10 Best Payroll Software & Services for Accountants Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

The best payroll software for accountants simplifies complex calculations, automates compliance, and streamlines client management—so you can focus on delivering strategic value instead of getting buried in admin.

With so many platforms offering overlapping features, from small-business essentials to enterprise-grade tools, choosing the right solution can feel overwhelming. The wrong choice can lead to compliance risks, wasted time, and costly errors that damage client trust.

Based on hands-on testing and industry experience, I’ve reviewed the top payroll platforms that are accurate, scalable, and tailored to the needs of accounting professionals.

In this guide, you’ll find solutions that fit a range of workflows—whether you’re managing payroll for a few employees or an entire client portfolio.

Why Trust Our HR Software Reviews

We’ve been testing and reviewing HR software since 2019. During that time, we’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews.

As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. Learn how we stay transparent, and take a look at our software review methodology.

Best Payroll Software for Accountants: Comparison Table

This comparison chart summarizes pricing details for my top payroll software selections for accountants to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global team compliance | Free trial + demo available | From $29/month | Website | |

| 2 | Best for IT and HR integration | Free demo available | From $8/user/month (billed annually) | Website | |

| 3 | Best for automating payroll tax calculations | 90-day free trial | Pricing upon request | Website | |

| 4 | Best for customizable payroll processing | Free demo available | Pricing upon request | Website | |

| 5 | Best for a cloud-based payroll system | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 6 | Best for small business invoicing | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 7 | Best for automated payroll processing | Free demo available | From $25 - $199/user/month | Website | |

| 8 | Best for affordability and simplicity | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 9 | Best for single-software efficiency | Free demo available | Pricing upon request | Website | |

| 10 | Best for mid-sized company HR | Free demo available | From $9/user/month | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Reviews of the Best Payroll Software for Accountants

Check out my comprehensive reviews to explore the strengths and weaknesses of leading payroll software for accountants. I’ll detail the features, benefits, and ideal scenarios for each platform to guide you in making an informed decision.Payroll software has become an indispensable tool for accountants, streamlining complex calculations, automating tax compliance, and improving overall efficiency. However, with so many platforms offering overlapping features—ranging from small business essentials to enterprise-grade tools—choosing the right solution can be daunting. Selecting the wrong software can lead to costly errors, wasted time, or compliance issues. In this article, we’ll break down expert reviews and insights to help you navigate your options and find a payroll solution that fits your clients’ needs and your workflow. Whether you’re managing payroll for a handful of employees or an entire portfolio, this guide will help you make a confident, informed choice.

Deel is a comprehensive HR platform designed to help businesses manage their global teams with ease, offering solutions for compliance, payments, and payroll.

Why I picked Deel: I selected Deel because it provides accountants with a comprehensive solution that caters to the complexities of managing global teams. Its ability to automate payroll and ensure compliance with local laws across over 150 countries makes it an excellent choice for those who require a reliable system with integrated HR features all in one place.

Standout features & integrations:

Features include comprehensive payroll services like the ability to pay teams on time with one click, handle taxes, and offer benefits and payslips. Deel also supports global hiring with in-house visa support and the creation of compliant contracts, making it easier for companies to hire and manage employees and contractors across different countries.

Integrations include BambooHR, Hibob, Workday, Workable, Expensify, Quickbooks, Xero, Netsuite, Greenhouse, Ashby, OneLogin, Okta, and more.

Pros and cons

Pros:

- All-in-one HR capabilities

- Facilitates local benefits and payroll across different countries

- Ensures compliance with local labor laws

Cons:

- May take time to learn how to maximize the platform's features

- Potential migration delays

New Product Updates from Deel

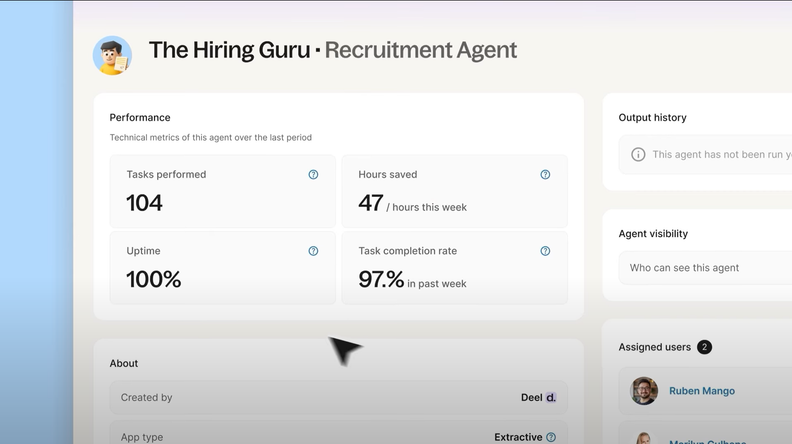

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Rippling streamlines HR and IT systems into a single, cohesive platform. It is best for IT and HR integration, offering a unified solution that simplifies complex processes across both domains.

Why I picked Rippling: I selected Rippling for its standout capability to merge IT management and HR functionalities, which is a differentiator in the payroll software market. It has a comprehensive approach that allows accountants to manage employee data, payroll, and IT resources in one place, ensuring consistency and accuracy across systems.

Standout features & integrations:

Features include automatic tax calculation and compliance management. It also allows businesses to automatically set up and manage employee devices and apps as soon as they onboard, which ensures a secure and efficient start for new hires. Furthermore, Rippling offers detailed employee self-service portals that empower employees to manage their details, payroll information, and benefits, enhancing transparency and engagement.

Integrations include leading platforms like QuickBooks, Xero, Trello, Slack, Asana, and Salesforce.

Pros and cons

Pros:

- Comprehensive employee self-service features

- Enhanced data security with IT integration

- Unified management of IT and HR systems

Cons:

- Limited information on specific integrations without direct inquiry

- May be complex for smaller businesses that do not require IT integration

New Product Updates from Rippling

Rippling Now Integrates with Points North

Rippling's new integration with Points North automates certified payroll reporting, ensuring compliance with Davis-Bacon and prevailing-wage laws by synchronizing data in real time and reducing manual errors. More details at Rippling Blog.

RUN powered by ADP is a comprehensive payroll and HR solution designed specifically for small businesses. It simplifies payroll processing, tax filing, and employee payment options.

Why I picked RUN: The software automatically calculates and files payroll taxes, which is a critical feature for accountants who manage multiple clients. This automation not only reduces the risk of human error but also ensures compliance with the latest tax laws and regulations across all 50 states. Additionally, the AI-powered error detection feature learns from previous payroll runs to flag potential errors before they occur.

Standout features & integrations:

Features include expert hiring & HR support and a mobile app that allows users to manage payroll and employee data from anywhere, providing flexibility and convenience with 24/7 assistance from payroll experts. It also offers direct deposit, an employee self-service portal, compliance support, time and attendance tracking, and garnishment payment services.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Robust mobile app

- Good payroll reporting options

- Employee self-service portal

Cons:

- Most HR functions are limited to higher-tier plans

- Initial setup can be complex

Paylocity is a cloud-based payroll and HR management platform that’s designed to simplify complex payroll and tax processes. For accountants, it offers features tailored to managing multiple clients or handling intricate payroll structures.

Why I picked Paylocity: I like that it offers customizable payroll processing. The software can be tailored to fit your company's pay structure and schedule, accommodating various compensation models. Features like automatic payroll audits also act as safeguards, highlighting any unexpected data entries before processing. This ensures accuracy and allows you to address potential issues proactively.

Standout features & integrations:

Features include automated tax filing and payment services. The platform audits each employee's information based on their location to ensure accurate tax calculations. Paylocity's tax experts prepare, review, and file all necessary tax documents for all U.S. states, plus Guam, Puerto Rico, and the Virgin Islands. This automation reduces manual effort and helps maintain compliance with various tax regulations.

Integrations include ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Pros and cons

Pros:

- Tailored workflows and reports

- On demand payment options

- Includes tax compliance services

Cons:

- Limited customization options in certain modules

- Lacks support for independent contractor payments

New Product Updates from Paylocity

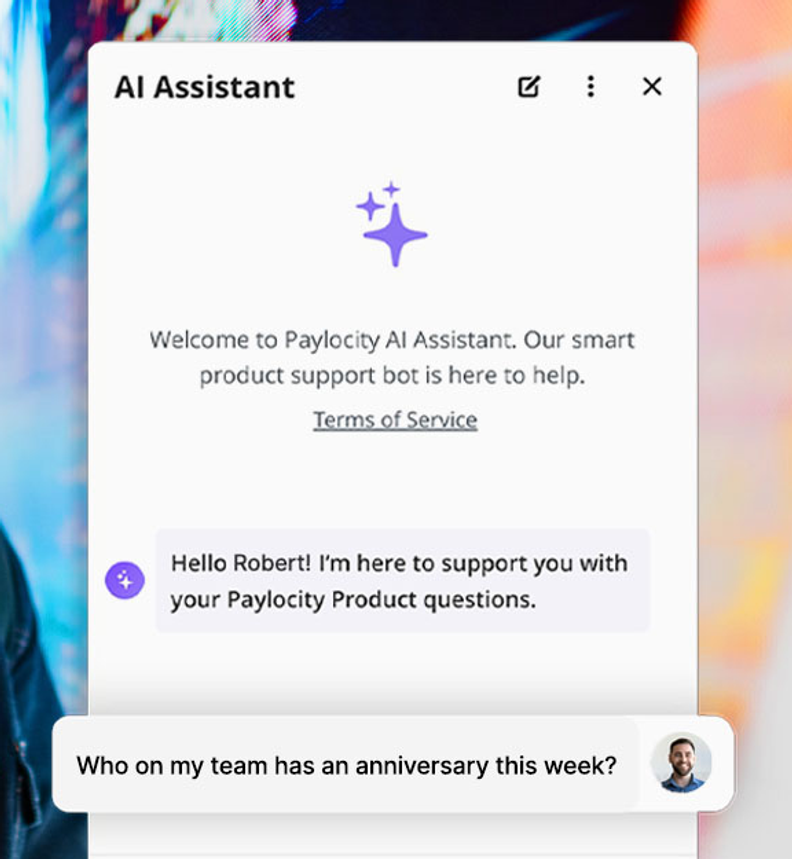

Paylocity AI Assistant Update

Paylocity introduces an AI Assistant that transitions from questions to actions swiftly, enhancing user efficiency. For more information, visit Paylocity's official site.

Xero is a cloud-based accounting software tailored for small to medium-sized businesses, providing a wide range of features to manage financial tasks efficiently. Its intuitive interface and real-time financial insights help business owners maintain control over their finances.

Why I picked Xero: Xero's cloud-based payroll system offers a range of features that cater specifically to the needs of accountants. The platform allows accountants to manage multiple pay schedules, handle various pay rates, and automate complex payroll calculations, such as multi-state taxes, directly within the software. Xero also provides robust reporting capabilities, enabling accountants to create detailed payroll registers, wage and tax reports, and labor cost analyses.

Standout features & integrations:

Features include custom settings and calculations for taxes, pensions, and leave. The employee self-service portal, Xero Me, also allows employees to access payslips and manage leave requests, therefore reducing the administrative burden on accountants.

Integrations include Hubdoc, Stripe, Xero Practice Manager, Shopify integration by Xero, HubSpot CRM integration, Xero Analytics Plus, Xero Inventory Plus, Xero Workpapers, Spendesk, and Dext.

Pros and cons

Pros:

- User-friendly interface

- Good reporting features

- Cloud-based accessibility

Cons:

- Mobile app is limited in functionality

- More advanced payroll capabilities may require integrations

New Product Updates from Xero

Xero Unveils Redesigned Certification Program

Xero has revamped its certification program, offering flexible learning with digital courses, live webinars, and badges. Open to all, it's free and self-paced. For more information, visit Xero's official site.

FreshBooks offers payroll software that integrates with its well-known accounting and invoicing tools, making it a great choice for small businesses and freelance accountants. It simplifies payroll processing while providing robust features for managing invoices and financial reports.

Why I picked FreshBooks: I chose FreshBooks because it excels in simplifying invoicing and financial management for small business owners, which often goes hand-in-hand with payroll tasks. It stands out from other payroll software because of its integration with the broader FreshBooks ecosystem, enhancing payroll and overall financial management. It also has a user-friendly interface and integrated invoicing functions.

Standout features & integrations:

Features include automatic tax calculations and filings to ensure compliance with federal and state regulations. The platform offers direct deposit and detailed pay stubs, helping businesses maintain transparency with their employees. Additionally, its robust reporting tools enable business owners to monitor payroll expenses and budget effectively.

Integrations include Gusto, Stripe, Shopify,Fundbox, Bench, Hubstaff, G Suite, Zoom, and among others.

Pros and cons

Pros:

- Effective handling of tax calculations and filings

- User-friendly for non-specialists

- Direct integration with FreshBooks accounting and invoicing

Cons:

- Annual commitment required

- Primarily beneficial for users already familiar with the FreshBooks ecosystem

Remofirst is a comprehensive global employment services tool that offers solutions for managing remote talent, including employer of record services, global payroll, international contractors, visas and work permits, and workforce management.

Why I picked Remofirst: I selected Remofirst because of its advanced features that streamline payroll management and enhance accuracy. Remofirst offers automated payroll processing, which reduces the time accountants spend on manual calculations and ensures timely payments. Its multi-currency support and compliance with international tax regulations also make it an invaluable tool for accountants handling clients with global operations. Additionally, the platform provides reporting and analytics to help maintain transparent records.

Standout features & integrations:

Features include workforce management, contract management, background checks, benefits management, equipment provisioning, and tools for managing visas and work permits. It also includes an employee cost calculator to calculate the cost of employing someone in a specific country.

Integrations include ADP.

Pros and cons

Pros:

- Ensures compliance with local laws

- Responsive, 24/7 customer support

- Handles payroll in multiple countries

Cons:

- Lacks extensive integrations

- No mobile app

Patriot Payroll is a payroll processing software designed to be both affordable and simple to use. It stands out as the best option for those seeking a straightforward and cost-effective solution for payroll management.

Why I picked Patriot Payroll: I chose Patriot Payroll for this list because of its clear focus on providing a user-friendly experience at a competitive price point. In comparing it to other payroll software, Patriot Payroll's commitment to simplicity without sacrificing essential features is what makes it different. It offers a robust set of features that cater to the needs of small to medium-sized businesses without overwhelming users with complexity or hidden costs.

Standout features & integrations:

Features include an easy three-step payroll process, free setup, and unlimited payrolls. Users can make on-the-fly pay rate changes and have access to a free employee portal. The software also provides free direct deposit, the ability to track reported tips, and customizable hours, money types, and deductions.

Integrations include QuickBooks Desktop, QuickBooks Online, Patriot's Accounting software, and other tools for time and attendance, HR, and 401(k) management.

Pros and cons

Pros:

- Efficient tax calculation and payment functionalities

- User-friendly interface suitable for beginners

- Cost-effective pricing structure

Cons:

- Integration details are vague

- Limited advanced features for larger businesses

Paycom provides an all-in-one payroll solution that incorporates HR, talent acquisition, and time management within a single software system. This integration allows accountants and HR professionals to handle all employee management processes from one platform.

Why I picked Paycom: I chose Paycom for its ability to streamline multiple HR functions into a single software system, reducing the need for multiple tools and interfaces. This integrated approach not only simplifies the user experience but also enhances data accuracy and accessibility across departments. The platform eliminates redundancies and improves workflow consistency in managing employee data.

