Automation is changing the way nearly every professional does their work in the modern world.

One look at the HR payroll software market, and it becomes obvious that payroll is no different as new software solutions are making the task of a payroll run easier than ever before.

In this article, I'm going to dig into the growth of the HR payroll software market, where it’s headed and take a look at some of the best solutions that are out there.

HR Payroll Software Market

Differing analysis of any market will leave with you quite a range of valuations and projections for market growth or decline.

Current size

For example, in 2023, the HR payroll software market was valued somewhere between $7.3 billion and $27 billion depending on which report you read. That number is expected to grow to somewhere between $8.1 billion and $33 billion in 2024.

Rather than get lost in the valuation, perhaps the more important thing to note is the compound annual growth rate (CAGR) for this market, which by all accounts is set for growth with the average estimate being somewhere in the ballpark of 10% annual growth.

Projected Size

At that growth rate, the HR payroll software market will grow to be worth somewhere between $19 billion and $60 billion by 2030.

In any case, the estimates are realistic given the implementation of AI into payroll processing and the increased reliability of payroll software platforms to tackle any compliance concern.

Importance of Payroll Software

Payroll software is of increasing importance for employers as practices around pay transparency and equity have become increasingly important to employees and are examined by state and national governments. For those looking for comprehensive solutions, exploring the best enterprise payroll software can be beneficial.

Other business factors making payroll software a major factor in organizational success include:

- Improving data security

- Creating efficiency that replaces manual processes

- Improved analytics and reporting

- Scalability for growing businesses

- Flexibility that suits technology capabilities

- Cost savings

Types of Payroll Software

Different types of payroll software cater to different business needs, providing solutions that range from comprehensive, all-in-one systems to specialized, industry-focused applications.

Here, we’ll focus on five of the most common types.

1. On-Premises Payroll Software

- Description: Installed directly on the company’s local servers and computers.

- Advantages: Offers full control over data security, customization, and integration with other on-premises systems.

- Ideal For: Large organizations with dedicated IT staff and specific customization needs.

2. Cloud-Based Payroll Software

- Description: Hosted on remote servers and accessed via the internet.

- Advantages: Provides flexibility, automatic updates, and remote access. Reduces the need for extensive IT infrastructure.

- Ideal For: Small to medium-sized businesses, remote teams, and companies looking for scalable solutions.

3. Integrated HR and Payroll Software

- Description: Combines payroll functions with broader human resources management tasks. Often comes in the form of an HRIS that has payroll functionality.

- Advantages: Streamlines HR processes, enhances data accuracy, and improves overall employee management.

- Ideal For: Organizations seeking a unified solution for HR and payroll management.

4. Industry-Specific Payroll Software

- Description: Tailored to meet the unique needs of specific industries, such as construction, healthcare, or retail.

- Advantages: Offers specialized features and compliance tools relevant to the industry.

- Ideal For: Businesses requiring industry-specific payroll functionalities and compliance requirements.

Related read: Reviews of the best payroll software for construction companies

5. Outsourced Payroll Services

- Description: Outsourced payroll is managed by third-party providers who handle all payroll-related tasks, such as a professional employer organization or employer of record.

- Advantages: The pros of using a payroll service include reduced administrative burden, ensured compliance, and allowing businesses to focus on core activities.

- Ideal For: Small businesses without dedicated payroll staff and companies looking to outsource non-core functions.

This is especially true for companies managing payroll across borders, where providers with built-in support for multi-country compliance, tax, and currency handling—like those offering global payroll solutions—can reduce both overhead and legal exposure.

Drivers of Payroll Software Market Growth

The payroll software market’s growth is driven by several key factors that are reshaping how businesses manage their payroll and HR functions. Let’s take a look at some of the most important ones.

Cloud vs. On-Premises Solutions

One of the biggest trends is the shift from traditional on-premises payroll software to cloud-based solutions. Cloud-based payroll software offers flexibility, scalability, and cost-effectiveness.

