Best Portuguese Employer of Record Service Shortlist

Here’s my pick of the 10 best Portugal EOR companies out of the 20 options I’ve reviewed:

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

Expanding into Portugal is an exciting opportunity—but navigating local employment laws, taxes, and compliance requirements can quickly become overwhelming. For many companies, the process of opening a legal entity, understanding Portuguese labor codes, and staying compliant with the Authority for Working Conditions (ACT) is a roadblock to hiring top talent.

That’s where Employer of Record (EOR) services come in. EORs handle the legal, tax, and HR responsibilities of hiring in Portugal, so you can onboard employees quickly, pay them compliantly, and stay focused on growing your business—without setting up a local entity.

Sounds like a smart move, right? However, which Portugal EOR service is the best fit for your needs?

I’ve reviewed dozens of global employment providers and evaluated the best options for hiring in Portugal based on factors like compliance expertise, ease of onboarding, and local support. This article will help you confidently choose a Portugal EOR service that fits your needs—so you can scale your team, not your stress.

Market Details for Hiring In Portugal

- Capital City: Lisbon

- Currency: Euro (EUR, €)

- Payroll Frequency: Monthly

- Official Language: Portuguese

- Approx. Population: 10.2 Million

- Public Holidays: 13 days

Why Hire Employees in Portugal?

Portugal is a prime destination for companies looking to hire top talent abroad due to its deep talent marketplace in the technology and creative sectors, including a wealth of professionals in IT, software development, engineering, and digital marketing.

The educational system in Portugal is excellent, producing graduates with expertise in data science, AI, web development, and customer service, making it a hub for tech startups and innovation. In addition, Portugal's competitive labor costs and high levels of English proficiency among its workforce make Portugal an attractive market for employing international talent.

Why Trust Our Reviews

We've been testing and reviewing HR software + services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Employer of Record in Portugal: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top Employer of Record selections for hiring staff in Portugal to help you find the best EOR service for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best AI-driven EOR platform | Free trial available | From $579/month | Website | |

| 2 | Best for budget-conscious remote team expansion | Free demo available | From $25 - $199/user/month | Website | |

| 3 | Best for combined global HR and EOR services | Free demo available | Pricing upon request | Website | |

| 4 | Best for offering local health benefits to Portuguese EOR employees | Free trial + demo available | From $29/month | Website | |

| 5 | Best for flexible global payment options | Free demo available | Pricing upon request | Website | |

| 6 | Best for hiring and paying talent in Portugal | Free demo available | From $199/employee/month or $19/contractor/month | Website | |

| 7 | Best EOR partner for enterprise organizations | Free demo available | From $595/employee/month or $49/contractor/month | Website | |

| 8 | Best for end-to-end employee support | Free demo available | $99/employee/month | Website | |

| 9 | Best for labor law compliance | Not available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 10 | Best for an advanced EOR management platform | Free demo available | Pricing upon request | Website |

-

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

Reviews of the Best Employer of Record Services in Portugal

To help you find the best EOR service for hiring employees in Portugal, I’ve described my top 10 selections in detail, including the specific services each provider offers and how HR teams can use them effectively. Additionally, I’ve listed 10 more EOR service providers for Portugal below if you’d like more options to consider.

Borderless AI is an AI-native employer of record platform that helps companies hire, pay, and manage employees and contractors across 170+ countries—including Portugal—without needing to set up a local entity. It combines core EOR services with smart automation that can support HR teams handling complex, high-growth markets.

Why I picked Borderless AI: If you’re looking to hire in Portugal without getting stuck in red tape, Borderless AI is built for speed and simplicity. You can generate a locally compliant contract in minutes, onboard in days, and manage ongoing payroll, taxes, and benefits without adding headcount. I also like how its AI agents reduce the manual effort of staying on top of labor law changes—something that’s always shifting in markets like Portugal.

It’s a good fit if your internal HR resources are lean or if you're hiring across multiple countries at once. Borderless AI can support both employees and contractors, which gives you more flexibility depending on your headcount needs in Portugal. For example, the AI will flag changes to minimum wage laws or statutory benefits and suggest updates to contracts or payroll settings in-platform.

Borderless AI Key Services:

The platform includes employer of record support, contractor management, and centralized payroll—designed to help you run HR operations across borders with fewer delays. It offers tools like a contract generator, HR knowledge base, and compensation benchmarking engine powered by AI.

Their support team is based in North America, and users get transparent cost breakdowns by region, which can help forecast hiring expenses before you commit. While integration details aren't listed on the website, API access is available.

Pros and cons

Pros:

- Facilitates international expansion without the need for local entities

- Offers clear, flat-rate pricing

- Provides an AI-powered assistant

Cons:

