Payroll Software for Contractors Shortlist

Here’s my pick of the 10 best software from the 16 tools reviewed.

Choosing the best payroll software for contractors can save your HR team hours of manual work, reduce compliance risks, and help you confidently pay freelancers, gig workers, and independent contractors—whether local or global. But finding a solution that fits your team’s unique needs isn’t easy.

Maybe you're wrestling with spreadsheets, juggling 1099 filings, or struggling to separate employee and contractor payments. Or maybe your current system just wasn’t built to handle non-traditional workers.

I’ve tested and reviewed dozens of HR tools over the years, and I know how important it is to find software that’s purpose-built for your needs. I put together this list to help you quickly compare options and find the best payroll software for contractors based on features, ease of use, and value.

These tools will help you automate payments, simplify tax filings, and stay compliant, so you can spend less time on admin and more time supporting your people.

Why Trust Our HR Software Reviews

We’ve been testing and reviewing HR software since 2019. As HR experts ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Payroll Software for Contractors: Comparison Chart

This comparison chart summarizes pricing, trial, and demo details for my top payroll software selections for contractors to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for compliant payments in 150+ countries | Free trial + demo available | From $29/month | Website | |

| 2 | Best for automatic tax calculations | 90-day free trial | Pricing upon request | Website | |

| 3 | Best for contractor payment flexibility | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best for paying US-based contractors | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 5 | Best for managing payroll in 180+ countries | Free demo available | Pricing upon request | Website | |

| 6 | Best for international compliance | Free trial available | From $29/user/month | Website | |

| 7 | Best for integrated payment solutions | Not available | From $6/user/month + $35/month base fee | Website | |

| 8 | Best for end-to-end contractor management | Free demo available | Pricing upon request | Website | |

| 9 | Best for automated contractor onboarding | Free demo available | Pricing upon request | Website | |

| 10 | Best for multi-country payroll | Free demo available | From $19/employee/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8

Best Payroll Software for Contractors Reviews

Here are of the best payroll software for managing contractor-only payments, including their key features, pros & cons, and notes on why I included them in this list. I’ve also noted additional use cases for each software system in the list to help you find the best option for your business needs.

Deel simplifies the process of hiring and paying contractors globally. It is best for compliant hiring across borders due to its robust legal infrastructure and localized contracts.

Why I picked Deel: I chose Deel because it specifically addresses the challenges of international payroll and compliance, areas where many other platforms fall short.

What makes it stand out is its tailored approach to meet diverse international labor laws, making it ideal for companies looking to expand globally without legal headaches.

Deel is best for organizations that need a reliable solution for compliant hiring across different countries.

Standout features & integrations:

Features include a comprehensive dashboard that allows users to manage contracts, track payments, and maintain compliance with local tax laws all in one place. It supports multiple payment methods and currencies, enhancing its usability for global teams.

Furthermore, Deel’s self-service portal enables contractors to manage invoices and payments independently, which simplifies administration for both parties.

Integrations include Adobe, Slack, QuickBooks, Salesforce, Google Workspace, Xero, Asana, Dropbox, Shopify, and Zendesk.

Pros and cons

Pros:

- Intuitive user interface

- Supports over 150 currencies and multiple payment methods

- Comprehensive compliance features

Cons:

- Complexity can be overwhelming for small businesses

- Higher cost compared to some competitors

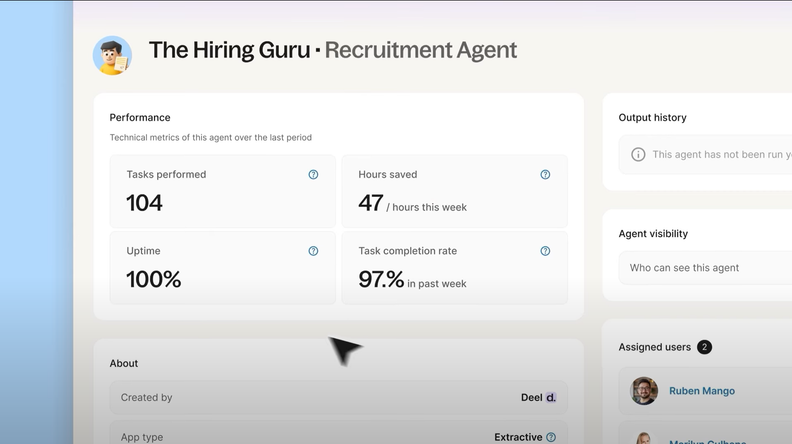

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

RUN powered by ADP is a comprehensive payroll and HR solution designed to simplify the payroll process for small businesses. This tool offers a range of features including automated payroll calculations, tax filing, benefits administration, and compliance management.

