Best Global Payroll Services Shortlist

Talk through what you’re looking for. Get a custom shortlist based on your needs. No fees.

TL;DR My top picks for international payroll solutions that support both employees and contractors, offer built-in employer of record (EOR) services, and help you stay compliant as you scale—without adding operational overhead.

Paying global teams is only part of the equation—international payroll platforms reduce legal and operational risk, so you can grow with confidence in every new country you enter.

The right solution will automate tax withholding, makes compliant payslips, converts currencies, and handles the paperwork, so no one’s chasing spreadsheets or googling labor laws at 11 p.m.

But the very best platforms also act as a system of record—integrating with tools like your HRMS, HRIS, HCM, recruitment platforms, (et cetera, et cetera), to sync data, surface compliance risks early, and scale with you as you expand into new countries.

In this guide, I’ll break down the global solutions worth your time, specifically for payroll, and specifically looking at:

- how they handle local compliance at scale

- what their implementation and support models look like

- which ones are best for contractor-heavy teams versus full-time employees

- and what trade-offs you might face around control, flexibility, and cost

You Can Trust Our Reviews

We invest in deep research to help you make better purchasing decisions. We've tested more than 2,000 tools and 200 service providers for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our review methodology.

Best Global Payroll Services: Comparison Chart

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

|

1

|

Best with all-in-one HR |

Free trial + demo available |

From $29/month | Website | |

|

2

|

Best for global payroll without local entities |

Free demo available |

Pricing upon request | Website | |

|

3

|

Best for budget-conscious remote team expansion |

Free demo available |

From $25 - $199/user/month | Website | |

|

4

|

Best for ease of use |

Free trial available |

From $29/user/month | Website | |

|

5

|

Best for onboarding and payment compliance |

Free demo available |

From $20/user/month (billed annually) | Website | |

|

6

|

Best for complex enterprise payroll setups |

Free demo available |

From $314/month | Website | |

|

7

|

Best for global expansion management |

Free demo available |

Pricing upon request | Website | |

|

8

|

Best for end-to-end employee management |

Free demo available |

From $595/employee/month or $49/contractor/month | Website | |

|

9

|

Best for global employee support & local benefits |

Free demo available |

$99/employee/month | Website | |

|

10

|

Best for integrated HR and payroll |

Free demo available |

Pricing upon request | Website |

-

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Guru

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6 -

Absorb LMS

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.6

Reviews of the Best Global Payroll Services

What to watch for: I’ve already gone through the feature lists—what really matters is how each provider handles tax obligations, local compliance updates, and how much control you’ll have as your team grows. That’s the lens I used in these reviews.

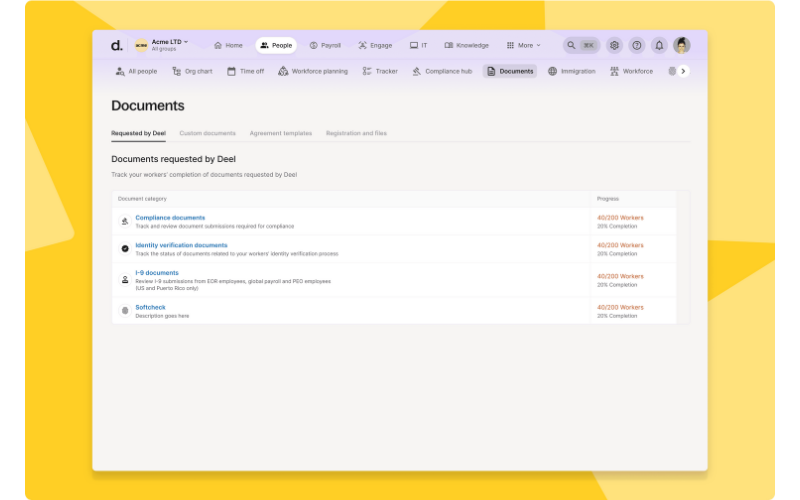

Deel is a global payroll service provider that can help you hire employees in over 150 countries. It allows you to hire anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll.

Why I picked Deel: Their automated processes let you set up global payroll in less than a month. Deel has local country experts working in-house to provide consultative approaches for each location you hire from, ensuring compliance with local pay standards.

Their platform lets you handle end-to-end workforce management, including custom contract adjustments, expense reimbursements, and off-cycle payroll adjustments.

Deel offers 10+ payment options for clients, ranging from bank transfers to cryptocurrency pay-ins. You can schedule payments in advance and run off-cycle payroll runs whenever needed.

For employees and contractors on Deel, they can self-manage their pay and personal data and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals.

Deel Features and Integrations:

Key features, in addition to their global payroll service run by local experts, include several new offerings that Deel's launched over the past year, including global mobility support, integrated Slack tools, and advanced integrations. Their global mobility service helps companies with visa sponsorship, allowing them to bring in candidates from abroad.

Deel is one of the largest international payroll solutions listed here, with the company reporting over 100,000 active worker contracts. They offer 24/7 online support and dedicated account managers for specific requests.

Integrations are available with Ashby, BambooHR, Expensify, Greenhouse, Hibon, NetSuite, Okta, OneLogin, Quickbooks, Xero, Workday, and Workable. They also have an Open API to support additional custom integrations too.

Pricing for Deel is available upon request and is a flat rate. You can also request a free demo through their website.

