Best German Employer of Record Service Shortlist

Here’s my pick of the 10 best German EOR companies out of the 20 options I’ve reviewed:

Get free help from our HR software advisors to find your match.

Hiring employees in Germany can feel overwhelming, especially when you’re navigating unfamiliar employment laws, social security requirements, and the risk of costly non-compliance. These legal hurdles can slow down your hiring process and add layers of administrative complexity that you may not be prepared for.

That’s where an Employer of Record (EOR) service can help. An EOR acts as the legal employer on your behalf in Germany, handling everything from employment contracts and payroll to taxes and compliance with the Federal Ministry of Labour and Social Affairs (BMAS). This allows you to onboard German talent quickly —without setting up a local entity — so you can focus on growing your business.

As a writer and researcher who has covered dozens of global HR topics for People Managing People, I’ve helped hundreds of HR professionals find the right partners to streamline hiring and compliance across borders. In this article, I’ve curated a list of the best Employer of Record services for hiring in Germany, so you can find a trusted partner without the guesswork.

Market Details for Hiring in Germany

- Capital City: Berlin

- Currency: Euro (€, EUR)

- Payroll Frequency: Monthly

- Official Language: German

- Approx. Population: 83 Million

- Public Holidays: 9 (plus regional variations)

Why Hire Employees in Germany?

Germany’s strong educational system ensures a steady stream of highly qualified graduates, especially in STEM fields. Germany's talent marketplace is well-known for its engineering and technological expertise, particularly in the automotive and manufacturing sectors. Plus, its IT sector is thriving, with a significant talent pool in software development, cybersecurity, and data analytics.

Germany’s innovative ecosystem, driven by a vibrant start-up culture in cities like Berlin and Munich, attracts skilled professionals in tech, finance, and creative industries. Furthermore, Germany’s leadership in renewable energy attracts experts in sustainable energy solutions and green technology.

In addition to the technical depth of Germany’s workforce, its strategic location in Europe also makes it an attractive location to hire new talent since it lends easy access to other major European markets.

Why Trust Our Reviews

We've been testing and reviewing HR software + services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Employer of Record in Germany: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top Employer of Record selections for hiring staff in Germany to help you find the best EOR service for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for offering local health benefits to German EOR employees | Free trial + demo available | From $29/month | Website | |

| 2 | Best AI-driven EOR platform | Free trial available | From $579/month | Website | |

| 3 | Best for budget-conscious remote team expansion | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best EOR service for quick employee onboarding | Free demo available | From $20/user/month (billed annually) | Website | |

| 5 | Best for combined global HR and EOR services | Free demo available | Pricing upon request | Website | |

| 6 | Best for employment compliance | Free demo available | Pricing upon request | Website | |

| 7 | Best for competitive benefits packages | Free trial available | From $29/user/month | Website | |

| 8 | Best German-based EOR for 170+ countries | Free demo available | From $314/month | Website | |

| 9 | Best for EOR-related educational resources for clients | 30-day free trial | From $25/employee/month | Website | |

| 10 | Best for hiring and paying talent in Germany | Free demo available | From $199/employee/month or $19/contractor/month | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Willo

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Boon

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.7

Reviews of the Best EOR Services in Germany

To make your search easier, I’ve reviewed my top 10 EOR picks for hiring in Germany, highlighting what each one offers and how they support HR teams. You’ll also find 10 more providers listed below for even more options to explore.