Businesses no longer need to maintain extensive IT infrastructure or worry about regular updates and security patches. With cloud solutions, everything is handled remotely, making it easier for businesses to scale their operations and access their payroll data from anywhere, at any time.

Artificial Intelligence (AI)

AI is revolutionizing the payroll software market by introducing advanced features that enhance accuracy and efficiency. AI-driven tools can automate complex calculations, predict payroll trends, and identify discrepancies before they become issues.

For example, AI can flag unusual patterns in payroll data that might indicate fraud or errors, helping businesses maintain payroll compliance and avoid costly mistakes.

Additionally, AI-powered chatbots can provide instant support to employees, answering common payroll queries and reducing the burden on HR teams.

Increased Automation of HR Processes

Modern payroll software integrates seamlessly with other HR systems, automating a wide range of processes from time tracking to benefits administration.

This automation reduces manual work, minimizes errors, and ensures that payroll processing is faster and more reliable.

For instance, automated time tracking systems can directly feed into payroll calculations, ensuring employees are paid accurately for the hours they've worked without manual data entry.

Regulatory Compliance and Reporting

Staying compliant with ever-changing labor laws and tax regulations is a major challenge for businesses. Payroll software simplifies compliance by automatically updating to reflect new laws and generating accurate tax reports.

This not only saves time but also helps businesses avoid penalties and legal issues. The ability to generate detailed reports and analytics also supports better decision-making and strategic planning.

Employee Self-Service

Modern payroll software often includes employee self-service portals, where employees can access their pay stubs, tax forms, and personal information. This feature improves transparency and empowers employees to manage their own payroll-related tasks, reducing the workload for HR departments.

Cost Efficiency

For many businesses, especially small and medium-sized enterprises, the cost is a significant factor when looking at payroll services or software.

Payroll technology can reduce the need for a large in-house HR team by automating many routine tasks. The shift to subscription-based models also means businesses can spread the cost over time, rather than making a large upfront investment.

Future Trends and Predictions

Employee expectations around pay are changing and with it, payroll systems will have to evolve to meet those expectations. Here are some areas where your payroll service or software providers will be looking to up their game in the coming years.

Flexible pay

Payroll is now predominantly a digital function, with only about 3% of U.S. employees still receiving paper checks. Offering diverse payment options will become essential as employees increase their financial literacy and begin to manage their money in new ways.

According to research from ADP, 76% of all employees say that it’s important to them that their employer offer flexible pay, sometimes called Earned Wage Access (EWA), or the ability to pull from accrued wages whenever they want rather than only receiving funds on a specific day within the pay period.

This also sometimes referred to as "on demand pay".

There are now systems that let employees manage their own payment schedules, with vendors and apps allowing them to choose when they get paid without disrupting their employer’s payroll processes.

Growth of cryptocurrency

And how those payments are received will likely change as well.

Cryptocurrency payments are becoming more popular, for example. A report from Statista shows that over 39% of American adults would consider using Bitcoin for transactions and purchases they make. It’s not unlikely then that more people will warm to the idea of receiving their paycheck via crypto in the future.

However, many employers are still unfamiliar with cryptocurrency and the associated risks and regulations. Issues like taxes, international laws, and the definition of “legal tender” need careful consideration.

For instance, Bitcoin isn't recognized as legal tender in countries like Belgium, Finland, and Sweden, but it isn't banned either. Payroll software can help manage these complexities with automated compliance, enabling employers to adopt Bitcoin payments smoothly.

More AI

There are some remarkable capabilities around AI for payroll. Whether that’s detecting anomalies, predicting employee requests or streamlining compliance, and avoiding errors through the automation of time-consuming tasks that are prone to error. But it also will drive improvement in some other key areas.

Real time analysis

AI-powered payroll systems can instantly analyze vast amounts of data, providing real-time insights and identifying patterns that human analysts might miss.