Why I picked RUN: It offers flexible payment options, allowing contractors to choose their preferred payment method, whether it be direct deposit, ADPCheck™, or the Wisely® Direct debit card.

In addition, the platform supports global payments, making it easier for businesses to manage international contractors. RUN also offers built-in tax and compliance, which automatically calculates and files payroll taxes.

Standout features & integrations:

Features include a self-service portal and mobile app provided by ADP that enable contractors to manage their funds and work assignments on the go, regardless of their location.

Another key feature is the expert hiring and HR support, providing tools and expertise to help businesses grow their teams, including legal services and employee onboarding.

Integrations include Absorb LMS, Avionte, ClearCompany, Clockshark, Deputy, Dolce, FinancialForce, Infor, JazzHR, Oracle, PayActiv, PlanSource, QuickBooks, Replicon, Sage Intacct, SAP SuccessFactors, Workday, Xero, ZipRecruiter, and 7Shifts.

Pros and cons

Pros:

- Good mobile app for on-the-go use

- Customizable reporting options

- Employee self-service portal

Cons:

- Most HR functions are only available on higher-tier plans

- Limited to up to 49 employees

RemoFirst provides a global payroll solution that enables businesses to hire and pay international contractors with ease. It focuses on flexibility and compliance, offering tailored payment solutions across multiple currencies and countries.

Why I picked RemoFirst: I chose RemoFirst for its exceptional ability to manage international contractor payments with high flexibility. It stands out in the crowded market of contractor payroll services by offering customizable payment options and currency choices, which are critical for businesses working with a diverse international workforce.

I believe RemoFirst is best for companies that require adaptable payment solutions to meet the varied needs of global contractors.

Standout features & integrations:

Features include real-time tracking of contractor payments and expenditures, providing clear visibility into financial operations. The platform supports a variety of payment methods, ensuring contractors can be paid in their preferred currency.

RemoFirst also automates compliance with local tax laws, reducing the administrative burden and risk of penalties.

Integrations include ADP.

Pros and cons

Pros:

- Simple and intuitive user interface

- Automated compliance checks

- Flexible payment options in multiple currencies

Cons:

- No mobile app

- Could use more native integrations with other tools

New Product Updates from RemoFirst

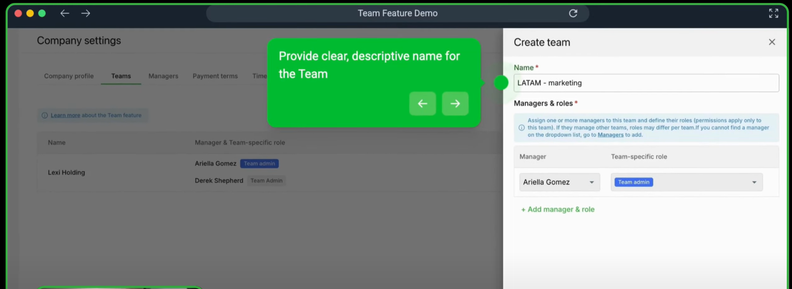

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

Patriot Payroll is an online payroll software that offers affordable payroll services with free direct deposit, making it a cost-effective option for businesses of all sizes. They provide free 2-day direct deposit for qualified customers and a range of comprehensive payroll reports and tools to manage payroll efficiently and accurately.

Why I picked Patriot Payroll: Their software offers features to make contractor management easier, including a free contractor portal to collect documents and empower your contractors to manage their own information, and the ability to pay contractors in the same payroll run as your employees.

You can also use Patriot Payroll to simplify your 1099 filing process since their system supports e-filing for 1099-NEC and 1099-MISC forms. You can prepare them using the software and send them directly to the IRS on behalf of all your active contractors.

Standout features & integrations:

Features include multiple pay rates, detailed payroll reports, printable or electronic W-2 forms, 2-day direct deposits, and the ability to e-file US tax documents.

