10 Best Canadian Employer of Record Shortlist

Here’s my pick of the 10 best Canadian EOR companies out of the 20 options I’ve reviewed:

The best employer of record in Canada helps you hire, pay, and manage Canadian employees, without needing to open a local entity or learn the intricacies of Canadian labor law.

Whether you already have remote staff in Canada or are exploring the idea of hiring north of the border for the first time, you might be running into some big challenges. Setting up a legal presence, handling payroll taxes, complying with provincial labor rules—it’s a lot to take on, especially when your focus should be on building a great team.

That’s where Canadian EOR services come in. They take care of HR admin, payroll, benefits, and compliance for your Canadian hires so you can onboard faster, avoid legal pitfalls, and stay focused on scaling your business.

As a Canadian HR professional, I've created this guide to help you confidently choose the right partner to hire and manage Canadian employees. I’ll also share insights from my experience navigating the Canadian employment landscape, so you know exactly what to expect.

Now, let’s dive into the top options and get you started—faster, and without the usual headaches.

Market Details for Hiring in Canada

- Capital City: Ottawa

- Currency: Canadian Dollars (CAD)

- Payroll Frequency: Bi-weekly or

Semi-monthly - Official Languages: English & French

- Approx. Population: 41 Million

- Public Holidays: 9 to 13, depending on the province

Why Hire Employees in Canada?

Canada is an appealing destination for hiring remote employees due to its highly educated workforce, strategic location, and trade agreements with major economies, including the US. It’s known for its deep talent marketplace in the technology, engineering, healthcare, and finance sectors. In particular, Canada's healthcare and engineering sectors are globally recognized.

The country offers a diverse and skilled labor pool, which is continually replenished by top-tier universities and research institutions. Cities like Toronto, Vancouver, and Montreal have established themselves as tech hubs, drawing in professionals from around the world. In addition, certain geographic areas of Canada offer access to talent that is bilingual in English and French.

Why Trust Our Reviews

We've been testing and reviewing HR software + services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Employer of Record Canada: Comparison Chart

This comparison chart summarizes pricing details about for my top Employer of Record selections for hiring Canadian staff to help you find the best EOR service for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for rapidly onboarding Canadian EOR employees | Free trial + demo available | From $29/month | Website | |

| 2 | Best Canadian-based AI-driven EOR platform | Free trial available | From $579/month | Website | |

| 3 | Best for budget-conscious remote team expansion | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best for navigating local tax regulations | Free demo available | Pricing upon request | Website | |

| 5 | Best support for full-time and contractor hiring | Free demo available | Pricing upon request | Website | |

| 6 | Best for hiring and paying talent in Canada | Free demo available | From $199/employee/month or $19/contractor/month | Website | |

| 7 | Best for EOR support in Canada | Free demo available | $99/employee/month | Website | |

| 8 | Best for competitive benefits packages | Free trial available | From $29/user/month | Website | |

| 9 | Best for fast support and in-house expertise | Free demo available | From $29/contractor/month to $499/EOR employee/month | Website | |

| 10 | Best for offering EOR employees flexible work spaces | Free demo available | Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5 -

ChartHop

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.3

Reviews of the Best Employer of Record for Canada

To help you find the best Canadian EOR service for you, I’ve described my top 10 selections in detail, including the specific services each provider offers, and how HR teams can use them. I’ve also included 10 more EOR service providers for Canada below if you’d like even more options to choose from.

Deel is a well-established employer of record platform that enables companies to rapidly employ people in 150+ countries, including within Canada.

Deel owns a local entity in Canada that is staffed with legal experts to keep track of regulatory changes, and ensure all legal obligations are met on your behalf. To hire a Canadian employee with Deel, the average onboarding time frame is 1 day.

Why I picked Deel: Deel offers a free employee cost calculator to help you estimate the cost of hiring a Canadian employee. You can compare different employer costs depending on the Canadian province you’re looking to hire in, including a breakdown of all required provincial and national benefits and withholdings.

The well-established business has launched several new offerings over the past year, including global payroll, global mobility support, integrated Slack tools, and advanced integrations.

Deel Key Services:

Deel offers end-to-end management for your Canadian employees covering everything from hiring and onboarding to termination and severance. Their web app is user-friendly and provides a range of features to help businesses manage their Canadian workers effectively, including contract management and expense tracking.

Their integrated contract management function supports advanced customizations such as stipends, signing bonuses, and stock options. You can also use Deel to offer Canadian benefit plans, such as pension plans or RRSP (registered retirement savings plan) programs.

In addition, Deel is known for its fast support. They offer 24/7 customer support and live chat.

