There are four main types of payroll systems:

- Traditional cloud-based systems

- Payroll as a module within HR software

- Industry-specific payroll solutions, and

- Combined payroll services and software.

In this article, I'll explain each type in detail to help you find the best fit for your needs.

What is Payroll Software?

Payroll software is a digital tool that automates employee wage payments, tax withholdings, benefit deductions, and direct deposits.

In addition to these core functions, it can also manage paid time off, calculate benefit costs, and generate year-end tax forms. Payroll software is used by HR teams, finance departments, and small business owners to save time, reduce manual errors, and stay compliant with tax regulations.

Types of Payroll Software

There are several kinds of payroll software available on the market, each catering to different business needs. Understanding the way each option operates will help you find the best fit for your business.

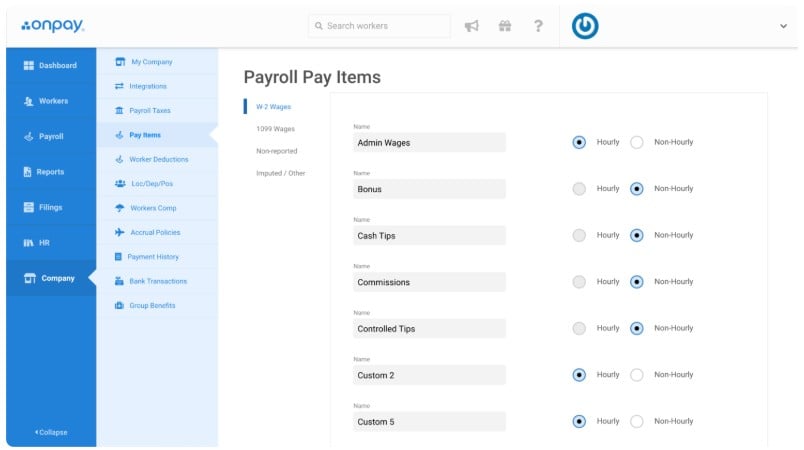

1. Traditional Cloud-Based Payroll Software

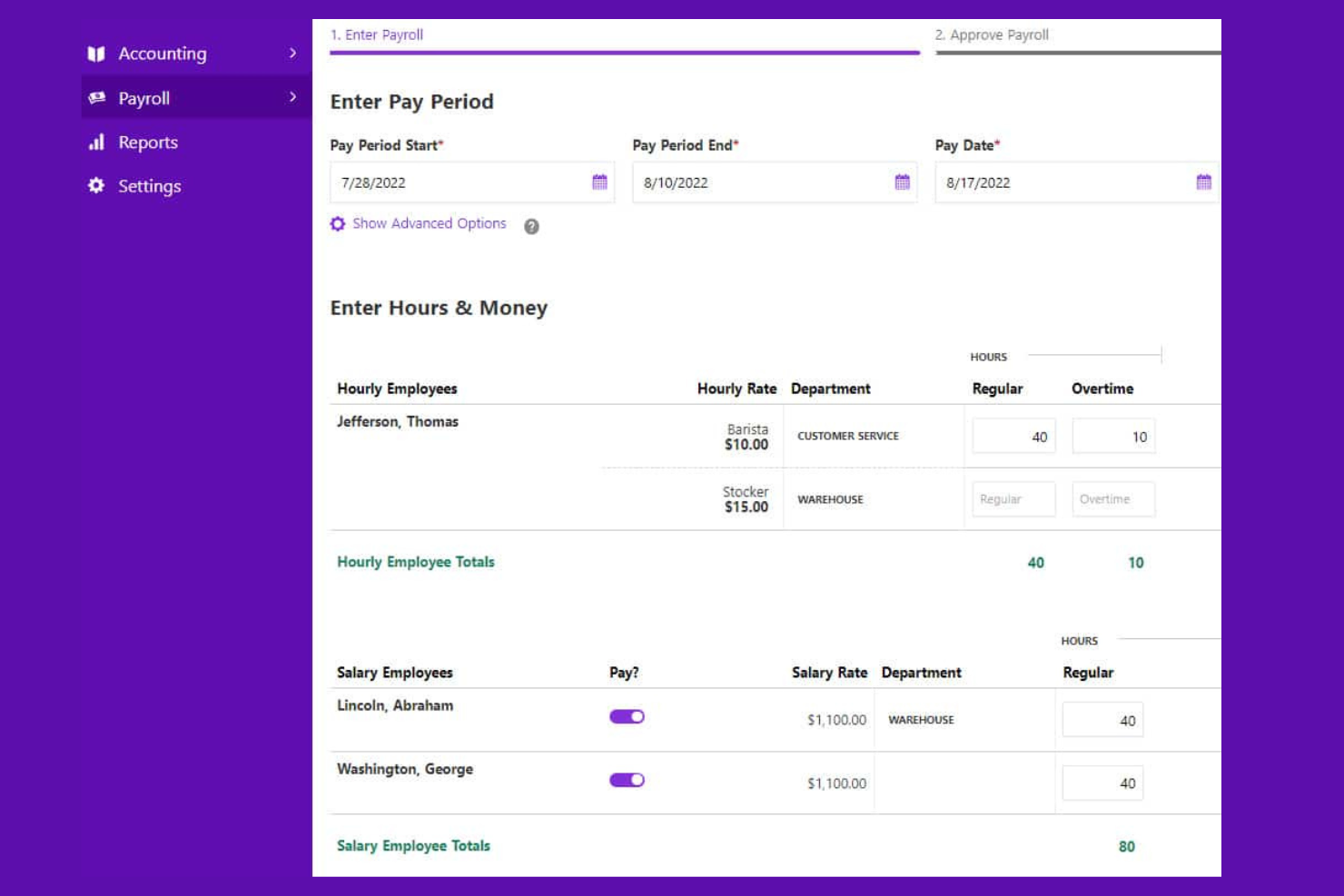

Traditional cloud-based payroll software refers to online payroll platforms that are accessible through the web—the most popular payroll configuration by far.

These systems offer a centralized repository for all payroll-related data and allow users to configure salary structures, manage deductions, and file for taxes directly from the platform itself. They are generally very user-friendly, with straightforward interfaces that make the process of running payroll simple and intuitive.

The main advantage of this model is accessibility. Since it’s hosted on a digital cloud, users can access payroll data from anywhere, at any time, via a secure internet connection.

Another huge advantage of using cloud-based payroll software is the fact that software updates and data backups are handled by the hosting payroll provider, placing far less responsibility on your in-house staff.

Payroll providers also regularly release updates to their software to capture changes to tax laws or labor legislation, minimizing your risk of compliance issues.

Within the cloud-based category, you can also find systems that specialize even further, including payroll software for small businesses or payroll for startups.

Payroll software with a strict focus on only payroll processing is sometimes referred to as standalone payroll software. This is in contrast to payroll software as a module, which I’ll cover next.

