Hiring an employee isn’t just about their hourly wage or annual salary. There’s a whole spectrum of costs that employers need to consider, from direct wages to taxes, benefits, and even overhead expenses, to understand the actual cost of an employee.

Understanding the true cost per hour of an employee helps businesses budget accurately and make informed hiring decisions. This is true for hiring the first employee or the 100th.

So, how much does an employee really cost per hour?

Let’s break it down.

Understanding the Basic Components of Employee Costs

Employee costs vary by whether the employee is full-time or part-time, if they’re employed through the use of an employer of record, and whether they’re an in-house employee or independent contractor.

Here are other key factors to consider when looking at the cost of an employee.

Direct Wages and Salaries

At the core of employee costs is the direct wage or salary. This is the amount paid directly to the employee for their work.

For hourly employees, it’s straightforward: multiply the hourly rate by the number of hours worked. For salaried employees, divide the employee’s base salary by the total number of work hours in a year (usually around 2,080 hours for full-time employees).

Example:

- Hourly wage: $20/hour

- Annual salary: $50,000/year ≈ $24/hour ($50,000 ÷ 2,080)

Employer Taxes and Contributions

Employers are responsible for several mandatory payroll benefits and contributions, which add to the employee’s cost:

- Social Security and Medicare (FICA): Typically, employers match the employee’s contribution, which is 6.2% for Social Security and 1.45% for Medicare. The Federal Insurance Contributions Act (FICA) mandates these contributions.

- Unemployment Insurance: Varies by state, but generally around 1-2% of the employee’s wage. Under the Federal Unemployment Tax Act (FUTA), employers are generally required to pay 6% of taxes for the first $7,000 earned by any employee.

- State-Specific Taxes: Some states have additional taxes like disability insurance or training taxes.

These costs of course will vary by where the employee is located. If they're in a different country, the best employer of record services can help you handle compliance with local regulations and tax policy and remove some of the burden from your HR team.

Example

For an employee earning $50,000/year:

- Social Security: $3,100/year

- Medicare: $725/year

- Unemployment Insurance: $500/year

- Total: $4,325/year ≈ $2.08/hour ($4,325 ÷ 2,080)

Employee Benefits

Benefits are a significant part of the total cost and can include:

- Health Insurance: Employer’s share can be around $6,000/year.

- Retirement Plans: Contributions can vary, but a common match might be 3% of salary, so $1,500/year for a $50,000 salary.

- Paid Time Off (PTO): If an employee gets 2 weeks of paid vacation, it’s roughly $1,923 for a $50,000 salary.

- Other Perks: Gym memberships, tuition reimbursements, etc., which can add up.

Example

- Health Insurance: $6,000/year

- Retirement Plan: $1,500/year

- PTO: $1,923/year

- Total: $9,423/year ≈ $4.53/hour ($9,423 ÷ 2,080)

Overhead

Overhead includes costs associated with providing workspaces, equipment, and other resources necessary for employees to do their jobs. This can cover:

- Office Space: Rent, utilities, and maintenance.

- Equipment: Computers, software, and other tools.

- Administrative Costs: HR, IT support, etc.

- Workers Compensation Insurance: Provides medical benefits and wage replacement to employees who are sick or injured on the job.

Example

Let’s assume, for simplicity's sake, that we’re talking about a business with one employee on the payroll.

- Office Space and Utilities: $3,000/year

- Equipment: $1,000/year

- Administrative Costs: $2,000/year

- Total: $6,000/year ≈ $2.88/hour ($6,000 ÷ 2,080)

Calculating Employee Cost

Basics of Calculating Labor Cost

To calculate the total labor cost, add up all direct and indirect costs associated with an employee. The formula is:

Direct Costs vs. Indirect Costs

- Direct Costs: Wages, taxes, and benefits.

- Indirect Costs: Training, equipment, workspace, and other overhead costs.

As part of this, you’ll want to keep detailed records on which options employees choose as well, such as the cost of employee benefit packages that differ, or varying rates of employer match contributions to 401k plans.

