20 Best Payroll Services for Small Businesses Shortlist

Here's my pick of the 20 best software from the 33 tools reviewed.

Navigating payroll can be a headache for small businesses. You juggle compliance, tax deadlines, and employee satisfaction. Payroll services can ease these burdens, helping you focus on what matters most—growing your business.

In my experience, the right payroll software makes a world of difference. I test and review these tools independently to provide you with an unbiased perspective. My goal is to help you find a solution that fits your team’s needs and budget.

In this article, you’ll find a well-researched shortlist of the best payroll services for small businesses. I’ll highlight their unique features and how they can address your specific challenges. Let’s make payroll stress a thing of the past.

Why Trust Our Software Reviews

Best Payroll Service Providers for Small Businesses Summary

This comparison chart summarizes pricing details for my top payroll services for small businesses to help you find the best one for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best global payroll with free HR tools | Free trial + demo available | From $29/month | Website | |

| 2 | Best for continuous payroll accuracy | Free demo available | Pricing upon request | Website | |

| 3 | Best for workflow and payment templates | Free demo available | From $8/user/month (billed annually) | Website | |

| 4 | Best for payroll and benefits administration | 30-day free trial | Pricing upon request | Website | |

| 5 | Best for automating payroll processing | 90-day free trial | Pricing upon request | Website | |

| 6 | Best for real-time payroll insights | Free demo available | Pricing upon request | Website | |

| 7 | Best for global payroll and EOR services | Free demo available | From $25 - $199/user/month | Website | |

| 8 | Best for automated tax filings | 30-day free trial | From $40/month + $6/user/month | Website | |

| 9 | Best for businesses looking for simple features | 30-day free trial | From $2.50/user/month (billed monthly) | Website | |

| 10 | Best for mobile accessibility | Free demo available | Pricing upon request | Website | |

| 11 | Best with a dedicated HR manager | Free demo available | From $99/month | Website | |

| 12 | Best for multi-country payroll compliance | Free demo available | Pricing upon request | Website | |

| 13 | Best for US-based businesses | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 14 | Best for remote access to payroll information | Up to 6 months free | Flat user pricing, upon request | Website | |

| 15 | Best for tax filing automation | Free demo available | Pricing upon request | Website | |

| 16 | Best for personalized payroll administration | Free consultation available | Pricing upon request | Website | |

| 17 | Best for payroll reporting | Free plan available | From $16/user/month | Website | |

| 18 | Best for managing payroll, bonuses, and commissions | Not available | From $8/employee/month + $50/month base fee | Website | |

| 19 | Best for Canadian small businesses | Free demo available | From $44/employee/month | Website | |

| 20 | Best for multi-state tax registration | 14-day free trial | From $3.99/user/month + $19/month base fee | Website |

-

Kudoboard

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Payroll Service for Small Businesses Reviews

Below are my detailed summaries of the best payroll services for small businesses that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you.

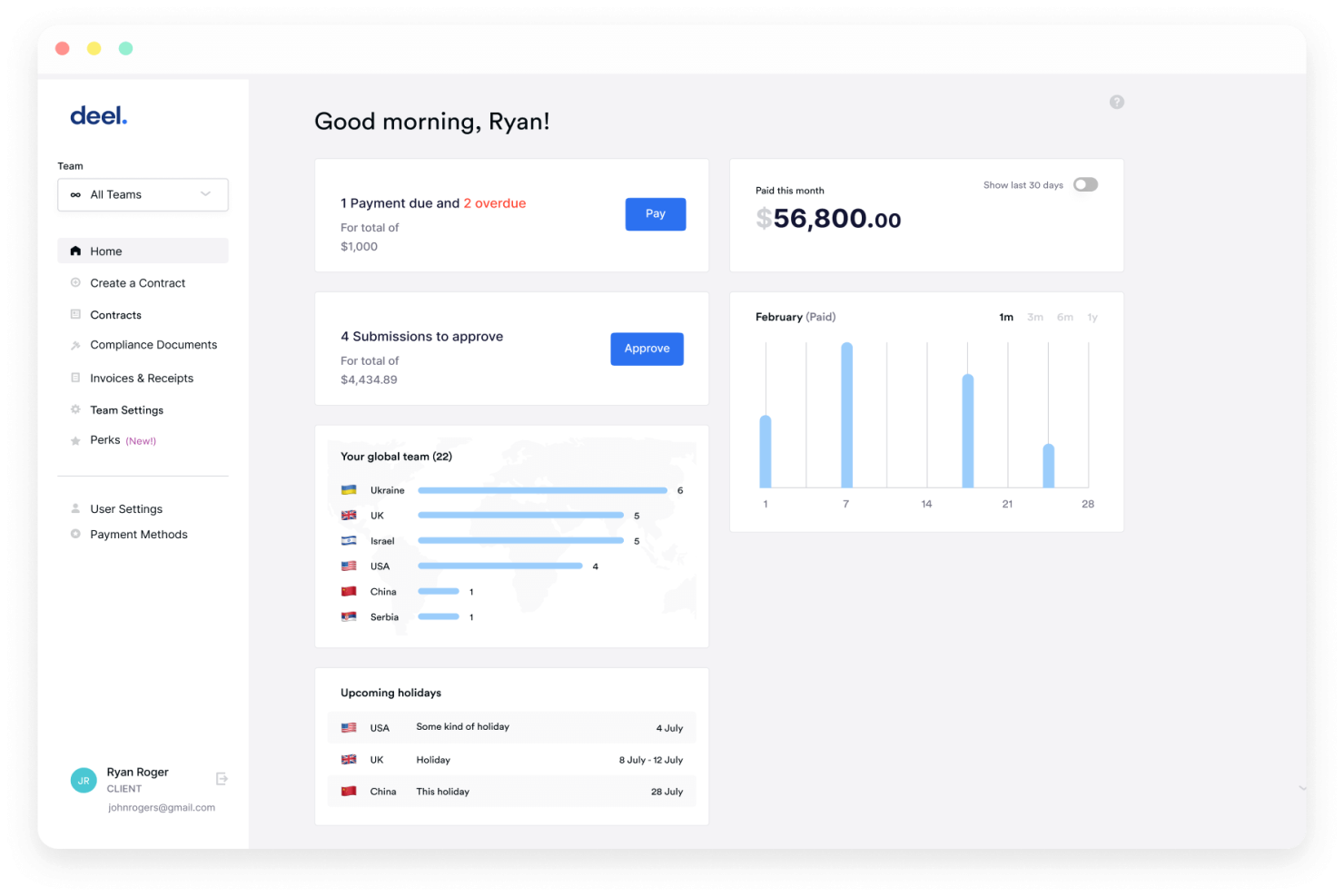

Deel is a global payroll service tailored for businesses operating in multiple countries. It primarily serves international teams, offering payroll management and compliance solutions.

Why I picked Deel: Deel excels in ensuring global compliance, making it ideal for companies with a global presence. It offers automated compliance monitoring and supports multi-currency payments, which help you effortlessly manage international payroll.

The platform’s in-house payroll support and local tax filing capabilities further set it apart. You can rely on Deel for efficient payroll processing across various regions.

Standout features & integrations:

Features include automated compliance monitoring, which helps you adhere to local regulations. Multi-currency payment support allows you to pay your team in their preferred currency. In-house payroll support provides expert assistance for complex payroll scenarios.

Integrations include QuickBooks, Xero, NetSuite, BambooHR, Workday, Gusto, ADP, SAP SuccessFactors, Oracle, and Rippling.

Pros and cons

Pros:

- Automated compliance checks

- In-house payroll support

- Local tax filing capabilities

Cons:

- Requires setup for custom reports

- Limited self-service options

New Product Updates from Deel

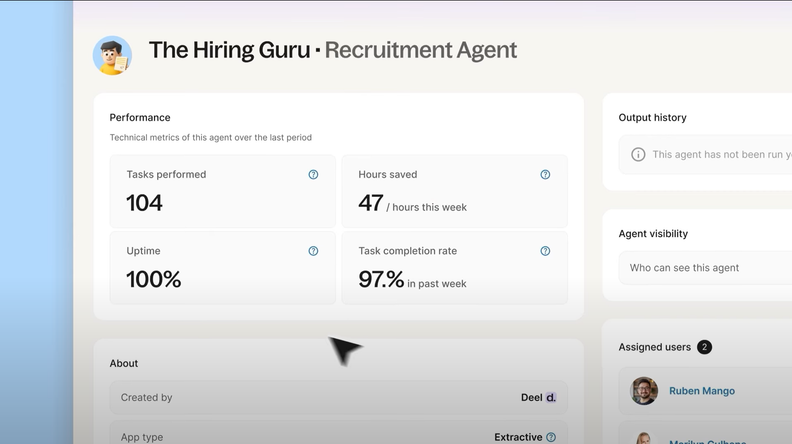

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

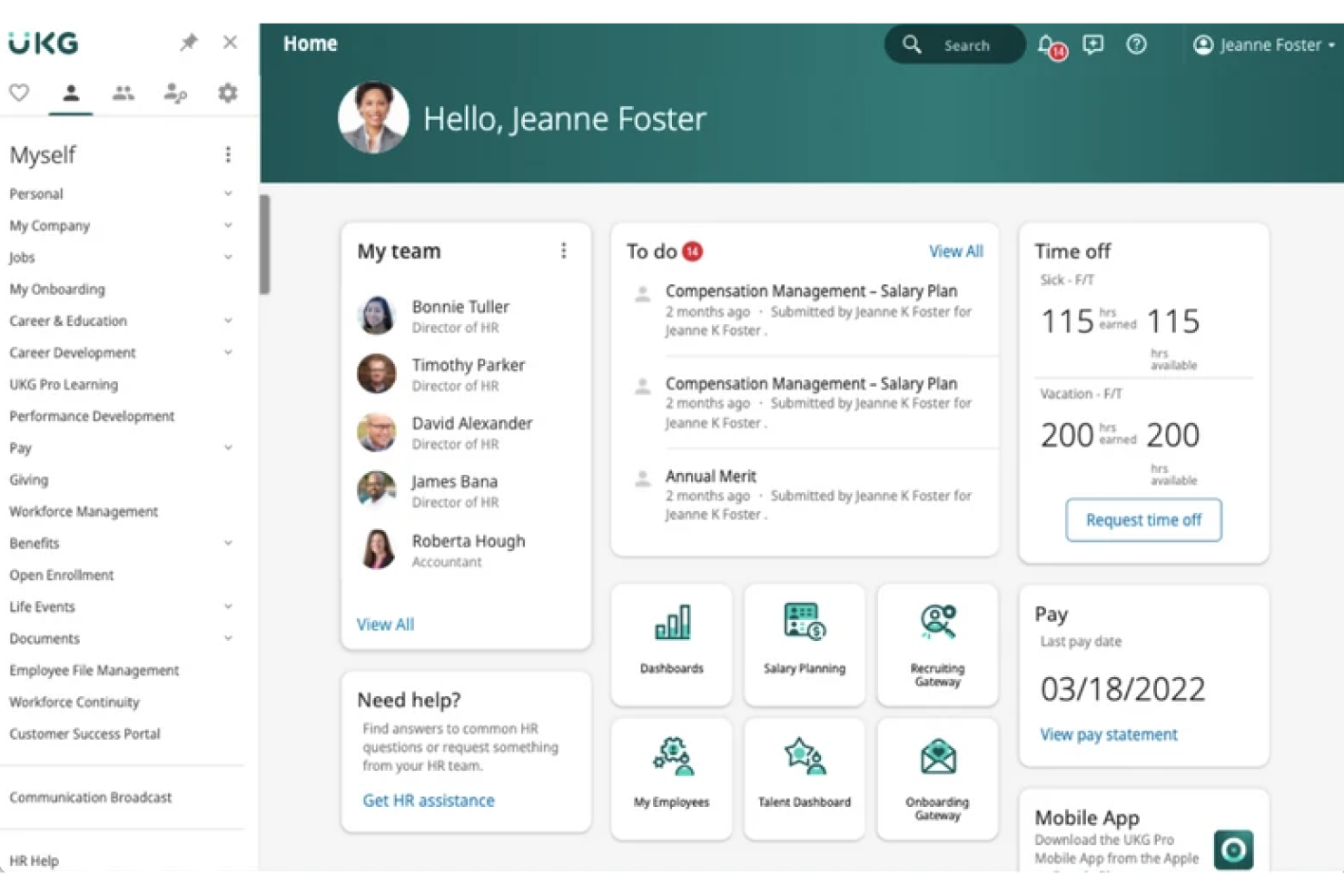

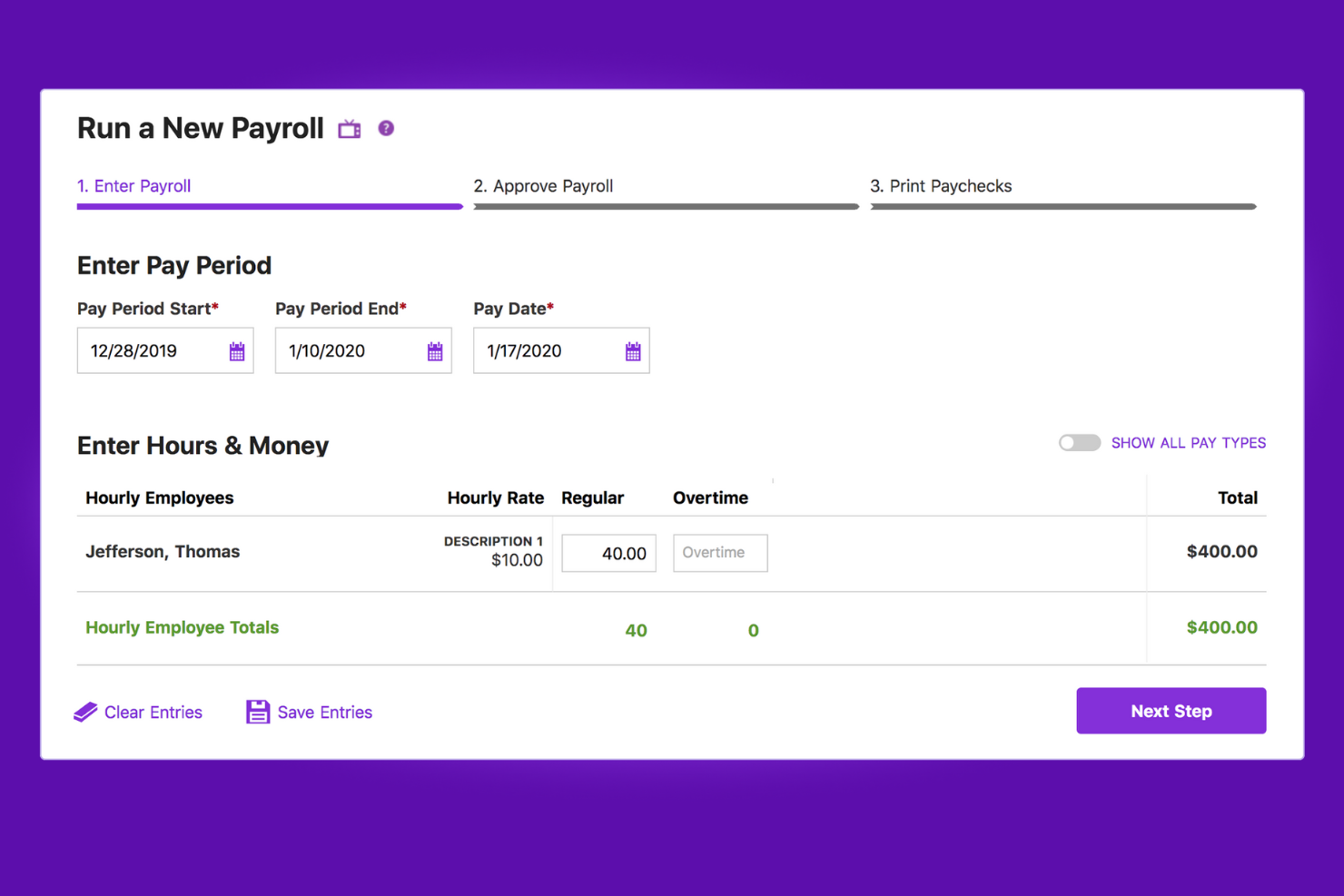

UKG Ready is a workforce management solution designed for businesses that need to handle HR, talent, time, and payroll processes in one place. It's designed for small and mid-sized organizations seeking to automate tasks and manage employees throughout their entire lifecycle.

Why I picked UKG: UKG Ready focuses on maintaining accurate payroll at all times by synchronizing data across time tracking, accruals, and employee profiles in real-time. You can preview payroll before processing, which reduces mistakes and the need for back-and-forth fixes.

The tool also allows your team to make updates at any time without needing to restart a pay run. Its system audits changes automatically, so you can catch issues early and maintain clean data. Everything updates as changes happen, giving you more confidence every pay period.

Features include built-in compliance tools that adjust to changing wage and hour rules. You can set up custom alerts to ensure your team stays on top of deadlines, approvals, and errors. The mobile app supports full self-service, allowing your team to handle time, pay, and scheduling independently.

Integrations include QuickBooks, Sage, ADP, NetSuite, Salesforce, SAP, Oracle, Microsoft Dynamics, Infor, and Workday.

Pros and cons

Pros:

- Mobile app supports full access

- Tracks edits automatically

- Syncs time and payroll in real time

Cons:

- Alerts need careful setup

- Reports feel outdated

Rippling is a versatile HR and payroll platform designed for small to medium-sized businesses. It handles payroll processing, benefits administration, and employee management.

Why I picked Rippling: Rippling offers extensive integration capabilities, allowing businesses to connect various tools and systems. Its automated payroll processing ensures accurate and timely payments.

Rippling's benefits administration tools also help you manage employee benefits efficiently. With its employee management features, you can oversee HR tasks seamlessly.

Standout features & integrations:

Features include automated payroll processing, which ensures accuracy and timeliness in employee payments. The benefits administration feature helps you manage and administer employee benefits effectively. Rippling also offers employee management tools to streamline HR tasks and processes.

Integrations include QuickBooks, Xero, Gusto, BambooHR, Slack, Salesforce, Expensify, Google Workspace, Microsoft 365, and Asana.

Pros and cons

Pros:

- Comprehensive employee management

- Efficient benefits administration

- Extensive integration capabilities

Cons:

- Setup feels tough for complex org charts

- PTO tracking doesn’t sync with pay cycles

New Product Updates from Rippling

Rippling Now Integrates with Points North

Rippling's new integration with Points North automates certified payroll reporting, ensuring compliance with Davis-Bacon and prevailing-wage laws by synchronizing data in real time and reducing manual errors. More details at Rippling Blog.