For example, AI can monitor payroll data for discrepancies, such as overtime inconsistencies or unusual payment patterns, and flag these issues immediately.

This level of instant analysis could help businesses address problems before they escalate, ensuring payroll accuracy and compliance with labor laws.

Predictive Analytics

AI can also use historical payroll data to predict future trends. By analyzing past payroll records, AI algorithms can forecast labor costs, budget needs, and potential financial risks.

This predictive capability allows businesses to plan more effectively and make informed decisions about hiring, budgeting, and resource allocation.

Conversational experience

The days of manual payroll reporting are coming to an end. Earlier this year, UKG announced it was deploying generative AI in its "Pro" platform to create a question-and-answer experience to streamline the payroll reporting process.

In other words, no more combing through datasets or manually reviewing employee profiles. A user of the platform can simply ask a text-based question such as “Show me all employees who have a wage garnishment” or “Create a list of all employees paying into multiple retirement accounts.”

“Payroll reporting often feels like seeking a needle in a haystack, and by the time the frantic search for information is over, it’s often too late to take action on,” said Hugo Sarrazin, chief product and technology officer at UKG in a press release. “With generative AI, we’re making critical payroll data easily searchable and accessible through conversational experiences, while also putting that information into actionable context for payroll teams.”

Enhanced security protocols

Advanced algorithms can identify unusual patterns and potential breaches instantly, allowing for swift action to protect sensitive data. AI also ensures continuous monitoring and updates, keeping payroll systems secure against evolving cyber threats.

This proactive approach minimizes risks and maintains the integrity of payroll information.

The Gig Economy Impact

More than one-third of the U.S. workforce is made of gig workers and that number is expected to grow to more than half of the workforce by 2027.

This trend presents an interesting question for our society about how these workers receive benefits with more insurance companies now offering policies and services specifically tailored to independent contractors.

In the future, it’s likely that payroll software will have to account for this and streamline payment of premiums to the contractors desired healthcare provider.

Best Solutions on the Market

At this point, you might be wondering about the best solutions on the market. We’re here to help.