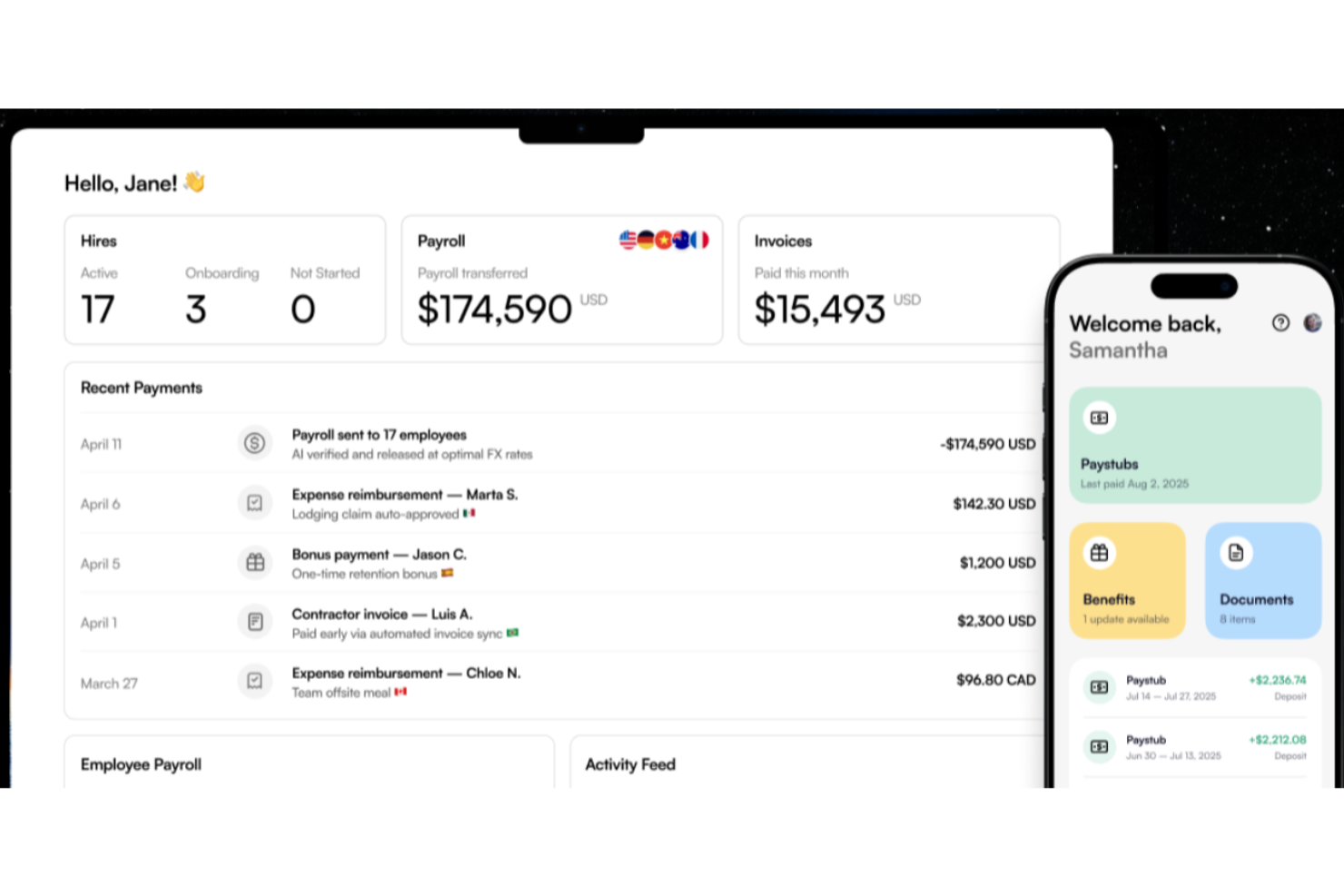

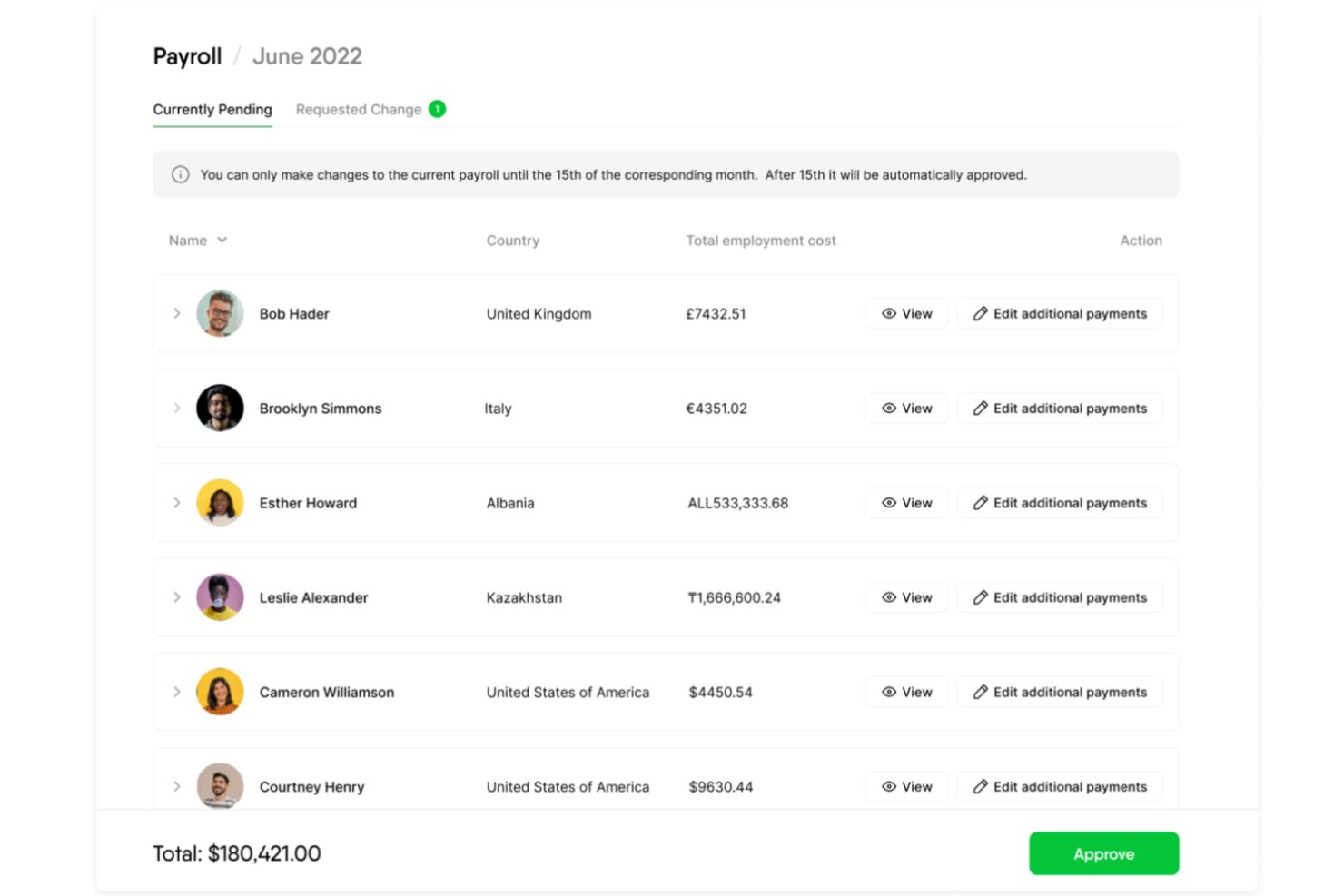

Deel is a well-established employer of record platform that helps companies rapidly employ workers in 150+ countries, including Germany.

Deel owns a local entity in Germany staffed with legal experts to keep track of regulatory changes and ensure all legal obligations are met on your behalf. To hire a German employee with Deel, the average onboarding time frame is 4 days.

Why I picked Deel: Deel excels as an EOR service provider in Germany by offering streamlined contract management, ensuring compliance with German employment laws. Deel also helps organizations offer localized employee benefits for German staff, including healthcare, pension, maternity leave, and workers' compensation insurance options.

In addition, Deel has launched several new offerings over the past year, including global payroll, global mobility support, integrated Slack tools, and advanced integrations. These services, all combined, facilitate efficient and compliant hiring processes within the German talent market.

Deel Key Services:

Deel offers end-to-end management for your German employees covering everything from hiring and onboarding to termination. Their web app is user-friendly and provides a range of features to help businesses manage their remote teams effectively, including contract management and expense tracking.

Their integrated contract management function supports advanced customizations such as stipends, signing bonuses, and stock options. You can also use Deel for visa and immigration support if you want to relocate existing employees to Germany, with Deel managing the entire visa process for your organization in-house.

Deel offers 24/7 customer support and live chat and is known for its fast support.

Pros and cons

Pros:

- Comprehensive employee benefits

- Local compliance expertise

- Fast onboarding process

Cons:

- Potential complexity for first-time users

- Limited customization options

Borderless AI is a fully AI-driven Employer of Record (EOR) platform that helps businesses hire and manage employees in Germany without setting up a local entity. It automates contract creation, compliance monitoring, payroll in euros, and benefit administration—making global expansion faster and more efficient.

