-name companies, including Adidas, Audi, Bayer, Ford, IKEA, Johnson & Johnson, MasterCard, Mazda, Mitsubishi, Shell, and Tesla.

Mercans Features and Integrations:

Features include three separate global payroll service models as follows:

- Their SaaS model (HR Blizz) allows you to self-manage your multi-country payroll through a single dashboard.

- Their Managed Services model pushes payroll off of your plate and into their hands, with them handling the complexities of your international payroll management.

- Their HRMS (human resources management services) model takes it one step further, and is suitable for companies who need more than just payroll support - for example international benefits administration.

Integrations are available with many human capital management (HCM) and enterprise resource planning (ERP) systems, including BambooHR, Sage, SAP SuccessFactors, Oracle Cloud HCM, UKG Pro, and Workday.

Pricing details for Mercans are available upon request. You can also request a free demo through their website.

You can pay international employees, contractors, or even international subsidiary employees with Skaud’s unified global payroll system, which is available in 160+ countries.

Why I picked Skaud: Their software consolidates your entire global payroll run onto one dashboard, so it’s easy to review and approve everything in one go and submit one bulk payment. Skaud also supports payments in 100+ currencies using optimized exchange rates and fee-free cross-border payments.

Skaud Features and Integrations:

Skaud's features, like many other international payroll service providers in this list, include remote employee onboarding, offering global employee benefits, tracking paid time-off (PTO), and managing tax compliance.

As part of their global hiring service, they will even stickhandle all the required documentation on your behalf, including work permits and visas for your new hires as well as their dependents.

Beyond that, they can even help with tracking company assets like phones and computer equipment.

Integration details are currently not available.

Pricing for Skaud starts at $199/month, though they have a freemium plan for onboarding and paying global contractors only. You can also request a free demo or a free trial through their website.

Dayforce is a cloud-based human capital management platform designed to support payroll, workforce management, and HR operations. It centralizes data from different parts of your business to help ensure consistency and accuracy across functions.

Why I picked Dayforce: I picked Dayforce because it brings clarity and control to global payroll operations by using a single solution to manage multiple countries. Instead of relying on third-party aggregators, Dayforce processes payroll directly, allowing your team to run payroll on demand and avoid delays tied to traditional batch processing. This real-time calculation model gives you visibility into data across the pay cycle so you can spot and correct issues before they become costly errors.

Another reason I chose Dayforce is its focus on helping you stay aligned with local payroll regulations in every country where you operate. Its global payroll engine is built to adapt to regional rules, tax structures, and benefits systems. This means you don’t need to manually keep up with local changes—Dayforce helps your business maintain compliance automatically.

Dayforce Features and Integrations:

Key features include pay-on-demand capabilities that let employees access earned wages before payday, which can help reduce financial stress and boost retention. The platform also supports payroll funding and disbursements across currencies and countries, eliminating the need to juggle multiple vendors.

Integrations include Salesforce, Nectar, Guru, Carbide, Synerion, Bucketlist Rewards, Setyl, Everstage, Boon, Microsoft Dynamics 365 Human Resources, and SAP Concur.

Pilot’s all-in-one HR and global payroll software makes it possible to hire and pay international employees in 160+ countries or make cross-border payments to global contractors in 240+ countries across 70+ local currencies.

Why I picked Pilot: They offer employer of record (EOR) services in 100+ countries (including the United States) meaning there’s no need to form a legal entity abroad just to hire international staff.

To fully round out their HR services, Pilot also offers employee benefits plans in 175+ countries, as well as a core HRIS (human resources information system) that consolidates all of your employee data into one place.

Pilot Features and Integrations:

Pilot’s online payroll software allows you to determine exactly which items should be paid, and when, eliminating any payroll blocks that could hold up the entire process. For simple payroll set-ups, you can also schedule automatic payments, or choose a mixture of items for automatic or manual approval.

Your international employees will also appreciate being paid in their currency of choice, directly into their bank accounts via direct deposit, instead of relying on third parties or e-wallets to access their money. Also worth noting, Pilot doesn’t charge any currency markups or extra bank transfer fees either.

Integration details are currently not available.

Pricing for Pilot starts at $29/contractor/month or $299/employee/month. You can also request a free demo through their website.