Standout features & integrations:

Features include an employee self-service portal that enables workers to manage their own HR tasks, such as time off entries and benefits management. It offers direct payroll processing, which is integrated with all other HR functionalities, ensuring accuracy and consistency across data. Additionally, Paycom's software facilitates compliance with automatic updates to meet changing tax codes and regulations.

Integrations include various business tools, enhancing its capabilities in areas such as employee scheduling, performance management, and benefits administration.

Pros and cons

Pros:

- Ensures compliance with up-to-date system adjustments

- Employee self-service feature reduces HR administrative tasks

- Unified platform simplifies management of HR tasks

Cons:

- Limited information on integration with external software

- Lack of transparency in pricing

Namely is a comprehensive HR and payroll software specifically designed for mid-sized companies. It focuses on simplifying complex HR processes while providing tools for payroll, benefits, and compliance within one integrated platform.

Why I picked Namely: I chose Namely for this list because it stands out as a modern HR solution tailored for the finance industry, offering a secure platform with unlimited user roles and permissions. Its ability to reduce risk and provide actionable business insights makes it a top choice for mid-sized companies. Its comprehensive set of tools supports the entire employee lifecycle, from onboarding to performance management, all within a single, integrated platform.

Standout features & integrations:

Features include a user-friendly interface that centralizes employee data, payroll, benefits, and compliance information, making it easy to manage from a single platform. The software offers performance management tools, helping businesses engage and develop their workforce. Additionally, Namely’s mobile app allows employees and managers to access essential HR functions on the go, enhancing flexibility and productivity.

Integrations include major payroll providers, time-tracking applications, and benefits management platforms, including Bonusly, Culture Amp, Equifax, Greenhouse, Lattice, Lever, LinkedIn Talent Hub, NetSuite, Slack, Small Improvements, Workable, Worktango, and 15Five. Zapier can also be connected to configure additional integrations.

Pros and cons

Pros:

- Mobile access enhances flexibility and productivity

- User-friendly interface suitable for mid-sized companies

- Integrates HR, payroll, and benefits into a single platform

Cons:

- May require extensive training to fully understand all features

- Lack of transparent pricing information

- Can be cost-prohibitive for smaller businesses

Other Payroll Software for Accountants to Consider

Below is a list of additional payroll software for accountants that didn’t make it into my top 10 list, but are still worth checking out:

- ADP

For comprehensive HR solutions

- Sage for Accountants

For accountant collaboration

- QuickBooks Payroll Elite

For integrated accounting

- Paychex Flex

For scalable payroll solutions

- Papaya Global

For AI-driven payroll and payments

- Paycor

For HR data analytics

- OnPay

For flexible payroll services

- Gusto

For a modern payroll experience

- BrightPay

For UK-based businesses

- Justworks Payroll

For benefits and HR tools

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Software for Accountants

When selecting payroll software that truly addresses the needs and pain points of accountants, it's essential to find a tool that does the basics well and then some.

I evaluated each option based on its functionality and how well it handles those day-to-day tasks. Here are the criteria I used to determine how these tools should perform to meet your specific payroll management needs in an accounting context:

Core Payroll Software for Accountants Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Payroll processing and direct deposit capabilities

- Accurate tax calculation and filing of payroll tax forms

- Employee self-service portals

- Integration with popular accounting systems and bookkeeping platforms

- Compliance management with labor laws and regulations

- Reporting and analytics for payroll data

Additional Standout Features (25% of total score): To help me uncover the winners from the stack, I also kept a keen eye out for unique features, including the following:

- Innovative automation features that reduce manual entry

- Customizable reporting tools

- Advanced security measures like multi-factor authentication

- Customizable payroll workflows tailored to various business sizes

- Integration with emerging technologies such as AI for predictive analytics

- Exceptional scalability options for growing businesses

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive navigation and user interface design