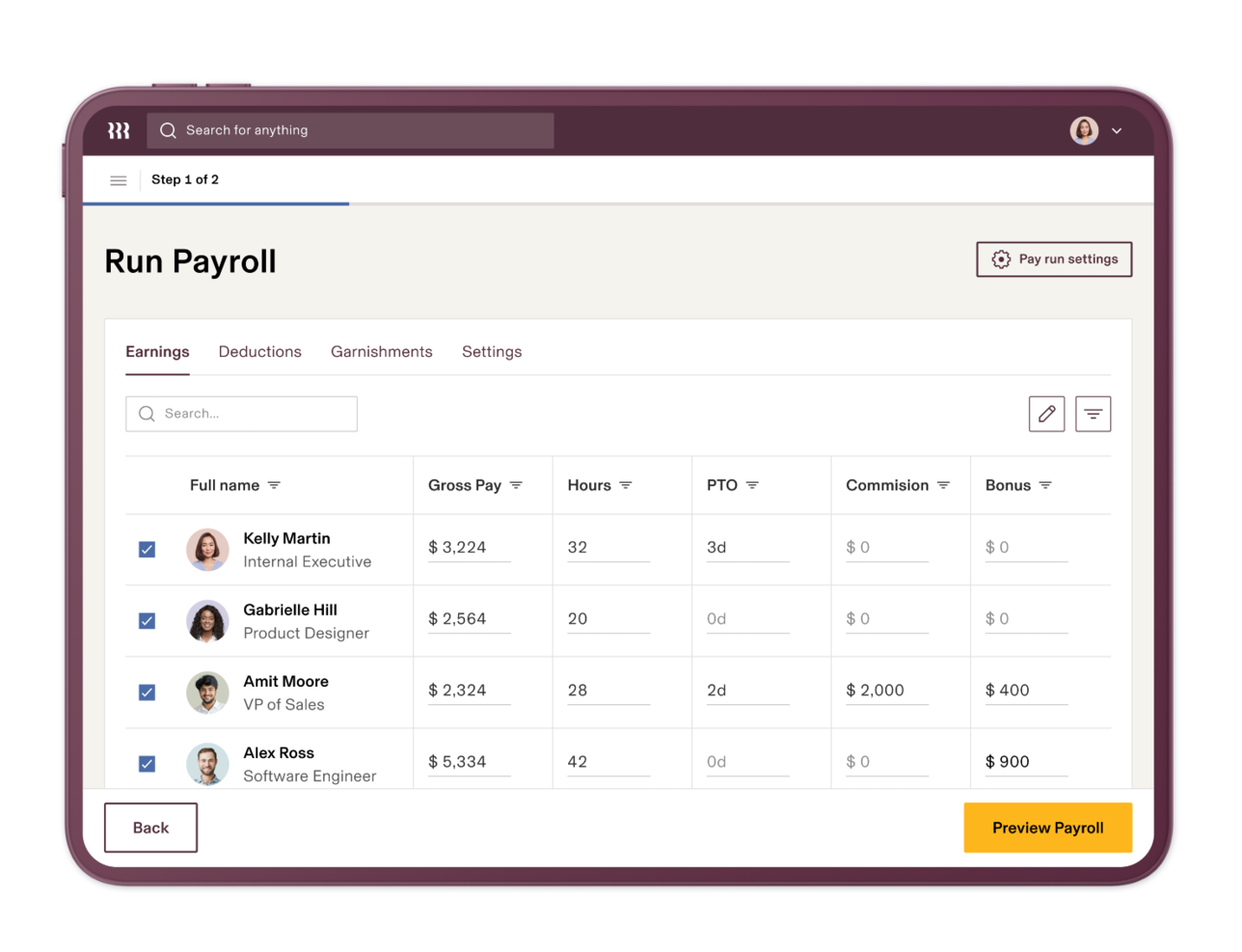

Rippling

Best for global payroll with tons of integrations

Rippling’s modern payroll system is part of their all-in one HR, payroll, and IT platform. It provides the robust functionality of legacy systems with the ease of newer systems to deliver the best of both worlds.

Why I picked Rippling: Rippling allows users to onboard new hires quickly and automatically, run payroll with a click, and pay employees or contractors, anywhere. Their system is built on centralized employee data, so businesses can automate all of the admin work that’s normally required to run payroll and update employee information.

Rippling Features and Integrations:

Features include domestic and global payroll, an organization chart, expense management, talent management, local tax filing, country-specific compliance, and international benefits programs. Companies can also manage their employees’ offer letters, I-9s, health insurance, and time off.

One feature I found particularly useful is the ability to compare your current pay run with previous runs side-by-side to quickly spot any changes. This visual comparison tool makes it easier to spot potential errors and verify that all expected payroll changes have been entered.

Integrations are available with Google Workspace, Typeform, Databricks, BrightHire, Atlassian, Google Workspace, Slack, Checkr, Zoom, GitHub, Asana, 1Password, Zendesk, Dropbox, Sage Intacct, Netsuite, Microsoft 365, QuickBooks, DocuSign, Upwork, LinkedIn, and dozens more.

Pros and cons

Pros

- Customizable reporting

- Efficient onboarding and offboarding

- Smooth employee self-service

Cons

- Limited customer support options

- Complex initial setup

New Product Updates from Rippling

Rippling Now Integrates with Points North

Rippling's new integration with Points North automates certified payroll reporting, ensuring compliance with Davis-Bacon and prevailing-wage laws by synchronizing data in real time and reducing manual errors. More details at Rippling Blog.