Patriot offers two payroll software options, Basic Payroll and Full Service Payroll, with features such as a simple three-step process for running payroll, free payroll setup, and U.S.-based support. The software is accessible anytime, anywhere, and offers customizable time-off accrual rules, free direct deposit, and integration with accounting software.

Integrations include Patriot Accounting, QuickBooks Online, QuickBooks Time, Plaid, and Workforce Time & Attendance.

Pros and cons

Pros:

- Responsive customer support

- Compliance with all 50 USA states

- Simplified payroll runs for employees and contractors

Cons:

- No global payroll abilities (USD only)

- Only available for US-based businesses

TopSource Worldwide is a global payroll and HR provider that helps businesses manage contractors across 180+ countries. It specializes in contractor of record services, ensuring payments, taxes, and compliance are handled seamlessly while also offering HR advisory and global mobility support.

Why I picked TopSource Worldwide: I picked TopSource because it gives you a reliable way to hire and pay contractors internationally without worrying about local tax and compliance issues. I especially like that it acts as the employer of record, which means you can work with talent abroad without setting up legal entities. You also get access to global HR advisory services, which can help you make smarter decisions about hiring and payroll.

TopSource Worldwide standout features and integrations:

Features include global payroll management, contractor compliance tools, and employer of record services in 180+ countries. The platform also supports entity setup, global mobility and immigration, and HR benefits advisory.

Integrations include Oracle NetSuite, SAP B1, Microsoft Dynamics, Salesforce, CRM/ERP platforms, e-commerce tools, logistics carriers, WMS, and custom APIs.

Pros and cons

Pros:

- Contractor compliance management tools

- Employer of record services included

- Supports payroll in 180+ countries

Cons:

- Interface may feel outdated

- Pricing not publicly available

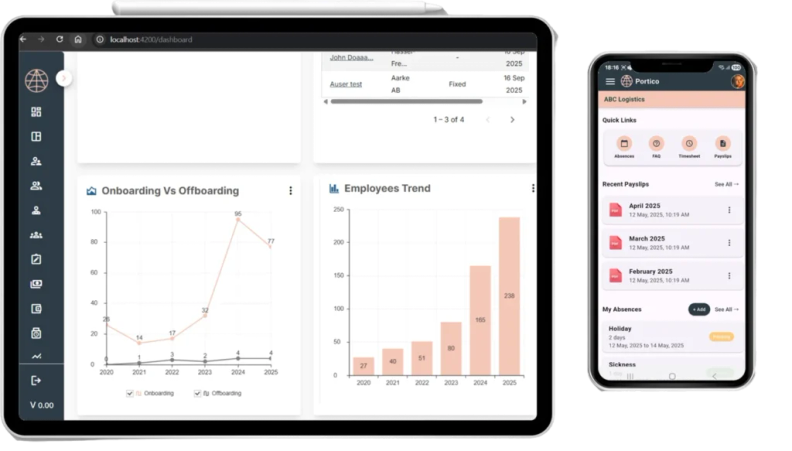

New Product Updates from TopSource

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

Remote specializes in global HR solutions, focusing on contractor management and ensuring compliance with international labor laws. It provides tools for hiring, paying, and managing contractors across different jurisdictions.

Why I picked Remote: I chose Remote because of its comprehensive approach to handling international labor laws and managing contractors globally with assured legal compliance. It stands out from other payroll software for its strong focus on international regulations and local law adherence. I believe Remote is best for companies that operate across multiple countries and need to navigate the complex landscape of international employment law effectively.

Standout features & integrations:

Features within Remote’s all-in-one platform include payroll, benefits, taxes, and compliance for international contractors, plus self-service onboarding, automated invoicing and payments, and access to health benefits for contractors. The platform also provides a misclassification risk tool to help businesses assess and mitigate the risk of incorrectly classifying workers.

Integrations include SAP SuccessFactors, Workday, BambooHR, ADP, Zendesk, Slack, Microsoft Teams, Salesforce, GitHub, and Jira.

Pros and cons

Pros:

- Free 30-day trial to test the platform

- Transparent payment process with complete visibility

- Localized contracts for over 200 countries

Cons:

- After the free trial, a monthly fee applies per active contractor

- Credit card payments carry a 3.5% service fee

Square Payroll facilitates the processing of contractor payments, integrating with various business systems. It simplifies payroll management, offering tools for automatic tax calculations, payment scheduling, and compliance checks.