Why I picked Borderless AI: Borderless AI simplifies the legal and administrative challenges of hiring in Germany with its AI-first infrastructure. From generating compliant contracts to automating tax calculations and ensuring timely payroll, the platform eliminates the friction of navigating complex German labor laws. Additionally, its built-in HR assistant provides real-time guidance. It’s also a cost-effective choice, offering zero upfront fees. With automated workflows and real-time compliance tracking, companies can onboard and pay German employees quickly—without operational delays.

Borderless AI Key Services:

Key services include euro-based payroll, compliant employment contracts, benefits administration (health insurance, pensions, and social security), and legal employer responsibilities under German law. The platform features HRGPT for live support, a compensation checker for salary benchmarks, and centralized dashboards to manage both employees and contractors.

Pros and cons

Pros:

- Facilitates international expansion without the need for local entities

- Offers clear, flat-rate pricing

- Provides an AI-powered assistant

Cons:

- Reporting and analytics tools are not extensive

- Does not offer direct recruitment or applicant tracking functionalities

Remofirst is a global EOR service provider on a mission to free employers from geographical boundaries so they can build global teams with ease. They offer EOR services in 180+ countries, eliminating the need to set up multiple legal entities abroad.

Why I picked Remofirst: If you're looking to grow your remote team in Germany, Remofirst is a solid choice, especially if you're budget-conscious. Germany has specific labor laws and regulations that can be tricky to navigate on your own, but Remofirst ensures compliance with local employment rules. They handle payroll, taxes, and employee benefits in line with German standards, so your company doesn't have to worry about legal risks.

They'll automatically calculate your team’s hours, time off, holidays, bonuses, and commissions so you don’t have to worry about it. Another reason Remofirst works well in Germany is its expertise in managing both full-time employees and contractors. With Germany's strict labor laws, it’s important to classify workers correctly and follow all necessary regulations.

Remofirst Key Services:

Their team of legal experts and HR professionals will ensure your business operations are always compliant with changing German regulations, with compliance documentation accessible at all times through your secure dashboard. Their customer support team is also available 24/7 in case you need additional help. All clients also receive a dedicated account manager as their main point of contact.

On top of their EOR services, Remofirst also provides international payroll and invoice management, global benefits management (including insurance and equity plans, plus time-off management), and employee support with obtaining visas and other immigration documentation. They can even help you with provisioning equipment to your distributed employees around the world. EOR pricing starts from $199/person/month.

Pros and cons

Pros:

- Comprehensive compliance management

- User-friendly platform

- Robust employee support

Cons:

- Dependence on third-party providers for some services

- Service availability may vary by region

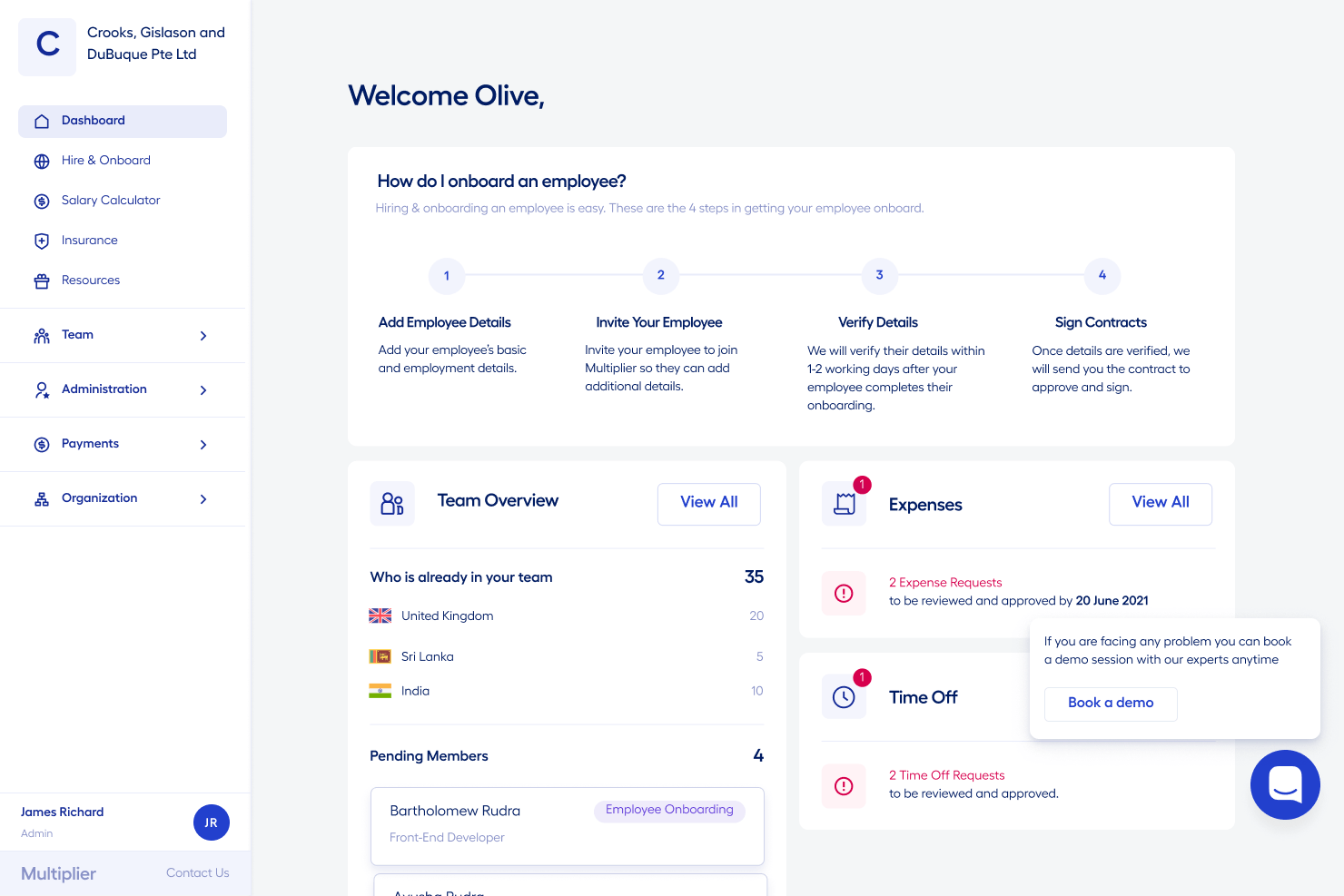

Multiplier is an employer of record company that provides HR and global payroll services to businesses, allowing them to outsource these responsibilities to a single provider. You can use their services to hire and manage employees based in Germany and comply with changing labor laws and tax policies.