- Reporting and analytics tools are not extensive

- Does not offer direct recruitment or applicant tracking functionalities

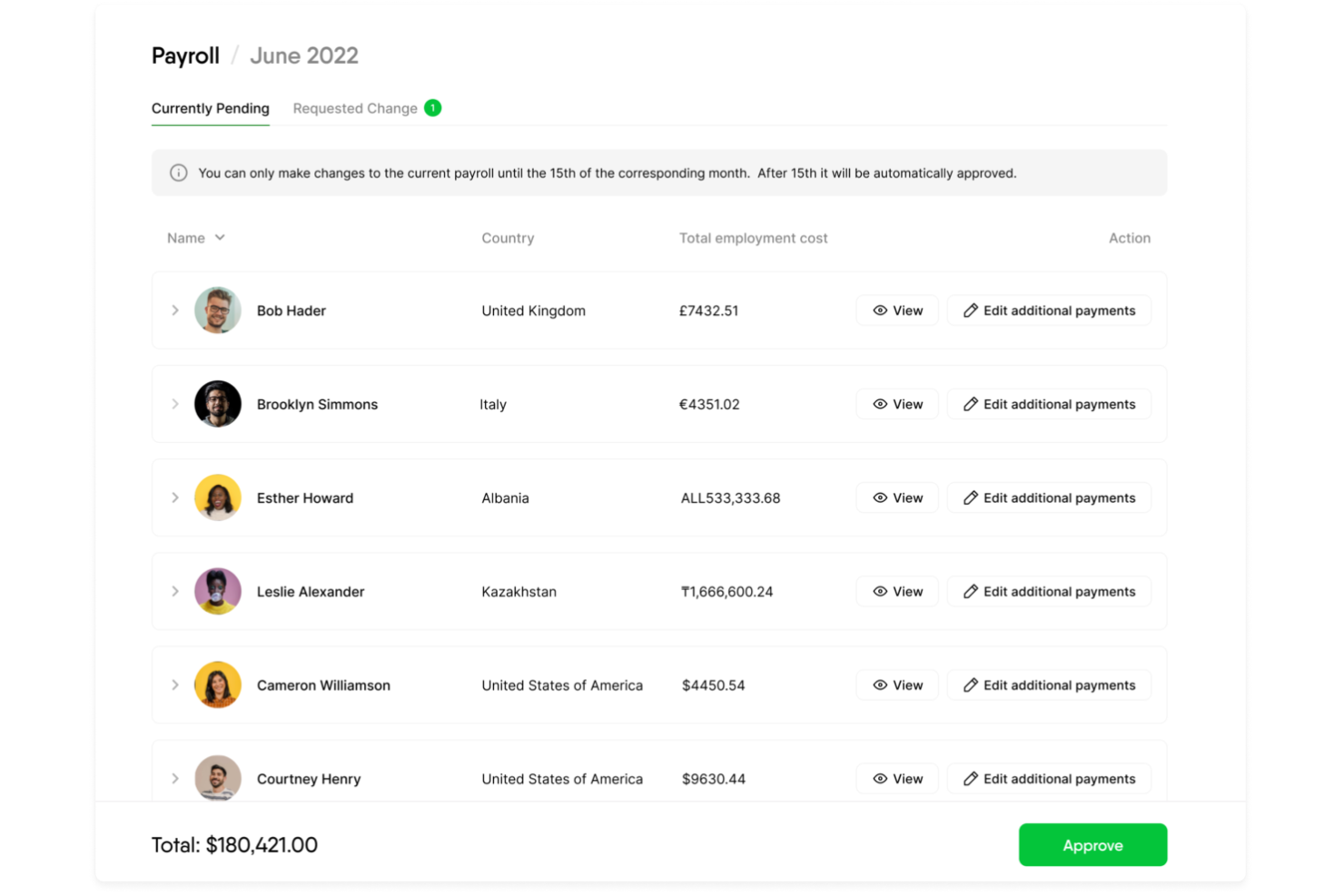

Remofirst is a global EOR service provider on a mission to free employers from geographical boundaries so they can build global teams with ease. They offer EOR services in 180+ countries, eliminating the need to set up multiple legal entities abroad.

Why I picked Remofirst: For companies expanding in Portugal, Remofirst makes hiring local talent straightforward. They ensure compliance with Portuguese labor laws and take care of things like registering employees for social security, managing local tax filings, and ensuring you're meeting all employment regulations. You don’t need to worry about the nuances of Portuguese labor contracts or termination processes—Remofirst handles all of it for you.

It also offers flexibility with both contractors and full-time employees. Whether you’re hiring a contractor for a project or bringing on a full-time employee, Remofirst ensures you’re following the correct legal framework for each type of worker. The service also provides health insurance and other benefits requirements in Portugal.

Remofirst Key Services:

Their team of legal experts and HR professionals will ensure your business operations are always compliant with changing Portuguese regulations, with compliance documentation accessible at all times through your secure dashboard. Their customer support team is also available 24/7 in case you need additional help. All clients also receive a dedicated account manager as their main point of contact.

On top of their EOR services, Remofirst also provides international payroll and invoice management, global benefits management (including insurance and equity plans, plus time-off management), and employee support with obtaining visas and other immigration documentation. They can even help you allocate equipment to your global employees.

Pros and cons

Pros:

- Robust employee support

- User-friendly platform

- Comprehensive compliance management

Cons:

- Service availability may vary by region

- Dependence on third-party providers for some services

TopSource Worldwide is an employer of record (EOR) service provider that handles all legal employment responsibilities for companies hiring in countries all over the world, including Portugal.

Why I picked TopSource Worldwide: It offers deep local expertise in Portuguese employment law, including mandatory payroll elements like the 13th and 14th salary months, social security contributions, meal allowances, and accident insurance. That means your hires are properly onboarded, paid, and protected under local regulations without you needing to understand every detail of the Portuguese Wage Code. You also get guidance for unique requirements like tax-exempt meal vouchers and statutory bonus scheduling.

Beyond compliance, TopSource pairs its EOR service with HR services that support global expansion strategies. You get access to quarterly global talent audits, instant contact with benefits and global employment law experts, and a direct line for phone support. This “beyond-EOR” suite helps you align HR decisions with long-term business goals instead of reacting to issues as they come up.