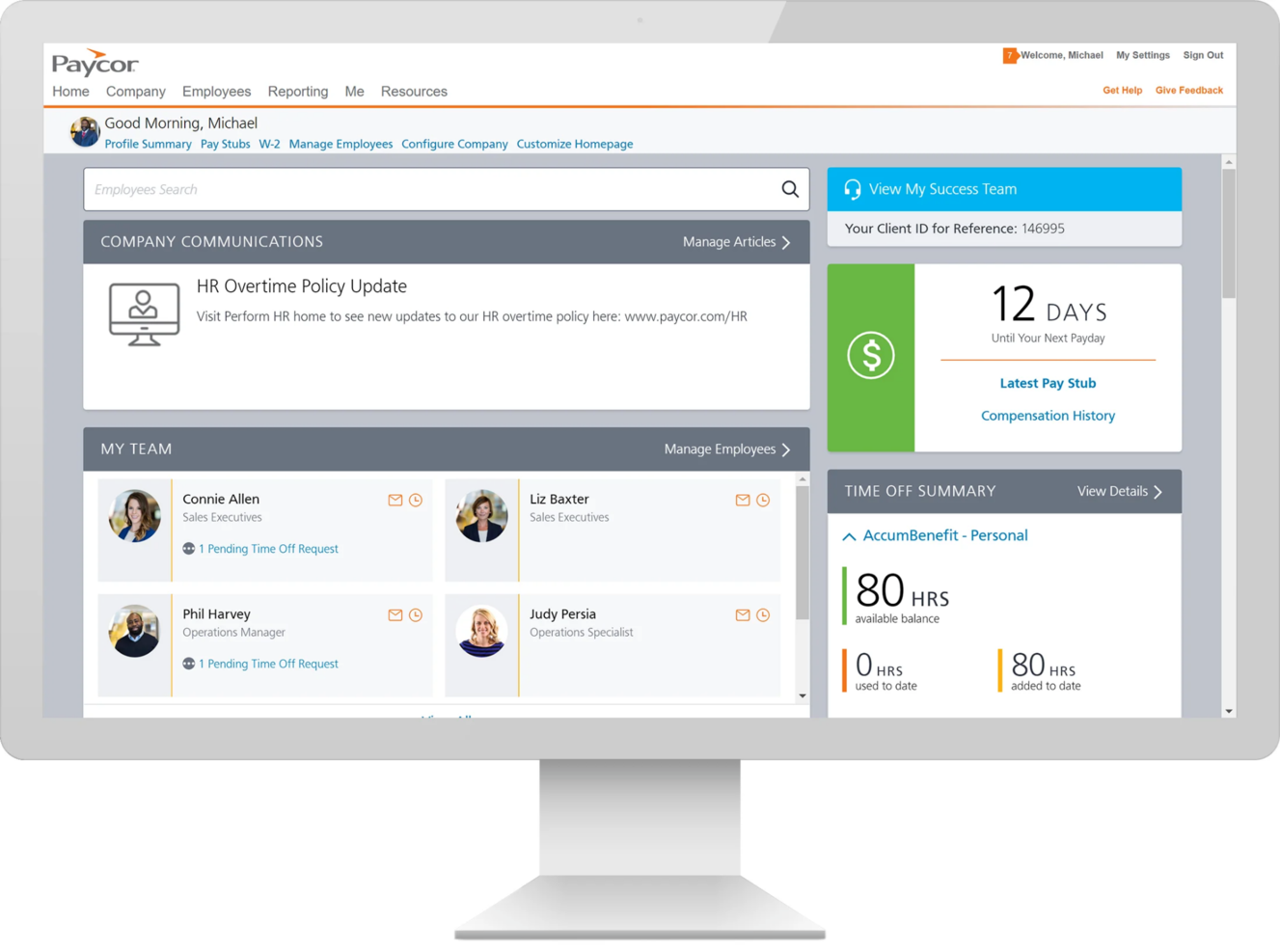

Paycor is a comprehensive HR and payroll platform designed for small to medium-sized businesses. It offers solutions for payroll processing, HR management, and employee benefits.

Why I picked Paycor: Paycor offers a comprehensive HR management solution, making it a strong choice for businesses seeking to integrate their HR functions. With Paycor, you can manage payroll, benefits, and employee records all in one place.

The platform's reporting tools help you gain insights into your HR data. Additionally, its user-friendly interface simplifies everyday HR tasks.

Standout features & integrations:

Features include customizable reporting, allowing you to generate reports tailored to your business needs. The employee self-service portal lets your team access their information and manage benefits. Paycor also offers compliance management tools to help you stay updated with regulations.

Integrations include QuickBooks, Xero, BambooHR, ADP, Salesforce, SAP SuccessFactors, Workday, Oracle, Microsoft Dynamics, and Gusto.

Pros and cons

Pros:

- Scalable for growing businesses

- Employee self-service portal

- Comprehensive HR management

Cons:

- Can be costly for smaller teams

- May need additional setup

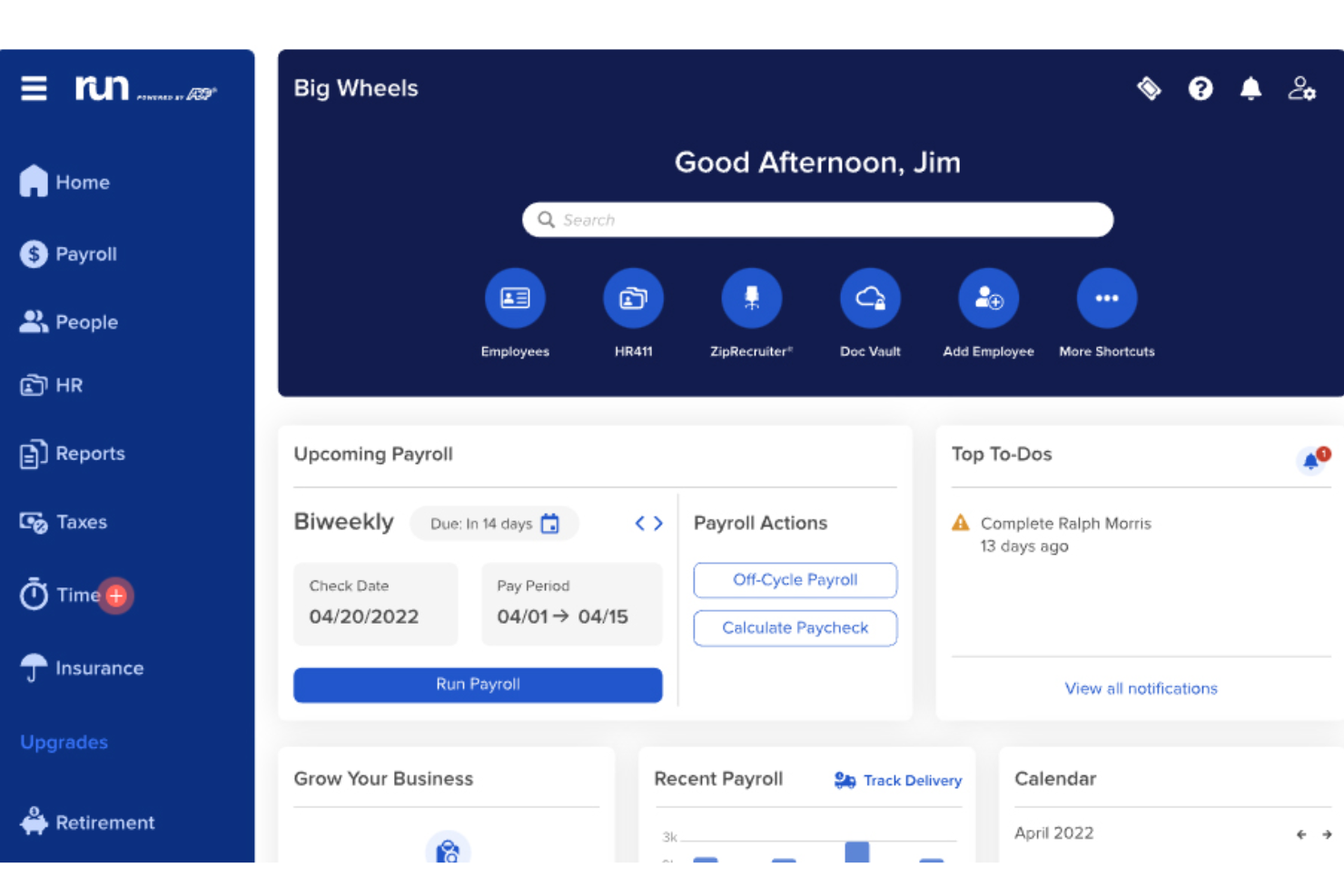

RUN Powered by ADP® is a payroll and HR solution tailored for small businesses. It offers payroll processing, tax filing, and employee management functions.

Why I picked RUN Powered by ADP®: RUN Powered by ADP® provides an accessible solution for small businesses looking to manage payroll efficiently. Its automated tax filing helps you stay compliant with tax regulations.

The platform's employee management tools allow you to track time and attendance. With its user-friendly interface, you can easily navigate payroll tasks.

Standout features & integrations:

Features include automated tax filing, which ensures compliance with tax laws. The time and attendance tracking feature helps you monitor employee hours. RUN Powered by ADP® also provides employee management tools to streamline HR tasks.

Integrations include QuickBooks, Xero, Wave, TSheets, Sage, BambooHR, ZipRecruiter, Slack, Square, and Gusto.

Pros and cons

Pros:

- Efficient time and attendance tracking

- User-friendly interface

- Automated tax filing

Cons:

- Can be complex for beginners

- Requires internet connection

Paylocity is a comprehensive payroll and HR platform designed for small to medium-sized businesses. It manages payroll processing, benefits administration, and employee engagement.

Why I picked Paylocity: Paylocity excels in fostering employee engagement, making it ideal for businesses looking to enhance workplace culture. It offers tools to facilitate communication and collaboration among your team.

The software's payroll processing ensures accuracy and timeliness in payments. With its benefits administration features, you can effectively manage employee benefits.

Standout features & integrations:

Features include communication tools that enhance team collaboration and engagement. The payroll processing feature ensures accurate and timely employee payments. Paylocity also offers benefits administration to help you manage and administer employee benefits efficiently.

Integrations include QuickBooks, Xero, Salesforce, BambooHR, ADP, Workday, Oracle, Microsoft Dynamics, NetSuite, and Gusto.

Pros and cons

Pros:

- Enhances workplace communication

- Accurate payroll processing

- Strong employee engagement tools

Cons:

- Requires internet connection

- Takes time to learn report builder

RemoFirst is a global payroll platform designed to help businesses manage international teams and contractors. It supports payroll processing, compliance, and contractor management in multiple countries.

Why I picked RemoFirst: RemoFirst excels in managing global contractors, making it ideal for businesses that hire internationally. It offers automated payroll processing to ensure timely payments.

The platform’s compliance features help you adhere to local laws and regulations. With its contractor management tools, you can efficiently oversee your global workforce.

Standout features & integrations:

Features include automated payroll processing, ensuring your team receives timely payments. The compliance management feature helps you stay updated with local regulations. RemoFirst also offers contractor management tools, allowing you to handle international hires efficiently.

Integrations include QuickBooks, Xero, BambooHR, Gusto, ADP, Paycor, SAP SuccessFactors, Workday, Oracle, and Rippling.