Why I picked Multiplier: Multiplier helps businesses quickly and easily onboard new employees, manage their payroll and benefits, and ensure compliance with local laws and regulations. Their EOR services are very fast, with the ability to employ new talent in less than 24 hours once you've decided which candidate you'd like to hire. Their 4-step onboarding process is also user-friendly, providing a good experience for your new employees.

Multiplier Key Services:

Their EOR services include payroll processing, tax compliance, benefits administration, and worker's compensation. Their team of local experts can also offer support with employee benefits management, including health insurance, retirement plans, and other perks that are specifically tailored to the German market. This service helps attract and retain top talent by offering competitive benefits packages.

By outsourcing your core HR responsibilities to Multiplier, you can reduce your exposure to the legal and financial risks associated with employing workers in Germany.

Pros and cons

Pros:

- Excellent customer service

- User-friendly platform

- Comprehensive compliance support

Cons:

- Dependence on third-party benefits providers

- Limited customization options

TopSource Worldwide is an employer of record (EOR) service provider that handles all legal employment responsibilities for companies hiring in countries all over the world, including Germany.

Why I picked TopSource Worldwide: It offers in-depth expertise in German employment law, including compliance with labor leasing legislation (Arbeitnehmerüberlassung) and the requirement to hold an AÜG license issued by the German Labour Ministry. This is essential if you’re hiring in Germany through a labor leasing model—TopSource ensures your leased employees receive equal treatment and don’t exceed the country’s strict 18-month employment limit.

Beyond basic compliance, TopSource combines its EOR offering with strategic HR and global expansion support. You get access to on-demand conversations with global employment law and benefits experts, quarterly global talent audits to help guide hiring and structure, and a direct phone line for employer support.

TopSource Worldwide Key Services:

Other features include built-in support for processing compliant German employment contracts and managing salary disbursements in line with local norms. TopSource also registers employees with the appropriate German authorities for income tax and social contributions, and handles payment deadlines and employee documentation so you don’t have to become an expert in local payroll rules.

Employers hiring in Germany via TopSource are also protected under the right licensing for labor leasing, meaning workers are hired under compliant models with the appropriate terms and durations. They even support employment verification, contract accuracy, and the ongoing compliance audits needed to stay aligned with German labor law.

Pros and cons

Pros:

- Service includes direct access to local experts

- Strategic HR guidance available for expansion planning

- Wide country coverage with 180+ supported markets

Cons:

- No integrations with popular HRIS platforms

- Limited reporting or automation features compared to tech-driven platforms

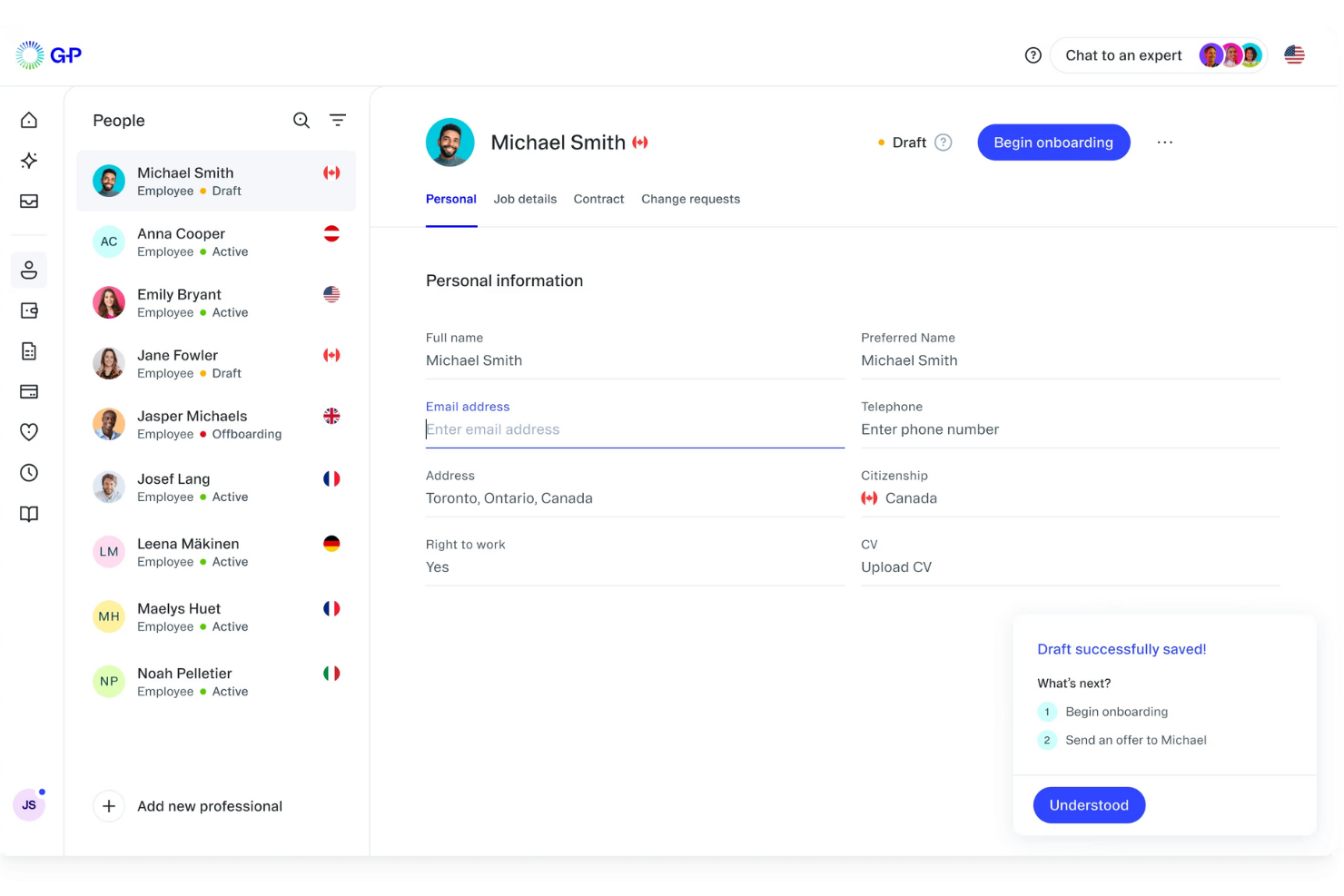

G-P is a global employment platform that helps companies hire and manage international teams without setting up local entities. Their Employer of Record (EOR) services cover over 180 countries, including Germany.