Remote People is a platform that specializes in recruiting, hiring, and managing remote talent across more than 150 countries. It offers a range of services to facilitate global workforce management, ensuring businesses can access top talent worldwide.

Why I Picked Remote People: One reason I picked Remote People as a top global payroll solution is its employer of record (EOR) services. These services allow you to hire employees in various countries without needing a local entity, while ensuring compliance and providing global employee benefits. This can be a game-changer for companies looking to expand their global reach quickly.

Another standout feature is their global payroll services, which manage payroll for employees in over 150 countries. This makes it easier for your team to handle international payroll complexities and ensures timely payments, reducing the administrative burden on your HR department.

Remote People Features and Integrations:

Key features include contractor management, which simplifies hiring and paying international contractors while ensuring liability coverage. Employee background checks are also offered to ensure reliable hiring decisions through thorough vetting processes.

Additionally, PEO services in the US provide compliant and cost-effective Professional Employer Organization support.

Integrations are not presently listed by Remote People.

Velocity Global is an international HR platform designed to help businesses expand their workforce across borders. Its services cover areas like payroll, compliance, and HR support, making it easier for your team to manage international employees.

Why I picked Velocity Global: Their multi-country payroll service enables you to pay employees in over 185 different countries from one platform, all while ensuring compliance with local tax and labor laws. Another key feature of Velocity Global’s services is its ability to provide localized benefits, like pensions or health insurance. This means your employees can get country-specific perks without you needing to worry about the complex logistics.

Velocity Global Features and Integrations:

Key features include a wide range of services designed to help your business expand. This includes their Employer of Record (EOR) service, which helps you hire employees in countries where you don’t have a legal entity. They also provide immigration support, helping your team navigate visa processes, and equity management, letting you offer stock options globally.

Integrations include Workday, ADP, Oracle, NetSuite, BambooHR, SAP SuccessFactors, and Greenhouse.

Pricing for Velocity Global is available upon request.

Other Global Payroll Service Providers

Here are a few more global payroll providers that didn’t make the best international payroll services list but are still worthy of consideration:

- Paylocity

For global payroll integration

- Oyster HR

For centralized multi-country payroll

- Papaya Global

For AI-backed compliance verification

- QuickBooks Payroll

For small business payroll needs

- Native Teams

For global employee support & local benefits

- Atlas HXM

For end-to-end employee management

- TopSource

For supporting business expansion

- Agile Hero

For global mobility support

- Worksuite

For global contractor management

- Alight

For earned wage access (pay-on-demand)

Related HR Software to Support Your Global Team

Your global payroll system is only as good as the tools it talks to. These curated software picks help you build a unified system that scales with your team—no spreadsheets, no silos.

- Expense Management Software

- Benefits Administration Platforms

- Remote Employee Monitoring Software

- Attendance Tracking Software

- Performance Management Software

- Applicant Tracking Systems

Don’t just think about what you need today—look ahead and make sure the system can handle more employees, more complex workflows, and additional integrations as your company grows.

Selection Criteria for Global Payroll Services

When selecting the best global payroll services providers to include in this list, I considered common business needs and pain points that these providers address. This included things like managing multi-country payroll compliance and reducing administrative burden for global HR teams.

I also used the following framework to keep my evaluation structured and fair:

| Selection Criteria | Evaluation Focus | Weighting |

|---|---|---|

| Core Global Payroll Services | I looked for providers that handle multi-country, multi-currency payroll in a single run, support all worker types, and give employees self-serve access to their pay info. Bonus points if they nailed compliance, secured cross-border data, offered useful reporting, and plugged into HR and finance systems without much fuss. | 25% |

| Additional Standout Services | Looked for platforms that go beyond the basics—offering built-in analytics, contractor-friendly workflows, localized benefits, and plug-and-play integrations. Bonus points for tackling complex, cross-border edge cases without friction. | 25% |

| Industry Experience | Prioritized providers with a proven track record in global payroll—deep country coverage, long tenure in the space, and demonstrated credibility through client logos, awards, or seasoned payroll professionals on staff. | 10% |

| Customer Onboarding | Looked for clear implementation timelines, dedicated onboarding support, and plug-and-play integrations that reduce lift on internal teams. Bonus points for thorough documentation and onboarding resources that don’t require a degree in payroll to understand. | 10% |