TopSource Worldwide Key Services:

Other features include built-in support for scheduling and paying Portugal’s statutory bonuses in June and November, as well as vacation and meal allowance disbursements through locally accepted Sodexo vouchers.

Employers are also registered with Tranquilidade for accident insurance coverage, ensuring all workplace risks are addressed according to local law. TopSource even supports complex scheduling norms like Portugal’s “schedule exempt regime,” helping teams manage overtime limits and contractual hour thresholds properly.

Pros and cons

Pros:

- Wide country coverage with 180+ supported markets

- Strategic HR guidance available for expansion planning

- Service includes direct access to local experts

Cons:

- Limited reporting or automation features compared to tech-driven platforms

- No integrations with popular HRIS platforms

Deel

Best for offering local health benefits to Portuguese EOR employees

Deel is a well-established employer of record platform that helps companies rapidly employ workers in 150+ countries, including Portugal.

Deel owns a local entity in Portugal staffed with legal experts to keep track of regulatory changes and ensure all legal obligations are met on your behalf. To hire an employee in Portugal with Deel, the average onboarding time frame is 3 days.

Why I picked Deel: Deel excels as an EOR service provider in Portugal by offering streamlined contract management, ensuring compliance with Portuguese employment laws. Deel also helps organizations offer localized employee benefits for Portuguese staff, including private health insurance, a compensation fund, labor accident insurance, employee training, and social security contributions.

In addition, Deel has launched several new offerings over the past year, including global payroll, global mobility support, integrated Slack tools, and advanced integrations. These services, all combined, facilitate efficient and compliant hiring processes within the Portuguese talent market.

Deel Key Services:

Deel offers end-to-end management for your employees based in Portugal, covering everything from hiring and onboarding to termination. Their web app is user-friendly and provides a range of features to help businesses manage their remote teams effectively, including contract management and expense tracking.

Their integrated contract management function supports advanced customizations such as stipends, signing bonuses, and stock options. You can also use Deel for visa and immigration support if you want to relocate existing employees to Portugal, with Deel managing the entire visa process for your organization in-house.

Deel offers 24/7 customer support and live chat and is known for its fast support.

Pros and cons

Pros:

- Comprehensive employee benefits

- Local compliance expertise

- Fast onboarding process

Cons:

- Potential complexity for first-time users

- Limited customization options

G-P is a leading EOR service provider that assists companies looking to hire and manage employees in Portugal. Their AI-driven global HR platform streamlines international hiring, compliance, payroll, and benefits administration, ensuring a smooth onboarding process for Portuguese employees.

Why I picked G-P: G-P’s sophisticated global EOR platform is designed to handle complex regulatory environments, making it easy for businesses to hire and manage employees in numerous countries, including Portugal.

New hires can be onboarded in days, with locally-compliant contracts according to Portuguese laws. Using G-P, you can also pay your EOR employees in over 180+ currencies (including cryptocurrencies) using Venmo or bank transfers.

G-P Key Services:

G-P offers automated onboarding processes, real-time expense reporting, and a dedicated support team, all of which contribute to its reputation as one of the best EOR services in Portugal.

Their team includes local HR experts who understand the intricacies of Portuguese labor laws and cultural nuances and can also assist with global expansion plans and executing global transactions as needed. Their platform even has an AI assistant, Gia to quickly answer all your questions related to localized employment regulations.

Pros and cons

Pros:

- Easy and quick international hiring and onboarding process

- Strong compliance and risk management

- Comprehensive global employment platform

Cons:

- Dependence on the platform for all HR functions

- Limited customization options

Skuad’s digital HR platform helps global employers hire, pay, and manage employees in over 160 countries, including Portugal. When you hire them as your Portuguese EOR partner, they’ll manage the whole hiring process on your behalf, including creating employment agreements and other legal documents.

Why I picked Skuad: As part of their EOR service, Skuad offers remote hiring and can facilitate payroll in multiple currencies. This includes the management of invoices as well as payroll automation. Skuad also offers robust compliance frameworks for local Portuguese employment laws, including visa and immigration processes, statutory benefits, and tax obligations.

Skuad Key Services:

Skuad's EOR services include remote employee onboarding, employee benefits, time-off tracking, and managing tax compliance. As part of their global hiring service, they’ll handle all the required documentation on your behalf, including work permits and visas for your new hires and their dependents.

Beyond that, Skuad can also help you distribute computer equipment to your new employees, and track company assets like phones and other IT devices.

Pros and cons

Pros:

- User-friendly platform

- Extensive HR support

- Comprehensive compliance management

Cons:

- Possible delays in customer support response time

- Limited customization options

Atlas HXM offers innovative companies the tools they need to compete in a global economy. As one of the largest, direct EOR service providers, Atlas HXM believes businesses should be able to employ whomever they want, wherever the talent exists.

Why I picked Atlas HXM: They're a popular choice across numerous industries, including non-profits, financial services, oil & gas, energy, life sciences, pharmaceuticals, technology, and government, and they can tailor their service offerings to your needs, whether you're a new startup, an SME, or an enterprise organization.

Atlas is committed to widening the margins of entrepreneurship and employment alike. As such, their business model helps startups and SMBs compete on the international playing field—turning commercial innovations into viable global enterprises. In doing so, Atlas brings opportunities to local economies and the people who work there.

Atlas HXM Key Services:

Services include Portuguese-specific compliance monitoring, employee engagement and productivity monitoring, and guidance on safety programs to minimize business risks.

Their technology platform is supported by international experts who deliver flexible services to companies wanting to expand across borders, including into Europe. Their services can help you onboard talent, manage compliance, and pay your global workforce without requiring a local entity or multiple third-party providers.