Pros and cons

Pros:

- Supports multiple countries

- Compliance with local regulations

- Efficient contractor management

Cons:

- Limited advanced reporting options

- May need setup for customization

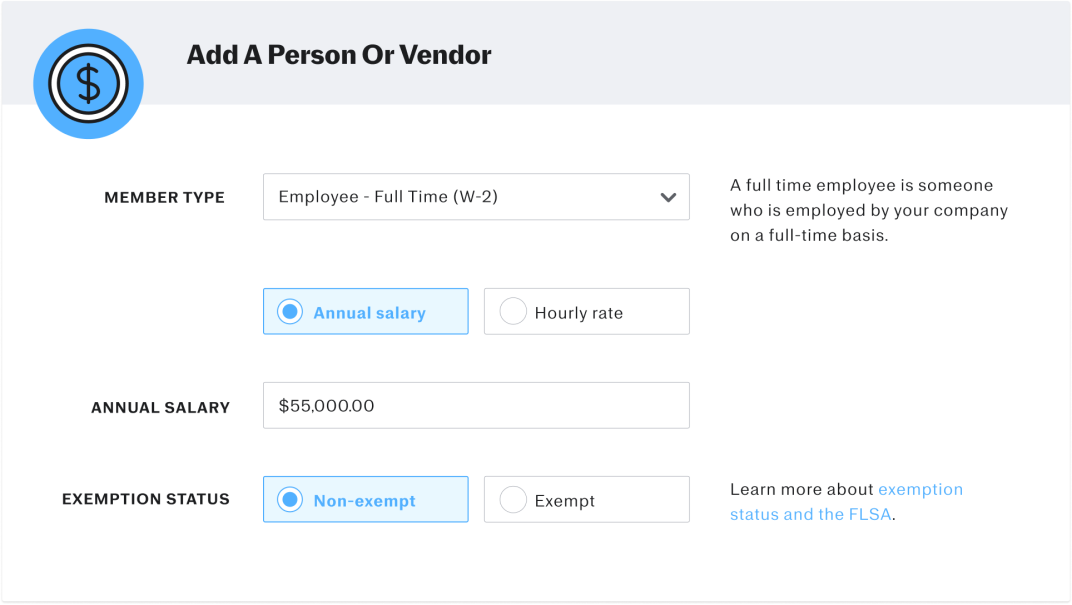

OnPay is a cloud-based payroll and HR solution designed for small businesses. It handles payroll processing, tax filing, and employee benefits management.

Why I picked OnPay: OnPay offers an intuitive interface that simplifies payroll tasks, making it easy for small business owners to manage. It provides automated tax filing to ensure compliance with regulations.

The platform’s employee management tools let you handle benefits and time tracking effortlessly. With OnPay, you can focus on running your business while it handles your payroll.

Standout features & integrations:

Features include automated tax filing, which ensures compliance with tax laws. The employee management feature allows you to manage benefits and track employee time. OnPay also offers customizable payroll reports to help you analyze your business's financial health.

Integrations include QuickBooks, Xero, TSheets, Magnify, Mineral, Vestwell, ThinkHR, Guideline, America’s Best 401k, and Deputy.

Pros and cons

Pros:

- Efficient employee management

- Automated tax filing

- Intuitive user interface

Cons:

- Requires internet connection

- Limited advanced HR features

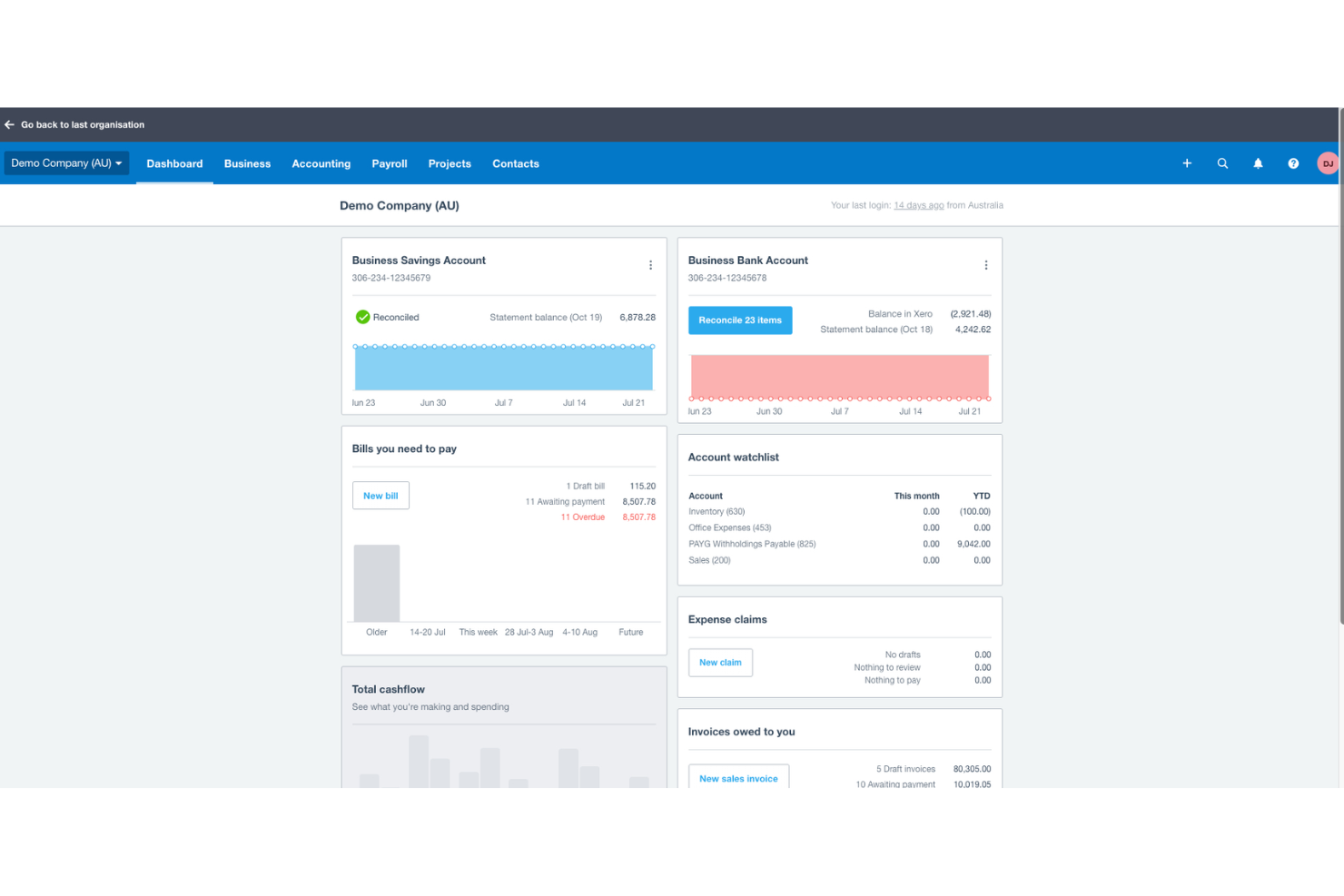

Xero is an online accounting software platform tailored for small businesses. It offers payroll processing, invoicing, and financial management functions.

Why I picked Xero: Xero excels in integrating payroll with accounting, making it a great choice for small businesses. It provides real-time financial reporting to help you make informed decisions.

Xero’s automated payroll feature also ensures timely payments and compliance with tax regulations. With its user-friendly dashboard, you can easily track your business's financial health.

Standout features & integrations:

Features include real-time financial reporting, which provides you with up-to-date insights into your business's performance. The automated payroll feature helps you manage employee payments effortlessly. Xero also offers invoicing capabilities, allowing you to send and track invoices easily.

Integrations include Stripe, PayPal, HubSpot, Square, Shopify, Vend, Deputy, Expensify, Gusto, and Microsoft 365.

Pros and cons

Pros:

- Efficient invoicing capabilities

- Strong accounting integration

- Real-time financial reporting

Cons:

- Updates sometimes break old settings

- Hard to customize for special rules

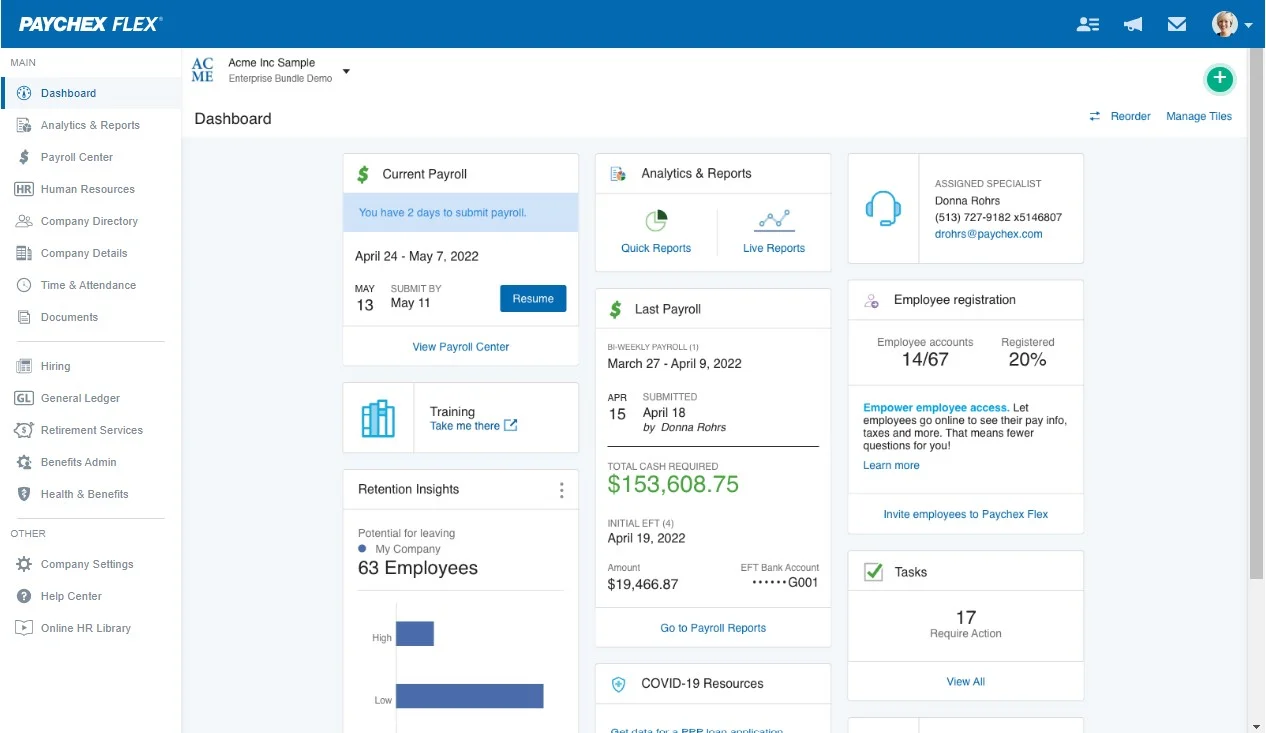

Paychex Flex is a versatile payroll and HR solution designed for small businesses. It offers payroll processing, tax filing, and employee benefits management.