Why I picked G-P: G-P stands out for EOR in Germany because it manages the entire employment lifecycle, from compliant contracts to payroll. Germany has strict labor laws, including requirements for employment contracts, working hours, and social security contributions. G-P ensures that employment contracts are locally compliant and that all statutory benefits are provided, reducing the risk of legal issues.

I also like that it offers AI-driven HR compliance solutions. This feature takes the guesswork out of managing your team by automating tasks like contract generation and onboarding. You can focus on your business goals while G-P handles the nitty-gritty details of HR management, making international expansion a smoother process.

G-P Key Services:

G-P also provides guidance for managing compensation and benefits in line with German standards. They ensure that employees receive mandatory benefits such as pension contributions, employment insurance, as well as optional benefits like health and dental insurance, bonuses, and remote work allowances.

They also offer global mobility support, which helps you manage employee relocations and assignments across different countries. G-P even has contractor hiring tools that facilitate the onboarding of contingent workers.

Pros and cons

Pros:

- Extensive global coverage in over 180 countries

- In-country experts provide guidance on local employment laws and practices

- Combines payroll, benefits, and compliance management in one platform

Cons:

- Lacks advanced HR functionalities like performance management

- Global mobility services are paid add-ons

Remote’s global HR solution offers EOR services that simplify payroll, benefits, taxes, and compliance for international workers. You can use their services to hire full-time employees or contractors and gain local market insights.

Once you’re ready to hire an employee in Germany, Remote can complete their onboarding process within 5 days.

Why I picked Remote: Remote helps companies compete for talent effectively in the European market by lending access to competitive benefits packages. They can help you offer health insurance, dental insurance, vision insurance, life and disability coverage, and mental health support services for your German employees. Remote also doesn’t add any markup to their benefits premiums or administration costs, making them a cost-effective choice.

Remote Key Services:

Services include global payroll processing, intellectual property and invention rights protection, and benefits packages that are tailored for the German market. Their software platform also covers experience reimbursement and time-off requests, which are quick and easy to approve through their online portal.

Pros and cons

Pros:

- Strong local expertise

- User-friendly platform

- Comprehensive compliance support

Cons:

- High cost per employee

- Limited customization options

Lano is a German-based global employment platform that enables businesses to hire and manage employees in over 170 countries without the need to establish local legal entities. By acting as an Employer of Record (EOR), Lano handles compliance, payroll, taxes, benefits, and HR administration, allowing you to focus on your core operations.

Why I picked Lano: Lano is a great choice for companies hiring in Germany because it ensures full compliance with German labor laws, tax requirements, and employee benefits. Germany has strict employment regulations, including statutory health insurance, social security contributions, and annual leave policies. Lano ensures that employees receive locally compliant contracts and all mandatory benefits, so you don’t have to navigate complex legal requirements yourself.

They also offer a fast onboarding process, allowing you to hire and integrate new employees in less than a week. Instead of spending months setting up a legal entity in Germany, you simply sign a Master Service Agreement with Lano, provide job offer details, and let Lano handle the rest.

Lano Key Services:

Other services include the ability to relocate employees with ease, allowing businesses to retain talent even when team members move across borders. Lano also provides a consolidated payroll management system that integrates multiple payroll providers, so you can manage payments and compliance in one place.

Additionally, the platform offers support for both full-time employees and contractors, giving companies flexibility in how they build their international teams.

Pros and cons

Pros:

- Fast onboarding process

- Provides locally compliant contracts and benefits

- Enables hiring in 170+ countries without setting up legal entities

Cons:

- Integration with existing systems may require setup effort

- No built-in recruitment services

Oyster HR is a global EOR service provider that helps businesses hire employees in Germany and other countries with full compliance. Their platform is designed to support seamless global expansion with a focus on compliance and employee experience.

Why I picked Oyster HR: Oyster offers educational resources to their EOR clients to help them navigate the global employment landscape. This includes useful financial tools that help you determine the full cost of hiring a new employee in any country, or whether it would be more cost-effective to fill a position with an international contractor rather than an employee.

In addition, the Oyster Academy is a helpful resource for companies that are new to the international work-from-anywhere scene, and includes training courses on ‘how to prepare for distributed work’, and ‘how to create a company culture in a distributed environment’.

Oyster HR Key Services:

Oyster HR offers a range of features, including streamlined onboarding, payroll, and benefits management, tailored specifically for the German market. Their platform stands out for its ease of use, compliance assurance, and dedicated support, making it an ideal choice for businesses looking to expand in Germany.

Their onboarding process is designed to be quick and efficient, helping new hires integrate into their roles smoothly. This feature includes digital contract management and automated document collection, making the entire process hassle-free for both employers and employees.

Pros and cons

Pros:

- Efficient onboarding process

- Strong compliance support

- Comprehensive global benefits packages

Cons:

- Potential delays due to time zone differences

- Limited customization options

Skuad is a comprehensive global HR platform designed to simplify international hiring, payroll, and compliance management for businesses. It enables companies to hire and manage employees and contractors in over 160 countries, including Germany, without the need for local subsidiaries. When you hire them as your German EOR partner, they’ll manage the whole hiring process on your behalf, including creating employment agreements and other legal documents.

Why I picked Skuad: As part of their EOR service, Skuad offers remote onboarding and can facilitate payroll in multiple currencies. This includes the management of invoices as well as payroll automation. Skuad also ensures compliance with local regulations and labor laws.

Skuad Key Services:

Skuad's EOR services include employee benefits, time-off tracking, and managing tax compliance. It also offers coverage for your copyrights, trademarks, and any other sensitive IP projects. As part of their global hiring service, they will even stickhandle all the required documentation on your behalf, including work permits and visas for your new hires as well as their dependents.

Beyond that, Skuad can also help you distribute computer equipment to your new employees, and track company assets like phones and other IT devices.

