10 Best Spanish Employer of Record Service Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Hiring in Spain sounds like a smart move—until you’re faced with confusing tax laws, employee classifications, and the paperwork of setting up a local entity.

That’s where a Spanish Employer of Record (EOR) can add value, by handling compliance, onboarding, payroll, and legal risks so you can hire faster and focus on growing your team.

In this guide, I break down the best EOR providers for hiring in Spain based on features, compliance support, pricing, and usability, so you can confidently choose a partner that fits your goals without wasting time or risking fines.

Market Details for Hiring in Spain

- Capital City: Madrid

- Currency: Euro (€, EUR)

- Payroll Frequency: Monthly

- Official Language: Spanish (Castilian)

- Approx. Population: 47.5 Million

- Public Holidays: 14 national holidays (varies per region)

Why Hire Employees in Spain?

Spain's universities and technical schools produce a steady stream of qualified professionals who are skilled in sectors such as technology, engineering, and finance. Additionally, the cost efficiency of hiring in Spain, with lower salaries and lower operational costs compared to other Western European countries, makes it an attractive option for businesses seeking to manage their budgets effectively.

In addition, Spain’s strategic location, multilingual workforce, and favorable time zone also make the country an attractive market for hiring foreign professionals, lending access to the European market at large.

Why Trust Our Reviews

We've been testing and reviewing HR software + services since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting a new HR service provider to work with.

We invest in deep research to help our audience make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Employer of Record in Spain: Pricing Comparison Chart

This comparison chart summarizes pricing details for my top Employer of Record selections for hiring staff in Spain to help you find the best EOR service for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for offering local health benefits | Free trial + demo available | From $29/month | Website | |

| 2 | Best AI-driven EOR platform | Free trial available | From $579/month | Website | |

| 3 | Best for budget-conscious remote team expansion | Free demo available | From $25 - $199/user/month | Website | |

| 4 | Best for employment compliance | Free demo available | Pricing upon request | Website | |

| 5 | Best for end-to-end support | Free demo available | $99/employee/month | Website | |

| 6 | Best for hiring and paying talent in Spain | Free demo available | From $199/employee/month or $19/contractor/month | Website | |

| 7 | Best for quick employee onboarding | Free demo available | From $20/user/month (billed annually) | Website | |

| 8 | Best for ease of use | Not available | From $199/employee/month | Website | |

| 9 | Best for competitive benefits packages | Free trial available | From $29/user/month | Website | |

| 10 | Best for fast support and in-house expertise | Free demo available | From $29/contractor/month to $499/EOR employee/month | Website |

-

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Reviews of the Best Employer of Record Services in Spain

To help you hire confidently in Spain, I’ve reviewed the top 10 EOR providers based on their services, strengths, and how HR teams can use them effectively. You’ll also find 10 additional providers further down if you want more options to explore.

Deel is a well-established employer of record platform that helps companies rapidly employ workers in 150+ countries, including Spain.

Deel owns a local entity in Spain staffed with legal experts to keep track of regulatory changes and ensure all legal obligations are met on your behalf. To hire a Spanish employee with Deel, the average onboarding time frame is 4 days.

Why I picked Deel: Deel excels as an EOR service provider in Spain by offering streamlined contract management, ensuring compliance with Spanish employment laws. Deel also helps organizations offer localized employee benefits for Spanish staff, including healthcare, social security, and flexible allowances for working from home, meals, and other flexible spending perks.

In addition, Deel has launched several new offerings over the past year, including global payroll, global mobility support, integrated Slack tools, and advanced integrations. These services, all combined, facilitate efficient and compliant hiring processes within the Spanish talent market.

Deel Key Services:

Deel offers end-to-end management for your Spanish employees covering everything from hiring and onboarding to termination. Their web app is user-friendly and provides a range of features to help businesses manage their remote teams effectively, including contract management and expense tracking.

Their integrated contract management function supports advanced customizations such as stipends, signing bonuses, and stock options. You can also use Deel for visa and immigration support if you want to relocate existing employees to Spain, with Deel managing the entire visa process for your organization in-house.

Deel offers 24/7 customer support and live chat and is known for its fast support.

Pros and cons

Pros:

- Comprehensive employee benefits

- Local compliance expertise

- Fast onboarding process

Cons:

- Potential complexity for first-time users

- Limited customization options

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

Borderless AI is an Employer of Record (EOR) platform built to help companies manage global teams with fewer barriers and more automation. They offer EOR, payroll, and contractor management services in 170+ countries—including Spain—without requiring you to open a local entity. The platform is AI-native, meaning its HR tools are powered by machine learning to support onboarding, compliance, and contract creation.

Why I picked Borderless AI: What stood out to me was its use of AI to automate compliance tasks—especially helpful when you’re juggling multiple hires or hiring in new markets. If you're hiring in Spain and want to move fast without sacrificing legal accuracy, Borderless AI is a strong option. You don’t need to deposit employee salaries upfront or figure out local labor rules on your own. The platform generates locally compliant contracts in minutes and takes care of tax filings, payroll, and Spanish benefits for you.