Pros and cons

Pros:

- User-friendly platform with localized support

- Comprehensive and customized onboarding

- Extensive local compliance expertise

Cons:

- Initial setup may require significant time and resources

- Limited customization options for specific HR policies

Native Teams is a global Employer of Record (EOR) provider that helps companies hire, onboard, and pay employees in Portugal and 85+ other countries—without the burden of opening a local legal entity. Their all-in-one platform covers everything from payroll to benefits administration, helping companies expand internationally while staying compliant with local labor laws.

Why I picked Native Teams: Native Teams stood out to me for its emphasis on local compliance and end-to-end employee support in Portugal. With a legal entity in the country, they ensure your team is employed in full alignment with Portuguese labor standards—covering everything from contracts and taxes to required benefits and employee protections.

They also offer flexibility across employment types. Whether you’re bringing on a full-time employee or engaging a contractor, Native Teams helps you stay compliant with the right legal framework for each case. Their services also include visa assistance, which is especially helpful for companies relocating international hires into Portugal.

Native Teams Key Services:

Native Teams provides legally compliant employment through their own Portuguese entity. Once you’ve sourced talent, they handle the rest—employment contracts, tax and benefit deductions, and ongoing compliance with national labor laws. The platform also manages salary payments in local currency, guided onboarding and offboarding, and offers both full-time EOR and contractor management options.

You’ll also get access to employee perks like health insurance and wellness benefits, plus dedicated expense cards for your team. Their relocation and visa assistance is ideal for teams hiring or transferring international workers to Portugal. For contractor and gig worker management, Native Teams supports multi-currency payments and offers custom contract templates.

Their support team includes local experts, and clients benefit from a centralized dashboard, fast fund transfers, and comprehensive compliance coverage.

Pros and cons

Pros:

- Offers localized payroll calculators for accurate salary and tax computations

- Provides compliant employment contracts and documentation

- Enables hiring globally without establishing a local entity

Cons:

- Covers fewer countries than some competitors

- May not offer advanced HR tools beyond essential employment features

Omnipresent is an employer of record (EOR) that helps businesses hire and manage employees across borders. Their services take care of all the legal, payroll, and compliance tasks for you, so you can focus on growing your team in different countries without needing to set up a local entity.

Why I picked Omnipresent: They provide specific services that cater to the country’s employment laws and regulations. For instance, they manage employee benefits that are legally required in Portugal, such as vacation entitlements, social security contributions, and meal allowances. They also ensure your team is compliant with local tax obligations and labor laws, reducing the risk of non-compliance and potential fines.

Omnipresent Key Services:

They handle global payroll, ensuring employees are paid accurately and on time in their local currencies, no matter where they’re located. They also provide benefits administration, so you can offer competitive packages to your employees, including health insurance and retirement plans that meet local standards.

Additionally, Omnipresent supports compliance with global data protection regulations, so your team’s personal data is managed securely. They also provide HR support, which can be particularly useful for businesses that don’t have in-house HR expertise.

Pros and cons

Pros:

- Easy to manage payroll for global teams in one platform

- Handles tax compliance across multiple countries

- Strong local expertise in employment regulations

Cons:

- Slow customer service response times

- Limited flexibility in customizing certain benefits packages

Mercans is a global EOR provider that offers services in Portugal, including global payroll and other HR solutions. Their services emphasize compliance, local expertise, and seamless integration for businesses expanding into the European market.

Why I picked Mercans: EOR services via Mercans include compliance management and extensive local knowledge, a commitment to personalized service, and access to an advanced technology platform to streamline payroll and HR processes. They stand out for their ability to handle complex employment scenarios, making them a top choice for companies seeking reliable EOR services in Portugal.

Mercans Key Services:

Mercans provides tailored HR solutions to support the diverse needs of each client. This customization ensures that businesses receive support aligned with their unique requirements, enhancing overall employee satisfaction.

Mercans also runs its EOR services from an advanced technology platform that includes real-time reporting and analytics features, giving client companies valuable insights into their global HR operations. This level of data also helps client companies make informed decisions and improve strategic planning.

Pros and cons

Pros:

- Extensive local expertise

- Personalized service

- Advanced technology platform

Cons:

- Integration challenges with some existing systems

- Limited physical presence in some regions

Other Portuguese Employer of Record Services

Here are some other EOR service providers in Portugal that didn’t make it into my top 10 shortlist, but are still worth considering:

- Velocity Global

For navigating complex regulatory landscapes

- Horizons

For a flexible EOR contract with no termination fee

- Remote

For competitive and cost-effective benefits packages

- Multiplier

EOR service for quick employee onboarding

- Papaya Global

For an AI-based payroll engine

- Oyster HR

For EOR-related educational resources for clients

- Rivermate

EOR service for managing the local social security system

- Gibson Watts Global

EOR service for risk management expertise

- EuroDev

For long-term European market entry

- Bradford Jacobs

For managing Portuguese payroll taxes

Hiring in Portugal: Important Details

Here are some key details to note if this is your first time hiring staff located in Portugal. Your EOR provider will manage these compliance details on your behalf. However, proactively informing yourself of these details is always recommended before you invest your resources into sourcing staff based in Portugal.

In Portugal:

- Employment laws in Portugal are set by the Ministry of Labour, Solidarity, and Social Security (Ministério do Trabalho, Solidariedade e Segurança Social) and various labour courts.

- The legal body that monitors compliance with labor laws in Portugal is called ACT (Autoridade para as Condições do Trabalho).