New Product Updates from Deel

500+ New Platform Enhancements for Global Hiring and Payroll

Deel announced over 500 platform enhancements focusing on global hiring, HR, payroll, and AI-driven compliance, featuring tools for faster hiring, smarter HR management, strategic planning, and enhanced payroll flexibility. For more details, visit the source: Deel Blog.

G-P is a global employment platform that helps businesses hire, manage, and pay international teams without setting up local entities. It offers tools to handle payroll, compliance, and HR tasks across 180+ countries. With G-P, companies can expand their workforce globally while ensuring local legal and tax compliance.

Why I picked G-P: G-P stands out for its ability to process payments to employees and contractors in over 180 countries, accommodating various currencies and preferred payment methods. This flexibility ensures that your team members receive payments in a manner that suits them best, whether through digital wallets, ACH, bank transfers, wire transfers, or virtual cards. Additionally, G-P's platform supports batch payments for multiple invoices, even in different currencies.

Another key feature is G-P's commitment to compliance. The platform offers tools to navigate complex international payroll regulations, including tax laws and worker classification rules. Their Global Payroll Compliance Checklist provides guidelines to implement a compliant global payroll system and highlights key information on global data protection regulations.

The platform even offers G-P Gia™, an AI-driven tool that provides HR compliance guidance, helping you make informed decisions and reduce operational costs.

G-P Features and Integrations:

Key features include equity payroll management, which allows you to offer equity-based compensation in supported countries while ensuring compliance with local labor laws. The platform also provides ongoing HR support, assisting with payroll, benefits, PTO, and expenses, and keeping you informed about changes in regulations.

Additionally, G-P's Employment Contract Generator enables you to create compliant employment contracts quickly, reducing the time to hire and ensuring adherence to local legal requirements.

Integrations include BambooHR, Personio, TriNet, UKG Pro, UKG Ready, Workday, SAP SuccessFactors, ADP, HiBob, and Sage Intacct.

Pricing for G-P is available upon request and depends on your specific needs.

RemoFirst is an international payroll service provider on a mission to free employers from geographical boundaries so they can access global talent with ease.

Why I picked RemoFirst: Their global payroll platform simplifies the international payroll process, paying your distributed employees in their own local currency, while giving you the option to summarize and aggregate your invoices into one payment, rather than making multiple individual payments.

RemoFirst’s software can also automatically calculate your team’s hours, time off, holidays, bonuses, and commissions so you don’t have to worry about it, especially if you are budget-conscious. Instead, you only need to review their monthly invoice and approve it for payment.

Their team of legal experts and HR professionals will also ensure your international payroll operations are always compliant with changing global regulations in all 170+ countries they operate in. To put your mind at ease, your compliance documentation is also accessible at all times through your secure dashboard.

Their customer support team is also always reachable 24/7 in case you need extra help. All clients also receive a dedicated account manager as their main point of contact too.

RemoFirst Features and Integrations:

Key features, in addition to their global payroll services, include global benefits management (including insurance and equity plans, plus time-off management), and employer of record (EOR) services, plus employee support for obtaining visas and other immigration documentation.

In addition, they can also help you with provisioning equipment to your distributed employees around the world.

Integrations include ADP.

Pricing for RemoFirst’s global payroll services cost from $199/employee/month. They also offer a $25/month plan if you only need to pay global contractors. Their services come with no hidden fees or fixed contract terms.

Remote helps companies of any size hire, pay, and manage full-time, part-time, or contract workers all around the world.

Why I picked Remote: They offer global payroll services, as well as assistance with benefits administration, taxes, compliance, and employer of record (EOR) services in over 50 countries.

In addition, Remote’s equity experts can also help you develop an incentive plan and strategy to offer stock options to your international team, with them taking the lead on all the requisite tax withholding and reporting requirements.

Remote Features and Integrations:

Key features include multi-country payroll processing that simplifies the payroll process and ensures compliance and accuracy in payroll management.

Remote also supports hiring in 85+ countries with their EOR product, and contractor management across 180+ countries, with new regions added constantly. Because of Remote’s 100% owned-entity model, you have access to local legal and HR experts for additional hiring and compliance guidance.

Integrations are available with 25+ software applications including Workday, BambooHR, Easop, Greenhouse, Gusto, Hibob, Personio, Sequoia, Slack, Xero, Zelt, and other systems.

They also have an Open API to support additional custom integrations, and companies can seamlessly connect Remote with over 5,000 external apps via the Zapier integration.

Pricing starts at EOR from $599/employee/month or $29/contractor/month, and they offer a 30-day free trial + a free plan is available.

Multiplier is a global payroll solution that provides HR and online payroll services to businesses, especially those who are entering new geographic locations or employing workers in different countries. Their unified platform helps businesses to manage their global payroll and HR operations, ensuring consistency and efficiency.

Why I picked Multiplier: Multiplier handles global payroll by partnering with local payroll providers and tax experts in the countries where its clients have employees; this enables Multiplier to provide accurate and compliant payroll processing services while ensuring that all relevant local taxes and contributions are paid on behalf of the employees.

Multiplier excels in providing a comprehensive and technology-driven solution for businesses managing global payroll and HR operations. The platform offers a user-friendly interface and integrates with other HR tools, making it easy for businesses to manage their payroll, benefits, and compliance in multiple countries.

Multiplier's team of experts also provides ongoing support and guidance, ensuring that businesses are always up-to-date with the latest laws and regulations.

Multiplier Features and Integrations:

Key features and services include payroll processing, tax compliance, benefits administration, and worker's compensation. Multiplier’s global payment system supports payments in 120+ currencies.