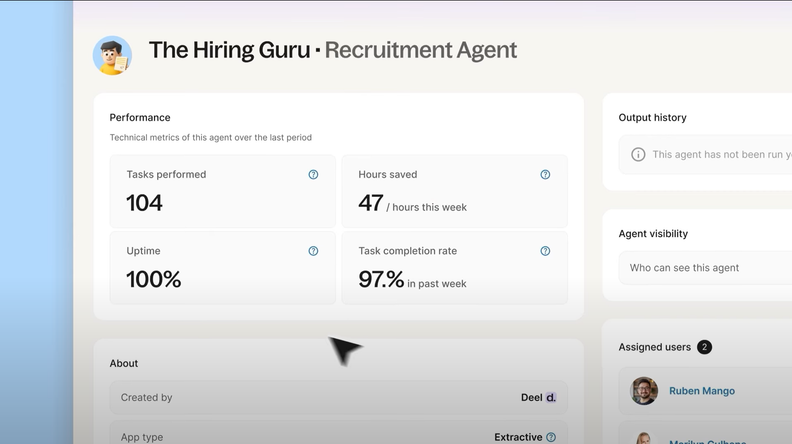

Deel

Best for compliant payroll in 150+ countries

Deel is a global payroll platform available in over 150 countries and all 50 U.S. states, ensuring compliance with local regulations. With Deel, you can hire and pay anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll.

For business leaders like Cara Barnes, Founder at Good Carma Consulting, this peace of mind is invaluable: “Deel was a way to guarantee that we were properly classifying [employees] correctly and also making sure we are paying the right taxes and dues to the government. Otherwise, it could be really costly afterward.”

Why I picked Deel: I chose this software because it provides end-to-end global workforce management, including contract adjustments, expense reimbursements, and off-cycle payroll adjustments. You can schedule payments in advance and run off-cycle payroll whenever needed.

It's also worth noting that the company has local country experts working in-house to run global payroll and ensure all regional contributions are accounted for. Their team provides 24/7 online support, and dedicated account managers are available for specific requests.

Deel Standout Features and Integrations:

Standout features I noticed were the software's 10+ payment options, ranging from bank transfers to cryptocurrency pay-ins. What makes this stand out from other options is that employees and contractors can self-manage their pay and personal data, and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals.

Integrations include Ashby, BambooHR, Expensify, Greenhouse, Hibob, NetSuite, Okta, OneLogin, QuickBooks, Xero, Workday, and Workable. The software’s open API can support additional custom software integrations.

Pros and cons

Pros

- Knowledgeable support staff

- Detailed dashboards

- Add-ons available to localized benefits and global payroll

Cons

- Limited invoice customization

- Contract templates could be simplified

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

UKG

Best for supporting employee engagement

UKG is an HR, payroll, & workforce management platform that offers solutions that cater to businesses of all sizes. They focus on enhancing workforce management and employee engagement, making it a valuable tool for organizations looking to optimize their payroll processes.

Why I picked UKG: the platform offers advanced payroll solutions like UKG Pro and UKG Ready, which integrate payroll with workforce management to reduce errors and boost efficiency. Its culture-focused approach supports employee engagement, while global payroll capabilities ensure compliance with local laws, making multi-country payroll management easier and more reliable.

UKG Features and Integrations:

Features include automated updates to ensure compliance with labor laws and tax regulations, mobile access for employees to manage their payroll data, and AI-driven insights that help improve workplace culture and employee engagement.

These features collectively contribute to a smoother payroll experience for both you and your team, enhancing overall satisfaction and efficiency.

Integrations include Flexspring, The Cloud Connectors, Kombo, Nagarro, Eljun LLC, Workato, Joynd, and Aquera 360.

Pros and cons

Pros

- Strong compliance support for multi-region operations

- AI-powered insights for engagement and planning

- Wide range of HR, payroll, and workforce tools

Cons

- No pricing mentioned

- Implementation may be complex for new teams

RUN Powered by ADP®

Best for small businesses

RUN by ADP is a comprehensive payroll and HR software solution designed to enhance payroll processing and human resource management for small businesses.

