The old-school way of managing assets is inefficient, especially if you own many assets. Manual entry into spreadsheets and frequent human errors are common issues limiting the scalability and efficiency of traditional methods. That’s where asset management software comes in—but what is asset management software exactly?

In this article, we’ll walk you through what asset management software is and why a modern business needs one. We’ll also give you an overview of key features to look for in an asset management system so you can pick the best tool for your business.

What Is Asset Management Software?

Asset management software solutions centralize asset data to make tracking assets easier across organizations.

Modern businesses rely on asset management software to reduce the administrative costs associated with managing assets. They streamline asset management by offering improved visibility of your assets, allowing you to optimize repair and maintenance expenses.

What Does Asset Management Software Do?

Asset management software consolidates asset data from all departments, so you always have real-time information for effective decision-making.

Here are a few examples of what asset management solutions can do for you:

1. Facilitates effective decision making

Say you’ve purchased ten computers with an equivalent feature set. Five of these computers come from a different manufacturer than the other five.

You enter these assets into your asset management software solution. Five computers purchased from manufacturer A stopped working over the next 18 months. Over the same time, only one of the computers purchased from manufacturer B stopped working.

Since you’ve tracked details about these assets in your system, you can view these details on your dashboard and identify these computers from a list of assets that could include hundreds of other assets. You may decide to only buy from manufacturer B in the future and save your company plenty of money.

2. Monitor asset ownership cost

The cost of owning an asset tends to increase as assets depreciate. For example, a machine might require more frequent repairs after you’ve used it for several years. In some cases, replacing the asset makes more sense than repairing the same asset over and over.

However, you’ll need accurate repair history and maintenance data to make a call on whether you should replace the asset. To make informed decisions about replacing or maintaining assets, consider utilizing tools like business tax management systems to analyze the full cost of ownership and potential tax benefits.

If the total cost of owning the asset (i.e., costs of repairing, maintaining, and operating) exceeds the economic benefits it offers to the business, it’s time to replace the asset.

3. Easy access to asset data

You’ll need asset data to monitor asset performance, make repair vs. replace decisions, and understand an asset’s tax implications resulting from asset depreciation, among other things.

When you use an asset management system, you’ll be able to sift through asset data more quickly. You’ll have the option to search asset data based on various parameters such as asset location, type, warranty, or repair history.

Access to this information can save plenty of time you’d have otherwise spent looking through spreadsheets.

4. Comply with IRS and FASB requirements

The IRS requires companies to maintain records that enable verification of certain information about the company’s assets.

You need records that show information like purchase price, deductions claimed for depreciation, use of assets, and more. Examples of documents that can help show this information include purchase invoices, canceled checks, and real estate closing statements.

FASB’s new accounting standards for leases will become effective for everyone by the end of 2022. You’ll need to be more diligent about recording leased assets.

Instead of handling asset data and documents manually, an asset management system simplifies the process of storing documents and submitting them to relevant parties as needed.

Benefits Of Asset Management Software

Here are the benefits you can expect by deploying a robust asset management software solution:

1. Saves time and money

The primary benefit of asset management software is saving time and money. They centralize all the data you need for monitoring assets and ensuring compliance without requiring manual data entry and are a key part of any holistic digital office management system. This reduces administrative burden, freeing up the team’s time and saving the company money.

Asset data provides insights that help you identify room for minimizing costs. For example, you may notice assets with minimal utilization demanding a lot of maintenance. You might decide to sell these assets and outsource the tasks you used the machine for to save money.

2. Real-time access to asset records

Suppose you’re a manufacturer. You know that a preventive maintenance program is essential to minimizing machine breakdowns and repair costs for physical assets.

However, ensuring the program’s consistency can be challenging when you have many assets. That’s where an asset management system can help.

Similarly, a software company may have assets like computers, servers, and digital assets like a software license. An asset management system can provide the information you need for monitoring these assets and save plenty of money.

For example, an average business spends 2x more on software assets than necessary because of a lack of visibility over the company’s software landscape.

3. Efficient asset lifecycle management

An asset has a limited useful life. Wear and tear can make your current assets inefficient or even useless.

Asset management software solutions can provide historical data on an asset type’s lifecycle. Access to this data can help estimate the life of new assets, allowing you to plan for taxes, ownership costs, and asset replacement.

To track and monitor assets like desks and conferences room equipment, meeting room booking software can help flag who used what, when, and how often.