| Customer Support | Strong support isn’t optional when payroll spans time zones and tax codes. I looked for 24/7 service, multilingual teams, and multiple contact channels—plus proof they actually solve problems fast. Reliable support keeps compliance tight and teams paid on time. | 10% |

| Value for Price | Cost alone isn’t the point—value is. I compared pricing transparency, flexibility across business sizes, and whether the features delivered justify the spend. Bonus points for providers that skip hidden fees and offer scalable packages that grow with you. | 10% |

| Customer Reviews | Analyzed customer feedback across platforms to surface common themes—reliability, responsiveness, ease of use, and how well the provider handled global complexity. I gave extra weight to reviews from teams managing multi-country payroll. | 10% |

Bottom line:

This framework shaped how I evaluated each global payroll provider—focusing not just on features, but on the real-world support, flexibility, and compliance infrastructure businesses need to operate internationally. It helped me surface vendors that don’t just promise global payroll—they actually deliver it, at scale, with clarity and confidence.

How to Choose a Global Payroll Provider

Choosing the right global payroll service starts with understanding your own needs. While these services can simplify complex tasks like managing international tax compliance and multi-currency payroll, the best solution for your business depends on your unique challenges.

Here are a few key questions to guide your selection process:

- What challenge are you solving? Are you struggling with multi-currency payments, navigating local compliance rules, or calculating taxes across borders? It's crucial to identify your challenges up-front to help guide your selection process.

- Who benefits most? Think about the internal team that will manage the service and how their daily tasks could become easier.

- What's your budget? Estimate how many international employees you’ll hire. Since most providers charge per employee per month, this will help you project costs.

- What outcomes matter? Focus on what success looks like—whether that’s consolidating global payroll into one platform or reducing compliance risks.

- How will it fit in? Consider how well the provider’s tools integrate with your existing HR systems to avoid workflow disruptions. Would their software framework integrate with your existing HR software, or would you face data management roadblocks?

And remember: just because a provider is well-known doesn’t mean it’s the right fit for your organization. Prioritize alignment over popularity!

Compliance is a huge factor. The system should help you stay on top of changing regulations, especially if you’re managing employees across different states or countries.

Trends in International Payroll Software

The international payroll market is evolving fast, but certain trends consistently show up in the tools that get it right. These are the features making global teams faster, safer, and a whole lot easier to scale.

Smarter Payroll Automation with AI

Modern payroll platforms use AI to streamline complex processes, calculating salaries, applying tax rules, converting currencies, and flagging potential compliance issues automatically.

Why it matters: You get fewer manual steps, fewer errors, and a faster, more reliable payroll cycle across every country you operate in, freeing up your team to focus on scaling, not spreadsheet firefighting.

End-to-End Integration with HR and Time Tools

Today’s global payroll tools don’t work in isolation. Instead, they connect with your HRIS, time tracking, and finance systems to create one continuous workflow.

Why it matters: Cleaner data, fewer admin tasks, and faster insights. This gives your HR and finance teams real-time visibility into costs, compliance, and headcount, so you can make smarter decisions, faster.

Tighter Data Security & Privacy Controls

Leading platforms are prioritizing security—rolling out stronger encryption, granular access controls, and built-in compliance with global privacy laws like GDPR.

Why it matters: You protect sensitive employee data across borders while staying compliant with evolving privacy regulations. That builds trust internally and shields your business from serious risk.

What are Global Payroll Services?

Global payroll services are outsourced solutions that manage employee compensation, taxes, and compliance across multiple countries. These services handle everything from local currency payments to labor law adherence, helping companies pay international teams accurately and on time.

HR and finance teams use global payroll services to simplify international payroll, reduce compliance risks, and avoid the hassle of managing multiple local providers.

Then, What is Local Payroll?

Local payroll is the process of managing employee compensation, taxes, and benefits within a single country. It typically involves in-house teams or domestic payroll providers who handle local labor laws, tax systems, and currency requirements.

This approach works well for companies operating in one country, but it becomes inefficient when expanding internationally or trying to centralize payroll operations across multiple regions.

Global Payroll vs EOR vs PEO: What’s the Difference?

These terms get tossed around a lot in international HR conversations—but they serve very different purposes.

- Global payroll services handle the logistics—paying people across countries, calculating taxes, converting currencies, staying compliant. But it assumes you already have legal entities wherever you’re hiring.