They also support both employees and contractors, which gives you flexibility as you scale. In Spain, for example, you could bring on a contractor quickly while testing the waters, then transition to full-time employment later with the same toolset.

Borderless AI Key Services:

Borderless AI includes a full set of global employment services: employer of record support, contractor onboarding, and centralized payroll management for Spanish hires. It’s equipped with AI tools like HRGPT and a contract generator to assist with everyday admin tasks—like answering HR questions or creating country-specific agreements.

Their team monitors legal changes and updates their platform accordingly, so your compliance documentation stays current. They also offer transparent cost breakdowns by country, which helps you forecast hiring expenses in Spain. Borderless AI’s North America–based support team is available to assist with setup or legal questions, and you can request a demo to explore the platform before committing.

Pros and cons

Pros:

- Facilitates international expansion without the need for local entities

- Offers clear, flat-rate pricing

- Provides an AI-powered assistant

Cons:

- Reporting and analytics tools are not extensive

- Does not offer direct recruitment or applicant tracking functionalities

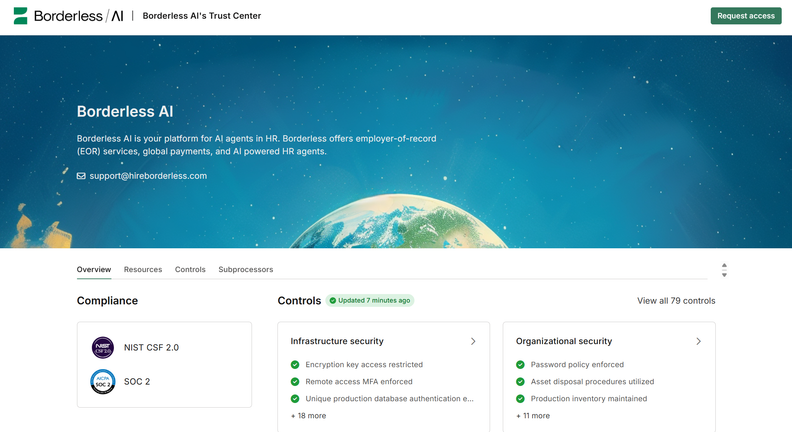

New Product Updates from Borderless AI

Borderless AI is Now SOC 2 Type II Certified

Borderless AI announced its SOC 2 Type II certification, emphasizing security and data protection with a new Trust Center and plans for ISO 27001 certification. More details are available at the Borderless AI Blog.

Remofirst is a global EOR service provider on a mission to free employers from geographical boundaries so they can build global teams with ease. They offer EOR services in 180+ countries, eliminating the need to set up multiple legal entities abroad.

Why I picked Remofirst: If you're looking to expand your remote team into Spain but are on a budget, Remofirst is a great option. Hiring remotely in Spain can get tricky because of specific legal requirements, like contracts in Spanish and mandatory employee benefits. Remofirst handles these details for you, helping you stay compliant while reducing the need for costly legal consultations. Remofirst takes care of local labor laws, payroll, tax filings, and compliance with Spanish employment regulations, so you don’t have to.

They'll automatically calculate your team’s hours, time off, holidays, bonuses, and commissions. They also ensure that your team members in Spain are treated fairly by offering localized benefits that meet Spanish labor standards. For example, they can manage benefits related to medical and health.

Remofirst Key Services:

Their team of legal experts and HR professionals will ensure your business operations are always compliant with changing Spanish regulations, with compliance documentation accessible at all times through your secure dashboard. Their customer support team is also available 24/7 in case you need additional help. All clients also receive a dedicated account manager as their main point of contact.

On top of their EOR services, Remofirst also provides international payroll and invoice management, global benefits management (including insurance and equity plans, plus time-off management), and employee support with obtaining visas and other immigration documentation. They can even help you allocate equipment to your global employees. Pricing for the EOR plan starts at $199/person/month.

Pros and cons

Pros:

- Robust employee support

- User-friendly platform

- Comprehensive compliance management

Cons:

- Service availability may vary by region

- Dependence on third-party providers for some services

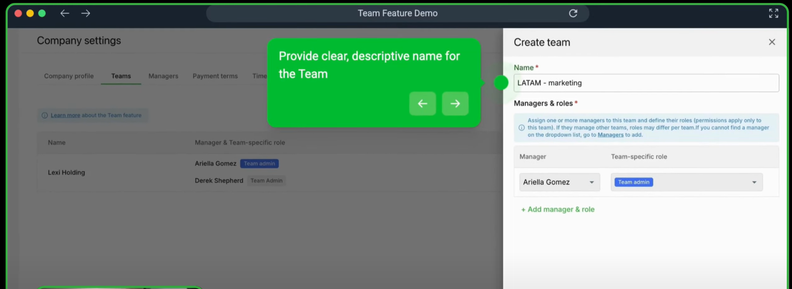

New Product Updates from RemoFirst

RemoFirst's Enhancements in Team Management and Notifications

RemoFirst has introduced new enhancements in team management and notification preferences, allowing more customization and efficiency. For more information, visit RemoFirst's official site.

G-P is a global employment platform that helps companies hire and manage international teams without the need to set up local entities. Their Employer of Record (EOR) services in Spain allow businesses to onboard talent quickly while ensuring compliance with local labor laws.

Why I picked G-P: Their Global Growth Platform™ allows you to start operations in Spain within minutes, leveraging their existing infrastructure. This means you can quickly tap into Spain's talent pool while G-P handles the complexities of local compliance and HR management.

Additionally, G-P's services in Spain are supported by a team of HR and legal experts who ensure that your hiring practices align with local labor laws. They manage the intricacies of employment contracts, benefits, and payroll, allowing you to focus on your business goals.

G-P Key Services:

G-P provides a Global Payroll solution that ensures your team members in Spain are paid accurately and on time. This centralized approach simplifies payroll management across multiple countries, reducing administrative burdens. They also offer benefits administration, helping you provide competitive packages that attract top talent. This service makes it easier to handle complex pay structures and local deductions.

G-P also supports local tax and social security compliance in Spain. This includes managing social security contributions, income tax deductions, and end-of-year tax filings. They even provide ongoing guidance on local employment regulations, including severance and terminations.

Pros and cons

Pros:

- Access to local HR and legal expertise

- Comprehensive compliance with Spanish labor laws

- Quick setup in Spain without establishing a local entity

Cons:

- Global mobility services are paid add-ons

- Dependence on G-P's platform for HR processes

Native Teams is a global platform designed to help companies legally employ and manage remote talent in different parts of the world. With their Employer of Record (EOR) services in Spain, they take on the legal responsibilities of employment so you don’t have to set up a local business entity.

Why I picked Native Teams: I chose Native Teams for its ability to simplify hiring in Spain by managing all legal and regulatory duties on your behalf. Its end-to-end support takes care of work contracts, payroll setup, tax contributions, and local employment compliance. With Native Teams acting as the legal employer, you’re free to focus on your team’s work while they handle the employment logistics.

I also like how Native Teams manages payroll and benefits for your employees. They make sure your team in Spain is paid on time, in the correct currency, and in compliance with Spanish tax regulations. They administer required benefits like health coverage and social security, along with optional extras. This makes it easier to keep employees happy while ensuring your business remains compliant.

Native Teams Key Services:

They offer a quick employee onboarding process, which is especially useful when you're looking to expand your team in Spain rapidly. With Native Teams, you can add new employees and get them started without the usual administrative hassles, allowing you to scale your operations.

Native Teams also provides assistance with visa and work permit applications, which is valuable when hiring non-EU workers in Spain. They create compliant employment contracts tailored to Spanish labor laws, protecting both your business and your team members.

Pros and cons

Pros:

- Enables hiring globally without establishing a local entity

- Provides compliant employment contracts and documentation

- Offers localized payroll calculators for accurate salary and tax computations

Cons:

- May not offer advanced HR tools beyond essential employment features

- Covers fewer countries than some competitors

New Product Updates from Native Teams

Native Teams Introduces Entity Management Solution

Native Teams unveils an all-in-one solution to streamline business entity management and reduce costs. For more information, visit Native Teams's official site.

Skuad’s digital HR platform helps global employers hire, pay, and manage employees in over 160 countries, including Spain. When you hire them as your Spanish EOR partner, they’ll manage the whole hiring process on your behalf, including creating employment agreements and other legal documents.

Why I picked Skuad: Skuad provides a comprehensive solution to hiring in Spain without the need to invest in a Spanish entity. This capability is particularly beneficial for small and medium-sized companies looking to expand globally without navigating the complex administrative and legal formalities of establishing offices abroad. Aside from hiring, Skuad also supports multiple currencies, allowing you to pay talent in Spain's local currency.

Skuad Key Services:

Skuad's EOR services include remote employee onboarding, employee benefits, time-off tracking, and managing tax compliance. As part of their global hiring service, they’ll handle all the required documentation on your behalf, including work permits and visas for your new hires and their dependents.

Beyond that, Skuad can also help you distribute computer equipment to your new employees, and track company assets like phones and other IT devices.

Pros and cons

Pros:

- User-friendly platform

- Extensive HR support

- Comprehensive compliance management

Cons:

- Possible delays in customer support response time

- Limited customization options

Multiplier is an employer of record company that provides HR and global payroll services to businesses, allowing them to outsource these responsibilities to a single provider. You can use their services to hire and manage employees based in Spain and comply with changing labor laws and tax policies.

Why I picked Multiplier: Multiplier helps businesses quickly and easily onboard new employees, manage their payroll and benefits, and ensure compliance with local laws and regulations. Their EOR services are very fast, with the ability to employ new talent in less than 24 hours once you've decided which candidate you'd like to hire. Their 4-step onboarding process is also user-friendly, providing a good experience for your new employees.

Multiplier Key Services:

Their EOR services include payroll processing, tax compliance, benefits administration, and worker's compensation. Their team of local experts can also offer support with employee benefits management, including health insurance, retirement plans, and other perks that are specifically tailored to the Spanish market. This service helps attract and retain top talent by offering competitive benefits packages.

By outsourcing your core HR responsibilities to Multiplier, you can reduce your exposure to the legal and financial risks associated with employing workers in Spain.

Pros and cons

Pros:

- Excellent customer service

- User-friendly platform

- Comprehensive compliance support

Cons:

- Dependence on third-party benefits providers

- Limited customization options

Remote People is a global Employer of Record (EOR) platform that helps companies hire and pay employees in over 150 countries, including Spain. The platform covers payroll, benefits, and compliance, allowing businesses to expand internationally without setting up a local entity. Remote People partners with legal and HR specialists in Spain to manage employment regulations and ensure compliance with local laws. Businesses can also use Remote People to hire contractors in Spain with proper agreements and liability coverage.

Why I picked Remote People: Remote People stands out by offering access to a large database of 300,000+ vetted candidates, which helps companies find qualified professionals quickly across industries like tech, marketing, and support. This is especially valuable for employers looking to build teams in Spain without a lengthy recruitment process.

Additionally, Remote People manages payroll, tax compliance, and employee benefits, reducing the administrative burden on companies. They also offer contractor management, visa sponsorship, and relocation support—making them a flexible solution for both permanent and project-based hiring.

Remote People Key Services:

Remote People offers full EOR support for hiring employees in Spain, covering contracts, payroll, benefits, and terminations. Their candidate placement guarantee gives employers added confidence in long-term hires.

The platform also provides contractor-of-record services, making it easier to manage freelancers with compliant agreements. Visa and relocation assistance are available for employees moving to Spain, and businesses have a dedicated support contact for ongoing HR needs.

Remote People’s services are designed to help employers confidently grow their teams in Spain while staying compliant with local labor laws.

Pros and cons

Pros:

- Candidate placement guarantee

- Includes contractor management services

- Wide database of vetted candidates

Cons:

- Smaller market presence compared to bigger EOR brands

- No known integrations

Remote’s global HR solution offers EOR services that simplify payroll, benefits, taxes, and compliance for international workers. You can use their services to hire full-time employees or contractors and gain local market insights.

Once you’re ready to hire an employee in Spain, Remote can complete their onboarding process within 3 days.

Why I picked Remote: Remote helps companies compete for talent effectively in the European market by lending access to competitive benefits packages. They can help you offer health insurance, dental insurance, vision insurance, life and disability coverage, and mental health support services for your Spanish employees. Remote also doesn’t add any markup to their benefits premiums or administration costs, making them a cost-effective choice.

Remote Key Services:

Services include global payroll processing, intellectual property and invention rights protection, and benefits packages that are tailored for the Spanish market. Their software platform also covers experience reimbursement and time-off requests, which are quick and easy to approve through their online portal.

Pros and cons

Pros:

- Strong local expertise

- User-friendly platform

- Comprehensive compliance support

Cons:

- High cost per employee

- Limited customization options

Omnipresent is a global employment platform designed to support businesses in hiring, onboarding, and managing employees and contractors across over 150 countries. It provides services like Employer of Record (EOR) and Professional Employer Organization (PEO) to help companies comply with local labor laws and tackle the intricacies of international employment.

Why I picked Omnipresent: A key feature that makes Omnipresent appealing is its ability to manage the entire hiring process, ensuring compliance with local labor laws, tax regulations, and social security requirements. This service allows businesses to onboard and manage international employees without the need to establish a legal entity, which can often be both time-consuming and costly. By handling the registration process with the Spanish government, Omnipresent reduces compliance risks, enabling companies to focus on their primary operations while accessing Spain's rich talent pool.

Omnipresent Key Services:

Omnipresent's Global Payroll Services manage payroll operations in over 150 countries, ensuring compliance with local regulations and timely employee payments. The Contractor Management tool streamlines the compliant hiring and management of global contractors, facilitating efficient payment processes. Additionally, the Expert Consultation service provides businesses with access to fast support and in-house expertise on international employment, benefits, and legal experts, guiding them through complex hiring processes.

These features collectively enhance Omnipresent's ability to simplify global employment solutions while maintaining compliance and operational efficiency.

Pros and cons

Pros:

- Compliance and legal support

- Payroll and benefits management

- Global hiring capabilities

Cons:

- Limited customization

- Steep learning curve

Other Spanish Employer of Record Services

Here are some other EOR service providers in Spain that didn’t make it into my top 10 shortlist, but are still worth considering:

- Horizons

For a flexible contract with no termination fee

- Velocity Global

For navigating complex regulatory landscapes

- Bradford Jacobs

For managing Spanish payroll taxes

- Rippling

For managing IT assets

- Oyster HR

For EOR-related educational resources for clients

- Papaya Global

For an AI-based payroll engine

- Atlas HXM

For enterprise organizations

- TopSource

For 24/5 dedicated support

- FoxHire

For hiring Spanish healthcare and higher education workers

- Allen Recruitment Consulting

For assistance with obtaining Spanish work permits

Hiring in Spain: Important Details

Here are some key details to note if this is your first time hiring staff located in Spain. Your EOR provider will manage these compliance details on your behalf. However, proactively informing yourself of these details is always recommended before you invest your resources into sourcing staff based in Spain.

In Spain:

- Employment laws are determined by the Ministry of Labour and Social Economy (Ministerio de Trabajo y Economía Social). They are responsible for a wide range of functions related to labor, employment, and social economy policies.

- Spain also has numerous collective bargaining agreements in place that determine labor standards for different job categories.

- You can hire employees or contractors. You can hire an employee under a fixed-term contract for a specific length of time, or as a permanent employee under an indefinite contract. However, employers are prohibited from offering the same person more than two successive fixed-term contracts for the same job within a specific length of time. Your Spanish EOR provider can help you determine the best hiring option depending on your needs while helping protect your business against accidental employee misclassification.

- Spain has both mandatory payroll deductions and social security contributions that must be collected. These include Personal Income Taxes, Unemployment Insurance, Occupational Accident and Disease Contributions, Wage Guarantee Fund Contributions, and Professional Training Contributions, as well as Seguridad Social, the name of Spain’s Social Security program.

- Spanish (Castilian dialect) is the official language in Spain, as well as other Spanish dialects including Catalan, Galician, and Basque.

- The standard working week in Spanish is 40 hours, with 9 hours per day maximum. A lengthy mid-day break of 1 to 2 hours (called a Siesta) is also customary in Spain. Overtime is generally discouraged, but if needed, employees can work a maximum of 80 hours of overtime per year.

- Spain requires 14 salary payments per year. This equates to 12 months of work, plus 2 additional payment periods — one during Christmas, and one during the holiday period in July. Some organizations pro-rate their salary payments to include the two extra months of pay spread out over 12 monthly payments. This is another important detail your Spanish EOR service can help you manage.

- Paid vacation in Spain starts at a minimum of 30 working days per year.

- There are 14 public holidays in Spain, including 12 that are recognized nationally, plus two locally celebrated holidays. Understanding and complying with employment norms and legal requirements surrounding Spanish public holidays is one area where your EOR service will shine, managing these occurrences hassle-free on your behalf.

- Spain offers maternity leave and paternity leave.

- Maternity leave is 16 weeks in Spain and begins after birth.

- Paternity leave was introduced in 2021 and grants fathers 16 weeks, also beginning at birth.

- Paid sick leave is offered in Spain. However, the amount of sick leave an employee is eligible for depends on their duration of employment and the reason for the leave.

- The probationary period in Spain is determined by the collective agreement for each job, ranging from 2 to 6 months.

- Termination of employment in Spain is also governed by collective bargaining agreements for each job type. Most jobs require a 15-day termination notice period, with employees receiving 20 days of gross salary as a severance payment. If an employee voluntarily chooses to terminate their employment, they must give 2 to 3 weeks' notice to their employer, depending on their collective agreement.

Selection Criteria for Employer of Record Spain

Uncovering the best EOR services for this list required a deep understanding of how these services can alleviate common challenges, such as legally hiring employees abroad, managing international payments, ensuring compliance with local labor laws, providing competitive benefits, and facilitating smooth onboarding.

Here are the specific criteria I used to carefully compare the service offerings for each provider in this list:

Core Employer of Record Services (25% of total score): To be considered for inclusion in this list, each EOR provider had to offer the following basic services first:

- The corporate structure to legally and compliantly hire employees in multiple countries without a local entity

- The ability to manage Spanish payroll and taxes in compliance with local regulations

- Assistance with offering competitive and locally compliant benefits packages

- Assistance with navigating visa and work permit processes for expatriate employees

- Robust procedures to ensure data privacy and security that comply with international standards, including GDPR and other requirements

Additional Standout Services (25% of total score): To help me narrow in on the best EOR services out of the numerous options available, I also took note of any unique or less common services, including:

- Advanced technology platforms that streamlined payroll and HR processes while still offering ease of use

- Specialized experience in hiring employees within specific new countries or key industries

- Services that enhance remote work compliance and global mobility needs

- Specialized customer support for complex immigration cases

- Assistance with international IT requirements, including managing computer equipment, software licenses, and other asset-tracking requirements

- A focus on eco-friendly and sustainable employment practices

Industry Experience (10% of total score): To evaluate the industry experience of each EOR service provider, I considered the following:

- How many years their business has operated in the EOR space

- Any industry recognitions or certifications the provider may hold in international HR and payroll

- Their depth of knowledge in local labor laws across multiple jurisdictions

- Their expertise in new markets, including how many different countries they offer local expertise in

- Evidence of a strong track record managing global expansion processes

- The combined experience and credentials of their team members, if available

Customer Onboarding (10% of total score): To get a sense of each provider's customer onboarding process, I considered the following factors:

- The availability of comprehensive onboarding materials, such as fact sheets, guides, FAQ repositories, or other training resources

- Support for integrating the EOR provider's software with existing HR systems

- Direct access to onboarding specialists, customer support, or a dedicated account manager during the setup phase

Customer Support (10% of total score): Since the EOR provider will act as your remote workers' legal employer, it's important to ensure you'll receive timely communications and top-level support. To evaluate the level of customer support each company offered, I considered the following:

- The availability of a multilingual support team that covers different time zones

- Multiple support channels, including phone, email, and live chat

- Evidence of responsiveness and effectiveness in resolving issues, as inferred from customer reviews

- The existence of dedicated account managers to provide assistance as needed

Value for Price (10% of total score): To gauge the overall value of each service, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of service offerings versus cost

- Flexibility in service packages to suit different business sizes and needs

Keep in mind that EOR services are complicated, and because of that the price tag can sometimes be high. However, the prices for their services still offer a good ROI considering the complexity of the premium-grade services you're gaining.

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how happy real users are with a service. To determine this, I considered the following factors:

- Consistently high ratings across various consumer review platforms

- Specific feedback on the ease of use of the EOR services

- Testimonials highlighting exceptional customer support and problem resolution

Using this assessment framework helped me identify the employer of record services that go beyond basic requirements to offer additional value through unique services, deep industry experience, smooth onboarding, effective support, and overall value for price.

What is an Employer of Record in Spain?

An Employer of Record (EOR) in Spain is a third-party service that legally employs your Spanish employees on your behalf—handling payroll, taxes, benefits, and compliance—while you remain in control of their day-to-day work.

Instead of navigating Spain’s complex labor laws yourself, an EOR takes on the legal responsibility, letting you hire quickly and compliantly without setting up a local entity or overloading your HR team.

Rather than asking your HR professionals to become experts in Spanish labor laws and regulations, you can outsource these requirements to an EOR in Spain and gain peace of mind that your future operations will always be compliant.

EOR vs Legal Entity

Not sure whether to use an EOR or set up your own legal entity in Spain? Here’s a quick side-by-side comparison to help you weigh the time, cost, and complexity of each option.

| Factor | Employer of Record (EOR) | Setting Up a Legal Entity |

|---|---|---|

| Setup Time | Days (often under a week) | Several weeks to months |

| Cost | Monthly fee per employee | High upfront legal, tax, and admin fees |

| Legal Responsibility | Handled by EOR | Fully on your company |

| Compliance Management | Included in EOR service | Must be managed in-house |

| Hiring Speed | Fast, EOR can onboard quickly | Slower due to registration delays |

| Payroll & Benefits Admin | Managed by EOR | Requires in-house setup and ongoing management |

| Ideal For | Testing new markets or hiring quickly without risk | Long-term expansion with local presence |

If you’re hiring a few employees or testing the waters in Spain, using an EOR is faster, simpler, and lower risk. Conversely, a legal entity can make sense if you’re planning a long-term investment and want full control—but it requires a lot more time, effort, and resources to get there.

How to Choose an Employer of Record in Spain

The right EOR can take the stress out of hiring in Spain, but only if it fits your specific needs. Before choosing a provider, get clear on the challenges you’re facing and the outcomes you want to achieve.

Here are five questions to guide your decision:

- What problem are you solving?

Are you struggling with compliance, payroll in Euros, sourcing talent in a specific region, or offering the right mix of Spanish employee benefits? Be specific about what you want help with—like hiring in specific geographic locations, or paying employees in Euros, etc. - Who will benefit from the EOR?

Think about who will manage the EOR relationship internally. How will it improve their workload, processes, or confidence in global hiring? - What's your budget?

Estimate how many employees you plan to hire in Spain. Since EOR fees are typically charged per employee per month, this helps forecast your total costs. - What outcomes matter most?

Do you need fast hiring in certain regions, better compliance support, or smoother onboarding? Define your success metrics up front to avoid wasting time on mismatched options. - Will it work with your HR systems?

Consider how the provider’s platform integrates with your current HR tools. Look for solutions that support your workflows, not complicate them.

Remember, every business is different — don’t assume that a Spanish employer of record service will work for your organization just because it's popular. Instead, choose the one that best fits your goals.

Trends in Employer of Record Services

As global hiring becomes the norm, EOR providers are stepping up with smarter, more flexible tools to help businesses manage payroll, compliance, benefits, and onboarding across borders. The latest innovations focus on tech-driven solutions, tailored support, and seamless global operations.

Here are the key trends shaping the future of EOR services:

- Immigration Support: There is a growing demand for assistance with immigration services like visa and work permit sponsorships, simplifying global talent acquisition processes for client companies immensely.

- Specialized Services for Diverse Needs: Several EOR providers have begun to offer IP and invention rights protection and equity incentive planning services, to cater to the specific needs of their client companies.