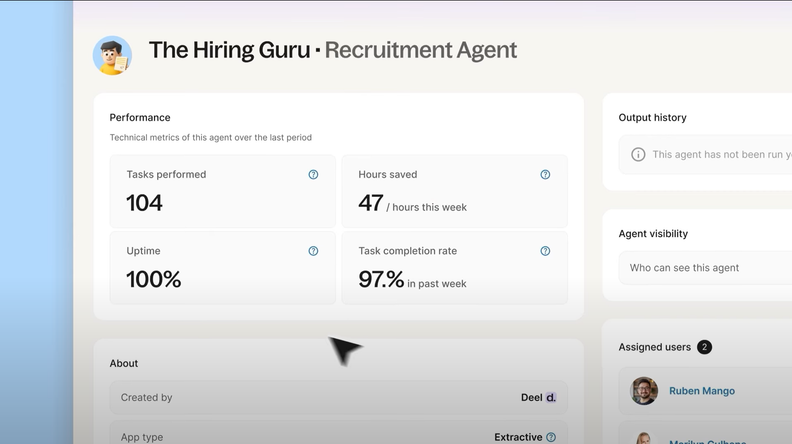

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Borderless AI is an AI-powered employer of record and global payroll platform that helps companies hire, onboard, manage, and pay international employees without setting up a foreign entity.

Why I picked Borderless AI: Borderless AI stands out because it ensures compliance with Canadian labor laws, including federal and provincial regulations. It handles employment contracts, payroll, tax filings, and benefits administration, allowing your company to hire in Canada without establishing a local entity.

Additionally, Borderless AI offers AI-powered tools that automate HR workflows, such as generating compliant employment agreements and answering HR-related questions. Its AI agent, Alberni, can assist with tasks like creating job descriptions and employment contracts, providing real-time support for HR decisions. This automation reduces manual HR work and ensures real-time compliance updates, which is crucial when managing a workforce across different jurisdictions.

Borderless AI Key Services:

Borderless AI offers country-specific onboarding workflows that adapt to local regulations and ensure new hires in Canada are set up compliantly from day one. You also get automated document management, where essential employment documents like contracts and tax forms are stored and organized centrally for both employers and employees.

Another important service is its employee benefits customization, which lets you offer perks that align with Canadian standards and expectations. This includes health insurance, paid time off, and statutory benefits tailored to each province. Borderless AI also provides a centralized compliance hub that’s updated regularly, giving your HR team one place to stay informed about changes to Canadian labor laws, payroll rules, or tax obligations,

New Product Updates from Borderless AI

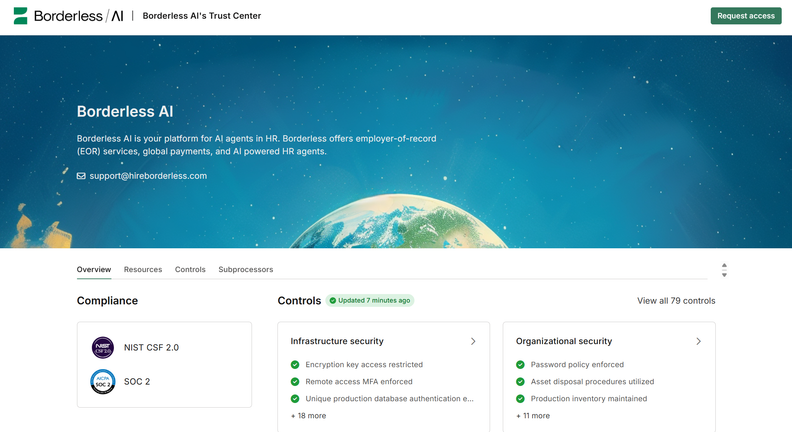

Borderless AI is Now SOC 2 Type II Certified

Borderless AI announced its SOC 2 Type II certification, emphasizing security and data protection with a new Trust Center and plans for ISO 27001 certification. More details are available at the Borderless AI Blog.

Remofirst is a global EOR service provider on a mission to free employers from geographical boundaries so they can build a global team with ease. You can use their EOR platform to hire and manage full-time employees or contractors in Canada, eliminating the need to set up a local entity.

Why I picked Remofirst: If you plan to expand your remote team to different countries, including Canada, Remofirst is a good option to consider, especially if you're on a budget. It offers a flexible approach, allowing you to hire full-time employees or contractors depending on your needs. Plus, Remofirst handles the complexities of Canadian employment law and ensures you're compliant with provincial tax law and employment standards.

Additionally, to simplify your payroll process, Remofirst summarizes and aggregates your EOR invoices for review, showing each EOR employee’s salary in their local currency, including Canadian dollars. They'll automatically calculate your team’s hours, time off, holidays, bonuses, and commissions so you don’t have to worry about it. Remofirst also offers locally relevant benefits packages.

Remofirst Key Services:

Their team of legal experts and HR professionals will ensure your business operations are always compliant with changing Canadian regulations, with compliance documentation accessible at all times through your secure dashboard. Their customer support team is also available 24/7 in case you need additional help. All clients also receive a dedicated account manager as their main point of contact.

On top of their EOR services, Remofirst also provides international payroll and invoice management, global benefits management (including insurance and equity plans, plus time-off management), and employee support with obtaining visas and other immigration documentation. They can even help you with provisioning equipment to your distributed employees around the world.