- EOR (Employer of Record) service goes further. The EOR provider becomes the legal employer for your hires in countries where you don’t have an entity. That means you can get up and running fast, without setting up a local company.

- PEO (Professional Employer Organization) is more local. It’s a co-employment model, usually in the U.S., where you and the PEO share employer responsibilities. You run the business; they handle the back-office HR.

The right choice depends on your setup. Going global without a legal entity? Use an EOR. Already registered and just need payroll support? Invest in a global payroll partner. Managing U.S. teams with limited in-house HR staff? A PEO might be the way to go.

For global payroll, about 30-40% of the data fields are country-specific, but the rest is the same. You need to understand what each country needs before you hire.

10 Key Features to Check in Global Payroll Platforms

Most payroll providers promise the basics, but when you’re managing employees or contractors across borders, it’s the details—like how they handle local tax filings or contractor onboarding—that make or break the experience.

The following are the features worth zeroing in on when considering global payroll providers.

1. Multi-Country Payroll Administration

I know this seems obvious, but look for automated payroll workflows that support multiple countries and currencies in a single run. The best providers handle everything—from salary calculations and currency conversions to tax deductions—so you’re not juggling spreadsheets.

2. Mobile-Friendly Payroll Functionalities

Add mobile access into the mix, and your team can manage payroll approvals or view key reports on the go—keeping things accurate, fast, and responsive no matter where you’re working from.

3. Payroll Reconciliation & Auditing

Don’t assume accuracy—verify it. The right provider will automatically reconcile payroll each cycle and run regular audits behind the scenes.

This ensures every payment aligns with your records, catches issues before they snowball, and keeps you compliant with international financial and tax standards. It’s how you stay audit-ready without adding admin overhead.

4. Local Compliance & Mobility Support

If you’re hiring talent in countries where you don’t have a legal presence, immigration becomes a major hurdle.

Some global payroll partners offer visa sponsorship and mobility services as part of their package. That means faster employee relocation, fewer third-party vendors to manage, and less red tape blocking your growth plans.

The complexity isn’t in the payroll calculations themselves, but in staying compliant with each country’s regulations. You have to be sure your system separates the data from the rules, especially when tax and social security rates change across borders.

5. Real-time Global Reporting

Get a live view of payroll spend across markets. Whether you’re comparing costs between LATAM and APAC or reviewing a specific department’s monthly burn, centralized dashboards let you surface spend anomalies, model future growth, and make smarter hiring and offboarding decisions—all from one place.

6. Tax Withholding & Filing

A strong provider should automatically handle country-specific tax calculations, withholdings, and filings for both employees and contractors. That includes things like income tax, social security contributions, and local levies.

Beyond accuracy, the real win is risk reduction. Offloading these responsibilities to a compliant provider helps you avoid penalties, late fees, or regulatory headaches—especially in countries where the rules change frequently.

Look for providers that support:

- Automated real-time tax updates

- Multi-country filings (not just calculations)

- Local tax document generation for employees

- Integration with your accounting and finance systems

If your provider can’t handle cross-border tax complexity confidently, they’re not truly global.

7. Employee Self-Service Portals

Let employees access payslips, tax documents, and personal details on their own—anytime, anywhere. A good self-service portal reduces HR admin load, improves transparency, and gives your global team the autonomy they expect.

8. Contractor & Worker Classification Support

If you’re hiring globally, chances are you’re working with a mix of contractors and employees. Look for providers that help you classify talent correctly across jurisdictions—and support onboarding, payments, and documentation for both groups.

9. Software Integrations

Global payroll doesn’t operate in a vacuum. Choose providers that integrate cleanly with your HRIS, HCM, and accounting platforms (like Workday, BambooHR, or QuickBooks). This keeps data synced and cuts down on manual entry—and the errors that come with it.

10. Data Security & Privacy Compliance

You’re dealing with sensitive personal and financial data. Your provider should offer bank-grade encryption, strict access controls, and be certified against standards like SOC 2, ISO 27001, or GDPR.

When it comes to employee data, peace of mind comes from knowing your systems are built to protect it.

Benefits of Multi-Country Payroll Services

Simplified Compliance: Navigating international tax laws and labor regulations is no small feat. A global payroll service helps you stay ahead of changing requirements, reducing legal exposure and administrative headaches.