- Clear and concise dashboard displays for at-a-glance information

- Streamlined processes that minimize the number of steps to complete tasks

- Mobile compatibility for on-the-go account management

- Visual clarity in reporting features for better data interpretation

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Comprehensive training materials, such as videos and documentation

- Availability of customizable templates for quick setup

- Interactive product tours to familiarize new users with features

- Support channels like chatbots and webinars for real-time assistance

- A clear roadmap for data migration and tool implementation

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Availability of 24/7 support through various channels

- Responsiveness and resolution times of the support team

- Access to a knowledgeable and specialized support staff

- Proactive monitoring and alerts for issues

- Community forums or knowledge bases for peer-to-peer assistance

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of feature sets against price points

- Flexibility in pricing plans to suit different business sizes

- Cost-effectiveness of the software over the long term

- Free trials or demos to evaluate the software before purchase

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Consistency in positive feedback across multiple review platforms

- Testimonials that highlight the software's reliability and efficiency

- Critiques that provide constructive feedback for potential improvements

- Trends in customer satisfaction over time

- Real-world examples of how the software has benefited other accounting firms

Through this comprehensive and specific set of criteria, I ensure that the payroll software selected for accountants meets the standard requirements and provides additional value, ease of use, and expert support that accountants need to manage payroll effectively.

How to Choose Payroll Software for Accountants

As you work through your own unique software selection process, keep the following points in mind:

| Factor | What to Consider |

|---|---|

| Ease of Use | Is the interface intuitive for your team? How steep is the learning curve? |

| Scalability | Can the software handle your current client base and future growth? |

| Compliance Support | Does the solution stay up to date with tax laws, filings, and labor regulations across regions? |

| Client Management | Can you easily manage multiple clients in one dashboard or system? |

| Integration Capabilities | Does it integrate with your accounting software, time tracking, or HR platforms? |

| Automation Features | Are there automated tax filings, payroll runs, reminders, and direct deposits? |

| Customizability | Can you tailor features, reports, and permissions to your firm’s needs? |

| Reporting & Analytics | Are reports comprehensive, easy to generate, and helpful for audits or insights? |

| Pricing | Is pricing per client, per user, or flat? Are there hidden fees for certain features? |

| Support & Training | Is the customer support responsive? Are onboarding and training resources provided? |

| Security & Data Privacy | Does the platform follow industry standards for data encryption and access control? |

| User Roles & Permissions | Can you control what different team members or clients can see and do? |

| Mobile Access | Is there a mobile app or mobile-optimized experience for remote access? |

| Reviews & Reputation | What do other accounting professionals say about their experience with the software? |

Trends in Payroll Software for Accountants in 2025

Here are some trends I’ve noticed in payroll software for accountants technology, plus what they might mean for the future of the online payroll industry. To uncover these trends, I sourced countless product updates, press releases, and release logs to tease out the most important insights:

AI-Powered Automation and Predictive Analytics

Payroll platforms are increasingly integrating artificial intelligence to automate repetitive tasks like classification of wages, deduction calculations, and even responding to basic employee queries.

In 2025, many tools offer predictive analytics that can forecast payroll expenses, cash flow implications, and compliance risks—enabling more proactive advising by accountants.

Embedded Compliance and Real-Time Tax Updates

With rapidly evolving tax laws and labor regulations across jurisdictions, modern payroll tools are embedding real-time compliance features.

These ensure local, state, and federal updates are automatically applied, reducing manual oversight and mitigating legal risks for firms managing multiple clients.

Multi-Entity and Global Payroll Capabilities

As more firms handle clients with distributed or international workforces, there’s growing demand for multi-entity and cross-border payroll support.

Software in 2025 increasingly supports multi-currency payroll, localized tax compliance, and country-specific reporting—streamlining international operations for accountants.

Consolidated Accounting and HR Integrations

Seamless integration with accounting, HR, and time-tracking platforms is now a must. Accountants benefit from unified dashboards where general ledger entries, employee benefits, and payroll data are synchronized, reducing reconciliation time and errors.