New Product Updates from RemoFirst

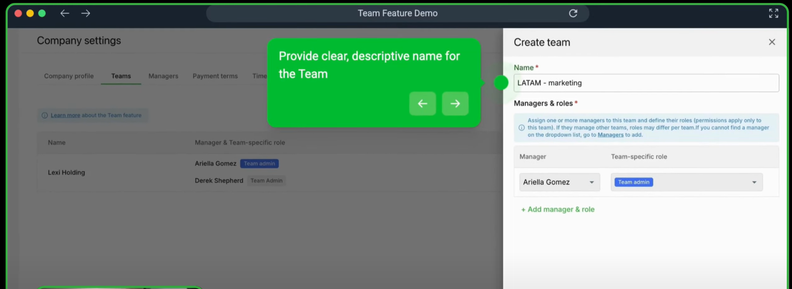

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

TopSource Worldwide is a global Employer of Record (EOR) service that helps businesses hire full-time employees in Canada without the need to set up a local entity. Their platform covers employment contracts, payroll, HR support, and benefits, ensuring compliance with Canadian employment laws while simplifying workforce management.

Why I picked TopSource Worldwide: If you’re looking to hire in Canada without establishing a local entity, TopSource Worldwide is a strong contender thanks to its thorough understanding of Canadian employment law and payroll compliance. Their services help you navigate local tax regulations, employee benefits requirements, and HR obligations with confidence.

Additionally, TopSource Worldwide offers tailored support through strategic HR advisory and personalized service, including compliance guidance and workforce management solutions. Their local expertise helps ensure your operations stay aligned with Canada’s evolving employment landscape. They also offer benefits like Registered Retirement Savings Plans (RRSPs) and health coverage to keep your employees well-supported.

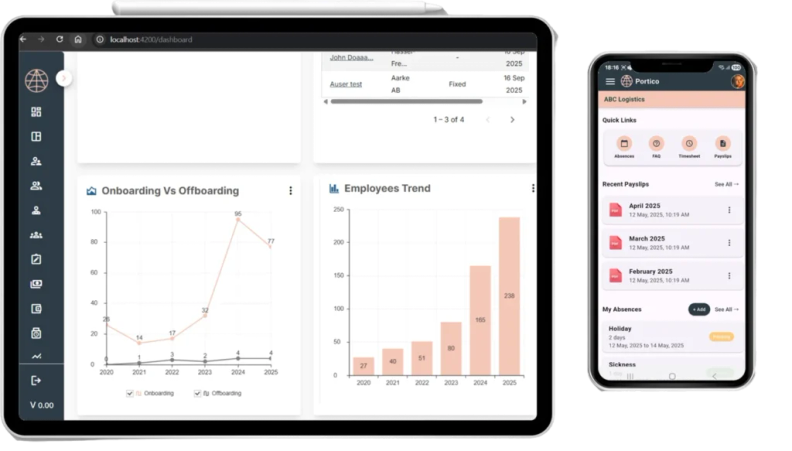

For budgeting purposes, their Global Employment Cost Calculator estimates hiring costs in Canada, accounting for taxes and benefits. Their Portico platform offers HRMS features to manage everything from onboarding to payroll in one place.

TopSource Worldwide Key Services:

Their team of legal, payroll, and HR experts help ensure compliance with Canadian laws, covering employment contracts, payroll processing, and statutory benefits. Clients also get personalized support through dedicated account managers and access to advisory services for local labor law guidance.

In addition to core EOR services, TopSource Worldwide provides global payroll solutions, benefits administration, tax and social security contributions, and assistance with entity setup.

New Product Updates from TopSource

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

G-P is a global Employer of Record (EOR) solution that helps companies hire, onboard, and manage employees in over 180 countries without the need to set up local entities. By taking on the legal responsibilities of employment, G-P enables businesses to expand internationally while ensuring compliance with local labor laws.

Why I picked G-P: One reason I chose G-P is its comprehensive handling of employment compliance. G-P manages payroll, employment contracts, statutory benefits, employee expenses, and termination processes, ensuring adherence to both federal and provincial laws. This is particularly beneficial in Canada, where labor legislation can be complex and varies by province.

Another thing that stood out to me is G-P's support for both full-time employees and contractors. This flexibility allows businesses to onboard a wide range of talent without worrying about setting up a local entity. Whether you're hiring permanent staff or engaging contractors for specific projects, G-P handles the unique compliance requirements for each worker type, including managing payments, contracts, and tax obligations.

G-P Key Services:

They provide tools that cover the entire employment lifecycle, from hiring to onboarding and managing employees. This comprehensive approach means that you have all the support you need throughout the different stages of employment. They also offer assistance with obtaining work visas and permits, ensuring that employees have the necessary authorization to work in Canada.

Another helpful service is G-P's guidance for managing compensation and benefits in line with Canadian standards. G-P ensures that employees receive mandatory benefits such as pension contributions, employment insurance, and workers' compensation, as well as optional benefits like health and dental insurance, bonuses, and remote work allowances.