2. Payroll as a Module

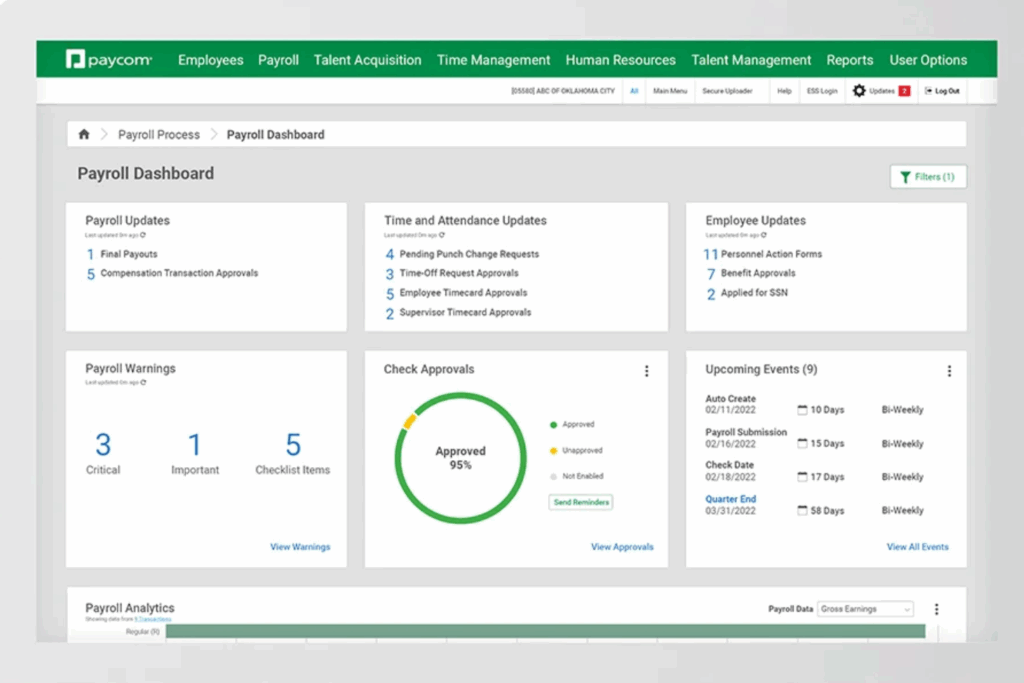

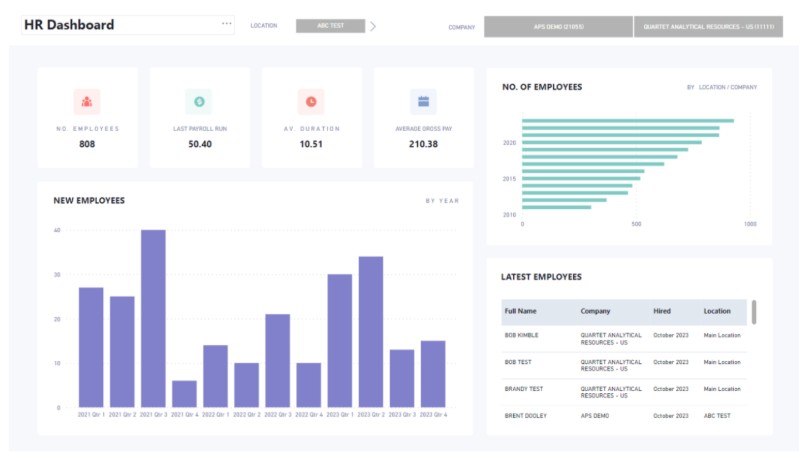

Another very common structure for payroll software is having it as a module within a larger HR management system, such as a Human Resources Information System (HRIS), Human Resources Management System (HRMS), or Human Capital Management (HCM) system.

Structuring payroll as a module within an HR system offers many advantages from a data management perspective since all the modules within the system are integrated.

That means you’ll be able to easily capture data from other modules such as time and attendance or benefits administration. This simplifies the payroll process considerably, rather than having to manually export data from another system to import into your HR software’s payroll module.

However, I should point out that these systems are also cloud-based, meaning they offer the same advantages I already noted above. Software updates and data back-ups are handled by the HR software provider, meaning less strain on your internal IT and HR staff.

These combined HR software and payroll systems also offer better ease of use from the employee perspective, since they’ll be able to access their pay stubs and submit PTO requests from within the same employee self-service module, rather than having to log into a separate system for each.

3. Industry-Specific Payroll Software

Industry-specific payroll software also exists for numerous industries, including construction, restaurants, recruitment agencies, and others. These systems offer additional features that make sense for their industry-specific contexts which extend beyond just basic payroll features. Some examples include:

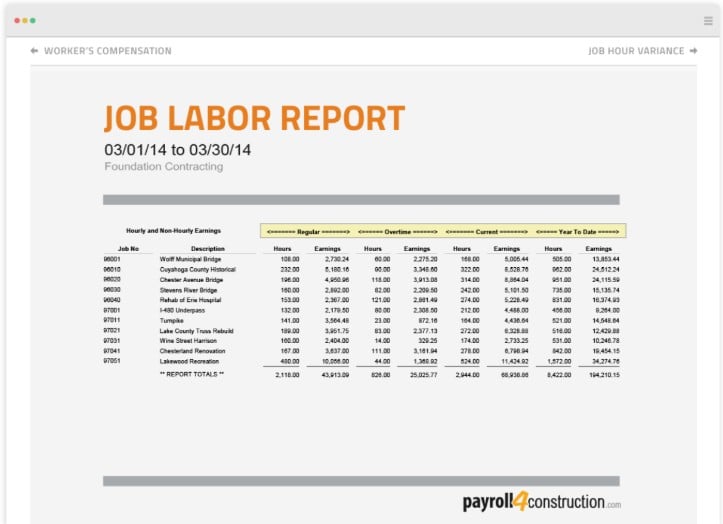

Construction Payroll Software

Construction payroll software includes features for handling union dues, certified payroll reports, and multiple job site management features, unlike standard payroll software. It also supports job costing and tracking prevailing wage compliance.