Pros and cons

Pros:

- User-friendly platform

- Extensive HR support

- Comprehensive compliance management

Cons:

- Limited customization options

- Tax deductions limited to Enterprise plan

Other German Employer of Record Services

Here are some other EOR service providers in Germany that didn’t make it into my top 10 shortlist, but are still worth considering:

- Atlas HXM

German EOR partner for enterprise organizations

- Omnipresent

For managing Germany's complex labor laws

- Horizons

For a flexible EOR contract with no termination fee

- Velocity Global

For navigating complex regulatory landscapes

- Universal Hires

With a dedicated HR advisor

- Rippling

EOR provider for managing IT assets

- Papaya Global

For an AI-based payroll engine

- FoxHire

For hiring German healthcare and higher education workers

- Plane

For US-based companies looking to hire German staff

- Safeguard Global

EOR service for NGOs and non-profit organizations

Hiring in Germany: Important Details

Here are some key details to note if this is your first time hiring staff located in Germany. Your EOR provider will manage these compliance details on your behalf. However, proactively informing yourself of these details is always recommended before you invest your resources into sourcing staff based in Germany.

In Germany:

- Employment laws are determined by the Federal Ministry of Labour and Social Affairs (BMAS). They are responsible for setting and managing regulations for labor conditions, health and safety at work, and social security.

- You can hire employees or contractors. Within the employee category, you can hire full-time or part-time employees, as well as temporary, seasonal, or interns. Each category has its own set of labor laws in Germany. Your German EOR provider can help you determine the correct classification to avoid employee misclassification issues.

- Germany has both mandatory payroll deductions and social security contributions that must be collected.

- Mandatory payroll deductions include income tax (Lohnsteuer), Solidarity surcharge (Solidaritätszuschlag), and the Church tax (Kirchensteuer, if applicable).

- Social security contributions include Health Insurance (Krankenversicherung), Pension Insurance (Rentenversicherung), Unemployment Insurance (Arbeitslosenversicherung), and Long-term Care Insurance (Pflegeversicherung).

- German is the official language, though English and French are used frequently too.

- The standard working week in German is 48 hours, with 10 hours per day maximum. Employees also must not work for more than six continuous hours without a break, or for more than six days consecutively without one day off.

- Paid vacation in Germany starts at a minimum of 24 working days per year. This is mandated by the Minimum Vacation Act for Employees.

- There are nine public holidays in Germany that are recognized nationally, plus others that vary by region or state. Paid public holidays include:

- New Year's Day (Neujahrstag)

- Good Friday (Karfreitag)

- Easter Monday (Ostermontag)

- Labour Day (Tag der Arbeit)

- Ascension Day (Christi Himmelfahrt)

- Whit Monday (Pfingstmontag)

- German Unity Day (Tag der Deutschen Einheit)

- Christmas Day (Erster Weihnachtstag)

- Boxing Day (Zweiter Weihnachtstag)

Understanding and complying with employment norms and legal requirements surrounding German public holidays is one area where your EOR service will shine, managing these occurrences hassle-free on your behalf.

- Germany offers maternity leave and paternity leave.

- Maternity leave begins 6 weeks before birth and ends 8 weeks after both (14 weeks total).

- Paternity leave can last up to 3 years and can be shared by both parents.

- Paid sick leave is 6 weeks in Germany. If an employee is still sick after 6 weeks, health insurance will typically kick in to provide financial support to the employee.

- The probationary period in Germany is 6 months. During this period, the notice period for termination is usually two weeks.

- Termination of employment in Germany requires adherence to specific legal regulations, including notice periods and valid reasons for termination. Notice periods vary based on the duration of employment and can range from 2 weeks to 7 months. Termination protection laws safeguard employees against unfair dismissal, particularly in companies with more than 10 employees.

Selection Criteria for Employer of Record Germany

Uncovering the best EOR services for this list required a deep understanding of how these services can alleviate common challenges, such as legally hiring employees abroad, managing international payments, ensuring compliance with local labor laws, providing competitive benefits, and facilitating smooth onboarding.

Here are the specific criteria I used to carefully compare the service offerings for each provider in this list:

Core Employer of Record Services (25% of total score): To be considered for inclusion in this list, each EOR provider had to offer the following basic services first:

- The corporate structure to legally and compliantly hire employees in multiple countries without a local entity

- The ability to manage worldwide payroll and taxes in compliance with local regulations

- Assistance with offering competitive and locally compliant benefits packages

- Assistance with navigating visa and work permit processes for expatriate employees

- Robust procedures to ensure data privacy and security that comply with international standards, including GDPR and other requirements

Additional Standout Services (25% of total score): To help me narrow in on the best EOR services out of the numerous options available, I also took note of any unique or less common services, including:

- Advanced technology platforms that streamlined payroll and HR processes while still offering ease of use

- Specialized experience in hiring employees within specific new countries or key industries

- Services that enhance remote work compliance and global mobility needs

- Specialized customer support for complex immigration cases

- Assistance with international IT requirements, including managing computer equipment, software licenses, and other asset-tracking requirements

- A focus on eco-friendly and sustainable employment practices

Industry Experience (10% of total score): To evaluate the industry experience of each EOR service provider, I considered the following:

- How many years their business has operated in the EOR space

- Any industry recognitions or certifications the provider may hold in international HR and payroll

- Their depth of knowledge in local labor laws across multiple jurisdictions

- Their expertise in new markets, including how many different countries they offer local expertise in

- Evidence of a strong track record managing global expansion processes

- The combined experience and credentials of their team members, if available

Customer Onboarding (10% of total score): To get a sense of each provider's customer onboarding process, I considered the following factors:

- The availability of comprehensive onboarding materials, such as fact sheets, guides, FAQ repositories, or other training resources

- Support for integrating the EOR provider's software with existing HR systems

- Direct access to onboarding specialists, customer support, or a dedicated account manager during the setup phase

Customer Support (10% of total score): Since the EOR provider will act as your remote workers' legal employer, it's important to ensure you'll receive timely communications and top-level support. To evaluate the level of customer support each company offered, I considered the following:

- The availability of a multilingual support team that covers different time zones

- Multiple support channels, including phone, email, and live chat

- Evidence of responsiveness and effectiveness in resolving issues, as inferred from customer reviews

- The existence of dedicated account managers to provide assistance as needed

Value for Price (10% of total score): To gauge the overall value of each service, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of service offerings versus cost

- Flexibility in service packages to suit different business sizes and needs

Keep in mind that EOR services are complicated, and because of that the price tag can sometimes be high. However, the prices for their services still offer a good ROI considering the complexity of the premium-grade services you're gaining.

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how happy real users are with a service. To determine this, I considered the following factors:

- Consistently high ratings across various consumer review platforms

- Specific feedback on the ease of use of the EOR services

- Testimonials highlighting exceptional customer support and problem resolution

Using this assessment framework helped me identify the employer of record services that go beyond basic requirements to offer additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

What is an Employer of Record in Germany?