- You can hire employees (full-time, part-time, temporary, or seasonal) or contractors. Your Portuguese EOR provider can help you determine the best hiring option depending on your needs while helping you prevent employee misclassification problems.

- Portugal has both mandatory payroll deductions and social security contributions that must be collected, including the following:

- Social Security Contribution (Segurança Social)

- Personal Income Tax (IRS - Imposto sobre o Rendimento das Pessoas Singulares)

- Labour Accident Insurance (Seguro de Acidentes de Trabalho)

- Portuguese is the official language in Portugal. However, Mirandese is also officially recognized as a co-official language in some regions, and many professionals also speak fluent English.

- The standard working week in Portugal is 40 hours per week for a 5-day work week. The maximum number of consecutive working days per week is 6 days.

- Overtime is allowed under the Portugal Labour Code and is calculated at an additional 25% for the first hour and 37.5% for subsequent hours on a weekday, and at 50% on weekends and holidays.

- In Portugal, employees are paid monthly, plus they receive a 13th and 14th-month payment. The 13th month payment is given in June (for summer holidays) and the 14th month is given in December (for Christmas).

- Paid vacation in Portugal starts at 22 days of annual leave per year.

- There are 13 national public holidays in Portugal that employees are paid for, plus several regional holidays that are celebrated locally within Porto, Braga, Madeira and Azores. Understanding and complying with employment norms and legal requirements surrounding Portuguese public holidays is one area where your EOR service will shine, managing these occurrences hassle-free on your behalf.

- National public holidays in Portugal include:

- New Year's Day (January 1)

- Good Friday (variable date)

- Easter Sunday (variable date)

- Freedom Day (April 25)

- Labour Day (May 1)

- Portugal Day (June 10)

- Corpus Christi (variable date)

- Assumption Day (August 15)

- Republic Day (October 5)

- All Saints' Day (November 1)

- Restoration of Independence Day (December 1)

- Immaculate Conception (December 8)

- Christmas Day (December 25)

- Portugal offers maternity leave and paternity leave.

- The maternity leave entitlement is 120 to 150 days, beginning up to 6 weeks before the child’s birth.

- The paternity leave entitlement for fathers is 20 days, to be taken within 6 weeks of the birth.

- During these leaves, employees receive 100% of their average earnings paid by Portugal’s Social Security system.

- Paid sick leave in Portugal can stretch up to 1,095 days (over three years), with the Social Security system covering 55% to 75% of the employee's average earnings.

- The probationary period in Portugal varies depending on the type of position. It’s typically 90 days for most employees, 180 days for positions of high complexity, responsibility, or technical nature, and up to 240 days for managerial roles.

- The termination terms in Portugal are mandated by the Portuguese Labour Code. The required notice period ranges from 15 days for employees with less than one year of service to 60 days for those with more than two years of service. This is another area where a local Portuguese EOR can provide assistance to ensure the probation period and related severance are handled correctly.

- Severance pay is mandatory and is calculated based on the employee's length of service, generally amounting to 12 days' base salary for each full year of employment.

Selection Criteria for Employer of Record Portugal

Choosing the right EOR means more than just checking for legal coverage—it’s about finding a partner that makes hiring in Portugal stress-free. I focused on providers that help solve key challenges like international onboarding, compliant payroll, competitive benefits, and navigating local labor laws.

My research drew on the latest EOR market data and a close evaluation of which providers offer the most value for companies ready to tap into Portugal’s global talent pool.

Here a summary of the criteria I used to assess each provider:

Core Employer of Record Services (25% of total score): To be considered for inclusion in this list, each EOR provider had to offer the following basic services first:

- The corporate structure to legally and compliantly hire employees in multiple countries without a local entity

- The ability to manage cross-border payroll and taxes in compliance with local regulations

- Assistance with offering competitive and locally compliant benefits packages

- Assistance with navigating visa and work permit processes for expatriate employees

- Robust procedures to ensure data privacy and security that comply with international standards, including GDPR and other requirements

Additional Standout Services (25% of total score): To help me narrow in on the best EOR services out of the numerous options available, I also took note of any unique or less common services, including:

- Advanced technology platforms that streamlined payroll and HR processes while still offering ease of use

- Specialized experience in hiring employees within specific new countries or key industries

- Services that enhance remote work compliance and global mobility needs

- Specialized customer support for complex immigration cases

- Assistance with international IT requirements, including managing computer equipment, software licenses, and other asset-tracking requirements

- A focus on eco-friendly and sustainable employment practices

Industry Experience (10% of total score): To evaluate the industry experience of each EOR service provider, I considered the following:

- How many years their business has operated in the EOR space

- Any industry recognitions or certifications the provider may hold in international HR and payroll

- Their depth of knowledge in local labor laws across multiple jurisdictions

- Their expertise in new markets, including how many different countries they offer local expertise in

- Evidence of a strong track record managing global expansion processes

- The combined experience and credentials of their team members, if available

Customer Onboarding (10% of total score): To get a sense of each provider's customer onboarding process, I considered the following factors:

- The availability of comprehensive onboarding materials, such as fact sheets, guides, FAQ repositories, or other training resources

- Support for integrating the EOR provider's software with existing HR systems

- Direct access to onboarding specialists, customer support, or a dedicated account manager during the setup phase

Customer Support (10% of total score): Since the EOR provider will act as your remote workers' legal employer, it's important to ensure you'll receive timely communications and top-level support. To evaluate the level of customer support each company offered, I considered the following:

- The availability of a multilingual support team that covers different time zones

- Multiple support channels, including phone, email, and live chat

- Evidence of responsiveness and effectiveness in resolving issues, as inferred from customer reviews

- The existence of dedicated account managers to provide assistance as needed

Value for Price (10% of total score): To gauge the overall value of each service, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of service offerings versus cost

- Flexibility in service packages to suit different business sizes and needs

Keep in mind that EOR services are complicated, and because of that the price tag can sometimes be high. However, the prices for their services still offer a good ROI considering the complexity of the premium-grade services you're gaining.