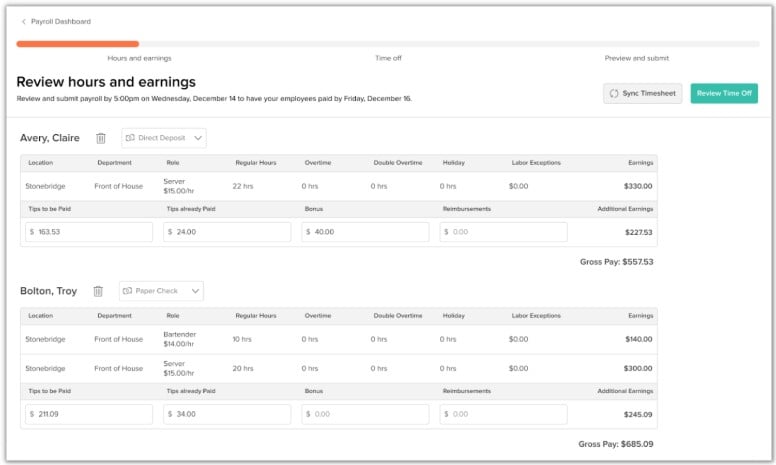

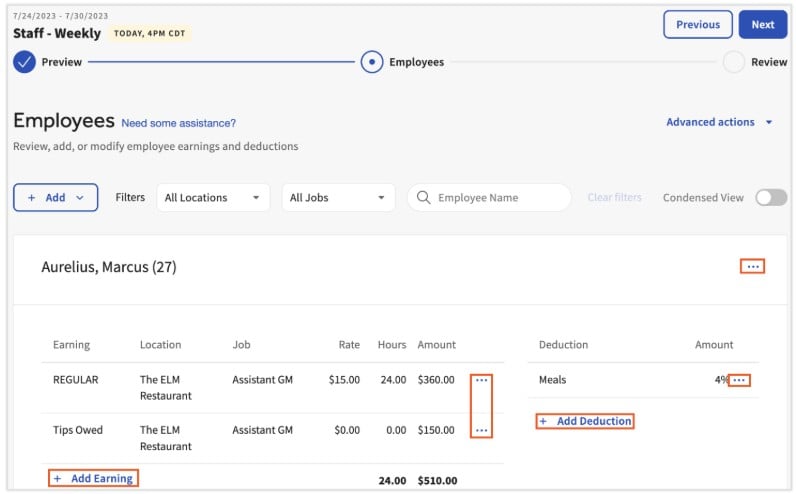

Restaurant Payroll Software

Restaurant payroll software caters to the unique needs of the food service industry by managing tip distribution, shift scheduling, and compliance with labor laws specific to restaurants. It also integrates with POS systems to streamline payroll calculations based on sales and tips.

Manufacturing Payroll Software

Manufacturing payroll software handles complex shift differentials, piece-rate pay, and labor costing specific to the manufacturing industry. It also integrates with production management systems to align payroll with production data and performance metrics.

There are many other options out there, so take the time to research different vendors if you’re looking for a niche-specific payroll provider. Or, pop up to our search field and double check, cause we may have already done the leg work for you, depending on your industry!

Again, I want to point out that these industry-specific payroll systems also operate within the cloud-based model. That means you won’t have to worry about managing software or compliance-related updates yourself. Instead, your payroll provider will update their software directly as needed.