A Step-by-Step Calculation Example

Example Calculation:

- Direct Wages: $24/hour

- Taxes and Contributions: $2.08/hour

- Benefits: $4.53/hour

- Overhead: $2.88/hour

Total Cost per Hour: $24 + $2.08 + $4.53 + $2.88 = $33.49/hour

Factors Influencing Employee Costs

Industry and Role-Specific Variations

The cost per hour can vary significantly based on industry and specific job roles. For example, high-tech industries may have higher overheads due to expensive equipment, while service industries might have higher training costs.

Geographic Location

Employee costs also vary by region. Employees in New York City or San Francisco typically command higher wages and benefits than those in rural areas, due to higher costs of living and local tax rates.

Company Size and Structure

Larger companies might enjoy economies of scale, reducing the per-employee cost. Smaller businesses may face higher costs per employee due to fewer resources and less negotiating power with benefits providers.

Hiring Processes

Recruitment itself is costly, from job ads to interview processes and onboarding. Internal recruiting costs include expenses associated with paying recruiting staff and hiring managers for their time spent on recruitment tasks.

Efficient hiring practices can significantly impact the overall cost per employee. External recruiting costs involve expenses such as job ads, recruitment agency fees, and other costs associated with attracting candidates from outside the organization.

Strategies To Optimize Employee Costs

Efficient Hiring Practices

- Use Temp Agencies: Temporarily fill positions without long-term commitments.

- Hire Freelancers: Pay for specific projects without the overhead of full-time employees (freelancer recruitment platforms are a good resource here).

- Remote Work: Save on office space and related expenses. Additionally, employers must pay taxes and unemployment insurance for their employees, including social security, Medicare, state and federal taxes.

Maximizing Employee Productivity

- Training and Development: Invest in training to improve efficiency.

- Clear Goals and Incentives: Align employee goals with company objectives and offer incentives for high performance.

Leveraging Technology and Automation

- HR Software: Automate payroll and benefits administration when doing payroll yourself.

- Productivity Tools: Use project management and communication tools to streamline workflows.

Can EOR Services Reduce Employee Cost?

An employer of record is a helpful service to control employee costs, particularly if you’re looking to hire internationally. Depending on the size and needs of your business, here are a few ways that an EOR can help your business reduce costs.

Economies of Scale

Bulk Purchasing Power: EORs often manage a large number of employees across multiple clients. This bulk purchasing power can lead to reduced costs for benefits and insurance premiums, which can be passed on to the employer.

Streamlined Processes: EORs have established systems and processes that can be more efficient than those of smaller companies, potentially reducing administrative costs.

Compliance and Risk Management

Avoiding Penalties: EORs specialize in employment law and tax compliance, reducing the risk of costly penalties for non-compliance.

Expertise: Their expertise can prevent errors in payroll and benefits administration, saving money in the long run.

Reduced Overhead

Administrative Costs: By outsourcing HR functions to an EOR, businesses can reduce their internal HR staffing and associated overhead costs.

Infrastructure Savings: Smaller companies may save on costs related to HR infrastructure, such as HR software and office space.