Why I picked RUN by ADP: I like its comprehensive suite of features tailored to meet the needs of small businesses. One of the most significant advantages is its ability to automate payroll processes, including tax calculations and filings. This feature not only saves time but also reduces the risk of errors, ensuring compliance with federal and state regulations.

The software also automatically calculates benefits and retirement deductions, and it customizes the experience based on the specific needs of the business and its employees.

RUN by ADP Standout Features and Integrations:

Standout features include AI-powered error detection that learns your payroll and proofs your data for you, flagging potential errors before they happen. It also offers direct deposit, multi-jurisdiction payroll, job costing, and a range of HR functions, like background checks, new employee onboarding, and forms and documents.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros

- Good integrations

- Employee self-service portal

- Good mobile app

Cons

- Most HR functions are only available on higher-tier plans

- Setup can be complex

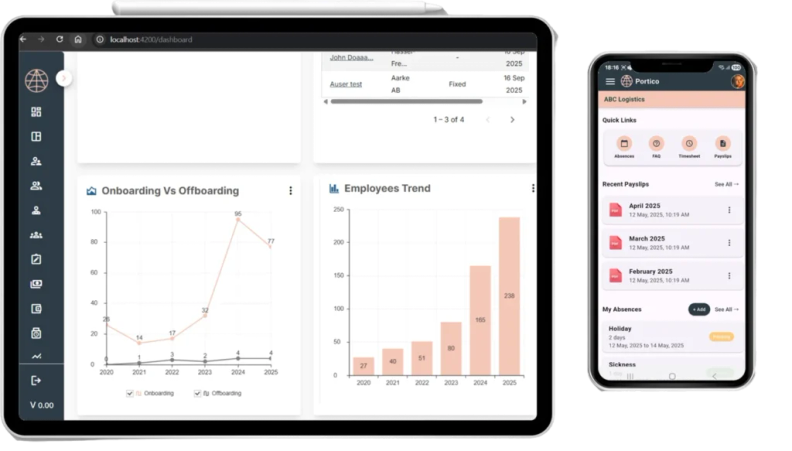

TopSource

Best for global payroll compliance

TopSource Worldwide is a global Employer of Record (EOR) provider offering payroll, compliance, and HR support to help businesses manage international hiring without establishing local entities. Its payroll solution covers processing payments in local currencies, managing statutory benefits, and ensuring compliance with employment laws.

Why I Picked TopSource Worldwide: I picked TopSource Worldwide because it’s a strong choice for businesses managing global payroll across multiple countries. It handles complex processes like paying employees in local currencies and managing contributions for taxes and benefits. This helps keep your business compliant while reducing manual effort.

Additionally, TopSource Worldwide offers strategic HR advisory and transition support from EOR to full-time employment, making it a flexible choice for businesses planning long-term growth in new markets.

TopSource Worldwide Standout Features and Integrations:

Standout features include its infrastructure for global operations, which supports compliance, payroll, and HR needs in over 180 countries. The platform also provides HR support, data security, and services like compliant employment contracts, onboarding, and advisory for international workforce management.

Integrations include Salesforce, NetSuite, SAP, Portico HR, and connections for CRM, ERP, API, EDI, and financial systems.

Pros and cons

Pros

- Legal employer of record in each location

- Includes global payroll and tax management

- Salary estimator tool helps plan ahead

Cons

- No public list of software integrations

- Pricing not publicly listed

New Product Updates from TopSource

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

Paycor

Best for automating payroll tasks

Paycor is a human capital management solution with payroll, workforce management, and employee experience features. The payroll product can handle payroll, expense management, time and attendance, and more.

Why I picked Paycor: Paycor offers automation features to run payroll automatically, as scheduled for a specific day and time. Multiple payment options are available through the software, including direct deposit, paycards, or on-demand pay.

It also provides in-depth compliance feedback to help you respect the employment laws in your state. Because of its robust functionality, I think it's best suited to large and enterprise businesses.