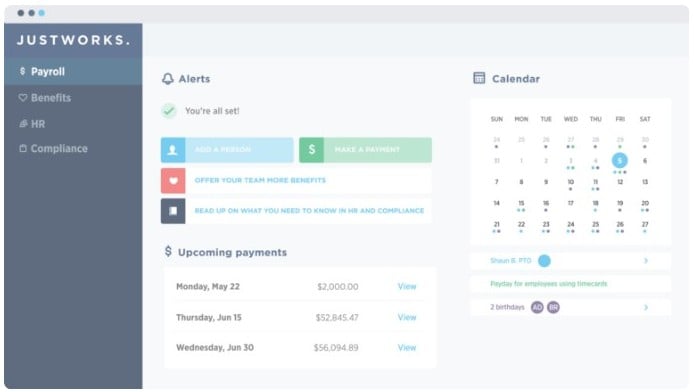

4. Combined Payroll Software and Payroll Services

I’ve grouped these together because they are both, essentially, services. However, there are different payroll services out there, and it’s important to understand the distinction between them.

Here’s a quick breakdown of each payroll service sub-type:

Full-Service Payroll

This is a service payroll companies offer where they manage your payroll processing on your behalf.

You’re responsible for keeping track of your employee data, and making changes to salaries, tax locations, and other employee-specific details as needed.

However, the company handles all other aspects of processing payroll, including calculating payroll taxes, federal taxes, local taxes, etc.

This option is helpful for many small business owners who want to completely rid themselves of payroll responsibilities, while ensuring payroll is processed correctly. Using this model, you are essentially outsourcing your payroll to a third-party payroll service to manage.

If this sounds like your situation, I recommend partnering with one of the payroll services for small businesses, which I’ve researched in detail. These services are generally very cost-effective and come with robust customer support.

PEO Companies

Another form of payroll outsourcing is partnering with a Professional Employer Organization (PEO). The nice part about using a PEO service is that they can help you with more than just payroll processing. Most PEO providers offer the following services:

- Payroll management

- Regulatory compliance

- Employee benefits management

- Talent management (including recruiting and staffing)

- Data management

- Risk management

- Workers’ compensation

PEO companies will set you up using their own software, so it’s important to ensure their payroll system integrates with whichever key HR software solutions you’re already using.

You can also expect top-level customer support from a PEO company, because you’re essentially hiring them to manage your payroll processes from start to finish.

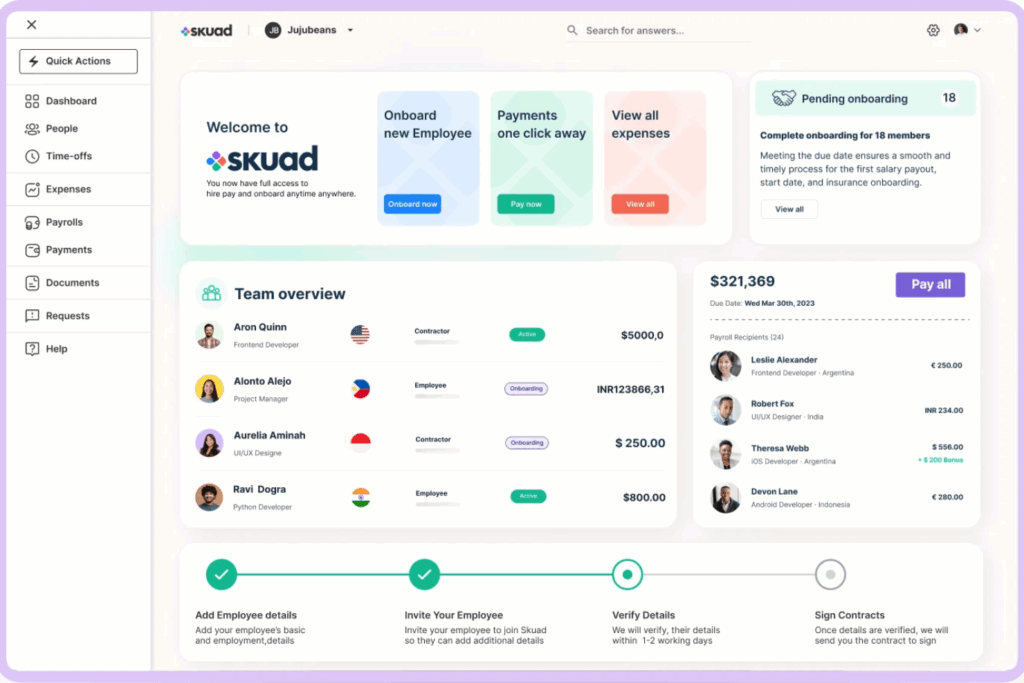

Global Payroll Software and Services

Global payroll software solutions represent a combination of sophisticated payroll software that can handle payments in multiple currencies, combined with customer support and payroll management from the payroll provider.