Skuad is a global HR platform that offers EOR and HR compliance services across 160+ countries, including Canada.

Why I picked Skuad: Skuad provides a comprehensive solution to hiring local employees in Canada without needing to open a Canadian entity. This capability is particularly beneficial for small and medium-sized companies looking to expand globally without navigating the complex administrative and legal formalities of establishing offices abroad.

Skuad stands out from other EOR services thanks to its automated and high-tech platform that offers access to a diverse talent pool of potential new hires. This helps businesses recruit Canadian workers and manage all the legal complexities such as background checks, payroll processing, and other administrative tasks.

Skuad Key Services:

Skuad's services include acting as an Employer of Record (EOR) or Agent of Record (AOR), global payroll processing, employee benefits management, compliance and taxation services, employment contracts automation, talent acquisition, and contractor management. They also offer a unified platform for workforce management that includes localized human resources support, payroll processing in multiple currencies, and advanced analytics for workforce insights.

Native Teams is an Employer of Record (EOR) service that enables businesses to hire, onboard, and pay employees in over 85 countries—including Canada—without establishing a local entity. Their platform centralizes HR, payroll, benefits, and compliance processes, helping companies expand globally while meeting local employment standards.

Why I picked Native Teams: I chose Native Teams because of their cost-effective Canadian EOR pricing, starting at just $99 per employee per month—well below industry averages. They offer full legal employment through their Canadian entity and manage contracts, payroll, taxes, and benefits with built-in compliance support. I also liked their employee-level support, which includes localized benefits and dedicated onboarding guidance to help new hires get started smoothly.

Native Teams Key Services:

Native Teams offers end-to-end EOR services in Canada, including employment contract generation tailored to Canadian labor laws, tax withholding and remittance, and benefits administration such as private health insurance. Their payroll system supports payments in CAD with bulk pay options and multi-currency support.

The platform also provides automated compliance monitoring, guided onboarding/offboarding, and expense card issuance for employee purchases. In addition to EOR services, Native Teams supports contractor payments, gig worker payroll, and relocation assistance—making it easier for businesses to hire across multiple worker types while staying compliant with Canadian regulations.

Remote’s global HR solution offers EOR services that simplify payroll, benefits, taxes, and compliance for Canadian workers. You can use their services to hire full-time employees or contractors, and gain local market insights.

Once you’re ready to hire a Canadian employee, Remote can complete their onboarding process in as quick as 2 days.

Why I picked Remote: Remote helps companies compete for talent effectively in the Canadian market by lending access to competitive benefits packages. They can help you offer health insurance, dental insurance, vision insurance, life and disability coverage, and mental health support services for your Canadian employees. Also worth noting, Remote does not add any markup to their benefits premiums or administration costs, making them a cost-effective choice.

Remote Key Services:

Services include global payroll processing, intellectual property and invention rights protection, and Canadian-specific benefit packages that are local and competitive. Their software platform also covers experience reimbursement and time-off requests, which are quick and easy to approve through their online portal.

Omnipresent is an Employer of Record (EOR) service that helps companies manage global teams by taking care of all the legal and administrative tasks tied to hiring employees abroad. Instead of navigating the complexities of setting up a legal entity in a new country, you can rely on Omnipresent to handle the process.

Why I picked Omnipresent: It covers everything from employee onboarding, local tax contributions, and benefits administration, making sure you're fully aligned with what Canadian authorities expect. With Omnipresent, you won’t have to worry about understanding Canadian employment standards or labor codes — they handle it all with their in-house expertise and quick support.

Their local expertise also extends to managing paid time off, health benefits, and mandatory deductions, so you can focus on growing your business while they deal with the complexities of Canadian labor law.

Omnipresent Key Services:

They handle payroll for your Canadian employees, ensuring that wages are paid accurately and on time, taking into account local currency and tax rules. They also offer guidance on local employee benefits, such as healthcare and pensions, helping you create a competitive package that will attract top talent in Canada.

Another helpful service Omnipresent provides is handling terminations and offboarding processes, making sure they’re done according to local rules to avoid any legal complications. Their platform also gives you access to reporting and data on your Canadian workforce, making it easier to keep track of expenses and manage your team.

Velocity Global is a well-known employer of record (EOR) and professional employer organization (PEO) provider that simplifies global hiring thanks to their network of on-the-ground experts in 185+ countries, including Canada.

Why I picked Velocity Global: I included Velocity Global in this list because, in addition to helping you source Canadian employees, they can also help you offer them a physical workspace as well. They achieve this through partnerships with flexible work spaces such as WeWork, Industrious, and The Office Group, creating a positive employee experience for your EOR hires.

Velocity Global Key Services:

Velocity Global’s services include payroll, compliance, benefits management, employee training, and risk management for your Canadian employee operations. Their team of experts takes care of all required paperwork and can get your new employees up and running in Canada in as quickly as 2 working days.