Why I picked Paychex Flex: Paychex Flex offers flexible payroll options, enabling small businesses to manage their payroll according to their specific needs. Its automated tax filing ensures compliance with tax regulations.

The platform's employee benefits management tools help you handle benefits enrollment and administration. With Paychex Flex, you can customize payroll settings to suit your business's unique requirements.

Standout features & integrations:

Features include automated tax filing, ensuring compliance with tax laws. The employee benefits management feature allows you to manage and administer benefits easily. Paychex Flex also offers customizable payroll settings, enabling you to tailor payroll processes to your needs.

Integrations include QuickBooks, Xero, Sage, BambooHR, TSheets, Indeed, ZipRecruiter, Salesforce, ADP, and Microsoft Dynamics.

Pros and cons

Pros:

- Efficient benefits management

- Automated tax filing

- Flexible payroll options

Cons:

- Reports feel clunky for small teams

- Hard to fix things without rep support

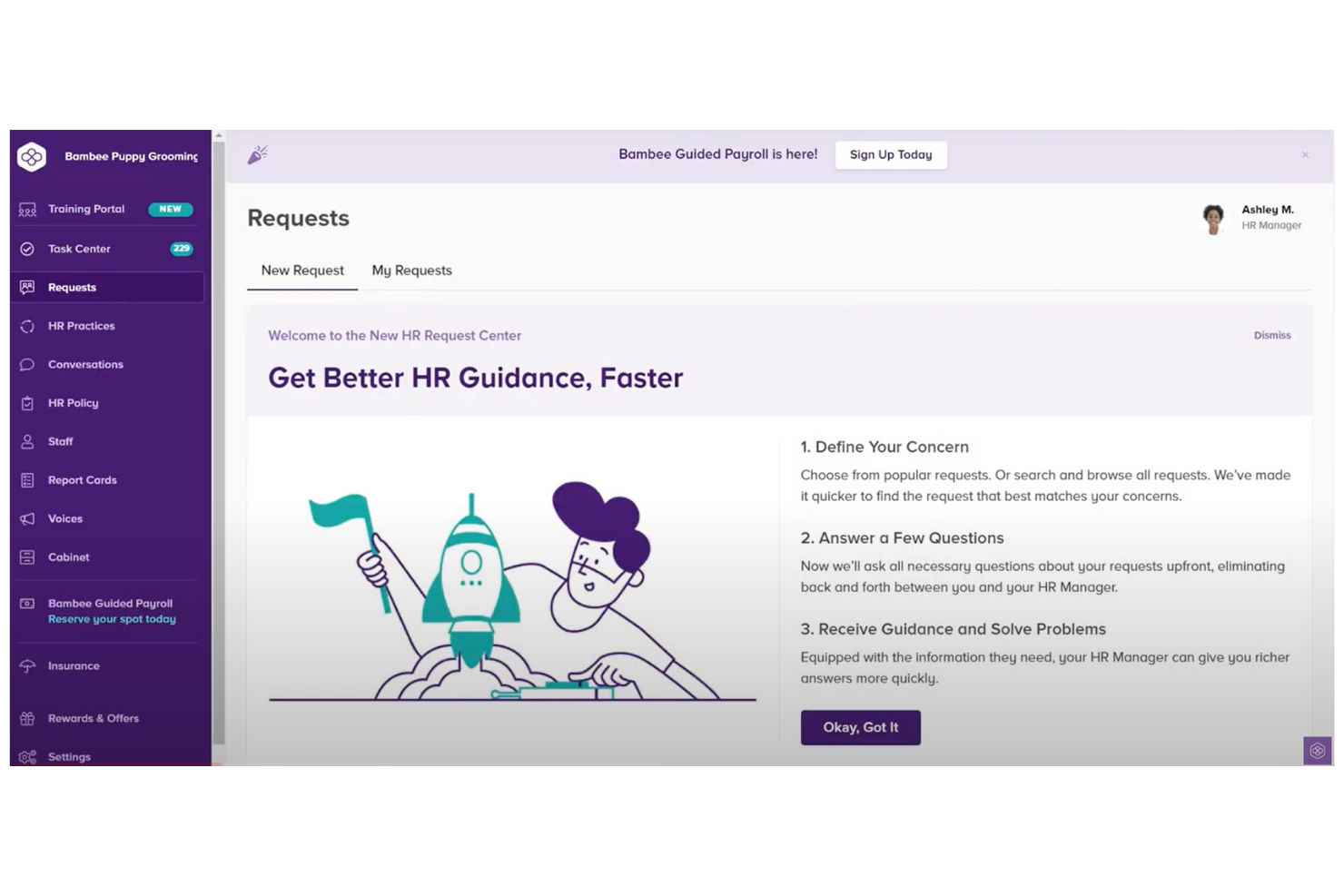

Bambee is an HR service platform aimed at small businesses that need expert HR support. It offers HR policy creation, employee management, and compliance assistance.

Why I picked Bambee: Bambee provides personalized HR guidance, which is crucial for small businesses without an in-house HR team. It assigns a dedicated HR manager to help you navigate complex HR issues.

Bambee's compliance monitoring ensures your business meets legal requirements. With its employee management tools, you can handle HR tasks efficiently.

Standout features & integrations:

Features include dedicated HR managers who provide personalized HR support. The compliance monitoring feature helps you stay updated with labor laws. Bambee also offers employee management tools to streamline HR processes.

Integrations include BambooHR, Gusto, QuickBooks, Xero, ADP, Paycor, Rippling, Zenefits, Paycom, and TriNet.

Pros and cons

Pros:

- Efficient HR task management

- Strong compliance monitoring

- Personalized HR guidance

Cons:

- Not ideal if you’ve got hourly turnove

- Limited options for custom workflows

TopSource is a global payroll solution designed for businesses operating in multiple countries. It handles payroll processing, compliance, and multi-country payroll management.

Why I picked TopSource: TopSource specializes in managing global payroll, which is essential for businesses with international operations. It offers comprehensive compliance support to ensure adherence to local regulations.

With its multi-country payroll processing, you can efficiently manage payroll across different regions. TopSource provides valuable insights into your payroll data with its reporting tools.

Standout features & integrations:

Features include comprehensive compliance support, which helps you navigate complex international regulations. The multi-country payroll processing feature enables you to manage payroll across multiple regions. TopSource also offers detailed reporting tools to give you insights into your payroll operations.

Integrations include SAP SuccessFactors, Workday, Oracle, QuickBooks, BambooHR, Xero, NetSuite, Salesforce, Microsoft Dynamics, and Gusto.

Pros and cons

Pros:

- Contractor and entity management

- Advisory for HR and benefits

- EOR support in 130+ countries

Cons:

- Limited performance management tools

- No built-in employee self-service

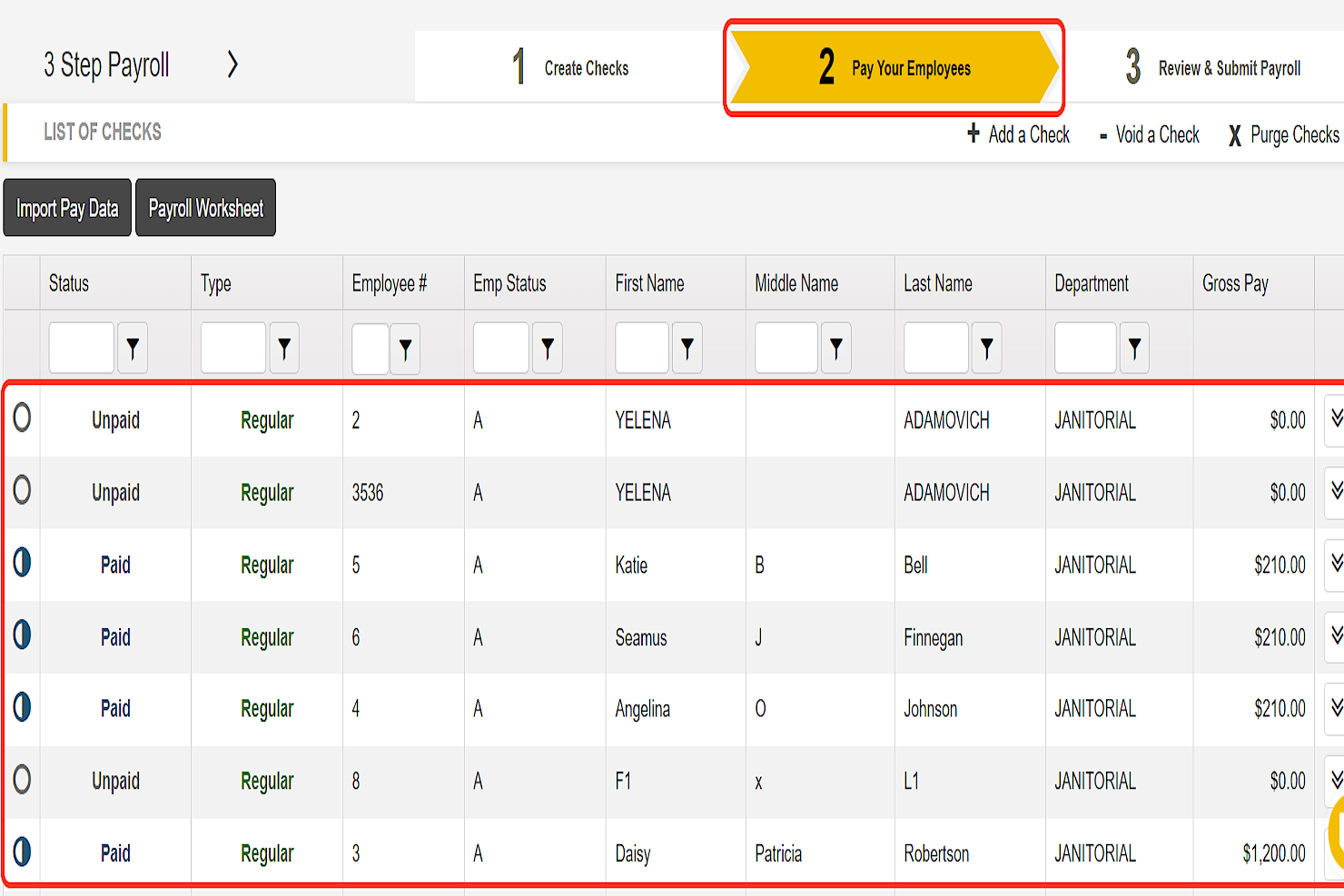

Patriot Payroll is an online payroll solution tailored for small businesses. It offers payroll processing, tax filing, and employee payment management at an affordable price.

Why I picked Patriot Payroll: Patriot Payroll provides cost-effective payroll services, making it ideal for budget-conscious small businesses. Its straightforward payroll processing helps you manage employee payments efficiently.

The tool’s automated tax filing ensures compliance with tax laws. With its user-friendly interface, you can easily navigate payroll tasks without hassle.

Standout features & integrations:

Features include automated tax filing, which helps you stay compliant with tax regulations. The platform offers direct deposit to ensure timely employee payments. Patriot Payroll also provides customizable payroll reports to help you analyze financial data effectively.

Integrations include QuickBooks, Xero, TSheets, BambooHR, Gusto, FreshBooks, Wave, TimeClock Plus, Square, and Paychex.

Pros and cons

Pros:

- Efficient direct deposit options

- Customizable payroll reports

- Cost-effective payroll solution

Cons:

- State filing status updates sometimes lag

- Hard to adjust pay dates last minute

PrimePay is a payroll and HR solution designed for small to medium-sized businesses. It offers payroll processing, HR management, and employee benefits administration.

Why I picked PrimePay: PrimePay offers personalized service, which is crucial for businesses seeking tailored support. It provides customizable payroll options to fit your business needs.

With dedicated account managers, you can receive support that understands your specific requirements. PrimePay also ensures compliance with tax regulations through automated filings.

Standout features & integrations:

Features include customizable payroll options, allowing you to tailor payroll processes to your business's specific needs. The platform provides dedicated account managers to offer personalized support. PrimePay also offers automated tax filings to ensure compliance with tax laws.

Integrations include QuickBooks, Xero, Sage, ADP, BambooHR, TSheets, Salesforce, Microsoft Dynamics, Gusto, and NetSuite.

Pros and cons

Pros:

- Scalable for medium-sized businesses

- Efficient tax compliance

- Personalized customer support

Cons:

- Needs better tools for bonuses

- Reports feel clunky for basic needs

TriNet is a comprehensive HR and payroll service tailored for small to medium-sized businesses across various industries. It offers payroll processing, benefits administration, and compliance support.

Why I picked TriNet: TriNet offers industry-specific solutions, which are crucial for businesses with specialized industry needs. It provides customizable HR services to fit the specific requirements of your industry.

TriNet's compliance support ensures your business adheres to industry regulations. With its benefits administration tools, you can efficiently manage employee benefits.

Standout features & integrations:

Features include customizable HR services that allow you to tailor solutions to your industry needs. The compliance support feature helps you navigate industry-specific regulations. TriNet also provides benefits administration tools to streamline the management of employee benefits.

Integrations include QuickBooks, Xero, NetSuite, BambooHR, Gusto, Salesforce, Microsoft Dynamics, Sage, ADP, and Workday.

Pros and cons

Pros:

- Efficient benefits administration

- Strong compliance support

- Industry-specific HR solutions

Cons:

- Hard to track PTO by location setup

- Delays happen with off-cycle checks

myHR Partner is a comprehensive HR service aimed at small to medium-sized businesses. It provides payroll administration, employee management, and compliance support.

Why I picked myHR Partner: myHR Partner offers personalized HR services, which is essential for businesses seeking tailored HR support. It assigns dedicated HR specialists who understand your business needs.

With its compliance assistance, you can ensure adherence to labor laws. myHR Partner also provides payroll management to handle employee payments efficiently.

Standout features & integrations:

Features include dedicated HR specialists who offer personalized support tailored to your business. The compliance assistance feature helps you navigate complex labor laws. myHR Partner also provides payroll management to handle payroll processes smoothly.

Integrations include ADP, Paychex, QuickBooks, Xero, Gusto, BambooHR, Rippling, Zenefits, Paycom, and TriNet.

Pros and cons

Pros:

- Efficient payroll management

- Strong compliance assistance

- Personalized HR support

Cons:

- Not ideal for fast-changing pay structures

- Limited offline functionality

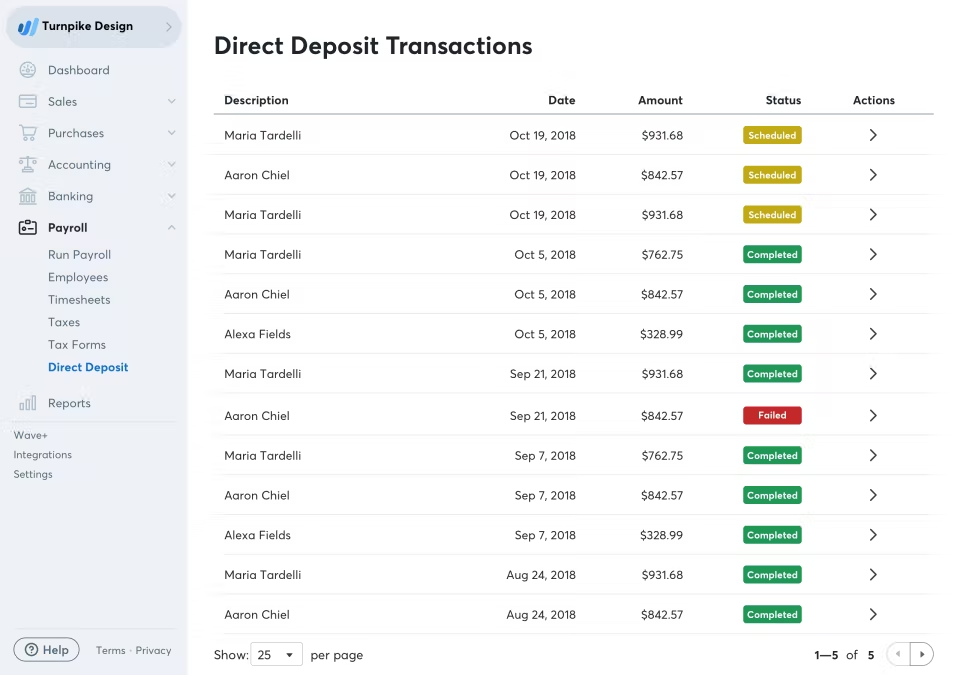

WAVE is a payroll and accounting solution designed for freelancers and small businesses. It offers payroll processing, invoicing, and expense management.

Why I picked WAVE: WAVE provides a simple and effective solution for freelancers who need to manage payroll and finances. Its invoicing feature helps you get paid on time.

With automated payroll, you can ensure accurate and timely payments. WAVE also offers expense tracking to help you manage your business finances efficiently.

Standout features & integrations:

Features include automated payroll processing, ensuring your team receives accurate and timely payments. The invoicing feature allows you to create and send professional invoices easily. WAVE also offers expense tracking to help you monitor and manage your business expenses.

Integrations include PayPal, Shoeboxed, Etsy, Zapier, Google Sheets, QuickBooks, Slack, Shopify, Stripe, and Mailchimp.

Pros and cons

Pros:

- Professional invoicing capabilities

- Effective for freelancers

- Simple setup process

Cons:

- No easy way to override auto taxes

- Lacks tools for multi-state filings

Justworks Payroll is a comprehensive payroll and HR solution designed for startups and small businesses. It offers payroll processing, benefits administration, and compliance support.

Why I picked Justworks Payroll: Justworks Payroll provides a streamlined solution for startups looking to manage payroll and HR efficiently. It offers automated payroll processing to ensure timely and accurate payments.

With its benefits administration tools, you can manage employee benefits easily. Justworks also provides compliance support to help your business adhere to regulations.

Standout features & integrations:

Features include automated payroll processing, which ensures accurate and timely employee payments. The benefits administration feature allows you to manage employee benefits with ease. Justworks also offers compliance support to help you navigate regulatory requirements.

Integrations include QuickBooks, Xero, Gusto, BambooHR, Salesforce, Expensify, Slack, Zenefits, HubSpot, and Asana.