Cost Savings: Automated workflows, consolidated data, and fewer manual errors drive down your payroll overhead. ADP reports that many companies using global payroll services see significant savings compared to managing local providers in each country.

Time Efficiency: Centralized systems reduce the time spent on approvals, manual calculations, and follow-ups. (That gives your team time back to focus on growth instead of admin.)

Enhanced Data Visibility & Security: When payroll data lives in one secure system, you gain both clarity and control. Global platforms use robust encryption and access controls to keep sensitive information safe while giving HR and finance teams instant visibility.

Better Employee Experience: On-time, accurate pay in local currencies builds trust. Global payroll systems also give employees self-serve access to payslips, tax documents, and leave balances, boosting transparency and reducing HR queries. (This kind of self-service is now expected.)

Faster Global Expansion: With built-in infrastructure for hiring and paying in new markets, you can expand into new countries faster, without waiting to set up legal entities or chase down local providers.

Flexibility & Agility: Global payroll platforms grow with you. Whether you’re entering your second market or your twentieth, the right provider supports new regions, workforce types, and compliance requirements without major rework.

Costs & Pricing Breakdown

Global payroll pricing depends on your team size, where your employees are located, and the level of service your team will need.

- Team Size: More employees = more complexity = higher cost.

- Country Coverage: Countries with strict tax or labor laws often cost more due to added compliance overhead.

- Payroll Frequency: Weekly payroll costs more than monthly due to extra processing cycles.

- System Integration: Need the platform to sync with your existing HR or finance tools? That may require custom work (and increase costs).

- Service Scope: Basic payroll is cheaper than packages that also include HR support, compliance, or EOR services.

- Compliance & Reporting: If you operate in a heavily regulated industry or need detailed reports, expect to pay a premium.

What I've found is that global payroll isn’t one-size-fits-all, and free options don't exist due to the complex and customized nature of the work involved. However, most providers offer custom quotes—and typically a free consult or demo—so shop around before committing.

New & Noteworthy Product Updates

Below, I've summarized the most recent release notes and product updates for my top global payroll service recommendations. Discover what’s now possible through new service improvements, software features, and other company updates, and why it matters for global payroll services.