Why I picked Square Payroll: I selected Square Payroll for its robust integration capabilities, which streamline the payroll process by linking directly with other business operations platforms.

I believe it is best for businesses looking for a payroll solution that enhances their existing payment infrastructure, as well as for those who already use other Square products.

Standout features & integrations:

Features include automated tax calculations, which ensure accuracy and compliance with local and federal tax requirements. It also provides easy online account access for employers and contractors, allowing for efficient management of payroll features.

The product supports flexible payment scheduling, which can be tailored to suit the specific needs of any business.

Integrations include Square POS, QuickBooks Online, Xero, TSheets, When I Work, Deputy, Gusto, and Zoho Books.

Pros and cons

Pros:

- Access to US-based payroll support

- Streamlined payroll process

- Streamlined payroll process

Cons:

- Variable pricing based on contractor count

- Exclusively for 1099 contractors

Wingspan is a platform designed to support businesses that primarily use independent contractors and contingent workers. It offers a wide range of end-to-end features to help manage the entire contractor lifecycle.

Why I picked Wingspan: I chose Wingspan for its ability to automate contractor payments. This includes rapid payment options like ACH transfers and instant payouts. Automation also extends to onboarding. Contractors can easily import tax forms and bank information.

This is augmented by the platform's capability to handle tax deductions and manage W-9 and 1099 forms, ensuring that both contractors and companies remain compliant with tax regulations.

Standout features & integrations:

Features include a self-service portal, ensuring efficient verification and compliance management. The platform also has strong compliance features and contractor benefits options, which provide access to benefits typically reserved for full-time employees, such as checking accounts, insurance options, and financial tools.

Integrations include QuickBooks, Sage, Xero, LinkedIn, Greenhouse, Salesforce, HubSpot, Airtable, Google Workspace, Zoho, Rippling, Gusto, DocuSign, BambooHR, and ADP.

Pros and cons

Pros:

- Good expense management features

- Simple onboarding workflows

- Handles tax compliance paperwork

Cons:

- Focus on contractors only, not employees

- Limited customization options

Rippling offers employee and contractor management software that streamlines onboarding and payroll processes. It is best for onboarding efficiency due to its comprehensive and automated system.

Why I picked Rippling: I selected Rippling for its automated contractor onboarding process, which significantly reduces the administrative burden typically associated with bringing new contractors on board. It differentiates itself with powerful automation features that handle everything from document management to regulatory compliance checks.

Rippling is best for businesses that require rapid scaling and need to onboard contractors quickly and efficiently.

Standout features & integrations:

Features include automated contractor onboarding, allowing companies to issue contracts, collect necessary tax forms, and set up payments, all from a single platform.

It features a unified dashboard that provides a comprehensive view of contractor details, work statuses, and compliance documentation.

In addition, Rippling’s robust security measures ensure that sensitive data is handled safely and in compliance with global regulations.

Integrations include Salesforce, Slack, Google Workspace, Microsoft 365, Asana, GitHub, Jira, Zoom, and LinkedIn.

Pros and cons

Pros:

- Automated onboarding processes

- Comprehensive contractor management dashboard

- Strong security and compliance features

Cons:

- Higher cost for smaller businesses

- May have a steep learning curve for new users

Plane offers a comprehensive payroll solution designed for businesses operating across multiple countries. This platform simplifies the complexities associated with international payroll management, including compliance with local tax laws and handling of currency conversions.

Why I picked Plane: I chose Plane for its focus on simplifying the complexities of multi-country payroll management. It stands out due to its robust compliance framework and ability to handle diverse payroll needs in various jurisdictions.

Plane is best for organizations that operate internationally and require a unified payroll solution that adheres to local laws and standards in multiple countries.

Standout features & integrations:

Features include automated updates on changing payroll regulations in different countries, ensuring businesses remain compliant. It also supports multi-currency transactions, which is essential for timely and accurate employee payments.

Plane also offers detailed payroll reporting tools, giving employers a clear view of their global financial commitments.

Integrations include QuickBooks, Xero, Gusto, Slack, TSheets, Asana, Stripe, Salesforce, Google Workspace, and Microsoft Teams.