4. Optimized maintenance programs

Preventive maintenance is key to increasing an asset’s useful life and minimizing repair expenses. Asset management software can provide maintenance data, so you’re always on guard for assets that might be approaching the end of their useful life.

You can optimize the maintenance program by changing the maintenance routine for specific assets based on the maintenance data. This might help extend the asset’s useful life. Alternatively, you may choose to run the machine to failure.

5. Helps internal and external auditors

Auditors need to verify the existence, value, and location of assets, among other things. Asset records play a crucial role in helping external auditors verify the validity of assets as they appear on your financial statements.

Moreover, internal auditors can use asset records to ensure there was no misappropriation of assets and that proper internal controls exist to protect the company’s assets.

Asset management software solutions may also include a feature that lets internal auditors receive status updates for assets, enabling them to monitor assets effectively.

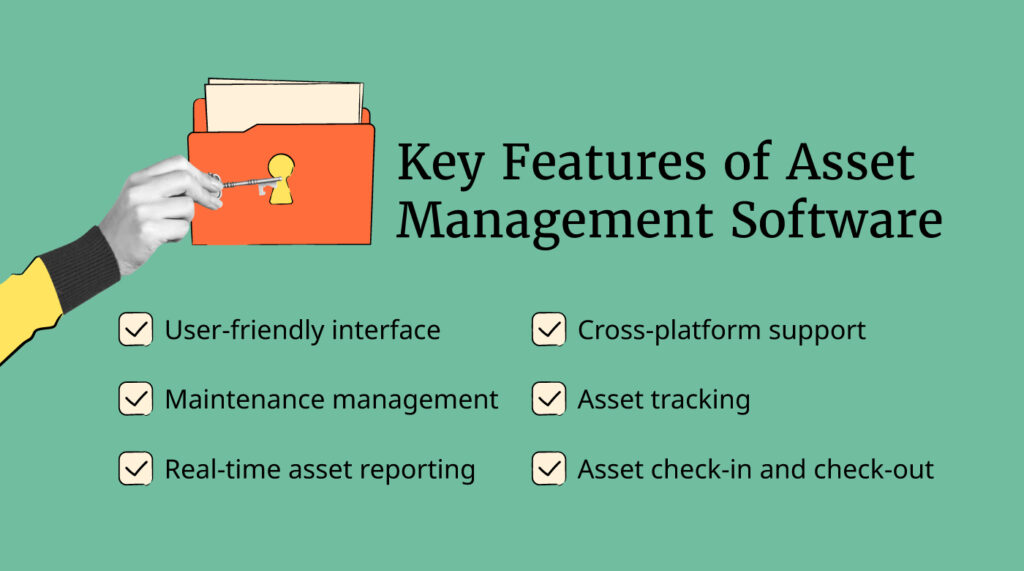

Key Features of Asset Management Software

The best asset management software solutions have the following features:

- User-friendly interface: A complex system often defeats the purpose of deploying it. You might save money from the reduced administrative workload, but you may need to spend extra on training your team to use the system if it’s complex. You want a system that’s intuitive and has a gentle learning curve.

- Cross-platform support: Select a system that works on all popular operating systems, especially if your team does a lot of fieldwork. A mobile app allows employees to update asset records on the fly, ensuring the data is always up to date.

- Maintenance management: Your asset management tool should have a built-in maintenance management module or integrate with an external maintenance tool like a computerized maintenance management system (CMMS). You should be able to plan asset maintenance, issue work orders, and track progress using your asset management system. With the best enterprise asset management software product, you can also monitor asset performance to implement a predictive maintenance program.

- Asset tracking: Companies track assets using various technologies like barcode, Bluetooth tracking, and RFID. Your asset management system must support these technologies and devices they require, like barcode scanners and RFID scanners.

- Real-time asset reporting: Once you’ve compiled the data, you need to interpret it. A dense spreadsheet can look intimidating. However, an asset management system simplifies interpretation by reporting asset data visually. The data updates in real-time so you can make smart decisions fast.

- Asset check-in and check-out: Often, multiple departments may need to use an asset. You need to be able to track the asset as it moves across departments, and for this, your system needs the check-in and check-out feature.

Need expert help selecting the right Digital Asset Management (DAM) Software?

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.

Manage Assets the Modern Way

Why spend all that time entering data manually into a spreadsheet? Save time and ensure far greater data accuracy with a robust asset management software product.

In addition to saving time and money, you’ll have access to various features that will facilitate insightful decision-making and streamline your asset management processes.

Further resources: