As you’re no doubt aware, processing payroll can be a time-consuming and complex task prone to errors, compliance headaches, and administrative burdens.

One study found that 88% of businesses suffered payroll errors in 2022 that could have been avoided using payroll software.

That's why many organizations turn to software to streamline the process and lessen the stress. But with so many options available, how do you find the right fit for your needs?

Use this guide to help you navigate your research and choose the best payroll solution to simplify your operations and ensure accuracy.

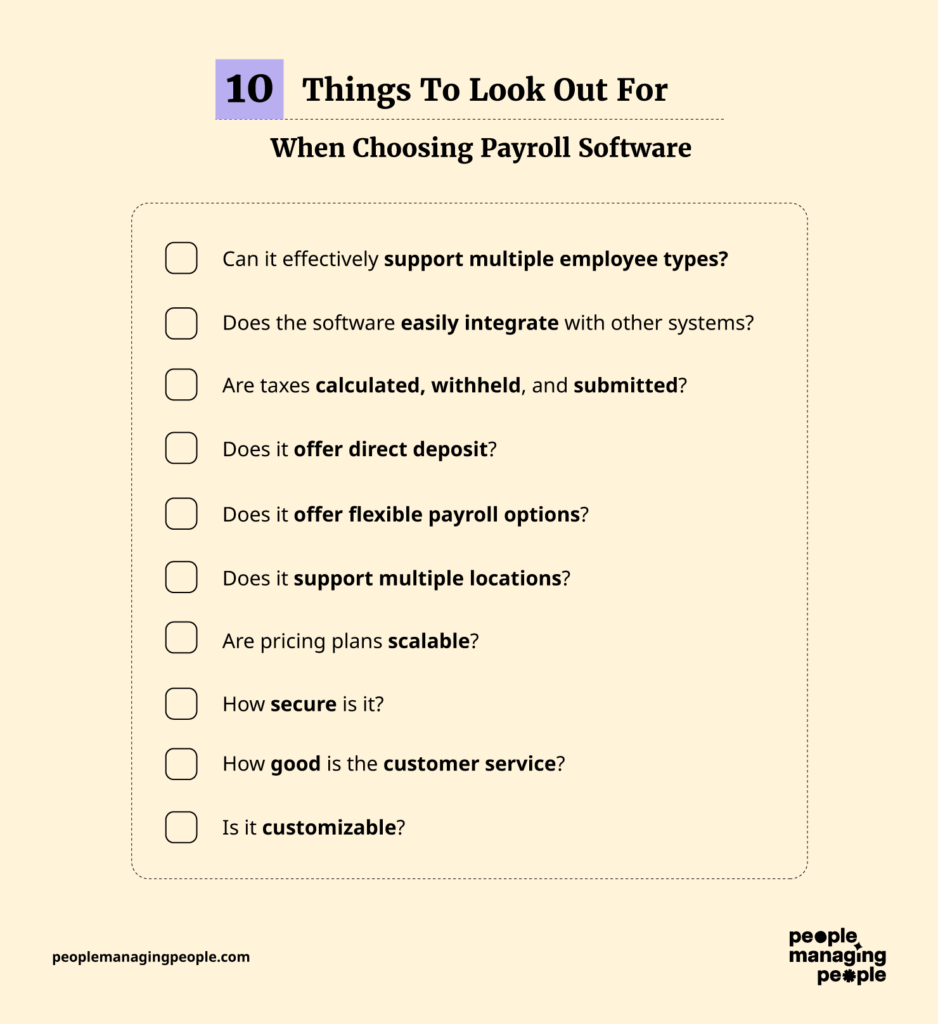

10 Things To Look Out For When Choosing Payroll Software

When choosing payroll software, you’re not just picking a tool—you’re selecting a core system that touches compliance, finance, employee trust, and business continuity.

I’m going to assume you’re aware of the main payroll software features so I won’t go into them here.

If I were choosing new payroll software for my organization, here’s what I’d be looking out for:

1. Can it effectively support multiple employee types?

It might be that you hire a mix of salaried and hourly employees and also contractors. As employees are classified based on their working hours, benefits, and job types, your HR software with payroll must be able to address the specific needs of your workforce.

It might be that you hire a mix of salaried and hourly employees and also contractors. As employees are classified based on their working hours, benefits, and job types, your payroll software must be able to address the specific needs of your workforce, including contractor payroll.

Some systems cater specifically to full-time or contract employees' payroll needs while others offer flexible categorization options.

Additionally, some services include self-service portals so employees can submit tax information and view hours and pay periods.

2. Does the software easily integrate with other systems?

Payroll software integrates with HRMS, accounting software, time and attendance systems, tax filing platforms, benefits administration software, ERP systems, direct deposit systems, compliance tools, mobile applications, and learning management systems.

If you choose to use a stand alone payroll system, you'll need it to share information with your HRMS or HRIS, accounting system, or time-tracking software. If so, it’s worth checking to see how easy these integrations will be.

3. Are taxes calculated, withheld, and submitted?

Managing payroll taxes is a real pain point. A reliable payroll system simplifies the process of calculating, withholding, and submitting taxes, preventing costly errors. It should also handle payroll garnishments seamlessly, ensuring compliance with court-ordered deductions for child support, tax levies, or other obligations.

Look for a provider that not only withholds the correct amounts but also files them with the right government agencies.

Couple of things to look out for:

- Is the provider a Registered Reporting Agent with the IRS?

- Is tax filing accuracy ‘guaranteed’ meaning the provider will cover the costs of any errors?

4. Does it offer direct deposit?

According to a survey by the American Payroll Association, 93% of employees are paid by electronic deposit. As such, this is a key feature I’d look out for in a payroll solution.

5. Does it offer flexible payroll options?

It might be that you want to pay employees on a weekly, biweekly, semi-monthly, or monthly as needed. Consequently, the ability to run unlimited payrolls and multiple frequencies is handy.

Additionally, on-demand pay is a much-appreciated perk that gives workers greater financial flexibility.

6. Does it support multiple locations?

If your org operates across different territories (or you think you might in the future like opening a new restaurant franchise that needs payroll) then can the software calculate and distribute pay where each employee works?

7. What kind of reporting capabilities does the system offer?

Payroll data is a goldmine for financial planning, compliance audits, and workforce strategy. Ask about built-in reports such as payroll summaries, tax liability, benefits deductions, and labor cost analyses. See whether reports can be customized or scheduled automatically.

Also, inquire whether the reports are exportable to CSV or integrate directly with your accounting tools.

Take it from me, the ability to generate clean, actionable reports can save time and improve decision-making.

8. Are pricing plans scalable?

Of course, the requirements of payroll software supporting a small local business will be quite different from those of a large, multinational organization.

The vendors you assess will likely have multiple payroll system pricing options depending on business size and requirements.

Typically, subscription plans include a monthly base fee and a monthly fee per employee. One good example of a payroll software provider following this model is Gusto, which charges businesses a base fee of $40 per month plus $6 for every employee. Thus, a company with 100 employees would pay $640 per month.

Many monthly subscription plans include multiple tiers, each offering different payroll features and services. The expensive plans might include extra technical help, extra HR support, multiple locations, and a personal accountant to prepare and submit taxes.

The monthly subscription model is preferred by businesses, irrespective of their sizes, because of the cheap monthly charge and scalability options.

Alternatively, a no-cost payroll solution can provide all the essential features you need without the high cost of traditional systems, though you may miss out on more advanced features.

9. How secure is it?

Payroll software stores sensitive employee information so it’s important to ensure that any solution you’re considering offers the following security measures:

- PCI compliance

- MFA (multi-factor authentication)

- Data encryption

- Password protections

- Limited access permissions

10. How good is the customer service?

Getting things right if you manage payroll yourself is pretty fundamental, so any issues need to be dealt with quickly. This is why I always look at the level of customer support available and read reviews related to customer support.

Some factors to assess:

- Helpful articles and videos

- Customer support lines

- Online chat

- In-house payroll experts.

11. Is it customizable?

The payroll software you choose must be customizable to your unique business needs. Upgrades or additions can often be added to the software to accommodate unique timings, currencies, or tax settings.

You will also want to look for customizable analytics dashboards for compensation reporting that can be tailored to specific needs.

Payroll Options To Consider

With the above in mind, here are a few payroll options to consider:

For more, check out our shortlist of the best payroll software.

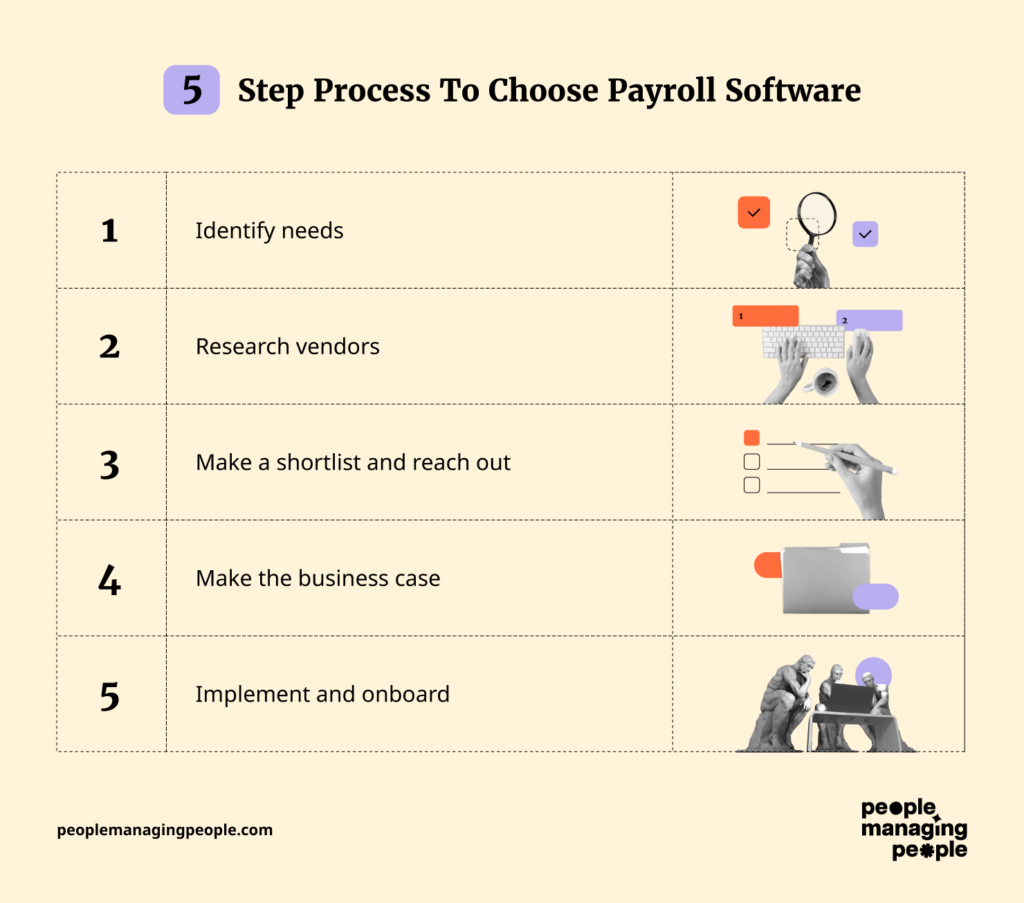

5-Step Process To Choose Payroll Software

Lastly, follow this 5-step process to help you choose the right software.

Step one: Identify needs

Before diving into vendor research, take time to understand the specific needs of your stakeholders, including your payroll team members, leaders, managers, and regular employees.

Questions to help you identify your needs:

- What are the most common challenges faced by the human resources/payroll/accounting department?

- How will each stakeholder use the new software?

- How is the current HR system or process falling short? (Process mapping can help here)

- What are the most frequent payroll-related complaints?

- How will any new software you purchase fit into your HR tech stack?

- What are your company’s policies and regulatory requirements regarding data security, supplier diversity, vendor contracts, etc.?

- How tech-savvy is your team? The software you select shouldn’t be more complex to set up and use than your team can manage.

- What is your budget?

- What kind of return on investment (ROI) would you expect to see?

Asking these questions will help you determine what exactly it is you need from your HR software, including the sub-type of payroll software you likely need the most.

Get input from your stakeholders (IT and finance are always useful) and use their feedback to write use cases and build a matrix comparing what’s important to each stakeholder group.

You’ll now be able to lead the conversation with vendors and give them a list of need-to-have and nice-to-have features for each user.

Step two: Research vendors

It’s time to do some market research and familiarize yourself with the leading payroll companies for your use case. Tons of websites (like us!) set out to list the best software choices for various needs and use cases.

For example, if you are looking to reduce human error and lower administrative overhead for your payroll processes, you'll want to think about comparing and picking from various automated payroll software tools.

Whereas you'll be researching a completely different set of payroll vendor options if outsourcing payroll altogether. There are pros and cons to outsourcing payroll to a secondary company that you'll have to understand.

Take the time to study each vendor website and take notes of any questions that arise. Are there case studies and reviews that demonstrate the tool's main use or selling point?

You can also join online communities or tap into your network for recommendations.

Some vendor-specific questions to ask:

- Who are the top vendors for your use case?

- Which are the best-rated in their category?

- What is each tool’s top-rated feature?

- Does the tool cater to small and medium-sized businesses or is it more suited for enterprise use?

- What do customer reviews and testimonials have to say? What are the most commonly reported benefits and drawbacks?

- What kind of onboarding, training, support, and other resources does the vendor offer?

- Is robust documentation available?

- Do the tool’s features meet your needs?

- Does the software integrate with the HR tools you’re already using?

- Is the user interface visually appealing?

- Is the user experience positive?

- Is it intuitive to navigate and easy to use?

- Is this tool too simple or complex for your human resource management needs?

- Does it offer the flexibility or customizability you need?

- Does it offer robust security standards and comply with data privacy regulations and best practices? Is an on-premise option available?

- Does the pricing meet your budget? Is the pricing clear?

- Is the price warranted based on the software’s capabilities? Are certain key features only available in more expensive pricing tiers?

- Does it offer a demo or free trial?

Step three: Make a shortlist and reach out

Now that you’ve identified some likely vendors, it’s time to go a bit deeper and book some demo calls.

- Send each vendor a request for information (RFI) so you can compare your options point for point

- If you want to be really thorough, send each of your shortlisted vendors a request for proposal (RFP). This will include key information about your company, your specific needs, a vendor questionnaire, and any specific proposal submission rules they should follow, such as submission deadlines.

- Schedule a meeting with their sales rep and go through your questions.

These calls, which should ideally include demonstrations of the product in action, will also help you get a feel for the vendor and whether you can form a good partnership.

To help compare vendors, use this handy evaluation template.

Step four: Make the business case

With all the above data gathered, it's time to put together your business case. This doesn't have to be a 10-page document, it can be as simple as a one-page memo (because who has time to read 10 pages anyway).

Decision-makers are looking for answers to the following questions:

- How much does it cost?

- What pain points will the software solve?

- If we didn’t invest in the software, then what?

- How long will it take to implement?

- Why do we need to invest now?

- What is the ROI of implementing this software?

You may not know the answers to the cost question; however, seeking approval at this stage will set you up for success.

Here's a business case template you can use for payroll automation software:

- Executive Summary: Brief overview of the proposal, key benefits, and conclusions.

- Current Situation and Problem Statement: Description of the current state and specific challenges or problems being addressed.

- Proposed Solution and Benefits: Detailed description of the proposed solution and its expected benefits, including a cost-benefit analysis.

- Implementation Plan and Risk Assessment: Step-by-step implementation strategy, timeframe, and a summary of potential risks with mitigation plans.

- Conclusion and Recommendations: A concise summary of the business case with final recommendations for decision-makers.

Step five: Implement and onboard

Make sure stakeholders are aware of your new solution and feel confident using it.

The main reason companies fail to see ROI on software purchases is failing to follow through on implementation and properly integrate their shiny new tool into day-to-day operations.

Effective change management is crucial. For employees to use your new software, they need to understand how it benefits them (e.g., how it saves them time, how their PTO requests will get approved faster, etc.) and know how to use it.

Here are some tips to help with this:

- Clearly communicate that you’re adopting the new system and what this will mean for employees. Invite employees to come forward with questions.

- Take advantage of any onboarding and training offered by the payroll software vendor and make it mandatory for employees to complete this training within a realistic timeframe.

- Designate someone with the responsibility of spearheading implementation and being a point of contact for any questions (and feedback) employees might have.

- Make employees aware of any self-service resources available and make sure they know how to log a support ticket if they run into difficulties.

Get Expert Help Finding The Right Payroll Software

If you’re struggling to choose the right software, let us help you. Just share your needs in the form below and you’ll get free access to our dedicated software advisors who match and connect you with the best vendors for your needs.