Under this model, you are responsible for updating your employee data within the global payroll software system. However, your payroll provider is responsible for processing payroll on your behalf, ensuring tax compliance in all the jurisdictions you have employees in.

As the name suggests, this service is intended for companies with staff based in different countries. As a result, it’s a more expensive option than other payroll services (read our deep dive on global payroll costs for more info on this). However, remember what you’re paying for:

- Global payroll processing (payments spanning multiple countries and multiple currencies, deposited directly into your employee’s bank accounts)

- In-country legal expertise and compliance monitoring

- International tax withholding and filing

- Payroll reconciliation and auditing

- Support for global HR workforce issues

If your organization plans to pay full-time employees, or even contractors, in different countries, using a global payroll provider is the way to go.

(Note: If you want to take things one step further and get the legalities of hiring international employees completely off your desk, an Employer of Record service would be a better choice.)

Other Payroll Options

There are other payroll configurations out there that are worth noting. However, they aren’t very user-friendly. Other options include:

- On-Premise Payroll Software: This refers to payroll software that’s installed locally on company servers that runs independently from other HR software. The one benefit of using an on-premise payroll system is that it provides more control over data security and customization, unlike standard cloud-based payroll software.

However, on-premise solutions require a significant upfront investment in implementation and IT resources, as well as ongoing maintenance to ensure the software stays up-to-date with changing tax regulations to avoid liabilities. - Open-Source Payroll Software: Open-source payroll software allows for extensive customization and is generally more cost-effective, as there are no licensing fees. However, you need to have a significant amount of technical expertise to implement and maintain an open-source payroll system compared to standard payroll software, making them a far less desirable option for most organizations.

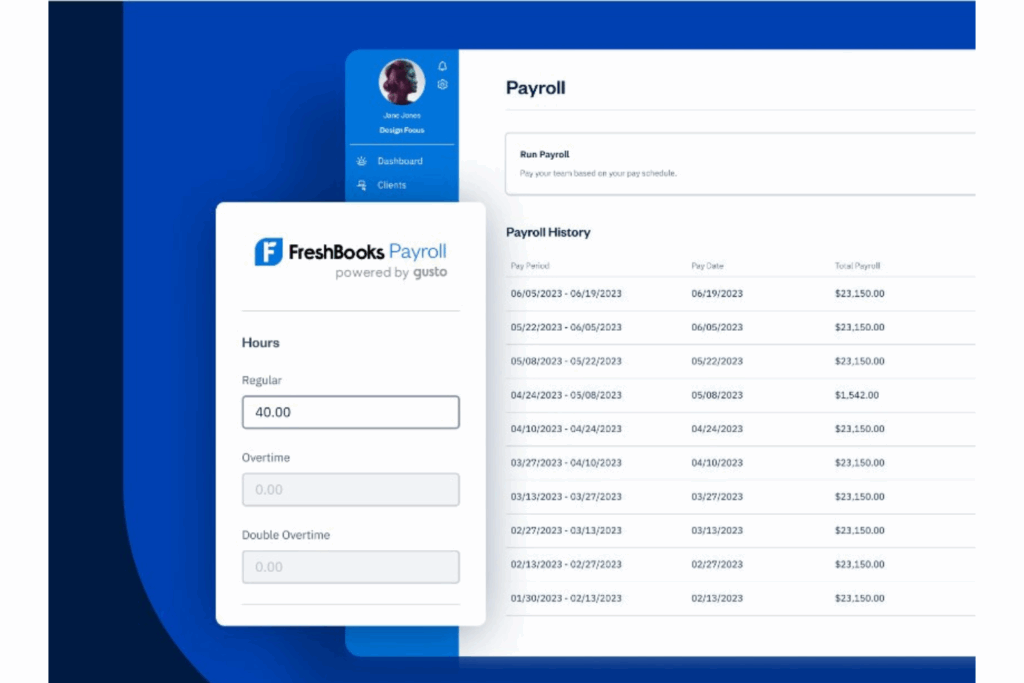

- Accounting Software: If your business is very small, you may be able to scrape by using an HR accounting software that offers payroll features. Using accounting software, you can pay your employees with physical paychecks, but this requires manual data entry and check printing. It also forces your employees to take extra steps to deposit their earnings into their bank account. For these reasons, it’s also a less appealing option for most businesses.