Integration details are not currently available.

Pricing for Multiplier's global payroll service starts at $20/employee/month or $40/contractor/month. You can also request a free demo of their platform through their website.

Lano is a global payroll and employment platform designed to help businesses manage and pay their international teams. With services spanning over 170 countries, Lano enables companies to hire, onboard, and compensate employees and contractors worldwide while ensuring compliance with local regulations.

Why I picked Lano: One reason I like Lano is its ability to centralize payroll operations across multiple countries—something especially important for complex enterprise payroll setups. Their platform lets you unify employee and salary data from various entities into a single system, giving you a clearer view of your global workforce costs.

This consolidation helps reduce administrative overhead and lowers the risk of errors that come with juggling multiple payroll systems across regions. For enterprises with layered structures and diverse teams, this level of control and consistency is key to keeping payroll accurate and manageable.

Additionally, Lano connects you to a network of vetted local payroll partners in over 170 countries. This setup helps ensure your payroll processes remain compliant with local laws, even as your operations grow and become more geographically spread out.

Lano Features and Integrations:

Features include customizable payroll reporting, allowing you to generate detailed reports tailored to your business needs, giving you insights into payroll costs and trends across your global workforce. Lano also offers automated data validation tools that reduce errors by flagging inconsistencies before payroll is processed.

In addition, Lano’s compliance management feature keeps track of changing local laws and regulations.

Integrations include HiBob, Lucca, Workday, Personio, Sage, and Zoho People.

HSP Group is a global payroll and expansion services provider that helps you run payroll in over 100 countries—without juggling multiple vendors or losing visibility into compliance. Their proprietary GateWay platform acts as your command center, giving you one place to manage global pay runs, monitor legal obligations, and track payroll accuracy across regions.

Why I picked HSP Group: HSP stood out for how they combine global payroll delivery with in-country compliance expertise. When you're paying people across jurisdictions, the challenge isn’t just making the payment—it’s getting tax filings, deadlines, and contracts right. HSP’s model gives you a single point of contact plus on-the-ground specialists who ensure each market stays compliant and audit-ready.

I also liked that HSP goes beyond payroll. Their support spans entity setup, accounting, tax, and HR governance—so if you're scaling into new regions or shifting from an EoR to your own local entity, you don’t have to restart with new partners.

HSP Group Features and Integrations:

The GateWay platform offers built-in compliance tracking, automated document management, and centralized calendar views for key payroll events across countries. This gives you visibility into what’s due where, and when—helping you catch issues early.

You also get access to global payroll project consulting, technical tax advisory, and relocation support, all led by internal teams rather than outsourced partners. Integrations cover key operational areas, including Employer of Record (EoR), HR administration, entity management, accounting, and technical consulting.

Atlas is a global payroll solution that enables innovative companies to compete in a global economy so that businesses can employ whomever they want, wherever the talent exists.

Why I picked Atlas: As the largest direct employer of record (EOR), Atlas is a technology platform that is supported by HR experts and delivers flexibility for companies to expand across borders, onboard talent, manage compliance, and pay their global workforce without the need for a local entity or multiple third-party providers.

With entities in over 160 countries, Atlas brings localized experience and expertise into an enterprise-grade technology platform that supports thousands of companies and remote teams.

The Atlas platform is uniquely designed to deliver end-to-end EOR solutions and empowered user experiences that provide self-service capabilities and real-time insights.

Atlas Features and Integrations:

Features include global payroll, country-specific business expense guidance tools, data dashboards, fast onboarding, compliant contracts, global expansion tools, compliance monitoring, and EOR services.

Integration details are not currently available.

Pricing for Atlas starts at $49/month for their contractor management service, or at $595/employee/month for their EOR and global payroll package. You can also request a free demo through their website.

Native Teams is a global payroll and employment platform that helps businesses manage international teams without setting up local entities. It supports payroll operations in over 85 countries, offering tools for compliant employment, contractor payments, tax support, and localized benefits—all through a centralized dashboard.

Why I picked Native Teams: Native Teams combines essential global payroll capabilities with an employee-first support model. It automates compliant contract creation, ensures accurate local tax handling, and provides full transparency for both employers and employees. I found its gig payment features especially useful for companies managing flexible or freelance talent across borders, with bulk uploads and fast payouts built in.

The platform focuses heavily on compliance and cost-efficiency, offering country-specific benefits and expense tools while keeping pricing clear and scalable. Native Teams may not have a wide integration network, but its hands-on support—ranging from onboarding assistance to local account managers—can make it easier for lean HR teams to stay compliant and in control.

Native Teams Features and Integrations:

Key features include payroll in local currencies, compliant contract generation, bulk payments for gig workers, automated tax and social contribution handling, and detailed payslips for employees. Expense and benefits management are also included, along with employee support services.

Integration details are not currently available.