Pros and cons

Pros:

- Offers detailed real-time reporting

- Automates local compliance checks

- Handles multiple currencies and tax regimes

Cons:

- Dependent on other systems for full functionality

- Potential complexity in initial setup

Other Payroll Software for Contractors

Below is a list of additional payroll software for contractors that didn’t make it into my top 10 list, but are still worth checking out:

- Wave Payroll

For small business payroll

- Multiplier

For global freelancer onboarding

- Oyster HR

For contractor conversion

- Papaya Global

For managing global contractor payments

- QuickBooks Payroll

For quick payroll processing

- Worksuite

For managing enterprise freelancers

- Gusto

For integrated employee benefits options

- OnPay

For streamlined tax filings

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Software for Contractors

Selecting the best payroll software for contractors requires a thorough understanding of the features and functionalities that address common use cases and pain points organizations face when managing contractor payments.

As a software testing expert, I’ve personally tried and researched many payroll management tools, and the selection criteria I used to create this list are tailored to meet the nuanced demands of payroll processing for contractors.

Here’s a summary of the main selection criteria I used:

Core Payroll Software Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Accurate tax calculation and filing

- Time tracking integration

- Multiple payment methods

- Compliance with labor laws

- Detailed financial reporting

Additional Standout Features (25% of total score): To help me find the best software out of numerous available options, I also kept a keen eye out for unique features, including the following:

- Innovative features that set a product apart from competitors

- Tools that offer unique automation capabilities

- Solutions that provide advanced analytics and forecasting

- Products that integrate seamlessly with other HR systems

- Examples of products that include AI-driven insights for better decision-making

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive navigation and user interface

- Clear and concise dashboard displays

- Responsive design for mobile access

- Streamlined workflows that reduce manual entry

- Visual elements like graphs and charts for at-a-glance information

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Availability of comprehensive training materials

- Step-by-step guides for initial setup

- Interactive product tours for new users

- Support channels like chatbots for immediate assistance

- Webinars and online resources for ongoing education

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Responsiveness of the support team

- Multiple channels for support (phone, email, chat)

- Availability of a knowledge base or FAQ section

- Customer service hours and availability of emergency support

- Quality of technical assistance provided

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models

- Comparison of feature sets against price points

- Assessment of scalability and upgrade costs

- Evaluation of any hidden fees or charges

- Consideration of free trials or money-back guarantees

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Overall satisfaction ratings

- Feedback on specific features and their effectiveness

- User testimonials about customer service experiences

- Analysis of common praises or complaints

- Trends in user recommendations or warnings

Using this assessment framework helped me identify the contractor payroll software that goes beyond basic requirements to offer additional value through unique features, ease of use, effective onboarding, reliable customer support, and overall cost-effectiveness, as evidenced by customer reviews.

How to Choose Payroll Software for Contractors

As you work through your own unique software selection process, keep the following points in mind:

- Compliance Management: Contractor payroll software must adhere to various tax laws and regulations. It should automatically update to reflect changes in legislation, thus ensuring that you remain compliant without having to manually track legal updates. For instance, in the US, this would include handling different state tax requirements and IRS regulations for 1099 forms.

- Flexible Payment Options: Contractors often have different payment terms than regular employees. The right software will offer flexibility in payment schedules (weekly, bi-weekly, monthly) and methods (direct deposit, checks, online payrolls). This is crucial for businesses that work with a diverse group of contractors who may have varying preferences for how they receive their payments.

- Scalability: As your business grows, your contractor base might expand. The payroll system should be able to scale with your business, accommodating an increasing number of contractors without a drop in performance or the need for a system overhaul. This is particularly relevant for startups and SMEs poised for rapid growth.

- Ease of Use: The software should be user-friendly, allowing both HR staff and contractors to navigate it with minimal training. A straightforward interface is essential to avoid errors and save time. For example, contractors should be able to easily submit their hours and view their payment history without needing assistance.

- Integration Capabilities: The payroll system should integrate with other software solutions you use, such as accounting software or project management tools. This ensures that data flows smoothly between systems, reducing the need for time-consuming manual data entry and the potential for errors. For businesses that use a suite of tools for operations, this integration is key to maintaining an efficient workflow.

Trends in Contractor Payroll Software

Contractor payroll tools are evolving fast to meet the needs of a more global, tech-savvy workforce. Here are several key trends reshaping the space:

- Increased Emphasis on Global Compliance Capabilities: Modern systems now auto-update to reflect local tax laws and labor regulations, giving companies peace of mind as they scale internationally without risking legal missteps.