- Enhanced Employee Benefits Packages: There's a growing trend in EOR providers going beyond standard healthcare coverage to offer a full spread of enterprise-level medical and health benefits, stock options, and even one-time benefits like moving bonuses. This trend demonstrates an understanding of the importance of attracting and retaining top talent globally.

- AI-Backed Knowledge Bases: Some EOR providers (including Deel) are beginning to offer legally vetted knowledge bases or information wikis that use artificial intelligence to surface answers to common questions quickly. This helps customers source details on hiring within a specific country fast, without relying on human-run support systems.

As the market continues to evolve, these trends are likely to shape the future of international employment, making it easier for businesses to navigate the challenges of global expansion. For a closer look at specific EOR providers that are capitalizing on these trends, I recommend reading our in-depth reviews of Atlas HXM, Deel, Omnipresent, and Remofirst.

Key Employer of Record Services

An Employer of Record (EOR) simplifies hiring and compliance in Spain by managing payroll, tax obligations, and labor laws. Key services include:

- Payroll in EUR: Ensures accurate salary payments in compliance with Spanish labor laws, including the Workers' Statute (Estatuto de los Trabajadores), covering wage rates, overtime, and record-keeping to avoid penalties from the Spanish Social Security and Labor Authorities.

- Tax Compliance and Social Security Contributions: Handles income tax (Impuesto sobre la Renta de las Personas Físicas, IRPF) and mandatory social security contributions such as pension, health insurance, and unemployment insurance, ensuring compliance with the Spanish Tax Agency (Agencia Tributaria) and the Social Security system (Seguridad Social).

- Labor Law Compliance: Provides expertise on Spanish labor regulations, including working hours, overtime, paid leave, and termination procedures under the Workers' Statute and collective bargaining agreements (Convenios Colectivos), mitigating legal risks. This ensures compliance with regional, national, and international workforce regulations and conventions.

- Talent Acquisition and Background Checks: Conducts industry-specific credential verification and background checks to ensure new hires meet Spanish legal standards for employment and professional certifications.

- Visa and Work Permits: Assists with securing the necessary visas and work permits for non-EU employees, ensuring compliance with Spanish immigration laws and the Ministry of Labour, Migration and Social Security.

- Onboarding and Offboarding: Manages compliant onboarding and terminations in line with Spanish labor laws, including notice periods, severance pay (finiquito), and proper documentation of employment cessation.

- Benefits Administration: Provides competitive benefits packages, including health insurance, pension contributions, meal vouchers (tickets restaurante), and transportation allowances, tailored to the Spanish labor market.

- HR Support: Offers ongoing consultation on Spanish employment laws, workplace safety regulations (Ley de Prevención de Riesgos Laborales), and compliance with mandatory employee-related documentation, such as payroll records and Social Security filings.

- Risk Management and Insurance: Oversees workers’ compensation and ensures compliance with local insurance requirements, such as occupational accident insurance and private health insurance, mitigating legal and financial risks.

- Multi-Language Support: Facilitates communication with Spain’s diverse workforce through translation and localization of employment contracts, legal documents, and HR materials.

Benefits of an Employer of Record Service

Expanding internationally doesn’t have to mean dealing with red tape, legal risks, or hiring delays. An EOR takes on the heavy lifting so you can hire globally with speed, confidence, and compliance.

Here’s what you gain by partnering with an EOR:

- Quick Market Entry: For organizations aiming to test new markets or hire talent in new countries where they have no legal presence, an EOR offers a swift and efficient solution to initiate operations, saving time and resources.

- Simplified Global Payroll: Using an EOR service simplifies the complex process of managing international payroll, including tax deductions, withholdings, and currency conversions for your employees worldwide.

- Global Compliance & Risk Mitigation: By managing compliance, an EOR service provides expertise in navigating the intricacies of employment laws, tax regulations, and insurance requirements in multiple jurisdictions, helping businesses safeguard their operations against compliance-related risks.

- Enhanced Benefits Negotiation: By leveraging their extensive networks and purchasing power, EORs can negotiate better international insurance rates and secure competitive benefit packages on your behalf, enhancing your ability to attract and retain top talent worldwide.

- Improved Cost Effectiveness: Using an EOR service is a cost-effective way for businesses to enter new markets, compared to the significant costs of establishing a new foreign entity. The latter option involves significant upfront legal fees, plus other costs related to office infrastructure, staffing, and local benefits and insurance coverage.

Understanding the benefits of an EOR service is crucial for strategic planning and operational efficiency. As businesses look towards international markets for growth opportunities, partnering with an EOR provider offers a streamlined, cost-effective, and compliant pathway to global expansion.

Need a better pitch for upper management on EOR services? Emphasizing hiring foreign workers’ costs and the ease of hiring internationally with an EOR could help.

Costs & Pricing for Employer of Record Services

Typically, the cost of an EOR service follows a fee per-employee, per-month pricing model, which can vary widely depending on a range of factors. This model allows for scalability and predictability in budgeting for international expansion efforts.