Paycor Standout Features and Integrations:

Standout features include its pay-on-demand feature, which allows employees to access their earned wages before their next official payday — a very modern functionality that not all payroll providers offer.

It's also convenient that expense management, scheduling and time tracking, and employee experience monitoring are all also available in the platform.

Integrations include several other tools for wage and salary verification, expense management, employee wellness, certified payroll, and FMLA. Key software systems to note include Certify, ESR, Payfactors, and WageWorks.

Pros and cons

Pros

- All-in-one solution well suited to enterprise businesses

- Live and on-demand product training and industry webinars

- Mobile app allows for payroll management on the go

Cons

- Time cards are a bit simplistic

- UX can be a little clunky at times

Paylocity

Best for HR, payroll, and integrations in one

Paylocity is an all-in-one payroll and human resources platform built to help businesses manage their workforce efficiently.

Why I picked Paylocity: When it comes to payroll, Paylocity helps you run payroll accurately and on time with automated tax calculations and filings. You can manage deductions and garnishments, ensure compliance with wage and hour regulations, and track payments for direct deposits or paychecks.

The system also provides detailed payroll reports that let you analyze labor costs and payroll data in real time. This way, you can keep track of everything from overtime to tax liabilities, without needing manual calculations or separate tools.

I also like that it's tightly integrated with its HR features, allowing you to manage processes outside of payroll, such as talent management, shift management, learning, and time tracking.

Paylocity Standout Features and Integrations:

Standout features include expense management, tax services that cover all 50 US states, on-demand payments, managed garnishment services, and global payroll abilities covering 100+ countries.

In addition to Paylocity's payroll features, their software also includes time and labor management tools that let you track employee attendance and manage shift schedules. Its talent management tools allow you to set up performance reviews and manage employee development.

In addition, the benefits administration feature helps your team handle employee health plans, retirement options, and other benefit packages.

Integrations include over 400 third-party tools across recruitment, productivity, communication, and benefits management, like ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Pros and cons

Pros

- Includes tax compliance services

- On demand payment options

- Includes performance management features

Cons

- Setup can be time consuming

- Lacks support for independent contractor payments

HiBob

Best for real-time payroll data access

HiBob is a human resources (HR) platform with integrated payroll software for businesses in the US and UK. Its Payroll Hub centralizes payroll tasks, making it easier to manage compensation, compliance, and employee data in one place.

Why I Picked HiBob: I picked HiBob because its Payroll Hub gives you real-time access to payroll data, reducing the risk of errors and helping you stay compliant. You can also run payroll on different cycles, such as weekly or monthly, depending on your business needs. HiBob’s compensation tools add further value by supporting salary reviews, bonuses, and equity management in one system, which helps ensure pay transparency and consistency across your organization.

HiBob Standout Features and Integrations

Standout features include its sandbox environment, where you can test payroll and HR processes without impacting live data, as well as built-in tools for time and attendance tracking to support accurate payroll runs. HiBob also offers learning management and performance review features, making it a broader HRIS platform.

Integrations include ADP, Deel, Google applications, Slack, Greenhouse, LinkedIn Learning, Microsoft Teams, Jira, Oyster, Paylocity, Zapier, and Xero.

Pros and cons

Pros

- Built-in compensation tools

- Flexible payroll cycle options

- Real-time payroll data hub

Cons

- Implementation fee required

- Limited to US and UK payroll

Remote People

Best for global payroll management

Remote People is a payroll software solution that helps businesses hire and manage remote talent globally. By offering a range of services, including global payroll management and compliance solutions, it enables companies to handle HR tasks across various countries.

Why I Picked Remote People: I picked Remote People as a top payroll software for its robust global payroll management, ensuring accurate, on-time payments across countries while handling local compliance through its employer of record services. It also streamlines contractor management for easy onboarding and payments, meets legal and tax obligations, and offers employee benefits management to help attract and retain top talent—making it a comprehensive solution for managing a diverse workforce.