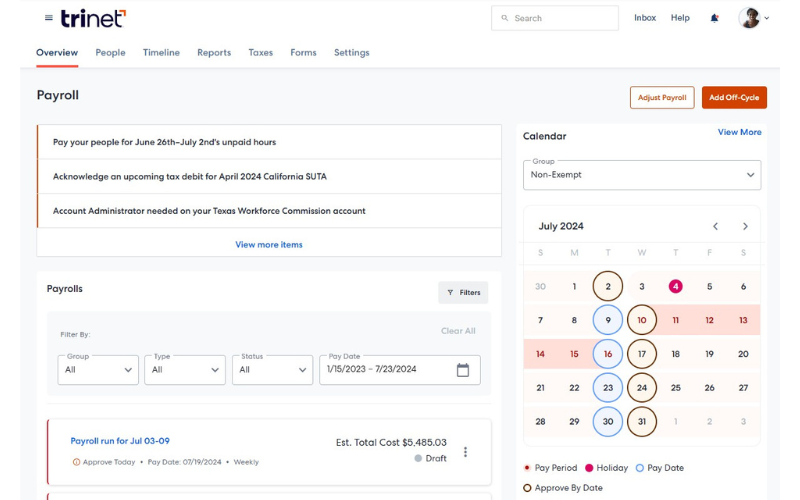

TriNet is a technology platform that provides HR services and global payroll services. It aims to help businesses manage their HR processes, employee benefits, and compliance requirements.

TriNet is best suited for businesses that operate on a global scale and need help managing their HR processes and payroll.

Why I picked TriNet: I picked TriNet as one of the best global payroll services because of its advanced features that cater to the specific needs of global businesses. Its integrated payroll system is designed to handle complex payroll regulations in various countries, making it an excellent choice for businesses that operate in multiple locations.

Another feature that makes TriNet stand out is its HR management system. It offers a centralized platform for managing HR tasks such as employee onboarding, time tracking, and benefits administration. This feature can help businesses streamline their HR processes and improve employee engagement.

TriNet Features and Integrations:

Key features include an employee perks program, global payroll solution, compliance with local tax laws and regulations, vendor perks and deals, payroll management system, custom rewards, a variety of payment options, and recognition programs.

Integrations include QuickBooks, Oracle NetSuite, Sage Intacct, BambooHR, Lattice, Greenhouse Software, Carta, and Xero.

Pricing is available upon request and a free demo is available.

Other Global Payroll Service Providers

Here are a few more global payroll providers that didn’t make the best international payroll services list but are still worthy of consideration:

-

ADP GlobalView Payroll

For scalable payroll

-

Worksome

For compliant freelancer payments

-

Omnipresent

For dedicated global payroll expertise

-

Pilot

For additional EOR services

-

Horizons

For in-country expertise

-

Skuad

For assistance with work permits

-

Rippling

For unified local and global payroll

-

Mercans

For HR outsourcing

-

Paylocity

For global payroll integration

-

Velocity Global

For supporting global expansion

-

QuickBooks Payroll

For small business payroll needs

-

Papaya Global

For AI-backed compliance verification

-

Oyster HR

For centralized multi-country payroll

-

Transformify

Add-on to an HRMS solution

-

Agile Hero

For global mobility support

-

Worksuite

For global contractor management

-

GoGlobal

For fast customer service, including 24-hour quotes

-

Blue Marble Global Payroll

For treasury management & HR outsourcing

-

IRIS FMP

For support with international employee benefits & compensation

-

Alight

For earned wage access (pay-on-demand)

Suggested HR Software to Support your Global Team

Your global payroll system is only as good as the tools it talks to. When it connects with your HRIS, ATS, and time tracking software, you cut down on errors, stay ahead of compliance issues, and keep every region in sync. These curated software picks help you build a unified system that scales with your team—no spreadsheets, no silos.

- Best HRIS

- Best HCM

- Best Attendance Tracking Software

- Best Expense Management Software

- Best Benefits Administration Platforms

- Best Applicant Tracking Systems

Don’t just think about what you need today—look ahead and make sure the system can handle more employees, more complex workflows, and additional integrations as your company grows.

Evaluation Criteria

| Criteria | Evaluation Focus | Weighting |

|---|---|---|

| Core Global Payroll Services | I looked for providers that handle multi-country, multi-currency payroll in a single run, support all worker types, and give employees self-serve access to their pay info. Bonus points if they nailed compliance, secured cross-border data, offered useful reporting, and plugged into HR and finance systems without much fuss. | 25% |

| Additional Standout Services | Looked for platforms that go beyond the basics—offering built-in analytics, contractor-friendly workflows, localized benefits, and plug-and-play integrations. Bonus points for tackling complex, cross-border edge cases without friction. | 25% |

| Industry Experience | Prioritized providers with a proven track record in global payroll—deep country coverage, long tenure in the space, and demonstrated credibility through client logos, awards, or seasoned payroll professionals on staff. | 10% |

| Customer Onboarding | Looked for clear implementation timelines, dedicated onboarding support, and plug-and-play integrations that reduce lift on internal teams. Bonus points for thorough documentation and onboarding resources that don’t require a degree in payroll to understand. | 10% |

| Customer Support | Strong support isn’t optional when payroll spans time zones and tax codes. I looked for 24/7 service, multilingual teams, and multiple contact channels—plus proof they actually solve problems fast. Reliable support keeps compliance tight and teams paid on time. | 10% |

| Value for Price | Cost alone isn’t the point—value is. I compared pricing transparency, flexibility across business sizes, and whether the features delivered justify the spend. Bonus points for providers that skip hidden fees and offer scalable packages that grow with you. | 10% |

| Customer Reviews | Analyzed customer feedback across platforms to surface common themes—reliability, responsiveness, ease of use, and how well the provider handled global complexity. I gave extra weight to reviews from teams managing multi-country payroll. | 10% |

Bottom line:

This framework shaped how I evaluated each global payroll provider—focusing not just on features, but on the real-world support, flexibility, and compliance infrastructure businesses need to operate internationally. It helped me surface vendors that don’t just promise global payroll—they actually deliver it, at scale, with clarity and confidence.