Pay On-Demand and Flexible Pay Schedules

Driven by changing workforce expectations, more platforms support on-demand pay (early wage access) and flexible payroll runs.

Accountants managing payroll must now consider systems that can accommodate these non-traditional pay cycles without compliance headaches.

What is Payroll Software for Accountants?

Payroll software for accountants is a specialized tool designed to help accounting professionals efficiently manage payroll services for multiple clients. It automates key tasks such as wage calculations, tax withholdings, direct deposits, and compliance filings across various jurisdictions.

Unlike general payroll platforms, these tools often include multi-client dashboards, customizable user permissions, and accountant-specific reporting features. They’re built to streamline workflows, reduce manual errors, and enable accountants to offer payroll as a scalable, value-added service.

Features of Payroll Software for Accountants

When selecting payroll software for accountants, it's essential to consider the features that will streamline payroll processes, ensure compliance, and provide robust reporting capabilities.

Accountants require tools that not only simplify the calculation of wages and taxes but also offer integration with other financial systems. Here are the top features to look for in payroll software that can help accountants manage payroll effectively.

- Automated Payroll Runs – Schedule recurring payroll with minimal manual input, reducing errors and saving time.

- Direct Deposit & Check Printing – Support electronic payments and generate physical checks as needed.

- Tax Calculations & Withholdings – Automatically calculate federal, state, and local taxes, plus deductions.

- Year-End Tax Form Generation – Generate and file forms like W-2s, 1099s, and T4s for employees and contractors.

- Tax Compliance Tools – Ensure payroll complies with evolving tax laws and labor regulations.

- E-Filing Capabilities – File payroll taxes electronically with relevant authorities to simplify compliance.

- Multi-State Payroll Support – Handle payroll for employees in different states with varying tax rules.

- Employee & Contractor Onboarding – Collect tax documents and bank info digitally to streamline setup.

- Multi-Client Dashboard – Manage all clients in one central platform for better oversight and efficiency.

- Employee Self-Service Portals – Let employees view pay stubs, tax forms, and update personal details.

- Client Collaboration Tools – Enable clients to review, approve, or manage payroll tasks with role-based access.

- Custom Reports & Analytics – Generate detailed payroll, tax, and labor cost reports for strategic insights.

- Audit-Ready Records – Maintain complete transaction logs and documentation for audit compliance.

- Forecasting Tools – Estimate future payroll costs and cash flow implications using historical data.

- Accounting Software Integrations – Sync payroll data with platforms like QuickBooks, Xero, and others.

- Time & Attendance Integration – Import hours worked directly from time tracking tools.

- HR & Benefits Sync – Connect payroll with HR systems for seamless benefits and personnel data updates.

- API Access – Customize workflows or connect with other systems through developer-friendly APIs.

- Role-Based Access Controls – Set permissions for staff, clients, and employees based on responsibilities.

- Two-Factor Authentication – Enhance account security through additional login verification methods.

- Encrypted Data Storage – Protect sensitive payroll data with enterprise-grade encryption.

- Secure Document Management – Store and access digital payroll records safely in the cloud.

- Activity Logging – Track user actions for accountability and compliance audits.

- Multi-Entity Support – Manage payroll for multiple companies or divisions from one platform.

- International Payroll Capabilities – Support global clients with multi-currency and localized tax features.

- Real-Time Compliance Updates – Automatically apply legal changes to payroll processing and tax rules.

- Scalable Functionality – Expand capabilities as your client base or firm grows.

Benefits of Payroll Software for Accountants

Payroll software for accountants helps streamline the complex and time-consuming task of managing payrolling.

These tools simplify the payroll process and ensure accuracy and compliance with tax laws and regulations.

Here are five primary benefits that payroll software can provide to both users and organizations.

- Enhanced Accuracy: Payroll software automates calculations and data entry, which diminishes the chances of mistakes that can occur with manual processing.