Remote People Features and Integrations:

Features include a database of over 300,000 vetted candidates, providing you with access to a wide pool of talent for your specific needs. The platform also offers executive recruitment services, allowing you to find experienced leaders to drive your company forward. Additionally, Remote People provides HR tools like salary and onboarding cost calculators to help you manage your budget and expenses effectively.

Integrations are not currently listed by Remote People.

Pros and cons

Pros

- Dedicated client support contact

- Provides global payroll, contractor, and relocation support

- Includes Employer of Record and PEO services

Cons

- Some services available only in certain regions

- No publicly listed integrations

Homebase

Best for managing hourly teams

Homebase is a payroll and team management platform tailored to the needs of small businesses, especially those with hourly employees.

Why I picked Homebase: I like that Homebase offers built-in payroll capabilities on top of strong scheduling and time tracking features. It's particularly helpful for managing hourly teams—automating shift swaps, time-off requests, and compliance tracking. That means less time juggling schedules and more time focusing on the business.

The platform also helps you stay compliant with labor laws and reduce payroll errors by syncing time clock data with payroll processing.

Homebase Standout Features and Integrations:

Standout features include automated scheduling, real-time time clocks with schedule alerts, built-in messaging for shift reminders, and PTO tracking. The software also supports employee onboarding, departmental permissions, and labor cost optimization.

Integrations include QuickBooks, Gusto, Square, Clover, Shopify, Xero, ADP, Zapier, Lightspeed, and Revel Systems.

Pros and cons

Pros

- Automated payroll and tax processes

- Offers direct deposit into bank accounts or printable checks

- Time tracking for accurate payroll

Cons

- Payroll functions are only available as an add-on

- No details on customization for specific business needs

Competitive Landscape

The competition for payroll software is fierce, including some of the biggest names in HR related software solutions. You’ll recognize some of these names and will have likely interacted with several of them if you’ve been in HR for a long period of time. They include the likes of:

- ADP

- Papaya Global

- Paychex

- Paycor

- BambooHR

- Deel

- Quickbooks

All of these payroll companies have cloud-based solutions and most are in some stage of implementing AI into their payroll solutions. Additionally, they all typically integrate with the most popular HRIS systems.

Some, like Deel, have fully embraced the flexible pay trend and are offering cryptocurrency pay-ins. Others, like ADP, have set themselves apart on the self-service front. Finding the right payroll solution for your business just depends on your needs, size and goals.

Familiarize yourself with the key features of payroll software that your business needs in a solution and establish a step-by-step process for selection.

FAQs

How do I select the right payroll software?

Essentially, the answer to this question will be much clearer once you follow a four step process.

- Define what requirements you have of the software

- Set a budget

- Evaluate features and functionality

- Make a pros and cons list to help you decide.

How much does payroll software cost?

Base plans for payroll software can start as low as $17 per month, while more established payroll service providers provide enterprise plans starting at $140 per month. You’ll want to check out our guide to payroll software costs to learn more.

Are some payroll software or service providers better for small businesses?

Yes. Different sized businesses have different needs and capabilities. Those with customizable features that can evolve as your company scales, a high level of affordability and a user friendly interface that someone in either HR or accounting can use with similar ease are best. Check out our favorites for best payroll services for small businesses.

How can I learn more about changes and trends in payroll software?

To stay up to date on changes and trends in payroll software, it’s important to regularly follow industry publications, payroll blogs, and product update announcements from leading payroll software providers. Subscribing to newsletters from trusted sources like the IRS or national payroll associations can also help you keep pace with evolving regulations, compliance updates, and best practices.

Another effective way to stay informed is by taking a payroll software training course. These courses often include modules on the latest technology trends, automation features, and regulatory changes, helping you build both practical skills and strategic insights. Many are updated regularly to reflect current industry standards, making them a reliable resource for continuous learning.

Stay in Touch

To remain up to date on all the latest in people management, from payroll to performance tracking, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.