How to Choose a Global Payroll Provider

| Factor | What to consider |

|---|---|

| Legal Infrastructure & EOR Support | Does the provider act as an Employer of Record (EOR) with legal entities in the countries you’re expanding into? This matters because hiring employees without a local entity can expose your business to misclassification risk, fines, or retroactive taxes. A compliant EOR absorbs this liability and ensures employment contracts, benefits, and tax withholdings are handled in accordance with local labor laws. Ask whether the provider owns its entities or works through partners—it affects control, speed, and legal accountability. |

| Contractor Support | Can the platform support both employees and independent contractors under one system? With the gig economy on the rise, misclassifying workers can result in major legal and tax penalties. A good provider will offer tailored onboarding, contract creation, invoicing, and local compliance checks for freelancers—especially in high-risk jurisdictions. |

| Ease of Implementation & Integration | Can you go live without months of back-and-forth? Ask about average onboarding timelines, integration options (e.g., HRIS, HCM, ERP), and migration support. Seamless setup isn’t just about convenience—it prevents delays in payroll runs and avoids compliance gaps during transition periods. Bonus: check for pre-built integrations with tools you already use. |

| Regulatory Compliance | Does the provider offer proactive compliance support across labor, tax, and social security regulations? Compliance is non-negotiable and failure comes with financial and reputational damage. Your provider should stay current with regulatory changes, offer in-market expertise, and prevent common risks like double taxation, misclassification, and improper benefits enrolment. |

| Data Protection & Privacy | Payroll involves sensitive PII and financial data. Ask about their security posture: Do they offer end-to-end encryption? Are they GDPR and SOC 2 compliant? Who owns the data, and where is it stored? International data transfers often invoke strict rules (e.g. Schrems II, local data residency laws). Choose vendors with robust audit trails and transparent data governance policies. |

| Support Model & Responsiveness | Can you reach a real human when it matters? Global payroll is high-stakes—delays or errors in pay can damage trust and morale. Look for vendors that offer 24/7 multilingual support, country-specific account managers, and clear escalation paths. Bonus if they offer employee self-service portals to offload admin from your HR team. |

| Global Payment Capabilities | How does the provider handle cross-border transactions? Avoid providers who rely solely on SWIFT or manual processes—these introduce delays, fees, and FX volatility. Look for local payment rails, real-time FX locks, and support for multiple currencies and wallets. This directly affects employee satisfaction, especially in emerging markets where pay timeliness and method matter. |

Compliance is a huge factor. The system should help you stay on top of changing regulations, especially if you’re managing employees across different states or countries.

Trends in International Payroll Software

The international payroll market’s evolving fast—but certain trends consistently show up in the tools that get it right. These are the features making global teams faster, safer, and a whole lot easier to scale.

Smarter Payroll Automation with AI

Modern payroll platforms use AI to streamline complex processes—calculating salaries, applying tax rules, converting currencies, and flagging potential compliance issues automatically.

Why it matters: You get fewer manual steps, fewer errors, and a faster, more reliable payroll cycle across every country you operate in—freeing up your team to focus on scaling, not spreadsheet firefighting.

End-to-End Integration with HR and Time Tools

Today’s global payroll tools don’t work in isolation—they connect with your HRIS, time tracking, and finance systems to create one continuous workflow.

Why it matters: Cleaner data, fewer admin tasks, and faster insights. This gives your HR and finance teams real-time visibility into costs, compliance, and headcount—so you can make smarter decisions, faster.

Tighter Data Security & Privacy Controls

Leading platforms are prioritizing security—rolling out stronger encryption, granular access controls, and built-in compliance with global privacy laws like GDPR.

Why it matters: You protect sensitive employee data across borders while staying compliant with evolving privacy regulations. That builds trust internally and shields your business from serious risk.

What is a Multi-Country Payroll Solution?

A multi-country payroll solution is a centralized platform that lets you pay employees and contractors in multiple countries through one system—handling salary calculations, tax withholdings, local currency payments, and compliance with labor laws in each jurisdiction.

These solutions reduce the need for separate vendors or country-specific processes by offering unified workflows, integrated reporting, and automation across borders. Some providers offer software only; others provide fully managed payroll or Employer of Record (EOR) services.

The goal is simple: reduce legal risk, cut administrative overhead, and make it easier to scale global teams without payroll chaos.

Then, what's local payroll?

Local payroll refers to the process of managing employee compensation, tax withholding, and statutory contributions within a single country.

It’s typically handled in-house or through a domestic payroll provider that’s set up to navigate only one set of labor laws, currencies, and compliance requirements. While this works well for companies with a single-country footprint, it doesn’t scale when you hire across borders or need to unify payroll reporting across regions.

Global Payroll vs EOR vs PEO: What’s the Difference?

These terms get tossed around a lot in international HR conversations—but they serve very different purposes.

- Global payroll handles the logistics—paying people across countries, calculating taxes, converting currencies, staying compliant. But it assumes you already have legal entities wherever you’re hiring.

- EOR (Employer of Record) goes further. It becomes the legal employer for your hires in countries where you don’t have an entity. That means you can get up and running fast, without setting up a local company.

- PEO (Professional Employer Organization) is more local. It’s a co-employment model, usually in the U.S., where you and the PEO share employer responsibilities. You run the business; they handle the back-office HR.