In addition to their EOR services, Velocity Global can also help you simplify your plans for global expansion through its global immigration services in case you’re wanting to move international employees to Canada.

Other Canadian Employer of Record Services

Here are some other Canadian EOR service providers that didn’t make the top list, in case you’d like a few more suggestions:

- Horizons

For a flexible EOR contract with no termination fee

- Rippling

For managing IT assets and required compliance training

- Pebl

For scaling globally

- Multiplier

For quick employee onboarding

- Oyster HR

For compliant global hiring

- Papaya Global

For assessing provincial compliance requirements

- Atlas HXM

Canadian EOR for small businesses

- Worksuite

For avoiding employee vs contractor misclassification errors

- FoxHire

For hiring Canadian healthcare and higher education workers

- Airswift

Canadian EOR for the energy, infrastructure, mining, and technology industries

Hiring in Canada: Important Details

Here are some key details to note if this is your first time hiring Canadian staff. Your EOR provider will manage these compliance details on your behalf. However, proactively informing yourself of these details is always recommended before you invest your resources into sourcing Canadian staff.

In Canada:

- Employment laws are determined federally and by province.

- For employees and employers involved in federally regulated industries (e.g., interprovincial services such as transportation, telecommunications, shipping, banking, etc.) the Canada Labour Code applies.

- For all other industries (i.e., those that aren’t federally regulated), provincial or territorial labour standards apply.

- You can hire three types of workers: employees, dependent contractors, and independent contractors. Your Canadian EOR provider can help you determine the best hiring option depending on your needs while helping you prevent employee misclassification issues.

- Employment taxes and payroll deductions include federal and provincial taxes, and contributions to the Canada Pension Plan (CPP), Employment Insurance (EI), and Workers’ Compensation Insurance. Employers must also deduct an Employment Health Tax, which varies by province.

- English and French are the two official languages in Canada.

- Standard working hours are eight hours per day and 40 hours per week, with some provincial exceptions up to 44 hours/week for certain industries (e.g., oil and gas, shipping, trucking, etc.).

- Paid vacation is determined according to provincial regulations (except for federally regulated industries) and often begins with two weeks of paid holidays per year.

- There are five paid public holidays in Canada: New Year’s Day, Good Friday, Canada Day, Labour Day, and Christmas Day.

- Statutory holidays are determined provincially and may include: Family Day, Easter Monday, Victoria Day, Civic Holiday, National Day for Truth and Reconciliation, Thanksgiving, Remembrance Day, and Boxing Day.

- Maternity leave is governed by federal laws with some provincial variations. During maternity/paternity leave, employees are eligible for compensation from the federal government. Some employers also offer additional compensation to employees on maternity/parental leave, though there is no legal requirement to do so.

- Maternity leave: Employees can take up to 15 weeks of maternity leave from their place of employment.

- Parental leave: Employees and their partners can choose between a standard or extended leave option:

- Standard leave is up to 40 weeks total, with a maximum of 35 weeks per parent.

- Extended leave is up to 69 weeks total, with a maximum of 61 weeks per parent).

- NOTE: There is no separate "paternity leave" in Canada. Instead, partners use parental leave.

- Paid sick leave is determined by provincial laws. Up to 17 weeks of unpaid medical leave is available according to Canadian Labour Laws.

- Probation in Canada ranges from 3 to 6 months, depending on the province and industry.

- Termination of employment is governed by Canadian Labour Laws and the Canada Severance Pay Law. Employees must be given a notice period ranging between 1 to 8 weeks, or pay in lieu of notice.

- If terminated, employees who have completed 1 year of service are eligible for severance pay equal to 2 paid days for every year of service prior to termination.

This overview reflects the most up-to-date (mid‑2025) employment regulations in Canada. Your EOR will manage all these aspects, but understanding them helps you set realistic expectations and evaluate providers effectively.

Selection Criteria for Employer of Record Canada

Finding the best EOR services for hiring in Canada meant digging deep into what organizations truly need—like legally hiring Canadian employees, managing payments in CAD, staying compliant with labor laws, offering competitive benefits, and making onboarding smooth.

Finally, I carefully compared service offerings using the selection criteria below to determine which EOR partners deliver the most value for organizations expanding into Canada.