- Real-Time Payroll Insights: Advanced dashboards now deliver instant visibility into payroll costs, contractor performance, and budget allocations—fueling faster, smarter decision-making.

- Holistic Integrations with Other Business Systems: Today’s payroll platforms connect effortlessly with ERP systems, HRIS, and accounting tools. This minimizes manual work, reduces errors, and keeps data in sync across teams.

- Enhanced Contractor Self-Service Portals: New self-service portals empower contractors to manage their own profiles, track payments, access tax forms, and submit invoices—improving their experience while lightening HR’s load.

- Mobile-First Functionalities: With remote work on the rise, payroll systems are becoming mobile-friendly, allowing both HR and contractors to handle key tasks on the go from any device.

Together, these trends reflect a growing demand for payroll software that’s global, connected, and easy to use, helping businesses adapt to an increasingly agile workforce.

What is Payroll Software for Contractors?

Payroll software for contractors is a tool that automates how businesses pay freelancers, independent contractors, and gig workers. It helps manage payments, track time, issue tax forms like 1099s, and stay compliant with labor and tax laws.

HR teams and business owners use this software to reduce manual work, avoid classification errors, and simplify multi-contractor payroll across regions or countries.

Features of Payroll Software for Contractors

When choosing payroll software for contractors, focus on features that solve your biggest pain points, whether that’s reducing manual work, staying compliant, or keeping your budget on track. The best tools streamline payroll, simplify compliance, and give you better control over your project finances.

Here are the top features to prioritize:

- Automated tax calculations: This feature simplifies the complex process of calculating local, state, and federal taxes for contractors. It ensures that payroll is compliant with tax laws, which is crucial for minimizing the risk of penalties.

- Multi-currency support: This feature supports payments to contractors in different currencies, which is essential for businesses operating internationally.

- Integration with accounting software: Connecting your payroll data to your other financial systems is vital for accurate financial reporting and simplifying the reconciliation process.

- Customizable payment schedules: This feature accommodates various contract terms and payment agreements, such as different pay rates and schedules, aligning with project timelines and budgets.

- Digital timesheets and project tracking: Accurate time-tracking or integrated timecards ensure that payments are based on the actual work completed, which is essential for budget management.

- Self-service portals for contractors: This feature allows contractors to access and manage their payment information and documents. It both reduces administrative overhead and enhances contractor satisfaction by empowering them with self-management tools.

- Compliance management tools: These tools are vital for keeping track of all contractor-related compliance needs while adhering to industry and legal standards, protecting your business from compliance risks.

- Real-time financial reporting: Up-to-date insights into your payroll expenditures are crucial for effective financial planning and immediate decision-making.

- Mobile access: This feature ensures that payroll tasks can be handled flexibly and on the go, fitting into the dynamic nature of managing diverse projects.

- Secure data encryption: High-level security is essential to protect sensitive contractor data, prevent data breaches, and maintain trust and compliance.

These features provide a robust framework for managing contractor payroll, ensuring each aspect of the process, from payment to compliance, is handled efficiently and securely.

If your organization is set to expand their use of contract labor, having a payroll system equipped with these capabilities is crucial to maintain operational efficiency and compliance.

Benefits of Payroll Software for Contractors

Payroll software takes the guesswork out of paying contractors, ensuring accuracy, speed, and compliance every step of the way. It not only simplifies complex payment processes but also boosts efficiency for both teams and organizations.

Here are some key advantages you’ll gain:

- Automated Tax Calculations: Automating tax calculations reduces the risk of human error. The software accurately computes taxes for each contractor, ensuring compliance with tax regulations and saving time on manual calculations.

- Simplified Invoicing and Billing: Streamlining the invoicing process, payroll software allows contractors to submit their hours and expenses, which are then automatically incorporated into the billing system, reducing administrative workload.

- Enhanced Record Keeping: Maintaining comprehensive records, the software keeps detailed logs of all payments and financial transactions, which are essential for auditing purposes and financial management.

- Customizable Payment Schedules: Offering flexibility, payroll software enables the creation of custom payment schedules to meet the unique needs of contractors and the business, ensuring timely and accurate payments.

- Integrated Time Tracking: By integrating time tracking features, the software allows for accurate recording of hours worked by contractors. This simplifies the payroll process and ensures that contractors are paid for the actual time worked.