An Employer of Record (EOR) in Germany is a third-party partner that legally employs your German-based hires on your behalf, while you stay in charge of their day-to-day work. The EOR handles payroll, taxes, benefits, and compliance with German labor laws, so you don’t have to become a legal expert to hire locally.

Using a German EOR lets you bypass the complexity of setting up a local entity, giving you a faster, safer way to grow your team in Germany—without the compliance risk.

Instead of asking your HR professionals to become experts in German labor laws and regulations, you can outsource these requirements to an EOR in Germany and gain peace of mind that your future operations will be compliant.

EOR vs Legal Entity

If you’re planning to hire employees in Germany, you'll need to decide whether to use an EOR or set up your own local legal entity. Both approaches can get the job done, but they come with very different timelines, costs, and responsibilities.

Here’s a quick comparison to help you weigh the pros and cons:

| Requirement | EOR in Germany | Legal Entity in Germany |

|---|---|---|

| Setup Time | A few days to a week | Several weeks to months |

| Legal Registration | Not required | Required with Handelsregister, Finanzamt, etc. |

| Compliance Responsibility | Managed by the EOR | Fully managed by your internal team |

| Payroll & Taxes | Handled by the EOR | Must be managed in-house or via local provider |

| HR Admin & Benefits | Included in EOR service | Must be set up and managed internally |

| Cost | Monthly per-employee fee | Higher upfront setup + ongoing admin and legal costs |

| Level of Control | Moderate | Full control over operations and processes |

| Scalability | Ideal for fast, flexible expansion | Better suited for long-term, large-scale operations |

Using an EOR is the fastest and simplest way to start hiring in Germany, especially if you're testing the market or expanding quickly. Setting up a legal entity may offer more control, but it comes with a bigger investment of time, money, and internal resources.

How to Choose an Employer of Record in Germany

A great EOR service can streamline hiring, reduce compliance risk, and make managing German employees far less complicated—but only if it aligns with your unique needs. To find the right fit, start by clarifying the specific challenges you're trying to solve.

As you evaluate your options, consider these key questions:

- What problem are you solve? Are you trying to hire in certain regions, simplify compliance, manage Euro-based payroll, or offer local benefits? Be specific about what you need help with, so you can find a provider who excels in that area.

- Who will benefit from the EOR service? Think about who will manage the EOR relationship internally. How will it improve their workload, processes, or confidence in global hiring?

- What's your budget? Estimate how many employees you plan to hire in Germany. Since EOR fees are typically charged per employee per month, this helps forecast your total costs.

- What outcomes matter most? Are you aiming for faster hiring, easier compliance, or better collaboration in a specific location? Define your success metrics up front and let your ultimate goals guide your decision.

- How will it fit with your HR systems? Consider how the EOR’s tech integrates with your current HR tools to avoid data silos or workflow disruption.

Remember every business is different — don’t assume that a German employer of record service will work for your organization just because it's popular. Instead, your ideal EOR should solve your pain points and grow with your team.

Trends in Employer of Record Services

With global hiring on the rise, companies need fast, compliant, and scalable ways to manage international teams. In response, EOR services are evolving, offering smarter tech, flexible features, and all-in-one platforms to simplify hiring, payroll, and compliance across borders.

Here are the latest trends shaping EOR services and the HR software behind them:

- Immigration Support: There is a growing demand for assistance with immigration services like visa and work permit sponsorships, simplifying global talent acquisition processes for client companies immensely.

- Specialized Services for Diverse Needs: Several EOR providers have begun to offer IP and invention rights protection and equity incentive planning services, to cater to the specific needs of their client companies.

- Enhanced Employee Benefits Packages: There's a growing trend in EOR providers going beyond standard healthcare coverage to offer a full spread of enterprise-level medical and health benefits, stock options, and even one-time benefits like moving bonuses. This trend demonstrates an understanding of the importance of using benefits to attract and retain German top talent.

- AI-Backed Knowledge Bases: Some EOR providers (including Deel) are beginning to offer legally vetted knowledge bases or information wikis that use artificial intelligence to surface answers to common questions quickly. This helps customers source details on hiring within a specific country fast, without relying on human-run support systems.

As the market continues to evolve, these trends are likely to shape the future of international employment, making it easier for businesses to navigate the challenges of global expansion. For a closer look at specific EOR providers that are capitalizing on these trends, I recommend reading our in-depth reviews of Atlas HXM, Omnipresent, Deel, and Remofirst.

Key Employer of Record Services

An Employer of Record (EOR) simplifies hiring and compliance in Germany by managing payroll, tax obligations, and labor laws. Key services include:

- Payroll in EUR: Ensures accurate salary payments in compliance with German labor laws, including the German Civil Code (Bürgerliches Gesetzbuch, BGB) and Works Constitution Act (Betriebsverfassungsgesetz), covering wage rates, overtime, and record-keeping to avoid penalties from labor authorities like the Federal Employment Agency (Bundesagentur für Arbeit).

- Tax Compliance and Social Contributions: Handles income tax (Lohnsteuer) and mandatory social security contributions such as health insurance, pension (Rentenversicherung), unemployment insurance, and long-term care insurance, ensuring adherence to the German tax office (Finanzamt) and social security system.

- Labor Law Compliance: Provides expertise on German labor regulations, including compliance with working hour laws, paid leave, collective bargaining agreements (Tarifverträge), and termination procedures, ensuring compliance with the German Labor Law (Arbeitsrecht) and alignment with global workforce laws and conventions.

- Talent Acquisition and Background Checks: Conducts industry-specific credential verification and background checks to ensure new hires meet German legal standards for employment and necessary certifications.

- Visa and Work Permits: Assists with securing the necessary German visas and work permits for non-EU employees, ensuring compliance with the Federal Office for Migration and Refugees (BAMF) and the Foreigner’s Authority (Ausländerbehörde) regulations.

- Onboarding and Offboarding: Manages compliant onboarding and terminations in line with German labor laws, including notice periods, severance pay, and the proper execution of end-of-employment documents like job references (Arbeitszeugnis).

- Benefits Administration: Provides competitive benefits packages, including health insurance, pension contributions, meal allowances, and transportation subsidies, tailored to the German labor market.

- HR Support: Offers ongoing consultation on German employment laws, workplace safety regulations (Arbeitsschutzgesetz), and compliance with mandatory employee documentation, including payroll and personnel records.