Here are the details I used to evaluate each Canadian EOR provider in this list:

Core EOR Services (25% of total score): To be considered for inclusion in this list, each Canadian EOR provider had to offer the following basic services first:

- The corporate structure to legally and compliantly hire employees in Canada without a local entity

- The ability to manage payroll and taxes in compliance with Canadian regulations and in Canadian dollars (CAD)

- Assistance with offering competitive and locally compliant benefits packages

- Assistance with navigating visa and work permit processes for expatriate employees relocating to Canada

- Robust procedures to ensure data privacy and security that comply with international standards, including the Personal Information Protection and Electronic Documents Act (PIPEDA) and other Canadian requirements

Additional Standout Services (25% of total score): To help me narrow in on the best Canadian EOR services out there, I also took note of any unique or less common services, including:

- Advanced technology platforms that streamline Canadian payroll and HR processes while still offering ease of use

- Specialized experience in hiring employees within key Canadian industries

- Services that enhance remote work compliance and employee mobility needs

- Specialized customer support for complex immigration cases

- Assistance with IT requirements, including managing computer equipment, software licenses, and other asset-tracking requirements

- A focus on eco-friendly and sustainable employment practices

Industry Experience (10% of total score): To evaluate the industry experience of each EOR service provider, I considered the following:

- How many years their business has operated in the EOR space

- Any industry recognitions or certifications the provider may hold in international or Canadian HR and payroll functions

- Their depth of knowledge regarding Canadian federal and provincial labor laws

- Their expertise in other markets, including how many different countries they offer local expertise in

- Evidence of a strong track record managing global expansion processes

- The combined experience and credentials of their team members, if available

Customer Onboarding (10% of total score): To get a sense of each provider's customer onboarding process, I considered the following factors:

- The availability of comprehensive onboarding materials, such as fact sheets, guides, FAQ repositories, or other training resources

- Support for integrating the EOR provider's software with existing HR systems

- Direct access to onboarding specialists, customer support, or a dedicated account manager during the setup phase

Customer Support (10% of total score): Since your EOR provider will act as your remote workers' legal employer, it's important to ensure you'll receive timely communications and top-level support. To evaluate the level of customer support each company offered, I considered the following:

- A multilingual support team (specifically English and French-speaking) that serves all Canadian time zones

- Multiple support channels, including phone, email, and live chat

- Evidence of responsiveness and effectiveness in resolving issues, as inferred from customer reviews

- The existence of dedicated account managers to provide assistance as needed

Value for Price (10% of total score): To gauge the overall value of each service, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of service offerings versus cost

- Flexibility in service packages to suit different business sizes and needs

Keep in mind that EOR services are complicated, and because of that the price tag can sometimes be high. However, the prices for their services still offer a good ROI considering the complexity of the premium-grade services you're gaining.

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how happy real users are with a service. To determine this, I considered the following factors:

- Consistently high ratings across various consumer review platforms

- Specific feedback on the ease of use of their Canadian EOR services

- Testimonials highlighting exceptional customer support and problem resolution

Using this assessment framework helped me identify the Canadian employer of record services that go beyond basic requirements to offer additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

An employer of record processes invoicing and salaries but reduces complexity by handling simpler payroll types, often focusing on salaried employees.

What is a Canadian Employer of Record?

A Canadian employer of record (EOR) is a third-party service that legally employs staff in Canada on your behalf, handling payroll, benefits, taxes, and compliance.

They're used by international companies that want to hire Canadian workers without setting up a local entity. EOR services solve complex challenges like navigating provincial labor laws, managing local tax obligations, and ensuring compliance—so you can focus on scaling your team, not bureaucracy.

EOR vs Legal Entity

If you’re weighing your options between working with an Employer of Record (EOR) or setting up a legal entity in Canada, it’s important to understand the key differences. While both approaches allow you to hire Canadian employees, they vary significantly in terms of complexity, cost, and time to hire.

Here’s a quick side-by-side comparison to help you decide which path makes the most sense for your business:

| Category | Employer of Record | Setting Up a Legal Entity |

|---|---|---|

| Setup Time | Days to weeks | Several months |

| Cost | Pay-as-you-go service fees | High upfront legal, tax, and admin costs |

| Legal Registration | Not required | Required with federal and provincial authorities |

| Employment Compliance | Handled by the EOR | Your responsibility |

| Payroll & Tax Filing | Managed by the EOR | You must register for and manage payroll/tax filings |

| Benefit Administration | Offered through EOR’s plans | You must source and manage benefit plans |

| HR & Onboarding Support | Included in most EOR services | Requires internal HR infrastructure |

| Control Over Operations | Less control over HR processes | Full control over employment practices |

Using an EOR is often the fastest and most cost-effective way to start hiring in Canada, especially if you're testing the market or hiring a small number of employees. On the other hand, setting up a legal entity may make more sense for companies planning a long-term investment with a larger local team.

If you already have a legal entity established in Canada, but you need some additional help providing HR services to your staff, you may want to consider using a PEO service in Canada instead.

How to Choose an Employer of Record in Canada

An EOR service can solve many different challenges and simplify the process of hiring and managing Canadian staff. To help you figure out which EOR service best fits your needs, you need to document your specific challenges first.

As you work through your own unique selection process, keep the following points in mind:

- What problem are you trying to solve? Start by identifying the challenges you're trying to overcome, whether that's sourcing Canadian staff in specific geographic locations, managing compliance against CRA requirements, paying employees in Canadian dollars, or offering health benefits to your Canadian staff.

- Who will benefit from the service? Consider who will manage the EOR relationship (i.e., who will your main contact people be in-house?) and how having an employer of record will improve their day-to-day work tasks.