2025 Q3: Global Payroll Service Updates

Deel Update Notes

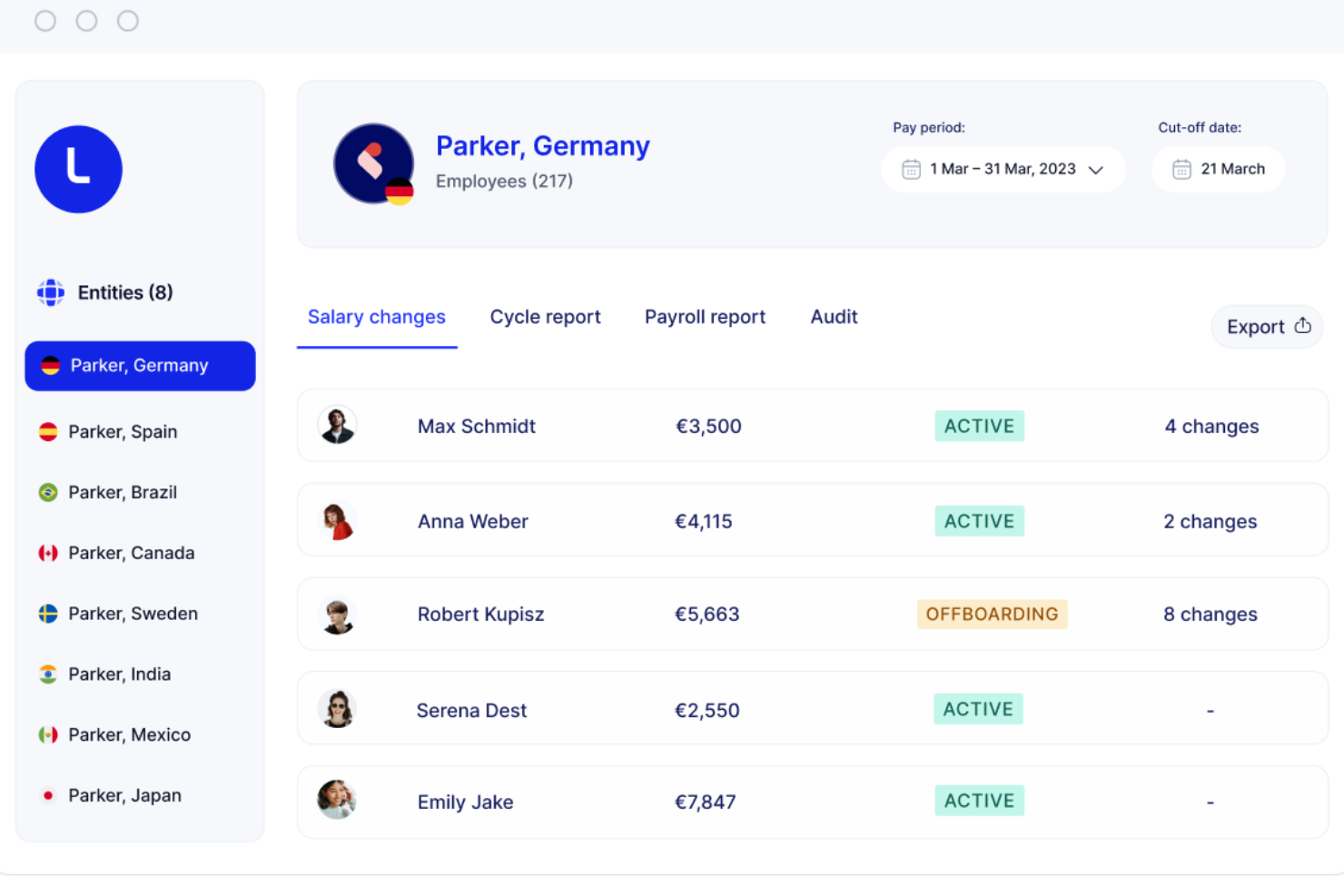

Deel recently rolled out three new features for its Global Payroll platform to make it easier for HR and payroll teams to handle everyday tasks without extra steps or outside support.

The update adds three tools. First, teams can send off-cycle payments like bonuses or corrections right from the dashboard. Second, the new bulk terminations option lets HR off-board multiple employees at once using a template that tracks key details. Third, the entity transfer feature moves an employee between legal entities with their data and contracts intact, updating payroll automatically.

These changes cut down on wasted time and manual work. Off-cycle payments get processed faster, bulk terminations reduce paperwork and errors, and entity transfers keep employee records consistent during moves. For users, the result is smoother payroll management and fewer compliance risks.

Verdict: This is a smart, high-value update that tackles real pain points for HR and payroll leaders.

Globalization Partners Update Notes

Globalization Partners (G-P) has rolled out the latest version of its AI-driven Employer of Record (EOR) platform. Built on a modern serverless, event-based architecture, the upgrade delivers a quicker, more streamlined way to hire and manage staff across 180+ countries.

At the core of this release are two standout tools: the Global Compliance Engine (GCE) and G-P Assist. The GCE gives users instant, country-specific compliance insights, while G-P Assist leverages agentic AI to provide quick answers to HR questions and connect teams with local experts. Beyond these tools, the platform includes self-service onboarding, an API-first approach for seamless integrations, and a responsive interface designed for any device.

For HR professionals, the benefits are clear: reduced compliance risk, faster onboarding, and less manual effort. The AI features support better accuracy and smarter decisions, while APIs ensure consistent data across connected systems. In practice, this means greater control, fewer bottlenecks, and a smoother global hiring experience.

Verdict: A strong upgrade that makes G-P’s platform faster, more intelligent, and more dependable for international HR teams.

Remote Update Notes

Remote has enhanced its Workday integration to eliminate manual data entry and keep HR and payroll fully aligned. The result is fewer errors, quicker updates, and smoother processes for global teams.

The upgraded integration now automatically syncs employee records and time-off data, removing the need for duplicate inputs. A new “Sync to Remote as” option gives companies flexibility to define each worker as an EOR employee, direct payroll hire, or contractor—ensuring data flows correctly and payroll is processed the right way.

For international organizations, this translates to lighter admin loads, reduced payroll errors, and stronger compliance. HR teams save time, payroll gains accuracy, and companies can shift focus from fixing mistakes to driving growth.