These alternative payroll options, in my opinion, are outdated, providing a less-than-ideal experience for anyone tasked with managing or using the software regularly.

Instead, I recommend digging deeper into cloud-based payroll software, payroll as a module, or payroll services to find the best direct deposit payroll software for your business.

Payroll Software Cost Considerations

The cost of new software is always a significant factor, and payroll software is no different. Pricing for payroll software solutions varies based on key factors such as the number of employees, the complexity of the payroll process, the features required, and whether it is a standalone product or part of a larger HR software suite.

Several different pricing models apply to payroll software, including:

- Software-as-a-Service: The traditional cloud-based model that carries a monthly fee plus a per-employee fee. Some payroll providers also offer a discounted version of their SaaS plans if you need payroll software exclusively for contractors.

- Fixed Pricing Model: A fixed monthly fee regardless of the number of employees you have.

- Free Payroll Software: This option, which also includes freemium or tester plans, is rare, though there are some decent options out there if your budget is very tight. (If so, take a look at my list of the best free payroll software to start.)

It's important to not only look at the upfront cost but also consider any ongoing monthly or annual fees. Some providers may also charge extra for services like direct deposit, tax filing, data integration, or even customer support.

You should also evaluate the potential return on investment (ROI) you’ll gain by investing in a new payroll system. Payroll software can save a company substantial time and resources by automating repetitive tasks, reducing error rates, and ensuring compliance with payroll tax laws. It also provides valuable reporting capabilities and integration with other HR functions.

Instead of viewing payroll software as a pure expense, you should consider it as an investment that can yield significant productivity gains and cost savings over time.

To learn more about the cost of payroll software, read my detailed breakdown of payroll software costs including potential hidden fees.

Payroll Software Key Features

Here are the most common payroll functionalities you can expect to find in modern payroll systems, with notes on why each feature is important. Check for these features to verify their depth before signing up with a payroll provider:

- Automated Payroll Processing: Automates the calculation of employee wages, deductions, and net pay. This reduces manual errors and saves time in payroll administration.

- Tax Calculation and Filing: Automatically calculates federal, state, and local taxes and handles filing. Ensuring accurate tax deductions and timely filing helps maintain compliance and avoid penalties.

- Direct Deposit: Facilitates direct deposit of employee paychecks into their bank accounts. This speeds up payment delivery and reduces the need for physical checks.

- Employee Self-Service Portal: Provides employees with online access to their payroll information, including pay stubs and tax forms. This empowers employees and reduces administrative inquiries.

- Compliance Management: Ensures adherence to labor laws, tax regulations, and industry standards. Compliance management minimizes the risk of legal issues and fines.

- Garnishment Management: Handles employee wage garnishments for child support, tax levies, and other court-ordered deductions. Accurate garnishment management ensures compliance with legal requirements and prevents payroll errors.

- Time and Attendance Tracking: Integrates with time-tracking systems to record employee hours and attendance. Accurate tracking is crucial for correct wage calculations and overtime management.

- Reporting and Analytics: Generates detailed payroll reports and analytics for financial planning and audits. These insights help HR and finance teams make informed decisions.

- Benefits Administration: Manages employee benefits, including health insurance, retirement plans, and other perks. Streamlining benefits administration enhances employee satisfaction and retention.

- Garnishment Management: Handles wage garnishments for child support, tax levies, and other court-ordered deductions. Proper management ensures legal compliance and accurate employee deductions.

- Mobile Access: Allows HR professionals and employees to access payroll information via mobile devices, either through dedicated mobile apps or mobile-friendly cloud-based user interfaces. Mobile access provides flexibility and convenience for on-the-go management.

If you’d like to delve deeper into any of these features, this article covering payroll software features is a solid next step.