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how happy real users are with a service. To determine this, I considered the following factors:

- Consistently high ratings across various consumer review platforms

- Specific feedback on the ease of use of the EOR services

- Testimonials highlighting exceptional customer support and problem resolution

Using this assessment framework helped me identify the employer of record services that go beyond basic requirements to offer additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

What is an Employer of Record in Portugal?

An Employer of Record (EOR) in Portugal refers to a third-party service that legally employs workers in Portugal on behalf of your company. While your organization retains control over these employees’ daily tasks and workloads, the EOR takes on the full legal responsibility for employment.

As the legal employer, the EOR assumes full legal responsibility for any new hires. This includes managing payroll, deducting taxes, ensuring compliance with local employment regulations, administering benefits, and handling any other employee-related requirements specific to Portugal.

Partnering with an EOR service is beneficial for companies wanting to hire skilled foreign workers or expand their operations into Portugal since it simplifies this process considerably.

Instead of requiring your HR team to master Portugal’s employment laws and regulations, you can delegate these responsibilities to a local EOR in Portugal and gain peace of mind that your global operations will be compliant.

EOR vs Legal Entity

Not sure whether you want to work with an EOR or attempt to open your own legal entity in Portugal? The right option depends on how quickly you need to hire, how much control you need over operations, and whether you're ready for the long-term commitment of establishing a local business presence.

Here’s a quick comparison to help you weigh the pros and cons:

| Factor | Employer of Record (EOR) | Legal Entity in Portugal |

|---|---|---|

| Setup Time | A few days to a week | Several weeks to months |

| Initial Cost | Low (monthly service fee) | High (legal, accounting, registration fees) |

| Compliance Responsibility | Handled by the EOR | Fully on your company |

| Onboarding Speed | Fast—employees can start almost immediately | Slow—delays until entity setup is complete |

| Ongoing Admin | Minimal—EOR handles payroll, tax, and benefits | High—requires in-house HR and legal resources |

| Control Over Operations | Moderate—shared with the EOR | Full control |

| IP Ownership | Usually assigned to you via contract | Owned directly by your entity |

| Termination Processes | Managed by the EOR in line with local labor laws | Must be handled internally, with legal oversight |

| Cost Breakdown | Predictable monthly fees, typically per employee | Variable and ongoing costs for compliance, admin, legal |

| Best For | Testing new markets or hiring quickly | Long-term expansion with full local presence |

If you’re looking to hire in Portugal without the red tape, an EOR offers a streamlined path to compliance and speed. But if you’re ready to commit long-term and build out full operations locally, setting up a legal entity may be the right move. It all depends on your goals, budget, and timeline.

How to Choose an Employer of Record in Portugal

An EOR service can solve many different challenges and simplify the process of hiring and managing staff in Portugal. To help you figure out which EOR service best fits your business needs, you need to document your specific challenges first.

As you work through your own unique selection process, keep the following points in mind:

- What problem are you trying to solve? Start by identifying the challenges you're trying to overcome, whether that's sourcing staff within a specific Portuguese district, managing compliance with Portugal’s employment laws and tax regulations, paying employees in Euros, or offering health benefits to your employees in Portugal.

- Who will benefit from the service? Consider who will manage the EOR relationship (i.e., who will your main contact people be in-house?) and how having an employer of record will improve their day-to-day work tasks.

- What is your budget? To evaluate cost, estimate how many employees you anticipate hiring in Portugal. Since EOR providers typically charge a monthly fee for each new hire, this will help you anticipate your monthly costs.

- What outcomes are important? Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to hire employees in Portugal within a certain district to help your company tap into a new customer base abroad. You could compare service providers until you’re blue in the face but if you aren’t thinking about the outcomes you want to achieve, you could waste a lot of valuable time.

- Would the EOR platform work with your technical requirements? Consider how the service provider's software ecosystem would work alongside your existing workflows and systems. Does their software framework integrate with your existing HR software, or would you face data management roadblocks?

Remember every business is different — don’t assume that a Portuguese employer of record service will work for your organization just because it's popular.

Trends in Employer of Record Services

As global hiring becomes the norm, businesses need faster, smarter ways to manage international teams. Today’s top EORs are leaning into tech-driven solutions that prioritize flexibility, compliance, and seamless support across borders.

Here are the latest trends shaping EOR services and the HR tech behind them:

- Immigration Support: There is a growing demand for assistance with immigration services like visa and work permit sponsorships, simplifying global talent acquisition processes for client companies immensely.

- Specialized Services for Diverse Needs: Several EOR providers have begun to offer IP and invention rights protection and equity incentive planning services, to cater to the specific needs of their client companies.

- Enhanced Employee Benefits Packages: There's a growing trend in EOR providers going beyond standard healthcare coverage to offer a full spread of enterprise-level medical and health benefits, stock options, and even one-time benefits like moving bonuses. This trend demonstrates an understanding of the importance of attracting and retaining top talent globally.