The right choice depends on your setup. Going global without a legal entity? EOR. Already registered and just need payroll? Global payroll. Managing U.S. teams? A PEO might be the way to go.

For global payroll, about 30-40% of the data fields are country-specific, but the rest is the same. You need to understand what each country needs before you hire.

9 Key Features to Look for in International Payroll Platforms

Most global payroll providers promise the basics. But when you’re managing employees or contractors across borders, it’s the details—like how they handle local tax filings or contractor onboarding—that make or break the experience. These are the features worth zeroing in on.

1. Multi-Country Payroll Administration

I know this seems obvious, but look for automated payroll workflows that support multiple countries and currencies in a single run. The best providers handle everything—from salary calculations and currency conversions to tax deductions—so you’re not juggling spreadsheets.

Add mobile access into the mix, and your team can manage payroll approvals or view key reports on the go—keeping things accurate, fast, and responsive no matter where you’re working from.

2. Payroll Reconciliation & Auditing

Don’t assume accuracy—verify it. The right provider will automatically reconcile payroll each cycle and run regular audits behind the scenes.

This ensures every payment aligns with your records, catches issues before they snowball, and keeps you compliant with international financial and tax standards. It’s how you stay audit-ready without adding admin overhead.

3. Local Compliance & Mobility Support

If you’re hiring talent in countries where you don’t have a legal presence, immigration becomes a major hurdle.

Some global payroll partners offer visa sponsorship and mobility services as part of their package. That means faster employee relocation, fewer third-party vendors to manage, and less red tape blocking your growth plans.

The complexity isn’t in the payroll calculations themselves, but in staying compliant with each country’s regulations. You have to be sure your system separates the data from the rules, especially when tax and social security rates change across borders.

4. Real-time Global Reporting

Get a live view of payroll spend across markets. Whether you’re comparing costs between LATAM and APAC or reviewing a specific department’s monthly burn, centralized dashboards let you surface spend anomalies, model future growth, and make smarter hiring and offboarding decisions—all from one place.

5. Tax Witholding & Filing

A strong provider should automatically handle country-specific tax calculations, withholdings, and filings for both employees and contractors. That includes things like income tax, social security contributions, and local levies.

Beyond accuracy, the real win is risk reduction. Offloading these responsibilities to a compliant provider helps you avoid penalties, late fees, or regulatory headaches—especially in countries where the rules change frequently.

Look for providers that support:

- Automated real-time tax updates

- Multi-country filings (not just calculations)

- Local tax document generation for employees

- Integration with your accounting and finance systems

If your provider can’t handle cross-border tax complexity confidently, they’re not truly global.

6. Employee Self-Service Portals

Let employees access payslips, tax documents, and personal details on their own—anytime, anywhere. A good self-service portal reduces HR admin load, improves transparency, and gives your global team the autonomy they expect.

7. Contractor & Worker Classification Support

If you’re hiring globally, chances are you’re working with a mix of contractors and employees. Look for providers that help you classify talent correctly across jurisdictions—and support onboarding, payments, and documentation for both groups.

8. Software Integrations

Global payroll doesn’t operate in a vacuum. Choose providers that integrate cleanly with your HRIS, HCM, and accounting platforms (like Workday, BambooHR, or Deel). This keeps data synced and cuts down on manual entry—and the errors that come with it.

9. Data Security & Privacy Compliance

You’re dealing with sensitive personal and financial data. Your provider should offer bank-grade encryption, strict access controls, and be certified against standards like SOC 2, ISO 27001, or GDPR.

When it comes to employee data, peace of mind comes from knowing your systems are built to protect it.

Benefits of Multi-Country Payroll Services

Simplified Compliance: Navigating international tax laws and labor regulations is no small feat. A global payroll service helps you stay ahead of changing requirements, reducing legal exposure and administrative headaches.

Top-tier providers update their systems in near real time to reflect regulatory changes—like mandatory pension contributions in the UK or 13th-month pay rules in the Philippines—so you stay compliant automatically.

Cost Savings: Automated workflows, consolidated data, and fewer manual errors drive down your payroll overhead. ADP reports that many companies using global payroll services see significant savings compared to managing local providers in each country. Providers that bundle payroll, benefits, and compliance into one system save you from bloated vendor contracts and duplicated workflows

Time Efficiency: Centralized systems reduce the time spent on approvals, manual calculations, and follow-ups. (That gives your team time back to focus on growth—not admin.)

Enhanced Data Visibility & Security: When payroll data lives in one secure system, you gain both clarity and control. Global platforms use robust encryption and access controls to keep sensitive information safe while giving HR and finance teams instant visibility.

Look for providers with ISO 27001 certification and GDPR-compliant architecture—both are non-negotiables for companies processing employee data across borders.

Better Employee Experience: On-time, accurate pay in local currencies builds trust. Global payroll systems also give employees self-serve access to payslips, tax documents, and leave balances—boosting transparency and reducing HR queries. (This kind of self-service is now expected.)

Faster Global Expansion: With built-in infrastructure for hiring and paying in new markets, you can enter countries faster—without waiting to set up legal entities or chase down local providers.

Flexibility & Agility: Global payroll platforms grow with you. Whether you’re entering your second market or your twentieth, the right provider supports new regions, workforce types, and compliance requirements without major rework.

Costs & Pricing Breakdown

Global payroll pricing depends on your team size, where your employees are located, and the level of service your team will need.

- Team Size: More employees = more complexity = higher cost.