The complexity isn’t in the payroll calculations themselves, but in staying compliant with each country’s regulations. You have to be sure your system separates the data from the rules, especially when tax and social security rates change across borders.

The complexity isn’t in the payroll calculations themselves, but in staying compliant with each country’s regulations. You have to be sure your system separates the data from the rules, especially when tax and social security rates change across borders.

Benefits of Using Payroll Software

Payroll software offers several benefits for organizations as a whole, and for those who use the software regularly to manage payroll processes. Here are several benefits you can expect to gain by implementing payroll software (or new and improved payroll software) in your organization:

- Time and cost efficiencies: Since payroll software automates many elements of the payroll process, it can significantly reduce the amount of time and effort required to complete payroll tasks, especially if your staff are currently relying on manual calculations for some aspects. This efficiency then translates into cost savings, as it reduces the amount of manual labor required.

- Employee self-service portals: By empowering employees to access their pay statements, tax documents, and personal information, you'll reduce the administrative demands on your HR staff, freeing them up to work on other tasks. Employee portals also give your staff more control over their personal details, providing a smoother experience for simple tasks such as changing addresses or updating bank account details.

- Improved compliance monitoring accuracy: By automatically updating with the latest tax rates and regulations, cloud-based payroll software reduces the risk of compliance-related issues due to incorrect payroll calculations.

- Enhanced data security: Payroll software offers secure data storage, encryption, and role-based permissions to restrict access to sensitive employee data to only those who need it, which is a significant improvement over manual payroll processes or paper-based data storage.

- Integrated reporting & analytics: As previously noted, payroll software is often one module within a larger HR management system. This allows users to generate reports on more than just payroll data. For example, you may also be able to run reports to assist with financial planning, budgeting, and decision-making, or monitor details such as employee hours worked during key times to predict future demand.

For more details on these benefits plus several more, read our detailed breakdown covering the benefits of an automated payroll system.

Future Trends in Payroll Automation

Interest in payroll automation continues to grow as more companies recognize its ability to streamline payroll processes, reduce errors, and enhance compliance.

Artificial intelligence (AI) and machine learning are expected to continue leading the development of payroll automation trends.

These technologies can use data to predict trends, track employee work hours, and even calculate payments based on various factors such as overtime, bonuses, and taxes.

This not only simplifies the work of HR professionals but also results in more accurate and timely payroll processing.

Another emerging trend is the implementation of blockchain technology in payroll automation. Blockchain can make payroll systems more secure and transparent, given its ability to provide an unalterable record of transactions.

Its potential to handle global payments could also simplify the process of paying international employees.

Several payroll companies are also exploring the potential of real-time payments to help organizations give employees instant access to their wages (also known as on-demand pay).

As these trends become more mainstream, we can anticipate a future where payroll processing is not just automated but also more efficient and employee-centered.

Choosing the Right Payroll Solution

Making the right choice when it comes to payroll solutions involves a careful analysis of your organization's needs and capabilities. It's crucial to ensure that whatever software or service you choose, it eases your workload and reduces human error.

Keep scalability in mind as well, as your business will likely grow. Investing in a flexible system is important.

While there are several different types of payroll software to choose from, your final decision should be based on the size of your organization, your budget constraints, and the level of control you require.

Always remember that a well-chosen payroll system can save your company time, money, and legal trouble.

To help you organize your selection process and make it easy to compare one vendor to the next, solicit detailed payroll proposals from your top 3 choices, at least.

Need Expert Help Selecting The Right Human Resources (HR) Software?

We’ve joined up with Crozdesk.com to give all our readers (yes, you!) access to Crozdesk’s software advisors. Just use the form below to share your needs, and they will contact you at no cost or commitment. You will then be matched and connected to a shortlist of vendors that best fit your company, and you can access exclusive software discounts!

Conclusion

I hope this article clarified the differences between the types of payroll software and services out there, bringing you one step closer to finding the best fit for your needs.

With options ranging from traditional cloud-based systems to specialized industry solutions and comprehensive payroll services, there is a perfect fit for every business need.

Consider your organization's specific requirements, scalability, and budget to make an informed decision.

Ultimately, investing in the right payroll software will streamline your payroll processes, save time, and reduce errors, ensuring smooth and timely compensation for your employees.

Join for More HR Insights

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.