- AI-Backed Knowledge Bases: Some EOR providers (including Deel) are beginning to offer legally vetted knowledge bases or information wikis that use artificial intelligence to surface answers to common questions quickly. This helps customers source details on hiring within a specific country fast, without relying on human-run support systems.

As the market continues to evolve, these trends are likely to shape the future of international employment, making it easier for businesses to navigate the challenges of global expansion.

For a closer look at specific EOR providers that are capitalizing on these trends, I recommend reading our in-depth reviews of Omnipresent, Skuad, and Velocity Global.

Key Employer of Record Services

An Employer of Record (EOR) simplifies hiring and compliance in Portugal by managing payroll, tax obligations, and labor laws. Key services include:

- Payroll in EUR: Ensures accurate salary payments in compliance with Portuguese labor laws, including the Labor Code (Código do Trabalho), covering wage rates, overtime, and record-keeping to avoid penalties from labor authorities and the Portuguese Social Security Institute (Segurança Social).

- Tax Compliance and Social Contributions: Handles income tax (Imposto sobre o Rendimento das Pessoas Singulares, IRS) and mandatory social security contributions, including pension, health insurance, and unemployment insurance, ensuring compliance with the Portuguese Tax Authority (Autoridade Tributária) and the social security system.

- Labor Law Compliance: Provides expertise on Portuguese labor regulations, including compliance with working hours, overtime, paid leave, and termination procedures as outlined in the Labor Code, ensuring compliance with regional, national, and international workforce laws and conventions.

- Talent Acquisition and Background Checks: Conducts industry-specific credential verification and background checks to ensure new hires meet Portuguese legal standards and professional certifications.

- Visa and Work Permits: Assists with securing the necessary visas and work permits for non-EU employees, ensuring compliance with the Portuguese Immigration and Borders Service (Serviço de Estrangeiros e Fronteiras, SEF).

- Onboarding and Offboarding: Manages compliant onboarding and terminations in line with Portuguese labor laws, including notice periods, severance pay, and the proper documentation required for terminations, such as the termination statement (Declaração de Cessação de Contrato).

- Benefits Administration: Provides competitive benefits packages, including health insurance, pension contributions, meal allowances (subsídio de refeição), and transportation subsidies, tailored to the Portuguese labor market.

- HR Support: Offers ongoing consultation on Portuguese employment laws, workplace safety regulations, and compliance with mandatory employee-related documentation, such as payroll and social security filings.

- Risk Management and Insurance: Oversees workers' compensation and ensures compliance with local insurance requirements, such as occupational accident insurance and health coverage, mitigating legal and financial risks.

- Multi-Language Support: Facilitates communication with Portugal’s diverse workforce through translation and localization of employment contracts, legal documents, and HR materials.

Benefits of an Employer of Record Service

EOR services are a savvy option for organizations looking to expand their global footprint without the complexities and liabilities associated with international employment laws and practices.

For companies contemplating global expansion, understanding the benefits of partnering with an EOR can provide the clarity and confidence you need to move forward.

Here are several benefits you’ll gain by using an EOR service:

- Quick Market Entry: For organizations aiming to test new markets or hire talent in new countries where they have no legal presence, an EOR offers a swift and efficient solution to initiate operations, saving time and resources.

- Simplified Global Payroll: Using an EOR service simplifies the complex process of managing international payroll, including tax deductions, withholdings, and currency conversions for your employees worldwide.

- Global Compliance & Risk Mitigation: By managing compliance, an EOR service provides expertise in navigating the intricacies of employment laws, tax regulations, and insurance requirements in multiple jurisdictions, helping businesses safeguard their operations against compliance-related risks.

- Enhanced Benefits Negotiation: By leveraging their extensive networks and purchasing power, EORs can negotiate better international insurance rates and secure competitive benefit packages on your behalf, enhancing your ability to attract and retain top talent worldwide.

- Improved Cost Effectiveness: Using an EOR service is a cost-effective way for businesses to enter new markets, compared to the significant costs of establishing a new foreign entity. The latter option involves significant upfront legal fees, plus other costs related to office infrastructure, staffing, and local benefits and insurance coverage.

Understanding the benefits of EOR services can help with strategic planning and improving operational efficiency. As businesses look towards international markets for growth opportunities, partnering with an EOR provider offers a streamlined, cost-effective, and compliant pathway to global expansion.

Costs & Pricing for Employer of Record Services

Typically, the cost of an EOR service follows a fee per-employee, per-month pricing model, which can vary widely depending on a range of factors. This model allows for scalability and predictability in budgeting for international expansion efforts.

In general, EOR services in Portugal cost between $199 to $2,000 per employee, per month.

Key factors that can influence the pricing of an employer of record service include:

- Geographic Location: Costs can vary significantly based on the country or countries you're hiring in. This is due to local economic conditions, labor laws, and the complexity of compliance requirements.

- Employee Seniority and Role Complexity: The level and nature of the roles being filled can also impact the monthly cost. Senior positions or roles requiring special qualifications may increase the price due to higher benefits and compensation management costs.

- Number of Employees: The total number of employees being managed can also impact the cost. In some cases, higher volumes may lead to volume discounts, making per-employee costs more economical.

- Custom Requirements: Any specific needs beyond the standard service offering may also contribute to the monthly cost. This may include customized solutions for recruitment, specialized employee onboarding, or unique compliance requirements, all of which can affect pricing.

Some EORs also operate under different pricing models, including a percentage of employee salary model, a fixed pricing model, and custom pricing models. If you'd like to delve deeper into the different factors that influence prices, my article explaining the intricacies of common EOR pricing structures is a natural next step.