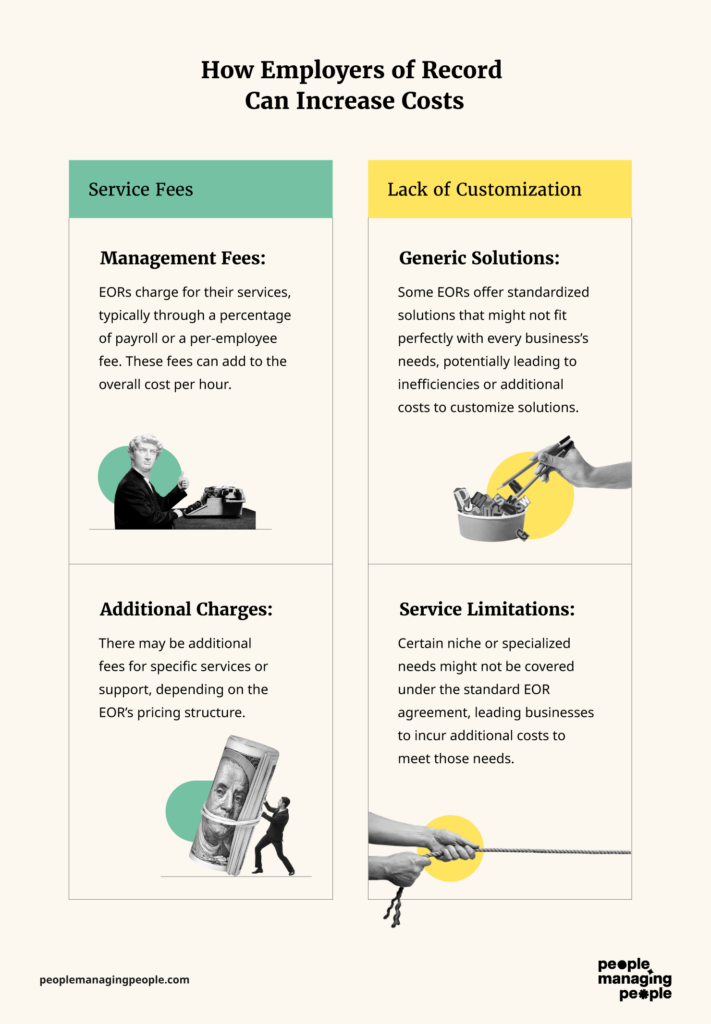

How Employers of Record Can Increase Costs

Service Fees

Management Fees: EORs charge for their services, typically through a percentage of payroll or a per-employee fee. These fees can add to the overall cost per hour.

Additional Charges: There may be additional fees for specific services or support, depending on the EOR’s cost structure.

Lack of Customization

Generic Solutions: Some EORs offer standardized solutions that might not fit perfectly with every business’s needs, potentially leading to inefficiencies or additional costs to customize solutions.

Service Limitations: Certain niche or specialized needs might not be covered under the standard EOR agreement, leading businesses to incur additional costs to meet those needs.

Cost-Benefit Analysis

To determine whether an EOR reduces or increases the cost per hour for employees, businesses should conduct a detailed cost-benefit analysis. There are three primary components to consider in doing this.

Total Cost Calculation: Compare the total costs of managing HR in-house, including salaries, benefits, compliance, and overhead, versus the total cost of using an EOR, including all service fees.

Indirect Savings: Consider potential indirect savings such as reduced legal risks, improved compliance, and efficiency gains from streamlined processes.

Service Quality: Evaluate the quality and scope of services provided by the EOR to ensure they align with the company’s needs.

Best Employer of Record Services to Control Employee Costs

Country-Specific EOR Services

Are you interested in hiring talent within a specific country? If so, our lists of the best EOR services for the following countries is a good place to start:

- Australia's best EOR services

- Brazil's best EOR services

- Canada's best EOR services

- Chile's best EOR services

- China's best EOR services

- Colombia's best EOR services

- France's best EOR services

- Germany's best EOR services

- Hong Kong's best EOR services

- India's best EOR services

- Indonesia's best EOR services

- Italy's best EOR services

- Japan's best EOR services

- Netherland's best EOR services

- Philippines' best EOR services

- Portugal's best EOR services

- Singapore's best EOR services

- Spain's best EOR services

- Switzerland's best EOR services

- Turkey's best EOR services

- UAE's best EOR services

- United Kingdom's best EOR services

Understanding the true cost of an employee goes beyond just their hourly wage or annual salary: Employers need to account for direct wages, taxes, benefits, and overhead expenses to get an accurate picture of the total cost per hour of an employee.

Employee costs vary significantly based on factors such as industry, geographic location, company size, and the hiring process: These variables can influence direct and indirect costs, making it essential for businesses to consider their unique circumstances when calculating labor costs.

Businesses can optimize employee costs through efficient hiring practices, maximizing employee productivity, and leveraging technology and automation: Additionally, using services like Employers of Record (EOR) can help reduce costs by offering economies of scale, streamlined processes, and risk management, though they may also introduce additional service fees.

Want to learn more about how you can control costs, outsource effectively and make the most of your budget?

Sign up for the People Managing People newsletter and you’ll receive all the latest insights and innovative ideas from leaders in HR and people management.