Pros and cons

Pros:

- Scalable for growing businesses

- Automated payroll processing

- Streamlined for startups

Cons:

- Hard to undo errors once pay runs finish

- Can’t adjust bonus settings mid-cycle

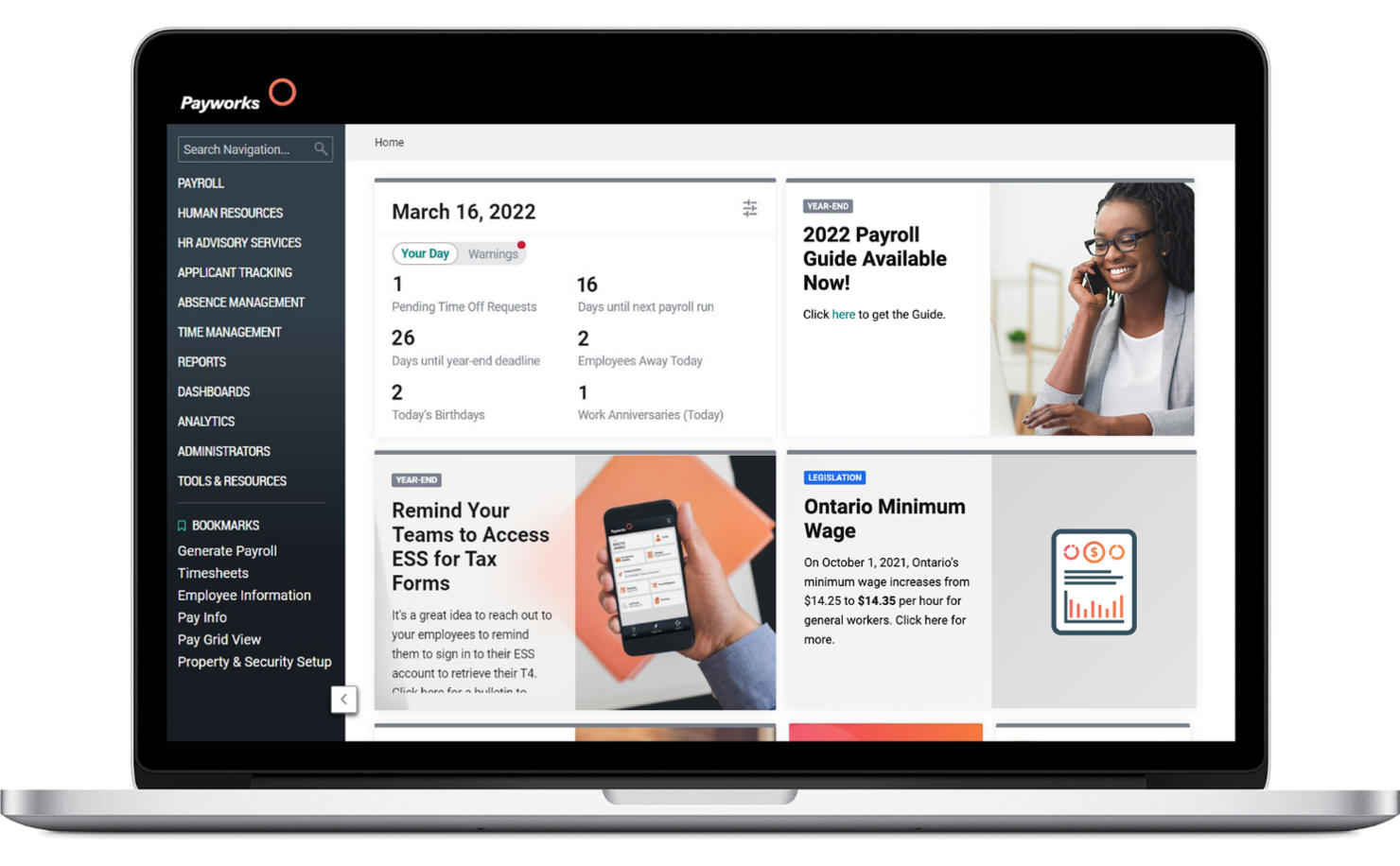

Payworks is a payroll and workforce management solution tailored for small Canadian businesses. It handles payroll processing, benefits administration, and compliance management.

Why I picked Payworks: Payworks provides specialized support for Canadian businesses, making it ideal for those needing localized payroll services. It offers compliance management to ensure adherence to Canadian regulations.

With its benefits administration tools, you can efficiently manage employee benefits. Payworks also provides detailed payroll reporting to give insights into your financial data.

Standout features & integrations:

Features include compliance management to keep you aligned with Canadian regulations. The benefits administration feature allows you to manage employee benefits effectively. Payworks also offers detailed payroll reporting to help you analyze your financial data.

Integrations include QuickBooks, Sage, BambooHR, Xero, Ceridian, ADP, SAP SuccessFactors, Workday, Oracle, and Microsoft Dynamics.

Pros and cons

Pros:

- Detailed payroll reporting

- Efficient benefits administration

- Strong compliance management

Cons:

- Needs more guidance for T4 prep steps

- PTO adjustments aren’t always intuitive

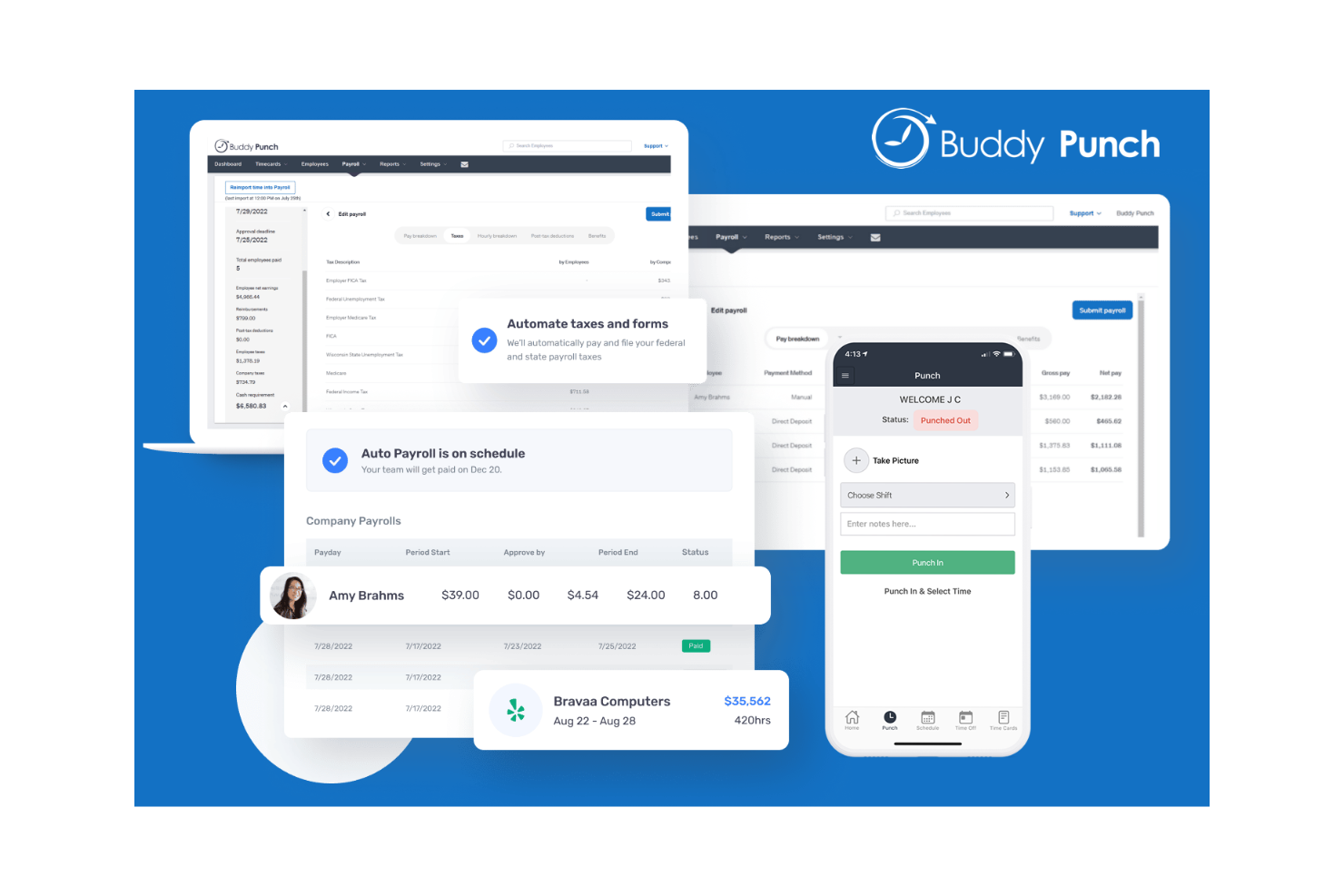

Buddy Punch is a time-tracking tool designed for small to medium-sized businesses. It helps teams manage employee hours and simplifies payroll processing.

Why I picked Buddy Punch: Buddy Punch excels in time tracking, making it ideal for businesses that need accurate employee time records. With features like GPS tracking and facial recognition, you can ensure employees are clocking in from the right locations.

The tool’s automated overtime calculations help you easily comply with labor laws. The ability to customize reports means you can tailor data to your specific needs.

Standout features & integrations:

Features include shift scheduling, which helps you plan and manage employee shifts efficiently. The PTO tracking feature enables you to manage employee time-off requests easily. Alerts and notifications keep you informed of any discrepancies in time entries.

Integrations include QuickBooks, Xero, ADP, Paychex, Paylocity, Gusto, BambooHR, Zapier, Slack, and Microsoft Teams.

Pros and cons

Pros:

- Real-time alerts and notifications

- Facial recognition for clock-ins

- GPS location tracking

Cons:

- Basic mobile app features

- No native payroll processing

Other Payroll Services for Small Businesses

Here are some additional payroll service for small businesses options that didn’t make it onto my shortlist, but are still worth checking out:

- Oyster HR

For international payroll compliance

- QuickBooks Payroll

For unlimited payroll runs

- Papaya Global

For expanding internationally

- ADP Workforce Now

For scalable payroll

- QuickBooks Online

For payroll and general accounting

- ADP GlobalView Payroll

For a robust mobile app

- Square

Online payroll service that helps you offer direct deposit payments for hourly workers.

- Gusto

Run payroll for international contractors from 80+ countries

- Wagepoint

Payroll software that enables you to simplify your payroll with automation and an employee self-service portal.

- SurePayroll

Payroll provider that enables you to set up and automate your payroll process.

- Alliance Payroll Services

Localized payroll service that helps you set up a paperless payroll and handles your taxes.

- Heartland

On-demand payroll service provider that connects you with payroll specialists to solve important issues.