- What is your budget? To evaluate cost, estimate how many Canadian employees you anticipate hiring. Since EOR providers typically charge a monthly fee for each new hire, this will help you anticipate your monthly costs.

- What outcomes are important? Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to hire employees within a specific province or city, making it easier for them to work together in person as needed. You could compare service providers until you’re blue in the face but if you aren’t thinking about the outcomes you want to achieve, you'll waste a lot of valuable time.

- How it would work within your organization? Consider how the service provider's software ecosystem would work alongside your existing workflows and systems. Would their software framework integrate with your existing HR software, or would you face data management roadblocks?

Remember every business is different — don’t assume that a Canadian employer of record service will work for your organization just because it's popular.

Key Employer of Record Services

In addition to my selection criteria above, I also assessed the depth of the other key services each Canadian EOR provider offered. While each one does have its own unique blend of options, this list covers the core functions every EOR provider should offer:

- Processing and funding payroll: ensuring that your employees are paid correctly and on time

- Depositing and filing taxes: covering all legal obligations regarding deducting and managing local and payroll taxes

- Dealing with timesheets: collecting and processing time records as necessary, including tracking time off requests

- Top talent acquisition: working with the client company to source additional talent from the global market as needed

- Background checks: checking the background of new hires to confirm their credentials and ensure their suitability for their role

- Employee onboarding: helping new hires assimilate into their new company and role

- Managing employment relationships: creating and maintaining appropriate employment contracts for staff members and dealing with any grievances

- Handling workers’ compensation: ensuring legal compliance with all workers’ compensation matters

- Maintaining certificates of insurance: providing an adequate level of cover for all business activities

- Administering benefits: managing and paying out employee benefits as appropriate, including local health insurance for remote workers

- Handling offboarding: dealing with the termination of employment and related matters as per the labor laws of each jurisdiction

Trends in Employer of Record Services

As more businesses expand across borders, the need for efficient, compliant, and user-friendly solutions for hiring employees abroad, and managing international payments, compliance, benefits, and onboarding has never been more critical.

As a result, EOR services have continued to evolve, with an emphasis on technology-driven solutions that offer flexibility, comprehensive support, and innovative features to facilitate global operations.

Here are the most recent trends affecting EOR services and the HR software systems that are used to offer them:

- Immigration Support: There is a growing demand for assistance with immigration services like visa and work permit sponsorships, simplifying global talent acquisition processes for client companies immensely.

- Specialized Services for Diverse Needs: Several EOR providers have begun to offer IP and invention rights protection and equity incentive planning services, to cater to the specific needs of their client companies.

- Enhanced Employee Benefits Packages: There's a growing trend in EOR providers going beyond standard healthcare coverage to offer a full spread of enterprise-level medical and health benefits, stock options, and even one-time benefits like moving bonuses. This trend demonstrates an understanding of the importance of attracting and retaining top talent effectively.

- AI-Backed Knowledge Bases: Some EOR providers (including Deel) are beginning to offer legally vetted knowledge bases or information wikis that use artificial intelligence to surface answers to common questions quickly. This helps customers source details on hiring within a specific country quickly, without relying on human-run support systems.

As the market continues to evolve, these trends are likely to shape the future of international employment, making it easier for businesses to navigate the challenges of global expansion. For a closer look at specific EOR providers that are capitalizing on these trends, I recommend reading our in-depth reviews of Velocity Global, Skuad, and Oyster HR.

Benefits of Using an EOR in Canada

A Canadian-specific EOR service offers many benefits for companies that want to hire top talent in Canada, including:

- They’ve already established a legal entity in Canada

- They’re up-to-speed on the local employment laws and tax regulations in Canada

- They can help you source and hire new talent quickly

- They can negotiate better insurance rates and benefit packages on your behalf

Using a Canadian EOR service is also cost-effective for businesses trying to enter a new market, compared to the significant costs of establishing a new Canadian entity. The latter option involves significant upfront legal fees, plus other costs related to office infrastructure, staffing, and local benefits and insurance coverage.

Costs & Pricing for Employer of Record Services in Canada

EOR services are complicated, which is why the price tag can sometimes be high. Most providers offer a flat rate per employee or contractor hired through their service. However, some only offer pricing details upon request. Either way, the prices for their services still offer a good ROI considering the complexity of the premium-grade services you're gaining.

In general, EOR services in Canada cost between $200 to $800 per employee, per month.

Key factors that can influence the pricing of an employer of record service include:

- Employee Seniority and Role Complexity: The level and nature of the roles being filled can impact the monthly cost. Senior positions or roles requiring special qualifications may increase the price due to higher benefits and compensation management costs.

- Number of Employees: The total number of employees being managed can also impact the cost. In some cases, higher volumes may lead to volume discounts, making per-employee costs more economical.

- Custom Requirements: Any specific needs beyond the standard service offering may also contribute to the monthly cost. This may include customized solutions for recruitment, specialized employee onboarding, or unique compliance requirements, all of which can affect pricing.