- Time Savings: By automating routine tasks, accountants can focus on more strategic financial activities, thus optimizing their time and contributing to the overall efficiency of the organization.

- Tax Compliance: Payroll software is regularly updated to comply with the latest tax regulations, helping businesses avoid costly penalties associated with non-compliance.

- Data Security: With advanced security measures in place, payroll software ensures that confidential employee data is safeguarded against unauthorized access or breaches.

- Integrated Systems: Many payroll software solutions can integrate with other HR systems, providing a cohesive platform for managing all HR-related tasks, which enhances data consistency and reduces duplication of effort.

Advanced payroll software can help accountants and in-house finance teams significantly improve their payroll management.

Leveraging these tools can provide a competitive edge, boost efficiency and accuracy, and support compliance and data security, all of which are critical components of successful business operations.

Costs & Pricing of Payroll Software for Accountants

Pricing for payroll software for accountants varies depending on the features, scalability, and level of support required.

Providers typically offer several pricing tiers to cater to different sizes of businesses and their specific needs, from small firms to large enterprises.

Understanding the available plan options will help you select the most appropriate software solution to streamline payroll processing efficiently while adhering to compliance standards.

Plan Comparison Table for Payroll Software

| Plan Type | Average Price | Common Features |

| Free Option | $0 per user/month | Basic payroll processing, tax calculations, limited reports, and customer support |

| Entry-Level | $20 - $40 per user/month | Payroll processing, tax filing, direct deposit, basic reporting, and customer support |

| Mid-Range | $40 - $80 per user/month | Enhanced payroll features, integrations with accounting software, advanced reporting, customer support |

| High-End | $80+ per user/month | Full-service payroll, HR management, compliance assistance, dedicated support, analytics |

| Custom/Enterprise | Quote-based pricing | Customizable features, enterprise-level support, international payroll capabilities, strategic integrations |

When considering a payroll software plan, it's essential to assess the specific needs of your accounting practice and the level of support and features you require. The right balance between cost and functionality will ensure that you can provide efficient and compliant payroll services to your clients.

Payroll Software for Accountants FAQs

Here are some answers to frequently asked questions you may have about payroll software for accountants:

How does payroll software improve accuracy and compliance?

Payroll software improves accuracy by automating calculations for wages, taxes, and deductions, reducing the likelihood of human error. It ensures compliance by staying up-to-date with tax laws and regulations, automatically applying these updates to payroll calculations. This helps accountants avoid penalties associated with non-compliance.

How can payroll software help me offer more value-added services to clients?

Modern payroll tools give you more than just automation—they unlock advisory opportunities. With access to real-time payroll metrics, tax liabilities, and labor cost trends, you can provide clients with insights on budgeting, workforce planning, and cash flow forecasting. Some platforms also allow white-labeling, so your firm can appear as the payroll provider. This elevates your role from service provider to strategic partner.

Should clients be able to access the system?

What features should accountants prioritize when choosing payroll software?

Prioritize multi-client management, direct integrations with accounting software, automated tax filings, audit trails, and strong reporting. Look for bulk processing and customizable roles so you can efficiently serve several clients from a single dashboard. Consider platforms that offer accountant-specific support and scalable pricing.

How do payroll solutions handle multi-client or multi-company management for accountants?

Many platforms provide a central dashboard to manage all your clients in one place. You can quickly toggle between companies, run payroll for each, and access separate reporting and compliance information, so you don’t risk mixing up accounts or client data.

Can I automate year-end tax forms and filings with payroll software?

Yes, most leading payroll solutions will automatically generate and file forms like W-2s and 1099s on your behalf, including reminders of key deadlines. You’ll also get digital copies for clients and employees, reducing the paperwork and hassle during busy periods.

What’s Next?

Choosing payroll software for accountants involves consideration of your business’s specific needs and budget constraints. If the options seem overwhelming and you’re unsure which features will best serve your operations, consider reaching out to the vendors for a detailed demonstration. This provides clarity on how a particular software can address your payroll challenges effectively.

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.