Adopting payroll software for contractors can significantly improve the payroll management process, providing a more efficient and reliable system for contractors and businesses. It saves time, reduces errors, ensures tax compliance, and enhances overall financial management

Costs & Pricing for Payroll Software for Contractors

Understanding pricing is key when choosing contractor payroll software. The right solution can automate everything from calculating pay and managing taxes to generating reports, all while keeping you compliant with labor laws.

Below is a breakdown of common pricing plans and what features are typically included at each level.

Plan Comparison Table for Payroll Software for Contractors

| Plan Type | Average Price | Common Features |

| Free | $0 | Basic payroll processing, direct deposit, and limited contractor management |

| Basic | $10 per contractor, per month | Automated payroll, tax calculations, direct deposit, and basic reporting |

| Standard | $25 per contractor, per month | All Basic features, advanced reporting, time tracking, and multi-state payroll |

| Premium | $50 per contractor, per month | All Standard features, dedicated support, HR tools, and benefits management |

| Enterprise | $100+ per contractor, per month | Custom solutions, full-service payroll, extensive integrations, and compliance support |

When selecting a payroll software plan for contractors, you should consider the size of your contractor workforce, the states in which they operate, and the level of support and features you require. It's important to choose a plan that not only fits your current needs but can also scale with your business.

Payroll Software For Contractors FAQs

Here are some answers to the frequently asked questions I’ve received about payroll software for contractors:

What features should I look for in payroll software for contractors?

When selecting payroll software for contractors, it’s important to consider features such as the ability to handle various tax forms relevant to contractor work, like Form 1099-NECs.

The software should also offer flexible payment schedules to accommodate different contract terms, and it should be able to manage multiple rates of pay if a contractor works on different projects with different pay scales.

Alongside this, the software should be compliant with IRS guidelines for contractor payments.

Can payroll software for contractors integrate with other systems?

Yes, many payroll software solutions designed for contractors can integrate with other systems. This includes accounting software, time-tracking apps, and project management tools. Integration capabilities allow for the automatic transfer of data, which can save time and reduce errors in bookkeeping.

Is it possible to pay contractors in different countries with payroll software?

Some payroll software solutions are equipped to handle international payments, which is beneficial for businesses that hire contractors from different countries. These solutions, referred to as global payroll solutions, can manage multiple currencies and adhere to various tax laws and regulations.

However, not all software has this capability, so it’s important to verify this feature if international payments are a requirement for your business.

How does payroll software for contractors handle taxes?

Payroll software for contractors typically includes features that assist with tax calculations and reporting. The software can calculate the appropriate taxes to be withheld based on the contractor’s information and the tax laws of their jurisdiction. It can also generate tax forms such as 1099s for independent contractors, which are necessary for annual tax filings.

Can contractors access their payment information through the software?

Many payroll software solutions offer self-service portals where contractors can access their payment information, including pay stubs, payment history, and tax forms. This feature provides transparency and allows contractors to manage their own financial records, which can be especially helpful during tax season.

How secure is payroll software for contractors?

Payroll software for contractors typically includes robust security measures to protect sensitive financial data. This often involves encryption of data both in transit and at rest, multi-factor authentication, and regular security audits.

It’s crucial to choose a software provider that prioritizes security and complies with industry standards to ensure the protection of your business and contractor data.

What kind of support can I expect with payroll software for contractors?

Support options vary by software provider, but many offer a range of support services including email support, live chat, phone support, and an online knowledge base. Some providers may also offer dedicated account managers or support for setup and training. It’s advisable to choose a provider that offers the level of support that aligns with your business needs.

How does contractor payroll software affect compliance?

Payroll software for contractors helps businesses maintain compliance with labor laws and tax regulations by automating many of the compliance-related tasks. The software can keep track of changing tax rates and regulations, generate necessary tax forms, and ensure that payments are made in accordance with legal requirements.

However, it’s still important for businesses to stay informed about the laws that affect their operations and ensure that their payroll software is updated accordingly.

What’s Next?

Payroll software for contractors addresses common operational challenges and introduces new efficiencies into your business processes. As you consider the future of your contractor management, think about how the integration of such a system could redefine the way you handle contractor engagements and payroll operations.

Take the next step by evaluating software options that align with your specific business needs and objectives, including the possible addition of contractor management software to complement your payroll operations.

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.