FAQs about EOR Services in Canada

If you’ve got specific questions about the requirements to hire Canadian employees or how EOR services work, these answers to frequently asked questions are a good place to start:

Can I use an EOR in Canada to hire both full-time employees and contractors?

Yes, a Canadian EOR typically supports hiring both full-time employees and independent contractors. However, Canadian law requires strict classification of worker types. Misclassifying an employee as a contractor can result in fines or back payments.

An EOR will advise you on correct worker classification and help structure contracts so you can confidently hire the talent you need, whether on a permanent or flexible/project basis.

How long does it take to onboard an employee in Canada using an EOR?

Onboarding with an EOR in Canada usually takes between 1 and 3 weeks, depending on how quickly all required documentation is provided and verified. Factors like background checks, work permit validation, and contract finalization can affect the timeline.

If you and your team promptly submit everything that’s needed, the EOR can often get your new hire started much faster than setting up an entity on your own.

What documents or information do I need to provide to an EOR to hire in Canada quickly?

To speed up the hiring process with an EOR, you’ll need to provide some key documents and information. This usually includes personal identification for each new hire (such as a passport or Canadian ID), a signed employment agreement, work permit or visa information for non-citizens, completed tax forms (like TD1), and core company details (business registration, contact info, etc.). Having this information ready in advance lets the EOR onboard your team quickly and accurately.

What are the standard working hours and overtime regulations in Canada?

Employees in Canada typically work 8 hours a day or 40 hours per week, though this can vary by province. Overtime usually starts after 8 hours a day or 40 hours a week and is paid at 1.5 times the regular rate. An EOR helps make sure your business meets all legal requirements, so your team doesn’t risk accidental non-compliance with local labor laws.

What are the minimum wage requirements in Canada?

In Canada, the minimum wage requirements vary depending on which province your employee or EOR hire is located in. As of April 1st, 2025, the current federal minimum wage in Canada increased from $17.30 to $17.75 CAD per hour. Staying on top of changes to minimum wages is just one of the benefits of working with an EOR.

What are the public holidays in Canada?

There are five nationwide public holidays in Canada, including: New Year, Good Friday, Canada Day, Labour Day, and Christmas Day. Many Canadian provinces also celebrate additional statutory holidays where employees are also given time off of work, including: Family Day, Easter Monday, Victoria Day, Civic Holiday, National Day for Truth and Reconciliation, Thanksgiving, Remembrance Day, and Boxing Day.

The number and timing of paid holidays can differ depending on where your employees are located. An EOR will track these regional holidays and adapt payroll schedules accordingly, helping you avoid errors and ensuring your employees receive statutory pay or time off as required by law.

Are there any risks to using an Employer of Record service?

Yes, while EORs take on most HR and compliance risks, choosing the wrong provider can expose you to issues. Some risks include hidden fees, poor service delivery, or lack of local legal expertise. Data privacy can also be a concern, especially if the EOR doesn’t follow Canadian data protection laws.

Make sure to vet an EOR thoroughly by reviewing client references, their financial stability, and their approach to employee data privacy before committing.

What are some of the consequences of non-compliance?

Non-compliance with Canadian labor laws can lead to significant problems, including fines, back pay requirements, government audits, or even being barred from hiring in Canada. For founders and HR professionals new to Canadian regulations, these risks are heightened.

An EOR safeguards you by monitoring regulatory updates, managing document filings, and making sure your payroll, tax filings, and contracts align with all relevant laws. This minimizes your exposure to unexpected costs or legal challenges.

Will my company or my employees need a Canadian bank account when using an EOR?

No, your company generally doesn’t need a Canadian bank account when working with an EOR, since the provider handles payroll and compliance locally. For employees, most EORs can pay into existing Canadian or international accounts, but having a Canadian bank account may help avoid transfer delays and minimize extra fees.

Discuss payment solutions with your chosen EOR to ensure a smooth and efficient payroll experience for your cross-border team.

Do EOR providers offer other types of global HR services?

Yes, most of the time they do. Many service providers in this space also offer professional employer organization services (also known as PEO services), as well as multi-country payroll services.

PEO services are a way of outsourcing human resources to support your international teams. They can help you with international compliance issues, benefits administration, workers’ compensation, and other HR administrative tasks.

Multi-country payroll services make it possible pay remote employees or independent contractors in multiple local currencies within the same unified payroll run. They also manage in-country compliance and tax requirements on your behalf, making the payroll process considerably easier.

Hire Canadian Talent with Confidence Using the Right EOR Partner

Whether you're scaling into Canada for the first time or looking for a better way to manage remote Canadian staff, the best employer of record services in Canada can take the weight of compliance, payroll, and legal admin off your shoulders—so you can focus on growing your team, not navigating red tape.

If this guide helped clarify your next steps, don’t miss our People Managing People newsletter. Each week, we share expert HR insights, podcast episodes, and trusted recommendations for software and services that help you build better workplaces—wherever your team is located.