- Payroll4Free

Free payroll service that helps businesses with 25 employees or less run their payroll and calculate their taxes.

Payroll Services Selection Criteria

When selecting the best payroll services for small businesses to include in this list, I considered common buyer needs and pain points like managing tax compliance and ensuring timely employee payments. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Process payroll accurately

- Calculate and withhold taxes

- Generate payroll reports

- Direct deposit payments

- Manage employee records

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Customizable payroll options

- Compliance with international regulations

- Advanced reporting capabilities

- Integration with HR tools

- Mobile access for payroll management

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Ease of navigation

- Minimal learning curve

- Clear instructions and help resources

- Consistent performance across devices

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Access to interactive product tours

- Usage of templates for easy setup

- Presence of chatbots for instant help

- Hosting of webinars for guidance

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- Availability of 24/7 support

- Access to live chat assistance

- Comprehensive help center resources

- Responsiveness to inquiries

- Quality of support documentation

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing against features offered

- Availability of tiered pricing plans

- Flexibility in contract terms

- Inclusion of essential features in base price

- Discounts for annual subscriptions

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Consistency of positive feedback

- Frequency of reported issues

- Satisfaction with customer support

- User testimonials about ease of use

- Overall rating compared to competitors

How to Choose a Payroll Service

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

|---|---|

| Scalability | Can the tool grow with your business? Look for options that accommodate increasing employee numbers without a steep price increase. |

| Integrations | Does it connect with your existing systems? Check for compatibility with your accounting software and HR tools. |

| Customizability | Can you tailor the payroll processes to fit your needs? Avoid rigid systems that don't allow adjustments to workflows. |

| Ease of use | Is the interface intuitive? Ensure it doesn’t require extensive training for your team to start using it effectively. |

| Implementation and onboarding | How quickly can you get started? Look for platforms that offer guided setups or support to minimize transition time. |

| Cost | Does the pricing fit your budget? Be wary of hidden fees and ensure the cost aligns with the features you actually need. |

| Security safeguards | How does it protect your data? Ensure it has strong encryption and complies with data protection laws to safeguard sensitive information. |

| Compliance requirements | Does it help you stay compliant with regulations? Make sure it supports tax filings and adherence to employment laws in your location. |

Trends in Payroll Services for Small Businesses

Being aware of trends in payroll services for small businesses is crucial for HR professionals and payroll specialists to ensure effective payroll management and compliance with evolving regulations. By staying informed about the latest trends, professionals can adopt modern tools and technologies that streamline payroll processes, enhance accuracy, and boost operational efficiency. This awareness enables small businesses to stay competitive in attracting and retaining top talent by offering efficient and accurate payroll services, contributing to employee satisfaction and overall business success. Here are four key trends for 2025:

Automation and AI-Driven Payroll Processing

Automation in payroll processing, utilizing Artificial Intelligence (AI) not only minimizes time-consuming tasks, such as manual data entry, but also enhances accuracy in payroll management. Other benefits include:

- Compliance: AI algorithms can handle complex calculations and tax withholdings, ensuring accuracy and compliance.

- Time Efficiency: AI automates routine tasks like payroll scheduling, freeing up HR professionals to focus on strategic initiatives.

- Error Reduction: AI can help reduces human errors in data entry, enhancing overall payroll accuracy.

By implementing AI-driven payroll systems, you can significantly reduce your manual workload and repetitive tasks, allowing you the time and resources to concentrate on more value-added activities. This can be especially beneficial if you work in small business, as your time and resources are particularly limited and valuable.

Cloud-Based Payroll Solutions

The shift towards cloud-based payroll solutions is a response to the need for data security and confidentiality. These systems offer enhanced security features, regular backups, and the ability to access payroll data securely from anywhere. This trend is particularly crucial for businesses with remote or hybrid work models, providing HR teams the flexibility to manage payroll remotely while ensuring data security. This trends can also be extremely beneficial to small businesses, which likely do not have the resources necessary to deal with a data leak.

On-Demand Pay and Flexible Payment Options

On-demand pay and flexible payment options have emerged as a response to the growing demand for employee-centric benefits. While it is certainly non-traditional, this trend offers a variety of benefits, including:

- Immediate Access to Wages: Allows employees to access a portion of their earned wages before the scheduled payday.

- Employee Satisfaction: Increases morale and loyalty by providing financial flexibility and autonomy.

- Retention Tool: Acts as a competitive advantage in attracting and retaining talent, especially in a dynamic workforce.

Implementing on-demand pay systems can be a strategic move for HR Managers to boost employee engagement and loyalty, making it a valuable addition to employee benefits packages. Moreover, while it may seem like a risk for small businesses, its impact on employee satisfaction and retention still make it a worthwhile strategy to consider.

Enhanced Compliance Features

With constantly changing payroll and labor laws, enhanced compliance features in payroll services are a must. Modern payroll systems are equipped to stay updated with the latest tax laws and regulations, ensuring businesses remain compliant. This is particularly crucial for small businesses, who cannot necessarily afford the legal fees associated with making tax mistakes.

For People Ops professionals, HR managers, and business leaders in small businesses, these emerging trends in payroll services offer strategic solutions to their most pressing challenges. Adopting these trends can not only make your job easier, but can also help position your small business for success in a competitive landscape.

What are Payroll Services?

Payroll services are third-party providers that can process payroll on your behalf. They can help you with a range of payroll-related tasks, like basic payroll processing and bookkeeping, and submitting direct deposits into employee bank accounts.

The primary purpose of payroll services is to free you from time-consuming tasks around navigating compensation management, deductions, and location-specific tax compliance.

Features

The depth of services provided varies from one payroll company to the next. And the features included in different payroll software can vary, too. Here are some common payroll features and services offered:

- Automated Payroll Processing: Automates the calculation of wages, ensuring employees are paid accurately and on time, reducing manual errors. The service should also offer multiple payment options, including direct deposit, physical paychecks, or even on-demand pay.

- Tax Filing Services: Helping you file taxes locally and federally with the IRS, CRA, or any other relevant governing body, ensuring compliance with tax regulations and avoiding penalties. This may also include making year-end tax payments on your behalf.

- Tax Compliance: Your payroll service provider will ensure you’re up-to-date on all applicable federal and state tax laws.

- Garnishment Services: Manages court-ordered wage garnishments, ensuring accurate deductions and compliance with legal requirements.

- Employee Self-Service Portal: Allows employees to access their payroll information, pay stubs, and tax documents, reducing administrative workload and improving transparency.

- Time and Attendance Tracking: Clocking employee hours and syncing them automatically with your online payroll services. This could also include managing PTO and time off requests.

- Benefits Administration: Manages employee benefits such as employee health benefits, disability and life insurance, retirement plans, RRSP contributions, health budgets, and other perks, ensuring accurate deductions and contributions.

- Payroll Reporting: Generates detailed payroll reports covering expenses, taxes, and deductions, helping businesses maintain clear financial records and make informed decisions.

- Bookkeeping: Maintaining the paperwork and records-keeping involved with running payroll for auditing and compliance purposes.

- Customer Support: Offers expert assistance and troubleshooting for payroll-related issues, ensuring smooth and efficient payroll operations.

- Software Integrations: You'll want your payroll service provider's software to integrate with your other small business human resource software, such as a cloud-based human resources information system (HRIS), allowing you to sync your employee data from other sources easily, preventing the possibility of errors.

Benefits

Implementing payroll services for small businesses provides several benefits for your team and your business. Here are a few you can look forward to:

- Time savings: Automated payroll processing reduces the time spent on manual calculations and paperwork.

- Accuracy: Features like tax calculation ensure precise payment and compliance, minimizing errors.

- Employee satisfaction: Direct deposit and self-service portals offer convenience, boosting employee morale and satisfaction.

- Compliance assurance: Compliance management helps you adhere to labor laws, avoiding potential fines and legal issues.

- Scalability: The ability to grow with your business means you won't outgrow your payroll solution as you expand.

- Cost efficiency: Streamlined processes and reduced errors can lead to cost savings over time.

- Data insights: Reporting tools provide valuable insights into payroll expenses, aiding in better financial planning.

Costs & Pricing

Selecting payroll services for small businesses requires an understanding of the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes common plans, their average prices, and typical features included in payroll services for small businesses:

Plan Comparison Table for Payroll Services for Small Businesses

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic payroll processing, limited support, and employee self-service. |

| Personal Plan | $5-$25/user/month | Payroll processing, tax calculations, direct deposit, and basic reporting. |

| Business Plan | $26-$50/user/month | Advanced reporting, compliance management, integrations, and benefits administration. |

| Enterprise Plan | $51-$100/user/month | Customizable payroll options, dedicated support, advanced analytics, and multi-country support. |

Payroll Services FAQs

Here are some answers to common questions about payroll services for small businesses:

How do payroll services differ from payroll software?

Payroll software is a tool you use yourself; payroll services are run by specialists who do the work for you. They often use their own technology but provide hands-on support, tax filing, and compliance management.

Can payroll services handle multi-state or remote employees?

Yes. Most established providers can manage payroll taxes for employees working in multiple states or locations, applying the correct local and state withholdings automatically.

Do payroll services handle contractors and freelancers?

Yes. Most established providers can manage payroll taxes for employees working in multiple states or locations, applying the correct local and state withholdings automatically.

How secure are payroll services?

Good providers use encryption, secure data centers, and strict access controls to protect sensitive information. Always review their data privacy and security certifications before signing up.

Can payroll services integrate with my accounting system?

Yes, many can sync with tools like QuickBooks, Xero, or NetSuite. Integration helps keep financial records accurate and reduces manual data entry.

Who is responsible if payroll is wrong?

If the provider guarantees accuracy, they’ll correct and cover the cost of any errors. Without such a guarantee, responsibility may still fall on the employer, so always clarify this in your service agreement.

What’s Next:

If you're in the process of researching payroll services for small businesses, connect with a SoftwareSelect advisor for free recommendations.

You fill out a form and have a quick chat where they get into the specifics of your needs. Then you'll get a shortlist of software to review. They'll even support you through the entire buying process, including price negotiations.