Verdict: A straightforward but impactful upgrade that cuts double entry and payroll friction for Workday–Remote users.

Multiplier Update Notes

Multiplier has updated its Pay Supplements tool to make handling bonuses, commissions, and extra payments simpler. The redesign focuses on speed, control, and better visibility for payroll teams.

Users can now set up one-time or recurring supplements, add notes, and manage variable amounts through a clearer workflow. Supplements can be revoked before payroll closes, and every action is tracked in a history log. The system also sorts supplements into tabs—pending, queued, processing, and completed—for quick status checks.

The update cuts down on errors and confusion. Teams get more flexibility when setting payments, better control if changes are needed, and stronger records for audits. Clear status tracking means fewer surprises and smoother payroll runs.

Verdict: This update is a smart step forward, giving teams more control and clarity over extra payments.

Frequently Asked Questions

Here are clear, expert-backed answers to the most common ones I hear from teams navigating global payroll.

Can I pay employees in a country where I don't have a local entity?

Yes, you can pay employees in countries where you don’t have a legal entity by using a global payroll provider that offers an Employer of Record (EOR) service. These providers manage employment, payroll, and compliance, handling taxes, benefits, and labor laws on your behalf, so you don’t need to set up a physical entity in each country. This can help you scale more quickly and reduce legal risks.

What security measures protect employee payroll data?

Global payroll providers typically use robust data security measures such as end-to-end encryption, password protection, secure data centers, and regular audits. Look for vendors with ISO 27001 or SOC 2 certifications and ask about GDPR compliance if you operate in or pay employees in the EU. Always ensure your provider offers transparency on how your employees’ information is stored and protected.

Can I switch between global payroll providers?

Yes, you can switch providers, though the process involves careful planning to mitigate compliance risks and data loss. Before making a change, audit your current contracts, prepare your payroll data for migration, and clarify key responsibilities during the transition. Make sure to communicate clearly with your team and international employees to avoid any disruptions or missed payments.

Are there any international payroll solutions for very small businesses or startups?

Yes, several global payroll services are designed for small businesses and startups needing to pay just one or a few international employees or contractors. Look for providers with flexible pricing, self-serve onboarding, and simple compliance tools. Some EOR platforms are ideal for startups hiring contractors, while others offer cost-effective options for scaling headcount globally.

How do global payroll services handle currency fluctuations?

Most global payroll platforms offer built-in currency conversion and allow you to pay employees in their local currency. Providers typically use real-time exchange rates and some may let you lock in rates ahead of payroll runs. Always ask if they charge currency conversion fees and how they manage sudden rate changes—this helps you avoid costly surprises.

How quickly can global payroll be up and running?

Global payroll setup can range from a few days to several weeks, depending on complexity, countries involved, and your provider’s onboarding process. You’ll need to gather necessary employee documents, banking information, and regulatory forms. Proactive communication and clear timelines from your provider help you launch faster and with fewer errors.

What challenges should I expect when onboarding new countries to my global payroll?

Expect to face compliance complexity, varied employment laws, language barriers, and limited banking options. Getting tax IDs, registering with authorities, and adapting to local regulations can slow down onboarding. Use a provider with expertise in your target countries, and always collect complete employee documentation early in the process to speed things up.

How do global payroll solutions stay compliant with changing local laws?

Global payroll providers monitor local regulations and update their systems regularly to meet new requirements. Many have in-country legal experts or compliance teams who keep track of employment laws, taxes, and reporting standards. Still, ask your provider how they stay current, and review their compliance processes before signing up.

What support can I expect if there’s a payroll error or dispute in another country?

Most providers offer dedicated support teams or account managers who handle cross-border payroll issues quickly. Choose a vendor with 24/7 or multilingual support and clear service-level agreements (SLAs) for resolving errors. Find out how they communicate and escalate issues and whether they’ll liaise directly with local authorities or employees if needed.

Next Steps for Scaling Global Payroll

Managing global payroll doesn’t have to be a headache. The right platform can streamline your systems, keep you compliant, and improve the experience for your international team. Start by auditing your current setup, identifying your must-have features, and asking vendors clear, direct questions before you commit.

Want to stay ahead on global HR trends? Subscribe to the People Managing People newsletter for practical updates, emerging tools, and actionable insights tailored to HR professionals.