When considering an EOR service, it is crucial to understand how these factors impact the overall cost to ensure that the service aligns with your business's needs and budget constraints. Anticipating the specific requirements of your international expansion strategy will help you choose the most cost-effective and efficient EOR solution for your needs.

FAQs about EOR Services in Portugal

If you’ve got specific questions about the requirements to hire Portuguese employees or how EOR services work, these answers to frequently asked questions are a good place to start:

What does an Employer of Record do?

An Employer of Record (EOR) service provider is a third-party entity that can help an organization hire a new employee in a country where it has no physical presence. It’s a useful service for businesses that are expanding internationally but don’t have physical offices established yet, or don’t ever plan to establish them. In these situations, the EOR provider becomes the legal employer of your remote staff on your behalf.

In this type of partnership, the EOR service provider deals with local employee-related matters such as managing payroll, deducting taxes, and administering the onboarding process for new employees. This allows organizations to access global talent while reducing their legal liabilities and compliance risks. This is because the EOR company assumes the legal responsibility for your international new hires on your behalf.

What are the minimum wage requirements in Portugal?

As of January 2024, the minimum wage in Portugal increased to €820 per month. This amount is the same across all age groups and for all regions in mainland Portugal. The regions of Madeira and the Azores have slightly different minimum wage rates due to the higher cost of living in these areas, with Madeira’s minimum wage at €850 per month and the Azores at €861 per month.

Portugal’s minimum wage is calculated over 14 monthly payments per year, including two additional payments made in June and December, known as the summer and Christmas bonuses. When spread over 12 months, the minimum wage is effectively higher, averaging around €956.66 per month.

Do EOR providers offer other types of global HR services?

Yes, most of the time they do. Many service providers in this space also offer professional employer organization services (also known as PEO services), as well as global payroll services.

PEO services are a way of outsourcing your HR function to support your international teams. PEO companies can help you with international compliance issues, benefits administration, workers’ compensation, and other HR administrative tasks.

Global payroll services allow you to easily pay remote employees or independent contractors within a unified payroll run. They manage in-country compliance requirements and juggle payments in multiple local currencies on your behalf.

To dive even deeper into this topic, read our article covering other types of global HR services to figure out the best fit for you.

What are some of the consequences of non-compliance?

As an organization, you never want to be deemed as non-compliant in the eyes of any government body. The exact rules and regulations will vary according to the jurisdiction you’re operating in, which is one of the main benefits of using an EOR service provider.

If you don’t use an EOR and you do hire international workers, you may quickly find yourself in non-compliance. The consequences of doing so will depend on the severity of the violation, but they could include all of the following:

- Fines and penalties

- Legal actions such as lawsuits or other litigation proceedings

- Corrective measures and compliance orders

- Revocation of business licenses or operating permits

- Reputational damage if the news becomes public (loss of public trust and loss of internal employee respect)

- Increased monitoring and additional government scrutiny

Companies who fail to follow international labor laws cannot simply say they were unaware of the legalities, and hence, didn’t follow them. That’s where an EOR service can really remove a lot of potential risk and liability from the international hiring process.

Are there any risks to using an Employer of Record service?

In the world of business, nothing is ever 100% risk-free, and that is true for EOR services as well. While EOR services do offer substantial advantages, here are some of the risks you should also be mindful of as you choose the right partner for you:

Financial risks:

- Hidden costs and service fees: Some EOR providers may charge additional service fees for specific tasks, such as processing documents, onboarding or offboarding employees, or providing additional HR advice.

- Mandatory benefits: Some countries require mandatory benefits for employees. In that case, the EOR will charge you for those benefits in addition to the employee salary and their service percentage, which can add up.

- Currency fluctuations: Exchange fluctuations can impact the cost of payroll and other financial transactions as the strength of a currency you’re using goes up or down.

Operational risks:

- Data security: Since you’re entrusting sensitive employee data to your EOR, you’ll want to consider the strength of their data protection practices and policies, including their incident response plans, IT penetration testing, and data management certifications, such as ISO 27001.

Strategic risks:

- Loss of control: You will need to relinquish some degree of control over the workforce management processes of your EOR employees, which may impact your organization’s strategic decision-making capabilities.

- Brand reputation: Any negative actions, incidents, or practices of your chosen EOR can directly impact your organization’s brand reputation and create a negative employee experience if not handled properly.

For a deeper dive into this topic, read our comprehensive analysis of EOR risks, including strategies to mitigate each potential issue upfront.

What is a nearshore vs offshore employee?

A nearshore employee is based in a country closer to the company’s location, typically within the same or a nearby time zone, making collaboration and communication easier due to the smaller time difference.

For North American companies, nearshore remote workers may reside in Canada, the Caribbean, or Central or South America.

An offshore employee is located in a country far from the hiring company’s home base, often in a different time zone, to capitalize on cost savings and increase access to a broader talent pool.

For North American companies, offshore remote workers may reside in Asia, Africa, or Europe.

Gain Access to the Best Talent with an EOR in Portugal

If you made it this far, I hope you have a better sense of how EOR services can simplify the process of hiring Portuguese employees. They're truly a valuable resource, whether you're an enterprise organization looking to snap up the top talent in Portugal, or a small business or startup trying to break into the Portuguese talent marketplace without launching your own entity.

If you found this article helpful, I recommend signing up for our weekly People Managing People newsletter too. You'll get access to the latest insights from thought leaders, as well as our latest podcasts, and more software and service recommendations.