- Risk Management and Insurance: Oversees workers' compensation and ensures compliance with local insurance requirements, including occupational accident insurance (Berufsgenossenschaften) and supplementary health insurance, to mitigate legal and financial risks.

- Multi-Language Support: Facilitates communication with Germany’s diverse workforce through the translation and localization of employment contracts, legal documents, and HR materials.

Benefits of an Employer of Record Service

If you're expanding globally, an EOR can take the legal and logistical weight off your shoulders, helping you hire across borders without setting up a local entity. Partnering with an EOR gives you the confidence to grow faster while staying fully compliant with foreign labor laws.

Here are some key benefits you can expect:

- Quick Market Entry: For organizations aiming to test new markets or hire talent in new countries where they have no legal presence, an EOR offers a swift and efficient solution to initiate operations, saving time and resources.

- Simplified Global Payroll: Using an EOR service simplifies the complex process of managing international payroll, including tax deductions, withholdings, and currency conversions for your employees worldwide.

- Global Compliance & Risk Mitigation: By managing compliance, an EOR service provides expertise in navigating the intricacies of employment laws, tax regulations, and insurance requirements in multiple jurisdictions, helping businesses safeguard their operations against compliance-related risks.

- Enhanced Benefits Negotiation: By leveraging their extensive networks and purchasing power, EORs can negotiate better international insurance rates and secure competitive benefit packages on your behalf, enhancing your ability to attract and retain top talent worldwide.

- Improved Cost Effectiveness: Using an EOR service is a cost-effective way for businesses to enter new markets, compared to the significant costs of establishing a new foreign entity. The latter option involves significant upfront legal fees, plus other costs related to office infrastructure, staffing, and local benefits and insurance coverage.

Understanding the benefits of an EOR service is crucial for strategic planning and operational efficiency. As businesses look towards international markets for growth opportunities, partnering with an EOR provider offers a streamlined, cost-effective, and compliant pathway to global expansion.

Costs & Pricing for Employer of Record Services

Typically, the cost of an EOR service follows a fee per-employee, per-month pricing model, which can vary widely depending on a range of factors. This model allows for scalability and predictability in budgeting for international expansion efforts.

In general, EOR services in Germany cost between $400 to $2,000 per employee, per month.

Key factors that can influence the pricing of an employer of record service include:

- Geographic Location: Costs can vary significantly based on the country or countries you're hiring in. This is due to local economic conditions, labor laws, and the complexity of compliance requirements.

- Employee Seniority and Role Complexity: The level and nature of the roles being filled can also impact the monthly cost. Senior positions or roles requiring special qualifications may increase the price due to higher benefits and compensation management costs.

- Custom Requirements: Any specific needs beyond the standard service offering may also contribute to the monthly cost. This may include customized solutions for recruitment, specialized employee onboarding, or unique compliance requirements, all of which can affect pricing.

- Number of Employees: The total number of employees being managed can also impact the cost. In some cases, higher volumes may lead to volume discounts, making per-employee costs more economical.

Some EORs also operate under different pricing models, including a percentage of employee salary model, a fixed pricing model, and custom pricing models.

When considering an EOR service, it is crucial to understand how these factors impact the overall cost to ensure that the service aligns with your business's needs and budget constraints. Anticipating the specific requirements of your international expansion strategy will help you choose the most cost-effective and efficient EOR solution for your needs.

FAQs about EOR Services in Germany

If you’ve got specific questions about the requirements to hire German employees or how EOR services work, these answers to frequently asked questions are a good place to start:

What does an Employer of Record in Germany do?

An EOR in Germany legally employs your team members on your behalf, so you don’t need to set up a German entity. The EOR handles local employment contracts, payroll in euros, tax deductions, social security contributions, and compliance with German labor laws—making it easier to hire and manage talent in Germany without the legal risk.

EOR services are ideal for companies expanding internationally without setting up local offices. They let you hire global talent while minimizing legal risk, since the EOR assumes full responsibility for compliance and employment on your behalf.

What are the minimum wage requirements in Germany?

The minimum wage in Germany is €12.41 per hour as of January 1, 2024. This rate is determined by the German Minimum Wage Act (Mindestlohngesetz) and is subject to periodic review and adjustments by the Minimum Wage Commission.

For more details, consult a German EOR partner, or visit the Mindestlohn Kommission website.

Do EOR providers offer other types of global HR services?

Yes, most of the time they do. Many service providers in this space also offer professional employer organization services (also known as PEO services), as well as international payroll services.

PEO services are a way to outsource your HR responsibilities to support your international teams. PEO companies can help you with international compliance issues, benefits administration, workers’ compensation, and other HR administrative tasks.

What are some of the consequences of non-compliance?

As an organization, you never want to be deemed as non-compliant in the eyes of any government body. The exact rules and regulations will vary according to the jurisdiction you’re operating in, which is one of the main benefits of using an EOR service provider.

If you don’t use an EOR and you do hire international workers, you may quickly find yourself in non-compliance. The consequences of doing so will depend on the severity of the violation, but they could include all of the following:

- Fines and penalties

- Legal actions such as lawsuits or other litigation proceedings

- Corrective measures and compliance orders

- Revocation of business licenses or operating permits

- Reputational damage if the news becomes public (loss of public trust and loss of internal employee respect)

- Increased monitoring and additional government scrutiny

Companies who fail to follow international labor laws cannot simply say they were unaware of the legalities, and hence, didn’t follow them. That’s where an EOR service can really remove a lot of potential risk and liability from the international hiring process.

Are there any risks to using an Employer of Record service?

While EORs offer major benefits, they aren’t risk-free. Here are a few considerations to keep in mind when choosing a provider:

-

Financial risks: Watch for hidden fees (like onboarding or advisory services), required benefit costs, and currency exchange fluctuations that can affect payroll expenses.

-

Operational risks: You’re sharing sensitive employee data, so strong data protection practices (like ISO 27001 certification) are a must.

-

Strategic risks: You may give up some control over employee management, and any missteps by the EOR could affect your employer brand.

Gain Access to the Best Talent with an EOR in Germany

If you made it this far, I hope you have a better sense of how EOR services can simplify the process of hiring German employees. They're truly a valuable resource, whether you're an enterprise organization looking to snap up the top talent in Germany, or a small business or startup trying to break into the German talent marketplace without launching your own entity.

If you found this article helpful, I recommend signing up for our weekly People Managing People newsletter too. You'll get access to the latest insights from thought leaders, as well as our latest podcasts, and more software and service recommendations.