In general, EOR services in Spain cost between $199 to $599/employee/month.

Key factors that can influence the pricing of an employer of record service include:

- Geographic Location: Costs can vary significantly based on the country or countries you're hiring in. This is due to local economic conditions, labor laws, and the complexity of compliance requirements.

- Employee Seniority and Role Complexity: The level and nature of the roles being filled can also impact the monthly cost. Senior positions or roles requiring special qualifications may increase the price due to higher benefits and compensation management costs.

- Custom Requirements: Any specific needs beyond the standard service offering may also contribute to the monthly cost. This may include customized solutions for recruitment, specialized employee onboarding, or unique compliance requirements, all of which can affect pricing.

- Number of Employees: The total number of employees being managed can also impact the cost. In some cases, higher volumes may lead to volume discounts, making per-employee costs more economical.

Some EORs also operate under different pricing models, including a percentage of employee salary model, a fixed pricing model, and custom pricing models.

When considering an EOR service, it is crucial to understand how these factors impact the overall cost to ensure that the service aligns with your business's needs and budget constraints. Anticipating the specific requirements of your international expansion strategy will help you choose the most cost-effective and efficient EOR solution for your needs.

FAQs About EOR Services in Spain

If you’ve got specific questions about the requirements to hire Spanish employees or how EOR services work, these answers to frequently asked questions are a good place to start:

What does an Employer of Record do?

An Employer of Record (EOR) is a third-party service that hires employees on your behalf in countries where you don’t have a legal entity. While you direct your team’s daily work, the EOR handles payroll, tax deductions, onboarding, and compliance with local employment laws.

This setup lets you access global talent quickly, without the legal risk or complexity of setting up an office abroad. The EOR becomes the legal employer, so you stay focused on growing your team, not navigating foreign regulations.

What are the minimum wage requirements in Spain?

As of January 1, 2024, the minimum wage in Spain, known as the Salario Mínimo Interprofesional (SMI), is set at €1,134 gross per month, distributed over 14 payments per year. This translates to approximately €1,323 gross per month if considered over 12 payments. For domestic workers, the minimum hourly wage is €8.87.

For more details, consult a Spanish EOR partner or learn more about the Salario Mínimo Interprofesional.

Do EOR providers offer other types of global HR services?

Yes, many service providers in this space also offer professional employer organization services (also known as PEO services), as well as multi-country payroll services.

PEO services, offered by PEO companies, are a popular partner for HR outsourcing. They can help you with international compliance issues, benefits administration, workers’ compensation, and other HR administrative tasks.

What are some of the consequences of non-compliance?

As an organization, you never want to be deemed as non-compliant in the eyes of any government body. The exact rules and regulations will vary according to the jurisdiction you’re operating in, which is one of the main benefits of using an EOR service provider.

If you don’t use an EOR and you do hire international workers, you may quickly find yourself in non-compliance. The consequences of doing so will depend on the severity of the violation, but they could include all of the following:

- Fines and penalties

- Legal actions such as lawsuits or other litigation proceedings

- Corrective measures and compliance orders

- Revocation of business licenses or operating permits

- Reputational damage if the news becomes public (loss of public trust and loss of internal employee respect)

- Increased monitoring and additional government scrutiny

Companies who fail to follow international labor laws cannot simply say they were unaware of the legalities, and hence, didn’t follow them. That’s where an EOR service can really remove a lot of potential risk and liability from the international hiring process.

Are there any risks to using an Employer of Record service?

While EOR services offer major advantages, like faster hiring and simplified compliance, they aren’t entirely risk-free. As with any partnership, it’s important to understand the potential downsides before choosing a provider.

Here are a few risks to keep in mind:

-

Financial risks: Unexpected fees can arise for onboarding, offboarding, or additional HR services. EORs may also charge separately for mandatory benefits in some countries. And, because payroll often involves currency exchange, fluctuations can impact your overall costs.

-

Operational risks: You’re entrusting sensitive employee data to a third party, so strong data security is essential. Look for providers with clear policies, certifications (like ISO 27001), and robust incident response protocols.

-

Strategic risks: Since the EOR becomes the legal employer, you’ll give up some control over HR processes, which could affect decision-making. And if your EOR delivers a poor employee experience or operates unethically, it could reflect poorly on your brand.

Carefully vetting EOR providers, and understanding the terms of your agreement, can help mitigate these risks and ensure a strong global hiring foundation.

Gain Access to the Best Talent with an EOR in Spain

If you made it this far, I hope you have a better sense of how EOR services can simplify the process of hiring Spanish employees. They're truly a valuable resource, whether you're an enterprise organization looking to snap up the top talent in Spain, or a small business or startup trying to break into the Spanish talent marketplace without launching your own entity.

If you found this article helpful, I recommend signing up for our weekly People Managing People newsletter too. You'll get access to the latest insights from thought leaders, as well as our latest podcasts, and more software and service recommendations.