- Country Coverage: Countries with strict tax or labor laws often cost more due to added compliance overhead.

- Payroll Frequency: Weekly payroll costs more than monthly due to extra processing cycles.

- System Integration: Need the platform to sync with your existing HR or finance tools? That may require custom work (and increase costs).

- Service Scope: Basic payroll is cheaper than packages that also include HR support, compliance, or EOR services.

- Compliance & Reporting: If you operate in a heavily regulated industry or need detailed reports, expect to pay a premium.

What I've found is that global payroll isn’t one-size-fits-all, and free options are pretty rare. Most providers can offer custom quotes—and typically a free consult or demo—so shop around before committing.

New & Noteworthy Product Updates

This next section tracks recent feature releases, UX improvements, and backend upgrades from the top global payroll providers I’ve evaluated for this list.

I focus on updates that affect compliance handling, cross-border payment workflows, integration capabilities, and admin controls—so you can quickly assess what’s changed, what’s genuinely useful, and how it impacts your payroll stack in real-world scenarios.

2025 Q2: Payroll Software Updates

Deel Update Notes

Deel recently introduced over 70 enhancements focused on improving their payroll and compliance functionalities. These updates collectively streamline HR operations, improve device management, and ensure adherence to compliance standards, thereby enhancing the overall user experience.

Key improvements include a new dashboard that tracks time off and automatically eliminates duplicate employee data, leading to more reliable workforce information and reducing the need for manual corrections. Furthermore, the rollout of pre-built workflow templates and a Quick Mode in the Workflow Builder automates routine tasks, enhancing operational efficiency.

These updates improve data accuracy and increase automated workflows, which collectively contribute to improved decision-making and operational efficiency. By focusing on these areas, Deel empowers organizations to manage their payroll and compliance tasks more effectively, reducing administrative burdens and ensuring compliance with relevant regulations.

Verdict: These changes reduce manual work, cut errors, and help teams stay compliant.

Remote Update Notes

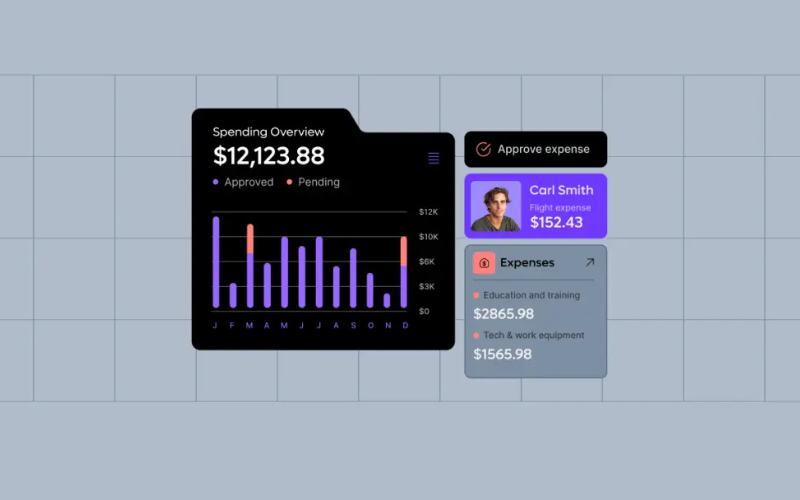

Remote has launched a new manager expense dashboard within its mobile app to simplify company expense tracking. This update aims to solve the common challenge of limited visibility into real-time spending, which often requires manual data collection and analysis.

The dashboard gives managers a centralized view of spending across their teams, including total expenses, average spend per employee, and categorized expense breakdowns. It helps identify budget trends, spot anomalies, and track expenses like travel, software, and office costs—all from a mobile device.

With real-time insights and on-the-go access, managers can make quicker, more informed financial decisions. The update strengthens transparency and improves budget oversight, supporting more efficient and proactive expense management.

Verdict: This new mobile-friendly functionality will improve the ease of expense tracking, particularly for managers who are frequently away from their desks.

Rippling Update Notes

Rippling recently rolled out several product updates, including a new integration with QuotaPath that streamlines commission payments, and expanded global payroll and EOR capabilities.

By connecting QuotaPath’s commission tracking features directly to Rippling, teams can automate commission calculations and payments, eliminate manual data entry, reduce the risk of errors, and ensure accurate, timely compensation for sales employees. This helps businesses manage complex commission structures more efficiently while maintaining data consistency across platforms.

In addition, Rippling has added global payroll and EOR support for 19 new countries, including Belgium, Italy, Norway, and Switzerland, allowing businesses to hire and pay employees compliantly in more regions.

The automation of commission payments helps organizations stay compliant and boosts employee satisfaction through precise and timely payouts. Meanwhile, the ability to onboard and pay employees in 19 additional countries enhances Rippling’s appeal for businesses looking to expand internationally without setting up local entities.

Verdict: These updates help by removing administrative burdens and improving global payroll scalability.

TriNet Update Notes

TriNet recently launched its enhanced HR Plus offering, a more robust Administrative Services Organization (ASO) solution designed for small and medium-sized businesses. This update delivers a combination of advanced technology and expert support to streamline HR, payroll, and benefits administration.

Key additions include a redesigned, more intuitive payroll application, the launch of TriNet Marketplace with pre-integrated business solutions and preferred pricing, and a new Learning Management system featuring AI-powered course recommendations and a library of over 1,000 training modules.

These enhancements provide greater flexibility, efficiency, and scalability for growing businesses. With improved tools for compliance, employee development, and operational management, HR teams can better support their workforce while focusing on strategic growth.

Verdict: These additions to TriNet's software and services will help clients modernize their HR function without much heavy lifting.

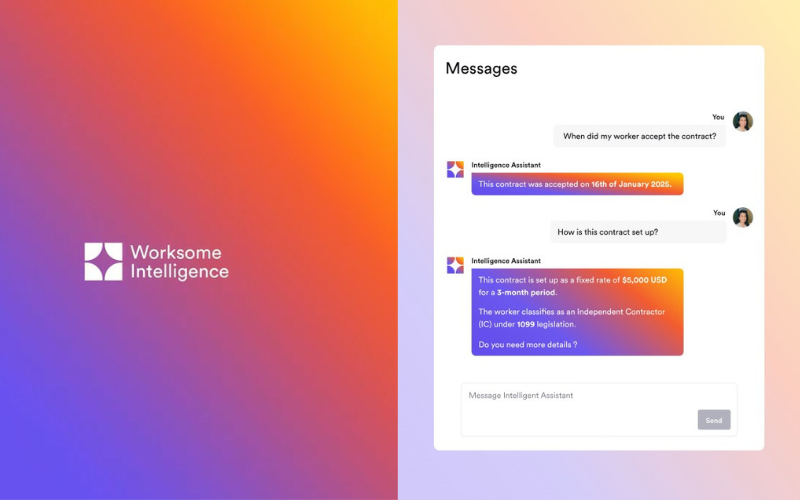

Worksome Update Notes

Worksome has launched Worksome Intelligence, an AI-powered enhancement to its freelance management platform. This update is designed to streamline how companies engage, manage, and pay their freelance workforce, offering smarter tools for a growing segment of the modern workforce.

The new AI features automate key processes like talent matching, onboarding, compliance, and invoicing. Worksome Intelligence provides data-driven recommendations, ensures proper classification, and integrates with existing systems to reduce manual tasks and improve workflow efficiency.

For users, this means faster freelancer onboarding, lower compliance risk, and more strategic workforce planning. By simplifying freelance management, Worksome Intelligence helps businesses scale their contingent workforce with confidence and agility.

Verdict: This new AI-powered software enhancement will reduce compliance risks for client companies while minimizing stress for employees and contractors.

Frequently Asked Questions

Here are clear, expert-backed answers to the most common ones I hear from teams navigating global payroll.

Can I pay employees in a country where I don't have a local entity?

Yes—with an Employer of Record (EOR). EOR providers legally employ your team in that country, run payroll, file taxes, and ensure compliance—so you can operate globally without setting up your own legal presence.

What security measures protect employee payroll data?

Global payroll platforms safeguard sensitive data using encrypted storage, strict access controls, and GDPR-compliant infrastructure. Choose a provider that undergoes regular audits and offers clear documentation on how they handle your data.

How common are global payroll, PEO, and EOR arrangements?

They’re not just common—they’re quickly becoming standard. According to ADP’s 2024 global payroll survey, 69% of businesses are now exploring some form of HR and payroll outsourcing, whether global, regional, or in-country. In the U.S. alone, over 500 PEOs support 208,000 businesses and 4.5 million employees. The EOR market is also gaining serious traction, with forecasts pointing to $9.17B in value by 2033. Bottom line: more companies are choosing these models to scale faster, stay compliant, and avoid the cost and complexity of setting up entities in every country they hire in.

Can I switch between global payroll providers?

Yes—but it takes more than flipping a switch. A successful transition requires clean data migration, reconfiguring your payroll settings, and training your team on the new system. The best global payroll providers offer hands-on onboarding support, including secure data transfers and guided setup to match your requirements.

Many also provide training to get your HR team up to speed fast. This kind of structured migration minimizes payroll disruption, ensures compliance, and helps you hit the ground running with your new provider.

Are there any international payroll solutions for very small businesses or startups?

Yes, there are global payroll solutions designed for very small businesses and startups. These payroll management solutions are tailored to be affordable, scalable, and user-friendly, allowing small teams to manage international payroll efficiently without extensive HR infrastructure.

They often offer features like automated tax compliance, integration with existing accounting software, and support for multiple currencies to simplify payroll processes as businesses grow and enter new markets.

Selecting a payroll company that specifically caters to small businesses can ensure you get the support and flexibility needed at this critical stage.

How do global payroll services handle currency fluctuations?

Global payroll services tackle currency fluctuations by utilizing real-time exchange rate systems and sophisticated software. This approach ensures that employees are paid accurately according to the latest currency values, safeguarding against sudden shifts in exchange rates.

Additionally, these services offer detailed reports and analytics, helping businesses understand the impact of currency fluctuations on their payroll expenses.

How quickly can global payroll be up and running?

Timelines vary, but most businesses can launch in a matter of weeks—not months. Top providers assign a dedicated onboarding lead to walk you through setup, employee enrollment, and compliance requirements from day one.

Next Steps for Scaling Global Payroll

Global payroll doesn’t have to be messy. With the right platform, you can consolidate systems, stay compliant, and give your team a better experience—wherever they are. Audit your current setup, flag your must-haves from the feature checklist above, and push vendors for transparent answers before signing anything.

If staying sharp on global HR trends is your thing, subscribe to the People Managing People newsletter. I’ll keep you up to date with need-to-know updates, tools worth watching, and tactical advice you won’t get anywhere else.